Servo Motors and Drives Market Size, Share & Trends Analysis Report by Product Type (Servo Motors, Servo Drives), Technology, Communication Protocol, Power Rating, Voltage Range, Offering, System Architecture, Mounting Type, Sales Channel, End-Use Industry and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Servo Motors and Drives Market Size, Share, and Growth

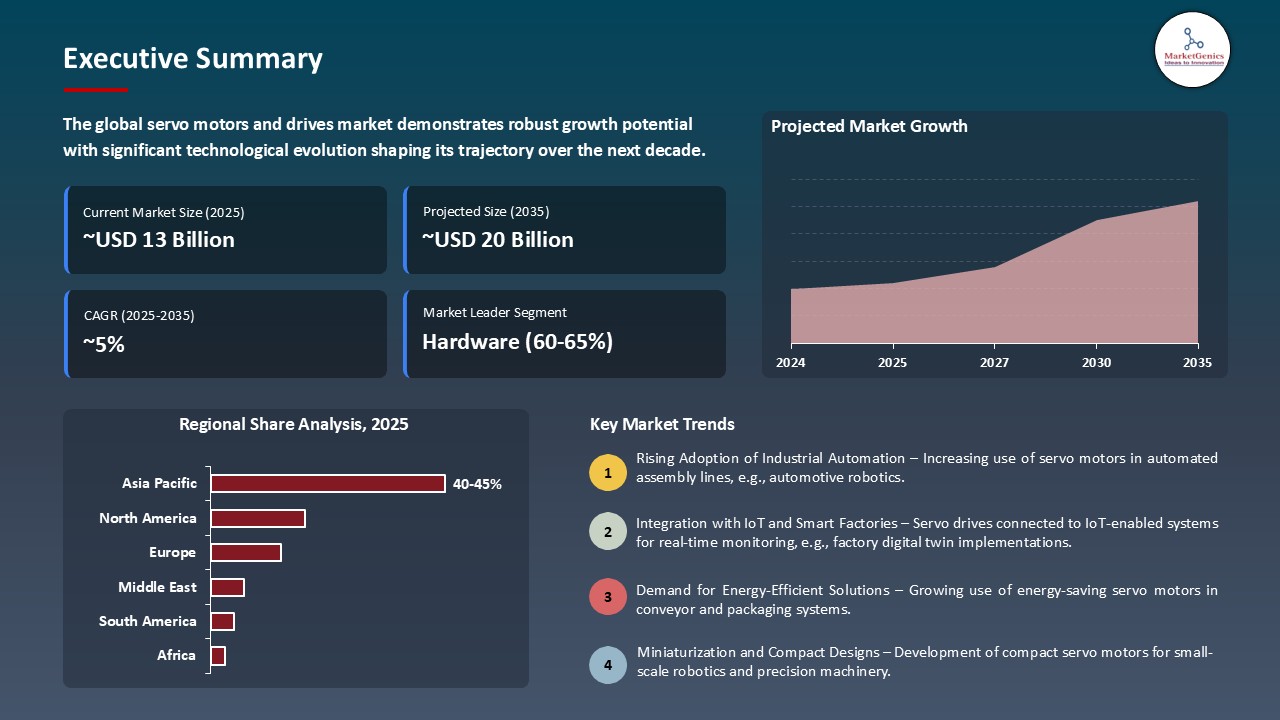

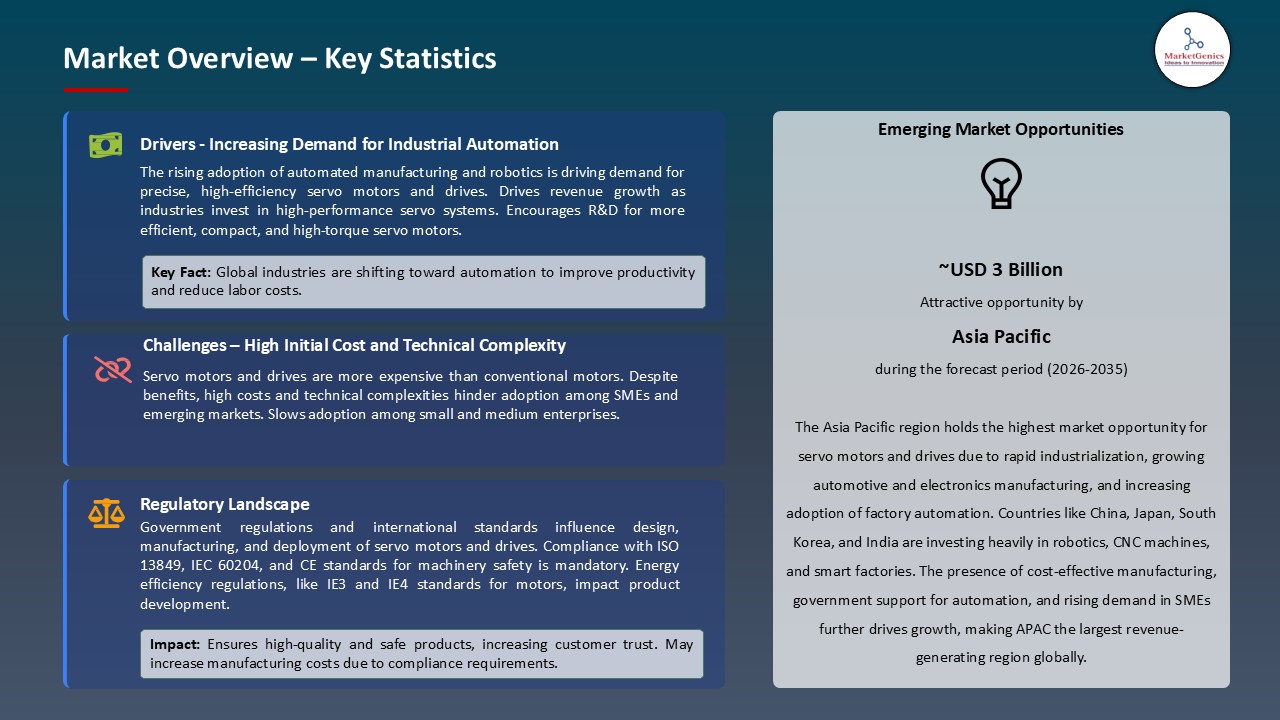

The global servo motors and drives market is witnessing strong growth, valued at USD 12.7 billion in 2025 and projected to reach USD 20.3 billion by 2035, expanding at a CAGR of 4.8% during the forecast period. North America is the fastest-growing region in the servo motors and drives market due to the early adoption of advanced manufacturing technologies, high demand for precision automation, and strong investments in research and development across key industrial sectors.

Oliver Giertz, Strategic Product Manager for Servo & Robots at Mitsubishi Electric, explained, “MELSERVO-JET was designed for companies looking to make targeted automation improvements with predictable results and controlled costs, it responds to today's approach to automation investments, where quick and measurable return on investment is essential”.

Servo motors and drives are being adopted in the market through continuous innovations in servo motors and drives, like increased torque density, reduced and lightweight systems, enhanced heat dissipation, and inbuilt safety functions like Safe Torque Off (STO) and vibration suppression. These improvements enable the manufactures to realize more accurate motion control, quicker response durations, and dependable working in extreme industrial applications such as robotics, packaging, electronics and vehicle uses.

The partnerships facilitate the development of the servo motors and drives market through innovation, developing product capabilities, and increasing access to the global market. To cite an example, in 2025, ABB integrated ESA technology developed by Samotics in old drives, which allowed to monitor condition, predictive maintenance and provide reliability on the motors, pumps and conveyors. This alliance is emphasizing digitalization and smart drive solutions as the new breakthrough in the servo motors and drives market.

The increased demand of accurate and coordinated control of multiple axes in robotics, CNC machines, and automated packaging systems offers a great opportunity to the servo motors and drives market. Multi-axis solutions are superior in increasing the performance of the operation, enhancing the quality of products and complex movements at small area. Due to the growing popularity of multi-axis systems with high-performance and innovative automation in industries, the demand to use more sophisticated and integrated multi-axis servo systems will increase consistently.

Servo Motors and Drives Market Dynamics and Trends

Driver: Rising Demand for High-Precision Motion Control in Packaging

- The increasing need of high-accuracy motion control in the packaging sector is an important force of the global servo motors and drives market. Precision in positioning, speed control and repeatability are very necessary in modern packaging lines to support the use of very complex process like filling, labeling, wrapping and sorting, and in the case of fast-moving consumer goods.

- Servo motors and drives have low tolerance to material waste and low downtime because the motors can be easily controlled in terms of torque and acceleration is very smooth and therefore, response time is fast. With the increasing interest of manufacturers to automation, customization, and high production speed, the use of advanced servo systems is gaining momentum.

- Yaskawa Sigma-7 servo drives allowed ESATEC Turbomailing machines to package cosmetics and food products in high precision, within millimeter accuracy, at 6,000-10,000 units/hours, controlling pick-and-place robots, conveyors, and folding units using integrated, responsive motion control.

- The speed, accuracy, and efficiency requirements of modern automated packaging require high-precision servo motors and drives.

Restraint: Competition from Low-Cost Alternatives

- The global servo motors and drives market is highly constrained by the competition by low-cost alternatives. Most small and medium-sized manufacturers, particularly in developing markets, use low-price generic motors and drives rather than expensive servo systems to save on capital costs.

- The general feature of these alternatives is that they can provide basic motion control, but are generally less precise, responsive, and reliable than advanced servo solutions and are restricted in use in high-speed, high-precision applications. This replacement creates competition to the established manufactures of servos where they have to balance performance and cost competitiveness. Low-cost alternatives may have worse after-sales services, shorter lifespan, and limited integration capabilities, leading to increased operational risks for end-users.

- Recognizing that established market enterprises are hesitant to invest in high-performance servo systems, overall market growth and acceptability in cost-sensitive industries such as packaging, textiles, and small-scale production may suffer.

Opportunity: Expansion in Semiconductor and Electronics Manufacturing

- The global Servo Motors and Drives market has an opportunity due to the fast growth of semiconductor and electronics manufacturing industry. Electronics assembly and semiconductor fabrication involves very tight motion control of processes like wafer manipulation, pick-and-place, and automated inspection, and a small fraction of a step is sufficient to cause a defect in the product.

- Servo motors and drives are also suitable in these applications because they are very accurate, repeatable, and responsive. With the increasing demand of small, faster, and more sophisticated electronic components, manufacturers are investing more in sophisticated automation systems.

- Mitsubishi Electric Corporation and MOVENSYS Inc. became strategic partners in order to develop a strong AC sub-servo and motion control products in the semiconductor and electronics manufacturing. The cooperation is a combination of high-speed, high-precision AC servo systems of Mitsubishi Electric and the Mitsubishi Electric with the so-called soft motion software of Movensys, which makes it possible to use multi-axis synchronous control without special hardware. The benefit of this integration is that manufacturers are able to have high-speed motion control, accurate motion control, lower total cost of ownership and enhance productivity.

- The trend is encouraging the use of high-performance servo systems capable of assuring precise reliable and efficient operations allowing scalability and improved productivity in semiconductor and electronics manufacturing.

Key Trend: Development of Integrated Motor Drives with IoT Connectivity

- IoT-Connected Integrated Motor Drives is a trend in the global Servo Motors and Drives market. Servo drives and motors are being fitted increasingly with IoT-enabled sensors and communication modules to allow real-time monitoring of parameters including temperature, vibration, torque, and energy consumption. The connectivity enables predictive maintenance, minimizes unexpected downtimes and improves the efficiency of equipment in general.

- Furthermore, integrated IoT-enabled drives enable a seamless transfer of data to factory automation and enterprise applications, empowering smarter production decisions, optimized processes, and Industry 4.0 alignment, thereby compelling industries that demand precise and trustworthy motion control to adopt.

- Lenze launched the i650 motec, a decentralized frequency drive with installed Logic PLC, positioning functionality, and STO safety through CIP Safety. This single-box drive allows the free control of single or multiple axes, decreases hardware and integration expenses, and provides single-step motion control over applications such as turntables, conveyors and lifting stations, which is the direction of intelligent, connected, and integrated motor drives.

- The trend emphasizes the increased ability towards intelligent, connected, and autonomous servo drives that increase efficiency, precision, and industrial automation features.

Servo-Motors-and-Drives-Market Analysis and Segmental Data

Hardware Dominate Global Servo Motors and Drives Market

- The hardware component, such as servo motors, drives, controllers, and amplifiers, remains the most dominant global servo motors and drives market, as it is essential in providing the world with accurate motion control, high-speed performance, and reliability in all industrial processes. Industries where high accuracy and repeatability must be employed are automotive, packaging, electronics, and robotics, which need hardware components.

- The development of such segment is a result of the advanced servo motors that have a higher torque, compact size, and in-built safety. Also, the implementation of the high-performance drives and amplifiers that promote the multi-axis control needs and real-time responsiveness further cement the top position of the hardware segment in the market.

- Siemens SINAMICS S200 servo drive system, which consists of a servo drive, SIMOTICS S-1FL2 motor, and motion cables, showed the hardware superiority in the market of Servo Motors and Drives. The compact system has a power range of 0.1757W, overload capacity of up to 350 percent, high-resolution encoder of 21 bits, and fast control of current, which is essential in propelling the market growth because of the importance of sophisticated hardware.

- The advanced and high-performance hardware is a backbone and the major driver of growth of the global servo motors and drives market.

Asia Pacific Leads Global Servo Motors and Drives Market Demand

- Asia Pacific region leads in the market of servo motors and drives, encouraged by the pace of industrialization, growth of automotive and electronics production, and growth in the use of automation in industries. China, Japan, South Korea and India among others are spending heavily in smart factories, robotics and CNC-based production systems which demand high precision in motion control.

- Market expansion is further contributed by the existence of key manufacturing centers, enabling governmental policies and swelling demand of energy-efficient and miniaturized servo solutions. Besides, the cost-effective location of manufacturing economy in the region promotes the implementation of the latest servo technologies making Asia Pacific a significant economic growth factor in the global market.

- Haitian Drive Systems is a major Chinese manufacturer of servo systems used in high-end applications that produce large quantities of medium- and high-power servo drives each year with a focus on precision, reliability, and stability. Haitian provides high-performance, advanced servo solutions to robotics, packaging and industrial automation companies, thus, helping them to achieve their goals of boosting operational efficiency, minimizing downtimes and high precision motion control.

- Asia Pacific is the world's largest servo motor and drive market, with rapid industrialization, automation adoption, and an increasing demand for high-precision motion control.

Servo-Motors-and-Drives-Market Ecosystem

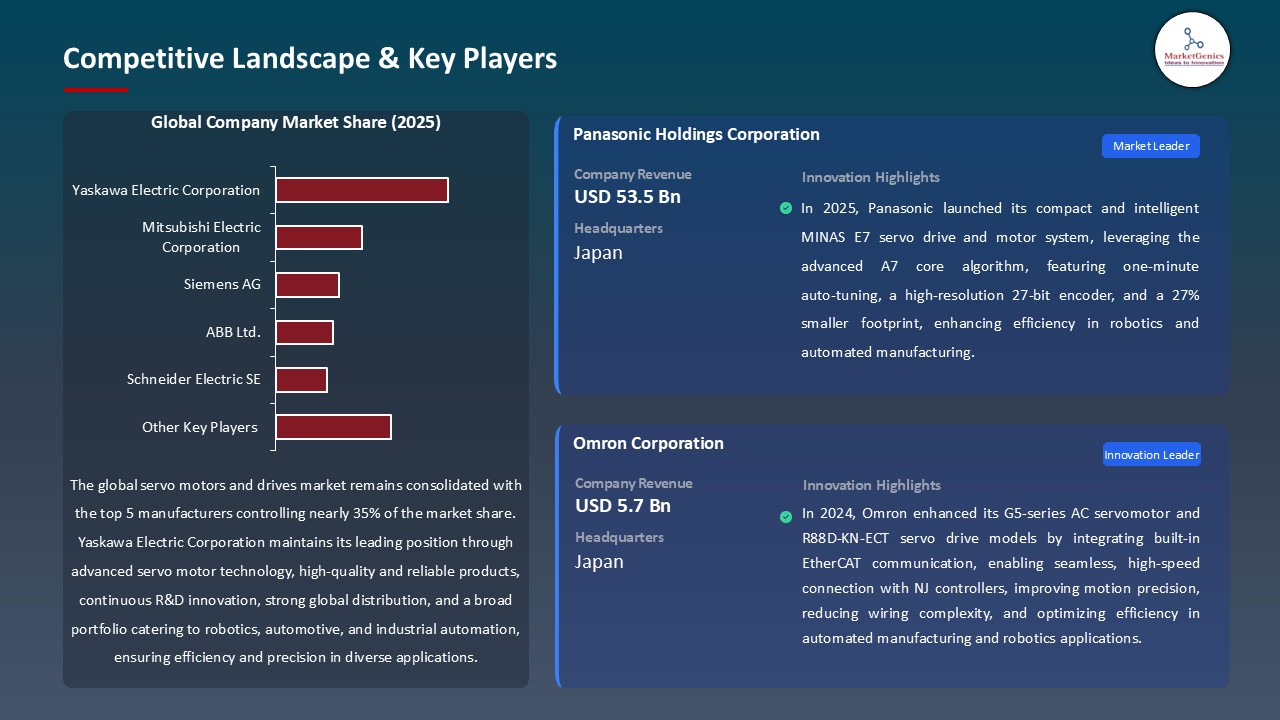

The servo motors and drives market is consolidated with the leading players, namely, Yaskawa Electric Corporation, Mitsubishi Electric Corporation, Siemens AG, ABB Ltd., and Schneider Electric SE. These well-established businesses have preserved their top position due to good relation with their customers, high-performance hardware that is reliable, and easy integration of the drives and motors in various uses in industries.

The market value chain includes servo motor and drive manufacturing, controller development, communication protocol development, system assembly, calibration and post-installation services, such as predictive maintenance and cybersecurity regulations.

The barrier to entry is high because established and stable systems are required and customer confidence is needed, but specialized vendors can keep innovating to fit niche applications, which leads to continuous technological evolution in the market.

Recent Development and Strategic Overview:

- In May 2025, Sigma-X high-end servo systems by Yaskawa were implemented in semiconductor and electronic production to work with wafer handling, wire bonding, wet etching, or PCB assembly. The systems offer high-precision multi-axis management, suppression of vibration, optimization of torque and predictive maintenance which offers reliability, repetitiveness and operational economy. Small motors and generalized tuning can be integrated in smaller machines and still meet the tough industry requirements (SEMI S2/S8).

- In June 2025, Mitsubishi Electric introduced its MELSERvo-JET servo drive line to Europe, with an appeal to manufacturers who want to find affordable automation. The system is flexible to a wide range of industrial applications with smaller solutions and can be powered by 0.1kW to 7kW with compact designs so that it can fit in any space. MELSERVO-JET offers a fast and easy installation, high performance, and quantifiable ROI allowing businesses to update production and improve performance of automation without substantial investment, handling the present market demands and increasing need of affordable and highly-precision motion control systems.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 12.7 Bn |

|

Market Forecast Value in 2035 |

USD 20.3 Bn |

|

Growth Rate (CAGR) |

4.8% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Servo-Motors-and-Drives-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Servo Motors and Drives Market, By Product Type |

|

|

Servo Motors and Drives Market, By Technology |

|

|

Servo Motors and Drives Market, By Communication Protocol |

|

|

Servo Motors and Drives Market, By Power Rating |

|

|

Servo Motors and Drives Market, By Voltage Range |

|

|

Servo Motors and Drives Market, By Offering |

|

|

Servo Motors and Drives Market, By System Architecture |

|

|

Servo Motors and Drives Market, By Mounting Type |

|

|

Servo Motors and Drives Market, By Sales Channel |

|

|

Servo Motors and Drives Market, By End-Use Industry |

|

Frequently Asked Questions

The global servo motors and drives market was valued at USD 12.7 Bn in 2025.

The global servo motors and drives market industry is expected to grow at a CAGR of 4.8% from 2026 to 2035.

Key factors driving demand include rising demand for high-precision motion control in packaging, increasing industrial automation adoption, technological innovation, and growing requirements for operational efficiency and safety compliance across multiple industry verticals.

In terms of offering, the hardware segment accounted for the major share in 2025.

Asia Pacific is the most attractive region for servo motors and drives market.

Prominent players operating in the global servo motors and drives market are ABB Ltd., AMK Group, Beckhoff Automation, Bosch Rexroth AG, Danfoss Group, Delta Electronics Inc., Emerson Electric Co., Fanuc Corporation, Fuji Electric Co., Ltd., Mitsubishi Electric Corporation, Moog Inc., Nidec Corporation, OMRON Corporation, Oriental Motor Co., Ltd., Panasonic Corporation, Parker Hannifin Corporation, Rockwell Automation Inc., SANYO DENKI CO., LTD., Schneider Electric SE, Servotronix Motion Control Ltd., Siemens AG, Toshiba Corporation, Yaskawa Electric Corporation, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Servo Motors and Drives Market Outlook

- 2.1.1. Servo Motors and Drives Market Size Volume (Million Units) and Value (US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Servo Motors and Drives Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 3.1.1. Automation & Process Control Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automation & Process Control Industry

- 3.1.3. Regional Distribution for Automation & Process Control Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Growing demand for industrial automation and robotics

- 4.1.1.2. Increasing need for high‑precision motion control in industries like semiconductor, aerospace, and CNC machining

- 4.1.1.3. Focus on energy efficiency and regulatory push for efficient motor systems

- 4.1.2. Restraints

- 4.1.2.1. High initial cost of servo systems (motors, drives, and installation)

- 4.1.2.2. Complexity in integration and requirement for skilled personnel for setup and maintenance

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- Component 4.4.1. Suppliers

- 4.4.2. Manufacturers

- 4.4.3. Distributors & Supply Chain

- 4.4.4. End-Users

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Servo Motors and Drives Market Demand

- 4.9.1. Historical Market Size – Volume (Million Units) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Volume (Million Units) and Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Servo Motors and Drives Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Servo Motors and Drives Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Servo Motors

- 6.2.1.1. AC Servo Motors

- 6.2.1.1.1. Synchronous AC Servo Motors

- 6.2.1.1.2. Asynchronous AC Servo Motors

- 6.2.1.2. DC Servo Motors

- 6.2.1.2.1. Brushed DC Servo Motors

- 6.2.1.2.2. Brushless DC Servo Motors

- 6.2.1.3. Linear Servo Motors

- 6.2.1.1. AC Servo Motors

- 6.2.2. Servo Drives

- 6.2.2.1. AC Servo Drives

- 6.2.2.2. DC Servo Drives

- 6.2.2.3. Digital Servo Drives

- 6.2.2.4. Analog Servo Drives

- 6.2.1. Servo Motors

- 7. Global Servo Motors and Drives Market Analysis, by Technology

- 7.1. Key Segment Analysis

- 7.2. Servo Motors and Drives Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Technology, 2021-2035

- 7.2.1. Pulse Width Modulation (PWM)

- 7.2.2. Field Oriented Control (FOC)

- 7.2.3. Direct Torque Control (DTC)

- 7.2.4. Sensor-based Technology

- 7.2.5. Sensorless Technology

- 7.2.6. Others

- 8. Global Servo Motors and Drives Market Analysis, by Communication Protocol

- 8.1. Key Segment Analysis

- 8.2. Servo Motors and Drives Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Communication Protocol, 2021-2035

- 8.2.1. EtherCAT

- 8.2.2. PROFINET

- 8.2.3. Ethernet/IP

- 8.2.4. Modbus

- 8.2.5. CANopen

- 8.2.6. SERCOS

- 8.2.7. Powerlink

- 8.2.8. Others

- 9. Global Servo Motors and Drives Market Analysis, by Power Rating

- 9.1. Key Segment Analysis

- 9.2. Servo Motors and Drives Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Power Rating, 2021-2035

- 9.2.1. Below 1 kW

- 9.2.2. 1 kW to 5 kW

- 9.2.3. 5 kW to 50 kW

- 9.2.4. Above 50 kW

- 10. Global Servo Motors and Drives Market Analysis, by Voltage Range

- 10.1. Key Segment Analysis

- 10.2. Servo Motors and Drives Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Voltage Range, 2021-2035

- 10.2.1. Up to 100V

- 10.2.2. 100V to 500V

- 10.2.3. Above 500V

- 11. Global Servo Motors and Drives Market Analysis, by Offering

- 11.1. Key Segment Analysis

- 11.2. Servo Motors and Drives Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Offering, 2021-2035

- 11.2.1. Hardware

- 11.2.1.1. Motors

- 11.2.1.2. Drives

- 11.2.1.3. Controllers

- 11.2.1.4. Encoders

- 11.2.1.5. Cables & Connectors

- 11.2.1.6. Others

- 11.2.2. Software

- 11.2.2.1. Configuration Software

- 11.2.2.2. Simulation Software

- 11.2.2.3. Monitoring Software

- 11.2.2.4. Others

- 11.2.3. Services

- 11.2.3.1. Installation & Commissioning

- 11.2.3.2. Maintenance & Repair

- 11.2.3.3. Training & Consulting

- 11.2.3.4. Others

- 11.2.1. Hardware

- 12. Global Servo Motors and Drives Market Analysis, by System Architecture

- 12.1. Key Segment Analysis

- 12.2. Servo Motors and Drives Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by System Architecture, 2021-2035

- 12.2.1. Centralized Systems

- 12.2.2. Decentralized Systems

- 12.2.3. Distributed Systems

- 12.2.4. Integrated Motor Drives (IMD)

- 12.2.5. Others

- 13. Global Servo Motors and Drives Market Analysis, by Mounting Type

- 13.1. Key Segment Analysis

- 13.2. Servo Motors and Drives Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Mounting Type, 2021-2035

- 13.2.1. Flange Mount

- 13.2.2. Foot Mount

- 13.2.3. Face Mount

- 13.2.4. Shaft Mount

- 13.2.5. Others

- 14. Global Servo Motors and Drives Market Analysis, by Sales Channel

- 14.1. Key Segment Analysis

- 14.2. Servo Motors and Drives Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Sales Channel, 2021-2035

- 14.2.1. Direct Sales

- 14.2.2. Distributors

- 14.2.3. Online Channels

- 15. Global Servo Motors and Drives Market Analysis, by End-Use Industry

- 15.1. Key Segment Analysis

- 15.2. Servo Motors and Drives Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by End-Use Industry, 2021-2035

- 15.2.1. Automotive

- 15.2.1.1. Assembly Line Automation

- 15.2.1.2. Robotic Welding

- 15.2.1.3. Paint Spraying Systems

- 15.2.1.4. Material Handling

- 15.2.1.5. CNC Machining

- 15.2.1.6. Others

- 15.2.2. Electronics & Semiconductor

- 15.2.2.1. Pick & Place Machines

- 15.2.2.2. Wire Bonding

- 15.2.2.3. Die Attach Systems

- 15.2.2.4. Wafer Handling

- 15.2.2.5. PCB Manufacturing

- 15.2.2.6. Component Testing Equipment

- 15.2.2.7. Others

- 15.2.3. Food & Beverage

- 15.2.3.1. Packaging Machinery

- 15.2.3.2. Filling & Capping Systems

- 15.2.3.3. Conveyor Systems

- 15.2.3.4. Cutting & Slicing Equipment

- 15.2.3.5. Others

- 15.2.4. Pharmaceutical & Medical Devices

- 15.2.4.1. Tablet Pressing Machines

- 15.2.4.2. Blister Packaging

- 15.2.4.3. Robotic Surgery Equipment

- 15.2.4.4. Diagnostic Equipment

- 15.2.4.5. Others

- 15.2.5. Packaging

- 15.2.5.1. Form-Fill-Seal Machines

- 15.2.5.2. Cartoning Equipment

- 15.2.5.3. Wrapping Machines

- 15.2.5.4. Palletizing Systems

- 15.2.5.5. Others

- 15.2.6. Metal & Machinery

- 15.2.6.1. CNC Milling Machines

- 15.2.6.2. CNC Lathes

- 15.2.6.3. Grinding Machines

- 15.2.6.4. Press Brakes

- 15.2.6.5. Others

- 15.2.7. Material Handling & Logistics

- 15.2.7.1. Automated Guided Vehicles (AGVs)

- 15.2.7.2. Conveyor Belt Systems

- 15.2.7.3. Warehouse Automation

- 15.2.7.4. Sorting Systems

- 15.2.7.5. Robotic Palletizers

- 15.2.7.6. Others

- 15.2.8. Aerospace & Defense

- 15.2.8.1. Flight Simulators

- 15.2.8.2. Radar Systems

- 15.2.8.3. Aircraft Manufacturing Equipment

- 15.2.8.4. Testing Equipment

- 15.2.8.5. Unmanned Aerial Vehicles (UAVs)

- 15.2.8.6. Precision Positioning Systems

- 15.2.8.7. Others

- 15.2.9. Robotics & Factory Automation

- 15.2.9.1. Industrial Robots

- 15.2.9.2. Collaborative Robots (Cobots)

- 15.2.9.3. SCARA Robots

- 15.2.9.4. Delta Robots

- 15.2.9.5. Articulated Robots

- 15.2.9.6. Cartesian Robots

- 15.2.9.7. Others

- 15.2.10. Renewable Energy

- 15.2.11. Oil & Gas

- 15.2.12. Plastics & Rubber

- 15.2.13. Printing & Paper

- 15.2.14. Others (Entertainment & Stage Equipment, etc.)

- 15.2.1. Automotive

- 16. Global Servo Motors and Drives Market Analysis and Forecasts, by Region

- 16.1. Key Findings

- 16.2. Servo Motors and Drives Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 16.2.1. North America

- 16.2.2. Europe

- 16.2.3. Asia Pacific

- 16.2.4. Middle East

- 16.2.5. Africa

- 16.2.6. South America

- 17. North America Servo Motors and Drives Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. North America Servo Motors and Drives Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Technology

- 17.3.3. Communication Protocol

- 17.3.4. Power Rating

- 17.3.5. Voltage Range

- 17.3.6. Offering

- 17.3.7. System Architecture

- 17.3.8. Mounting Type

- 17.3.9. Sales Channel

- 17.3.10. End-use Industry

- 17.3.11. Country

- 17.3.11.1. USA

- 17.3.11.2. Canada

- 17.3.11.3. Mexico

- 17.4. USA Servo Motors and Drives Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Technology

- 17.4.4. Communication Protocol

- 17.4.5. Power Rating

- 17.4.6. Voltage Range

- 17.4.7. Offering

- 17.4.8. System Architecture

- 17.4.9. Mounting Type

- 17.4.10. Sales Channel

- 17.4.11. End-use Industry

- 17.5. Canada Servo Motors and Drives Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Technology

- 17.5.4. Communication Protocol

- 17.5.5. Power Rating

- 17.5.6. Voltage Range

- 17.5.7. Offering

- 17.5.8. System Architecture

- 17.5.9. Mounting Type

- 17.5.10. Sales Channel

- 17.5.11. End-use Industry

- 17.6. Mexico Servo Motors and Drives Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Technology

- 17.6.4. Communication Protocol

- 17.6.5. Power Rating

- 17.6.6. Voltage Range

- 17.6.7. Offering

- 17.6.8. System Architecture

- 17.6.9. Mounting Type

- 17.6.10. Sales Channel

- 17.6.11. End-use Industry

- 18. Europe Servo Motors and Drives Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Europe Servo Motors and Drives Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Technology

- 18.3.3. Communication Protocol

- 18.3.4. Power Rating

- 18.3.5. Voltage Range

- 18.3.6. Offering

- 18.3.7. System Architecture

- 18.3.8. Mounting Type

- 18.3.9. Sales Channel

- 18.3.10. End-use Industry

- 18.3.11. End-use Industry

- 18.3.11.1. Germany

- 18.3.11.2. United Kingdom

- 18.3.11.3. France

- 18.3.11.4. Italy

- 18.3.11.5. Spain

- 18.3.11.6. Netherlands

- 18.3.11.7. Nordic Countries

- 18.3.11.8. Poland

- 18.3.11.9. Russia & CIS

- 18.3.11.10. Rest of Europe

- 18.4. Germany Servo Motors and Drives Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Technology

- 18.4.4. Communication Protocol

- 18.4.5. Power Rating

- 18.4.6. Voltage Range

- 18.4.7. Offering

- 18.4.8. System Architecture

- 18.4.9. Mounting Type

- 18.4.10. Sales Channel

- 18.4.11. End-use Industry

- 18.5. United Kingdom Servo Motors and Drives Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Technology

- 18.5.4. Communication Protocol

- 18.5.5. Power Rating

- 18.5.6. Voltage Range

- 18.5.7. Offering

- 18.5.8. System Architecture

- 18.5.9. Mounting Type

- 18.5.10. Sales Channel

- 18.5.11. End-use Industry

- 18.6. France Servo Motors and Drives Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Technology

- 18.6.4. Communication Protocol

- 18.6.5. Power Rating

- 18.6.6. Voltage Range

- 18.6.7. Offering

- 18.6.8. System Architecture

- 18.6.9. Mounting Type

- 18.6.10. Sales Channel

- 18.6.11. End-use Industry

- 18.7. Italy Servo Motors and Drives Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Technology

- 18.7.4. Communication Protocol

- 18.7.5. Power Rating

- 18.7.6. Voltage Range

- 18.7.7. Offering

- 18.7.8. System Architecture

- 18.7.9. Mounting Type

- 18.7.10. Sales Channel

- 18.7.11. End-use Industry

- 18.8. Spain Servo Motors and Drives Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Technology

- 18.8.4. Communication Protocol

- 18.8.5. Power Rating

- 18.8.6. Voltage Range

- 18.8.7. Offering

- 18.8.8. System Architecture

- 18.8.9. Mounting Type

- 18.8.10. Sales Channel

- 18.8.11. End-use Industry

- 18.9. Netherlands Servo Motors and Drives Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Product Type

- 18.9.3. Technology

- 18.9.4. Communication Protocol

- 18.9.5. Power Rating

- 18.9.6. Voltage Range

- 18.9.7. Offering

- 18.9.8. System Architecture

- 18.9.9. Mounting Type

- 18.9.10. Sales Channel

- 18.9.11. End-use Industry

- 18.10. Nordic Countries Servo Motors and Drives Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Product Type

- 18.10.3. Technology

- 18.10.4. Communication Protocol

- 18.10.5. Power Rating

- 18.10.6. Voltage Range

- 18.10.7. Offering

- 18.10.8. System Architecture

- 18.10.9. Mounting Type

- 18.10.10. Sales Channel

- 18.10.11. End-use Industry

- 18.11. Poland Servo Motors and Drives Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Product Type

- 18.11.3. Technology

- 18.11.4. Communication Protocol

- 18.11.5. Power Rating

- 18.11.6. Voltage Range

- 18.11.7. Offering

- 18.11.8. System Architecture

- 18.11.9. Mounting Type

- 18.11.10. Sales Channel

- 18.11.11. End-use Industry

- 18.12. Russia & CIS Servo Motors and Drives Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Product Type

- 18.12.3. Technology

- 18.12.4. Communication Protocol

- 18.12.5. Power Rating

- 18.12.6. Voltage Range

- 18.12.7. Offering

- 18.12.8. System Architecture

- 18.12.9. Mounting Type

- 18.12.10. Sales Channel

- 18.12.11. End-use Industry

- 18.13. Rest of Europe Servo Motors and Drives Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Product Type

- 18.13.3. Technology

- 18.13.4. Communication Protocol

- 18.13.5. Power Rating

- 18.13.6. Voltage Range

- 18.13.7. Offering

- 18.13.8. System Architecture

- 18.13.9. Mounting Type

- 18.13.10. Sales Channel

- 18.13.11. End-use Industry

- 19. Asia Pacific Servo Motors and Drives Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Asia Pacific Servo Motors and Drives Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Technology

- 19.3.3. Communication Protocol

- 19.3.4. Power Rating

- 19.3.5. Voltage Range

- 19.3.6. Offering

- 19.3.7. System Architecture

- 19.3.8. Mounting Type

- 19.3.9. Sales Channel

- 19.3.10. End-use Industry

- 19.3.11. Country

- 19.3.11.1. China

- 19.3.11.2. India

- 19.3.11.3. Japan

- 19.3.11.4. South Korea

- 19.3.11.5. Australia and New Zealand

- 19.3.11.6. Indonesia

- 19.3.11.7. Malaysia

- 19.3.11.8. Thailand

- 19.3.11.9. Vietnam

- 19.3.11.10. Rest of Asia Pacific

- 19.4. China Servo Motors and Drives Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Technology

- 19.4.4. Communication Protocol

- 19.4.5. Power Rating

- 19.4.6. Voltage Range

- 19.4.7. Offering

- 19.4.8. System Architecture

- 19.4.9. Mounting Type

- 19.4.10. Sales Channel

- 19.4.11. End-use Industry

- 19.5. India Servo Motors and Drives Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Technology

- 19.5.4. Communication Protocol

- 19.5.5. Power Rating

- 19.5.6. Voltage Range

- 19.5.7. Offering

- 19.5.8. System Architecture

- 19.5.9. Mounting Type

- 19.5.10. Sales Channel

- 19.5.11. End-use Industry

- 19.6. Japan Servo Motors and Drives Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Technology

- 19.6.4. Communication Protocol

- 19.6.5. Power Rating

- 19.6.6. Voltage Range

- 19.6.7. Offering

- 19.6.8. System Architecture

- 19.6.9. Mounting Type

- 19.6.10. Sales Channel

- 19.6.11. End-use Industry

- 19.7. South Korea Servo Motors and Drives Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Technology

- 19.7.4. Communication Protocol

- 19.7.5. Power Rating

- 19.7.6. Voltage Range

- 19.7.7. Offering

- 19.7.8. System Architecture

- 19.7.9. Mounting Type

- 19.7.10. Sales Channel

- 19.7.11. End-use Industry

- 19.8. Australia and New Zealand Servo Motors and Drives Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Technology

- 19.8.4. Communication Protocol

- 19.8.5. Power Rating

- 19.8.6. Voltage Range

- 19.8.7. Offering

- 19.8.8. System Architecture

- 19.8.9. Mounting Type

- 19.8.10. Sales Channel

- 19.8.11. End-use Industry

- 19.9. Indonesia Servo Motors and Drives Market

- 19.9.1. Country Segmental Analysis

- 19.9.2. Product Type

- 19.9.3. Technology

- 19.9.4. Communication Protocol

- 19.9.5. Power Rating

- 19.9.6. Voltage Range

- 19.9.7. Offering

- 19.9.8. System Architecture

- 19.9.9. Mounting Type

- 19.9.10. Sales Channel

- 19.9.11. End-use Industry

- 19.10. Malaysia Servo Motors and Drives Market

- 19.10.1. Country Segmental Analysis

- 19.10.2. Product Type

- 19.10.3. Technology

- 19.10.4. Communication Protocol

- 19.10.5. Power Rating

- 19.10.6. Voltage Range

- 19.10.7. Offering

- 19.10.8. System Architecture

- 19.10.9. Mounting Type

- 19.10.10. Sales Channel

- 19.10.11. End-use Industry

- 19.11. Thailand Servo Motors and Drives Market

- 19.11.1. Country Segmental Analysis

- 19.11.2. Product Type

- 19.11.3. Technology

- 19.11.4. Communication Protocol

- 19.11.5. Power Rating

- 19.11.6. Voltage Range

- 19.11.7. Offering

- 19.11.8. System Architecture

- 19.11.9. Mounting Type

- 19.11.10. Sales Channel

- 19.11.11. End-use Industry

- 19.12. Vietnam Servo Motors and Drives Market

- 19.12.1. Country Segmental Analysis

- 19.12.2. Product Type

- 19.12.3. Technology

- 19.12.4. Communication Protocol

- 19.12.5. Power Rating

- 19.12.6. Voltage Range

- 19.12.7. Offering

- 19.12.8. System Architecture

- 19.12.9. Mounting Type

- 19.12.10. Sales Channel

- 19.12.11. End-use Industry

- 19.13. Rest of Asia Pacific Servo Motors and Drives Market

- 19.13.1. Country Segmental Analysis

- 19.13.2. Product Type

- 19.13.3. Technology

- 19.13.4. Communication Protocol

- 19.13.5. Power Rating

- 19.13.6. Voltage Range

- 19.13.7. Offering

- 19.13.8. System Architecture

- 19.13.9. Mounting Type

- 19.13.10. Sales Channel

- 19.13.11. End-use Industry

- 20. Middle East Servo Motors and Drives Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Middle East Servo Motors and Drives Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Technology

- 20.3.3. Communication Protocol

- 20.3.4. Power Rating

- 20.3.5. Voltage Range

- 20.3.6. Offering

- 20.3.7. System Architecture

- 20.3.8. Mounting Type

- 20.3.9. Sales Channel

- 20.3.10. End-use Industry

- 20.3.11. Country

- 20.3.11.1. Turkey

- 20.3.11.2. UAE

- 20.3.11.3. Saudi Arabia

- 20.3.11.4. Israel

- 20.3.11.5. Rest of Middle East

- 20.4. Turkey Servo Motors and Drives Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Technology

- 20.4.4. Communication Protocol

- 20.4.5. Power Rating

- 20.4.6. Voltage Range

- 20.4.7. Offering

- 20.4.8. System Architecture

- 20.4.9. Mounting Type

- 20.4.10. Sales Channel

- 20.4.11. End-use Industry

- 20.5. UAE Servo Motors and Drives Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Technology

- 20.5.4. Communication Protocol

- 20.5.5. Power Rating

- 20.5.6. Voltage Range

- 20.5.7. Offering

- 20.5.8. System Architecture

- 20.5.9. Mounting Type

- 20.5.10. Sales Channel

- 20.5.11. End-use Industry

- 20.6. Saudi Arabia Servo Motors and Drives Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Technology

- 20.6.4. Communication Protocol

- 20.6.5. Power Rating

- 20.6.6. Voltage Range

- 20.6.7. Offering

- 20.6.8. System Architecture

- 20.6.9. Mounting Type

- 20.6.10. Sales Channel

- 20.6.11. End-use Industry

- 20.7. Israel Servo Motors and Drives Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Product Type

- 20.7.3. Technology

- 20.7.4. Communication Protocol

- 20.7.5. Power Rating

- 20.7.6. Voltage Range

- 20.7.7. Offering

- 20.7.8. System Architecture

- 20.7.9. Mounting Type

- 20.7.10. Sales Channel

- 20.7.11. End-use Industry

- 20.8. Rest of Middle East Servo Motors and Drives Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Product Type

- 20.8.3. Technology

- 20.8.4. Communication Protocol

- 20.8.5. Power Rating

- 20.8.6. Voltage Range

- 20.8.7. Offering

- 20.8.8. System Architecture

- 20.8.9. Mounting Type

- 20.8.10. Sales Channel

- 20.8.11. End-use Industry

- 21. Africa Servo Motors and Drives Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. Africa Servo Motors and Drives Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Product Type

- 21.3.2. Technology

- 21.3.3. Communication Protocol

- 21.3.4. Power Rating

- 21.3.5. Voltage Range

- 21.3.6. Offering

- 21.3.7. System Architecture

- 21.3.8. Mounting Type

- 21.3.9. Sales Channel

- 21.3.10. End-use Industry

- 21.3.11. Country

- 21.3.11.1. South Africa

- 21.3.11.2. Egypt

- 21.3.11.3. Nigeria

- 21.3.11.4. Algeria

- 21.3.11.5. Rest of Africa

- 21.4. South Africa Servo Motors and Drives Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Product Type

- 21.4.3. Technology

- 21.4.4. Communication Protocol

- 21.4.5. Power Rating

- 21.4.6. Voltage Range

- 21.4.7. Offering

- 21.4.8. System Architecture

- 21.4.9. Mounting Type

- 21.4.10. Sales Channel

- 21.4.11. End-use Industry

- 21.5. Egypt Servo Motors and Drives Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Product Type

- 21.5.3. Technology

- 21.5.4. Communication Protocol

- 21.5.5. Power Rating

- 21.5.6. Voltage Range

- 21.5.7. Offering

- 21.5.8. System Architecture

- 21.5.9. Mounting Type

- 21.5.10. Sales Channel

- 21.5.11. End-use Industry

- 21.6. Nigeria Servo Motors and Drives Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Product Type

- 21.6.3. Technology

- 21.6.4. Communication Protocol

- 21.6.5. Power Rating

- 21.6.6. Voltage Range

- 21.6.7. Offering

- 21.6.8. System Architecture

- 21.6.9. Mounting Type

- 21.6.10. Sales Channel

- 21.6.11. End-use Industry

- 21.7. Algeria Servo Motors and Drives Market

- 21.7.1. Country Segmental Analysis

- 21.7.2. Product Type

- 21.7.3. Technology

- 21.7.4. Communication Protocol

- 21.7.5. Power Rating

- 21.7.6. Voltage Range

- 21.7.7. Offering

- 21.7.8. System Architecture

- 21.7.9. Mounting Type

- 21.7.10. Sales Channel

- 21.7.11. End-use Industry

- 21.8. Rest of Africa Servo Motors and Drives Market

- 21.8.1. Country Segmental Analysis

- 21.8.2. Product Type

- 21.8.3. Technology

- 21.8.4. Communication Protocol

- 21.8.5. Power Rating

- 21.8.6. Voltage Range

- 21.8.7. Offering

- 21.8.8. System Architecture

- 21.8.9. Mounting Type

- 21.8.10. Sales Channel

- 21.8.11. End-use Industry

- 22. South America Servo Motors and Drives Market Analysis

- 22.1. Key Segment Analysis

- 22.2. Regional Snapshot

- 22.3. South America Servo Motors and Drives Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 22.3.1. Product Type

- 22.3.2. Technology

- 22.3.3. Communication Protocol

- 22.3.4. Power Rating

- 22.3.5. Voltage Range

- 22.3.6. Offering

- 22.3.7. System Architecture

- 22.3.8. Mounting Type

- 22.3.9. Sales Channel

- 22.3.10. End-use Industry

- 22.3.11. Country

- 22.3.11.1. Brazil

- 22.3.11.2. Argentina

- 22.3.11.3. Rest of South America

- 22.4. Brazil Servo Motors and Drives Market

- 22.4.1. Country Segmental Analysis

- 22.4.2. Product Type

- 22.4.3. Technology

- 22.4.4. Communication Protocol

- 22.4.5. Power Rating

- 22.4.6. Voltage Range

- 22.4.7. Offering

- 22.4.8. System Architecture

- 22.4.9. Mounting Type

- 22.4.10. Sales Channel

- 22.4.11. End-use Industry

- 22.5. Argentina Servo Motors and Drives Market

- 22.5.1. Country Segmental Analysis

- 22.5.2. Product Type

- 22.5.3. Technology

- 22.5.4. Communication Protocol

- 22.5.5. Power Rating

- 22.5.6. Voltage Range

- 22.5.7. Offering

- 22.5.8. System Architecture

- 22.5.9. Mounting Type

- 22.5.10. Sales Channel

- 22.5.11. End-use Industry

- 22.6. Rest of South America Servo Motors and Drives Market

- 22.6.1. Country Segmental Analysis

- 22.6.2. Product Type

- 22.6.3. Technology

- 22.6.4. Communication Protocol

- 22.6.5. Power Rating

- 22.6.6. Voltage Range

- 22.6.7. Offering

- 22.6.8. System Architecture

- 22.6.9. Mounting Type

- 22.6.10. Sales Channel

- 22.6.11. End-use Industry

- 23. Key Players/ Company Profile

- 23.1. ABB Ltd.

- 23.1.1. Company Details/ Overview

- 23.1.2. Company Financials

- 23.1.3. Key Customers and Competitors

- 23.1.4. Business/ Industry Portfolio

- 23.1.5. Product Portfolio/ Specification Details

- 23.1.6. Pricing Data

- 23.1.7. Strategic Overview

- 23.1.8. Recent Developments

- 23.2. AMK Group

- 23.3. Beckhoff Automation

- 23.4. Bosch Rexroth AG

- 23.5. Danfoss Group

- 23.6. Delta Electronics Inc.

- 23.7. Emerson Electric Co.

- 23.8. Fanuc Corporation

- 23.9. Fuji Electric Co., Ltd.

- 23.10. Mitsubishi Electric Corporation

- 23.11. Moog Inc.

- 23.12. Nidec Corporation

- 23.13. OMRON Corporation

- 23.14. Oriental Motor Co., Ltd.

- 23.15. Panasonic Corporation

- 23.16. Parker Hannifin Corporation

- 23.17. Rockwell Automation Inc.

- 23.18. SANYO DENKI CO., LTD.

- 23.19. Schneider Electric SE

- 23.20. Servotronix Motion Control Ltd.

- 23.21. Siemens AG

- 23.22. Toshiba Corporation

- 23.23. Yaskawa Electric Corporation

- 23.24. Other Key Players

- 23.1. ABB Ltd.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data