Automotive Chromium Market Size, Share & Trends Analysis Report by Type (Decorative Plating, Hard Chrome Plating, Chromate Conversion Coating, Functional Coatings, Others), Chromium Valence State, Application Area, Process Type, Coating Layer Type, Propulsion Type, Vehicle Type, End-Use, Distribution Channel, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025 – 2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Automotive Chromium Market Size, Share, and Growth

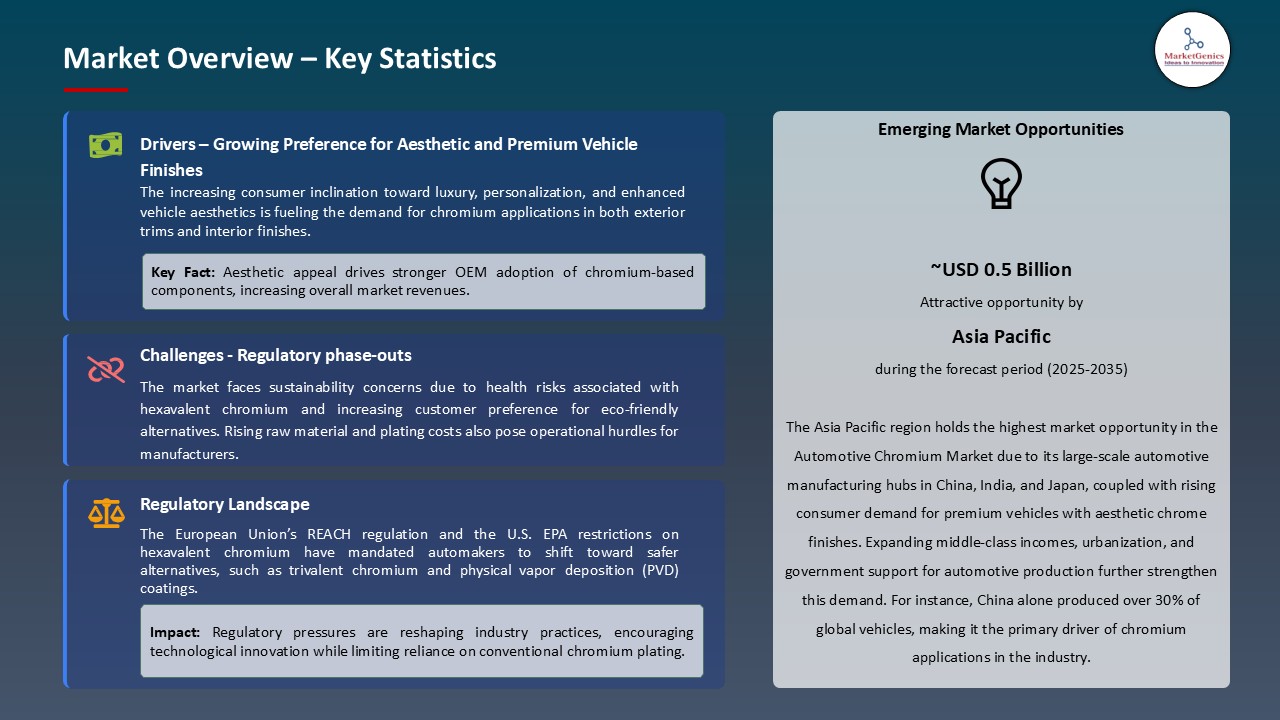

The global automotive chromium market is experiencing robust growth, with its estimated value of USD 2.1 billion in the year 2025 and USD 3.0 billion by the period 2035, registering a CAGR of 3.6%. Asia Pacific leads the market with market share of 38.2% with USD 0.8 billion revenue. Growing consumer preference for premium aesthetics combined with regulatory-driven sustainable coatings is propelling steady growth of the automotive chromium market.

SurTec International GmbH introduced advanced surface treatment solutions, with Managing Director Dr. Jörg Rinck underlining their role in enhancing corrosion resistance for automotive chromium parts.

Global automotive chromium market is mainly driven by the increased consideration on vehicle looks, endurance and sustainability of passenger and commercial vehicles. Chromium plating and chrome-like finishes and coating are being used more and more by automakers and suppliers to provide consumers with performance and style by offering corrosion resistance, high levels of surface hardness, and high-quality finishes.

The increased use of electric vehicles (EVs) is also increasing the demand of chromium as producers require lightweight yet attractive elements in the trims, grills, and wheels, aligning closely with trends seen in the Automotive Lightweight Materials. An example is MacDermid Enthone Industrial Solutions, which in March 2024 declared the growth of its trivalent chromium plating technology to international OEMs, to meet increased stricter environmental regulations and at the same time deliver premium decorative finishes.

Equally, to provide automotive companies with environmentally friendly and long-lasting finishes, Atotech, a subsidiary of MKS Instruments, introduced its new sustainable chromium (VI-free) plating line in June 2024 in Germany. These developments explain why the adoption of chromium in the automotive industry is being enhanced by the technological innovation and regulatory alignment.

Adjacent opportunities to the global automotive chromium market include advanced eco-friendly plating chemicals, lightweight alloy coatings, automotive surface protection films, sustainable decorative finishes, and electric vehicle component plating solutions. These areas benefit from regulatory compliance, design innovation, and EV adoption, creating expansion avenues for existing players.

Automotive Chromium Market Dynamics and Trends

Driver: Automotive finishes demand rises with sustainability-driven surface-treatment innovation

- As automakers are adding more chromium-based and chromium-alternative finishes to fulfill both aesthetic and stricter sustainability goals, suppliers are turning to greener chemistries and cleaner production. In May 2025, BASF Chemetall declared a significant energy- and sustainability target and committed to grow the utilization of renewable electricity at production sites as it develops more environmentally-friendly surface-treatment solutions in automotive use.

- This corporate shift minimizes the carbon intensity of the decorative and functional plating supply chains and allows them to provide OEMs with compliant, lower-footprint finishes that meet regulatory demands and consumer requirements to buy environmentally-friendly luxury. In July 2025 Chemetall announced that its Pinghu plant is now 100% powered by renewable electricity, which further supports the idea that production-side decarbonization is being scaled.

- The chromium and chromium-alternative finishes are under increased demand as sustainability commitments by key suppliers open the OEM specifications and procurement.

Restraint: Regulatory phase-outs and chemical-authorization uncertainty increase compliance costs

- Suppliers and OEMs are responding to regulatory initiatives to eliminate hexavalent chromium in a number of uses by redesigning processes, qualifying alternatives and dealing with transitional liabilities-activities that exacerbate the cost and project schedule. Regulatory action on the use and authorisation of chromium (VI) in Europe has resulted in periods of uncertainty in the sourcing of aerospace and automotive coatings, making long-term sourcing plans difficult.

- In the meantime, reorganization and strategic portfolio restructuring among specialty chemical houses has altered vendor footprint, and the customer must re-qualify suppliers or risk service outages; the increased automotive portfolio of SurTec and its acceptance of bonded coating of OKS seen how reorganization of a vendor can lead to frictions in the short run.

- Regulatory and vendor-structure uncertainty increases compliance spending and adoption lags, putting margins at risk.

Opportunity: High-value EV components demand corrosion-resistant, lightweight plating solutions

- The fast electrification of vehicle portfolios is providing compelling opportunities to innovative chromium-free ornamental and practical finishes that offer shielding against corrosion with a diminished mass and better recovery. The suppliers in a position to offer tested and OEM certified chromium (VI)-free passivation to battery housings, connector terminals, and lightweight alloys will have premium orders to tap into as EV platforms proliferate.

- SurTec markets its chromium (VI)-free passivation SurTec 650 to aluminium battery enclosures as an OEM-quality product in line with EV demand, indicating that the suppliers can directly target battery-intensive vehicle architectures.

- Simultaneously, the sustainability investments of Chemetall and its renewable-energy-intensive production capacity enhance the credibility of suppliers who submit bids on high-value EV trimming and connector plating contracts, as sustainability credentials are emerging as procurement discriminators.

Key Trend: Shift toward circular-economy plating and low-carbon production at scale

- Automotive OEMs and Tier-1 manufacturers are beginning to consider the total lifecycle footprint of plated parts and prefer suppliers with low emissions production capabilities coupled with recyclable chemistries and low levels of hazardous waste, a priority that increasingly intersects with the Electric Vehicle Battery Recycling. Cases in the industry include suppliers making investments in renewable power and process upgrades to reduce scope-1 and scope-2 emissions and coming up with recyclable or hard-wearing alternatives to hard chrome, which extends component life.

- The Chemetall renewable electricity achievement and related site enhancements are representative of how capital is being invested to decarbonize finishing processes and solve OEM sustainability procurement requirements. At the same time, specialty surface-treatment companies are expanding portfolios to encompass Cr (VI)-free passivation chemistries designed to serve battery systems and lightweight alloys, which reflects an underlying product-level shift that is allied with circularity objectives and regulatory orientation.

- Low-carbon, circular plating suppliers will be able to reap procurement benefits and long-term durability in the automotive market.

Automotive Chromium Market Analysis and Segmental Data

Shining Appeal: Decorative Plating Leads Automotive Chromium Demand

- The decorative plating segment has the greatest demand in the automotive chromium market where automakers are putting a greater focus on the refined appearance and durability to draw consumers in the luxury and mass-market cars. Ornamental chromium finishes are smooth, mirror like, resistant to corrosion, and add to design appeal as well as part life. Most recently, Hyundai introduced its 2025 Genesis GV80 SUV with sophisticated chrome plating decorative trims emphasizing modern design in addition to being able to meet the global requirements of durability and performance that confirm the superiority of decorative plating.

- Also, the concept of decorative plating is being redefined through sustainability-inspired innovations that are consistent with OEM environmental promises. As an illustration, eco-friendly trims are being introduced by BMW as part of its next-generation electric iX models, with chromium finishes that lower the environmental footprint without compromising a luxurious look. These advances demonstrate the way the decorative plating combines luxury and sustainability, fueling OEM popularity in markets.

Asia Pacific Dominance: Automotive Chromium Market Driven by Regional Growth

- Asia Pacific has the largest automotive chromium demand because of their large automotive production sector, fast consumer demand on the stylish vehicles and the promotion of manufacturing by the government. Automakers in the region are adding chromium finishes more and more to make vehicles more appealing and long lasting. In June 2024 Toyota unveiled chrome enhanced trims in its new Crown SUV models in Japan which are based on the increasing consumer desire to have high-end looks in the mass-market cars.

- The growth of luxury and electric vehicle markets in China and India also increases the demand, and chromium plating is still a symbol of status and power there. In one such instance, in March 2024, BYD announced its Song L EV, which features chromium-plated trims and grilles to distinguish itself, and strengthen durability in emerging EV markets. Such adoption across mass and luxury vehicles cements Asia Pacific's lead in this market.

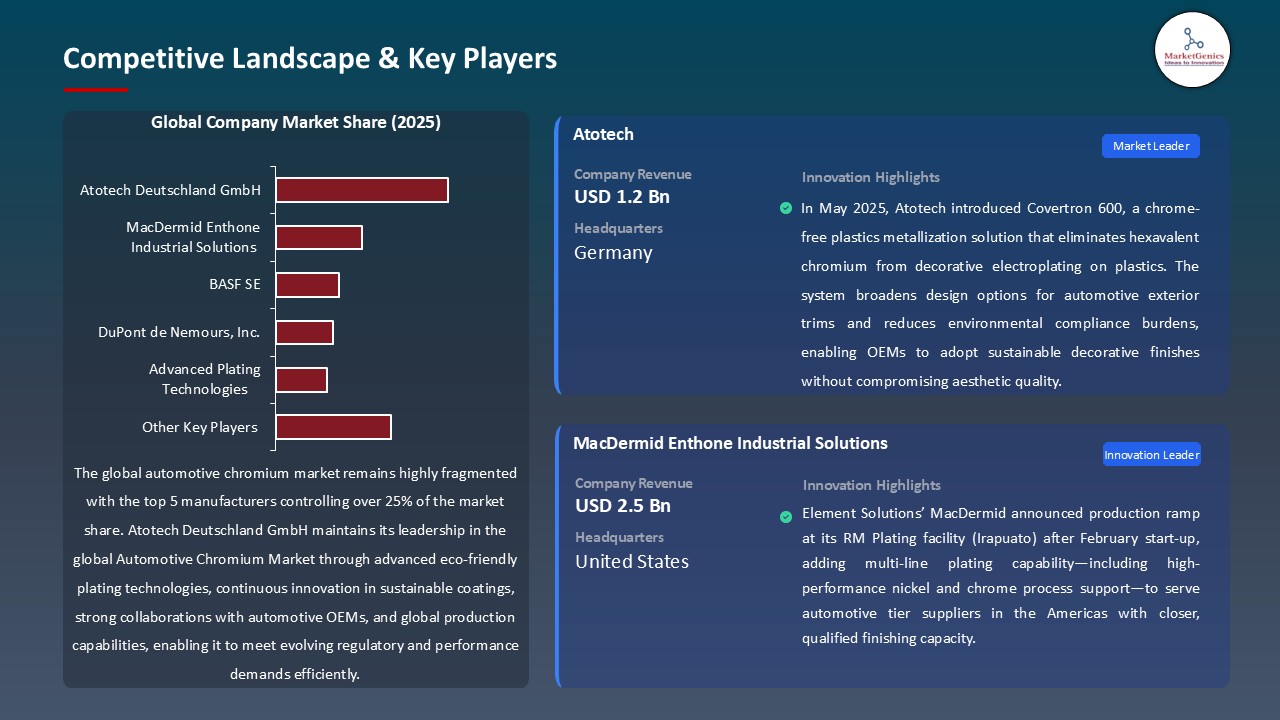

Automotive Chromium Market Ecosystem

The global automotive chromium market reflects a highly fragmented structure, with Tier 1 players such as BASF SE, DuPont de Nemours, Inc., and Atotech Deutschland GmbH holding strong technological and supply chain advantages, while Tier 2 and Tier 3 players like Srinivasa Industries and GalvaMetal Ltd. contribute to niche applications and regional demand. Market concentration is medium, as large multinationals dominate innovation while smaller firms provide customization. Porter’s five forces indicate medium buyer concentration due to diversified automakers and high supplier concentration, as raw material and plating technology are controlled by limited global leaders.

Recent Development and Strategic Overview:

- In May 2025, MKS’ Atotech opened new facility in Derio, Bizkaia, Spain, a strategic investment designed to support the company’s General Metal Finishing business across the Iberia Region, including Spain and Portugal. The new site serves as a hub for key operational functions in Southern Europe, including sales and service, chemical and physical laboratories, material science, finance, HES, and IT.

- In April 2025, MacDermid Enthone announced targeted industry support and capacity investments to accelerate customer adoption of sustainable plating through a partnership and tooling initiative, expanding hands-on technical services and advanced plating equipment access for contract platers, a commercial tactic to shorten qualification cycles for OEMs demanding Cr (VI)-free or low-impact alternatives.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 2.1 Bn |

|

Market Forecast Value in 2035 |

USD 3.0 Bn |

|

Growth Rate (CAGR) |

3.6% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value

|

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Automotive Chromium Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Type |

|

|

By Chromium Valence State |

|

|

By Application Area |

|

|

By Process Type |

|

|

By Coating Layer Type |

|

|

By Propulsion Type |

|

|

By Vehicle Type |

|

|

By End-Use |

|

|

By Distribution Channel |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Automotive Chromium Market Outlook

- 2.1.1. Automotive Chromium Market Size (Value – US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Automotive Chromium Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automotive & Transportation Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automotive & Transportation Industry

- 3.1.3. Regional Distribution for Automotive & Transportation Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Automotive & Transportation Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Growing demand for premium and luxury vehicles with aesthetic appeal

- 4.1.1.2. Rising adoption of chrome plating in automotive components for durability

- 4.1.1.3. Increasing customization trends in vehicle interiors and exteriors

- 4.1.2. Restraints

- 4.1.2.1. Stringent environmental regulations on hexavalent chromium usage

- 4.1.2.2. Availability of alternative lightweight and eco-friendly coating materials

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Automotive Chromium Manufacturers

- 4.4.3. Distributors/ Suppliers

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Automotive Chromium Market Demand

- 4.9.1. Historical Market Size - in Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - in Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Automotive Chromium Market Analysis, by Type

- 6.1. Key Segment Analysis

- 6.2. Automotive Chromium Market Size (Value - US$ Bn), Analysis, and Forecasts, by Type, 2021-2035

- 6.2.1. Decorative Plating

- 6.2.2. Hard Chrome Plating

- 6.2.3. Chromate Conversion Coating

- 6.2.4. Functional Coatings

- 6.2.5. Others (Chrome Passivation, Chromium Pigments, etc.)

- 7. Global Automotive Chromium Market Analysis, by Chromium Valence State

- 7.1. Key Segment Analysis

- 7.2. Automotive Chromium Market Size (Value - US$ Bn), Analysis, and Forecasts, by Chromium Valence State, 2021-2035

- 7.2.1. Hexavalent Chromium (Cr⁶⁺)

- 7.2.2. Trivalent Chromium (Cr³⁺)

- 7.2.3. Hard Chromium

- 7.2.4. Decorative Chromium

- 7.2.5. Others (Nickel-Chromium, Chromium-Vanadium, etc.)

- 8. Global Automotive Chromium Market Analysis, by Application Area

- 8.1. Key Segment Analysis

- 8.2. Automotive Chromium Market Size (Value - US$ Bn), Analysis, and Forecasts, by Application Area, 2021-2035

- 8.2.1. Exterior Trim

- 8.2.1.1. Grilles

- 8.2.1.2. Door Handles

- 8.2.1.3. Mirror Caps

- 8.2.1.4. Emblems

- 8.2.1.5. Others

- 8.2.2. Interior Trim

- 8.2.2.1. Dashboards

- 8.2.2.2. Knobs

- 8.2.2.3. Gear Shifters

- 8.2.2.4. Vents

- 8.2.2.5. Others

- 8.2.3. Wheels and Rims

- 8.2.4. Bumpers and Guard Plates

- 8.2.5. Exhaust Pipes and Covers

- 8.2.6. Engine Components

- 8.2.6.1. Pistons

- 8.2.6.2. Cylinders

- 8.2.6.3. Valves

- 8.2.6.4. Others

- 8.2.7. Chassis Components

- 8.2.7.1. Suspension

- 8.2.7.2. Bearings

- 8.2.7.3. Others

- 8.2.8. Other Applications

- 8.2.1. Exterior Trim

- 9. Others Global Automotive Chromium Market Analysis, by Process Type

- 9.1. Key Segment Analysis

- 9.2. Automotive Chromium Market Size (Value - US$ Bn), Analysis, and Forecasts, by Process Type, 2021-2035

- 9.2.1. Electroplating

- 9.2.2. Physical Vapor Deposition

- 9.2.3. Chemical Vapor Deposition

- 9.2.4. Thermal Spray Coating

- 9.2.5. Electroless Plating

- 9.2.6. Spray Chrome Coating

- 9.2.7. Others

- 10. Global Automotive Chromium Market Analysis, by Coating Layer Type

- 10.1. Key Segment Analysis

- 10.2. Automotive Chromium Market Size (Value - US$ Bn), Analysis, and Forecasts, by Coating Layer Type, 2021-2035

- 10.2.1. Single-layer

- 10.2.2. Dual-layer (Nickel + Chromium)

- 10.2.3. Triple-layer (Copper + Nickel + Chromium)

- 10.2.4. Laminated Coatings (Chromium-Composite)

- 10.2.5. Hybrid Coatings

- 11. Global Automotive Chromium Market Analysis, by Propulsion Type

- 11.1. Key Segment Analysis

- 11.2. Automotive Chromium Market Size (Value - US$ Bn), Analysis, and Forecasts, by Propulsion Type, 2021-2035

- 11.2.1. Internal Combustion Engine (ICE) Vehicles

- 11.2.2. Hybrid Vehicles

- 11.2.3. Battery Electric Vehicles

- 11.2.4. Plug-in Hybrid Electric Vehicles (PHEVs)

- 11.2.5. Fuel Cell Vehicles (FCEVs)

- 12. Global Automotive Chromium Market Analysis, by Vehicle Type

- 12.1. Key Segment Analysis

- 12.2. Automotive Chromium Market Size (Value - US$ Bn), Analysis, and Forecasts, by Vehicle Type, 2021-2035

- 12.2.1. Passenger Vehicles

- 12.2.2. Commercial Vehicles

- 12.2.2.1. Light Commercial Vehicles (LCVs)

- 12.2.2.2. Heavy Commercial Vehicles (HCVs)

- 12.2.3. Two-Wheelers

- 12.2.4. Electric Vehicles (EVs)

- 12.2.5. Luxury and Premium Vehicles

- 12.2.6. Off-road Vehicles & Utility Terrain Vehicles (UTVs)

- 13. Global Automotive Chromium Market Analysis, by End-Use

- 13.1. Key Segment Analysis

- 13.2. Automotive Chromium Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-Use, 2021-2035

- 13.2.1. OEMs (Original Equipment Manufacturers)

- 13.2.2. Aftermarket/Replacement Segment

- 13.2.3. Tier-1 and Tier-2 Suppliers

- 13.2.4. Restoration and Customization Workshops

- 13.2.5. Automotive Design Studios

- 14. Global Automotive Chromium Market Analysis, by Distribution Channel

- 14.1. Key Segment Analysis

- 14.2. Automotive Chromium Market Size (Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 14.2.1. Direct Sales

- 14.2.2. Distributors and Dealers

- 14.2.3. Online Retail

- 14.2.4. Automotive Parts Stores

- 14.2.5. Others

- 15. Global Automotive Chromium Market Analysis and Forecasts, by Region

- 15.1. Key Findings

- 15.2. Automotive Chromium Market Size (Volume - Million Units and Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 15.2.1. North America

- 15.2.2. Europe

- 15.2.3. Asia Pacific

- 15.2.4. Middle East

- 15.2.5. Africa

- 15.2.6. South America

- 16. North America Automotive Chromium Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. North America Automotive Chromium Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Type

- 16.3.2. Chromium Valence State

- 16.3.3. Application Area

- 16.3.4. Process Type

- 16.3.5. Coating Layer Type

- 16.3.6. Propulsion Type

- 16.3.7. Vehicle Type

- 16.3.8. End-Use

- 16.3.9. Distribution Channel

- 16.3.10. Country

- 16.3.10.1. USA

- 16.3.10.2. Canada

- 16.3.10.3. Mexico

- 16.4. USA Automotive Chromium Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Type

- 16.4.3. Chromium Valence State

- 16.4.4. Application Area

- 16.4.5. Process Type

- 16.4.6. Coating Layer Type

- 16.4.7. Propulsion Type

- 16.4.8. Vehicle Type

- 16.4.9. End-Use

- 16.4.10. Distribution Channel

- 16.5. Canada Automotive Chromium Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Type

- 16.5.3. Chromium Valence State

- 16.5.4. Application Area

- 16.5.5. Process Type

- 16.5.6. Coating Layer Type

- 16.5.7. Propulsion Type

- 16.5.8. Vehicle Type

- 16.5.9. End-Use

- 16.5.10. Distribution Channel

- 16.6. Mexico Automotive Chromium Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Type

- 16.6.3. Chromium Valence State

- 16.6.4. Application Area

- 16.6.5. Process Type

- 16.6.6. Coating Layer Type

- 16.6.7. Propulsion Type

- 16.6.8. Vehicle Type

- 16.6.9. End-Use

- 16.6.10. Distribution Channel

- 17. Europe Automotive Chromium Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Europe Automotive Chromium Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Type

- 17.3.2. Chromium Valence State

- 17.3.3. Application Area

- 17.3.4. Process Type

- 17.3.5. Coating Layer Type

- 17.3.6. Propulsion Type

- 17.3.7. Vehicle Type

- 17.3.8. End-Use

- 17.3.9. Distribution Channel

- 17.3.10. Country

- 17.3.10.1. Germany

- 17.3.10.2. United Kingdom

- 17.3.10.3. France

- 17.3.10.4. Italy

- 17.3.10.5. Spain

- 17.3.10.6. Netherlands

- 17.3.10.7. Nordic Countries

- 17.3.10.8. Poland

- 17.3.10.9. Russia & CIS

- 17.3.10.10. Rest of Europe

- 17.4. Germany Automotive Chromium Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Type

- 17.4.3. Chromium Valence State

- 17.4.4. Application Area

- 17.4.5. Process Type

- 17.4.6. Coating Layer Type

- 17.4.7. Propulsion Type

- 17.4.8. Vehicle Type

- 17.4.9. End-Use

- 17.4.10. Distribution Channel

- 17.5. United Kingdom Automotive Chromium Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Type

- 17.5.3. Chromium Valence State

- 17.5.4. Application Area

- 17.5.5. Process Type

- 17.5.6. Coating Layer Type

- 17.5.7. Propulsion Type

- 17.5.8. Vehicle Type

- 17.5.9. End-Use

- 17.5.10. Distribution Channel

- 17.6. France Automotive Chromium Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Type

- 17.6.3. Chromium Valence State

- 17.6.4. Application Area

- 17.6.5. Process Type

- 17.6.6. Coating Layer Type

- 17.6.7. Propulsion Type

- 17.6.8. Vehicle Type

- 17.6.9. End-Use

- 17.6.10. Distribution Channel

- 17.7. Italy Automotive Chromium Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Type

- 17.7.3. Chromium Valence State

- 17.7.4. Application Area

- 17.7.5. Process Type

- 17.7.6. Coating Layer Type

- 17.7.7. Propulsion Type

- 17.7.8. Vehicle Type

- 17.7.9. End-Use

- 17.7.10. Distribution Channel

- 17.8. Spain Automotive Chromium Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Type

- 17.8.3. Chromium Valence State

- 17.8.4. Application Area

- 17.8.5. Process Type

- 17.8.6. Coating Layer Type

- 17.8.7. Propulsion Type

- 17.8.8. Vehicle Type

- 17.8.9. End-Use

- 17.8.10. Distribution Channel

- 17.9. Netherlands Automotive Chromium Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Type

- 17.9.3. Chromium Valence State

- 17.9.4. Application Area

- 17.9.5. Process Type

- 17.9.6. Coating Layer Type

- 17.9.7. Propulsion Type

- 17.9.8. Vehicle Type

- 17.9.9. End-Use

- 17.9.10. Distribution Channel

- 17.10. Nordic Countries Automotive Chromium Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Type

- 17.10.3. Chromium Valence State

- 17.10.4. Application Area

- 17.10.5. Process Type

- 17.10.6. Coating Layer Type

- 17.10.7. Propulsion Type

- 17.10.8. Vehicle Type

- 17.10.9. End-Use

- 17.10.10. Distribution Channel

- 17.11. Poland Automotive Chromium Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Type

- 17.11.3. Chromium Valence State

- 17.11.4. Application Area

- 17.11.5. Process Type

- 17.11.6. Coating Layer Type

- 17.11.7. Propulsion Type

- 17.11.8. Vehicle Type

- 17.11.9. End-Use

- 17.11.10. Distribution Channel

- 17.12. Russia & CIS Automotive Chromium Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Type

- 17.12.3. Chromium Valence State

- 17.12.4. Application Area

- 17.12.5. Process Type

- 17.12.6. Coating Layer Type

- 17.12.7. Propulsion Type

- 17.12.8. Vehicle Type

- 17.12.9. End-Use

- 17.12.10. Distribution Channel

- 17.13. Rest of Europe Automotive Chromium Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Type

- 17.13.3. Chromium Valence State

- 17.13.4. Application Area

- 17.13.5. Process Type

- 17.13.6. Coating Layer Type

- 17.13.7. Propulsion Type

- 17.13.8. Vehicle Type

- 17.13.9. End-Use

- 17.13.10. Distribution Channel

- 18. Asia Pacific Automotive Chromium Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. East Asia Automotive Chromium Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Type

- 18.3.2. Chromium Valence State

- 18.3.3. Application Area

- 18.3.4. Process Type

- 18.3.5. Coating Layer Type

- 18.3.6. Propulsion Type

- 18.3.7. Vehicle Type

- 18.3.8. End-Use

- 18.3.9. Distribution Channel

- 18.3.10. Country

- 18.3.10.1. China

- 18.3.10.2. India

- 18.3.10.3. Japan

- 18.3.10.4. South Korea

- 18.3.10.5. Australia and New Zealand

- 18.3.10.6. Indonesia

- 18.3.10.7. Malaysia

- 18.3.10.8. Thailand

- 18.3.10.9. Vietnam

- 18.3.10.10. Rest of Asia Pacific

- 18.4. China Automotive Chromium Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Type

- 18.4.3. Chromium Valence State

- 18.4.4. Application Area

- 18.4.5. Process Type

- 18.4.6. Coating Layer Type

- 18.4.7. Propulsion Type

- 18.4.8. Vehicle Type

- 18.4.9. End-Use

- 18.4.10. Distribution Channel

- 18.5. India Automotive Chromium Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Type

- 18.5.3. Chromium Valence State

- 18.5.4. Application Area

- 18.5.5. Process Type

- 18.5.6. Coating Layer Type

- 18.5.7. Propulsion Type

- 18.5.8. Vehicle Type

- 18.5.9. End-Use

- 18.5.10. Distribution Channel

- 18.6. Japan Automotive Chromium Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Type

- 18.6.3. Chromium Valence State

- 18.6.4. Application Area

- 18.6.5. Process Type

- 18.6.6. Coating Layer Type

- 18.6.7. Propulsion Type

- 18.6.8. Vehicle Type

- 18.6.9. End-Use

- 18.6.10. Distribution Channel

- 18.7. South Korea Automotive Chromium Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Type

- 18.7.3. Chromium Valence State

- 18.7.4. Application Area

- 18.7.5. Process Type

- 18.7.6. Coating Layer Type

- 18.7.7. Propulsion Type

- 18.7.8. Vehicle Type

- 18.7.9. End-Use

- 18.7.10. Distribution Channel

- 18.8. Australia and New Zealand Automotive Chromium Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Type

- 18.8.3. Chromium Valence State

- 18.8.4. Application Area

- 18.8.5. Process Type

- 18.8.6. Coating Layer Type

- 18.8.7. Propulsion Type

- 18.8.8. Vehicle Type

- 18.8.9. End-Use

- 18.8.10. Distribution Channel

- 18.9. Indonesia Automotive Chromium Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Type

- 18.9.3. Chromium Valence State

- 18.9.4. Application Area

- 18.9.5. Process Type

- 18.9.6. Coating Layer Type

- 18.9.7. Propulsion Type

- 18.9.8. Vehicle Type

- 18.9.9. End-Use

- 18.9.10. Distribution Channel

- 18.10. Malaysia Automotive Chromium Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Type

- 18.10.3. Chromium Valence State

- 18.10.4. Application Area

- 18.10.5. Process Type

- 18.10.6. Coating Layer Type

- 18.10.7. Propulsion Type

- 18.10.8. Vehicle Type

- 18.10.9. End-Use

- 18.10.10. Distribution Channel

- 18.11. Thailand Automotive Chromium Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Type

- 18.11.3. Chromium Valence State

- 18.11.4. Application Area

- 18.11.5. Process Type

- 18.11.6. Coating Layer Type

- 18.11.7. Propulsion Type

- 18.11.8. Vehicle Type

- 18.11.9. End-Use

- 18.11.10. Distribution Channel

- 18.12. Vietnam Automotive Chromium Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Type

- 18.12.3. Chromium Valence State

- 18.12.4. Application Area

- 18.12.5. Process Type

- 18.12.6. Coating Layer Type

- 18.12.7. Propulsion Type

- 18.12.8. Vehicle Type

- 18.12.9. End-Use

- 18.12.10. Distribution Channel

- 18.13. Rest of Asia Pacific Automotive Chromium Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Type

- 18.13.3. Chromium Valence State

- 18.13.4. Application Area

- 18.13.5. Process Type

- 18.13.6. Coating Layer Type

- 18.13.7. Propulsion Type

- 18.13.8. Vehicle Type

- 18.13.9. End-Use

- 18.13.10. Distribution Channel

- 19. Middle East Automotive Chromium Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Middle East Automotive Chromium Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Type

- 19.3.2. Chromium Valence State

- 19.3.3. Application Area

- 19.3.4. Process Type

- 19.3.5. Coating Layer Type

- 19.3.6. Propulsion Type

- 19.3.7. Vehicle Type

- 19.3.8. End-Use

- 19.3.9. Distribution Channel

- 19.3.10. Country

- 19.3.10.1. Turkey

- 19.3.10.2. UAE

- 19.3.10.3. Saudi Arabia

- 19.3.10.4. Israel

- 19.3.10.5. Rest of Middle East

- 19.4. Turkey Automotive Chromium Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Type

- 19.4.3. Chromium Valence State

- 19.4.4. Application Area

- 19.4.5. Process Type

- 19.4.6. Coating Layer Type

- 19.4.7. Propulsion Type

- 19.4.8. Vehicle Type

- 19.4.9. End-Use

- 19.4.10. Distribution Channel

- 19.5. UAE Automotive Chromium Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Type

- 19.5.3. Chromium Valence State

- 19.5.4. Application Area

- 19.5.5. Process Type

- 19.5.6. Coating Layer Type

- 19.5.7. Propulsion Type

- 19.5.8. Vehicle Type

- 19.5.9. End-Use

- 19.5.10. Distribution Channel

- 19.6. Saudi Arabia Automotive Chromium Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Type

- 19.6.3. Chromium Valence State

- 19.6.4. Application Area

- 19.6.5. Process Type

- 19.6.6. Coating Layer Type

- 19.6.7. Propulsion Type

- 19.6.8. Vehicle Type

- 19.6.9. End-Use

- 19.6.10. Distribution Channel

- 19.7. Israel Automotive Chromium Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Type

- 19.7.3. Chromium Valence State

- 19.7.4. Application Area

- 19.7.5. Process Type

- 19.7.6. Coating Layer Type

- 19.7.7. Propulsion Type

- 19.7.8. Vehicle Type

- 19.7.9. End-Use

- 19.7.10. Distribution Channel

- 19.8. Rest of Middle East Automotive Chromium Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Type

- 19.8.3. Chromium Valence State

- 19.8.4. Application Area

- 19.8.5. Process Type

- 19.8.6. Coating Layer Type

- 19.8.7. Propulsion Type

- 19.8.8. Vehicle Type

- 19.8.9. End-Use

- 19.8.10. Distribution Channel

- 20. Africa Automotive Chromium Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Africa Automotive Chromium Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Type

- 20.3.2. Chromium Valence State

- 20.3.3. Application Area

- 20.3.4. Process Type

- 20.3.5. Coating Layer Type

- 20.3.6. Propulsion Type

- 20.3.7. Vehicle Type

- 20.3.8. End-Use

- 20.3.9. Distribution Channel

- 20.3.10. Country

- 20.3.10.1. South Africa

- 20.3.10.2. Egypt

- 20.3.10.3. Nigeria

- 20.3.10.4. Algeria

- 20.3.10.5. Rest of Africa

- 20.4. South Africa Automotive Chromium Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Type

- 20.4.3. Chromium Valence State

- 20.4.4. Application Area

- 20.4.5. Process Type

- 20.4.6. Coating Layer Type

- 20.4.7. Propulsion Type

- 20.4.8. Vehicle Type

- 20.4.9. End-Use

- 20.4.10. Distribution Channel

- 20.5. Egypt Automotive Chromium Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Type

- 20.5.3. Chromium Valence State

- 20.5.4. Application Area

- 20.5.5. Process Type

- 20.5.6. Coating Layer Type

- 20.5.7. Propulsion Type

- 20.5.8. Vehicle Type

- 20.5.9. End-Use

- 20.5.10. Distribution Channel

- 20.6. Nigeria Automotive Chromium Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Type

- 20.6.3. Chromium Valence State

- 20.6.4. Application Area

- 20.6.5. Process Type

- 20.6.6. Coating Layer Type

- 20.6.7. Propulsion Type

- 20.6.8. Vehicle Type

- 20.6.9. End-Use

- 20.6.10. Distribution Channel

- 20.7. Algeria Automotive Chromium Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Type

- 20.7.3. Chromium Valence State

- 20.7.4. Application Area

- 20.7.5. Process Type

- 20.7.6. Coating Layer Type

- 20.7.7. Propulsion Type

- 20.7.8. Vehicle Type

- 20.7.9. End-Use

- 20.7.10. Distribution Channel

- 20.8. Rest of Africa Automotive Chromium Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Type

- 20.8.3. Chromium Valence State

- 20.8.4. Application Area

- 20.8.5. Process Type

- 20.8.6. Coating Layer Type

- 20.8.7. Propulsion Type

- 20.8.8. Vehicle Type

- 20.8.9. End-Use

- 20.8.10. Distribution Channel

- 21. South America Automotive Chromium Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. Central and South Africa Automotive Chromium Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Type

- 21.3.2. Chromium Valence State

- 21.3.3. Application Area

- 21.3.4. Process Type

- 21.3.5. Coating Layer Type

- 21.3.6. Propulsion Type

- 21.3.7. Vehicle Type

- 21.3.8. End-Use

- 21.3.9. Distribution Channel

- 21.3.10. Country

- 21.3.10.1. Brazil

- 21.3.10.2. Argentina

- 21.3.10.3. Rest of South America

- 21.4. Brazil Automotive Chromium Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Type

- 21.4.3. Chromium Valence State

- 21.4.4. Application Area

- 21.4.5. Process Type

- 21.4.6. Coating Layer Type

- 21.4.7. Propulsion Type

- 21.4.8. Vehicle Type

- 21.4.9. End-Use

- 21.4.10. Distribution Channel

- 21.5. Argentina Automotive Chromium Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Type

- 21.5.3. Chromium Valence State

- 21.5.4. Application Area

- 21.5.5. Process Type

- 21.5.6. Coating Layer Type

- 21.5.7. Propulsion Type

- 21.5.8. Vehicle Type

- 21.5.9. End-Use

- 21.5.10. Distribution Channel

- 21.6. Rest of South America Automotive Chromium Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Type

- 21.6.3. Chromium Valence State

- 21.6.4. Application Area

- 21.6.5. Process Type

- 21.6.6. Coating Layer Type

- 21.6.7. Propulsion Type

- 21.6.8. Vehicle Type

- 21.6.9. End-Use

- 21.6.10. Distribution Channel

- 22. Key Players/ Company Profile

- 22.1. Advanced Plating Technologies

- 22.1.1. Company Details/ Overview

- 22.1.2. Company Financials

- 22.1.3. Key Customers and Competitors

- 22.1.4. Business/ Industry Portfolio

- 22.1.5. Product Portfolio/ Specification Details

- 22.1.6. Pricing Data

- 22.1.7. Strategic Overview

- 22.1.8. Recent Developments

- 22.2. Atotech Deutschland GmbH

- 22.3. BASF SE

- 22.4. Covestro AG

- 22.5. DuPont de Nemours, Inc.

- 22.6. Electro Chemical Finishing (ECF)

- 22.7. Elementis plc

- 22.8. GalvaMetal Ltd.

- 22.9. Hunter Chemical LLC

- 22.10. Kuntz Electroplating Inc.

- 22.11. MacDermid Enthone Industrial Solutions

- 22.12. MKW Group (MKW GmbH)

- 22.13. Plastic Omnium SA

- 22.14. Sarrel Group

- 22.15. Srinivasa Industries

- 22.16. Technic Inc.

- 22.17. The Sherwin-Williams Company

- 22.18. Other Key Players

- 22.1. Advanced Plating Technologies

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation