Textile Recycling Market Size, Share & Trends Analysis Report by Material Type (Cotton, Wool, Polyester, Nylon, Acrylic, Silk, Rayon/Viscose, Spandex/Elastane, Blended Fabrics, Others (Hemp, Linen, Jute)), Source, Recycling Method, Process, End-use Industry, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Textile Recycling Market Size, Share, and Growth

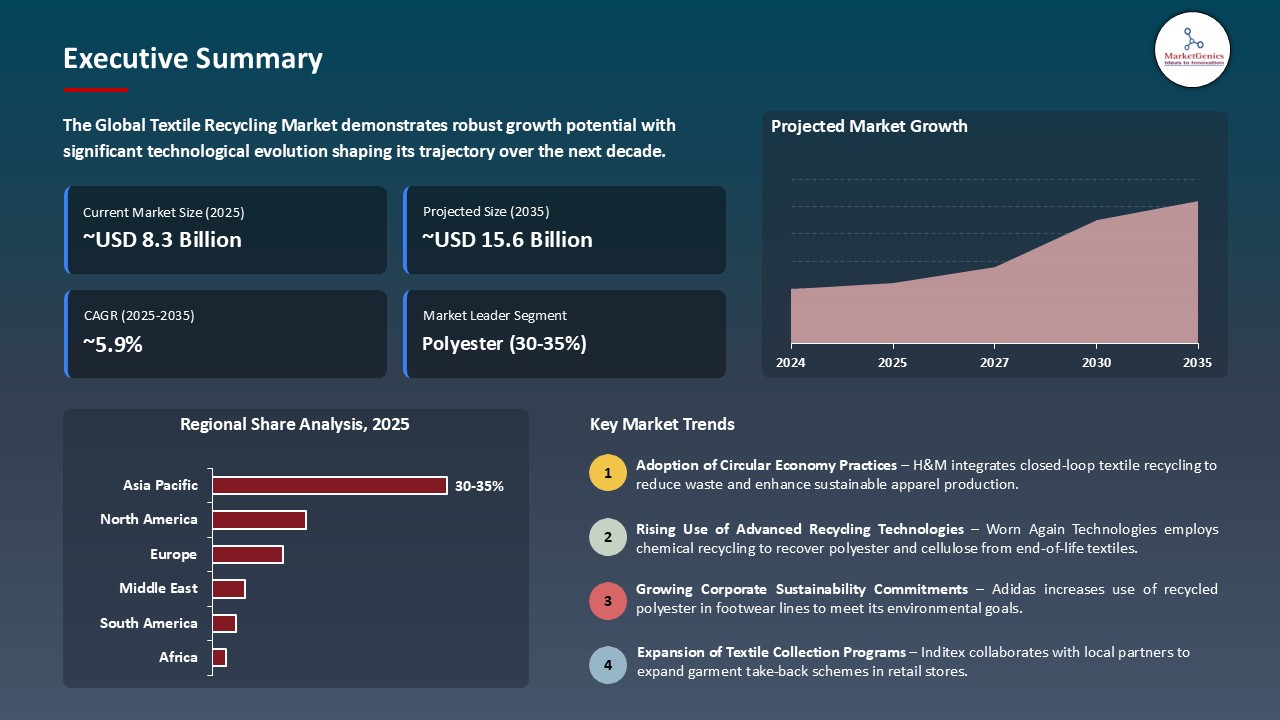

The global textile recycling market is experiencing robust growth, with its estimated value of USD 8.3 billion in the year 2025 and USD 15.6 billion by the period 2035, registering a CAGR of 5.9% during the forecast time. Asia Pacific leads the market with market share of 34.5% with USD 2.8 billion revenue.

Unifi Inc., guided by its Chief Product Officer Meredith Boyd, has revitalized textile-to-textile recycling—turning factory waste into Repreve fibers—thus preserving jobs and maintaining a domestic supply chain while partnering with brands like Nike and Patagonia.

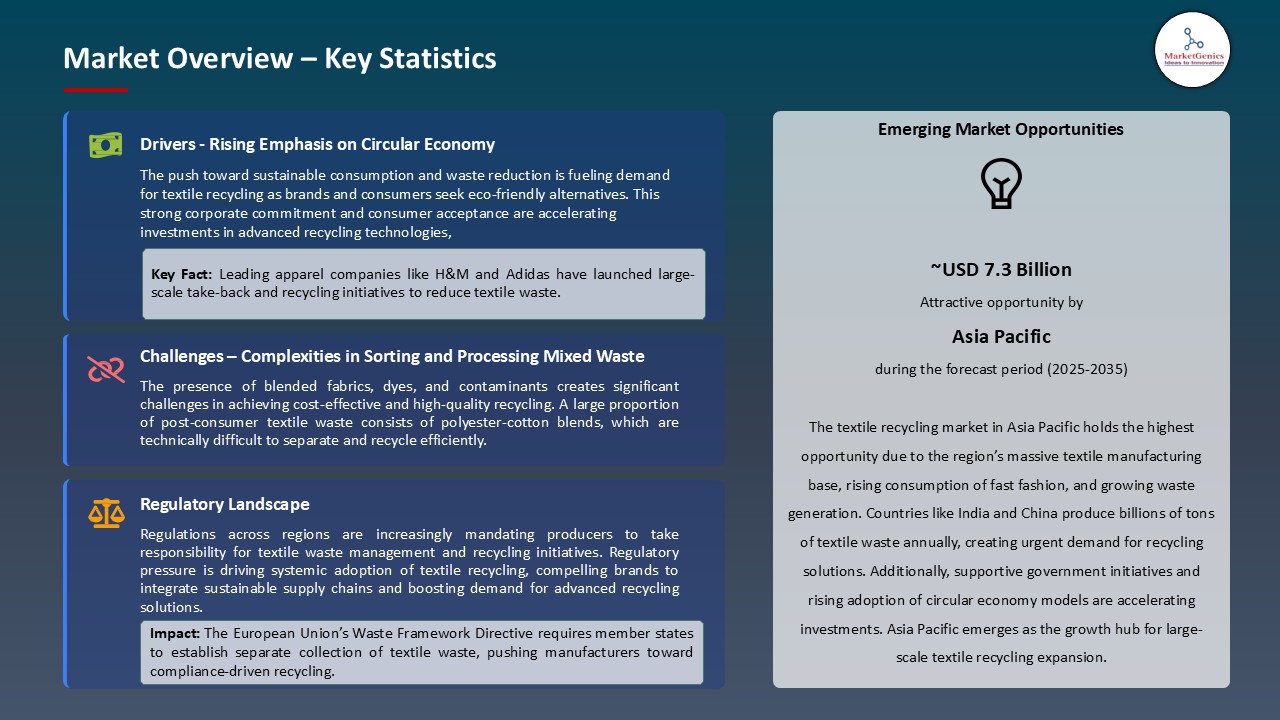

The elevated environmental awareness and the growth in the levels of textile waste are pushing worldwide apparel-producing brand names to incorporate recycling in the base of their business. In 2024, H&M Group has extended its garment collection program in stores to all of Europe, further backing its move toward a circular economy through the recovery of post-consumer textiles.

On the other hand, increasing cost of raw materials is prompting the firms to resort to recycled materials to help decrease reliance on virgin materials. In May 2025, Indorama Ventures reported increased output at the recycled polyester plant it owns in France benefiting from textile waste as a source to maintain the same input prices and achieve sustainability goals. Such efforts indicate a transition towards economically constrained (but voluntary) recycling incorporation. Raw material cost volatility and brand-led supply chain innovations are discretely adding to the steady acceleration of the market.

Adjacent opportunities include the growth of recycled textile-based insulation materials in construction, increasing demand for sustainable packaging using textile waste fibers, and innovations in chemical recycling technologies for fiber regeneration. These sectors are growing with the textile recycling together since they both have sustainability objectives.

Textile Recycling Market Dynamics and Trends

Driver: Rising Government Regulations Supporting Circular Economy is Encouraging Textile Recycling Initiatives

- The global textile recycling market is growing on a large scale because governments in both developed and emerging economies are enacting strict measures to ensure that the practice of textile recycling becomes a reality in the textile industry through the application of principles of a circular economy. The European Union Waste Framework Directive and other regulations like the Extended Producer Responsibility (EPR) are forcing brands to handle the disposal of their post-consumer textile materials by participating in in-house recycling or through partnership with recyclers.

- As an example, in early 2025, Adidas has released a completely recyclable shoe line-Futurecraft.Loop 2.0 that is within its commitment to the EU Green Deal which is produced through exclusive usage of recyclable polyester and closed-loop supply chains. Due to the alignment of its product development towards the benchmark of regulatory requirements, Adidas can not only expect to stay compliant, as well as improve its ESG standing in the process.

Restraint: Infrastructural Limitations in Sorting and Recycling Facilities are Hindering Market Scalability

- Although the awareness levels and the participation of the brands have increased, the textile recycling market remains limited by the harsh infrastructural dearth in the gathering, fiber separation, and processing. Textile waste is heterogeneous, consisting of blends that cannot be recycled in the mainstream, in a mechanical or chemical way, simply because the recycling of these sophisticated materials requires highly specific technologies.

- The absence of standardized sorting technologies contaminates and creates inefficiencies in the recycling process, narrowing the potential scale of recycling activities. In 2025, Levi Strauss & Co claimed that almost a third of the post-consumer garments that they had collected could not be processed because of the lack of the available sorting infrastructure that would distinguish between synthetic and natural fibers.

- Accordingly, a significant part of the recyclable textiles still occupies landfills or incinerators in spite of collection efforts. In the absence of powerful sorting technology and decentralized recycling facilities, widespread implementation of textile recycling is both logistically and financially difficult.

Opportunity: Expansion of Recycled Textile Applications in Automotive and Furniture Sectors is Creating New Revenue Streams

- Even outside apparel, there are new markets with lucrative adjacent opportunities as more textile recyclates go into non-traditional applications like car interiors and furniture upholstery, further diversifying profitable uses of the materials. Automotive OEMs face pressure to incorporate sustainable materials into the process of vehicle manufacture so as to comply with restricting emission and end-of-life regulations.

- In 2025, BMW partnered with Swedish company Renewcell to create the interiors of its cars using Circulose, a patent material made out of recycled fabrics, and this contrasted with virgin inputs. IKEA, similarly, recently announced the launch of furniture covers made of eco-fiber, which is composed of post-consumer cotton waste, further supporting the use of circular resources into its product range. These advances immensely highlight the growing recycling market beyond fashion-centric cycles into industrial and consumer goods usage.

- The recyclers can now have diversified revenue sources, which can allow them to up-scale operations and receive more investment.

Key Trend: Technological Innovation in Fiber-to-Fiber Recycling is Transforming Material Recovery Efficiency

- A prominent shift towards fiber-to-fiber chemical recycling technologies is changing the textile recycling landscape, as such technologies can handle blended textiles at high recovery rates. In contrast to mechanical processing technologies, such innovations bring fibers back to near-virgin quality, which allows manufacturers to reuse them in high-performance products.

- In 2025, Infinited Fiber Company opened its first commercial-scale facility in Finland, producing regenerated textile fiber “Infinna” from polycotton and waste garments. Brands such as Patagonia and GANNI already apply this fiber to their spring collections, which proves its business feasibility. These technologies are overcoming recycling-related obstacles that have been present since day one, since they allow older, more complex textile mixtures to be processed and recycled.

- The innovations will most likely turn into groundbreaking, transforming the processes of material flow in the textile market and reinforcing the feasibility of the closed-loop system as they become more affordable and accessible.

Textile Recycling Market Analysis and Segmental Data

High Demand for Recycled Polyester Driven by Brand Commitments and Circular Manufacturing

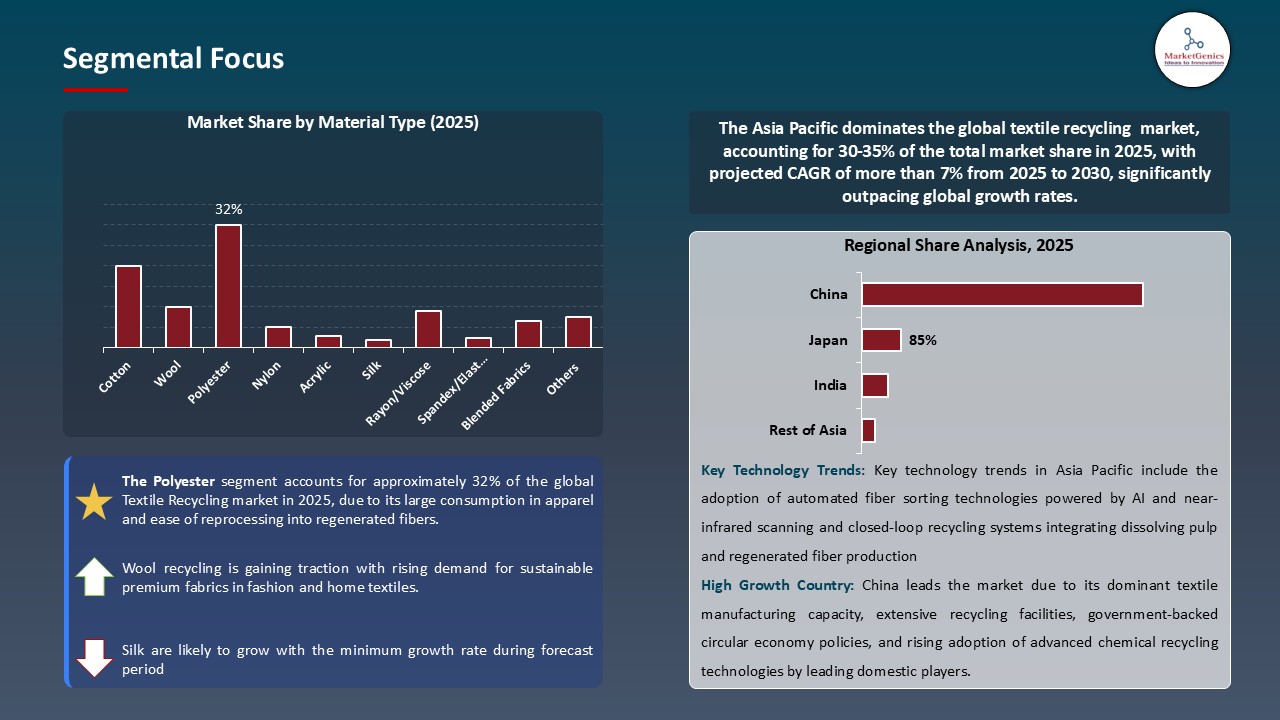

- Polyester dominates the textile recycling market due to its widespread use in apparel, sportswear, and home furnishings, making it the most abundant recyclable synthetic fiber. In January 2025, Nike massively incorporated recycled polyester throughout Dri Fit lineage to incorporate post-consumer PET and polyester waste, a step that would tie in with its Move to Zero initiative. Brands have and continue to turn to recycled polyester (rPET) because it is durable and retains performance characteristics and provides lower carbon footprint than virgin polyester.

- As environmental awareness increases and the market seeks more environmentally friendly products, manufacturers have moved to adopt rPET as a way of establishing regulatory and ESG goals. High-volume, low-cost polyester recovery is also favored by the availability of mature mechanical recycling technologies. The high demand of rPET is bolstering the future of polyester as the foundation of scalable textile recycling.

Asia Pacific Leads Textile Recycling Due to Industrial Scale and Regulatory Push

- Asia Pacific has the maximum demand in the textile recycling market because of its lead in global textile production and the increasing pressure to deal with post-industrial and post-consumer waste. Arvind Limited, an Indian textile exporter, began its zero-waste denim production program in 2025, when it introduced the use of recycled cotton and polyester fibres at scale in its manufacturing facilities in Gujarat.

- India, China and Bangladesh, among others, produce enormous quantities of textile waste, and, therefore, domestic textile manufacturers consider recycling to minimize the environmental burden and to achieve cost reduction. Moreover, the governments of the region are also encouraging sustainability by introducing their own incentives and waste management laws. China’s 2024 Circular Economy Action Plan set mandatory recycling quotas for large textile factories, pushing manufacturers to integrate recyclates into their value chains.

- The region is quickly turning into a textile ecosystem hotspot due to policy support and an easy supply of inexpensive labour. The adoption of textile recycling in Asia Pacific is being fast-tracked by its integrated supply chains and the policy requirement.

Textile Recycling Market Ecosystem

The textile recycling market is moderately fragmented, with a medium-to-high level of market competition due to the presence of both established Tier 1 players (e.g., Lenzing AG, UNIFI, Hyosung Group) and a wide network of emerging Tier 2 and Tier 3 companies (e.g., iinouiio Ltd, Brandeur, FRIVEP). The buyer concentration remains moderate as demand is diversified across fashion, automotive, and industrial sectors, while supplier concentration is low due to the abundance of post-consumer textile sources and decentralized collection networks.

Recent Development and Strategic Overview:

- In June 2025, Recover, a global leader in recycled cotton fiber, opened a new 14,000 m² recycling plant in Dong Nai, Vietnam. This facility utilizes Recover's RMix technology, enabling the processing of cotton-polyester blends without fiber separation and boasts an annual capacity of 10,000 tons. The plant is a key part of Recover's strategy to expand its global manufacturing footprint and promote circularity in the textile industry.

- In June 2025, Unifi's Repreve brand, which uses recycled PET bottles, played a key role in the company's revitalization of U.S. operations and expansion into textile-to-textile recycling in China. This initiative involved recycling over 42 billion bottles into fiber for major brands like Nike and Patagonia.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 8.3 Bn |

|

Market Forecast Value in 2035 |

USD 15.6 Bn |

|

Growth Rate (CAGR) |

5.9% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value

|

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Textile Recycling Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Material Type |

|

|

By Source |

|

|

By Recycling Method |

|

|

By Process |

|

|

By End-Use Industry |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Textile Recycling Market Outlook

- 2.1.1. Textile Recycling Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Textile Recycling Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Industrial Machinery Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Industrial Machinery Industry

- 3.1.3. Regional Distribution for Industrial Machinery Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Industrial Machinery Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising consumer demand for sustainable and circular fashion

- 4.1.1.2. Government regulations promoting recycling and landfill diversion

- 4.1.1.3. Technological advancements in fiber regeneration and chemical recycling

- 4.1.2. Restraints

- 4.1.2.1. Limited infrastructure for textile waste collection and sorting

- 4.1.2.2. High costs and energy requirements associated with advanced recycling technologies

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Textile Recycling Companies

- 4.4.3. Distributors

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Textile Recycling Market Demand

- 4.9.1. Historical Market Size - in Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - in Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Textile Recycling Market Analysis, by Material Type

- 6.1. Key Segment Analysis

- 6.2. Textile Recycling Market Size (Value - US$ Bn), Analysis, and Forecasts, by Material Type, 2021-2035

- 6.2.1. Cotton

- 6.2.2. Wool

- 6.2.3. Polyester

- 6.2.4. Nylon

- 6.2.5. Acrylic

- 6.2.6. Silk

- 6.2.7. Rayon/Viscose

- 6.2.8. Spandex/Elastane

- 6.2.9. Blended Fabrics (e.g., Poly-Cotton)

- 6.2.10. Others (e.g., Hemp, Linen, Jute)

- 7. Global Textile Recycling Market Analysis, by Source

- 7.1. Key Segment Analysis

- 7.2. Textile Recycling Market Size (Value - US$ Bn), Analysis, and Forecasts, by Source, 2021-2035

- 7.2.1. Post-Consumer Waste

- 7.2.1.1. Worn apparel

- 7.2.1.2. Household textiles (e.g., bed linens, towels)

- 7.2.1.3. Footwear and accessories

- 7.2.1.4. Others

- 7.2.2. Post-Industrial Waste

- 7.2.2.1. Manufacturing scraps

- 7.2.2.2. Defective productions

- 7.2.2.3. Cutting-room waste

- 7.2.2.4. Overstock and unsold inventory

- 7.2.2.5. Others

- 7.2.1. Post-Consumer Waste

- 8. Global Textile Recycling Market Analysis, by Recycling Method

- 8.1. Key Segment Analysis

- 8.2. Textile Recycling Market Size (Value - US$ Bn), Analysis, and Forecasts, by Recycling Method, 2021-2035

- 8.2.1. Open-loop Recycling

- 8.2.2. Closed-loop Recycling

- 8.2.3. Hybrid Recycling

- 9. Global Textile Recycling Market Analysis, by Process

- 9.1. Key Segment Analysis

- 9.2. Textile Recycling Market Size (Value - US$ Bn), Analysis, and Forecasts, by Process, 2021-2035

- 9.2.1. Mechanical Recycling

- 9.2.1.1. Garnetting (for wool and cotton)

- 9.2.1.2. Shredding and carding

- 9.2.1.3. Re-spinning

- 9.2.1.4. Others

- 9.2.2. Chemical Recycling

- 9.2.2.1. Depolymerization (e.g., for polyester and nylon)

- 9.2.2.2. Solvent-based separation

- 9.2.2.3. Enzymatic treatment

- 9.2.2.4. Others

- 9.2.3. Thermal Recycling

- 9.2.3.1. Incineration with energy recovery

- 9.2.4. Upcycling/Downcycling

- 9.2.4.1. Upcycling into higher-value items (e.g., bags, accessories)

- 9.2.4.2. Downcycling into insulation, padding, rags

- 9.2.1. Mechanical Recycling

- 10. Global Textile Recycling Market Analysis, by End-use Industry

- 10.1. Key Segment Analysis

- 10.2. Textile Recycling Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-use Industry, 2021-2035

- 10.2.1. Apparel & Fashion

- 10.2.1.1. Fast fashion brands (e.g., recycled denim, t-shirts)

- 10.2.1.2. High-end fashion (e.g., eco-luxury labels)

- 10.2.1.3. Others

- 10.2.2. Home Furnishings

- 10.2.2.1. Carpets and rugs

- 10.2.2.2. Upholstery

- 10.2.2.3. Curtains and draperies

- 10.2.2.4. Others

- 10.2.3. Automotive

- 10.2.3.1. Seat padding

- 10.2.3.2. Interior insulation

- 10.2.3.3. Carpeting

- 10.2.3.4. Others

- 10.2.4. Construction

- 10.2.4.1. Wall insulation

- 10.2.4.2. Soundproofing material

- 10.2.4.3. Others

- 10.2.5. Industrial Applications

- 10.2.5.1. Wipes and rags

- 10.2.5.2. Geotextiles

- 10.2.5.3. Filtration fabrics

- 10.2.5.4. Others

- 10.2.6. Retail and Packaging

- 10.2.6.1. Reusable bags

- 10.2.6.2. Eco-packaging solutions

- 10.2.6.3. Others

- 10.2.7. Medical and Hygiene

- 10.2.7.1. Bandages

- 10.2.7.2. Sanitary textiles

- 10.2.7.3. Others

- 10.2.8. Other End-use Industries

- 10.2.1. Apparel & Fashion

- 11. Global Textile Recycling Market Analysis and Forecasts, by Region

- 11.1. Key Findings

- 11.2. Textile Recycling Market Size (Volume - Mn Units and Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 11.2.1. North America

- 11.2.2. Europe

- 11.2.3. Asia Pacific

- 11.2.4. Middle East

- 11.2.5. Africa

- 11.2.6. South America

- 12. North America Textile Recycling Market Analysis

- 12.1. Key Segment Analysis

- 12.2. Regional Snapshot

- 12.3. North America Textile Recycling Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 12.3.1. Material Type

- 12.3.2. Source

- 12.3.3. Recycling Method

- 12.3.4. Process

- 12.3.5. End-Use Industry

- 12.3.6. Country

- 12.3.6.1. USA

- 12.3.6.2. Canada

- 12.3.6.3. Mexico

- 12.4. USA Textile Recycling Market

- 12.4.1. Country Segmental Analysis

- 12.4.2. Material Type

- 12.4.3. Source

- 12.4.4. Recycling Method

- 12.4.5. Process

- 12.4.6. End-Use Industry

- 12.5. Canada Textile Recycling Market

- 12.5.1. Country Segmental Analysis

- 12.5.2. Material Type

- 12.5.3. Source

- 12.5.4. Recycling Method

- 12.5.5. Process

- 12.5.6. End-Use Industry

- 12.6. Mexico Textile Recycling Market

- 12.6.1. Country Segmental Analysis

- 12.6.2. Material Type

- 12.6.3. Source

- 12.6.4. Recycling Method

- 12.6.5. Process

- 12.6.6. End-Use Industry

- 13. Europe Textile Recycling Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. Europe Textile Recycling Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Material Type

- 13.3.2. Source

- 13.3.3. Recycling Method

- 13.3.4. Process

- 13.3.5. End-Use Industry

- 13.3.6. Country

- 13.3.6.1. Germany

- 13.3.6.2. United Kingdom

- 13.3.6.3. France

- 13.3.6.4. Italy

- 13.3.6.5. Spain

- 13.3.6.6. Netherlands

- 13.3.6.7. Nordic Countries

- 13.3.6.8. Poland

- 13.3.6.9. Russia & CIS

- 13.3.6.10. Rest of Europe

- 13.4. Germany Textile Recycling Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Material Type

- 13.4.3. Source

- 13.4.4. Recycling Method

- 13.4.5. Process

- 13.4.6. End-Use Industry

- 13.5. United Kingdom Textile Recycling Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Material Type

- 13.5.3. Source

- 13.5.4. Recycling Method

- 13.5.5. Process

- 13.5.6. End-Use Industry

- 13.6. France Textile Recycling Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Material Type

- 13.6.3. Source

- 13.6.4. Recycling Method

- 13.6.5. Process

- 13.6.6. End-Use Industry

- 13.7. Italy Textile Recycling Market

- 13.7.1. Country Segmental Analysis

- 13.7.2. Material Type

- 13.7.3. Source

- 13.7.4. Recycling Method

- 13.7.5. Process

- 13.7.6. End-Use Industry

- 13.8. Spain Textile Recycling Market

- 13.8.1. Country Segmental Analysis

- 13.8.2. Material Type

- 13.8.3. Source

- 13.8.4. Recycling Method

- 13.8.5. Process

- 13.8.6. End-Use Industry

- 13.9. Netherlands Textile Recycling Market

- 13.9.1. Country Segmental Analysis

- 13.9.2. Material Type

- 13.9.3. Source

- 13.9.4. Recycling Method

- 13.9.5. Process

- 13.9.6. End-Use Industry

- 13.10. Nordic Countries Textile Recycling Market

- 13.10.1. Country Segmental Analysis

- 13.10.2. Material Type

- 13.10.3. Source

- 13.10.4. Recycling Method

- 13.10.5. Process

- 13.10.6. End-Use Industry

- 13.11. Poland Textile Recycling Market

- 13.11.1. Country Segmental Analysis

- 13.11.2. Material Type

- 13.11.3. Source

- 13.11.4. Recycling Method

- 13.11.5. Process

- 13.11.6. End-Use Industry

- 13.12. Russia & CIS Textile Recycling Market

- 13.12.1. Country Segmental Analysis

- 13.12.2. Material Type

- 13.12.3. Source

- 13.12.4. Recycling Method

- 13.12.5. Process

- 13.12.6. End-Use Industry

- 13.13. Rest of Europe Textile Recycling Market

- 13.13.1. Country Segmental Analysis

- 13.13.2. Material Type

- 13.13.3. Source

- 13.13.4. Recycling Method

- 13.13.5. Process

- 13.13.6. End-Use Industry

- 14. Asia Pacific Textile Recycling Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. East Asia Textile Recycling Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Material Type

- 14.3.2. Source

- 14.3.3. Recycling Method

- 14.3.4. Process

- 14.3.5. End-Use Industry

- 14.3.6. Country

- 14.3.6.1. China

- 14.3.6.2. India

- 14.3.6.3. Japan

- 14.3.6.4. South Korea

- 14.3.6.5. Australia and New Zealand

- 14.3.6.6. Indonesia

- 14.3.6.7. Malaysia

- 14.3.6.8. Thailand

- 14.3.6.9. Vietnam

- 14.3.6.10. Rest of Asia Pacific

- 14.4. China Textile Recycling Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Material Type

- 14.4.3. Source

- 14.4.4. Recycling Method

- 14.4.5. Process

- 14.4.6. End-Use Industry

- 14.5. India Textile Recycling Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Material Type

- 14.5.3. Source

- 14.5.4. Recycling Method

- 14.5.5. Process

- 14.5.6. End-Use Industry

- 14.6. Japan Textile Recycling Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Material Type

- 14.6.3. Source

- 14.6.4. Recycling Method

- 14.6.5. Process

- 14.6.6. End-Use Industry

- 14.7. South Korea Textile Recycling Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Material Type

- 14.7.3. Source

- 14.7.4. Recycling Method

- 14.7.5. Process

- 14.7.6. End-Use Industry

- 14.8. Australia and New Zealand Textile Recycling Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Material Type

- 14.8.3. Source

- 14.8.4. Recycling Method

- 14.8.5. Process

- 14.8.6. End-Use Industry

- 14.9. Indonesia Textile Recycling Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Material Type

- 14.9.3. Source

- 14.9.4. Recycling Method

- 14.9.5. Process

- 14.9.6. End-Use Industry

- 14.10. Malaysia Textile Recycling Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Material Type

- 14.10.3. Source

- 14.10.4. Recycling Method

- 14.10.5. Process

- 14.10.6. End-Use Industry

- 14.11. Thailand Textile Recycling Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Material Type

- 14.11.3. Source

- 14.11.4. Recycling Method

- 14.11.5. Process

- 14.11.6. End-Use Industry

- 14.12. Vietnam Textile Recycling Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Material Type

- 14.12.3. Source

- 14.12.4. Recycling Method

- 14.12.5. Process

- 14.12.6. End-Use Industry

- 14.13. Rest of Asia Pacific Textile Recycling Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Material Type

- 14.13.3. Source

- 14.13.4. Recycling Method

- 14.13.5. Process

- 14.13.6. End-Use Industry

- 15. Middle East Textile Recycling Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Middle East Textile Recycling Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Material Type

- 15.3.2. Source

- 15.3.3. Recycling Method

- 15.3.4. Process

- 15.3.5. End-Use Industry

- 15.3.6. Country

- 15.3.6.1. Turkey

- 15.3.6.2. UAE

- 15.3.6.3. Saudi Arabia

- 15.3.6.4. Israel

- 15.3.6.5. Rest of Middle East

- 15.4. Turkey Textile Recycling Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Material Type

- 15.4.3. Source

- 15.4.4. Recycling Method

- 15.4.5. Process

- 15.4.6. End-Use Industry

- 15.5. UAE Textile Recycling Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Material Type

- 15.5.3. Source

- 15.5.4. Recycling Method

- 15.5.5. Process

- 15.5.6. End-Use Industry

- 15.6. Saudi Arabia Textile Recycling Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Material Type

- 15.6.3. Source

- 15.6.4. Recycling Method

- 15.6.5. Process

- 15.6.6. End-Use Industry

- 15.7. Israel Textile Recycling Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Material Type

- 15.7.3. Source

- 15.7.4. Recycling Method

- 15.7.5. Process

- 15.7.6. End-Use Industry

- 15.8. Rest of Middle East Textile Recycling Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Material Type

- 15.8.3. Source

- 15.8.4. Recycling Method

- 15.8.5. Process

- 15.8.6. End-Use Industry

- 16. Africa Textile Recycling Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Africa Textile Recycling Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Material Type

- 16.3.2. Source

- 16.3.3. Recycling Method

- 16.3.4. Process

- 16.3.5. End-Use Industry

- 16.3.6. Country

- 16.3.6.1. South Africa

- 16.3.6.2. Egypt

- 16.3.6.3. Nigeria

- 16.3.6.4. Algeria

- 16.3.6.5. Rest of Africa

- 16.4. South Africa Textile Recycling Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Material Type

- 16.4.3. Source

- 16.4.4. Recycling Method

- 16.4.5. Process

- 16.4.6. End-Use Industry

- 16.5. Egypt Textile Recycling Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Material Type

- 16.5.3. Source

- 16.5.4. Recycling Method

- 16.5.5. Process

- 16.5.6. End-Use Industry

- 16.6. Nigeria Textile Recycling Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Material Type

- 16.6.3. Source

- 16.6.4. Recycling Method

- 16.6.5. Process

- 16.6.6. End-Use Industry

- 16.7. Algeria Textile Recycling Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Material Type

- 16.7.3. Source

- 16.7.4. Recycling Method

- 16.7.5. Process

- 16.7.6. End-Use Industry

- 16.8. Rest of Africa Textile Recycling Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Material Type

- 16.8.3. Source

- 16.8.4. Recycling Method

- 16.8.5. Process

- 16.8.6. End-Use Industry

- 17. South America Textile Recycling Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Central and South Africa Textile Recycling Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Material Type

- 17.3.2. Source

- 17.3.3. Recycling Method

- 17.3.4. Process

- 17.3.5. End-Use Industry

- 17.3.6. Country

- 17.3.6.1. Brazil

- 17.3.6.2. Argentina

- 17.3.6.3. Rest of South America

- 17.4. Brazil Textile Recycling Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Material Type

- 17.4.3. Source

- 17.4.4. Recycling Method

- 17.4.5. Process

- 17.4.6. End-Use Industry

- 17.5. Argentina Textile Recycling Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Material Type

- 17.5.3. Source

- 17.5.4. Recycling Method

- 17.5.5. Process

- 17.5.6. End-Use Industry

- 17.6. Rest of South America Textile Recycling Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Material Type

- 17.6.3. Source

- 17.6.4. Recycling Method

- 17.6.5. Process

- 17.6.6. End-Use Industry

- 18. Key Players/ Company Profile

- 18.1. Ambercycle

- 18.1.1. Company Details/ Overview

- 18.1.2. Company Financials

- 18.1.3. Key Customers and Competitors

- 18.1.4. Business/ Industry Portfolio

- 18.1.5. Product Portfolio/ Specification Details

- 18.1.6. Pricing Data

- 18.1.7. Strategic Overview

- 18.1.8. Recent Developments

- 18.2. American Textile Recycling Service

- 18.3. Birla Cellulose

- 18.4. Brandeur

- 18.5. ECOTEX COLLECT

- 18.6. FRIVEP

- 18.7. Hyosung Group

- 18.8. I:CO – I:Collect GmbH

- 18.9. iinouiio Ltd

- 18.10. Infinited Fiber Company

- 18.11. Lenzing AG

- 18.12. Martex Fiber Southern Corporation

- 18.13. Renewcell

- 18.14. SOEX Group

- 18.15. Texaid Group

- 18.16. The Boer Group

- 18.17. The WoolMark Company

- 18.18. UNIFI, Inc.

- 18.19. Worn Again Technologies

- 18.20. Other Key players

- 18.1. Ambercycle

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation