Aerospace Coatings Market Size, Share & Trends Analysis Report by Resin Type (Polyurethane, Epoxy, Acrylic, Alkyd, Fluoropolymer, Polysiloxane, Polyimide, Others), Product Type, Technology, Application Method, Aircraft Component, Aircraft Type, Functionality, Substrate Type, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Aerospace Coatings Market Size, Share, and Growth

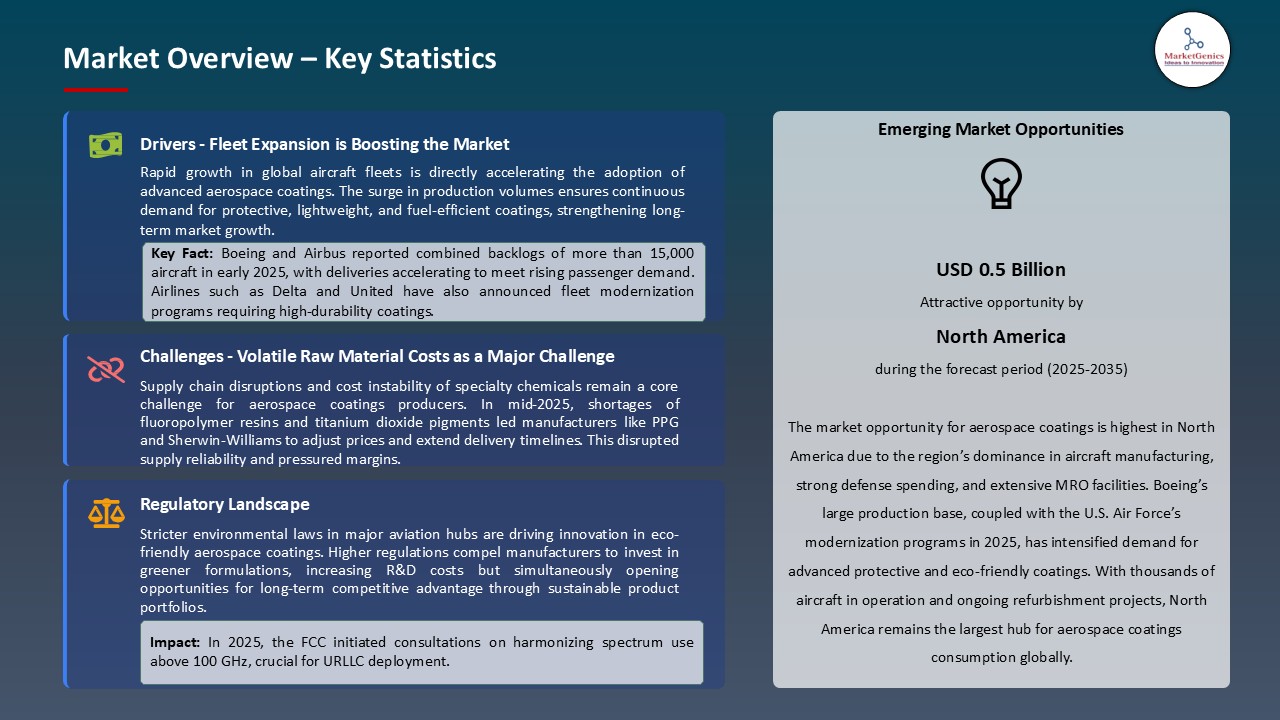

The global aerospace coatings market is experiencing robust growth, with its estimated value of USD 1.3 billion in the year 2025 and USD 2.7 billion by the period 2035, registering a CAGR of 7.2%. North America leads the market with market share of 39.3% with USD 0.5 billion revenue.

On May 5, 2025, Ed Hilborne, Global Marketing and Product Manager of Aerospace Coatings, highlighted that aerospace order backlogs—around 15,800 aircraft at the end of 2024—have driven strong demand for advanced coatings that enhance durability and fuel efficiency, such as lightweight basecoat/clearcoat systems reducing maintenance frequency and operational weight

The demand for aerospace coatings is being fueled by growing aircraft manufacturing, aircraft fleet restoration, and an increasing focus on lightweight, long-lasting, and environmental conscious coatings that can raise fuel efficiencies and aircraft service life. As the trend towards sustainability continues, industry players are turning to next-generation waterborne and chrome-free paints to comply with government regulations, but achieve the same standard of extreme performance.

As an example, in February 2025, AkzoNobel announced the expansion of its Aerofleet Coatings Management digital platform which enables airlines to monitor coating durability and perform optimized repainting programs with decreasing maintenance costs and carbon emission. The global market of aerospace coatings is growing steadily based on constant innovation in the advanced coating technology in line with sustainability ambitions.

The global aerospace coatings market has significant opportunities in adjacent markets such as aircraft interiors coatings, space-grade protective coatings, unmanned aerial vehicle (UAV) coatings, advanced nanocoatings for defense and sustainable raw materials to make coating formulas. These adjacent markets leverage synergies in innovation to increase the level of adoption and technology breakthroughs in expansive applications in the areas of aerospace and defence.

Aerospace Coatings Market Dynamics and Trends

Driver: Growing Demand for Lightweight Coatings in Aerospace Applications Driving Market Expansion

- The aviation industry is increasingly prioritizing light material in order to optimize on fuel efficiency and performance. Lightweight coatings, like nanocomposites or advanced polymers, are becoming increasingly popular as they allow decreasing the total weight of an aircraft and still offer sufficient protection against environmental impacts.

- Organizations such as PPG industries have led this change, with innovative light weight coating products that have passed the rigid aerospace standards. As an example, PPG has launched its AeroBrite line, which offers low-density paints allowing increased fuel efficiency without reducing the durability. This drive toward sustainability and operating at lower costs is driving manufacturers towards implementing these advanced coatings.

- Moreover, the increased environmental regulations also recognize the necessity of lightweight and environmentally-friendly solutions in aircraft production. The current trend of lightweight coatings is likely to influence the market size of the aerospace coatings industry considerably, as the industry graduates to efficiency-driven innovation.

Restraint: Stringent Regulatory Compliance in Aerospace Coatings Presenting Challenges for Manufacturers

- The aerospace coatings industry is grappling with severe regulatory constraints in the aviation sector around the globe. Such regulations usually involve environmental and safety-related regulations, which require manufacturers to meet complex compliance requirements.

- As an example, the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) standards are strict on chemical composition of plane coatings. These standards have created a challenge posed by companies such as AkzoNobel, who have spiraled on the complexities to comply to these standards through products offered. The challenges lies in the production of coating materials that are not only compliant with these regulations but also ones that are of high quality and durable.

- Manufacturers might also have an extra expense on research and development to comply with these standards which may make the market growth slow. As a result, regulatory environment becomes one of the key aspects, which manufacturers have to consider in order to remain within the same market niche.

Opportunity: Rising Opportunities in Eco-Friendly Coatings for Sustainable Aerospace Solutions

- The rising focus on sustainability across the aerospace industry is providing a tremendous amount of opportunity to eco-friendly coating solutions. The manufacturers have currently started concentrating on the preparation of low volatile organic compounds (VOCs), and sustainable raw materials as coatings. As an example, BASF introduced recently a new line eco-friendly coating within the sector of aerospace with lower environmental load with the similar high performance.

- These are innovations that not only suffice regulatory needs, but they are also attractive to environmentally sensitive consumers and businesses. The necessity to be sustainable in the operations may increase the demand in eco-friendly coatings by airlines and manufacturers. The trend has opened the door to companies that could distinguish themselves by being sustainable in practice hence becoming more market share.

- The trend in eco-friendly paint offers profitable prospects and could open the market of aerospace coatings to a vast extent.

Key Trend: Increasing Focus on Advanced Coating Technologies as a Prominent Trend in Aerospace Industry

- High-performance coating technologies are fast emerging as a major trend in the aerospace coatings market due to requirements of intensity of performance, durability and protection. New technologies like thermal barrier coatings and self-healing coatings are becoming popular, and they are providing passengers with better protection against harsh environmental conditions and mechanical fatigue.

- Advanced coatings by companies such as Sherwin-Williams with nanotechnology have also been developed, which dramatically enhance resistance to corrosion and wear. The ability to integrate smart coatings that will be able to monitor their own state and give real-time data is also growing. Such developments not only enhance the life span of the aircraft but also aid in the general safety and efficiency.

- The focus on sophisticated coating technologies will transform the aerospace coatings market, improving performance and safety levels within the sector.

Aerospace Coatings Market Analysis and Segmental Data

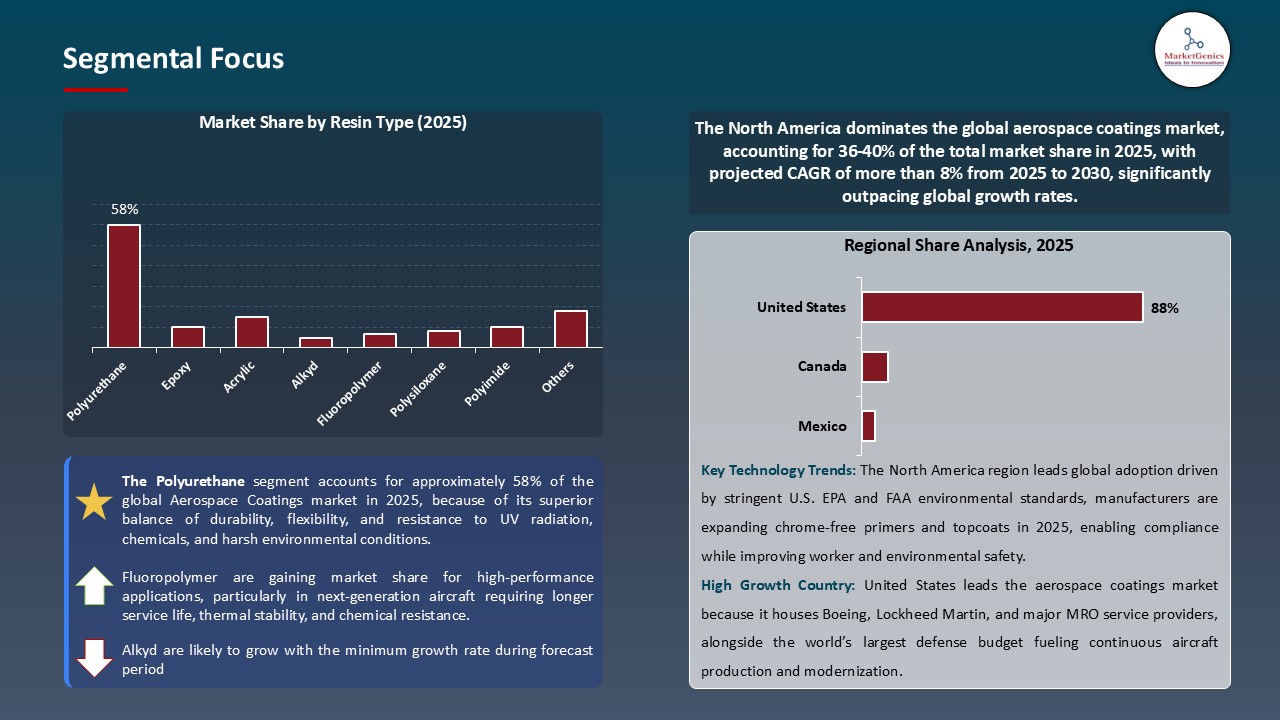

Dominance of Polyurethane Resin in Aerospace Coatings Market

- The polyurethane segment holds the highest demand in the aerospace coatings market due to its superior durability, chemical resistance, and exceptional gloss retention that ensures aircraft aesthetics and long-term protection. In June of 2024, AkzoNobel announced an expansion of its Aerodur 3001/3002 polyurethane-based basecoat-clearcoat platform, claiming a rising usage in OEM and MRO work.

- Moreover, the polyurethane coating has great UV resistance with long maintenance periods to lower the lifecycle cost of airlines due to the increasing pressure of their operations. They are sustainable due to their compatibility with higher levels of waterborne formulations. In 2024, PPG has already invested to further expand its polyurethane coatings production capacity in North America, which highlights the high customer dependence on these resins.

- The increased popularity of polyurethane resins will positively impact the dynamically increasing aerospace coatings market, improving the efficiency and durability of aircraft.

North America’s Leading Role in Aerospace Coatings Market

- The North American region has the largest market with demands of the aerospace coatings clearly based on the high concentration of OEms of aircrafts and MRO facilities as well as the defense industry which maintain constant coating activities. In April 2024, Sherwin-Williams Aerospace Coatings unveiled a plan to expand in Wichita, Kansas, to keep up with supplier Boeing and additional regional aviation clients.

- Moreover, strong defense expenditure in the region and state-sponsored modernization of military fleets are further boosting the use of advanced coatings. Illustratively, in 2024, Lockheed Martin increased production of F-35s, requiring specialized protective coatings that provide stealth capability, and resistance against corrosion.

- The combination of commercial and defense demand maintains the leadership position of North America which will continue long-term stable development with the suppliers of aerospace coating products being entrenched within the OEM and defense sectors of the region.

Aerospace Coatings Market Ecosystem

The global aerospace coatings market is moderately consolidated, with Tier 1 players such as Akzo Nobel N.V., PPG Industries, Inc., BASF SE, Sherwin-Williams, and Axalta Coating Systems holding significant market share, while Tier 2 and Tier 3 firms like Hohman Plating, Permagard Aviation, and Lankwitzer Lackfabrik serve niche applications. Buyer concentration remains high due to limited aircraft OEMs and MRO operators, giving them stronger negotiating power, whereas supplier concentration is moderate, with material providers exerting influence through technological expertise and regulatory compliance.

Recent Development and Strategic Overview:

- In May 2025, IFI and AkzoNobel strengthened their partnership to expand access to high-performance aerospace coatings for General Aviation Original Equipment Manufacturers (OEMs) in Europe. This collaboration aims to make advanced coating solutions more accessible, fostering innovation and driving growth within the General Aviation (GA) sector.

- In May 2025, PPG announced a major capacity and capability investment—a $380 million project to build a new aerospace coatings and sealants manufacturing facility in Shelby, North Carolina. The multi‑year project is positioned to produce the company’s full line of aerospace coatings and sealants and to strengthen regional supply chain resilience while addressing an order backlog the company described as significant.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 1.3 Bn |

|

Market Forecast Value in 2035 |

USD 2.7 Bn |

|

Growth Rate (CAGR) |

7.2% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value

|

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Aerospace Coatings Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Resin Type |

|

|

By Product Type |

|

|

By Technology |

|

|

By Application Method |

|

|

By Aircraft Component |

|

|

By Aircraft Type |

|

|

By Functionality |

|

|

By Substrate Type |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Aerospace Coatings Market Outlook

- 2.1.1. Aerospace Coatings Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Aerospace Coatings Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Aerospace & Defense Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Aerospace & Defense Industry

- 3.1.3. Regional Distribution for Aerospace & Defense Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Aerospace & Defense Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Expanding global aircraft production backlogs and fleet modernization programs

- 4.1.1.2. Rising demand for eco-friendly, chrome-free, and low-VOC coating solutions

- 4.1.1.3. Increasing MRO activities driven by aging commercial and defense aircraft fleets

- 4.1.2. Restraints

- 4.1.2.1. Volatility in raw material prices for specialty resins and pigments.

- 4.1.2.2. Stringent regulatory compliance costs associated with environmental and safety standards

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Coating Manufacturers

- 4.4.3. Distributors

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Aerospace Coatings Market Demand

- 4.9.1. Historical Market Size - in Value (US$ Bn), 2021-2024

- 4.9.2. Current and Future Market Size - in Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Aerospace Coatings Market Analysis, by Resin Type

- 6.1. Key Segment Analysis

- 6.2. Aerospace Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, by Resin Type, 2021-2035

- 6.2.1. Polyurethane

- 6.2.2. Epoxy

- 6.2.3. Acrylic

- 6.2.4. Alkyd

- 6.2.5. Fluoropolymer

- 6.2.6. Polysiloxane

- 6.2.7. Polyimide

- 6.2.8. Others

- 7. Global Aerospace Coatings Market Analysis, by Product Type

- 7.1. Key Segment Analysis

- 7.2. Aerospace Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 7.2.1. Topcoats

- 7.2.2. Primers

- 7.2.3. Pretreatments

- 7.2.4. Specialty Coatings

- 7.2.5. Sealers

- 7.2.6. Strippers

- 7.2.7. Base Coats

- 7.2.8. Clear Coats

- 7.2.9. Others

- 8. Global Aerospace Coatings Market Analysis, by Technology

- 8.1. Key Segment Analysis

- 8.2. Aerospace Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, by Technology, 2021-2035

- 8.2.1. Solvent-based Coatings

- 8.2.2. Water-based Coatings

- 8.2.3. Powder Coatings

- 8.2.4. UV-Cured Coatings

- 8.2.5. Nano-Coatings

- 8.2.6. Others

- 9. Global Aerospace Coatings Market Analysis, by Application Method

- 9.1. Key Segment Analysis

- 9.2. Aerospace Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, by Application Method, 2021-2035

- 9.2.1. Spray Application

- 9.2.2. Brush Application

- 9.2.3. Dip Coating

- 9.2.4. Electrostatic Application

- 9.2.5. Roll Coating

- 9.2.6. Flow Coating

- 9.2.7. Electrodeposition

- 9.2.8. Vacuum Deposition

- 9.2.9. Others

- 10. Global Aerospace Coatings Market Analysis, by Aircraft Component

- 10.1. Key Segment Analysis

- 10.2. Aerospace Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, by Aircraft Component, 2021-2035

- 10.2.1. Fuselage

- 10.2.2. Wings

- 10.2.3. Engine Components

- 10.2.4. Landing Gear

- 10.2.5. Interior Components

- 10.2.6. Control Surfaces

- 10.2.7. Propellers

- 10.2.8. Avionics Housing

- 10.2.9. Others

- 11. Global Aerospace Coatings Market Analysis, by Aircraft Type

- 11.1. Key Segment Analysis

- 11.2. Aerospace Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, by Aircraft Type, 2021-2035

- 11.2.1. Commercial Aviation

- 11.2.2. Military/Defense Aircraft

- 11.2.3. General Aviation

- 11.2.4. Helicopters

- 11.2.5. UAVs/Drones

- 11.2.6. Space Vehicles

- 11.2.7. Cargo Aircraft

- 11.2.8. Business Jets

- 12. Global Aerospace Coatings Market Analysis, by Functionality

- 12.1. Key Segment Analysis

- 12.2. Aerospace Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, by Functionality, 2021-2035

- 12.2.1. Corrosion Protection

- 12.2.2. UV & Weather Resistance

- 12.2.3. Chemical Resistance

- 12.2.4. Heat & Thermal Protection

- 12.2.5. Aesthetic/Branding

- 13. Global Aerospace Coatings Market Analysis, by Substrate Type

- 13.1. Key Segment Analysis

- 13.2. Aerospace Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, by Substrate Type, 2021-2035

- 13.2.1. Aluminum Alloys

- 13.2.2. Composite Materials

- 13.2.3. Steel & Other Metals

- 13.2.4. Plastics & Polymers

- 13.2.5. Others

- 14. Global Aerospace Coatings Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Aerospace Coatings Market Size (Volume - Mn Units and Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Aerospace Coatings Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Aerospace Coatings Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Resin Type

- 15.3.2. Product Type

- 15.3.3. Technology

- 15.3.4. Application Method

- 15.3.5. Aircraft Component

- 15.3.6. Aircraft Type

- 15.3.7. Functionality

- 15.3.8. Substrate Type

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Aerospace Coatings Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Resin Type

- 15.4.3. Product Type

- 15.4.4. Technology

- 15.4.5. Application Method

- 15.4.6. Aircraft Component

- 15.4.7. Aircraft Type

- 15.4.8. Functionality

- 15.4.9. Substrate Type

- 15.5. Canada Aerospace Coatings Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Resin Type

- 15.5.3. Product Type

- 15.5.4. Technology

- 15.5.5. Application Method

- 15.5.6. Aircraft Component

- 15.5.7. Aircraft Type

- 15.5.8. Functionality

- 15.5.9. Substrate Type

- 15.6. Mexico Aerospace Coatings Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Resin Type

- 15.6.3. Product Type

- 15.6.4. Technology

- 15.6.5. Application Method

- 15.6.6. Aircraft Component

- 15.6.7. Aircraft Type

- 15.6.8. Functionality

- 15.6.9. Substrate Type

- 16. Europe Aerospace Coatings Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Aerospace Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Resin Type

- 16.3.2. Product Type

- 16.3.3. Technology

- 16.3.4. Application Method

- 16.3.5. Aircraft Component

- 16.3.6. Aircraft Type

- 16.3.7. Functionality

- 16.3.8. Substrate Type

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Aerospace Coatings Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Resin Type

- 16.4.3. Product Type

- 16.4.4. Technology

- 16.4.5. Application Method

- 16.4.6. Aircraft Component

- 16.4.7. Aircraft Type

- 16.4.8. Functionality

- 16.4.9. Substrate Type

- 16.5. United Kingdom Aerospace Coatings Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Resin Type

- 16.5.3. Product Type

- 16.5.4. Technology

- 16.5.5. Application Method

- 16.5.6. Aircraft Component

- 16.5.7. Aircraft Type

- 16.5.8. Functionality

- 16.5.9. Substrate Type

- 16.6. France Aerospace Coatings Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Resin Type

- 16.6.3. Product Type

- 16.6.4. Technology

- 16.6.5. Application Method

- 16.6.6. Aircraft Component

- 16.6.7. Aircraft Type

- 16.6.8. Functionality

- 16.6.9. Substrate Type

- 16.7. Italy Aerospace Coatings Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Resin Type

- 16.7.3. Product Type

- 16.7.4. Technology

- 16.7.5. Application Method

- 16.7.6. Aircraft Component

- 16.7.7. Aircraft Type

- 16.7.8. Functionality

- 16.7.9. Substrate Type

- 16.8. Spain Aerospace Coatings Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Resin Type

- 16.8.3. Product Type

- 16.8.4. Technology

- 16.8.5. Application Method

- 16.8.6. Aircraft Component

- 16.8.7. Aircraft Type

- 16.8.8. Functionality

- 16.8.9. Substrate Type

- 16.9. Netherlands Aerospace Coatings Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Resin Type

- 16.9.3. Product Type

- 16.9.4. Technology

- 16.9.5. Application Method

- 16.9.6. Aircraft Component

- 16.9.7. Aircraft Type

- 16.9.8. Functionality

- 16.9.9. Substrate Type

- 16.10. Nordic Countries Aerospace Coatings Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Resin Type

- 16.10.3. Product Type

- 16.10.4. Technology

- 16.10.5. Application Method

- 16.10.6. Aircraft Component

- 16.10.7. Aircraft Type

- 16.10.8. Functionality

- 16.10.9. Substrate Type

- 16.11. Poland Aerospace Coatings Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Resin Type

- 16.11.3. Product Type

- 16.11.4. Technology

- 16.11.5. Application Method

- 16.11.6. Aircraft Component

- 16.11.7. Aircraft Type

- 16.11.8. Functionality

- 16.11.9. Substrate Type

- 16.12. Russia & CIS Aerospace Coatings Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Resin Type

- 16.12.3. Product Type

- 16.12.4. Technology

- 16.12.5. Application Method

- 16.12.6. Aircraft Component

- 16.12.7. Aircraft Type

- 16.12.8. Functionality

- 16.12.9. Substrate Type

- 16.13. Rest of Europe Aerospace Coatings Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Resin Type

- 16.13.3. Product Type

- 16.13.4. Technology

- 16.13.5. Application Method

- 16.13.6. Aircraft Component

- 16.13.7. Aircraft Type

- 16.13.8. Functionality

- 16.13.9. Substrate Type

- 17. Asia Pacific Aerospace Coatings Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. East Asia Aerospace Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Resin Type

- 17.3.2. Product Type

- 17.3.3. Technology

- 17.3.4. Application Method

- 17.3.5. Aircraft Component

- 17.3.6. Aircraft Type

- 17.3.7. Functionality

- 17.3.8. Substrate Type

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Aerospace Coatings Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Resin Type

- 17.4.3. Product Type

- 17.4.4. Technology

- 17.4.5. Application Method

- 17.4.6. Aircraft Component

- 17.4.7. Aircraft Type

- 17.4.8. Functionality

- 17.4.9. Substrate Type

- 17.5. India Aerospace Coatings Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Resin Type

- 17.5.3. Product Type

- 17.5.4. Technology

- 17.5.5. Application Method

- 17.5.6. Aircraft Component

- 17.5.7. Aircraft Type

- 17.5.8. Functionality

- 17.5.9. Substrate Type

- 17.6. Japan Aerospace Coatings Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Resin Type

- 17.6.3. Product Type

- 17.6.4. Technology

- 17.6.5. Application Method

- 17.6.6. Aircraft Component

- 17.6.7. Aircraft Type

- 17.6.8. Functionality

- 17.6.9. Substrate Type

- 17.7. South Korea Aerospace Coatings Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Resin Type

- 17.7.3. Product Type

- 17.7.4. Technology

- 17.7.5. Application Method

- 17.7.6. Aircraft Component

- 17.7.7. Aircraft Type

- 17.7.8. Functionality

- 17.7.9. Substrate Type

- 17.8. Australia and New Zealand Aerospace Coatings Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Resin Type

- 17.8.3. Product Type

- 17.8.4. Technology

- 17.8.5. Application Method

- 17.8.6. Aircraft Component

- 17.8.7. Aircraft Type

- 17.8.8. Functionality

- 17.8.9. Substrate Type

- 17.9. Indonesia Aerospace Coatings Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Resin Type

- 17.9.3. Product Type

- 17.9.4. Technology

- 17.9.5. Application Method

- 17.9.6. Aircraft Component

- 17.9.7. Aircraft Type

- 17.9.8. Functionality

- 17.9.9. Substrate Type

- 17.10. Malaysia Aerospace Coatings Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Resin Type

- 17.10.3. Product Type

- 17.10.4. Technology

- 17.10.5. Application Method

- 17.10.6. Aircraft Component

- 17.10.7. Aircraft Type

- 17.10.8. Functionality

- 17.10.9. Substrate Type

- 17.11. Thailand Aerospace Coatings Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Resin Type

- 17.11.3. Product Type

- 17.11.4. Technology

- 17.11.5. Application Method

- 17.11.6. Aircraft Component

- 17.11.7. Aircraft Type

- 17.11.8. Functionality

- 17.11.9. Substrate Type

- 17.12. Vietnam Aerospace Coatings Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Resin Type

- 17.12.3. Product Type

- 17.12.4. Technology

- 17.12.5. Application Method

- 17.12.6. Aircraft Component

- 17.12.7. Aircraft Type

- 17.12.8. Functionality

- 17.12.9. Substrate Type

- 17.13. Rest of Asia Pacific Aerospace Coatings Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Resin Type

- 17.13.3. Product Type

- 17.13.4. Technology

- 17.13.5. Application Method

- 17.13.6. Aircraft Component

- 17.13.7. Aircraft Type

- 17.13.8. Functionality

- 17.13.9. Substrate Type

- 18. Middle East Aerospace Coatings Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Aerospace Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Resin Type

- 18.3.2. Product Type

- 18.3.3. Technology

- 18.3.4. Application Method

- 18.3.5. Aircraft Component

- 18.3.6. Aircraft Type

- 18.3.7. Functionality

- 18.3.8. Substrate Type

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Aerospace Coatings Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Resin Type

- 18.4.3. Product Type

- 18.4.4. Technology

- 18.4.5. Application Method

- 18.4.6. Aircraft Component

- 18.4.7. Aircraft Type

- 18.4.8. Functionality

- 18.4.9. Substrate Type

- 18.5. UAE Aerospace Coatings Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Resin Type

- 18.5.3. Product Type

- 18.5.4. Technology

- 18.5.5. Application Method

- 18.5.6. Aircraft Component

- 18.5.7. Aircraft Type

- 18.5.8. Functionality

- 18.5.9. Substrate Type

- 18.6. Saudi Arabia Aerospace Coatings Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Resin Type

- 18.6.3. Product Type

- 18.6.4. Technology

- 18.6.5. Application Method

- 18.6.6. Aircraft Component

- 18.6.7. Aircraft Type

- 18.6.8. Functionality

- 18.6.9. Substrate Type

- 18.7. Israel Aerospace Coatings Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Resin Type

- 18.7.3. Product Type

- 18.7.4. Technology

- 18.7.5. Application Method

- 18.7.6. Aircraft Component

- 18.7.7. Aircraft Type

- 18.7.8. Functionality

- 18.7.9. Substrate Type

- 18.8. Rest of Middle East Aerospace Coatings Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Resin Type

- 18.8.3. Product Type

- 18.8.4. Technology

- 18.8.5. Application Method

- 18.8.6. Aircraft Component

- 18.8.7. Aircraft Type

- 18.8.8. Functionality

- 18.8.9. Substrate Type

- 19. Africa Aerospace Coatings Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Aerospace Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Resin Type

- 19.3.2. Product Type

- 19.3.3. Technology

- 19.3.4. Application Method

- 19.3.5. Aircraft Component

- 19.3.6. Aircraft Type

- 19.3.7. Functionality

- 19.3.8. Substrate Type

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Aerospace Coatings Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Resin Type

- 19.4.3. Product Type

- 19.4.4. Technology

- 19.4.5. Application Method

- 19.4.6. Aircraft Component

- 19.4.7. Aircraft Type

- 19.4.8. Functionality

- 19.4.9. Substrate Type

- 19.5. Egypt Aerospace Coatings Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Resin Type

- 19.5.3. Product Type

- 19.5.4. Technology

- 19.5.5. Application Method

- 19.5.6. Aircraft Component

- 19.5.7. Aircraft Type

- 19.5.8. Functionality

- 19.5.9. Substrate Type

- 19.6. Nigeria Aerospace Coatings Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Resin Type

- 19.6.3. Product Type

- 19.6.4. Technology

- 19.6.5. Application Method

- 19.6.6. Aircraft Component

- 19.6.7. Aircraft Type

- 19.6.8. Functionality

- 19.6.9. Substrate Type

- 19.7. Algeria Aerospace Coatings Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Resin Type

- 19.7.3. Product Type

- 19.7.4. Technology

- 19.7.5. Application Method

- 19.7.6. Aircraft Component

- 19.7.7. Aircraft Type

- 19.7.8. Functionality

- 19.7.9. Substrate Type

- 19.8. Rest of Africa Aerospace Coatings Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Resin Type

- 19.8.3. Product Type

- 19.8.4. Technology

- 19.8.5. Application Method

- 19.8.6. Aircraft Component

- 19.8.7. Aircraft Type

- 19.8.8. Functionality

- 19.8.9. Substrate Type

- 20. South America Aerospace Coatings Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Central and South Africa Aerospace Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Resin Type

- 20.3.2. Product Type

- 20.3.3. Technology

- 20.3.4. Application Method

- 20.3.5. Aircraft Component

- 20.3.6. Aircraft Type

- 20.3.7. Functionality

- 20.3.8. Substrate Type

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Aerospace Coatings Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Resin Type

- 20.4.3. Product Type

- 20.4.4. Technology

- 20.4.5. Application Method

- 20.4.6. Aircraft Component

- 20.4.7. Aircraft Type

- 20.4.8. Functionality

- 20.4.9. Substrate Type

- 20.5. Argentina Aerospace Coatings Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Resin Type

- 20.5.3. Product Type

- 20.5.4. Technology

- 20.5.5. Application Method

- 20.5.6. Aircraft Component

- 20.5.7. Aircraft Type

- 20.5.8. Functionality

- 20.5.9. Substrate Type

- 20.6. Rest of South America Aerospace Coatings Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Resin Type

- 20.6.3. Product Type

- 20.6.4. Technology

- 20.6.5. Application Method

- 20.6.6. Aircraft Component

- 20.6.7. Aircraft Type

- 20.6.8. Functionality

- 20.6.9. Substrate Type

- 21. Key Players/ Company Profile

- 21.1. 3M Company

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. AHC Oberflächentechnik GmbH

- 21.3. Akzo Nobel N.V.

- 21.4. Anest Iwata Corporation

- 21.5. Argosy International Inc.

- 21.6. Axalta Coating Systems Ltd.

- 21.7. BASF SE

- 21.8. Brycoat Inc.

- 21.9. Henkel AG & Co. KGaA

- 21.10. Hentzen Coatings, Inc.

- 21.11. Hohman Plating & Manufacturing LLC

- 21.12. IHI Ionbond AG

- 21.13. Lankwitzer Lackfabrik GmbH

- 21.14. Mankiewicz Gebr. & Co.

- 21.15. Permagard Aviation

- 21.16. Plasma Coatings Inc.

- 21.17. PPG Industries, Inc.

- 21.18. Sherwin-Williams Aerospace Coatings

- 21.19. Socomore S.A.S.

- 21.20. The Sherwin-Williams Company

- 21.21. Zircotec Ltd.

- 21.22. Other Key Players

- 21.1. 3M Company

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation