Fertilizer Spreader Market Size, Share, Growth Opportunity Analysis Report by Product Type (Drop Spreaders, Rotary/Spinner Spreaders, Pendulum Spreaders, Manure Spreaders, Pneumatic Spreaders, Others), Mechanism, Mounting Type, Spreader Capacity, Application, End User, Distribution Channel, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Fertilizer Spreader Market Size, Share, and Growth

The global market for fertilizer spreader is witnessed to grow at a compound annual growth rate (CAGR) of 5.1% from USD 3.9 billion in 2025 to USD 6.4 billion by 2035. Asia Pacific leads the market with market share of 41% with USD 1.6 billion revenue.

In March 2024, the Fertilizer Spreader Market is being shaped through precision agriculture and automation of spreaders today. The newest GPS-guided, IoT-enabled fertilizer spreaders employ precision agriculture technology to help farmers apply fertilizer more efficiently and sustainably because they reduce waste and increase sustainability.

Fertilizer spreaders are becoming popular for modern agriculture, landscaping, and commercial agriculture because of the need for efficiency in nutrient applications, improving yield, and being better caretakers of environmental stewardship. The common market leader is GPS enabled, Variable Rate Technology (VRT) fertilizer spreaders for high technique, control, and reduced input losses. For an example, Amazone just recently unveiled their fertilizer spreaders, containing AI-based calibration assistance, sensor-based nutrient mapping and allows a user to apply dates driven by conditions in the field in real time.

Owing to increasing global food demand and precision agriculture advances, fertilizer spreaders are going to be also considered significant assets to ag operations. In particular, those manufacturing fertilizer spreaders are fabricating them with smart sensors that offer the ability to have automated steering and ISOBUS support. This all helps support data driven agriculture, enhance efficiencies, and reduce operators’ engagement in the field with high acreage.

Additionally, both agriculture and horticulture industry sectors are expected to recognize fertilizer spreaders as accountabilities for demand. Major manufacturers, KUHN Group, Deere & Company, and Kubota are innovating with autonomous operation, remote diagnostics, and cloud connectivity factors so as to enhance productivity in the field, consistency in application, and in alignment with sustainable farming practices.

Further, there's also a new wave of applications emerging in organic and climate-smart agricultural practices that are expanding the activities of conventional fertilizer spreaders. Many of these systems facilitate controlled and environmental-friendly input distribution- and thus will help farming community meet environmental regulations while improving soil health and yields in all agro-ecological zones.

Fertilizer Spreader Market Dynamics and Trends

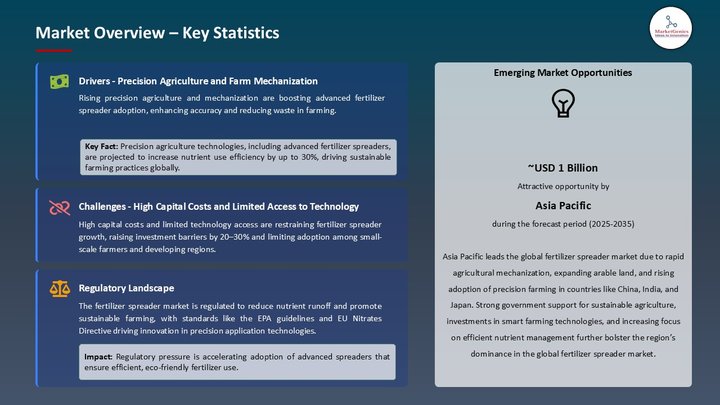

Drivers: Precision Agriculture and Farm Mechanization Accelerating Fertilizer Spreader Market Growth

- The increased use of precision agriculture and the mechanization of agricultural processes are generating premium demand for fertilizer spreaders worldwide. Farmers are increasingly using spreaders as a means to improve nutrient efficiency as well as reduce manual labor and environmental run-off. Fertilizer spreaders featuring GPS and variable rate technology (VRT) allow for site-specific application of fertilizers thereby decreasing waste and increasing crop yields.

- Therefore, these factors anticipated driving demand for fertilizer spreaders globally, especially in an era where labor shortages remain and input costs are rising. When considering the operational advantages of precision agriculture and mechanization for farmers, it is a matter of efficiency and precision. Continued government subsidies and policies encouraging the purchase of advanced farm machinery is also contributing to global market growth, especially in India, Brazil, and the U.S.

- Furthermore, with the integrated agricultural focus on sustainability, including more efficient spreading of fertilizer effectively decreases excessive fertilizer application and reduces environmental impact.

Restraints: High Capital Costs and Limited Access to Technology Constraining Fertilizer Spreader Market Growth

- The steep upfront costs associated with modern fertilizer spreaders, as well as the limited adoption of precision agriculture technology among small and marginal farmers, are two of the most prominent constraints on market adoption. Advanced spreaders with built-in GPS and automation equipment are prohibitively expensive to most farmers, particularly in developing economies.

- Moreover, traditional farmers typically dominate agricultural in countries characterized by fragmented landholdings or where the mechanization infrastructure is nascent. Investing in fertilizer spreaders does not provide an immediate return on investment in equivalent manner so far this will delay the adoption of.

- Even further and maybe more stringent on the sale of precision agriculture technologies in poorer rural areas is the fact that due to lack of training in poor rural areas, establishing a flimsy after-sales network to build service retrieval and quality damage repair to these expensive precision agriculture machines may also constrain their sale.

Opportunity: Integration of Smart Technologies and IoT Enabling Fertilizer Spreader Market Innovation

- A growing number of smart technologies, such as GPS-controlled systems, IoT sensors, AI-based mapping, and real-time soil monitoring, provide significant opportunity in the fertilizer spreader market. The accompanying smart farming technologies aim to remove inefficiencies in fertilizer use, lower the input costs for fertilizer, and improve environmental stewardship.

- With the broad focus on climate-smart agriculture around the world, governments and agritech companies are heavily funding projects around digital agriculture. Smart spreaders that work weather, amend field conditions to deliver nutrients in the right amount, while removing waste, improving yields, and embracing lower greenhouse gas emissions.

- Furthermore, this increasing trend provides lots of room for creativity and innovation when building solutions that respond to local conditions and technology-enabled solutions. The equipment manufacturers that will expand automation and connectivity will have the greatest opportunities in this next stage of growth.

Key Trend: Adoption of Variable Rate Application (VRA) Systems Transforming Fertilizer Spreader Market

- The increased use of Variable Rate Application (VRA) technology in fertilizer spreaders is a clear trend; this method allows farmers to apply nutrients at various rates based on targets. This indicates a broader transition to more data-driven, scalable, and more environmentally sustainable farming practices.

- Further, as farmers strive to create greater productivity while reducing waste from field inputs or environmental sustainability concerns, the use of VRA systems using GPS and maps presented in many programs today, allows for fertilizer applications that compliment field zones. With VRA, farmers can get more nutrient use efficiency while reducing runoff and maximizing yield potential on any given zone.

- Additionally, this trend is very strong in North America and Europe, but emerging in Brazil, India and Australia as precision farming continues to develop. Manufacturers are integrating VRA motivation into mid-range products that make this technology available to farmers who are smaller scale commercial operators as well.

Fertilizer Spreader Market Analysis and Segmental Data

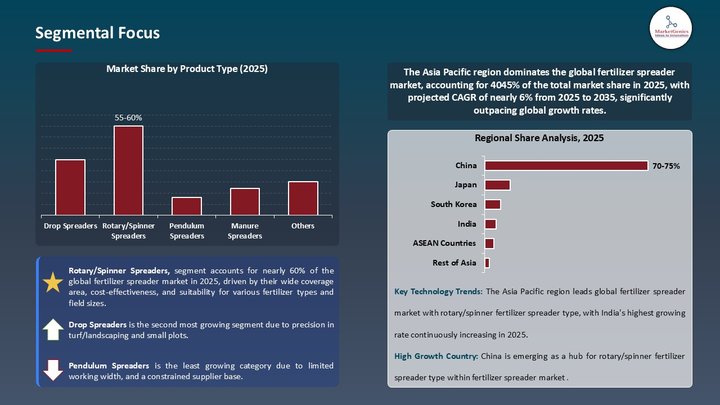

Based on the Product Type, Rotary/Spinner Spreaders holds the largest share

- Rotary/spinner spreaders command a majority of the fertilizer spreader market by type due to their broad coverage, simplicity of use, and relative low costs. Rotary spreaders are unique because they can broadcast fertilizer in a circular fan pattern, making them effective for large areas and commonly used by fertilizer distributors, commercial farmers, and small users alike due to their simple construction, phases of low maintenance, and ability to work with multiple types of fertilizer.

- Additionally, rotary spreaders are more economically viable for small budgets in areas with little technical precision equipment. Functionally, a rotary spreader can generally provide a uniformly and even spread across the field for improved crop yield, leading them to gain popularity.

Asia Pacific Dominates Global Fertilizer Spreader Market in 2025 and beyond

- The Asia Pacific region is the largest market in the world for fertilizer spreaders because of relatively high agricultural density and the increase in food demand along with the increasing use of mechanized equipment for farms. Countries like China, India, and Indonesia have millions of farmers and lots of people living on agriculture to push a country through as the primary protein source to feed its people and to support the economy.

- While more farmers in the Asia Pacific region searching for ways to increase crop production capacity to create a more profitable operation, and lower labor costs, fertilizer spreaders presented their only opportunity to apply fertilizer significantly faster and efficiently than traditional manual broadcast without more hands to sow. Many farmers have bought into fertilizer spreaders and the government support and subsidies for modern farming equipment have left them without any choice because of the difference in speed and efficacy.

- Additionally with increased awareness of precision farming and increased access to machines of lower price points, agronomists and agricultural engineers indicated the use of fertilizer spreaders is increasing overall in the Asia Pacific region, and national markets for fertilizer spreaders are growing, clearly indicating the region is the market leader.

Fertilizer Spreader Market Ecosystem

The world fertilizer spreader market will have a medium level of consolidation in 2025, and is moderately regarded as concentrated because of the medium to high players in the market. Tier 1 companies like Deere & Company, Kubota Corporation, and CNH Industrial N.V. dominate the market with their technology, global distribution, and brand equity. Tier 2 players like AGCO, Kuhn Group, and CLAAS have important regional influence. Tier 3 players serve niche or very localized markets. Buyer power is medium because there is a better focus on efficiencies, and supplier power is low because most components and materials are widely available.

Recent Development and Strategic Overview:

- In May 2025, Unveiled by AGCO Corporation was its "TerraSpread Pro Series", next-generation line of precision fertilizer spreaders suited for vast operations throughout Australia, Europe, and North America. Developed at AGCO's Precision Ag Innovation Center in Minnesota, the TerraSpread Pro includes real-time VRA (Variable Rate Application) systems, autonomous spreading pathways, and AI-integrated nutrient mapping. Made for easy integration with AGCO's Fuse smart farming platform, this line greatly increases nutrient efficiency and reduces nutrient loss.

In April 2025, Kubota Corporation developed the "EcoSpread Series", which includes a compact tractor-mounted fertilizer spreader that is designed for smallholder farmers at locations in Asia-Pacific and Sub-Saharan Africa. The EcoSpread Series was developed internally at Kubota's Osaka R&D facility while utilizing energy, utility and synchronized machine regulations that aim to provide low fuel consumption, durable design, and remedies for fragmentation of fields by providing different spreading patterns of fertilizer

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 3.9 Bn |

|

Market Forecast Value in 2035 |

USD 6.4 Bn |

|

Growth Rate (CAGR) |

5.1% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2020 – 2024 |

|

Market Size Units |

USD Bn for Value Thousand Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Fertilizer Spreader Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Product Type |

|

|

By Mechanism |

|

|

By Mounting Type |

|

|

By Spreader Capacity |

|

|

By Application |

|

|

By End User |

|

|

By Distribution Channel |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Fertilizer Spreader Market Outlook

- 2.1.1. Fertilizer Spreader Market Size (Value - US$ Billion; Thousand Units - Volume), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Fertilizer Spreader Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Fertilizer Spreader Industry Overview, 2025

- 3.1.1. Chemicals & Materials Industry Ecosystem Analysis

- 3.1.2. Key Trends for Chemicals & Materials Industry

- 3.1.3. Regional Distribution for Chemicals & Materials Industry

- 3.2. Supplier Customer Data

- 3.3. Source Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.6. Raw Material Analysis

- 3.1. Fertilizer Spreader Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Precision Agriculture and Farm Mechanization Accelerating Fertilizer Spreader Market Growth

- 4.1.2. Restraints

- 4.1.2.1. High Capital Costs and Limited Access to Technology Constraining Fertilizer Spreader Market Growth

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Components Sourcing

- 4.4.2. Manufacturing/Processing

- 4.4.3. Wholesalers/ E-commerce Platform

- 4.4.4. End-use/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Fertilizer Spreader Market Demand

- 4.9.1. Historical Market Size - Value (US$ Billion); Volume (Thousand Units), 2021-2024

- 4.9.2. Current and Future Market Size - Value (US$ Billion); Volume (Thousand Units), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Fertilizer Spreader Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Fertilizer Spreader Market Size (Value - US$ Billion); (Volume - Thousand Units), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Drop Spreaders

- 6.2.2. Rotary/Spinner Spreaders

- 6.2.3. Pendulum Spreaders

- 6.2.4. Manure Spreaders

- 6.2.5. Pneumatic Spreaders

- 6.2.6. Others

- 7. Fertilizer Spreader Market Analysis, by Mechanism

- 7.1. Key Segment Analysis

- 7.2. Fertilizer Spreader Market Size (Value - US$ Billion); (Volume - Thousand Units), Analysis, and Forecasts, by Mechanism, 2021-2035

- 7.2.1. Hydraulic

- 7.2.2. Mechanical

- 7.2.3. Electric

- 8. Fertilizer Spreader Market Analysis, by Mounting Type

- 8.1. Key Segment Analysis

- 8.2. Fertilizer Spreader Market Size (Value - US$ Billion); (Volume - Thousand Units), Analysis, and Forecasts, by Mounting Type, 2021-2035

- 8.2.1. Mounted

- 8.2.2. Trailed

- 8.2.3. Self-Propelled

- 9. Fertilizer Spreader Market Analysis, by Spreader Capacity

- 9.1. Key Segment Analysis

- 9.2. Fertilizer Spreader Market Size (Value - US$ Billion); (Volume - Thousand Units), Analysis, and Forecasts, by Spreader Capacity, 2021-2035

- 9.2.1. Below 1000 Liters

- 9.2.2. 1000–2000 Liters

- 9.2.3. Above 2000 Liters

- 10. Fertilizer Spreader Market Analysis, by Application

- 10.1. Key Segment Analysis

- 10.2. Fertilizer Spreader Market Size (Value - US$ Billion); (Volume - Thousand Units), Analysis, and Forecasts, by Application, 2021-2035

- 10.2.1. Agriculture

- 10.2.2. Horticulture

- 10.2.3. Landscaping

- 10.2.4. Forestry

- 10.2.5. Others

- 11. Fertilizer Spreader Market Analysis, by End User

- 11.1. Key Segment Analysis

- 11.2. Fertilizer Spreader Market Size (Value - US$ Billion); (Volume - Thousand Units), Analysis, and Forecasts, by End User, 2021-2035

- 11.2.1. Farmers

- 11.2.2. Agricultural Contractors

- 11.2.3. Farm Cooperatives

- 11.2.4. Government & Institutional Bodies

- 11.2.5. Others

- 12. Fertilizer Spreader Market Analysis, by Distribution Channel

- 12.1. Key Segment Analysis

- 12.2. Fertilizer Spreader Market Size (Value - US$ Billion); (Volume - Thousand Units), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 12.2.1. OEMs (Direct Sales)

- 12.2.2. Aftermarket (Distributors, Retailers, Online)

- 13. Fertilizer Spreader Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Fertilizer Spreader Market Size (Value - US$ Billion); (Volume - Thousand Units), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Fertilizer Spreader Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Fertilizer Spreader Market Size (Value - US$ Billion); (Volume - Thousand Units), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Mechanism

- 14.3.3. Mounting Type

- 14.3.4. Spreader Capacity

- 14.3.5. Application

- 14.3.6. End User

- 14.3.7. Distribution Channel

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Fertilizer Spreader Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Mechanism

- 14.4.4. Mounting Type

- 14.4.5. Spreader Capacity

- 14.4.6. Application

- 14.4.7. End User

- 14.4.8. Distribution Channel

- 14.5. Canada Fertilizer Spreader Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Mechanism

- 14.5.4. Mounting Type

- 14.5.5. Spreader Capacity

- 14.5.6. Application

- 14.5.7. End User

- 14.5.8. Distribution Channel

- 14.6. Mexico Fertilizer Spreader Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Mechanism

- 14.6.4. Mounting Type

- 14.6.5. Spreader Capacity

- 14.6.6. Application

- 14.6.7. End User

- 14.6.8. Distribution Channel

- 15. Europe Fertilizer Spreader Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Fertilizer Spreader Market Size (Value - US$ Billion); (Volume - Thousand Units), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Mechanism

- 15.3.3. Mounting Type

- 15.3.4. Spreader Capacity

- 15.3.5. Application

- 15.3.6. End User

- 15.3.7. Distribution Channel

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Fertilizer Spreader Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Mechanism

- 15.4.4. Mounting Type

- 15.4.5. Spreader Capacity

- 15.4.6. Application

- 15.4.7. End User

- 15.4.8. Distribution Channel

- 15.5. United Kingdom Fertilizer Spreader Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Mechanism

- 15.5.4. Mounting Type

- 15.5.5. Spreader Capacity

- 15.5.6. Application

- 15.5.7. End User

- 15.5.8. Distribution Channel

- 15.6. France Fertilizer Spreader Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Mechanism

- 15.6.4. Mounting Type

- 15.6.5. Spreader Capacity

- 15.6.6. Application

- 15.6.7. End User

- 15.6.8. Distribution Channel

- 15.7. Italy Fertilizer Spreader Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Mechanism

- 15.7.4. Mounting Type

- 15.7.5. Spreader Capacity

- 15.7.6. Application

- 15.7.7. End User

- 15.7.8. Distribution Channel

- 15.8. Spain Fertilizer Spreader Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Mechanism

- 15.8.4. Mounting Type

- 15.8.5. Spreader Capacity

- 15.8.6. Application

- 15.8.7. End User

- 15.8.8. Distribution Channel

- 15.9. Netherlands Fertilizer Spreader Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Product Type

- 15.9.3. Mechanism

- 15.9.4. Mounting Type

- 15.9.5. Spreader Capacity

- 15.9.6. Application

- 15.9.7. End User

- 15.9.8. Distribution Channel

- 15.10. Nordic Countries Fertilizer Spreader Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Product Type

- 15.10.3. Mechanism

- 15.10.4. Mounting Type

- 15.10.5. Spreader Capacity

- 15.10.6. Application

- 15.10.7. End User

- 15.10.8. Distribution Channel

- 15.11. Poland Fertilizer Spreader Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Product Type

- 15.11.3. Mechanism

- 15.11.4. Mounting Type

- 15.11.5. Spreader Capacity

- 15.11.6. Application

- 15.11.7. End User

- 15.11.8. Distribution Channel

- 15.12. Russia & CIS Fertilizer Spreader Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Product Type

- 15.12.3. Mechanism

- 15.12.4. Mounting Type

- 15.12.5. Spreader Capacity

- 15.12.6. Application

- 15.12.7. End User

- 15.12.8. Distribution Channel

- 15.13. Rest of Europe Fertilizer Spreader Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Product Type

- 15.13.3. Mechanism

- 15.13.4. Mounting Type

- 15.13.5. Spreader Capacity

- 15.13.6. Application

- 15.13.7. End User

- 15.13.8. Distribution Channel

- 16. Asia Pacific Fertilizer Spreader Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. East Asia Fertilizer Spreader Market Size (Value - US$ Billion); (Volume - Thousand Units), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Mechanism

- 16.3.3. Mounting Type

- 16.3.4. Spreader Capacity

- 16.3.5. Application

- 16.3.6. End User

- 16.3.7. Distribution Channel

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia-Pacific

- 16.4. China Fertilizer Spreader Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Mechanism

- 16.4.4. Mounting Type

- 16.4.5. Spreader Capacity

- 16.4.6. Application

- 16.4.7. End User

- 16.4.8. Distribution Channel

- 16.5. India Fertilizer Spreader Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Mechanism

- 16.5.4. Mounting Type

- 16.5.5. Spreader Capacity

- 16.5.6. Application

- 16.5.7. End User

- 16.5.8. Distribution Channel

- 16.6. Japan Fertilizer Spreader Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Mechanism

- 16.6.4. Mounting Type

- 16.6.5. Spreader Capacity

- 16.6.6. Application

- 16.6.7. End User

- 16.6.8. Distribution Channel

- 16.7. South Korea Fertilizer Spreader Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Mechanism

- 16.7.4. Mounting Type

- 16.7.5. Spreader Capacity

- 16.7.6. Application

- 16.7.7. End User

- 16.7.8. Distribution Channel

- 16.8. Australia and New Zealand Fertilizer Spreader Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Mechanism

- 16.8.4. Mounting Type

- 16.8.5. Spreader Capacity

- 16.8.6. Application

- 16.8.7. End User

- 16.8.8. Distribution Channel

- 16.9. Indonesia Fertilizer Spreader Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Mechanism

- 16.9.4. Mounting Type

- 16.9.5. Spreader Capacity

- 16.9.6. Application

- 16.9.7. End User

- 16.9.8. Distribution Channel

- 16.10. Malaysia Fertilizer Spreader Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Mechanism

- 16.10.4. Mounting Type

- 16.10.5. Spreader Capacity

- 16.10.6. Application

- 16.10.7. End User

- 16.10.8. Distribution Channel

- 16.11. Thailand Fertilizer Spreader Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Mechanism

- 16.11.4. Mounting Type

- 16.11.5. Spreader Capacity

- 16.11.6. Application

- 16.11.7. End User

- 16.11.8. Distribution Channel

- 16.12. Vietnam Fertilizer Spreader Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Mechanism

- 16.12.4. Mounting Type

- 16.12.5. Spreader Capacity

- 16.12.6. Application

- 16.12.7. End User

- 16.12.8. Distribution Channel

- 16.13. Rest of Asia Pacific Fertilizer Spreader Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Mechanism

- 16.13.4. Mounting Type

- 16.13.5. Spreader Capacity

- 16.13.6. Application

- 16.13.7. End User

- 16.13.8. Distribution Channel

- 17. Middle East Fertilizer Spreader Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Fertilizer Spreader Market Size (Value - US$ Billion); (Volume - Thousand Units), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Mechanism

- 17.3.3. Mounting Type

- 17.3.4. Spreader Capacity

- 17.3.5. Application

- 17.3.6. End User

- 17.3.7. Distribution Channel

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Fertilizer Spreader Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Mechanism

- 17.4.4. Mounting Type

- 17.4.5. Spreader Capacity

- 17.4.6. Application

- 17.4.7. End User

- 17.4.8. Distribution Channel

- 17.5. UAE Fertilizer Spreader Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Mechanism

- 17.5.4. Mounting Type

- 17.5.5. Spreader Capacity

- 17.5.6. Application

- 17.5.7. End User

- 17.5.8. Distribution Channel

- 17.6. Saudi Arabia Fertilizer Spreader Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Mechanism

- 17.6.4. Mounting Type

- 17.6.5. Spreader Capacity

- 17.6.6. Application

- 17.6.7. End User

- 17.6.8. Distribution Channel

- 17.7. Israel Fertilizer Spreader Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Mechanism

- 17.7.4. Mounting Type

- 17.7.5. Spreader Capacity

- 17.7.6. Application

- 17.7.7. End User

- 17.7.8. Distribution Channel

- 17.8. Rest of Middle East Fertilizer Spreader Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Mechanism

- 17.8.4. Mounting Type

- 17.8.5. Spreader Capacity

- 17.8.6. Application

- 17.8.7. End User

- 17.8.8. Distribution Channel

- 18. Africa Fertilizer Spreader Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Fertilizer Spreader Market Size (Value - US$ Billion); (Volume - Thousand Units), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Mechanism

- 18.3.3. Mounting Type

- 18.3.4. Spreader Capacity

- 18.3.5. Application

- 18.3.6. End User

- 18.3.7. Distribution Channel

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Fertilizer Spreader Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Mechanism

- 18.4.4. Mounting Type

- 18.4.5. Spreader Capacity

- 18.4.6. Application

- 18.4.7. End User

- 18.4.8. Distribution Channel

- 18.5. Egypt Fertilizer Spreader Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Mechanism

- 18.5.4. Mounting Type

- 18.5.5. Spreader Capacity

- 18.5.6. Application

- 18.5.7. End User

- 18.5.8. Distribution Channel

- 18.6. Nigeria Fertilizer Spreader Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Mechanism

- 18.6.4. Mounting Type

- 18.6.5. Spreader Capacity

- 18.6.6. Application

- 18.6.7. End User

- 18.6.8. Distribution Channel

- 18.7. Algeria Fertilizer Spreader Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Mechanism

- 18.7.4. Mounting Type

- 18.7.5. Spreader Capacity

- 18.7.6. Application

- 18.7.7. End User

- 18.7.8. Distribution Channel

- 18.8. Rest of Africa Fertilizer Spreader Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Mechanism

- 18.8.4. Mounting Type

- 18.8.5. Spreader Capacity

- 18.8.6. Application

- 18.8.7. End User

- 18.8.8. Distribution Channel

- 19. South America Fertilizer Spreader Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Central and South Africa Fertilizer Spreader Market Size (Value - US$ Billion); (Volume - Thousand Units), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Mechanism

- 19.3.3. Mounting Type

- 19.3.4. Spreader Capacity

- 19.3.5. Application

- 19.3.6. End User

- 19.3.7. Distribution Channel

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Fertilizer Spreader Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Mechanism

- 19.4.4. Mounting Type

- 19.4.5. Spreader Capacity

- 19.4.6. Application

- 19.4.7. End User

- 19.4.8. Distribution Channel

- 19.5. Argentina Fertilizer Spreader Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Mechanism

- 19.5.4. Mounting Type

- 19.5.5. Spreader Capacity

- 19.5.6. Application

- 19.5.7. End User

- 19.5.8. Distribution Channel

- 19.6. Rest of South America Fertilizer Spreader Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Mechanism

- 19.6.4. Mounting Type

- 19.6.5. Spreader Capacity

- 19.6.6. Application

- 19.6.7. End User

- 19.6.8. Distribution Channel

- 20. Key Players/ Company Profile

- 20.1. Adams Fertilizer Equipment

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. AGCO Corporation

- 20.3. AMAZONE H. Dreyer GmbH & Co. KG

- 20.4. Bogballe A/S

- 20.5. Bredal A/S

- 20.6. CLAAS KGaA mbH

- 20.7. CNH Industrial N.V.

- 20.8. Cosmo S.r.l.

- 20.9. Deere & Company

- 20.10. GEA Group AG

- 20.11. Kubota Corporation

- 20.12. Kuhn Group

- 20.13. Kverneland Group

- 20.14. Mahindra & Mahindra Ltd.

- 20.15. Rauch Landmaschinenfabrik GmbH

- 20.16. SULKY

- 20.17. Sulky-Burel

- 20.18. Teagle Machinery Ltd

- 20.19. Vicon (part of Kverneland Group)

- 20.20. Yanmar Co., Ltd.

- 20.21. Other key Players

- 20.1. Adams Fertilizer Equipment

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

etitayers

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation