- The global micronutrient fertilizers market is valued at USD 6.2 billion in 2025.

- The market is projected to grow at a CAGR of 6.9% during the forecast period of 2026 to 2035.

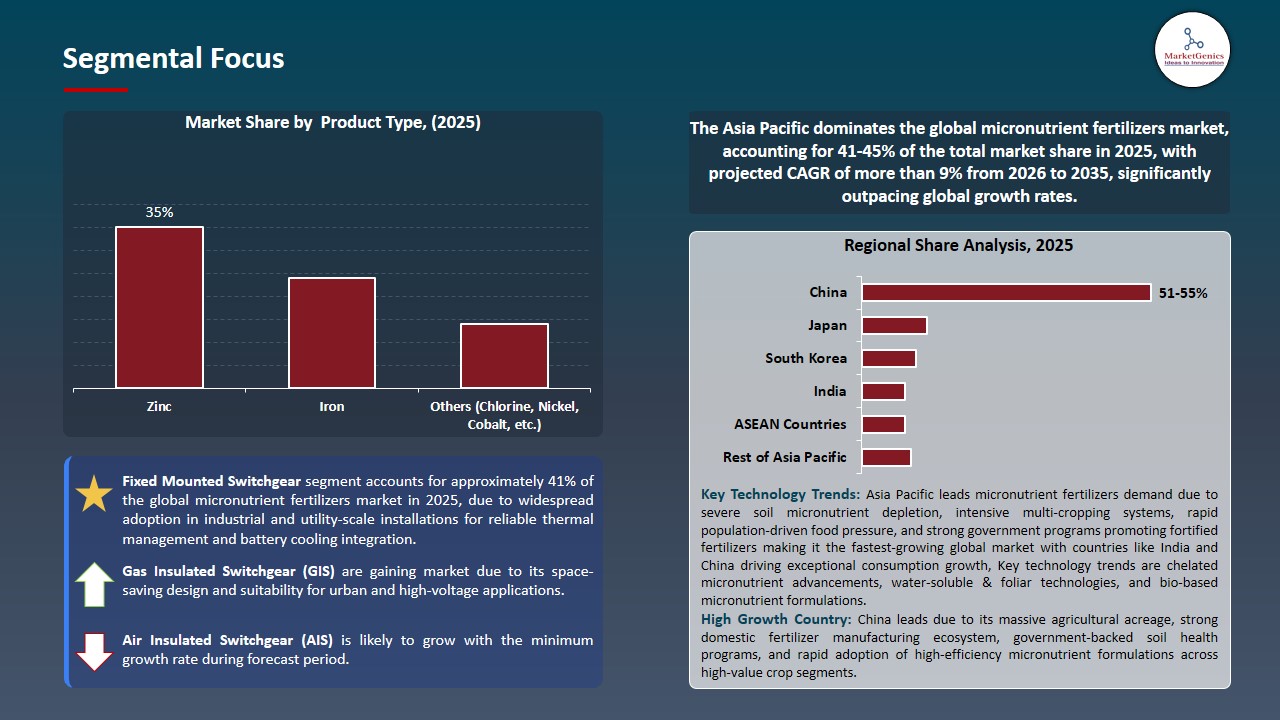

- The zinc segment holds major share ~35% in the global micronutrient fertilizers market, due to widespread zinc deficiency in soils and its essential role in improving crop productivity.

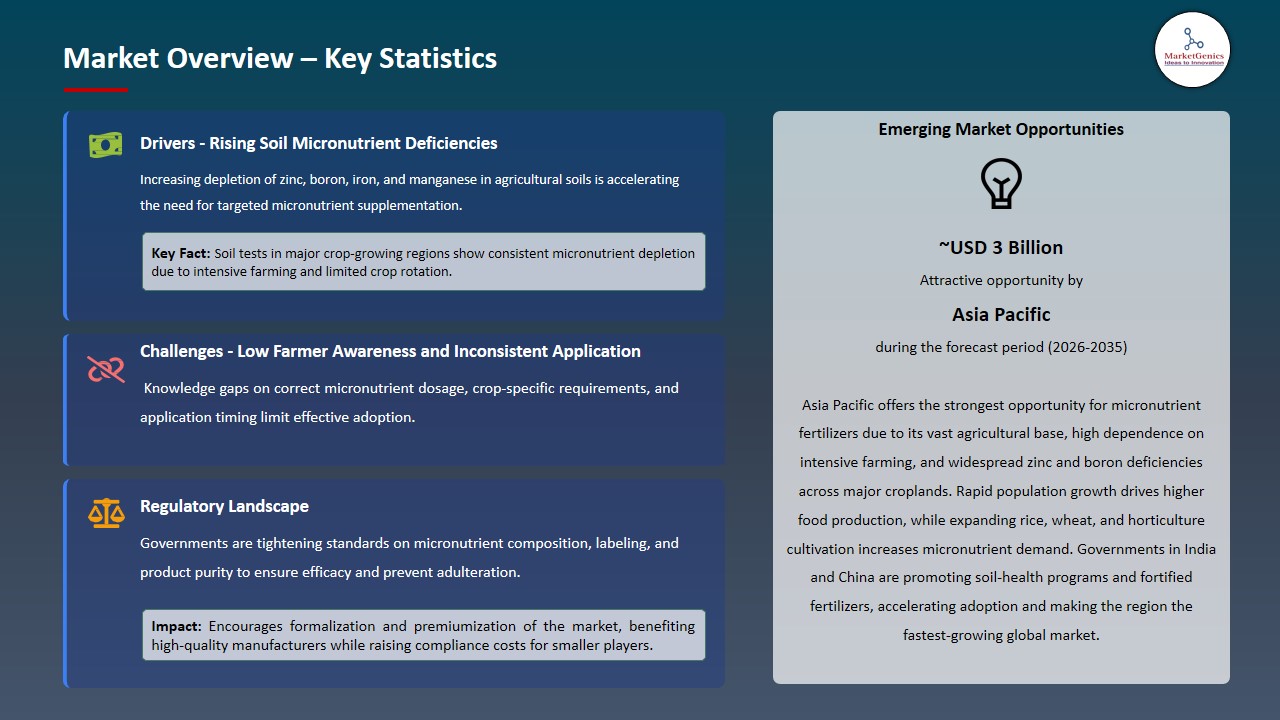

- The micronutrient fertilizers market growing due to increasing soil micronutrient depletion, especially zinc and boron, is accelerating corrective fertilizer use.

- The micronutrient fertilizers market is driven by government support for balanced fertilization programs is encouraging farmers to adopt micronutrient products.

- The top five players accounting for ~40% of the global micronutrient-fertilizers-market share in 2025.

- In February 2025, Haifa Group opened a state-of-the-art Multicote blending facility, strengthening its capacity to deliver efficient, sustainable plant-nutrition solutions to local growers.

- In December 2024, Yara introduced the “YaraSuna” organic and organo-mineral portfolio, featuring six high–organic-carbon micropellet formulations that support soil biology and provide balanced nutrition.

- Global Micronutrient Fertilizers Market is likely to create the total forecasting opportunity of ~USD 6 Bn till 2035.

- Asia Pacific is most attractive region due to widespread soil micronutrient deficiencies, large-scale cultivation of high-value crops, rapid adoption of precision farming, and strong government support for balanced nutrient management programs.

-

The global micronutrient fertilizers market is expanding strongly owing to precision agriculture that allows applying nutrient management site-specifically through soil tests, tissue testing, and yield mapping, instead of a blanket application, and makes the economically viable micronutrient application more possible.

- Major manufacturers are promoting the advancement of digital diagnostics of micronutrients. For instance, in 2025, Haifa Group became the first AI-driven lab in the world to be certified under ISO 17025, which it earned, receiving the certification of its Croptune AI-powered diagnostic lab. The achievement is also a supporting leadership move to be more precise with micronutrient management and adoption of advanced digital fertilizer solutions.

- Additionally, it can be integrated with farm management information systems to give prescriptive nutrient advice that can be based on crop nutrient loss, yield guidelines, and soil test patterns, deciding the optimum timing and rate of application of micronutrients to maximum effectiveness.

- The structural demand of micronutrient fertilizers is being stimulated by the uptake of precision agriculture, awareness of the importance of micronutrients, and the use of decision-support tools, and promoted through the premiumization of agronomic services based on targeted delivery and integrated services.

-

Farmers in economically disadvantaged nations with limited access to extension services, soil testing, and technical know-how often lack understanding about micronutrient shortages, leading to a global demand for micronutrient fertilizers. The lack of symptomatic deficiencies tends to lead to inadequate appreciation of micronutrient deficiency that constrains the demand expansion in major agricultural fields.

- For instance, in 2024–2025, zinc-deficient soils on the surface, over 39 percent, and boron-deficient soils, more than 32%, were detected in soils in Uttar Pradesh, India, but many of the smallholder farmers were unaware of these latent yield-limiting deficiencies. Lack of awareness on hidden micronutrient deficiencies by farmers limits market adoption and growth potential.

- Moreover, low utilization of micronutrients and complicated formulation decisions create distribution and quality-management issues in areas with poorly-developed agricultural supply chains, which frequently becomes little or poor-quality products to smallholder farmers.

- Thus, micronutrient fertilizer growth is limited by farmer education gaps, supply chain constraints and reliance on macronutrients in areas that have high agricultural area, though low adoption.

-

The global micronutrient fertilizers market has high growth potential due to biofortification policies that will improve nutritional value of crops, especially zinc and iron in staple crops, as a solution to global micronutrient deficiencies. These initiatives combine food production and human health, which are appealing to sources of development and the government, rather than conventional commercial stimuli.

- For instance, in August 2024, HarvestPlus collaborated with ICRISAT and CGIAR’s Breeding Resources Initiative to enhance zinc and iron analysis through shared XRF and NIRS services, accelerating global biofortified crop development. This partnership enhances the production of bio fortified foods and consequently more demand of specific micronutrient fertilizers.

- Additionally, premium markets are increasingly preferring nutritionally fortified foods like selenium-enriched wheat, high-zinc rice, and vegetables that are fortified with micronutrients, which allow price-based pricing that can support specific uses of micronutrients.

- The biofortification integrates nutrition security with premium positioning and institutional support, which will lead to market expansion and a rapid shift to sustainable micronutrient adoption.

-

The global micronutrient fertilizers market is advancing towards sustainable, organic-friendly and environmentally friendly formulations due to the migration of the industry to less impactful nutrient control. These inventions help address the increasing regulations on synthetic inputs and generate better-valued and more premium product divisions.

- For instance, in October 2024, BASF announced that it has entered into an agreement with AgroSpheres to jointly develop sustainable and biologically based crop-nutrition technologies, to assist the industry in moving to environmentally friendly micronutrient systems. The partnership expedites the implementation of low-impact biological nutrition and next-generation micronutrient resolutions.

- Furthermore, nano-formulations, controlled-release technologies considerably reduce the required volumes of applications, which enhances environmental efficiency and reduces labor requirements and equipment utilization. These new-fangled delivery systems do not only comply with the sustainability-oriented production paradigm, but also support economic feasibility in high-labor-cost markets.

- The sustainability transition is pushing the definite division between low-end traditional products and high-end, sustainability-oriented ones, and opening the prospects of next-generation formulations generated to bring together functionality and regulatory and sustainability benefits.

-

The zinc segment dominates the global micronutrient fertilizers market due to the prevalence of soil deficiencies in major cereal areas, its importance in protein production and grain growth, consistently good yield responses, and amenable economics which favors regular use in commercial agriculture. As an example, in February 2025, Fauji Fertilizer Company introduced Sona Urea Zinc Coated which is a urea granule treated with zinc sulfate, containing both nitrogen and zinc in one product, enhanced-efficiency product.

- Moreover, zinc deficiency has evident visual effects that include retarded growth, retarded maturity, and lower seed set that can make farmers promptly notice and act upon this condition, which facilitates market acceptance. This is in contrast to less pronounced micronutrient deficiencies that need complex diagnostic methods.

- Widespread deficiencies, high yield advantages, visible symptoms, and biofortification advantages underpin zinc’s market leadership and make it a key entry point for broader micronutrient adoption.

-

Asia Pacific leads the global micronutrient fertilizers market is supported by intensive agriculture on limited farm lands, high-value horticultural yielding that demands exact management of micronutrients and government policies encouraging balanced fertilization which aims at correcting the old-fashioned soil micronutrient erosion. As an example, in February 2025, Indian government has launched Soil Health Card Scheme. The scheme offers states to give soil health cards informing farmers on the status of nutrients and the amount of recommended fertilizers required to enhance soil fertility.

- Moreover, the region of the Asian Pacific has the largest production of fruits and vegetables, which makes the micronutrient demand high because precise management of nutrients in horticultural crops is an effective method of preserving the yield, quality, and shelf life. Their high-end market position also helps them to adapt full-fledged fertility programs including regular micronutrient applications.

- The region benefits high capacities of micronutrient production in China and India, which favor effective chain supply and prices. The major manufacturers offer extensive portfolios of micronutrients based on local crop and soil needs that enhance the adoption of the product in the regional market.

- Asia Pacific has intensive farming systems, high-quality horticulture, government-supportive programs, robust manufacturing foundation and sizeable workforce in agriculture, making the region the foremost market and chief force behind the worldwide demand of micronutrient fertilizers.

-

In February 2025, Haifa Group declared that it had deployed a state-of-the-art Multicote combination facility in Uberlandia, Brazil. This planned growth strengthens the idea of Haifa to deliver innovative, efficient, and sustainable plant nutrition solutions to the Brazilian growers.

- In December 2024, Yara launched an organic and organo-mineral portfolio, called YaraSuna, which consists of six, high-organic-carbon, and micropelletized formulations, that are made to enhance soil biology and provide balanced nutrition.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Agrium Inc.

- AgroLiquid

- Baicor LC

- BASF SE

- Brandt Consolidated Inc.

- Compass Minerals International

- Coromandel International Limited

- Haifa Group

- Helena Agri-Enterprises LLC

- ICL Fertilizers

- Koch Agronomic Services

- Micromix Plant Health Ltd.

- Nufarm Limited

- Nutrien Ltd.

- Sapec Agro SA

- Stoller USA Inc.

- The Mosaic Company

- Valagro SpA

- Yara International ASA

- Zuari Agro Chemicals Ltd.

- Other Key Players

- Zinc

- Zinc Sulfate

- Zinc Oxide

- Zinc Chelates

- Others

- Iron

- Ferrous Sulfate

- Ferric Chelates

- Iron Oxide

- Others

- Manganese

- Manganese Sulfate

- Manganese Oxide

- Manganese Chelates

- Others

- Boron

- Borax

- Boric Acid

- Sodium Borate

- Others

- Copper

- Copper Sulfate

- Copper Oxide

- Copper Chelates

- Others

- Molybdenum

- Sodium Molybdate

- Ammonium Molybdate

- Others

- Others (Chlorine, Nickel, Cobalt, etc.)

- Non-Chelated

- Inorganic Salts

- Oxides

- Chelated

- EDTA Chelated

- DTPA Chelated

- EDDHA Chelated

- Others

- Cereals & Grains

- Pulses & Legumes

- Oilseeds

- Vegetables

- Fruits & Nuts

- Forage & Turf Grasses

- Liquid

- Solution

- Suspension

- Emulsion

- Others

- Solid

- Granular

- Powder

- Prilled

- Others

- Direct Sales

- Manufacturer to Farmer

- Contract Farming

- Indirect Sales

- Distributors

- Retailers

- Agricultural Cooperatives

- Others

- Online Sales

- Agriculture

- Field Crops

- Horticulture

- Plantation Crops

- Protected Cultivation

- Others

- Turf & Landscape

- Sports Turf

- Residential Lawn

- Commercial Landscape

- Others

- Hydroponics & Greenhouse

- Commercial Hydroponics

- Greenhouse Cultivation

- Others

- Organic Farming

- Certified Organic

- Biodynamic Farming

- Others

- Nursery & Floriculture

- Other End-users

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Micronutrient Fertilizers Market Size, Share & Trends Analysis Report by Product Type (Zinc, Iron, Manganese, Boron, Copper, Molybdenum, Others), Form, Crop Type, Formulation, Distribution Channel, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Micronutrient Fertilizers Market Size, Share, and Growth

The global micronutrient fertilizers market is experiencing robust growth, with its estimated value of USD 6.2 billion in the year 2025 and USD 12.1 billion by the period 2035, registering a CAGR of 6.9%, during the forecast period. The micronutrient fertilizers market is driven by rising soil nutrient depletion, expanding cultivation of high-value and high-yield crops, and growing adoption of precision farming that enables targeted micronutrient application. Increasing focus on improving crop quality, food nutrition, and productivity, along with supportive government initiatives promoting balanced fertilization, further accelerates demand.

Amit Noam, CEO of Lavie Bio said, "We are very proud of the collaborations' significant progress, which was achieved by leveraging artificial intelligence to drive rapid advancements in our research, Using ICL's deep agricultural expertise has been essential in focusing Lavie Bio's discovery efforts and has enabled us to advance to field trials in multiple target geographies quickly. Our team did a remarkable job of pushing our discovery process and platform to new heights, continuously improving computational accuracy and reducing both the time and cost to market for our novel products."

The global micronutrient fertilizer market growth is driven by an increase in crop production and the depletion of soil micronutrient since the expanded use of macro nutrients in farming has led to depletion of the necessary trace elements required in crop development. For instance, in July 2024, ICL declared an AI-based collaboration with Lavie Bio in the discovery of microbial solutions that, when combined with fertilizers, increase the uptake of zinc and enhance crop resistance to adverse environmental factors. This collaboration boosts efficiency of micronutrients and adoption of stress-tolerant advanced fertilizer technologies.

In addition, the global micronutrient fertilizers market is driven by improvements in the areas of chelation, nano-formulations, and foliar application technologies, which increase the efficiency of nutrient uptake, lowers application rates, and provides the opportunity to directly correct deficiencies. As an example, in June 2024, Coromandel International launched a nano fertilizer manufacturing plant in Kakinada, India, which includes the production of nano DAP and nano urea, which improve the efficiency of nutrient up-take. These new technologies are enhancing the efficiency of fertilizers and greater use of precision micronutrient solutions.

The global micronutrient fertilizers market presents adjacent opportunities in biofertilizers, foliar sprays, seed treatment solutions, soil conditioners, and precision agriculture technologies. These industries supplement micronutrient applications through improvement of soil, nutrition of crops, and specific delivery. The move to these neighboring markets enhances the general growth potential and promotes integrated and sustainable crop nutrition solutions.

Micronutrient Fertilizers Market Dynamics and Trends

Driver: Precision Agriculture and Nutrient Management Optimization

Restraint: Low Awareness and Knowledge Gaps in Smallholder Agriculture

Opportunity: Biofortification and Nutritional Quality Enhancement

Key Trend: Sustainable and Organic-Compatible Formulations

Micronutrient-Fertilizers-Market Analysis and Segmental Data

Zinc Dominate Global Micronutrient Fertilizers Market

Asia Pacific Leads Global Micronutrient Fertilizers Market Demand

Micronutrient-Fertilizers-Market Ecosystem

The global micronutrient fertilizers market is moderately consolidated, with high concentration among key players such as Yara International ASA, The Mosaic Company, Coromandel International Limited, Haifa Group, and ICL Fertilizers, who dominate through large portfolio of products, good distribution channels, strong agronomic support services and long-term investments in crop specific nutrient innovation.

For instance, in 2024-2025, Coromandel international enhanced its nano-fertilizer research development by undertaking pilot studies of the nano-micronutrient formulations and strengthening the controlled-release delivery technologies to aid increased nutrient-use efficiency.

The innovation will improve the efficiency of nutrient use and Coromandel International will be in a position to respond to the increasing demand of high-performance micronutrient solutions.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 6.2 Bn |

|

Market Forecast Value in 2035 |

USD 12.1 Bn |

|

Growth Rate (CAGR) |

6.9% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Kilo Tons for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Micronutrient-Fertilizers-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Micronutrient Fertilizers Market, By Product Type |

|

|

Micronutrient Fertilizers Market, By Form |

|

|

Micronutrient Fertilizers Market, By Crop Type |

|

|

Micronutrient Fertilizers Market, By Formulation |

|

|

Micronutrient Fertilizers Market, By Distribution Channel

|

|

|

Micronutrient Fertilizers Market, By End-users

|

|

Frequently Asked Questions

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation