Fishing Equipment Market Size, Share, Growth Opportunity Analysis Report by Product Type (Fishing Rods, Fishing Reels, Fishing Lines, Fishing Hooks, Fishing Lures & Baits, Fishing Nets & Traps, Tackle Boxes, Others (Swivels, Sinkers, Floats)), Fishing Type, Material Type, Application, Sales Type, End User, Distribution Channel and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Fishing Equipment Market Size, Share, and Growth

The global fishing equipment market is experiencing robust growth, with its estimated value of USD 13.4 billion in the year 2025 and USD 21.7 billion by the period 2035, registering a CAGR of 4.9%. North America leads the market with market share of 47% with USD 6.3 billion revenue.

2025 provides a complete technological upgrade to the fishing equipment market. There has been rapid innovation in rods, reels, lures and even smart accessories with features such as integrated GPS powered by software, wireless fish finders, and environmentally conscious materials. Just like a fisherman honing the perfect lure for new seasons, manufacturers are adapting these innovations to their recreational and professional clientele.

Fishing gear is becoming more advanced across commercial, recreational, and industrial activity, due to technology pushes and the increasing focus on sustainability, efficiency, and performance. The technologically supercharged, smart fishing movement has emerged and is reshaping the marketplace, with manufacturers introducing automation, data, and online materials. Notably, in mid-2024, Shimano released their next generation of electronic reels, providing AI-based tension sensing and dynamic depth monitoring capability for commercial and high market performance in sport fishing.

With the growing global requirement for seafood and national push for regulated and responsible fishing, the importance of fishing gear will only grow in marine and inland fisheries. Companies are adopting sonar systems and GPS-enabled systems and remote-operated fishing drones as well as emerging trawling systems that increase catch while decreasing by catch and habitat damage.

The recreational fishing segment is also growing in size, due to increased tourism, lifestyles, and government plans to improve access to play and promote an outdoor life. Companies like Pure Fishing, Daiwa, and Rapala VMC have engaged with digital elements such as digitally-connected mobile app technology, smart bite detection, and adjustable drag systems that offer customizable performance and overall enjoyment.

Furthermore, new and growing applications in aquaculture and offshore fishing also continue to drive change in fishing equipment markets. It is worth noting that, aqua farms and industrial fisheries are incorporating highly technological and precise netting systems, automated feeding mechanisms, and environmental response gear to improve efficiencies and sustainability. Each of these applications serves also to set the stage for further growth in the fishing equipment market part of ocean conservation efforts and food security objectives.

Fishing Equipment Market Dynamics and Trends

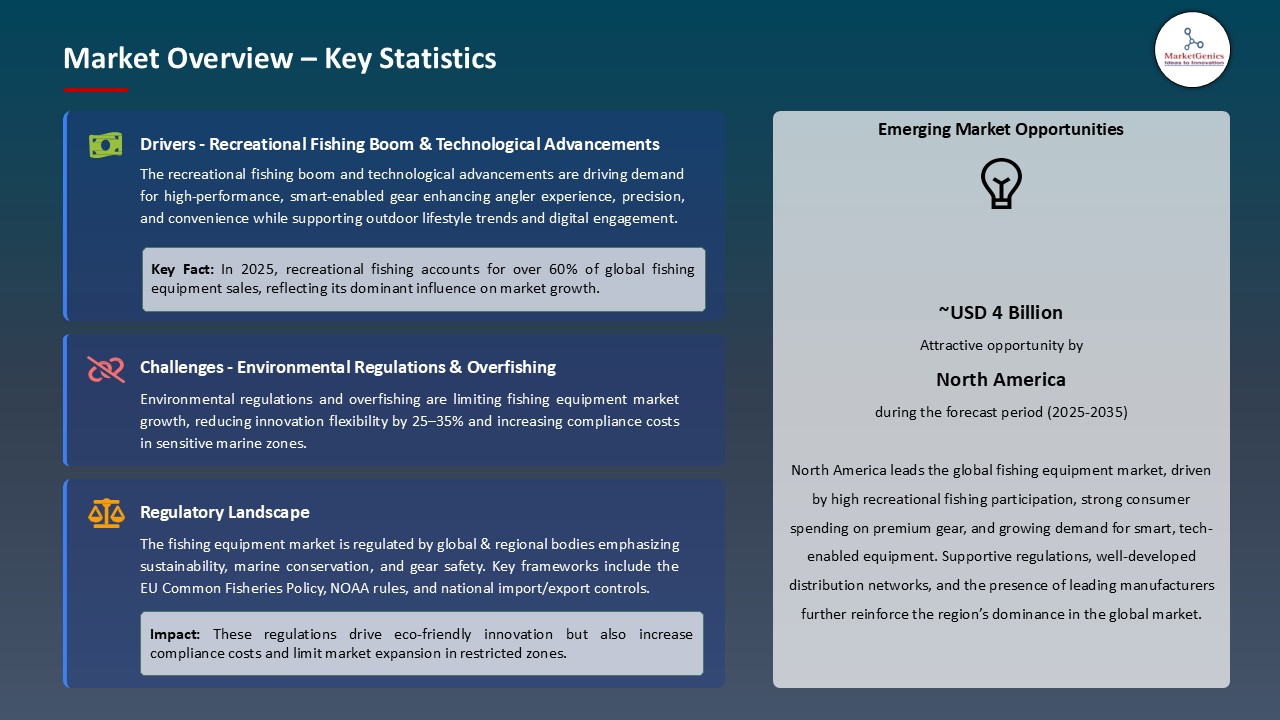

Drivers: Recreational Fishing Boom and Technological Advancements Supporting Fishing Equipment Market Expansion

- The increase in recreational fishing around the world is compounded in the fishing equipment market by advancements in technology after the pandemic. Due to the advancements in fishing gear, innovation of smart fishing gear like sonar fish finders and GPS integrated devices, and new lightweight and durable materials fishing equipment is accelerating the fishing experience and converting new hobbyists into the fishing equipment market.

- Further, recreational fishing is being recognized as both a leisure activity and sport is expanding, particularly in North America, Europe, and parts of Asia-Pacific. More participation will follow due to the increase in eco-tourism and fishing tournaments, which expands the overall recreational fishing demographic.

- Likewise, equipment design advancements, such as corrosion-resistant reels, sensitive rods, and biodegradable lures are helping both amateur and professional anglers expand the fishing equipment market.

Restraints: Environmental Regulations and Overfishing Concerns Hindering Fishing Equipment Market Development

- The fishing equipment market is hindered with stricter environmental regulations due to issues including greater awareness of loss of marine biodiversity, and global concerns regarding overfishing. Regulatory agencies are establishing catch limits, managing gear, and establishing conservation areas that ban all forms of commercial and recreational fishing.

- Making a stir, agencies in both governments and international organizations are banning unsustainable fishing techniques or fishing to extinction. Although these approaches are necessary for maintaining a healthy ecosystem, the limit on fishing is having an impact on equipment demand. The commercial fishers who rely on fishing equipment are observing a stranglehold on their net design, trawling methods, or fishing zones.

- Lastly, there is rising public pressure regarding plastic waste from fishing gear and marine pollution which drives manufacturers to spend on sustainability measures that may not be cost-effective for them. Also, increased production costs with also hindered the profitability of fishing equipment manufacturers.

Opportunity: Rising Demand for Sustainable Fishing Gear and Eco-Tourism Driving Growth in Fishing Equipment Market

- The global trends of sustainability and marine conservation are now demanding eco-friendly fishing gears and materials and booming eco-tourism and sport fishing markets are driving innovation in combat gear that is lightweight, high-performance and sustainable gear for amateur and professional anglers.

- Both consumers and environmental regulators are pushing manufacturers to improve the ecological impact of fishing. Biodegradable lures, low-impact nets, and GPS- enabled catch tracking tools are all areas in search of innovation. Additionally, outdoor recreational activities are rapidly increasing in North America and Europe, minor consumers in emerging markets in Southeast Asia and Latin America also offer potential growth as fishing tourism and coastal recreation grows.

Key Trend: Rising Popularity of Modular and Multi-Functional Fishing Equipment among Outdoor Enthusiasts

- Owing to the modern recreational anglers look for versatility, portability, and technology in their equipment, the market is significantly shifting towards modular, lightweight and multi-functional fishing gear. With the rise of concepts like "Adventure Fishing", anglers want gear that can take them across a variety of environments: fresh to saltwater, shore to boat fishing. This has created a wave of new products: telescoping rods, collapsible reels, and modular lure systems.

- Additionally, innovations and digital enhancements like Bluetooth fish finders, wearable gear, and smart tackle boxes are driving a trend that is not only pushing for innovation and education by brands to promote new gear that serves as a gateway into adventure sports focused on weekend getaways and solo travel, particularly an audience of young and technologically-oriented consumers. Brands that are providing customizable kits or tech-enabled yet old-fashioned kits, are gaining ground in a new consumer environment.

Fishing Equipment Market Analysis and Segmental Data

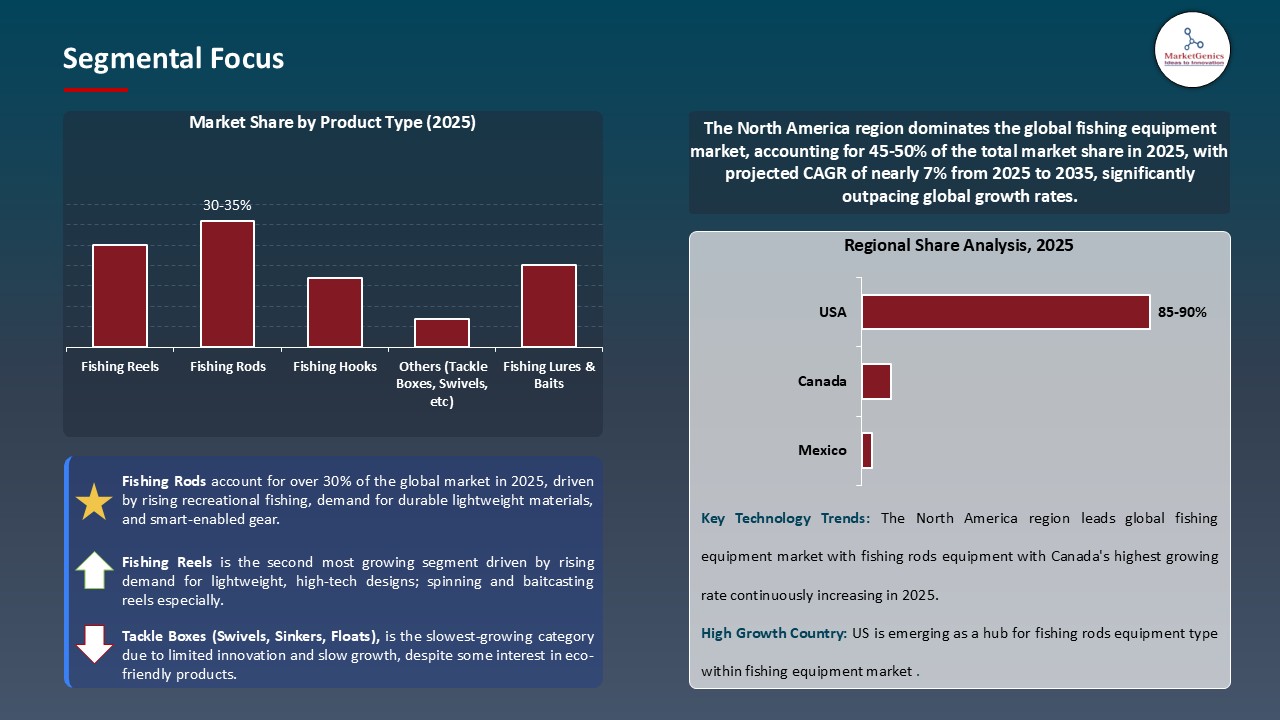

Based on the Product Type, Fishing Rods Dominates the Global Fishing Equipment Market

- Fishing rods prospected to hold the biggest market share based on product type because fishing rods are important for recreational and sport fishing. There are very few ways to go fishing fresh or saltwater fishing or fly fishing, without having to rely on some form of a fishing rod. Moreover, considering there are many levels of angler, rods are generally always a basic and essential piece of fishing gear. Fishing rods come in numerous types, sizes and materials, which depend entirely on the users' preference, fishing location, and the species being pursued.

- Likewise, there are developments in rod materials. Although carbon fiber, fiberglass, and other materials that are lightweight, durable, and flexible are being marketed more frequently for fishing rods, composite materials should also be used for fishing rods. Moreover, the preferred use of convenient beginner rods and travel rods has increased with the interest in leisure fishing and outdoor activities, proving their dominance in the market.

North America Dominates Global Fishing Equipment Market in 2025 and ahead

- North America dominates the fishing gear and equipment sector given the size of the recreational fishing population in North America’s many lakes, rivers, and coastlines, combined with its vast culture of an outdoor and fishing through recreational or slogging on behalf of your family and family. Everything in North America tends to be centered on fishing. North Americans fish mostly for fun or for family time.

- All relatively normal activity that drives high demand for fishing rods, reels, lures, and all types of bait and tackle. North America angler market also leads the world in innovation related to fishing. North America is at the forefront with smart fishing technology and products such as electronics - Fish Finders.

- Further, North America has more environmentally sustainable fishing products and processes than anywhere else in the world. In North America, angler participation and behavior is reinforced by regular fishing tournaments and competitions as well as government (federal or state) organized and supported outdoor recreation. It is not commonplace to consider fishing as an organized family unit.

Fishing Equipment Market Ecosystem

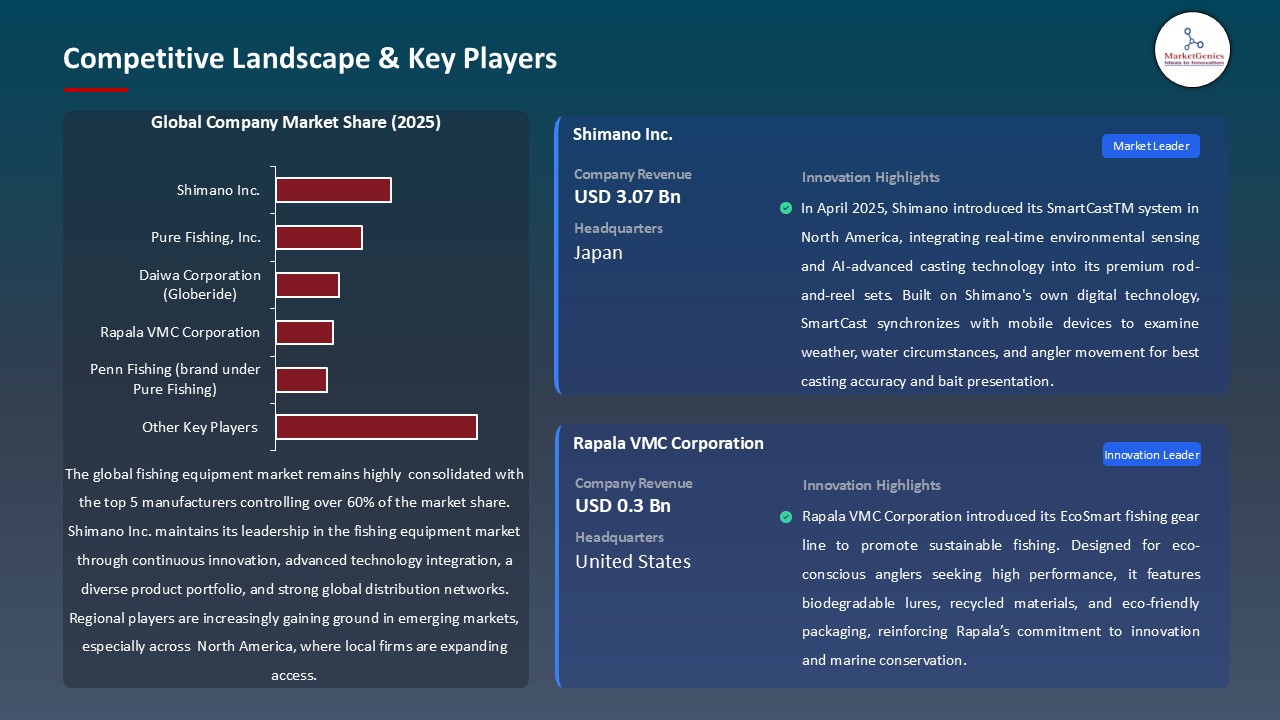

The global fishing equipment market is highly consolidated. The players are concentrated moderately around tiers 1 to 3. Tier 1 players such as Shimano, Pure Fishing and Rapala VMC become dominant players with their strong brand portfolios and global scale. Companies located in tier 2 such as Daiwa and Johnson Outdoors has made considerable headway in specific regional markets. Tier 3 players tend to cater to niche and more budget-specific categories. Buyer power is moderate given different types of consumers, while supplier power is generally low to moderate since most fishing equipment has an array of suppliers.

Recent Development and Strategic Overview:

- In June 2025, Daiwa (Globeride Inc.) launched its “InfinityCast X Series”, a smart rod-and-reel system featuring Bluetooth connectivity, real-time cast tracking, and temperature-tuned drag systems. Developed at Globeride’s innovation center in Japan, the system is designed to serve urban and coastal recreational anglers alike. With carbon nanotube rods and AI-enhanced line tension adjustment, the InfinityCast X Series has better precision and longer cast distances. The line is now available in key markets in Japan, the U.S., and the UK, and it has gained traction among an audience of curious sport fishing enthusiasts.

- In March 2025, Rapala VMC Corporation has launched its new “BioLure Natural Series”, an innovative line of biodegradable lures infused with fish-attractants for eco-conscious anglers throughout Europe and North America. These products were developed and tested by marine biologists in Scandinavian waters. Designed to mimic the movement of prey in their local water, they safely dissolve after a longer use. The BioLure series is plastic-free, and made with renewable marine-sourced biopolymers with an EU Ecolabel certification.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 13.4 Bn |

|

Market Forecast Value in 2035 |

USD 21.7 Bn |

|

Growth Rate (CAGR) |

4.9% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

USD Bn for Value Thousand Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Fishing Equipment Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Product Type |

|

|

By Fishing Type |

|

|

By Material Type |

|

|

By Application |

|

|

By Sales Type |

|

|

By End User |

|

|

By Distribution Channel |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Fishing Equipment Market Outlook

- 2.1.1. Fishing Equipment Market Size (Volume - Thousand Units and Value - USD Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Fishing Equipment Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Fishing Equipment Industry Overview, 2025

- 3.1.1. Agriculture Industry Ecosystem Analysis

- 3.1.2. Key Trends for Agriculture Industry

- 3.1.3. Regional Distribution for Agriculture Industry

- 3.2. Supplier Customer Data

- 3.3. Source Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.6. Raw Material Analysis

- 3.1. Fishing Equipment Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Recreational Fishing Boom and Technological Advancements Supporting Fishing Equipment Market Expansion

- 4.1.2. Restraints

- 4.1.2.1. Environmental Regulations and Overfishing Concerns Hindering Fishing Equipment Market Development

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Component Suppliers

- 4.4.2. Fishing Equipment Manufacturers

- 4.4.3. Dealers/Distributors

- 4.4.4. Wholesalers/ E-commerce Platform

- 4.4.5. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Fishing Equipment Market Demand

- 4.9.1. Historical Market Size – (Volume - Thousand Units and Value - USD Bn), 2021-2024

- 4.9.2. Current and Future Market Size – (Volume - Thousand Units and Value - USD Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Fishing Equipment Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Fishing Equipment Market Size (Volume - Thousand Units and Value - USD Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Fishing Rods

- 6.2.2. Fishing Reels

- 6.2.3. Fishing Lines

- 6.2.4. Fishing Hooks

- 6.2.5. Fishing Lures & Baits

- 6.2.6. Fishing Nets & Traps

- 6.2.7. Tackle Boxes

- 6.2.8. Others (Swivels, Sinkers, Floats)

- 7. Fishing Equipment Market Analysis, by Fishing Type

- 7.1. Key Segment Analysis

- 7.2. Fishing Equipment Market Size (Volume - Thousand Units and Value - USD Bn), Analysis, and Forecasts, by Fishing Type, 2021-2035

- 7.2.1. Freshwater Fishing

- 7.2.2. Saltwater Fishing

- 7.2.3. Ice Fishing

- 7.2.4. Fly Fishing

- 7.2.5. Bow Fishing

- 7.2.6. Others

- 8. Fishing Equipment Market Analysis, by Material Type

- 8.1. Key Segment Analysis

- 8.2. Fishing Equipment Market Size (Volume - Thousand Units and Value - USD Bn), Analysis, and Forecasts, by Material Type, 2021-2035

- 8.2.1. Carbon Fiber

- 8.2.2. Fiberglass

- 8.2.3. Plastic

- 8.2.4. Stainless Steel

- 8.2.5. Others

- 9. Fishing Equipment Market Analysis, by Application

- 9.1. Key Segment Analysis

- 9.2. Fishing Equipment Market Size (Volume - Thousand Units and Value - USD Bn), Analysis, and Forecasts, by Application, 2021-2035

- 9.2.1. Recreational Fishing

- 9.2.2. Commercial Fishing

- 9.2.3. Competitive/Sport Fishing

- 9.2.4. Subsistence Fishing

- 9.2.5. Others

- 10. Fishing Equipment Market Analysis, by Sales Type

- 10.1. Key Segment Analysis

- 10.2. Fishing Equipment Market Size (Volume - Thousand Units and Value - USD Bn), Analysis, and Forecasts, by Sales Type, 2021-2035

- 10.2.1. New Equipment

- 10.2.2. Rental Equipment

- 10.2.3. Refurbished Equipment

- 11. Fishing Equipment Market Analysis, by End-user

- 11.1. Key Segment Analysis

- 11.2. Fishing Equipment Market Size (Volume - Thousand Units and Value - USD Bn), Analysis, and Forecasts, by End-User, 2021-2035

- 11.2.1. Individual/Amateur

- 11.2.2. Professional/Commercial

- 11.2.3. Sports Enthusiasts

- 11.2.4. Others

- 12. Fishing Equipment Market Analysis, by Distribution Channel

- 12.1. Key Segment Analysis

- 12.2. Fishing Equipment Market Size (Volume - Thousand Units and Value - USD Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 12.2.1. Online Retail

- 12.2.2. Offline Retail

- 12.2.2.1. Specialty Stores

- 12.2.2.2. Hypermarkets/Supermarkets

- 12.2.2.3. Sports Retailers

- 12.2.3. Direct Sales

- 13. Fishing Equipment Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Fishing Equipment Market Size (Volume - Thousand Units and Value - USD Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Global Animal Genetics Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Global Animal Genetics Market Size (Volume - Thousand Units and Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Fishing Type

- 14.3.3. Material Type

- 14.3.4. Application

- 14.3.5. Sales Type

- 14.3.6. End User

- 14.3.7. Distribution Channel

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Global Animal Genetics Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Fishing Type

- 14.4.4. Material Type

- 14.4.5. Application

- 14.4.6. Sales Type

- 14.4.7. End User

- 14.4.8. Distribution Channel

- 14.5. Canada Global Animal Genetics Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Fishing Type

- 14.5.4. Material Type

- 14.5.5. Application

- 14.5.6. Sales Type

- 14.5.7. End User

- 14.5.8. Distribution Channel

- 14.6. Mexico Global Animal Genetics Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Fishing Type

- 14.6.4. Material Type

- 14.6.5. Application

- 14.6.6. Sales Type

- 14.6.7. End User

- 14.6.8. Distribution Channel

- 15. Europe Global Animal Genetics Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Global Animal Genetics Market Size (Volume - Thousand Units and Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Fishing Type

- 15.3.3. Material Type

- 15.3.4. Application

- 15.3.5. Sales Type

- 15.3.6. End User

- 15.3.7. Distribution Channel

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Global Animal Genetics Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Fishing Type

- 15.4.4. Material Type

- 15.4.5. Application

- 15.4.6. Sales Type

- 15.4.7. End User

- 15.4.8. Distribution Channel

- 15.5. United Kingdom Global Animal Genetics Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Fishing Type

- 15.5.4. Material Type

- 15.5.5. Application

- 15.5.6. Sales Type

- 15.5.7. End User

- 15.5.8. Distribution Channel

- 15.6. France Global Animal Genetics Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Fishing Type

- 15.6.4. Material Type

- 15.6.5. Application

- 15.6.6. Sales Type

- 15.6.7. End User

- 15.6.8. Distribution Channel

- 15.7. Italy Global Animal Genetics Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Fishing Type

- 15.7.4. Material Type

- 15.7.5. Application

- 15.7.6. Sales Type

- 15.7.7. End User

- 15.7.8. Distribution Channel

- 15.8. Spain Global Animal Genetics Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Fishing Type

- 15.8.4. Material Type

- 15.8.5. Application

- 15.8.6. Sales Type

- 15.8.7. End User

- 15.8.8. Distribution Channel

- 15.9. Netherlands Global Animal Genetics Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Product Type

- 15.9.3. Fishing Type

- 15.9.4. Material Type

- 15.9.5. Application

- 15.9.6. Sales Type

- 15.9.7. End User

- 15.9.8. Distribution Channel

- 15.10. Nordic Countries Global Animal Genetics Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Product Type

- 15.10.3. Fishing Type

- 15.10.4. Material Type

- 15.10.5. Application

- 15.10.6. Sales Type

- 15.10.7. End User

- 15.10.8. Distribution Channel

- 15.11. Poland Global Animal Genetics Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Product Type

- 15.11.3. Fishing Type

- 15.11.4. Material Type

- 15.11.5. Application

- 15.11.6. Sales Type

- 15.11.7. End User

- 15.11.8. Distribution Channel

- 15.12. Russia & CIS Global Animal Genetics Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Product Type

- 15.12.3. Fishing Type

- 15.12.4. Material Type

- 15.12.5. Application

- 15.12.6. Sales Type

- 15.12.7. End User

- 15.12.8. Distribution Channel

- 15.13. Rest of Europe Global Animal Genetics Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Product Type

- 15.13.3. Fishing Type

- 15.13.4. Material Type

- 15.13.5. Application

- 15.13.6. Sales Type

- 15.13.7. End User

- 15.13.8. Distribution Channel

- 16. Asia Pacific Global Animal Genetics Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. East Asia Global Animal Genetics Market Size (Volume - Thousand Units and Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Fishing Type

- 16.3.3. Material Type

- 16.3.4. Application

- 16.3.5. Sales Type

- 16.3.6. End User

- 16.3.7. Distribution Channel

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia-Pacific

- 16.4. China Global Animal Genetics Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Fishing Type

- 16.4.4. Material Type

- 16.4.5. Application

- 16.4.6. Sales Type

- 16.4.7. End User

- 16.4.8. Distribution Channel

- 16.5. India Global Animal Genetics Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Fishing Type

- 16.5.4. Material Type

- 16.5.5. Application

- 16.5.6. Sales Type

- 16.5.7. End User

- 16.5.8. Distribution Channel

- 16.6. Japan Global Animal Genetics Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Fishing Type

- 16.6.4. Material Type

- 16.6.5. Application

- 16.6.6. Sales Type

- 16.6.7. End User

- 16.6.8. Distribution Channel

- 16.7. South Korea Global Animal Genetics Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Fishing Type

- 16.7.4. Material Type

- 16.7.5. Application

- 16.7.6. Sales Type

- 16.7.7. End User

- 16.7.8. Distribution Channel

- 16.8. Australia and New Zealand Global Animal Genetics Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Fishing Type

- 16.8.4. Material Type

- 16.8.5. Application

- 16.8.6. Sales Type

- 16.8.7. End User

- 16.8.8. Distribution Channel

- 16.9. Indonesia Global Animal Genetics Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Fishing Type

- 16.9.4. Material Type

- 16.9.5. Application

- 16.9.6. Sales Type

- 16.9.7. End User

- 16.9.8. Distribution Channel

- 16.10. Malaysia Global Animal Genetics Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Fishing Type

- 16.10.4. Material Type

- 16.10.5. Application

- 16.10.6. Sales Type

- 16.10.7. End User

- 16.10.8. Distribution Channel

- 16.11. Thailand Global Animal Genetics Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Fishing Type

- 16.11.4. Material Type

- 16.11.5. Application

- 16.11.6. Sales Type

- 16.11.7. End User

- 16.11.8. Distribution Channel

- 16.12. Vietnam Global Animal Genetics Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Fishing Type

- 16.12.4. Material Type

- 16.12.5. Application

- 16.12.6. Sales Type

- 16.12.7. End User

- 16.12.8. Distribution Channel

- 16.13. Rest of Asia Pacific Global Animal Genetics Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Fishing Type

- 16.13.4. Material Type

- 16.13.5. Application

- 16.13.6. Sales Type

- 16.13.7. End User

- 16.13.8. Distribution Channel

- 17. Middle East Global Animal Genetics Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Global Animal Genetics Market Size (Volume - Thousand Units and Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Fishing Type

- 17.3.3. Material Type

- 17.3.4. Application

- 17.3.5. Sales Type

- 17.3.6. End User

- 17.3.7. Distribution Channel

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Global Animal Genetics Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Fishing Type

- 17.4.4. Material Type

- 17.4.5. Application

- 17.4.6. Sales Type

- 17.4.7. End User

- 17.4.8. Distribution Channel

- 17.5. UAE Global Animal Genetics Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Fishing Type

- 17.5.4. Material Type

- 17.5.5. Application

- 17.5.6. Sales Type

- 17.5.7. End User

- 17.5.8. Distribution Channel

- 17.6. Saudi Arabia Global Animal Genetics Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Fishing Type

- 17.6.4. Material Type

- 17.6.5. Application

- 17.6.6. Sales Type

- 17.6.7. End User

- 17.6.8. Distribution Channel

- 17.7. Israel Global Animal Genetics Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Fishing Type

- 17.7.4. Material Type

- 17.7.5. Application

- 17.7.6. Sales Type

- 17.7.7. End User

- 17.7.8. Distribution Channel

- 17.8. Rest of Middle East Global Animal Genetics Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Fishing Type

- 17.8.4. Material Type

- 17.8.5. Application

- 17.8.6. Sales Type

- 17.8.7. End User

- 17.8.8. Distribution Channel

- 18. Africa Global Animal Genetics Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Global Animal Genetics Market Size (Volume - Thousand Units and Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Fishing Type

- 18.3.3. Material Type

- 18.3.4. Application

- 18.3.5. Sales Type

- 18.3.6. End User

- 18.3.7. Distribution Channel

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Global Animal Genetics Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Fishing Type

- 18.4.4. Material Type

- 18.4.5. Application

- 18.4.6. Sales Type

- 18.4.7. End User

- 18.4.8. Distribution Channel

- 18.5. Egypt Global Animal Genetics Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Fishing Type

- 18.5.4. Material Type

- 18.5.5. Application

- 18.5.6. Sales Type

- 18.5.7. End User

- 18.5.8. Distribution Channel

- 18.6. Nigeria Global Animal Genetics Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Fishing Type

- 18.6.4. Material Type

- 18.6.5. Application

- 18.6.6. Sales Type

- 18.6.7. End User

- 18.6.8. Distribution Channel

- 18.7. Algeria Global Animal Genetics Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Fishing Type

- 18.7.4. Material Type

- 18.7.5. Application

- 18.7.6. Sales Type

- 18.7.7. End User

- 18.7.8. Distribution Channel

- 18.8. Rest of Africa Global Animal Genetics Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Fishing Type

- 18.8.4. Material Type

- 18.8.5. Application

- 18.8.6. Sales Type

- 18.8.7. End User

- 18.8.8. Distribution Channel

- 19. South America Global Animal Genetics Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Central and South Africa Global Animal Genetics Market Size (Volume - Thousand Units and Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Fishing Type

- 19.3.3. Material Type

- 19.3.4. Application

- 19.3.5. Sales Type

- 19.3.6. End User

- 19.3.7. Distribution Channel

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Global Animal Genetics Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Fishing Type

- 19.4.4. Material Type

- 19.4.5. Application

- 19.4.6. Sales Type

- 19.4.7. End User

- 19.4.8. Distribution Channel

- 19.5. Argentina Global Animal Genetics Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Fishing Type

- 19.5.4. Material Type

- 19.5.5. Application

- 19.5.6. Sales Type

- 19.5.7. End User

- 19.5.8. Distribution Channel

- 19.6. Rest of South America Global Animal Genetics Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Fishing Type

- 19.6.4. Material Type

- 19.6.5. Application

- 19.6.6. Sales Type

- 19.6.7. End User

- 19.6.8. Distribution Channel

- 20. Key Players/ Company Profile

- 20.1. AFTCO Mfg. Co., Inc.

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Bass Pro Shops

- 20.3. Berkley (a brand of Pure Fishing)

- 20.4. Cabela’s Inc.

- 20.5. Daiwa Corporation

- 20.6. Eagle Claw Fishing Tackle Co.

- 20.7. Gamakatsu Co., Ltd.

- 20.8. Hardy & Greys Ltd.

- 20.9. Johnson Outdoors Inc.

- 20.10. Okuma Fishing Tackle Co., Ltd.

- 20.11. Orvis Company Inc.

- 20.12. Penn Fishing Tackle Manufacturing Company

- 20.13. Preston Innovations

- 20.14. Pure Fishing, Inc.

- 20.15. Rapala VMC Corporation

- 20.16. SeaKnight Fishing Tackle Co., Ltd.

- 20.17. Shimano Inc.

- 20.18. St. Croix Rods

- 20.19. Tica Fishing Tackle

- 20.20. Zebco Brands

- 20.21. Other key Players

- 20.1. AFTCO Mfg. Co., Inc.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation