Printing Inks Market Size, Share & Trends Analysis Report by Ink Type (Conventional Inks, Digital Inks, Specialty Inks, Security Inks, Others), Printing Process, Substrate Type, Resin Type, End-Users, Distribution Channel, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Printing Inks Market Size, Share, and Growth

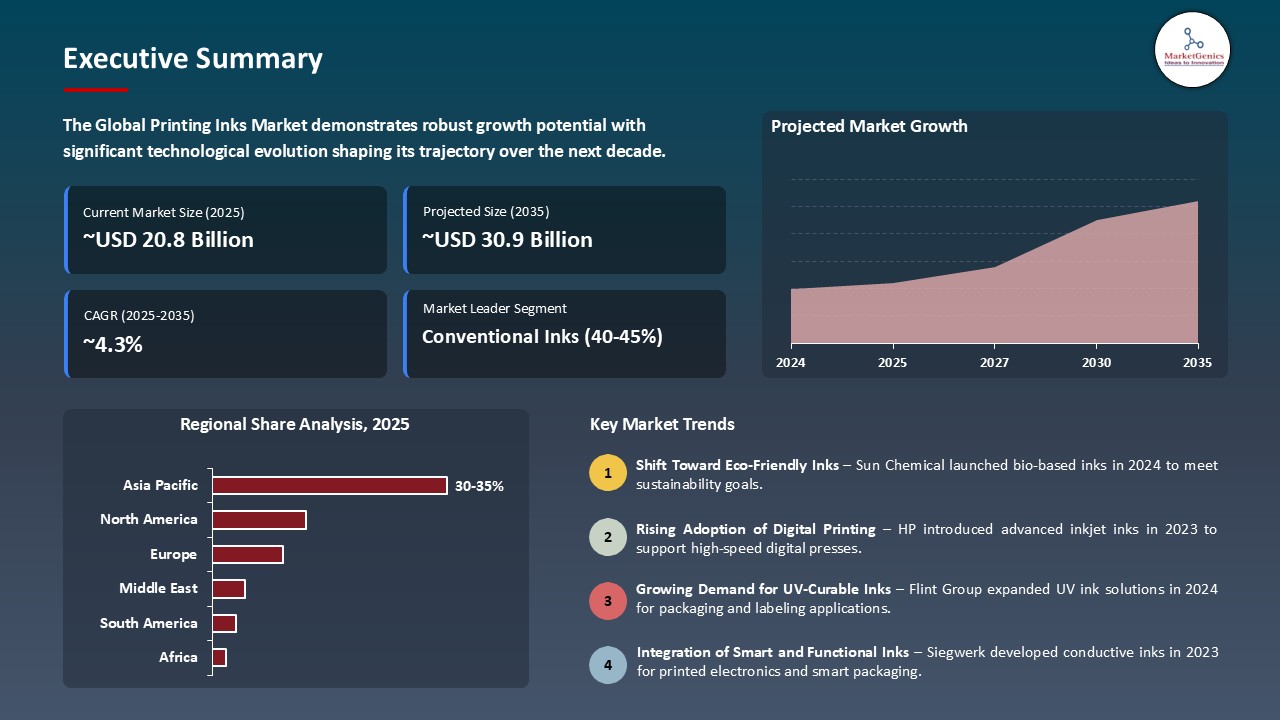

The global printing inks market is experiencing robust growth, with its estimated value of USD 20.8 billion in the year 2025 and USD 30.9 billion by the period 2035, registering a CAGR of 4.3%. Asia Pacific leads the market with market share of 32.6% with USD 6.7 billion revenue.

"Under Manish Bhatia, MD & CEO of DIC India Limited, DIC opened the “Optima” toluene-free ink manufacturing plant in Gujarat. This strategically situated facility produces over 10,000 tonnes annually and underscores the company’s sustainability and regional growth ambitions."

The high demand of the sustainable and high-performance solutions in packaging and commercial printing is a driving force in the global Printing Inks market. In January 2025, hubergroup launched its DYNAMICA Ink Series, a fast-drying, cobalt- and mineral oil-free commercial ink system tailored to high-speed presses and providing durability, high-density color, and sustainable credentials eco-driven, Cradle-to-Cradle certified to enable IPA-free process.

Not less significant, in July 2025, Sun Chemical introduced SunCure Advance ECO UV sheetfed inks in the folding carton work, which contains 25-30% bio-renewable content with elevated press stability of more than 20,000 impressions per hour. The innovations are a testament to the convergence of performance, productivity and sustainability. Growing interest in sustainable and product high-efficiency ink formulations is driving innovation and expanding the area under which the global printing inks market can be employed.

Adjacent opportunities to the global Printing Inks market include digital printing solutions, 3D printing materials, sustainable packaging inks, specialty coatings, and conductive inks for electronics. These sectors are closely aligned with printing technologies, fostering cross-market innovation, material advancements, and new application growth.

Printing Inks Market Dynamics and Trends

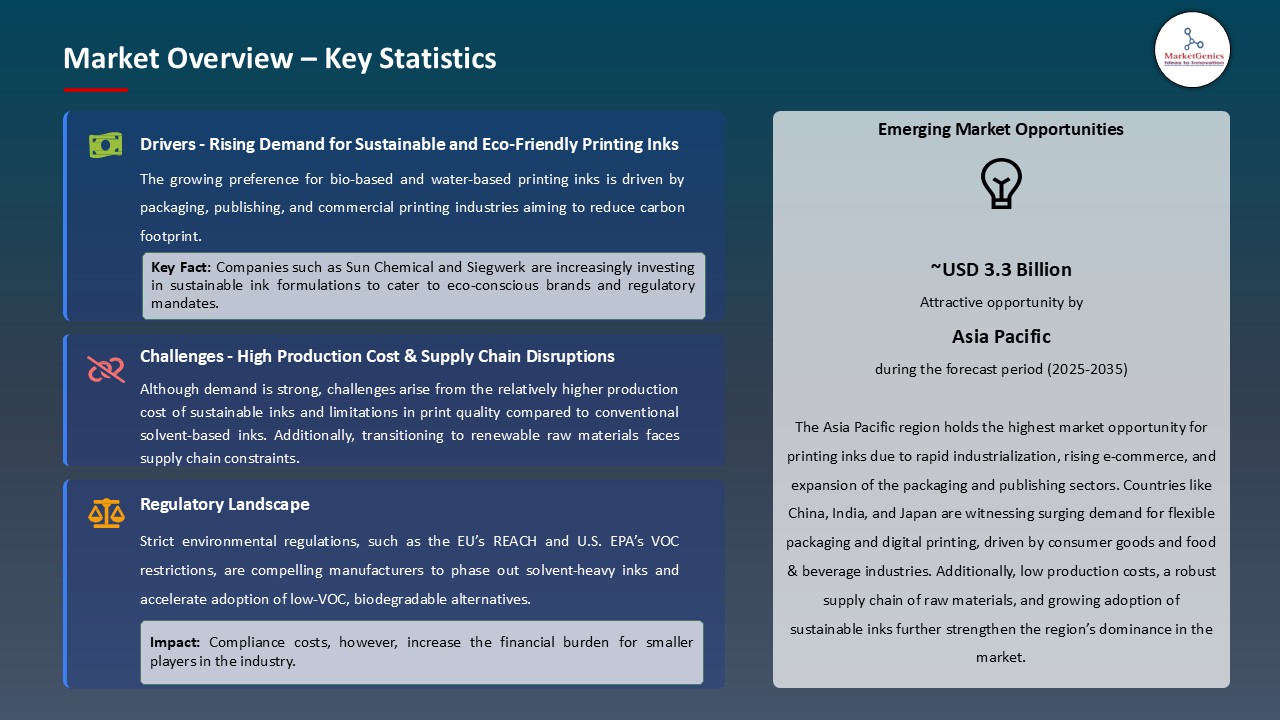

Driver: Rising Adoption of Eco-Friendly and Sustainable Printing Inks in Packaging Applications

- The packaging sector is currently experiencing a structural shift with sustainability being at the top of consumer and manufacturer agendas. Environmentally friendly and eco-specifications like water-based, soy-based and UV-curable inks are growing in use to satisfy environmental requirements and lower emissions of harmful volatile organicless. The driver has become prominent in industries such as food and beverage, pharmaceuticals and cosmetic products where safety and environmental regulations are crucial. The increased consumer awareness of eco-friendly packaging solutions is propelling the printing ink demand towards going green.

- For instance, in June 2024, Sun Chemical has increased its stock of bio-renewable printing inks specially designed to support flexible packaging printed applications, such that the carbon footprint is reduced, and the performance is not compromised.

- The adoption of sustainable inks is a major trend in the long-term growth of the market, as it puts printing in line with the aims of the circular economy.

Restraint: Volatility in Crude Oil-Based Raw Material Prices Affecting Printing Ink Production Costs

- Traditional solvent-based inks manufacturers are highly dependent on petrochemical derivatives, which exposes the industry to global fluctuations in the price of crude oil. Such reliance places the printing ink producing enterprises at risk of cost volatility, which compromises margins and destabilizes supply chains. The pressure is especially evident when it comes to geopolitical tensions or market shortages as was seen in the post-Russia Ukraine crisis, which caused drastic increases in the costs of crude oil.

- This volatility forces manufacturers either to bear these costs, or transfer them to their clients, and this hampers market competitiveness. In March 2024, Flint Group cited margin pressure caused by petrochemical feedstock inflation that it was forced to adjust prices to deliver profitability throughout its packaging inks division.

- The volatility of crude oil derivatives still acts as a significant barrier to the predictability of cost structure of ink producers.

Opportunity: Expanding Demand for Digital Printing Inks Driven by E-Commerce Packaging Growth

- The e-commerce boom has transformed the printing industry into a massive opportunity, now making the digital printing inks important which can provide quick customizable cost-effective quickcido0404888d packaging solutions. With digital inks, short runs, variable information printing and ecommerce or personalized branding are all viable options in contrast to traditional printing, which is of great interest to online retailers and consumer brands.

- The continuous desire of consumers to have personalized experiences and fast-paced delivery models also spills the use of digital printing ink at an even faster rate. In January 2024, HP Inc. unveiled a new generation of digital inkjet solutions aimed at addressing the needs of e-commerce and corrugated packaging customers, where it supports the on-demand and high-resolution print capabilities of large-scale retailers.

- Increased growth in digital inks printing supports the scalability of the market due to the dynamic nature of the e-commerce driven ecosystem in terms of packaging.

Key Trend: Rising Penetration of Conductive and Functional Printing Inks in Smart Packaging Solutions

- In addition to traditional uses, printing inks industry is experiencing a transition to application in smart packaging and printed electronic. With these advanced inks, features like NFC tags, QR codes, and temperature indicators may be embedded, making packaging interactive and tracking as well, closely aligned with developments in the conductive plastics.

- The use of IoT-enabled packaging in logistics, healthcare, and retail is gaining popularity, enhancing the topicality of this trend. As an illustration, in May 2024, Henkel launched its new generation of conductive inks used in printed electronics, which were integrated into smart packaging concepts to achieve supply chain visibility.

- The penetration of functional ink is an innovation driver thus making the printing inks market a key catalyst to smart packaging technologies.

Printing Inks Market Analysis and Segmental Data

Conventional Inks Dominate Printing Inks Market Owing to Established Applications and Cost Competitiveness

- The demand for conventional inks remains highest in the global printing inks market due to their widespread usage across newspapers, magazines, packaging, and commercial printing applications. They are economical, highly compatible on a wide variety of substrates, with an older established infrastructure, which makes them the favorite printing option in high-volume printing requirements, particularly where formulations rely on inputs from the organic pigments. Their consistency of performance ensures high adoption irrespective of the sustainability concerns.

- In April 2024, Siegwerk launched a new conventional coloured ink across Asia as demand in the packaging and publishing market continues to grow on the materials, signifying the continuing use of traditional printing processes. The conventional inks remain the dominant inks because of scalability, cost benefits, and industrialized usage.

Asia Pacific Leads Printing Inks Market Driven by Packaging Expansion and E-commerce Growth

- The Asia Pacific region holds the highest demand in the global printing inks market, largely driven by rapid growth in packaging, publishing, and commercial printing sectors. Increased demand in the consumption of packaged foods, personal care products and pharmaceutical goods, in addition to increased e-commerce activities contributes to the high-scale consumption of ink in the region.

-

Toyo Ink SC Holdings announced in March 2024 an expansion of packaging ink production facility in Malaysia to meet increasing demand in the region. Asia Pacific leads in terms of high manufacturing capability and end-use industry expansion.

Printing Inks Market Ecosystem

-

The global printing inks market demonstrates a moderately fragmented structure, with concentration levels ranging from medium to high across Tier 1, Tier 2, and Tier 3 players. Tier 1 companies such as DIC Corporation, Sun Chemical, Flint Group, Sakata Inx, and Toyo Ink dominate with global reach and diversified portfolios, while Tier 2 and Tier 3 firms cater to regional and niche requirements. Buyer concentration is relatively high due to packaging and publishing industry dependence, while supplier concentration remains medium, given diversified raw material sources.

Recent Development and Strategic Overview:

- In July 2025, Sun Chemical showcased its expanded portfolio of eco-conscious analogue and digital ink solutions, including UV LED, water-based, and Electron Beam-curable systems for labels and flexible packaging. The company emphasized recycling-ready solutions like the SolarWave series and deinkable options tailored for circular packaging compliance.

-

In April 2025, Toyo Printing Inks, under the Artience Group, inaugurated a 62,500 m² plant in Manisa, Turkey, doubling production capacity and enhancing its innovation capabilities. The facility emphasizes sustainable manufacturing, renewable technology, and includes a sizable R&D center to rapidly respond to packaging market needs.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 29.8 Bn |

|

Market Forecast Value in 2035 |

USD 30.9 Bn |

|

Growth Rate (CAGR) |

4.3% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value

|

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Printing Inks Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Ink Type |

|

|

By Printing Process |

|

|

By Substrate Type |

|

|

By Resin Type |

|

|

By End-Users |

|

|

By Distribution Channel |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Printing Inks Market Outlook

- 2.1.1. Printing Inks Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Printing Inks Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Chemical & Material Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Chemical & Material Industry

- 3.1.3. Regional Distribution for Chemical & Material Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Chemical & Material Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for flexible and sustainable packaging solutions

- 4.1.1.2. Increasing adoption of digital printing across commercial and industrial applications

- 4.1.1.3. Expanding use of specialty inks in textiles, electronics, and 3D printing

- 4.1.2. Restraints

- 4.1.2.1. Fluctuating raw material prices impacting production costs

- 4.1.2.2. Stringent environmental regulations on solvent-based inks

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Printing Inks Manufacturers

- 4.4.3. Distributors/ Suppliers

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Printing Inks Market Demand

- 4.9.1. Historical Market Size - in Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - in Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Printing Inks Market Analysis, by Ink Type

- 6.1. Key Segment Analysis

- 6.2. Printing Inks Market Size (Value - US$ Bn), Analysis, and Forecasts, by Ink Type, 2021-2035

- 6.2.1. Conventional Inks

- 6.2.1.1. Oil-based

- 6.2.1.2. Solvent-based Inks

- 6.2.1.3. Water-based Inks

- 6.2.1.4. Others

- 6.2.2. Digital Inks

- 6.2.2.1. UV-curable Inks

- 6.2.2.2. Latex Inks

- 6.2.2.3. Eco-solvent

- 6.2.2.4. Aqueous

- 6.2.2.5. Others

- 6.2.3. Specialty Inks

- 6.2.3.1. Conductive

- 6.2.3.2. Magnetic

- 6.2.3.3. Thermochromic

- 6.2.3.4. Photochromic

- 6.2.3.5. Others

- 6.2.4. Security Inks

- 6.2.4.1. Fluorescent

- 6.2.4.2. Phosphorescent

- 6.2.4.3. Others

- 6.2.5. Other Ink Types (Electron Beam (EB) Inks, Hot Melt Inks, Hybrid Inks, etc.)

- 6.2.1. Conventional Inks

- 7. Global Printing Inks Market Analysis, by Printing Process

- 7.1. Key Segment Analysis

- 7.2. Printing Inks Market Size (Value - US$ Bn), Analysis, and Forecasts, by Printing Process, 2021-2035

- 7.2.1. Flexographic Printing Inks

- 7.2.2. Gravure Printing Inks

- 7.2.3. Lithographic (Offset) Printing Inks

- 7.2.4. Digital Printing Inks

- 7.2.5. Screen Printing Inks

- 7.2.6. Letterpress Printing Inks

- 7.2.7. 3D Printing Inks

- 7.2.8. Others

- 8. Global Printing Inks Market Analysis, by Substrate Type

- 8.1. Key Segment Analysis

- 8.2. Printing Inks Market Size (Value - US$ Bn), Analysis, and Forecasts, by Substrate Type, 2021-2035

- 8.2.1. Paper & Paperboard

- 8.2.2. Plastics

- 8.2.3. Metals

- 8.2.4. Glass

- 8.2.5. Textile/Fabric

- 8.2.6. Ceramic

- 8.2.7. Wood

- 8.2.8. Films and Foils

- 8.2.9. Others

- 9. Global Printing Inks Market Analysis, by Resin Type

- 9.1. Key Segment Analysis

- 9.2. Printing Inks Market Size (Value - US$ Bn), Analysis, and Forecasts, by Resin Type, 2021-2035

- 9.2.1. Acrylic Resin

- 9.2.2. Alkyd Resin

- 9.2.3. Polyamide Resin

- 9.2.4. Polyurethane Resin

- 9.2.5. Nitrocellulose Resin

- 9.2.6. Vinyl Resin

- 9.2.7. Others

- 10. Global Printing Inks Market Analysis, by End-Users

- 10.1. Key Segment Analysis

- 10.2. Printing Inks Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-Users, 2021-2035

- 10.2.1. Packaging Industry

- 10.2.1.1. Food & Beverage Packaging

- 10.2.1.2. Pharmaceutical Packaging

- 10.2.1.3. Cosmetics & Personal Care Packaging

- 10.2.1.4. Industrial Packaging

- 10.2.1.5. E-commerce Packaging

- 10.2.1.6. Others

- 10.2.2. Publishing & Commercial Printing

- 10.2.2.1. Books & Magazines

- 10.2.2.2. Newspapers

- 10.2.2.3. Catalogs & Brochures

- 10.2.2.4. Marketing Materials

- 10.2.2.5. Others

- 10.2.3. Textiles & Apparel

- 10.2.3.1. Fashion Apparel

- 10.2.3.2. Home Textiles

- 10.2.3.3. Technical Textiles

- 10.2.3.4. Sportswear

- 10.2.3.5. Others

- 10.2.4. Electronics & Electrical

- 10.2.4.1. Printed Circuit Boards (PCBs)

- 10.2.4.2. Solar Cells

- 10.2.4.3. Displays & Touchscreens

- 10.2.4.4. RFID Tags

- 10.2.4.5. Others

- 10.2.5. Automotive Industry

- 10.2.5.1. Interior Components

- 10.2.5.2. Exterior Graphics

- 10.2.5.3. Dashboards & Panels

- 10.2.5.4. Decorative Elements

- 10.2.5.5. Others

- 10.2.6. Building & Construction

- 10.2.6.1. Wallpapers

- 10.2.6.2. Decorative Laminates

- 10.2.6.3. Signage & Graphics

- 10.2.6.4. Architectural Films

- 10.2.6.5. Others

- 10.2.7. Healthcare & Medical

- 10.2.7.1. Medical Device Labeling

- 10.2.7.2. Pharmaceutical Packaging

- 10.2.7.3. Diagnostic Test Strips

- 10.2.7.4. Medical Textiles

- 10.2.7.5. Others

- 10.2.8. Consumer Goods

- 10.2.8.1. Toys & Games

- 10.2.8.2. Household Products

- 10.2.8.3. Sporting Goods

- 10.2.8.4. Promotional Items

- 10.2.8.5. Others

- 10.2.9. Other End-Users

- 10.2.1. Packaging Industry

- 11. Global Printing Inks Market Analysis, by Distribution Channel

- 11.1. Key Segment Analysis

- 11.2. Printing Inks Market Size (Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 11.2.1. Direct Sales

- 11.2.2. Distributors/Dealers

- 11.2.3. Online Retail

- 11.2.4. Specialty Stores

- 12. Global Printing Inks Market Analysis and Forecasts, by Region

- 12.1. Key Findings

- 12.2. Printing Inks Market Size (Volume - Million Units and Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 12.2.1. North America

- 12.2.2. Europe

- 12.2.3. Asia Pacific

- 12.2.4. Middle East

- 12.2.5. Africa

- 12.2.6. South America

- 13. North America Printing Inks Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. North America Printing Inks Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Product Type

- 13.3.2. End-use Industry

- 13.3.3. Distribution Channel

- 13.3.4. Country

- 13.3.4.1. USA

- 13.3.4.2. Canada

- 13.3.4.3. Mexico

- 13.4. USA Printing Inks Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Ink Type

- 13.4.3. Printing Process

- 13.4.4. Substrate Type

- 13.4.5. Resin Type

- 13.4.6. End-users

- 13.4.7. Distribution Channel

- 13.5. Canada Printing Inks Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Ink Type

- 13.5.3. Printing Process

- 13.5.4. Substrate Type

- 13.5.5. Resin Type

- 13.5.6. End-users

- 13.5.7. Distribution Channel

- 13.6. Mexico Printing Inks Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Ink Type

- 13.6.3. Printing Process

- 13.6.4. Substrate Type

- 13.6.5. Resin Type

- 13.6.6. End-users

- 13.6.7. Distribution Channel

- 14. Europe Printing Inks Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Europe Printing Inks Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Ink Type

- 14.3.2. Printing Process

- 14.3.3. Substrate Type

- 14.3.4. Resin Type

- 14.3.5. End-users

- 14.3.6. Distribution Channel

- 14.3.7. Country

- 14.3.7.1. Germany

- 14.3.7.2. United Kingdom

- 14.3.7.3. France

- 14.3.7.4. Italy

- 14.3.7.5. Spain

- 14.3.7.6. Netherlands

- 14.3.7.7. Nordic Countries

- 14.3.7.8. Poland

- 14.3.7.9. Russia & CIS

- 14.3.7.10. Rest of Europe

- 14.4. Germany Printing Inks Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Ink Type

- 14.4.3. Printing Process

- 14.4.4. Substrate Type

- 14.4.5. Resin Type

- 14.4.6. End-users

- 14.4.7. Distribution Channel

- 14.5. United Kingdom Printing Inks Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Ink Type

- 14.5.3. Printing Process

- 14.5.4. Substrate Type

- 14.5.5. Resin Type

- 14.5.6. End-users

- 14.5.7. Distribution Channel

- 14.6. France Printing Inks Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Ink Type

- 14.6.3. Printing Process

- 14.6.4. Substrate Type

- 14.6.5. Resin Type

- 14.6.6. End-users

- 14.6.7. Distribution Channel

- 14.7. Italy Printing Inks Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Ink Type

- 14.7.3. Printing Process

- 14.7.4. Substrate Type

- 14.7.5. Resin Type

- 14.7.6. End-users

- 14.7.7. Distribution Channel

- 14.8. Spain Printing Inks Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Ink Type

- 14.8.3. Printing Process

- 14.8.4. Substrate Type

- 14.8.5. Resin Type

- 14.8.6. End-users

- 14.8.7. Distribution Channel

- 14.9. Netherlands Printing Inks Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Ink Type

- 14.9.3. Printing Process

- 14.9.4. Substrate Type

- 14.9.5. Resin Type

- 14.9.6. End-users

- 14.9.7. Distribution Channel

- 14.10. Nordic Countries Printing Inks Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Ink Type

- 14.10.3. Printing Process

- 14.10.4. Substrate Type

- 14.10.5. Resin Type

- 14.10.6. End-users

- 14.10.7. Distribution Channel

- 14.11. Poland Printing Inks Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Ink Type

- 14.11.3. Printing Process

- 14.11.4. Substrate Type

- 14.11.5. Resin Type

- 14.11.6. End-users

- 14.11.7. Distribution Channel

- 14.12. Russia & CIS Printing Inks Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Ink Type

- 14.12.3. Printing Process

- 14.12.4. Substrate Type

- 14.12.5. Resin Type

- 14.12.6. End-users

- 14.12.7. Distribution Channel

- 14.13. Rest of Europe Printing Inks Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Ink Type

- 14.13.3. Printing Process

- 14.13.4. Substrate Type

- 14.13.5. Resin Type

- 14.13.6. End-users

- 14.13.7. Distribution Channel

- 15. Asia Pacific Printing Inks Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. East Asia Printing Inks Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Ink Type

- 15.3.2. Printing Process

- 15.3.3. Substrate Type

- 15.3.4. Resin Type

- 15.3.5. End-users

- 15.3.6. Distribution Channel

- 15.3.7. Country

- 15.3.7.1. China

- 15.3.7.2. India

- 15.3.7.3. Japan

- 15.3.7.4. South Korea

- 15.3.7.5. Australia and New Zealand

- 15.3.7.6. Indonesia

- 15.3.7.7. Malaysia

- 15.3.7.8. Thailand

- 15.3.7.9. Vietnam

- 15.3.7.10. Rest of Asia Pacific

- 15.4. China Printing Inks Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Ink Type

- 15.4.3. Printing Process

- 15.4.4. Substrate Type

- 15.4.5. Resin Type

- 15.4.6. End-users

- 15.4.7. Distribution Channel

- 15.5. India Printing Inks Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Ink Type

- 15.5.3. Printing Process

- 15.5.4. Substrate Type

- 15.5.5. Resin Type

- 15.5.6. End-users

- 15.5.7. Distribution Channel

- 15.6. Japan Printing Inks Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Ink Type

- 15.6.3. Printing Process

- 15.6.4. Substrate Type

- 15.6.5. Resin Type

- 15.6.6. End-users

- 15.6.7. Distribution Channel

- 15.7. South Korea Printing Inks Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Ink Type

- 15.7.3. Printing Process

- 15.7.4. Substrate Type

- 15.7.5. Resin Type

- 15.7.6. End-users

- 15.7.7. Distribution Channel

- 15.8. Australia and New Zealand Printing Inks Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Ink Type

- 15.8.3. Printing Process

- 15.8.4. Substrate Type

- 15.8.5. Resin Type

- 15.8.6. End-users

- 15.8.7. Distribution Channel

- 15.9. Indonesia Printing Inks Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Ink Type

- 15.9.3. Printing Process

- 15.9.4. Substrate Type

- 15.9.5. Resin Type

- 15.9.6. End-users

- 15.9.7. Distribution Channel

- 15.10. Malaysia Printing Inks Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Ink Type

- 15.10.3. Printing Process

- 15.10.4. Substrate Type

- 15.10.5. Resin Type

- 15.10.6. End-users

- 15.10.7. Distribution Channel

- 15.11. Thailand Printing Inks Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Ink Type

- 15.11.3. Printing Process

- 15.11.4. Substrate Type

- 15.11.5. Resin Type

- 15.11.6. End-users

- 15.11.7. Distribution Channel

- 15.12. Vietnam Printing Inks Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Ink Type

- 15.12.3. Printing Process

- 15.12.4. Substrate Type

- 15.12.5. Resin Type

- 15.12.6. End-users

- 15.12.7. Distribution Channel

- 15.13. Rest of Asia Pacific Printing Inks Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Ink Type

- 15.13.3. Printing Process

- 15.13.4. Substrate Type

- 15.13.5. Resin Type

- 15.13.6. End-users

- 15.13.7. Distribution Channel

- 16. Middle East Printing Inks Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Middle East Printing Inks Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Ink Type

- 16.3.2. Printing Process

- 16.3.3. Substrate Type

- 16.3.4. Resin Type

- 16.3.5. End-users

- 16.3.6. Distribution Channel

- 16.3.7. Country

- 16.3.7.1. Turkey

- 16.3.7.2. UAE

- 16.3.7.3. Saudi Arabia

- 16.3.7.4. Israel

- 16.3.7.5. Rest of Middle East

- 16.4. Turkey Printing Inks Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Ink Type

- 16.4.3. Printing Process

- 16.4.4. Substrate Type

- 16.4.5. Resin Type

- 16.4.6. End-users

- 16.4.7. Distribution Channel

- 16.5. UAE Printing Inks Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Ink Type

- 16.5.3. Printing Process

- 16.5.4. Substrate Type

- 16.5.5. Resin Type

- 16.5.6. End-users

- 16.5.7. Distribution Channel

- 16.6. Saudi Arabia Printing Inks Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Ink Type

- 16.6.3. Printing Process

- 16.6.4. Substrate Type

- 16.6.5. Resin Type

- 16.6.6. End-users

- 16.6.7. Distribution Channel

- 16.7. Israel Printing Inks Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Ink Type

- 16.7.3. Printing Process

- 16.7.4. Substrate Type

- 16.7.5. Resin Type

- 16.7.6. End-users

- 16.7.7. Distribution Channel

- 16.8. Rest of Middle East Printing Inks Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Ink Type

- 16.8.3. Printing Process

- 16.8.4. Substrate Type

- 16.8.5. Resin Type

- 16.8.6. End-users

- 16.8.7. Distribution Channel

- 17. Africa Printing Inks Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Africa Printing Inks Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Ink Type

- 17.3.2. Printing Process

- 17.3.3. Substrate Type

- 17.3.4. Resin Type

- 17.3.5. End-users

- 17.3.6. Distribution Channel

- 17.3.7. Country

- 17.3.7.1. South Africa

- 17.3.7.2. Egypt

- 17.3.7.3. Nigeria

- 17.3.7.4. Algeria

- 17.3.7.5. Rest of Africa

- 17.4. South Africa Printing Inks Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Ink Type

- 17.4.3. Printing Process

- 17.4.4. Substrate Type

- 17.4.5. Resin Type

- 17.4.6. End-users

- 17.4.7. Distribution Channel

- 17.5. Egypt Printing Inks Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Ink Type

- 17.5.3. Printing Process

- 17.5.4. Substrate Type

- 17.5.5. Resin Type

- 17.5.6. End-users

- 17.5.7. Distribution Channel

- 17.6. Nigeria Printing Inks Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Ink Type

- 17.6.3. Printing Process

- 17.6.4. Substrate Type

- 17.6.5. Resin Type

- 17.6.6. End-users

- 17.6.7. Distribution Channel

- 17.7. Algeria Printing Inks Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Ink Type

- 17.7.3. Printing Process

- 17.7.4. Substrate Type

- 17.7.5. Resin Type

- 17.7.6. End-users

- 17.7.7. Distribution Channel

- 17.8. Rest of Africa Printing Inks Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Ink Type

- 17.8.3. Printing Process

- 17.8.4. Substrate Type

- 17.8.5. Resin Type

- 17.8.6. End-users

- 17.8.7. Distribution Channel

- 18. South America Printing Inks Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Central and South Africa Printing Inks Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Ink Type

- 18.3.2. Printing Process

- 18.3.3. Substrate Type

- 18.3.4. Resin Type

- 18.3.5. End-users

- 18.3.6. Distribution Channel

- 18.3.7. Country

- 18.3.7.1. Brazil

- 18.3.7.2. Argentina

- 18.3.7.3. Rest of South America

- 18.4. Brazil Printing Inks Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Ink Type

- 18.4.3. Printing Process

- 18.4.4. Substrate Type

- 18.4.5. Resin Type

- 18.4.6. End-users

- 18.4.7. Distribution Channel

- 18.5. Argentina Printing Inks Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Ink Type

- 18.5.3. Printing Process

- 18.5.4. Substrate Type

- 18.5.5. Resin Type

- 18.5.6. End-users

- 18.5.7. Distribution Channel

- 18.6. Rest of South America Printing Inks Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Ink Type

- 18.6.3. Printing Process

- 18.6.4. Substrate Type

- 18.6.5. Resin Type

- 18.6.6. End-users

- 18.6.7. Distribution Channel

- 19. Key Players/ Company Profile

- 19.1. AGFA-Gevaert Group

- 19.1.1. Company Details/ Overview

- 19.1.2. Company Financials

- 19.1.3. Key Customers and Competitors

- 19.1.4. Business/ Industry Portfolio

- 19.1.5. Product Portfolio/ Specification Details

- 19.1.6. Pricing Data

- 19.1.7. Strategic Overview

- 19.1.8. Recent Developments

- 19.2. ALTANA AG

- 19.3. Arets Graphics N.V.

- 19.4. BASF SE

- 19.5. Canon Inc.

- 19.6. DIC Corporation

- 19.7. DuPont de Nemours, Inc.

- 19.8. Epson America, Inc.

- 19.9. Flint Group

- 19.10. FUJIFILM Sericol India Pvt Ltd.

- 19.11. HP Inc.

- 19.12. Huber Group

- 19.13. Mimaki Engineering Co., Ltd.

- 19.14. Nazdar Ink Technologies

- 19.15. Royal Dutch Printing Ink Factories Van Son

- 19.16. Sakata Inx Corporation

- 19.17. Siegwerk Druckfarben AG & Co. KGaA

- 19.18. Sun Chemical Corporation

- 19.19. T&K Toka Co., Ltd.

- 19.20. Tokyo Printing Ink Mfg Co., Ltd.

- 19.21. Toyo Ink SC Holdings Co., Ltd.

- 19.22. Wikoff Color Corporation

- 19.23. Xerox Corporation

- 19.24. Zeller+Gmelin GmbH & Co. KG

- 19.25. Other Key Players

- 19.1. AGFA-Gevaert Group

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation