Synthetic Biology Platforms Market Size, Share & Trends Analysis Report by Technology Type (Genome Engineering, DNA Synthesis & Sequencing, Bioinformatics & Software Tools, Synthetic Cells & Minimal Genomes, Metabolic Engineering Platforms, Protein Engineering & Design), Product Type, Application, Organism Type, Component, End-User Type, Platform Complexity, Deployment Mode, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Synthetic Biology Platforms Market Size, Share, and Growth

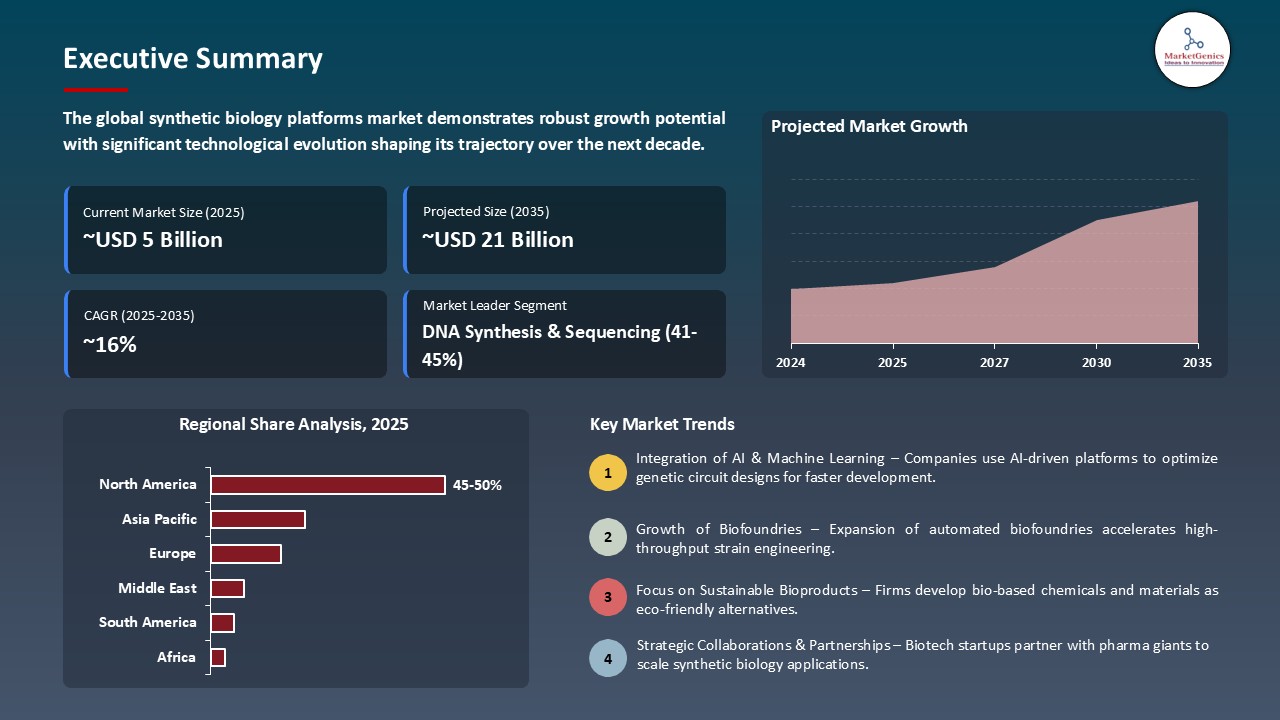

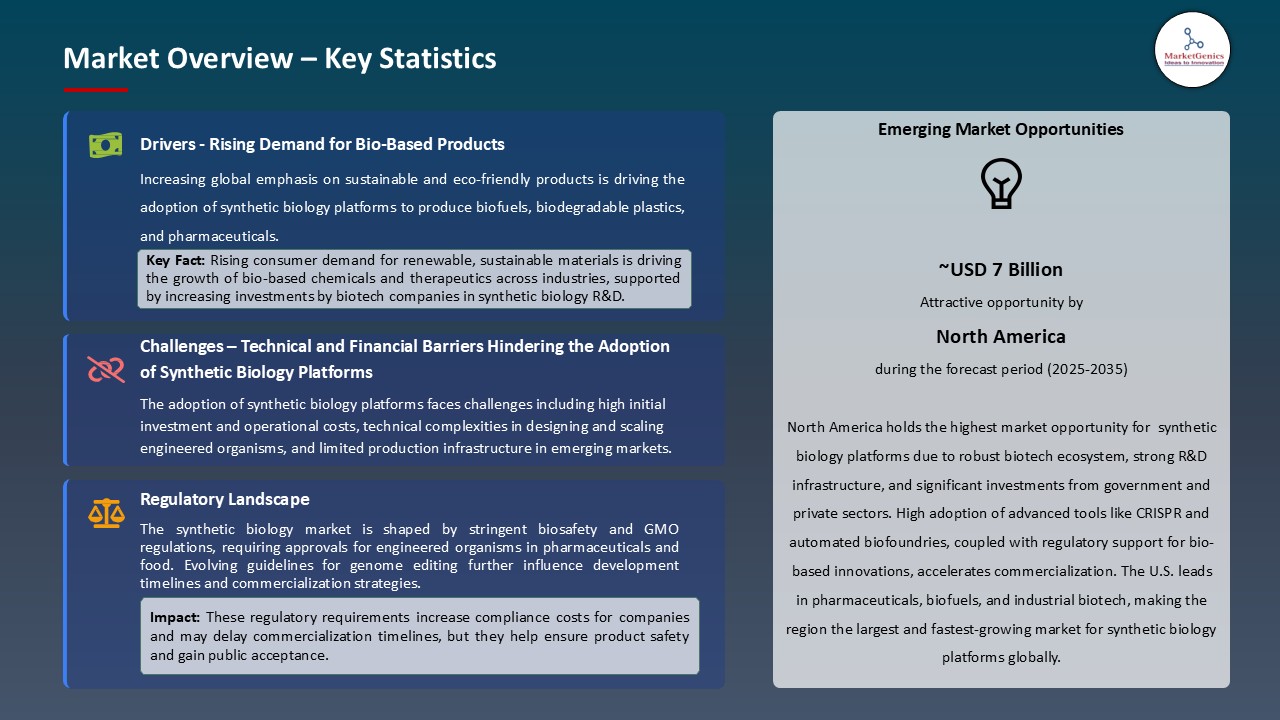

The global synthetic biology platforms market is experiencing robust growth, with its estimated value of USD 4.8 billion in the year 2025 and USD 20.6 billion by the period 2035, registering a CAGR of 15.7%, during the forecast period. The global synthetic biology platforms market is growing rapidly, driven by AI-driven biofoundries, rising applications in healthcare and industrial biotech, and demand for sustainable biomanufacturing. Growth is supported by investments, strategic partnerships, and advances in automated DNA synthesis, protein design, and genome engineering, while digital lab tools and high-throughput screening enhance efficiency and scalability.

Ben Lamm, Co-Founder and CEO of Colossal Biosciences, said: "The Colossal Woolly Mouse marks a watershed moment in our de-extinction mission. By engineering multiple cold-tolerant traits from mammoth evolutionary pathways into a living model species, we've proven our ability to recreate complex genetic combinations that took nature millions of years to create. This success brings us a step closer to our goal of bringing back the woolly mammoth."

The global synthetic biology platforms market is primarily driven by increasing integration of AI-driven automation, modular biofoundries, and cloud-based design tools. For instance, in February 2025, Latent Labs launched its generative-AI synthetic biology platform to be able to design new proteins and biomolecules to find drugs. The platform takes advantage of machine learning to optimize protein structures through the combination of automated lab workflows to expedite the development of therapeutics and industrial enzymes and minimize trial-and-error experiments.

The new technological developments in bioengineering include cloud-linked DNA synthesis, automated organism design, and AI-assisted protein modeling that make bioengineering projects more precise, fast, and successful. For instance, in November 2024, Twist Bioscience launched its Automated Gene Synthesis 2.0 system, a system that used predictive algorithms and robotics to enhance sequence accuracy and reduce turnaround time by over 40 percent. This technology facilitates expedited drug discovery, cell therapy discovery as well as biotechnology in agriculture.

Biotech startups and global technology corporations are also introducing other emerging technologies like modular synthetic biology workstations, AI-based genome editing platforms and digital biofoundries, making them more accessible, customized, and scalable. These systems reduce human intervention, permit design of experiments remotely and allow high throughput biological testing. The trend of bioeconomy development and sustainable production promoted by government efforts in North America, Europe, and Asia-Pacific is catalyzing the implementation and commercialization of next-generation synthetic biology solutions in healthcare, agriculture, and industry.

Synthetic Biology Platforms Market Dynamics and Trends

Driver: Integration of Artificial Intelligence (AI) in Synthetic Biology

- The incorporation of AI in synthetic biology is transforming the field with the capability of quick genome design, forecasting the metabolic pathways, and optimizing cellular functions. The tendency is driving accelerated therapeutic, industrial enzyme and bio-based chemical discovery in addition to minimizing trial and error experimentation, which conserves both time and resources. The AI-based tools enable researchers to model biological operations and determine the best routes before experimental confirmation which improves efficiency and creativity.

- The AI-driven systems can ease accurate genetic engineering, forecast the outcomes of metabolism, and streamline the bioproduction systems. For instance, in August 2025, Ginkgo Bioworks collaborated with Inductive Bio and Tangible Scientific to roll out AI-driven lab-in-the-loop processes throughout the biopharma sector. This partnership combines speedy ADME screening, design-based chemistry, and compound management that permit quicker medication discovery and enhances the yield whilst reducing the expenses of running the business.

- These artificial intelligence-driven technologies increase productivity levels, cut costs incurred in experiments, and decrease commercialization cycles. This trend enhances the global Synthetic Biology Platforms Market by facilitating scalable, accurate, and efficient biomanufacturing to help the speedy implementation of synthetic biology solutions in various industries.

Restraint: Data Privacy Concerns and Regulatory Challenges

- The fast development of synthetic biology presents major ethical issues, especially in such aspects as gene editing, the development of synthetic life, and the work with microbial systems. These advancements bring up concern regarding the long-term ecological effects, unintended effects and responsible use of the advanced biotechnologies. Ethical issues also include the right to intellectual property, fair access, and possible malicious intent of synthetic biology to other uses.

- Regulatory frameworks find it difficult to keep up with the rapidly changing technological environment, which causes inconsistencies, gaps, and uncertainties in governance. Most countries do not have extensive policies on risk assessment, biosafety, and regulation of synthetic biology uses, and these might serve as obstacles to compliance and operation by companies and research institutions.

- These constitute both ethical and regulatory compounding issues, which can impede uptake, inhibit investment, and establish commercialisation trepidation about new platforms in synthetic biology. The necessity of strong governance, unified rules and regulations, as well as clear-cut supervision is critical to provide responsible, safe and socially acceptable growth of the field.

Opportunity: Expansion into Personalized Medicine and Therapeutics

- Development of CRISPR technology and gene editing and synthetic biology are creating new opportunities in personalized medicine and synthetic biology. Nowadays, innovators can develop personalized therapies to fit specific patient genetic profiles, rare diseases, and complicated conditions and increase efficacy and treatment outcomes.

- Partnerships between biotech businesses, research institutes and healthcare institutions are on the rise which is amplifying the pace of translation of synthetic biology inventions into clinical and industrial practice. These partnerships are to address technology, funding, and regulatory assistance gaps to allow the personalized therapies to be more accessible and scalable.

- Companies are also entering strategic alliances in a bid to integrate synthetic biology platforms with phenotypic characterization, high-throughput screening and multi-omics data. For instance, in 2023 Synthego launched CRISPR Discovery Partners, a group of firms such as Arctoris, BrainXell, Curia, PhenoVista and Pluristyx to provide end-to-end Genome engineering and downstream services, to rapidly discover drugs and develop therapeutics.

- Expanding such combined solutions can permit precise intervention of cancer and genetic diseases and immunotherapies. These innovations bring in new patient outcomes, adoption of synthetic biology solutions, and large-scale growth prospects in the biotech and pharmaceutical sectors around the globe.

Key Trend: Decentralized Innovation in Synthetic Biology R&D

- Synthetic biology platforms market is decentralizing and collaborative in patterns of research and manufacture. This will facilitate making synthetic biology tools more accessible, speed up innovation, and reduce reliance on centralized laboratories, resulting in an increase in the focus of startups, academic labs, and other small biotech companies.

- To democratize gene editing, cell engineering, and high-throughput screening technologies, organizations are setting up regional hubs, incubators, and shared biomanufacturing locations. In August 2023 Synthego has expanded its strategic partnership with bit.bio, a market leader in human cell programming. This partnership aims to design, produce, test, and commercially provide optimized multiplexed genetic editing solutions at a very fast speed, which will scale up and refine cell engineering to be applicable in therapeutics.

- Also, the application of cloud-based bioinformatics, remote automation, and digital labs administrative solutions streamline the process of experimentation, encourages quicker information-based decision making, and enhances efficiency in operations. The trend will support the ability of more organizations to participate in research and development of synthetic biology, and sustainable growth, adoption and innovation in the market worldwide.

Synthetic Biology Platforms Market Analysis and Segmental Data

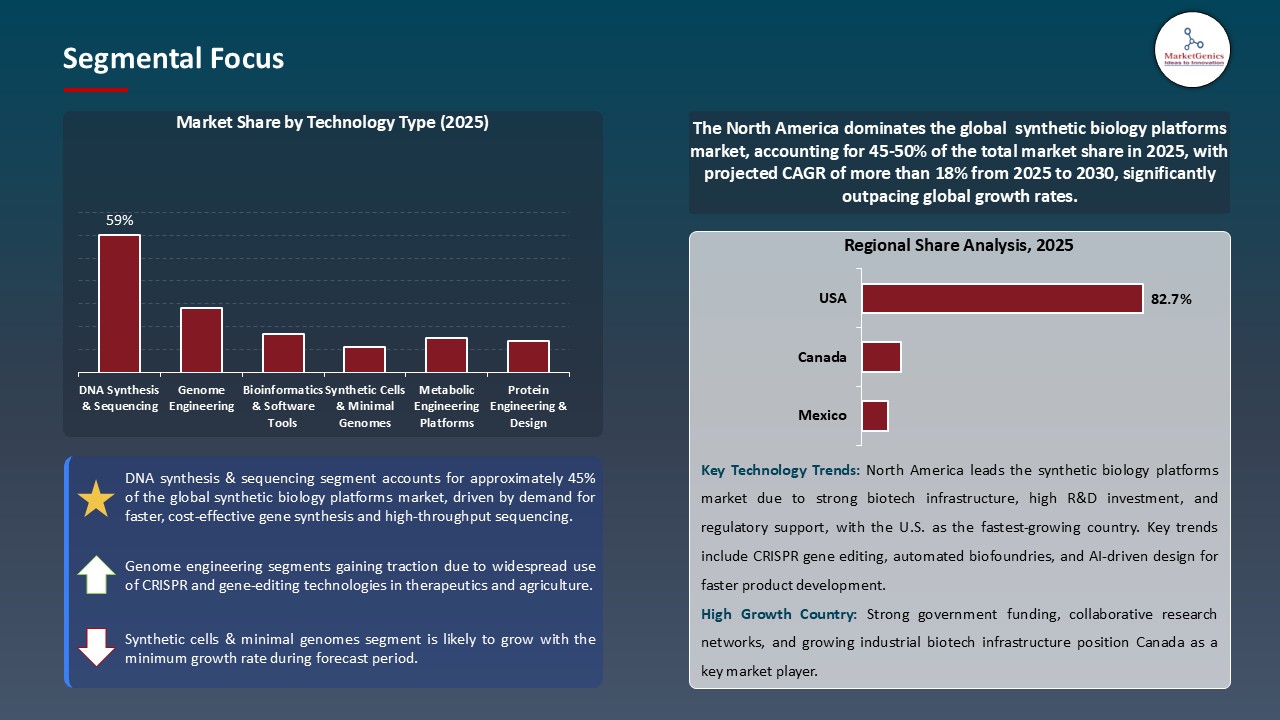

DNA Synthesis & Sequencing Dominate Global Synthetic Biology Platforms Market

- DNA synthesis and sequencing segment is set to conquer the global synthetic biology platforms market because of the increasing demands of synthetic genes, genome engineering, and high-throughput sequencing technologies. Gene fragments, oligonucleotides, and next-generation sequencing (NGS) kits are products that are required in research, drug development, and precision biotechnology applications.

- The technological advances are driving the efficiency and accuracy of DNA synthesis and sequencing. Recent technological breakthroughs such as automated high-throughput oligo synthesizers, CRISPR-based genome editing systems, and long-read sequencing systems make genetic analysis of large scales faster, accurate, and precise. The combination of AI-based sequence analysis systems enables researchers to understand complicated genomic data, shorten design-build-test times, and streamline synthetic constructs to industrial and therapeutic use.

- Furthermore, a notable advancement in the area of the technology and production of DNA synthesis, such as in August 2024, Twist Bioscience broadened the scope of its gene catalogs by making it possible to synthesize long gene fragments to more than 50 kilobases (kb) in length. The development increases the ability of the company to serve more complex synthetic biology applications including large scale gene synthesis in therapeutic and industrial applications.

North America Leads Global Synthetic Biology Platforms Market Demand

- North America is the leading market in the synthetic biology platforms market with the presence of big investments in the biotechnology field, good regulatory environment and the presence of major genome engineering and synthetic biology firms. The leadership of the region is also encouraged by the aspect of hastening drug discovery and industrial biotech applications.

- The region has a well-established system of biotech companies, research centers, and startups, which facilitates the fast implementation of new advanced synthetic biology solutions. For instance, Synthego introduced engineered cell libraries on its Eclipse Platform, offering arrayed CRISPR-edited cells to functional screening assays. The innovation enables researchers to undertake high throughput experiments more quickly and accurately, reflecting North America as the pioneer in integrating technology, innovation, and research.

- Strong government assistance, funding measures and smooth regulatory channels are other measures that reinforce the outline of the region. Combined with state-of-the-art manufacturing plants, AI-based analytics and tactical partnerships, North America remains the largest market share and draws international investment in synthetic biology platforms.

Synthetic Biology Platforms Market Ecosystem

The worldwide synthetic biology platforms market is a dynamic ecosystem with such major biotech and life sciences companies as Thermo Fisher Scientific, Merck KGaA, Twist Biosciences, Ginkgo Bioworks, and GenScript Biotech. As the leaders in the fields of synthetic biology applications in industries, including gene synthesis, CRISPR-based genome editing, high throughput DNA / RNA libraries, and biologics production, the leading players must handle the challenge to enable faster research, industrial biotech solutions, and drug discovery.

The major participants in the financing are federal grants, universities, and venture capital, with an objective to promote R&D, translational research and larger-scale synthetic biology programs that subsequently stimulates innovation in cell therapies, engineered enzymes and microbial production systems. As an example, EditCo Bio, a firm established by the acquisition of the engineered cell solutions business, of Synthego byEditCo Bio and Telegraph Hill Partners, published its operations in March 2024 in an effort to further the research efforts of cellular engineering. Such a strategic move points to internalization of the technology induced innovation in the market ecosystem.

Also, startups and academic laboratories are making complementary technologies, such as AI-assisted genome design, biofoundries, and automated laboratory platforms. This synergistic process of strategic alliances, technology and sustained investment is creating sustainable growth, fast deployment and global expansion of synthetic biology solutions.

Recent Development and Strategic Overview:

- In June 2025, Ainnocence launched its BioSynthAI platform, a cutting-edge AI-driven synthetic biology solution designed to accelerate product discovery and design in biopharma and industrial biotechnology. The platform integrates advanced generative models with molecular simulation to optimize enzyme engineering, metabolic pathway design, and protein synthesis. This launch enhances R&D efficiency, shortens development timelines, and demonstrates the growing role of AI in driving innovation across the global synthetic biology platforms market.

- In May 2025, Ribbon Bio launched its MiroSynth DNA molecules, a high-throughput solution for complex synthetic DNA needed in next-generation synthetic biology applications. This product expands the company’s capability to deliver accurate, large-scale DNA constructs for biopharma and industrial biotech, supporting faster innovation and improved scalability in the synthetic biology platforms market.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 4.8 Bn |

|

Market Forecast Value in 2035 |

USD 20.6 Bn |

|

Growth Rate (CAGR) |

15.7% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value

|

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Synthetic Biology Platforms Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Synthetic Biology Platforms Market, By Technology Type |

|

|

Synthetic Biology Platforms Market, By Product Type |

|

|

Synthetic Biology Platforms Market, By Application |

|

|

Synthetic Biology Platforms Market, By Organism Type |

|

|

Synthetic Biology Platforms Market, By Component |

|

|

Synthetic Biology Platforms Market, End-User Type |

|

|

Synthetic Biology Platforms Market, By Platform Complexity |

|

|

Synthetic Biology Platforms Market, By Deployment Mode |

|

Frequently Asked Questions

The global synthetic biology platforms market was valued at USD 4.8 Bn in 2025.

The global synthetic biology platforms market industry is expected to grow at a CAGR of 15.7% from 2025 to 2035.

The demand for the synthetic biology platforms market is driven by the growing use of genetic engineering, DNA synthesis, and metabolic pathway optimization across pharmaceuticals, biotechnology, and industrial applications. Rising R&D investments, government funding, and collaborations between biotech firms and research institutions are accelerating innovation.

In terms of technology type, the DNA synthesis & sequencing segment accounted for the major share in 2025.

Key players in the global synthetic biology platforms market include prominent companies such as Agilent Technologies, Amyris, Atum (formerly DNA2.0), Benchling, Codexis, Eurofins Genomics, GenScript Biotech, Ginkgo Bioworks, Illumina, Inscripta, Integrated DNA Technologies (IDT), Merck KGaA, New England Biolabs (NEB), Synopsys, Synthego, Synthetic Genomics, TeselaGen Biotechnology, Thermo Fisher Scientific, Twist Bioscience, Zymergen, and Other Key Players

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Synthetic Biology Platforms Market Outlook

- 2.1.1. Synthetic Biology Platforms Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Synthetic Biology Platforms Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Healthcare Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare Industry

- 3.1.3. Regional Distribution for Healthcare Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Healthcare Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for bio-based products and sustainable solutions.

- 4.1.1.2. Advancements in gene editing and synthetic biology tools (e.g., CRISPR, gene synthesis).

- 4.1.1.3. Increasing investments and collaborations in biotech and pharmaceutical R&D.

- 4.1.2. Restraints

- 4.1.2.1. High initial investment and operational costs.

- 4.1.2.2. Regulatory and ethical concerns around genetically engineered organisms.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Research & Discovery

- 4.4.2. Synthesis & Assembly

- 4.4.3. Scale-Up & Manufacturing

- 4.4.4. Commercialization & Application

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Synthetic Biology Platforms Market Demand

- 4.9.1. Historical Market Size – Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Synthetic Biology Platforms Market Analysis, by Technology Type

- 6.1. Key Segment Analysis

- 6.2. Synthetic Biology Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Technology Type, 2021-2035

- 6.2.1. Genome Engineering

- 6.2.1.1. CRISPR/Cas9

- 6.2.1.2. TALENs (Transcription Activator-Like Effector Nucleases)

- 6.2.1.3. Zinc Finger Nucleases (ZFNs)

- 6.2.1.4. Meganucleases

- 6.2.1.5. Others

- 6.2.2. DNA Synthesis & Sequencing

- 6.2.2.1. Oligonucleotide Synthesis

- 6.2.2.2. Gene Synthesis

- 6.2.2.3. Next-Generation Sequencing (NGS)

- 6.2.2.4. Others

- 6.2.3. Bioinformatics & Software Tools

- 6.2.3.1. Computer-Aided Design (CAD) Software

- 6.2.3.2. Biological Modeling & Simulation

- 6.2.3.3. Data Analytics Platforms

- 6.2.3.4. Others

- 6.2.4. Synthetic Cells & Minimal Genomes

- 6.2.5. Metabolic Engineering Platforms

- 6.2.6. Protein Engineering & Design

- 6.2.1. Genome Engineering

- 7. Global Synthetic Biology Platforms Market Analysis, by Product Type

- 7.1. Key Segment Analysis

- 7.2. Synthetic Biology Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 7.2.1. Enabling Technologies

- 7.2.1.1. Enzymes

- 7.2.1.2. Cloning Kits

- 7.2.1.3. Chassis Organisms

- 7.2.1.4. Synthetic Genes

- 7.2.1.5. Others

- 7.2.2. Enabled Products

- 7.2.2.1. Synthetic Drugs

- 7.2.2.2. Biofuels

- 7.2.2.3. Biomaterials

- 7.2.2.4. Specialty Chemicals

- 7.2.2.5. Others

- 7.2.3. Software Platforms

- 7.2.4. Services

- 7.2.4.1. Custom DNA Synthesis

- 7.2.4.2. Strain Engineering Services

- 7.2.4.3. Contract Research Services

- 7.2.4.4. Others

- 7.2.1. Enabling Technologies

- 8. Global Synthetic Biology Platforms Market Analysis, by Application

- 8.1. Key Segment Analysis

- 8.2. Synthetic Biology Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Application, 2021-2035

- 8.2.1. Drug Discovery & Development

- 8.2.1.1. Target Identification & Validation

- 8.2.1.2. Lead Optimization

- 8.2.1.3. Preclinical Testing

- 8.2.1.4. Biologics Development

- 8.2.1.5. Others

- 8.2.2. Biofuel & Biomaterial Production

- 8.2.2.1. Bioethanol

- 8.2.2.2. Biodiesel

- 8.2.2.3. Bio-based Plastics

- 8.2.2.4. Biofibers

- 8.2.2.5. Others

- 8.2.3. Agricultural Biotechnology

- 8.2.3.1. Crop Enhancement

- 8.2.3.2. Biopesticides

- 8.2.3.3. Biofertilizers

- 8.2.3.4. Others

- 8.2.4. Industrial Enzyme Production

- 8.2.4.1. Food & Nutrition

- 8.2.4.2. Alternative Proteins

- 8.2.4.3. Flavors & Fragrances

- 8.2.4.4. Food Additives

- 8.2.4.5. Others

- 8.2.5. Environmental Applications

- 8.2.5.1. Bioremediation

- 8.2.5.2. Biosensors

- 8.2.5.3. Others

- 8.2.6. Chemical Synthesis

- 8.2.7. Diagnostics Development

- 8.2.8. Other Applications

- 8.2.1. Drug Discovery & Development

- 9. Global Synthetic Biology Platforms Market Analysis, by Organism Type

- 9.1. Key Segment Analysis

- 9.2. Synthetic Biology Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Organism Type, 2021-2035

- 9.2.1. Prokaryotic Systems

- 9.2.1.1. Escherichia coli

- 9.2.1.2. Bacillus subtilis

- 9.2.1.3. Pseudomonas putida

- 9.2.1.4. Cyanobacteria

- 9.2.1.5. Others

- 9.2.2. Eukaryotic Systems

- 9.2.2.1. Saccharomyces cerevisiae (Yeast)

- 9.2.2.2. Pichia pastoris

- 9.2.2.3. Mammalian Cell Lines

- 9.2.2.4. Plant Cells

- 9.2.2.5. Others

- 9.2.3. Cell-Free Systems

- 9.2.4. Hybrid & Synthetic Systems

- 9.2.1. Prokaryotic Systems

- 10. Global Synthetic Biology Platforms Market Analysis, by Component

- 10.1. Key Segment Analysis

- 10.2. Synthetic Biology Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Component, 2021-2035

- 10.2.1. Hardware

- 10.2.1.1. Automated Liquid Handling Systems

- 10.2.1.2. DNA Synthesizers

- 10.2.1.3. Bioreactors & Fermentation Systems

- 10.2.1.4. Analytical Instruments

- 10.2.1.5. Others

- 10.2.2. Software

- 10.2.2.1. Design Software

- 10.2.2.2. Analysis Software

- 10.2.2.3. Workflow Management Systems

- 10.2.2.4. Others

- 10.2.3. Consumables

- 10.2.3.1. Reagents & Kits

- 10.2.3.2. Culture Media

- 10.2.3.3. DNA Building Blocks

- 10.2.3.4. Others

- 10.2.4. Services

- 10.2.1. Hardware

- 11. Global Synthetic Biology Platforms Market Analysis, by End-User Type

- 11.1. Key Segment Analysis

- 11.2. Synthetic Biology Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-User Type, 2021-2035

- 11.2.1. Academic & Research Institutes

- 11.2.1.1. Universities

- 11.2.1.2. Government Research Organizations

- 11.2.1.3. Private Research Foundations

- 11.2.1.4. Others

- 11.2.2. Biotechnology Companies

- 11.2.2.1. Large Enterprises

- 11.2.2.2. Small & Medium Enterprises (SMEs)

- 11.2.2.3. Startups

- 11.2.2.4. Others

- 11.2.3. Pharmaceutical Companies

- 11.2.4. Industrial Manufacturing Companies

- 11.2.5. Agriculture Companies

- 11.2.6. Contract Research Organizations (CROs)

- 11.2.7. Government Agencies

- 11.2.8. Others

- 11.2.1. Academic & Research Institutes

- 12. Global Synthetic Biology Platforms Market Analysis, by Platform Complexity

- 12.1. Key Segment Analysis

- 12.2. Synthetic Biology Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Platform Complexity, 2021-2035

- 12.2.1. Basic Platforms

- 12.2.1.1. Single-Function Systems

- 12.2.1.2. Entry-Level Tools

- 12.2.1.3. Others

- 12.2.2. Intermediate Platforms

- 12.2.2.1. Multi-Function Systems

- 12.2.2.2. Integrated Workflows

- 12.2.2.3. Others

- 12.2.3. Advanced Platforms

- 12.2.3.1. High-Throughput Systems

- 12.2.3.2. Fully Automated Systems

- 12.2.3.3. AI-Integrated Platforms

- 12.2.3.4. Others

- 12.2.1. Basic Platforms

- 13. Global Synthetic Biology Platforms Market Analysis, by Deployment Mode

- 13.1. Key Segment Analysis

- 13.2. Synthetic Biology Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Deployment Mode, 2021-2035

- 13.2.1. On-Premise Solutions

- 13.2.2. Cloud-Based Platforms

- 13.2.3. Hybrid Systems

- 14. Global Synthetic Biology Platforms Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Synthetic Biology Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Synthetic Biology Platforms Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Synthetic Biology Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Technology Type

- 15.3.2. Product Type

- 15.3.3. Application

- 15.3.4. Organism Type

- 15.3.5. Component

- 15.3.6. End-User Type

- 15.3.7. Platform Complexity

- 15.3.8. Deployment Mode

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Synthetic Biology Platforms Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Technology Type

- 15.4.3. Product Type

- 15.4.4. Application

- 15.4.5. Organism Type

- 15.4.6. Component

- 15.4.7. End-User Type

- 15.4.8. Platform Complexity

- 15.4.9. Deployment Mode

- 15.5. Canada Synthetic Biology Platforms Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Technology Type

- 15.5.3. Product Type

- 15.5.4. Application

- 15.5.5. Organism Type

- 15.5.6. Component

- 15.5.7. End-User Type

- 15.5.8. Platform Complexity

- 15.5.9. Deployment Mode

- 15.6. Mexico Synthetic Biology Platforms Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Technology Type

- 15.6.3. Product Type

- 15.6.4. Application

- 15.6.5. Organism Type

- 15.6.6. Component

- 15.6.7. End-User Type

- 15.6.8. Platform Complexity

- 15.6.9. Deployment Mode

- 16. Europe Synthetic Biology Platforms Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Synthetic Biology Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Technology Type

- 16.3.2. Product Type

- 16.3.3. Application

- 16.3.4. Organism Type

- 16.3.5. Component

- 16.3.6. End-User Type

- 16.3.7. Platform Complexity

- 16.3.8. Deployment Mode

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Synthetic Biology Platforms Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Technology Type

- 16.4.3. Product Type

- 16.4.4. Application

- 16.4.5. Organism Type

- 16.4.6. Component

- 16.4.7. End-User Type

- 16.4.8. Platform Complexity

- 16.4.9. Deployment Mode

- 16.5. United Kingdom Synthetic Biology Platforms Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Technology Type

- 16.5.3. Product Type

- 16.5.4. Application

- 16.5.5. Organism Type

- 16.5.6. Component

- 16.5.7. End-User Type

- 16.5.8. Platform Complexity

- 16.5.9. Deployment Mode

- 16.6. France Synthetic Biology Platforms Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Technology Type

- 16.6.3. Product Type

- 16.6.4. Application

- 16.6.5. Organism Type

- 16.6.6. Component

- 16.6.7. End-User Type

- 16.6.8. Platform Complexity

- 16.6.9. Deployment Mode

- 16.7. Italy Synthetic Biology Platforms Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Technology Type

- 16.7.3. Product Type

- 16.7.4. Application

- 16.7.5. Organism Type

- 16.7.6. Component

- 16.7.7. End-User Type

- 16.7.8. Platform Complexity

- 16.7.9. Deployment Mode

- 16.8. Spain Synthetic Biology Platforms Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Technology Type

- 16.8.3. Product Type

- 16.8.4. Application

- 16.8.5. Organism Type

- 16.8.6. Component

- 16.8.7. End-User Type

- 16.8.8. Platform Complexity

- 16.8.9. Deployment Mode

- 16.9. Netherlands Synthetic Biology Platforms Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Technology Type

- 16.9.3. Product Type

- 16.9.4. Application

- 16.9.5. Organism Type

- 16.9.6. Component

- 16.9.7. End-User Type

- 16.9.8. Platform Complexity

- 16.9.9. Deployment Mode

- 16.10. Nordic Countries Synthetic Biology Platforms Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Technology Type

- 16.10.3. Product Type

- 16.10.4. Application

- 16.10.5. Organism Type

- 16.10.6. Component

- 16.10.7. End-User Type

- 16.10.8. Platform Complexity

- 16.10.9. Deployment Mode

- 16.11. Poland Synthetic Biology Platforms Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Technology Type

- 16.11.3. Product Type

- 16.11.4. Application

- 16.11.5. Organism Type

- 16.11.6. Component

- 16.11.7. End-User Type

- 16.11.8. Platform Complexity

- 16.11.9. Deployment Mode

- 16.12. Russia & CIS Synthetic Biology Platforms Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Technology Type

- 16.12.3. Product Type

- 16.12.4. Application

- 16.12.5. Organism Type

- 16.12.6. Component

- 16.12.7. End-User Type

- 16.12.8. Platform Complexity

- 16.12.9. Deployment Mode

- 16.13. Rest of Europe Synthetic Biology Platforms Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Technology Type

- 16.13.3. Product Type

- 16.13.4. Application

- 16.13.5. Organism Type

- 16.13.6. Component

- 16.13.7. End-User Type

- 16.13.8. Platform Complexity

- 16.13.9. Deployment Mode

- 17. Asia Pacific Synthetic Biology Platforms Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. East Asia Synthetic Biology Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Technology Type

- 17.3.2. Product Type

- 17.3.3. Application

- 17.3.4. Organism Type

- 17.3.5. Component

- 17.3.6. End-User Type

- 17.3.7. Platform Complexity

- 17.3.8. Deployment Mode

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Synthetic Biology Platforms Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Technology Type

- 17.4.3. Product Type

- 17.4.4. Application

- 17.4.5. Organism Type

- 17.4.6. Component

- 17.4.7. End-User Type

- 17.4.8. Platform Complexity

- 17.4.9. Deployment Mode

- 17.5. India Synthetic Biology Platforms Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Technology Type

- 17.5.3. Product Type

- 17.5.4. Application

- 17.5.5. Organism Type

- 17.5.6. Component

- 17.5.7. End-User Type

- 17.5.8. Platform Complexity

- 17.5.9. Deployment Mode

- 17.6. Japan Synthetic Biology Platforms Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Technology Type

- 17.6.3. Product Type

- 17.6.4. Application

- 17.6.5. Organism Type

- 17.6.6. Component

- 17.6.7. End-User Type

- 17.6.8. Platform Complexity

- 17.6.9. Deployment Mode

- 17.7. South Korea Synthetic Biology Platforms Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Technology Type

- 17.7.3. Product Type

- 17.7.4. Application

- 17.7.5. Organism Type

- 17.7.6. Component

- 17.7.7. End-User Type

- 17.7.8. Platform Complexity

- 17.7.9. Deployment Mode

- 17.8. Australia and New Zealand Synthetic Biology Platforms Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Technology Type

- 17.8.3. Product Type

- 17.8.4. Application

- 17.8.5. Organism Type

- 17.8.6. Component

- 17.8.7. End-User Type

- 17.8.8. Platform Complexity

- 17.8.9. Deployment Mode

- 17.9. Indonesia Synthetic Biology Platforms Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Technology Type

- 17.9.3. Product Type

- 17.9.4. Application

- 17.9.5. Organism Type

- 17.9.6. Component

- 17.9.7. End-User Type

- 17.9.8. Platform Complexity

- 17.9.9. Deployment Mode

- 17.10. Malaysia Synthetic Biology Platforms Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Technology Type

- 17.10.3. Product Type

- 17.10.4. Application

- 17.10.5. Organism Type

- 17.10.6. Component

- 17.10.7. End-User Type

- 17.10.8. Platform Complexity

- 17.10.9. Deployment Mode

- 17.11. Thailand Synthetic Biology Platforms Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Technology Type

- 17.11.3. Product Type

- 17.11.4. Application

- 17.11.5. Organism Type

- 17.11.6. Component

- 17.11.7. End-User Type

- 17.11.8. Platform Complexity

- 17.11.9. Deployment Mode

- 17.12. Vietnam Synthetic Biology Platforms Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Technology Type

- 17.12.3. Product Type

- 17.12.4. Application

- 17.12.5. Organism Type

- 17.12.6. Component

- 17.12.7. End-User Type

- 17.12.8. Platform Complexity

- 17.12.9. Deployment Mode

- 17.13. Rest of Asia Pacific Synthetic Biology Platforms Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Technology Type

- 17.13.3. Product Type

- 17.13.4. Application

- 17.13.5. Organism Type

- 17.13.6. Component

- 17.13.7. End-User Type

- 17.13.8. Platform Complexity

- 17.13.9. Deployment Mode

- 18. Middle East Synthetic Biology Platforms Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Synthetic Biology Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Technology Type

- 18.3.2. Product Type

- 18.3.3. Application

- 18.3.4. Organism Type

- 18.3.5. Component

- 18.3.6. End-User Type

- 18.3.7. Platform Complexity

- 18.3.8. Deployment Mode

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Synthetic Biology Platforms Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Technology Type

- 18.4.3. Product Type

- 18.4.4. Application

- 18.4.5. Organism Type

- 18.4.6. Component

- 18.4.7. End-User Type

- 18.4.8. Platform Complexity

- 18.4.9. Deployment Mode

- 18.5. UAE Synthetic Biology Platforms Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Technology Type

- 18.5.3. Product Type

- 18.5.4. Application

- 18.5.5. Organism Type

- 18.5.6. Component

- 18.5.7. End-User Type

- 18.5.8. Platform Complexity

- 18.5.9. Deployment Mode

- 18.6. Saudi Arabia Synthetic Biology Platforms Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Technology Type

- 18.6.3. Product Type

- 18.6.4. Application

- 18.6.5. Organism Type

- 18.6.6. Component

- 18.6.7. End-User Type

- 18.6.8. Platform Complexity

- 18.6.9. Deployment Mode

- 18.7. Israel Synthetic Biology Platforms Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Technology Type

- 18.7.3. Product Type

- 18.7.4. Application

- 18.7.5. Organism Type

- 18.7.6. Component

- 18.7.7. End-User Type

- 18.7.8. Platform Complexity

- 18.7.9. Deployment Mode

- 18.8. Rest of Middle East Synthetic Biology Platforms Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Technology Type

- 18.8.3. Product Type

- 18.8.4. Application

- 18.8.5. Organism Type

- 18.8.6. Component

- 18.8.7. End-User Type

- 18.8.8. Platform Complexity

- 18.8.9. Deployment Mode

- 19. Africa Synthetic Biology Platforms Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Synthetic Biology Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Technology Type

- 19.3.2. Product Type

- 19.3.3. Application

- 19.3.4. Organism Type

- 19.3.5. Component

- 19.3.6. End-User Type

- 19.3.7. Platform Complexity

- 19.3.8. Deployment Mode

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Synthetic Biology Platforms Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Technology Type

- 19.4.3. Product Type

- 19.4.4. Application

- 19.4.5. Organism Type

- 19.4.6. Component

- 19.4.7. End-User Type

- 19.4.8. Platform Complexity

- 19.4.9. Deployment Mode

- 19.5. Egypt Synthetic Biology Platforms Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Technology Type

- 19.5.3. Product Type

- 19.5.4. Application

- 19.5.5. Organism Type

- 19.5.6. Component

- 19.5.7. End-User Type

- 19.5.8. Platform Complexity

- 19.5.9. Deployment Mode

- 19.6. Nigeria Synthetic Biology Platforms Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Technology Type

- 19.6.3. Product Type

- 19.6.4. Application

- 19.6.5. Organism Type

- 19.6.6. Component

- 19.6.7. End-User Type

- 19.6.8. Platform Complexity

- 19.6.9. Deployment Mode

- 19.7. Algeria Synthetic Biology Platforms Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Technology Type

- 19.7.3. Product Type

- 19.7.4. Application

- 19.7.5. Organism Type

- 19.7.6. Component

- 19.7.7. End-User Type

- 19.7.8. Platform Complexity

- 19.7.9. Deployment Mode

- 19.8. Rest of Africa Synthetic Biology Platforms Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Technology Type

- 19.8.3. Product Type

- 19.8.4. Application

- 19.8.5. Organism Type

- 19.8.6. Component

- 19.8.7. End-User Type

- 19.8.8. Platform Complexity

- 19.8.9. Deployment Mode

- 20. South America Synthetic Biology Platforms Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Central and South Africa Synthetic Biology Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Technology Type

- 20.3.2. Product Type

- 20.3.3. Application

- 20.3.4. Organism Type

- 20.3.5. Component

- 20.3.6. End-User Type

- 20.3.7. Platform Complexity

- 20.3.8. Deployment Mode

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Synthetic Biology Platforms Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Technology Type

- 20.4.3. Product Type

- 20.4.4. Application

- 20.4.5. Organism Type

- 20.4.6. Component

- 20.4.7. End-User Type

- 20.4.8. Platform Complexity

- 20.4.9. Deployment Mode

- 20.5. Argentina Synthetic Biology Platforms Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Technology Type

- 20.5.3. Product Type

- 20.5.4. Application

- 20.5.5. Organism Type

- 20.5.6. Component

- 20.5.7. End-User Type

- 20.5.8. Platform Complexity

- 20.5.9. Deployment Mode

- 20.6. Rest of South America Synthetic Biology Platforms Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Technology Type

- 20.6.3. Product Type

- 20.6.4. Application

- 20.6.5. Organism Type

- 20.6.6. Component

- 20.6.7. End-User Type

- 20.6.8. Platform Complexity

- 20.6.9. Deployment Mode

- 21. Key Players/ Company Profile

- 21.1. Agilent Technologies.

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Amyris

- 21.3. Atum (formerly DNA2.0)

- 21.4. Benchling

- 21.5. Codexis

- 21.6. Eurofins Genomics

- 21.7. GenScript Biotech

- 21.8. Ginkgo Bioworks

- 21.9. Illumina

- 21.10. Inscripta

- 21.11. Integrated DNA Technologies (IDT)

- 21.12. Merck KGaA

- 21.13. New England Biolabs (NEB)

- 21.14. Synopsys

- 21.15. Synthego

- 21.16. Synthetic Genomics

- 21.17. TeselaGen Biotechnology

- 21.18. Thermo Fisher Scientific

- 21.19. Twist Bioscience

- 21.20. Zymergen

- 21.21. Other Key Players

- 21.1. Agilent Technologies.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data