E-commerce Packaging Market Size, Share & Industry Analysis, by Packaging Type (Corrugated Boxes, Protective Packaging, Mailer Packaging, Mailer Packaging, Flexible Packaging, Rigid Packaging, Returnable Packaging, Eco-friendly Packaging, Others), Material, Application, Functionality, End-users, Distribution Channel, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) - Global Industry Data, Trends, and Forecasts, 2025‒2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

E-Commerce Packaging Market, Size, Share and Growth

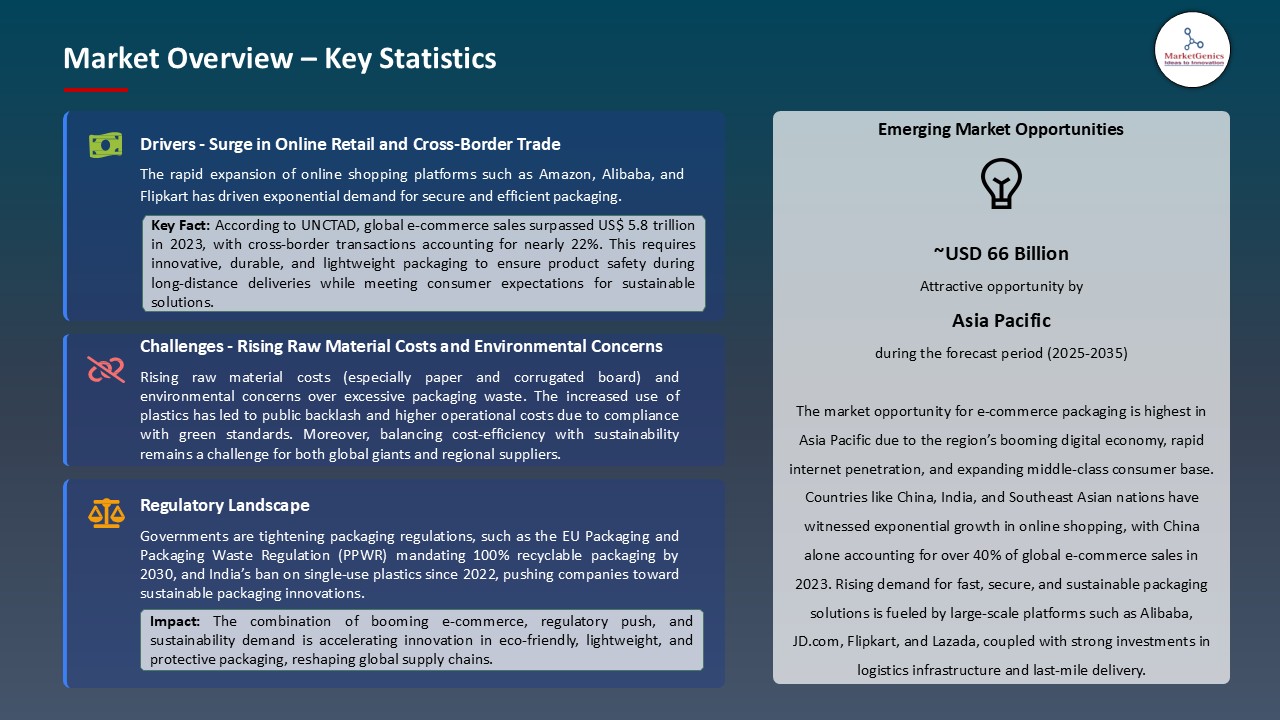

The global e-commerce packaging market size was valued at USD 81.6 billion in 2025 and is projected to USD 203.4 billion by 2035, exhibiting a CAGR of 8.6% during the forecast period. The rapid global expansion of the e-commerce industry is propelling market growth.

"In an exclusive conversation with Live Mint, Vaibhav Anant (founder and CEO of Bambrew) shares how, with an 8x growth in 2024, Bambrew is betting on bamboo, seaweed, and other natural fibres to create scalable, compostable packaging that performs like plastic without the environmental cost."

The emerging economies are likely to increase the usage of e-commerce packaging because of increased smart phone users and increased disposable income. The United Nations Conference on Trade and Development (UNCTAD) reported that, as of 2023, e-commerce transactions worldwide reached USD 30 trillion, which further highlights the sheer magnitude to which consumers are currently able to use the internet in order to approach online platforms.

Such exponential grow is directly proportional to upsurged demands of reliable, protective and branded packaging solutions. Consumers would want timely delivery, returns, and complete products and it is required that packaging should be efficiently done as a part of the fulfillment process.

Moreover, the increased volumes of delicate and high-value products transported through e-commerce have created the need to invent new protective and smart packaging technologies. As an example, DS Smith launched the DS3 (Drop, Impact, Shock, Crush, Shake) immersion test, (DISCS 9 reporting). This is the testing mechanism that modifies the real-world conditions of shipping and advances the structural soundness of e-commerce shipping. These innovations are crucial because brands seek to minimize returns based on damaged items, which is a common problem in the online shopping sphere.

Consequently, such packaging providers are conceptualizing modular and flexible modus operandi that complies to customs and branding concerns of various markets, thereby allowing brands to express to the international consumers without much logistical hitch.

E-Commerce Packaging Market Dynamics and Trends

Driver: Advancements in Automated packaging systems

- Automated e-commerce packaging refers to the use of technology and machinery to streamline the packaging process for online orders. This can include automated systems for measuring, packing, sealing, and labeling products, which enhances efficiency, reduces labor costs, and minimizes packaging waste.

- Automation packaging accelerates the packaging process, so that companies can handle larger volumes of orders in a shorter period. This is critical in the current e-commerce environment, where consumers expect fast delivery times. Automated systems can process orders quickly without compromising accuracy, results higher customer satisfaction.

- Automation accelerates throughput during peak periods e.g., Black Friday while also enabling existing personnel to transition into more skilled roles, thereby supporting workforce sustainability. Furthermore, the deployment of predictive maintenance empowered by AI and IoT technologies is gaining traction.

Restraint: Lack of Proper Recycling Infrastructure for Plastics, Potentially Leading to Increased Waste and Environmental Impact

- The insufficient of appropriate plastic recycling infrastructure, especially for e-commerce packaging, highlight the significance of environmental problems. In the EU, for instance, plastic packaging waste rose by 27% over the past decade and now accounts for approximately 40 % of total plastic demand, yet only around 40 % of such materials are recycled.

- In India, e-commerce expansion is similarly hampered by infrastructural deficits. For instance, in the country flexible plastic packaging consumption ranges between 150,000 to 200,000 MT per month, yet less than 5 percent of that volume is collected for recycling, largely dependent on an informal sector of rag pickers.

- Further, facilities often lack the capacity to sort contaminated or multi‑layered plastics into usable feedstock. Weak implementation and uneven regional rollout of EPR schemes, with persistent reliance on informal collection systems. Varied regulatory responses by jurisdictions, often outpacing physical infrastructure and imposing transitional costs that hinder adoption of sustainable packaging.

Opportunity: Integration of Artificial Intelligence in Packaging Processes

- Artificial Intelligence (AI) implementation at the packaging stage is a huge opportunity of the e-commerce packaging market. In March 2025, the workforce optimization firm Ranpak stressed the need to combine human workers and AI and automation in warehouses.

- Ranpak has a stable alliance with large corporations such as Amazon, Ikea, and Urban Outfitters to whom they invest in robotics firms to advance the warehouse activities further. In 2024 their revenue was up 10 per cent and the use of packaging systems that help in accelerating the filling of the box has soared.

- Incorporation of AI in the packaging services increases the efficiency and scalability, which provides the e-commerce companies a competitive advantage when it comes to addressing the rising consumer needs.

Key Trend: Emphasis on Minimalist and Functional Packaging Designs

- E-commerce majors are progressively shifting towards simple, practical packaging styles to consumer desires and environmental burdens. This would be shifting towards the use of lesser materials and a sufficiently good packaging to carry the product in transit.

- An example; the companies are adopting compact, efficient packaging that uses less material and supports reusable packaging formats to reduce shipping costs and lower environmental impact. Focus on minimalist designs goes hand in hand with consumer taste towards simplicity and sustainability. With the trend becoming commonplace, packaging firms would also need to innovate to create useful packages that meet the functional aspects, cost-sensitive, and environmental factors.

E-Commerce Packaging Market Analysis and Segmental Data

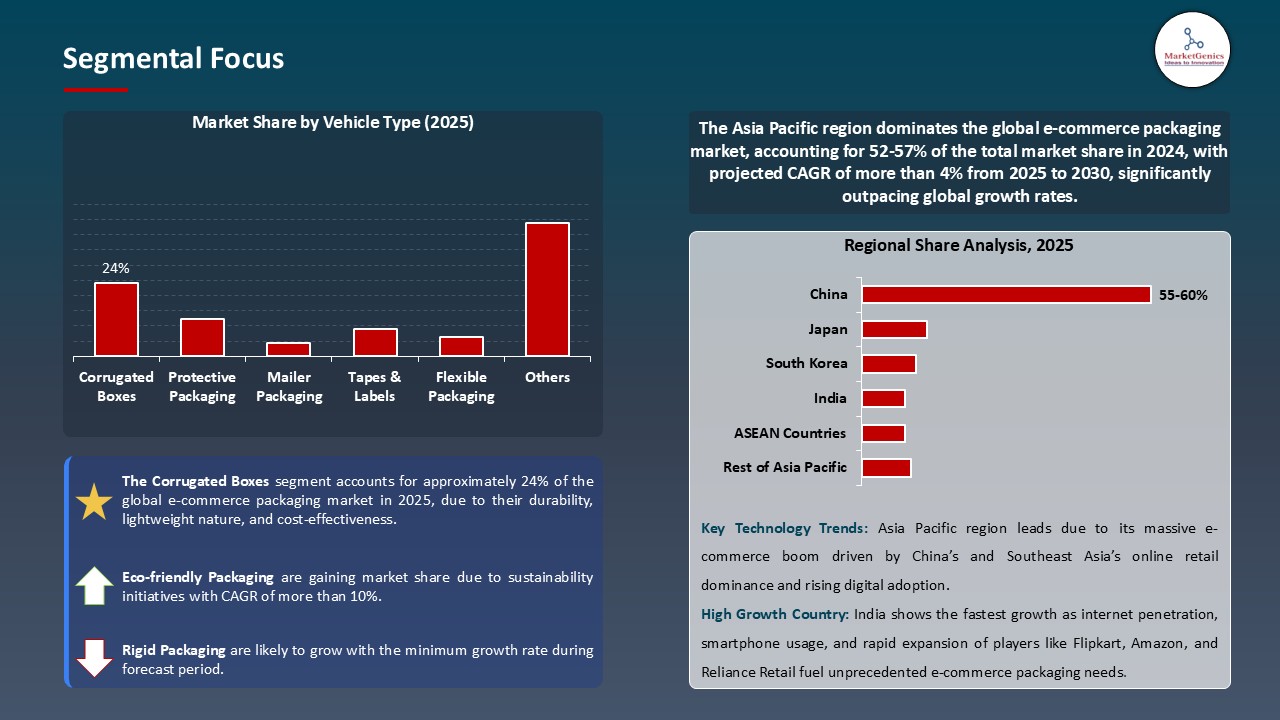

Rising Preference for Corrugated Boxes in E-Commerce Packaging

- The demand for corrugated boxes is highest in the e-commerce packaging market due to their durability, lightweight nature, and cost-effectiveness. In September 2025, WestRock launched its Amazon reinforced recycled corrugated boxes, which would add more security to the fragile products during shipping in Amazon fulfillment centers in North America.

- These boxes are also helpful in achieving sustainability objectives in that they employ materials that can be recycled hence minimizing packaging materials on a global scale. They also have the advantage of accommodating different sizes and relative convenience of branding which establishes them as preference among e-commerce retailers. More companies are incorporating the use of corrugated solutions as this would guarantee safe delivery with the least impact on the environment and transportation costs.

- Corrugated boxes are still the leading type of packaging based on their efficiency, protection, and sustainability to adapt to the changing requirements of e-commerce in the global market.

Asia Pacific Leading Growth in E-Commerce Packaging

- The Asia Pacific region dominates the e-commerce packaging market due to rapid online retail expansion, rising smartphone penetration, and growing consumer preference for home delivery. In July 2025, Flipkart relied on environmentally friendly corrugated boxes provided by Paperboard Packaging Company India to make high end sales during the festival season where lots of shipping took place.

- The regional demand is also increased by China with a strong manufacturing ecosystem and Japan that has an advanced transportation system. Firms such as WestRock and Smurfit Kappa are making investments into scalable packaging capacities in Southeast Asia to meet a rising volume of e-commerce. The increased green sensitivity and the governmental support of green materials are also the elements that promote faster implementation of new packaging materials.

- The Pacific region is recording a high increase in the e-commerce market and consumer base which is pushing the rapid adoption of sustainable and cost-efficient packaging in addition to cementing its pace in the international market.

E-commerce Packaging Market Ecosystem

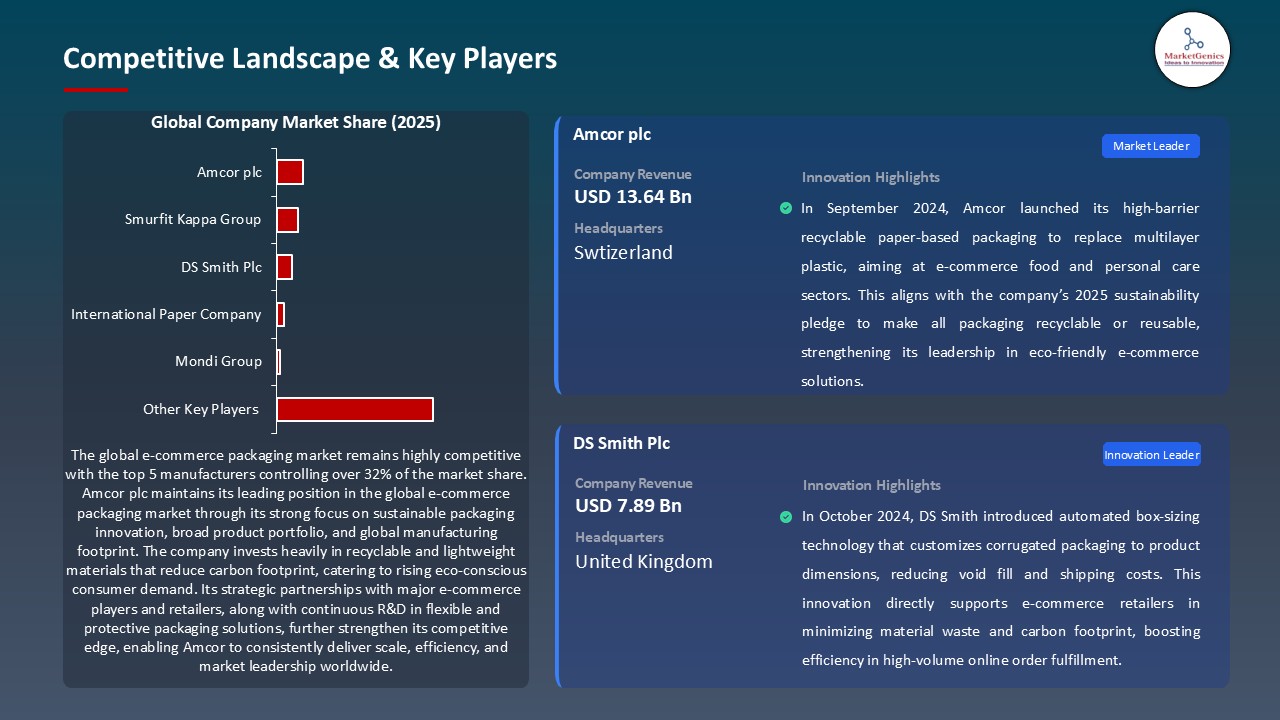

Key players in the global e-commerce packaging market include prominent companies such as Amcor plc, Smurfit Kappa Group, DS Smith Plc, International Paper Company, Mondi Group and Other Key Players.

The company opportunities in the global e-commerce packaging market are moderately fragmented, with Tier 1 companies like Smurfit Kappa, DS Smith, Mondi, and Amcor having really immense global footprints; Tier 2 companies such as Pregis, Sealed Air, and Huhtamaki are dominant within regions; and Tier 3 companies like Packhelp and Shorr Packaging focus on niche solutions. There is medium concentration in the market because competition prevails around the sustainability and automation of innovations. Buyer concentration high, for there are many e-commerce retailers that hold bargaining power; Supplier concentration moderate, due to the diversification of sources for raw materials.

Recent Development and Strategic Overview:

- In March 2025, Ranpak emphasized the importance of integrating human workers with AI and automation in warehouse operations. The company, known for providing sustainable paper packaging and automation systems, focuses on reducing plastic use and enhancing efficiency. Ranpak partners with major companies like Amazon, Ikea, and Urban Outfitters, investing in robotics companies to further innovate warehouse operations.

- In January 2024, Mold-Tek Packaging Ltd (MTPL) has opened three new manufacturing facilities in Cheyyar (Tamil Nadu), Sultanpur (Telangana), and Panipat (Haryana). These facilities will add 5,500 tons to the company's annual production capacity, bringing the total capacity to 54,000 tons by the end of FY25 (financial year 2024-25). The total investment in these three units was approximately Rs. 100 crore (US$ 11.5 million).

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 81.6 Bn |

|

Market Forecast Value in 2035 |

USD 203.4 Bn |

|

Growth Rate (CAGR) |

8.6% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

E-commerce Packaging Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Packaging Type |

|

|

By Material |

|

|

By Application |

|

|

By Functionality |

|

|

By End-users |

|

|

By Distribution Channel |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global E-Commerce Packaging Market Outlook

- 2.1.1. E-Commerce Packaging Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global E-Commerce Packaging Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Packaging Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Packaging Industry

- 3.1.3. Regional Distribution for Packaging Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Packaging Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rapid growth of e-commerce and online retail channels

- 4.1.1.2. Advancements in innovative and smart packaging technologies

- 4.1.2. Restraints

- 4.1.2.1. High costs associated with sustainable and specialty packaging materials

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Packaging Manufacturers

- 4.4.3. Technology Integrators

- 4.4.4. Distributors/ Suppliers

- 4.4.5. E-Commerce Platforms & Retailers

- 4.4.6. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global E-Commerce Packaging Market Demand

- 4.9.1. Historical Market Size - in Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - in Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global E-Commerce Packaging Market Analysis, Packaging Type

- 6.1. Key Segment Analysis

- 6.2. E-Commerce Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, by Packaging Type, 2021-2035

- 6.2.1. Corrugated Boxes

- 6.2.1.1. Single-Wall Boxes

- 6.2.1.2. Double-Wall Boxes

- 6.2.1.3. Triple-Wall Boxes

- 6.2.1.4. Others

- 6.2.2. Protective Packaging

- 6.2.2.1. Bubble Wrap

- 6.2.2.2. Air Pillows

- 6.2.2.3. Foam Packaging

- 6.2.2.4. Molded Pulp

- 6.2.2.5. Others

- 6.2.3. Mailer Packaging

- 6.2.3.1. Padded Mailers

- 6.2.3.2. Poly Mailers

- 6.2.3.3. Paper Mailers

- 6.2.3.4. Others

- 6.2.4. Tapes & Labels

- 6.2.4.1. Printed Tapes

- 6.2.4.2. Security Tapes

- 6.2.4.3. Shipping & Return Labels

- 6.2.4.4. Others

- 6.2.5. Flexible Packaging

- 6.2.5.1. Pouches

- 6.2.5.2. Bags & Envelopes

- 6.2.5.3. Others

- 6.2.6. Rigid Packaging

- 6.2.6.1. Paperboard Boxes

- 6.2.6.2. Rigid Mailer Boxes

- 6.2.6.3. Others

- 6.2.7. Returnable Packaging

- 6.2.7.1. Reusable Boxes

- 6.2.7.2. Re-sealable Mailers

- 6.2.7.3. Others

- 6.2.8. Eco-friendly Packaging

- 6.2.8.1. Biodegradable Packaging

- 6.2.8.2. Compostable Materials

- 6.2.8.3. Recyclable Packaging

- 6.2.9. Others

- 6.2.1. Corrugated Boxes

- 7. Global E-Commerce Packaging Market Analysis, by Material

- 7.1. Key Segment Analysis

- 7.2. E-Commerce Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, by Material, 2021-2035

- 7.2.1. Paper & Paperboard

- 7.2.2. Plastic

- 7.2.2.1. Polyethylene (PE)

- 7.2.2.2. Polypropylene (PP)

- 7.2.3. PET

- 7.2.4. Corrugated Fiberboard

- 7.2.5. Biodegradable & Compostable Materials

- 7.2.6. Foam

- 7.2.7. Metal

- 7.2.8. Glass

- 7.2.9. Others

- 8. Global E-Commerce Packaging Market Analysis, by Application

- 8.1. Key Segment Analysis

- 8.2. E-Commerce Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, by Application, 2021-2035

- 8.2.1. Fashion & Apparel

- 8.2.2. Electronics & Consumer Devices

- 8.2.3. Cosmetics & Personal Care

- 8.2.4. Food & Beverages

- 8.2.5. Home & Kitchen Appliances

- 8.2.6. Healthcare & Pharmaceuticals

- 8.2.7. Books & Stationery

- 8.2.8. Sports & Outdoor Equipment

- 8.2.9. Toys & Baby Products

- 8.2.10. Automotive Parts

- 8.2.11. Subscription Boxes

- 8.2.12. Others

- 9. Global E-Commerce Packaging Market Analysis, by Functionality

- 9.1. Key Segment Analysis

- 9.2. E-Commerce Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, by Functionality, 2021-2035

- 9.2.1. Tamper-Evident

- 9.2.2. Lightweight

- 9.2.3. Shock Absorbent

- 9.2.4. Temperature-Controlled/Insulated

- 9.2.5. Easy to Open/Reseal

- 9.2.6. Sustainable/Reusable

- 9.2.7. Custom/Branded Packaging

- 9.2.8. Others

- 10. Global E-Commerce Packaging Market Analysis, by End-users

- 10.1. Key Segment Analysis

- 10.2. E-Commerce Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 10.2.1. E-commerce Retailers

- 10.2.1.1. Direct-to-Consumer (DTC) Brands

- 10.2.1.2. Marketplaces

- 10.2.2. Third-Party Logistics Providers (3PLs)

- 10.2.3. Subscription Box Companies

- 10.2.4. Courier/Postal Services

- 10.2.5. Others

- 10.2.1. E-commerce Retailers

- 11. Global E-Commerce Packaging Market Analysis, by Distribution Channel

- 11.1. Key Segment Analysis

- 11.2. E-Commerce Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 11.2.1. Online Sales of Packaging Solutions

- 11.2.2. Offline/ Wholesale Supply

- 11.2.3. Direct Manufacturer Distribution

- 11.2.4. Third-Party Distributors

- 12. Global E-Commerce Packaging Market Analysis and Forecasts, by Region

- 12.1. Key Findings

- 12.2. E-Commerce Packaging Market Size (Volume - Thousand Units and Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 12.2.1. North America

- 12.2.2. Europe

- 12.2.3. Asia Pacific

- 12.2.4. Middle East

- 12.2.5. Africa

- 12.2.6. South America

- 13. North America E-Commerce Packaging Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. North America E-Commerce Packaging Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Packaging Type

- 13.3.2. Material

- 13.3.3. Application

- 13.3.4. Functionality

- 13.3.5. End-users

- 13.3.6. Distribution Channel

- 13.3.7. Country

- 13.3.7.1. USA

- 13.3.7.2. Canada

- 13.3.7.3. Mexico

- 13.4. USA E-Commerce Packaging Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Packaging Type

- 13.4.3. Material

- 13.4.4. Application

- 13.4.5. Functionality

- 13.4.6. End-users

- 13.4.7. Distribution Channel

- 13.5. Canada E-Commerce Packaging Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Packaging Type

- 13.5.3. Material

- 13.5.4. Application

- 13.5.5. Functionality

- 13.5.6. End-users

- 13.5.7. Distribution Channel

- 13.6. Mexico E-Commerce Packaging Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Packaging Type

- 13.6.3. Material

- 13.6.4. Application

- 13.6.5. Functionality

- 13.6.6. End-users

- 13.6.7. Distribution Channel

- 14. Europe E-Commerce Packaging Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Europe E-Commerce Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Packaging Type

- 14.3.2. Material

- 14.3.3. Application

- 14.3.4. Functionality

- 14.3.5. End-users

- 14.3.6. Distribution Channel

- 14.3.7. Country

- 14.3.7.1. Germany

- 14.3.7.2. United Kingdom

- 14.3.7.3. France

- 14.3.7.4. Italy

- 14.3.7.5. Spain

- 14.3.7.6. Netherlands

- 14.3.7.7. Nordic Countries

- 14.3.7.8. Poland

- 14.3.7.9. Russia & CIS

- 14.3.7.10. Rest of Europe

- 14.4. Germany E-Commerce Packaging Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Packaging Type

- 14.4.3. Material

- 14.4.4. Application

- 14.4.5. Functionality

- 14.4.6. End-users

- 14.4.7. Distribution Channel

- 14.5. United Kingdom E-Commerce Packaging Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Packaging Type

- 14.5.3. Material

- 14.5.4. Application

- 14.5.5. Functionality

- 14.5.6. End-users

- 14.5.7. Distribution Channel

- 14.6. France E-Commerce Packaging Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Packaging Type

- 14.6.3. Material

- 14.6.4. Application

- 14.6.5. Functionality

- 14.6.6. End-users

- 14.6.7. Distribution Channel

- 14.7. Italy E-Commerce Packaging Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Packaging Type

- 14.7.3. Material

- 14.7.4. Application

- 14.7.5. Functionality

- 14.7.6. End-users

- 14.7.7. Distribution Channel

- 14.8. Spain E-Commerce Packaging Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Packaging Type

- 14.8.3. Material

- 14.8.4. Application

- 14.8.5. Functionality

- 14.8.6. End-users

- 14.8.7. Distribution Channel

- 14.9. Netherlands E-Commerce Packaging Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Packaging Type

- 14.9.3. Material

- 14.9.4. Application

- 14.9.5. Functionality

- 14.9.6. End-users

- 14.9.7. Distribution Channel

- 14.10. Nordic Countries E-Commerce Packaging Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Packaging Type

- 14.10.3. Material

- 14.10.4. Application

- 14.10.5. Functionality

- 14.10.6. End-users

- 14.10.7. Distribution Channel

- 14.11. Poland E-Commerce Packaging Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Packaging Type

- 14.11.3. Material

- 14.11.4. Application

- 14.11.5. Functionality

- 14.11.6. End-users

- 14.11.7. Distribution Channel

- 14.12. Russia & CIS E-Commerce Packaging Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Packaging Type

- 14.12.3. Material

- 14.12.4. Application

- 14.12.5. Functionality

- 14.12.6. End-users

- 14.12.7. Distribution Channel

- 14.13. Rest of Europe E-Commerce Packaging Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Packaging Type

- 14.13.3. Material

- 14.13.4. Application

- 14.13.5. Functionality

- 14.13.6. End-users

- 14.13.7. Distribution Channel

- 15. Asia Pacific E-Commerce Packaging Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. East Asia E-Commerce Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Packaging Type

- 15.3.2. Material

- 15.3.3. Application

- 15.3.4. Functionality

- 15.3.5. End-users

- 15.3.6. Distribution Channel

- 15.3.7. Country

- 15.3.7.1. China

- 15.3.7.2. India

- 15.3.7.3. Japan

- 15.3.7.4. South Korea

- 15.3.7.5. Australia and New Zealand

- 15.3.7.6. Indonesia

- 15.3.7.7. Malaysia

- 15.3.7.8. Thailand

- 15.3.7.9. Vietnam

- 15.3.7.10. Rest of Asia Pacific

- 15.4. China E-Commerce Packaging Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Packaging Type

- 15.4.3. Material

- 15.4.4. Application

- 15.4.5. Functionality

- 15.4.6. End-users

- 15.4.7. Distribution Channel

- 15.5. India E-Commerce Packaging Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Packaging Type

- 15.5.3. Material

- 15.5.4. Application

- 15.5.5. Functionality

- 15.5.6. End-users

- 15.5.7. Distribution Channel

- 15.6. Japan E-Commerce Packaging Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Packaging Type

- 15.6.3. Material

- 15.6.4. Application

- 15.6.5. Functionality

- 15.6.6. End-users

- 15.6.7. Distribution Channel

- 15.7. South Korea E-Commerce Packaging Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Packaging Type

- 15.7.3. Material

- 15.7.4. Application

- 15.7.5. Functionality

- 15.7.6. End-users

- 15.7.7. Distribution Channel

- 15.8. Australia and New Zealand E-Commerce Packaging Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Packaging Type

- 15.8.3. Material

- 15.8.4. Application

- 15.8.5. Functionality

- 15.8.6. End-users

- 15.8.7. Distribution Channel

- 15.9. Indonesia E-Commerce Packaging Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Packaging Type

- 15.9.3. Material

- 15.9.4. Application

- 15.9.5. Functionality

- 15.9.6. End-users

- 15.9.7. Distribution Channel

- 15.10. Malaysia E-Commerce Packaging Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Packaging Type

- 15.10.3. Material

- 15.10.4. Application

- 15.10.5. Functionality

- 15.10.6. End-users

- 15.10.7. Distribution Channel

- 15.11. Thailand E-Commerce Packaging Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Packaging Type

- 15.11.3. Material

- 15.11.4. Application

- 15.11.5. Functionality

- 15.11.6. End-users

- 15.11.7. Distribution Channel

- 15.12. Vietnam E-Commerce Packaging Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Packaging Type

- 15.12.3. Material

- 15.12.4. Application

- 15.12.5. Functionality

- 15.12.6. End-users

- 15.12.7. Distribution Channel

- 15.13. Rest of Asia Pacific E-Commerce Packaging Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Packaging Type

- 15.13.3. Material

- 15.13.4. Application

- 15.13.5. Functionality

- 15.13.6. End-users

- 15.13.7. Distribution Channel

- 16. Middle East E-Commerce Packaging Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Middle East E-Commerce Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Packaging Type

- 16.3.2. Material

- 16.3.3. Application

- 16.3.4. Functionality

- 16.3.5. End-users

- 16.3.6. Distribution Channel

- 16.3.7. Country

- 16.3.7.1. Turkey

- 16.3.7.2. UAE

- 16.3.7.3. Saudi Arabia

- 16.3.7.4. Israel

- 16.3.7.5. Rest of Middle East

- 16.4. Turkey E-Commerce Packaging Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Packaging Type

- 16.4.3. Material

- 16.4.4. Application

- 16.4.5. Functionality

- 16.4.6. End-users

- 16.4.7. Distribution Channel

- 16.5. UAE E-Commerce Packaging Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Packaging Type

- 16.5.3. Material

- 16.5.4. Application

- 16.5.5. Functionality

- 16.5.6. End-users

- 16.5.7. Distribution Channel

- 16.6. Saudi Arabia E-Commerce Packaging Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Packaging Type

- 16.6.3. Material

- 16.6.4. Application

- 16.6.5. Functionality

- 16.6.6. End-users

- 16.6.7. Distribution Channel

- 16.7. Israel E-Commerce Packaging Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Packaging Type

- 16.7.3. Material

- 16.7.4. Application

- 16.7.5. Functionality

- 16.7.6. End-users

- 16.7.7. Distribution Channel

- 16.8. Rest of Middle East E-Commerce Packaging Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Packaging Type

- 16.8.3. Material

- 16.8.4. Application

- 16.8.5. Functionality

- 16.8.6. End-users

- 16.8.7. Distribution Channel

- 17. Africa E-Commerce Packaging Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Africa E-Commerce Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Packaging Type

- 17.3.2. Material

- 17.3.3. Application

- 17.3.4. Functionality

- 17.3.5. End-users

- 17.3.6. Distribution Channel

- 17.3.7. Country

- 17.3.7.1. South Africa

- 17.3.7.2. Egypt

- 17.3.7.3. Nigeria

- 17.3.7.4. Algeria

- 17.3.7.5. Rest of Africa

- 17.4. South Africa E-Commerce Packaging Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Packaging Type

- 17.4.3. Material

- 17.4.4. Application

- 17.4.5. Functionality

- 17.4.6. End-users

- 17.4.7. Distribution Channel

- 17.5. Egypt E-Commerce Packaging Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Packaging Type

- 17.5.3. Material

- 17.5.4. Application

- 17.5.5. Functionality

- 17.5.6. End-users

- 17.5.7. Distribution Channel

- 17.6. Nigeria E-Commerce Packaging Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Packaging Type

- 17.6.3. Material

- 17.6.4. Application

- 17.6.5. Functionality

- 17.6.6. End-users

- 17.6.7. Distribution Channel

- 17.7. Algeria E-Commerce Packaging Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Packaging Type

- 17.7.3. Material

- 17.7.4. Application

- 17.7.5. Functionality

- 17.7.6. End-users

- 17.7.7. Distribution Channel

- 17.8. Rest of Africa E-Commerce Packaging Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Packaging Type

- 17.8.3. Material

- 17.8.4. Application

- 17.8.5. Functionality

- 17.8.6. End-users

- 17.8.7. Distribution Channel

- 18. South America E-Commerce Packaging Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Central and South Africa E-Commerce Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Packaging Type

- 18.3.2. Material

- 18.3.3. Application

- 18.3.4. Functionality

- 18.3.5. End-users

- 18.3.6. Distribution Channel

- 18.3.7. Country

- 18.3.7.1. Brazil

- 18.3.7.2. Argentina

- 18.3.7.3. Rest of South America

- 18.4. Brazil E-Commerce Packaging Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Packaging Type

- 18.4.3. Material

- 18.4.4. Application

- 18.4.5. Functionality

- 18.4.6. End-users

- 18.4.7. Distribution Channel

- 18.5. Argentina E-Commerce Packaging Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Packaging Type

- 18.5.3. Material

- 18.5.4. Application

- 18.5.5. Functionality

- 18.5.6. End-users

- 18.5.7. Distribution Channel

- 18.6. Rest of South America E-Commerce Packaging Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Packaging Type

- 18.6.3. Material

- 18.6.4. Application

- 18.6.5. Functionality

- 18.6.6. End-users

- 18.6.7. Distribution Channel

- 19. Key Players/ Company Profile

- 19.1. International Paper Company

- 19.1.1. Company Details/ Overview

- 19.1.2. Company Financials

- 19.1.3. Key Customers and Competitors

- 19.1.4. Business/ Industry Portfolio

- 19.1.5. Product Portfolio/ Specification Details

- 19.1.6. Pricing Data

- 19.1.7. Strategic Overview

- 19.1.8. Recent Developments

- 19.2. Smurfit Kappa Group

- 19.3. WestRock Company

- 19.4. Mondi Group

- 19.5. DS Smith Plc

- 19.6. Sealed Air Corporation

- 19.7. Amcor Plc

- 19.8. Huhtamaki Oyj

- 19.9. Pregis LLC

- 19.10. Berry Global Inc.

- 19.11. Rengo Co., Ltd.

- 19.12. Sonoco Products Company

- 19.13. Stora Enso Oyj

- 19.14. Cascades Inc.

- 19.15. Georgia-Pacific LLC

- 19.16. Intertape Polymer Group Inc. (IPG)

- 19.17. Packhelp S.A.

- 19.18. RAJA Group

- 19.19. Uline, Inc.

- 19.20. Shorr Packaging Corp.

- 19.21. Other Key Players

- 19.1. International Paper Company

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation