Rubber Track Market Size, Share, Growth Opportunity Analysis Report by Product Type (Overlapping/ Non-continuous Wire Strand and Continuous Wire Strand), Component, Trade Pattern, Equipment, Application, Sales Channel and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Rubber Track Market Size, Share, and Growth

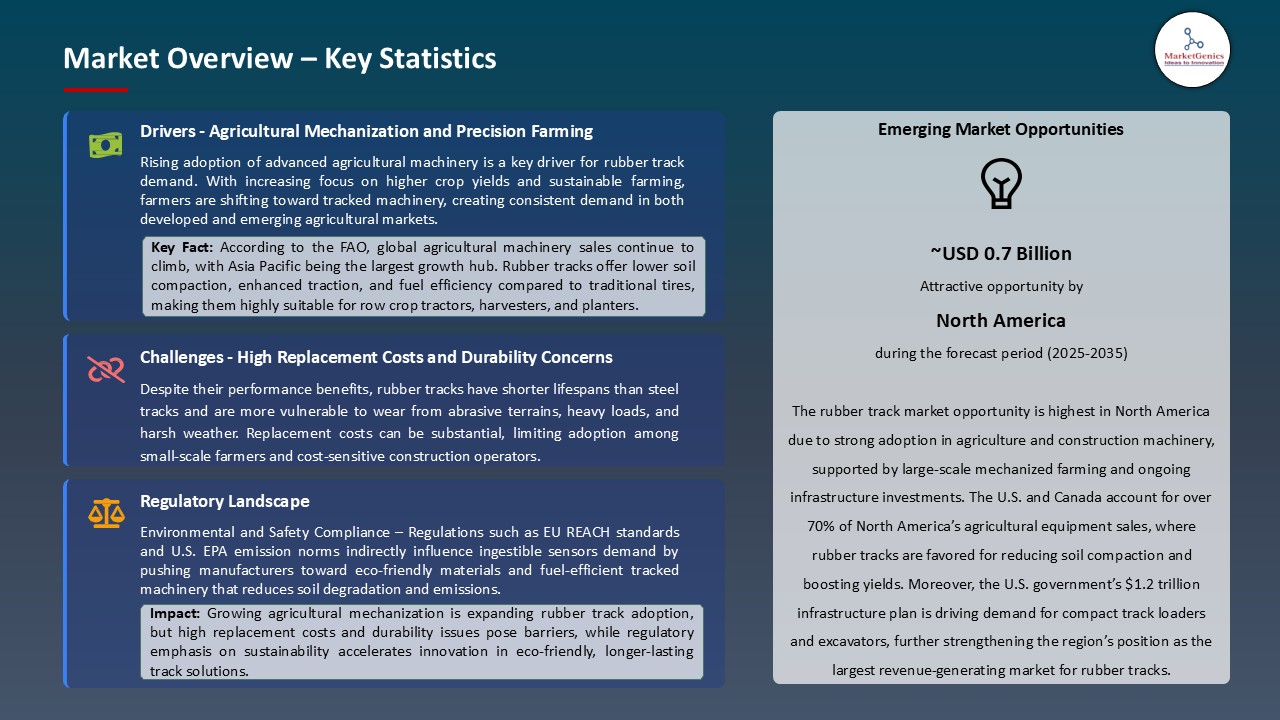

The worldwide rubber track market is expanding from USD 2.1 billion in 2025 to USD 4.0 billion by the year 2035, showing a CAGR of 5.9% over the forecast period. With continued advances worldwide in research and development aimed at improving track performance and durability, the global platform for rubber tracks flourishes. Manufacturers engineer rubber compounds and steel cord reinforcements that can better resist wear and flex at different temperatures.

"Bridgestone and Camso are famous examples of companies that came up with rubber tracks that provide enhanced traction and reduced ground pressure to meet the increasingly demanding needs of modern construction and agricultural machinery. This makes equipment last longer, and operators can benefit from better productivity and cost savings."

The global rubber track market as key opportunities arising around agriculture automation; an off-road autonomous vehicle market; defense UGVs using rubber tracks for stealth and mobility; and electrification of construction equipment, wherein rubber tracks are required to be lightweight yet highly durable. Together, these segments strive to diversify from and bring long-term growth to rubber track manufacturers.

Rubber Track Market Dynamics and Trends

Driver: Technological Advancements in Rubber Track Design

- Due to ongoing technological innovations enhancing track performance and durability, the international rubber track market is witnessing a tremendous upswing in growth. This saw producers develop superior rubber compounds and steel cord reinforcements coming with better wear-resistance properties while retaining a level of flexibility against changing temperature conditions.

- For instance, companies like Bridgestone and Camso created their rubber track materials to supply rubber tracks with better traction and less ground pressure, addressing the hindrances faced by machines operating in modern construction and agriculture. The benefits thus offered are that they prevent very frequent replacement requirements of equipment, hence operational efficiency and cost savings.

Driver: Expansion in Agriculture and Construction Sectors

- With fast industrialization of agriculture and increased construction activities worldwide, the demand for rubber tracks continues to grow. Rubber tracks are preferred over steel tracks as they cause lesser compaction of the soils, offer better maneuverability, and provide much better traction on all sorts of terrain, positioning them as functional alternatives within the Off-the-road (OTR) Tire.

- Moreover, using rubber tracks on machinery for tractors and harvesters enhances productivity in the fields and reduces crop damages in agriculture while in construction; rubber track-fitted equipment forms one of the most important factors in urban projects wherein ground disturbance needs to be kept to a minimum.

Restraint: High Initial Costs and Maintenance Requirements

- The high entrance prices for rubber tracks and the maintenance form some serious restraints on the market growth. Premium rubber tracks command extreme prices when they bear fancy features such as reinforcement layers or non-marking surfaces.

- Leveling up performance rubber tracks will, in turn, cost 20%-30% over the usual tracks, but small-time operators barely adopt them. Following this, cleaning and adjustments to tension practices keep contributing to the added operational cost. These considerations accentuate the tough game for price-sensitive markets, where matters of affordability are usually major; hence, such users go toward other realization tracks, including steel tracks or used tracks.

Opportunity: Growing Demand for Sustainable Rubber Tracks

- Growing awareness on sustainability presents huge opportunities to the rubber track market. Being an environmentally friendly PCR, manufacturers are now developing rubber tracks that are biodegradable and recyclable. More than 15% of new rubber tracks that entered the market in 2023 were designed with sustainability in mind, serving industries that prioritize environmentally friendly work practices. Such rubber tracks have good uptake in regions like Europe and North America, where strong environmental regulations are in effect.

- Along with this, the growing demand for electric construction and farm equipment offers further opportunities since rubber tracks go well with the low-noise and vibration features present in these machines.

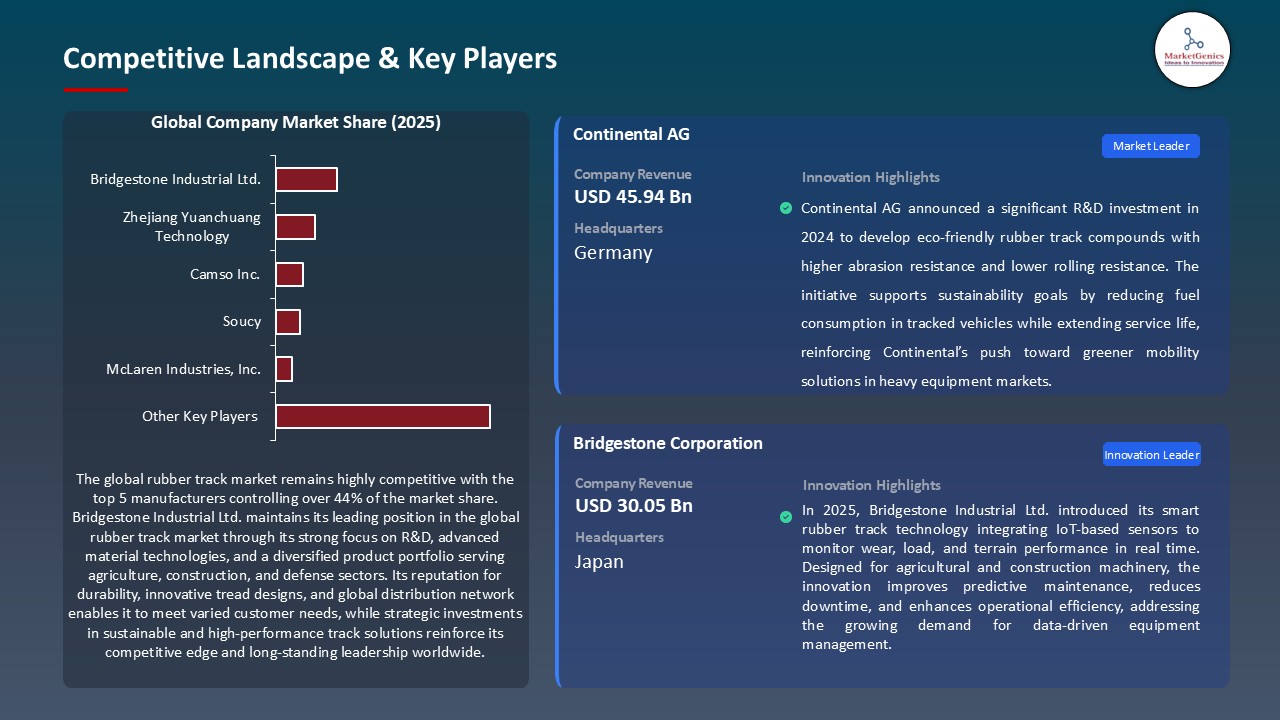

Key Trend: Integration of Smart Technologies in Rubber Tracks

- In the rubber track sector, a move towards smart technology for enhancing performance and maintenance is currently in trend. Manufacturers are inserting sensors within rubber tracks to monitor factors like temperature, pressure, and wear in real-time. The data evaluated provides for predictive maintenance; thus, less downtime is experienced and track service life is increased.

- Moreover, IoT technology presents a scenario for remote monitoring and diagnostics, thus raising productivity. For instance, such companies are making smart tracks that can prompt fleet management systems, thereby providing data concerning use and fill maintenance.

Rubber Track Market Analysis and Segmental Data

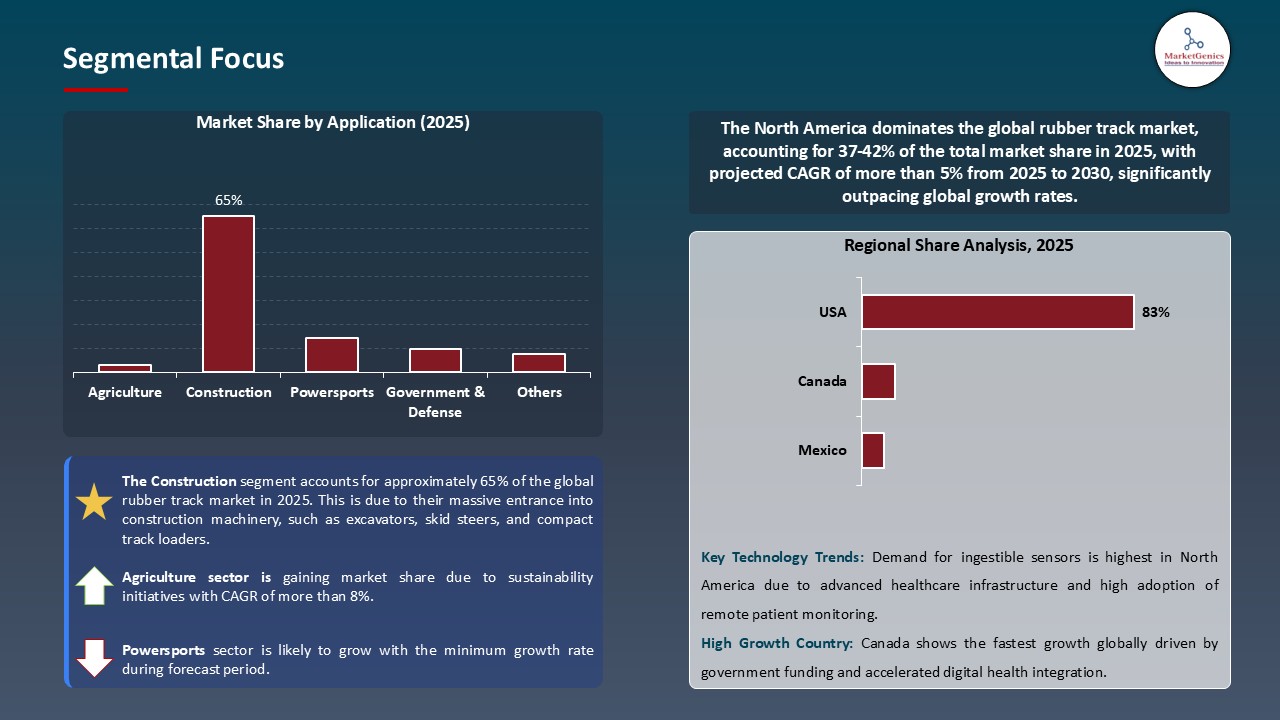

Based on Application, the Construction Segment Retains the Largest Share

- The construction segment holds major share ~65% in the global rubber track market. This is due to their massive entrance into construction machinery, such as excavators, skid steers, and compact track loaders. In essence, these tracks present excellent traction and reduced ground pressure for better maneuverability in urban construction projects and sensitive terrains.

- For example, in December 2022, China Railway Construction Corporation Limited finished undersea tunneling for the Hengqin extension line of the Macao Light Rapid Transit, thereby expounding on the significance of rubber-tracked machinery in strong, complex construction projects.

- Moreover, raising the group's needs for machinery needed for infrastructure and construction. Construction investments in India are slated to touch USD 1.4 trillion by 2025, with large proportions going to roads, highways, and urban infrastructure. The huge investments underline the increasing requirements of construction machinery, thereby facilitating the demand for rubber tracks in the construction industry.

Snowmobile Tracks Expected to Be Top by Propulsion Through Forecast Period

- The segment of snowmobile track is registering the highest growth in the rubber tracks market in the world as a result of rapidly growing winter sports popularity and booming snow tourism activities, intersecting seasonal demand patterns seen in the Automotive Tire. Snowmobiling provides very good mobility on snow-covered terrain and is hence important for winter recreation and transport in snow-laden areas.

- The demand for snowmobiling is high in Canada, the USA, and the Nordic Countries where an immense area gets covered under snow. Such high demand would hence require the manufacturing of rubber tracks that are highly durable and efficient under harsh winter working environments. Hence, manufacturers are in the working of trying to put together better rubber compounds and tread designs that can enhance snowmobile track performance and safety.

- Hence, for instance, Camso and Polaris have developed new-generation snowmobile tracks to provide increased traction and durability to meet the growing needs of winter sports enthusiasts and professionals.

North America Dominates Global Rubber Track Market in 2025 and Beyond

- In view of heavy investments in infrastructure and advanced agricultural practices, the demand for rubber tracks has been the highest in North America. Support for infrastructure projects started when nearly USD 400 billion was apportioned under the USA Bipartisan Infrastructure Law for facilitating construction equipment fitted with rubber tracks, to ensure smooth operations with less disturbance to adjacent infrastructures in dense urban areas. Moreover, the focus on precision farming and environmentally sound practices in agriculture in the area is encouraging the use of rubber-tracked equipment to increase farm productivity and soil health.

- Seminal manufacturers and suppliers also boost the market growth in North America. Bridgestone and Camso had developed improved rubber tracks that offered better wear resistance and enhanced traction properties, key to their heavy-duty applications in construction and agriculture. This efficiency in construction equates to operational cost profits derived out of the equipment lifetimes increased by such advancements.

Rubber Track Market Ecosystem

Key players in the global rubber track market include prominent companies such as Bridgestone Corporation, Camso Inc., Zhejiang Yuanchuang Technology, Soucy, McLaren Industries, Inc. and Other Key Players.

The market is fragmented for rubber-track-setting companies-a fine balance across the Tier 1 (e.g., Bridgestone, Camso, Continental) and second-tier players (e.g., Soucy, McLaren Industries) and the Tier 3 players (e.g., DIGBITS, Chermack Machine). The Tier 1 players enjoy vast technological capabilities and supply chain facilities, whereas quite a few smaller suppliers cater to niche or regional demands. Buyer concentration remains medium, and on demand, it falls under agriculture, construction, and defense; supplier concentration remains comparatively low due to the alikeness of raw materials and component suppliers.

Recent Development and Strategic Overview:

- In June 2024, The Michelin Group launched a new series of rubber tracks at Eurosatory 2024 to further diversify its product portfolio. The new introduction intends to address the increased demand coming from sectors such as defense and construction. The new rubber tracks aim to achieve better durability and performance over variable terrains, thus keeping pace with the industry's demand for more versatile and robust equipment.

- In January 2024, Mattracks has been successful in developing a new generation of narrow rubber tracks meant for row crop applications that measure anywhere from 9.6 to 12 inches. The tracks reduce soil compaction by as much as 40% in comparison to tires, therefore leading to increased crop yield and profits for the farmer. There is a rubber torsion anti-torque system working on one side, with a rubber torsion rocker internal suspension on the other side of the design, giving it excellent stability and good performance for agricultural operations.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 2.1 Bn |

|

Market Forecast Value in 2035 |

USD 4.0 Bn |

|

Growth Rate (CAGR) |

5.9% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Rubber Track Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Product Type |

|

|

By Component |

|

|

By Trade Pattern |

|

|

By Equipment |

|

|

By Application |

|

|

By Sales Channel |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Rubber Track Market Outlook

- 2.1.1. Rubber Track Market Size (Volume – Mn Units and Value - US$ Bn), and Forecasts, 2020-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Rubber Track Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automotive & Transportation Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automotive & Transportation Industry

- 3.1.3. Regional Distribution for Automotive & Transportation Industry

- 3.2. Supplier Customer Data

- 3.3. Component Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the Component & Raw Material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Automotive & Transportation Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for compact construction equipment in urban infrastructure projects.

- 4.1.1.2. Growth in mechanized agriculture across developing economies.

- 4.1.1.3. Advancements in rubber track technology improving durability and terrain adaptability.

- 4.1.2. Restraints

- 4.1.2.1. Volatility in natural rubber prices due to environmental and geopolitical factors.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Component Suppliers

- 4.4.2. Rubber Track Manufacturers

- 4.4.3. Dealers/ Distributors

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Rubber Track Market Demand

- 4.9.1. Historical Market Size - in Volume (Mn Units) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - in Volume (Mn Units) and Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Rubber Track Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Rubber Track Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2020-2035

- 6.2.1. Overlapping/ Non-continuous Wire Strand

- 6.2.2. Continuous Wire Strand

- 7. Global Rubber Track Market Analysis, by Component

- 7.1. Key Segment Analysis

- 7.2. Rubber Track Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Component, 2020-2035

- 7.2.1. Rubber

- 7.2.2. Metal Pieces

- 7.2.3. Steel Cord

- 7.2.4. Textile Wrapping

- 7.2.5. Others

- 8. Global Rubber Track Market Analysis, by Trade Pattern

- 8.1. Key Segment Analysis

- 8.2. Rubber Track Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Trade Pattern, 2020-2035

- 8.2.1. Standard Block Tread

- 8.2.2. C-lug Thread

- 8.2.3. Straight Bar Tread

- 8.2.4. Multi-bar Tread

- 8.2.5. Others

- 9. Global Rubber Track Market Analysis, by Equipment

- 9.1. Key Segment Analysis

- 9.2. Rubber Track Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Equipment, 2020-2035

- 9.2.1. Snowmobile Tracks

- 9.2.2. Skid Steer Tracks

- 9.2.3. Snow Groomer Tracks

- 9.2.4. Earth-mover Tracks

- 9.2.5. Skid Loader Rubber Tracks

- 9.2.6. Dump Carrier Rubber Tracks

- 9.2.7. Excavator Rubber Tracks

- 9.2.8. Others

- 10. Global Rubber Track Market Analysis, by Application

- 10.1. Key Segment Analysis

- 10.2. Rubber Track Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Application, 2020-2035

- 10.2.1. Agriculture

- 10.2.2. Construction

- 10.2.3. Powersports

- 10.2.4. Government & Defense

- 10.2.5. Others

- 11. Global Rubber Track Market Analysis, by Sales Channel

- 11.1. Key Segment Analysis

- 11.2. Rubber Track Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Sales Channel, 2020-2035

- 11.2.1. OEM

- 11.2.2. Aftermarket

- 12. Global Rubber Track Market Analysis and Forecasts, by Region

- 12.1. Key Findings

- 12.2. Rubber Track Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Region, 2020-2035

- 12.2.1. North America

- 12.2.2. Europe

- 12.2.3. Asia Pacific

- 12.2.4. Middle East

- 12.2.5. Africa

- 12.2.6. South America

- 13. North America Rubber Track Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. North America Rubber Track Market Size Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 13.3.1. Product Type

- 13.3.2. Component

- 13.3.3. Trade Pattern

- 13.3.4. Equipment

- 13.3.5. Application

- 13.3.6. Sales Channel

- 13.3.7. Country

- 13.3.7.1. USA

- 13.3.7.2. Canada

- 13.3.7.3. Mexico

- 13.4. USA Rubber Track Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Product Type

- 13.4.3. Component

- 13.4.4. Trade Pattern

- 13.4.5. Equipment

- 13.4.6. Application

- 13.4.7. Sales Channel

- 13.5. Canada Rubber Track Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Product Type

- 13.5.3. Component

- 13.5.4. Trade Pattern

- 13.5.5. Equipment

- 13.5.6. Application

- 13.5.7. Sales Channel

- 13.6. Mexico Rubber Track Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Product Type

- 13.6.3. Component

- 13.6.4. Trade Pattern

- 13.6.5. Equipment

- 13.6.6. Application

- 13.6.7. Sales Channel

- 14. Europe Rubber Track Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Europe Rubber Track Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 14.3.1. Product Type

- 14.3.2. Component

- 14.3.3. Trade Pattern

- 14.3.4. Equipment

- 14.3.5. Application

- 14.3.6. Sales Channel

- 14.3.7. Country

- 14.3.7.1. Germany

- 14.3.7.2. United Kingdom

- 14.3.7.3. France

- 14.3.7.4. Italy

- 14.3.7.5. Spain

- 14.3.7.6. Netherlands

- 14.3.7.7. Nordic Countries

- 14.3.7.8. Poland

- 14.3.7.9. Russia & CIS

- 14.3.7.10. Rest of Europe

- 14.4. Germany Rubber Track Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Component

- 14.4.4. Trade Pattern

- 14.4.5. Equipment

- 14.4.6. Application

- 14.4.7. Sales Channel

- 14.5. United Kingdom Rubber Track Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Component

- 14.5.4. Trade Pattern

- 14.5.5. Equipment

- 14.5.6. Application

- 14.5.7. Sales Channel

- 14.6. France Rubber Track Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Component

- 14.6.4. Trade Pattern

- 14.6.5. Equipment

- 14.6.6. Application

- 14.6.7. Sales Channel

- 14.7. Italy Rubber Track Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Product Type

- 14.7.3. Component

- 14.7.4. Trade Pattern

- 14.7.5. Equipment

- 14.7.6. Application

- 14.7.7. Sales Channel

- 14.8. Spain Rubber Track Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Product Type

- 14.8.3. Component

- 14.8.4. Trade Pattern

- 14.8.5. Equipment

- 14.8.6. Application

- 14.8.7. Sales Channel

- 14.9. Netherlands Rubber Track Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Product Type

- 14.9.3. Component

- 14.9.4. Trade Pattern

- 14.9.5. Equipment

- 14.9.6. Application

- 14.9.7. Sales Channel

- 14.10. Nordic Countries Rubber Track Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Product Type

- 14.10.3. Component

- 14.10.4. Trade Pattern

- 14.10.5. Equipment

- 14.10.6. Application

- 14.10.7. Sales Channel

- 14.11. Poland Rubber Track Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Product Type

- 14.11.3. Component

- 14.11.4. Trade Pattern

- 14.11.5. Equipment

- 14.11.6. Application

- 14.11.7. Sales Channel

- 14.12. Russia & CIS Rubber Track Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Product Type

- 14.12.3. Component

- 14.12.4. Trade Pattern

- 14.12.5. Equipment

- 14.12.6. Application

- 14.12.7. Sales Channel

- 14.13. Rest of Europe Rubber Track Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Product Type

- 14.13.3. Component

- 14.13.4. Trade Pattern

- 14.13.5. Equipment

- 14.13.6. Application

- 14.13.7. Sales Channel

- 15. Asia Pacific Rubber Track Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. East Asia Rubber Track Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 15.3.1. Product Type

- 15.3.2. Component

- 15.3.3. Trade Pattern

- 15.3.4. Equipment

- 15.3.5. Application

- 15.3.6. Sales Channel

- 15.3.7. Country

- 15.3.7.1. China

- 15.3.7.2. India

- 15.3.7.3. Japan

- 15.3.7.4. South Korea

- 15.3.7.5. Australia and New Zealand

- 15.3.7.6. Indonesia

- 15.3.7.7. Malaysia

- 15.3.7.8. Thailand

- 15.3.7.9. Vietnam

- 15.3.7.10. Rest of Asia Pacific

- 15.4. China Rubber Track Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Component

- 15.4.4. Trade Pattern

- 15.4.5. Equipment

- 15.4.6. Application

- 15.4.7. Sales Channel

- 15.5. India Rubber Track Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Component

- 15.5.4. Trade Pattern

- 15.5.5. Equipment

- 15.5.6. Application

- 15.5.7. Sales Channel

- 15.6. Japan Rubber Track Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Component

- 15.6.4. Trade Pattern

- 15.6.5. Equipment

- 15.6.6. Application

- 15.6.7. Sales Channel

- 15.7. South Korea Rubber Track Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Component

- 15.7.4. Trade Pattern

- 15.7.5. Equipment

- 15.7.6. Application

- 15.7.7. Sales Channel

- 15.8. Australia and New Zealand Rubber Track Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Component

- 15.8.4. Trade Pattern

- 15.8.5. Equipment

- 15.8.6. Application

- 15.8.7. Sales Channel

- 15.9. Indonesia Rubber Track Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Product Type

- 15.9.3. Component

- 15.9.4. Trade Pattern

- 15.9.5. Equipment

- 15.9.6. Application

- 15.9.7. Sales Channel

- 15.10. Malaysia Rubber Track Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Product Type

- 15.10.3. Component

- 15.10.4. Trade Pattern

- 15.10.5. Equipment

- 15.10.6. Application

- 15.10.7. Sales Channel

- 15.11. Thailand Rubber Track Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Product Type

- 15.11.3. Component

- 15.11.4. Trade Pattern

- 15.11.5. Equipment

- 15.11.6. Application

- 15.11.7. Sales Channel

- 15.12. Vietnam Rubber Track Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Product Type

- 15.12.3. Component

- 15.12.4. Trade Pattern

- 15.12.5. Equipment

- 15.12.6. Application

- 15.12.7. Sales Channel

- 15.13. Rest of Asia Pacific Rubber Track Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Product Type

- 15.13.3. Component

- 15.13.4. Trade Pattern

- 15.13.5. Equipment

- 15.13.6. Application

- 15.13.7. Sales Channel

- 16. Middle East Rubber Track Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Middle East Rubber Track Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 16.3.1. Product Type

- 16.3.2. Component

- 16.3.3. Trade Pattern

- 16.3.4. Equipment

- 16.3.5. Application

- 16.3.6. Sales Channel

- 16.3.7. Country

- 16.3.7.1. Turkey

- 16.3.7.2. UAE

- 16.3.7.3. Saudi Arabia

- 16.3.7.4. Israel

- 16.3.7.5. Rest of Middle East

- 16.4. Turkey Rubber Track Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Component

- 16.4.4. Trade Pattern

- 16.4.5. Equipment

- 16.4.6. Application

- 16.4.7. Sales Channel

- 16.5. UAE Rubber Track Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Component

- 16.5.4. Trade Pattern

- 16.5.5. Equipment

- 16.5.6. Application

- 16.5.7. Sales Channel

- 16.6. Saudi Arabia Rubber Track Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Component

- 16.6.4. Trade Pattern

- 16.6.5. Equipment

- 16.6.6. Application

- 16.6.7. Sales Channel

- 16.7. Israel Rubber Track Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Component

- 16.7.4. Trade Pattern

- 16.7.5. Equipment

- 16.7.6. Application

- 16.7.7. Sales Channel

- 16.8. Rest of Middle East Rubber Track Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Component

- 16.8.4. Trade Pattern

- 16.8.5. Equipment

- 16.8.6. Application

- 16.8.7. Sales Channel

- 17. Africa Rubber Track Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Africa Rubber Track Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 17.3.1. Product Type

- 17.3.2. Component

- 17.3.3. Trade Pattern

- 17.3.4. Equipment

- 17.3.5. Application

- 17.3.6. Sales Channel

- 17.3.7. Country

- 17.3.7.1. South Africa

- 17.3.7.2. Egypt

- 17.3.7.3. Nigeria

- 17.3.7.4. Algeria

- 17.3.7.5. Rest of Africa

- 17.4. South Africa Rubber Track Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Component

- 17.4.4. Trade Pattern

- 17.4.5. Equipment

- 17.4.6. Application

- 17.4.7. Sales Channel

- 17.5. Egypt Rubber Track Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Component

- 17.5.4. Trade Pattern

- 17.5.5. Equipment

- 17.5.6. Application

- 17.5.7. Sales Channel

- 17.6. Nigeria Rubber Track Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Component

- 17.6.4. Trade Pattern

- 17.6.5. Equipment

- 17.6.6. Application

- 17.6.7. Sales Channel

- 17.7. Algeria Rubber Track Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Component

- 17.7.4. Trade Pattern

- 17.7.5. Equipment

- 17.7.6. Application

- 17.7.7. Sales Channel

- 17.8. Rest of Africa Rubber Track Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Component

- 17.8.4. Trade Pattern

- 17.8.5. Equipment

- 17.8.6. Application

- 17.8.7. Sales Channel

- 18. South America Rubber Track Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Central and South Africa Rubber Track Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 18.3.1. Product Type

- 18.3.2. Component

- 18.3.3. Trade Pattern

- 18.3.4. Equipment

- 18.3.5. Application

- 18.3.6. Sales Channel

- 18.3.7. Country

- 18.3.7.1. Brazil

- 18.3.7.2. Argentina

- 18.3.7.3. Rest of South America

- 18.4. Brazil Rubber Track Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Component

- 18.4.4. Trade Pattern

- 18.4.5. Equipment

- 18.4.6. Application

- 18.4.7. Sales Channel

- 18.5. Argentina Rubber Track Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Component

- 18.5.4. Trade Pattern

- 18.5.5. Equipment

- 18.5.6. Application

- 18.5.7. Sales Channel

- 18.6. Rest of South America Rubber Track Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Component

- 18.6.4. Trade Pattern

- 18.6.5. Equipment

- 18.6.6. Application

- 18.6.7. Sales Channel

- 19. Key Players/ Company Profile

- 19.1. Bridgestone Corporation

- 19.1.1. Company Details/ Overview

- 19.1.2. Company Financials

- 19.1.3. Key Customers and Competitors

- 19.1.4. Business/ Industry Portfolio

- 19.1.5. Product Portfolio/ Specification Details

- 19.1.6. Pricing Data

- 19.1.7. Strategic Overview

- 19.1.8. Recent Developments

- 19.2. Camso Inc.

- 19.3. CFS Machinery Co., Ltd.

- 19.4. CGA Ricambi

- 19.5. Chermack Machine Inc.

- 19.6. Continental AG

- 19.7. DIGBITS Ltd.

- 19.8. Gruppo Minitop srl

- 19.9. ITR America

- 19.10. McLaren Industries, Inc.

- 19.11. Poson Forging Co., Ltd.

- 19.12. Soucy

- 19.13. X-Trac Rubber Tracks

- 19.14. Zhejiang Yuanchuang Technology

- 19.15. Other Key Players

- 19.1. Bridgestone Corporation

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation