Military Flight Training School Market Size, Share, Growth Opportunity Analysis Report by Training Type (Basic Flight Training, Advanced Flight Training, Lead-In Fighter Training (LIFT), Tactical / Combat Training, Instrument Flight Rules (IFR) Training, Night Flying Training, Weapons & Weapons Delivery Training, Formation / Aerial Refueling Training and Others), Platform/ Aircraft Type, Training Mode, Training Level, End User and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Military Flight Training School Market Size, Share, and Growth

The global military flight training school market is projected to grow from USD 3.1 Billion in 2025 to USD 4.2 Billion in 2035, with a strong CAGR of 3.0% during the forecasted period. North America leads the military flight training school market with market share of 46.2% with USD 1.4 billion revenue.

In September 2025, CAE Inc., under the leadership of Marc Parent (President & CEO), launched its NextGen Virtual Pilot Training Ecosystem integrating AI-driven adaptive learning and mixed-reality simulation for military flight schools. This strategy enhances pilot readiness, reduces training costs, and aligns with modern air force digital transformation initiatives globally.

The global military flight training school market is led by the increased demand of advanced training and modernization of the air force fleets with the help of simulation. In June 2025, Lockheed Martin Corporation launched its Full Mission Simulator that used AI to enhance combat preparedness by providing a simulation of a real-world scenario with an F-35.

Leonardo S.p.A. added its M-346 Integrated Training System in next-generation jet pilot programs in April 2025. Such developments are driving increased use of technology incorporated military training systems across the world.

The opportunities the global military flight training school market has are AI-powered systems of pilot evaluation, VR/AR-based combat simulations, and autonomous aircraft training modules. These segments make the training of pilots more realistic and economical. These neighboring technologies are forming integrated, data-based ecosystems, enhancing future-orientedness in terms of the global military aviation training programs.

Military Flight Training School Market Dynamics and Trends

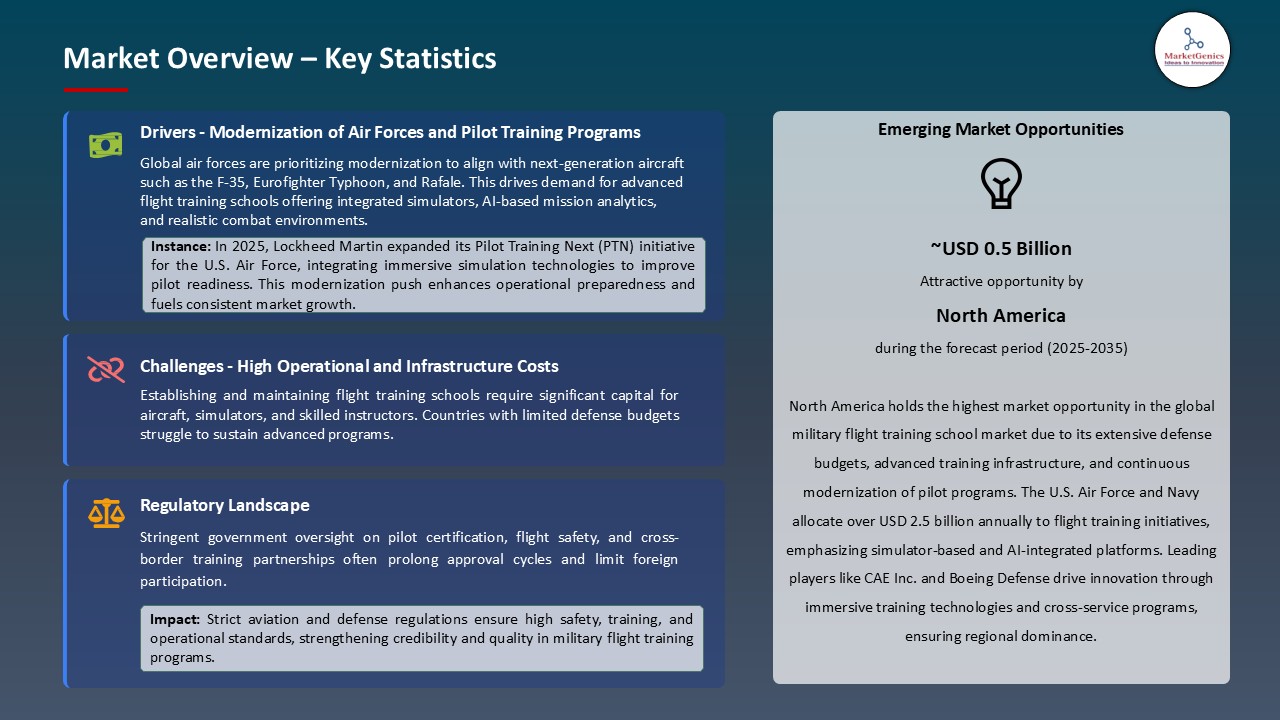

Driver: Rising Demand for Next-Generation Pilot Training Programs

- The growing demand of next-generation pilot training programs with the ability to meet the operation requirements of fifth and sixth-generation combat airplanes is driving the global military flight training school market. The air forces of the present day are focusing on the multi-domain operations, and pilots have to learn to operate sophisticated avionics, digital warfare systems, and data-oriented decision-making. To satisfy these requirements, flight schools are embracing very modern synthetic training environments (STEs) and full-mission simulators as well as live-virtual-constructive (LVC) integration systems.

- In 2025, Lockheed Martin Corporation has increased its Integrated Pilot Training System (IPTS) with the U.S.Airforce and it involves immersive simulation, real-time analytics, and adaptive learning which is driven by AI to train pilots more effectively. In the same manner, Future Aircrew Training (UKMFTS) program of the U.K. Royal Air Force emphasizes the worldwide tendency to the extensive, technology-oriented training of pilots in the context of the modern combat preparedness.

- An increasing investment in smart training systems is enhancing operational preparedness, pilot efficiency, and combat survivability greatly, and training providers are enjoying solid growth over the long term.

Restraint: High Operational and Infrastructure Costs

- The military flight training school market is experiencing a significant inhibitor of high infrastructure and maintenance expenses related to flight training facilities. Creation of a complete flight training environment demands a significant investment in aircraft definition, service, airfield apparatus, cutting-edge simulators and computer security infrastructures on online study devices. These are the financial strains that are quite difficult to manage especially when traditional defense budgets are scarce which causes modernization programs to be held back. It is anticipated to hampers the growth of global

- In 2024, BAE Systems plc disclosed that the cost of its plan to build an advanced pilot training centre in Saudi Arabia increased because of an increase in the logistical, aircraft maintenance and simulator installation fees on its Hawk trainer jets. In addition, the large costs of maintenance, and regular system updates impose further financial pressure on the budgets, and outsourcing and training alliances with other countries can be a better option.

- The high operational costs discourage mass adoption and modernization especially in the emerging economies, and this slows down the growth of pilot training networks that are globally standardized.

Opportunity: Integration of AI and AR/VR in Training Ecosystems

- The increased adoption of artificial intelligence (AI), augmented reality (AR), and virtual reality (VR) offers a disruptive business opportunity to the military flight training school market. Such technologies allow very realistic simulation settings, adaptive learning experiences, and pilot assessment based on data. AI algorithms analyze the behavior of flights, identify areas of skills, and create individual training packages to improve the performance of pilots.

- In 2025, CAE Inc. released its AI based Adaptive Training Suite to the Royal Canadian Air Force that provides real-time flight performance support and AR enabled tactical situations. AR/VR headsets and motion-based simulators can be used to cut physical flight hours and operational costs, enhance retention, and situational awareness as well. This is a digital revolution that is leading to collaboration between defense contractors and technology innovators, which is widening the software-based training ecosystem market.

- The union of AI and immersive technologies also contributes to the increased efficiency and flexibility of operations, making digital training one of the foundations of future defense policies.

Key Trend: Shift Toward Joint and Multinational Training Programs

- The key trends in the military flight training school market is the shift in the multinational and joint training programs in order to increase the interoperability of allied air forces. Training centers help minimize redundancy of resources, cost optimization, and spread of similarity in tactical doctrines to partner states. Governments are also allotting alliances with defense contractors to set forth international training facilities with standard curriculums and modernized teacher aircrafts.

- In 2025, Leonardo S.p.A. together with the Italian Air Force plans to expand its International Flight Training School (IFTS) in Decimomannu, Italy to train Japanese, Austrian and Canadian pilots on its M-346 Master aircraft. The success of the program indicates an increasing trend in the world towards common train resource and common simulation platforms.

- The tendency towards multinational cooperation is creating stability in defense, in cost-effectiveness, and in the unceasing upgrade of pilot skills throughout world air forces, to reinforce the durable linkage in defense ties.

Military Flight Training School Market Analysis and Segmental Data

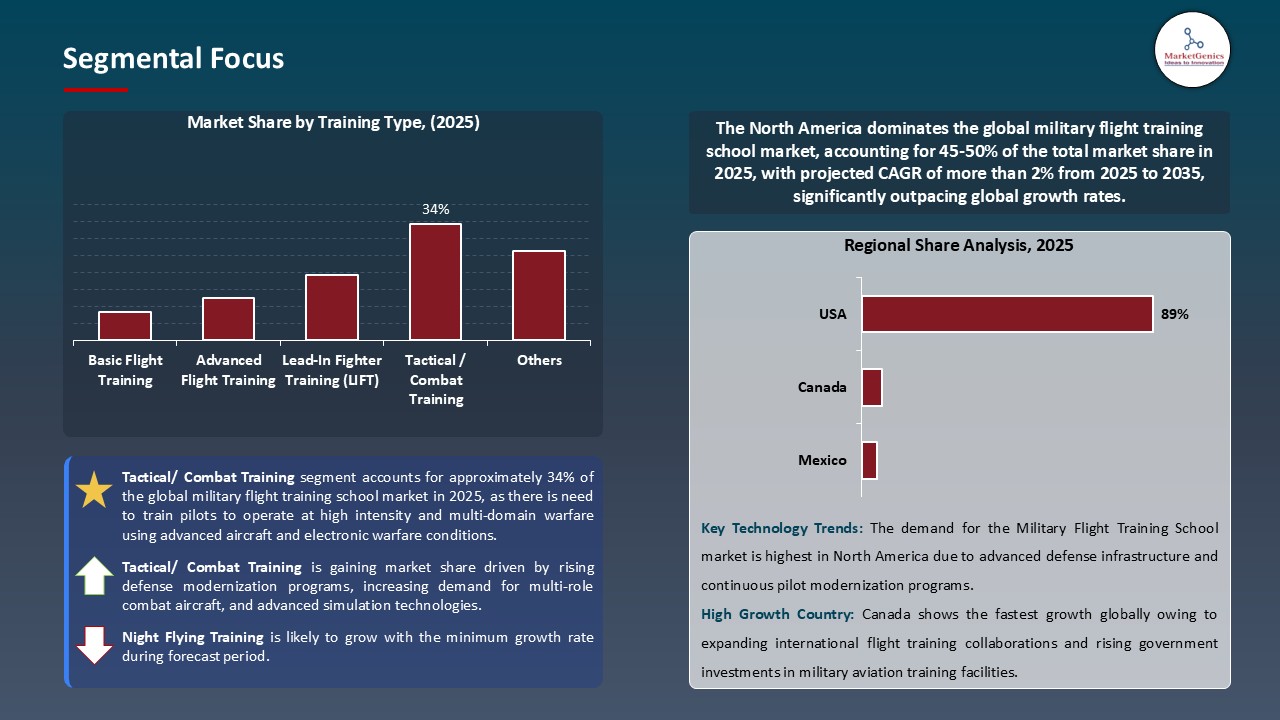

Based on Training Type, the Tactical / Combat Training Segment Retains the Largest Share

- The tactical / combat training segment holds major share ~34% in the global military flight training school market, as there is need to train pilots to operate at high intensity and multi-domain warfare using advanced aircraft and electronic warfare conditions. Innovative air forces now need more than just visual-range (VDR) combat military men, those capable of detecting and responding in real-time within a dynamic situation. With the nation upgrading to the fifth and sixth generation fighters, training is centered on air-to-air, air-to-ground and network-centric warfare competencies.

- In 2025, Lockheed Martin Corporation improved Tactical Mission Rehearsal System to facilitate training of F-35 pilots with suggestions of immersive combat simulations with built-in threat libraries and live-virtual-constructive (LVC) environment that recreated actual battle field conditions.

- The increasing use of digital simulation systems, AI-related analytics, and modules of multi-aircraft coordination only encourage the use of tactical training in the allied countries.

- The ever-increasing demand of mission-realistic, data-driven combat training is hastening the investments in next-generation tactical simulation and pilot preparedness programs in the world.

North America Dominates Global Military Flight Training School Market in 2025 and Beyond

- Military flight training school market has the most demand in North America because the region is experiencing a wide scope of defense modernization efforts, technological superiority, and the largest military budget in the globe mostly due to the United States. U.S Air Force and Navy are constantly investing in pilot preparedness, sophisticated simulation, and future generation training facilities to deal with the problem of pilot shortages and changing war demands.

- In 2025, CAE Inc. renewed its training collaboration with the U.S. Air Force to provide enhanced T-7A Red Hawk simulators with AI-based adaptive learning modules to improve the performance of pilots in a tactical setting. This is indicative of the concern of the region towards technologically advanced scenario-driven training on the future air combat operations.

- Moreover, the increased involvement of Canada in NATO drills and training programs with other countries also contributes to the need of integrated flight training systems.

- Its position of advanced military pilot training infrastructure and innovation is maintained by robust defense expenditure and modernization efforts throughout North America.

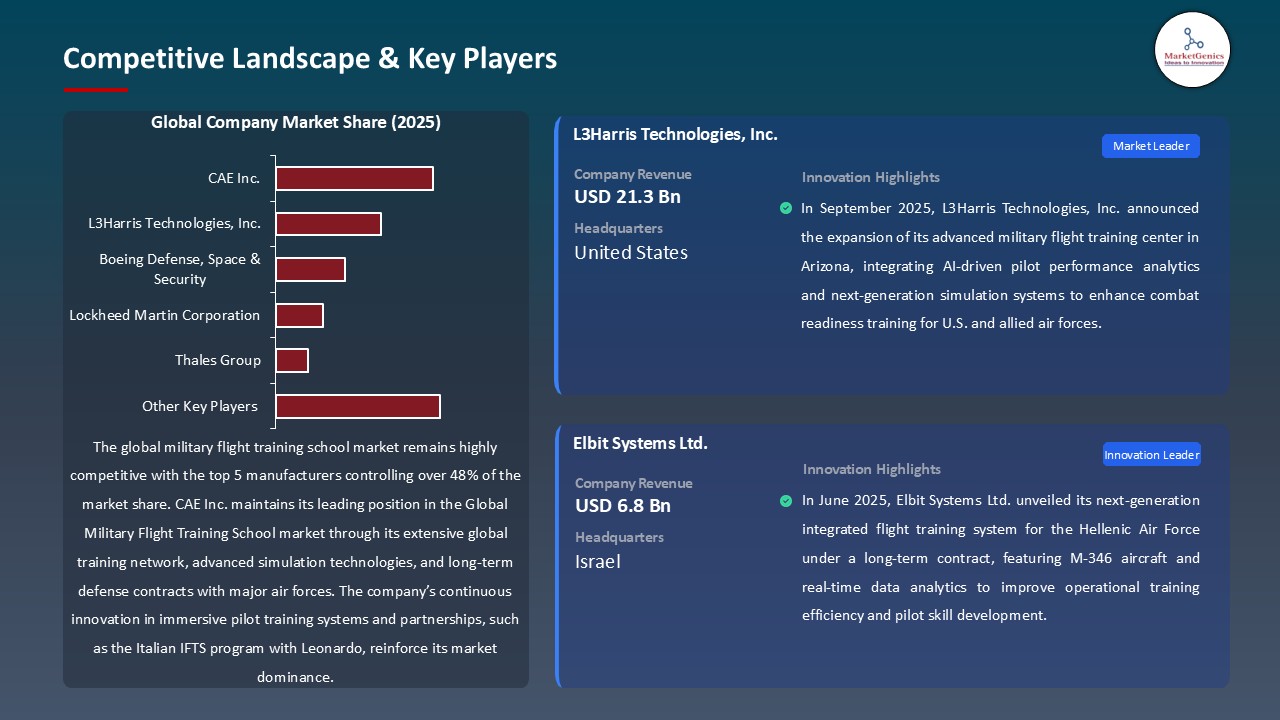

Military-Flight-Training-School-Market Ecosystem

The global military flight training school market is moderately consolidated, with Tier 1 players, which include CAE Inc., Boeing Defense, Space and security, Lockheed Martin Corporation, BAE systems plc dominates the market owing to their sophisticated simulation technologies, international training systems, and long-term defense contracts. Tier 2 participants such as Leonardo S.p.A., Thales Group and Elbit systems Ltd. are involved in the specialized aircraft and virtual training solutions and Tier 3 players such as Pilatus Aircraft Ltd and Embraer Defense and security are involved in the production of cost-effective trainer aircraft.

The two nodes’ aircraft and simulator manufacturing are associated with the value chain as OEMs and technology providers design high-performance training systems, and training service provision, in which the companies provide pilot training, operational support, and maintenance.

In September 2025, L3Harris Technologies unveiled its new MissionEdge Integrated Training Program to the U.S. Air Force to improve real-time data analytics and performance optimization in the tactical training. The moderate consolidation of the ecosystem promotes innovation, interoperability, and technological progress in the world pilot training solution.

Recent Development and Strategic Overview:

- In October 2025, Boeing Defense, Space and Security and Leonardo S.p.A. said they had bid jointly to deliver the first-entry rotary wing training solution to the U.S. Army in an AW119T trainer in a contractor-owned, contractor-operated (COCO) contract.

- In April 2025, CAE, Inc. opens the project of Italian International Flight Training School PPP, CAE, in collaboration with Leonardo and the Italian Air Force, created a public-private partnership via which the International Flight Training School (IFTS) will be run in Italy to provide pilot training services to more than 13 allied air forces with integrated flight and ground training systems.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 3.1 Bn |

|

Market Forecast Value in 2035 |

USD 4.2 Bn |

|

Growth Rate (CAGR) |

3.0% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Military-Flight-Training-School-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Military Flight Training School Market, By Training Type |

|

|

Military Flight Training School Market, By Platform/ Aircraft Type |

|

|

Military Flight Training School Market, By Training Mode |

|

|

Military Flight Training School Market, By Training Level |

|

|

Military Flight Training School Market, By End User |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Military Flight Training School Market Outlook

- 2.1.1. Military Flight Training School Market Size (Volume - Units & Value - US$ Billion), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to-Market Strategy

- 2.5.1. Customer/ End Use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Military Flight Training School Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Aerospace & Defense Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Aerospace & Defense Industry

- 3.1.3. Regional Distribution for Aerospace & Defense

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.1. Global Aerospace & Defense Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising defense budgets and modernization of air forces globally.

- 4.1.1.2. Increasing demand for advanced simulation and AI-integrated flight training systems.

- 4.1.1.3. Growing pilot shortages due to expanding military aircraft fleets and global operations.

- 4.1.2. Restraints

- 4.1.2.1. High operational and infrastructure setup costs for advanced training facilities.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis/ Ecosystem Analysis

- 4.4.1. Aircraft and Simulator Suppliers

- 4.4.2. Training Infrastructure and Facility Management Providers

- 4.4.3. Maintenance, Support, and Service Providers

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Porter’s Five Forces Analysis

- 4.7. PESTEL Analysis

- 4.8. Global Military Flight Training School Market Demand

- 4.8.1. Historical Market Size - in Value (Volume - Units & Value - US$ Billion), 2021-2024

- 4.8.2. Current and Future Market Size - in Value (Volume - Units & Value - US$ Billion), 2025–2035

- 4.8.2.1. Y-o-Y Growth Trends

- 4.8.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Military Flight Training School Market Analysis, by Training Type

- 6.1. Key Segment Analysis

- 6.2. Military Flight Training School Market Size (Value - US$ Billion), Analysis, and Forecasts, by Training Type, 2021-2035

- 6.2.1. Basic Flight Training

- 6.2.2. Advanced Flight Training

- 6.2.3. Lead-In Fighter Training (LIFT)

- 6.2.4. Tactical / Combat Training

- 6.2.5. Instrument Flight Rules (IFR) Training

- 6.2.6. Night Flying Training

- 6.2.7. Weapons & Weapons Delivery Training

- 6.2.8. Formation / Aerial Refueling Training

- 6.2.9. Others

- 7. Global Military Flight Training School Market Analysis, by Platform/ Aircraft Type

- 7.1. Key Segment Analysis

- 7.2. Military Flight Training School Market Size (Volume - Units & Value - US$ Billion), Analysis, and Forecasts, by Platform/ Aircraft Type, 2021-2035

- 7.2.1. Fixed-Wing Trainer Aircraft

- 7.2.2. Rotary-Wing (Helicopter) Trainer

- 7.2.3. Tiltrotor / VTOL Trainer

- 7.2.4. Jet Trainer

- 7.2.5. Propeller / Turboprop Trainer

- 7.2.6. Unmanned Aerial Vehicle (UAV) Operator Training

- 7.2.7. Others

- 8. Global Military Flight Training School Market Analysis, by Training Mode

- 8.1. Key Segment Analysis

- 8.2. Military Flight Training School Market Size (Value - US$ Billion), Analysis, and Forecasts, by Training Mode, 2021-2035

- 8.2.1. Live Flight Training (Aircraft)

- 8.2.2. Flight Simulation Training (Full-Mission Simulators)

- 8.2.3. Synthetic/VR/AR Training & Desktop Simulators

- 8.2.4. Classroom / Ground School

- 8.2.5. Combined / Integrated Training Programs

- 8.2.6. Others

- 9. Global Military Flight Training School Market Analysis, by Training Level

- 9.1. Key Segment Analysis

- 9.2. Military Flight Training School Market Size (Value - US$ Billion), Analysis, and Forecasts, by Training Level, 2021-2035

- 9.2.1. Initial Entry / Ab Initio Training

- 9.2.2. Basic Pilot Training

- 9.2.3. Advanced Pilot Training

- 9.2.4. Conversion / Transition Training (type-rating)

- 9.2.5. Recurrent / Refresher Training

- 9.2.6. Test Pilot / Experimental Training

- 9.2.7. Others

- 10. Global Military Flight Training School Market Analysis, by End User

- 10.1. Key Segment Analysis

- 10.2. Military Flight Training School Market Size (Value - US$ Billion), Analysis, and Forecasts, by End User, 2021-2035

- 10.2.1. Air Force Training Schools

- 10.2.2. Naval Aviation Training / Fleet Air Arm

- 10.2.3. Army Aviation Training Centers

- 10.2.4. Marine Corps Aviation Training

- 10.2.5. Joint / Combined Military Training Academies

- 10.2.6. Private Defense Contractors

- 10.2.7. Others

- 11. Global Military Flight Training School Market Analysis and Forecasts, by Region

- 11.1. Key Findings

- 11.2. Military Flight Training School Market Size (Volume - Units & Value - US$ Billion), Analysis, and Forecasts, by Region, 2021-2035

- 11.2.1. North America

- 11.2.2. Europe

- 11.2.3. Asia Pacific

- 11.2.4. Middle East

- 11.2.5. Africa

- 11.2.6. South America

- 12. North America Military Flight Training School Market Analysis

- 12.1. Key Segment Analysis

- 12.2. Regional Snapshot

- 12.3. North America Military Flight Training School Market Size (Volume - Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 12.3.1. Training Type

- 12.3.2. Platform/ Aircraft Type

- 12.3.3. Training Mode

- 12.3.4. Training Level

- 12.3.5. End User

- 12.3.6. Country

- 12.3.6.1. USA

- 12.3.6.2. Canada

- 12.3.6.3. Mexico

- 12.4. USA Military Flight Training School Market

- 12.4.1. Country Segmental Analysis

- 12.4.2. Training Type

- 12.4.3. Platform/ Aircraft Type

- 12.4.4. Training Mode

- 12.4.5. Training Level

- 12.4.6. End User

- 12.5. Canada Military Flight Training School Market

- 12.5.1. Country Segmental Analysis

- 12.5.2. Training Type

- 12.5.3. Platform/ Aircraft Type

- 12.5.4. Training Mode

- 12.5.5. Training Level

- 12.5.6. End User

- 12.6. Mexico Military Flight Training School Market

- 12.6.1. Country Segmental Analysis

- 12.6.2. Training Type

- 12.6.3. Platform/ Aircraft Type

- 12.6.4. Training Mode

- 12.6.5. Training Level

- 12.6.6. End User

- 13. Europe Military Flight Training School Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. Europe Military Flight Training School Market Size (Volume - Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 13.3.1. Training Type

- 13.3.2. Platform/ Aircraft Type

- 13.3.3. Training Mode

- 13.3.4. Training Level

- 13.3.5. End User

- 13.3.6. Country

- 13.3.6.1. Germany

- 13.3.6.2. United Kingdom

- 13.3.6.3. France

- 13.3.6.4. Italy

- 13.3.6.5. Spain

- 13.3.6.6. Netherlands

- 13.3.6.7. Nordic Countries

- 13.3.6.8. Poland

- 13.3.6.9. Russia & CIS

- 13.3.6.10. Rest of Europe

- 13.4. Germany Military Flight Training School Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Training Type

- 13.4.3. Platform/ Aircraft Type

- 13.4.4. Training Mode

- 13.4.5. Training Level

- 13.4.6. End User

- 13.5. United Kingdom Military Flight Training School Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Training Type

- 13.5.3. Platform/ Aircraft Type

- 13.5.4. Training Mode

- 13.5.5. Training Level

- 13.5.6. End User

- 13.6. France Military Flight Training School Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Training Type

- 13.6.3. Platform/ Aircraft Type

- 13.6.4. Training Mode

- 13.6.5. Training Level

- 13.6.6. End User

- 13.7. Italy Military Flight Training School Market

- 13.7.1. Country Segmental Analysis

- 13.7.2. Training Type

- 13.7.3. Platform/ Aircraft Type

- 13.7.4. Training Mode

- 13.7.5. Training Level

- 13.7.6. End User

- 13.8. Spain Military Flight Training School Market

- 13.8.1. Country Segmental Analysis

- 13.8.2. Training Type

- 13.8.3. Platform/ Aircraft Type

- 13.8.4. Training Mode

- 13.8.5. Training Level

- 13.8.6. End User

- 13.9. Netherlands Military Flight Training School Market

- 13.9.1. Country Segmental Analysis

- 13.9.2. Training Type

- 13.9.3. Platform/ Aircraft Type

- 13.9.4. Training Mode

- 13.9.5. Training Level

- 13.9.6. End User

- 13.10. Nordic Countries Military Flight Training School Market

- 13.10.1. Country Segmental Analysis

- 13.10.2. Training Type

- 13.10.3. Platform/ Aircraft Type

- 13.10.4. Training Mode

- 13.10.5. Training Level

- 13.10.6. End User

- 13.11. Poland Military Flight Training School Market

- 13.11.1. Country Segmental Analysis

- 13.11.2. Training Type

- 13.11.3. Platform/ Aircraft Type

- 13.11.4. Training Mode

- 13.11.5. Training Level

- 13.11.6. End User

- 13.12. Russia & CIS Military Flight Training School Market

- 13.12.1. Country Segmental Analysis

- 13.12.2. Training Type

- 13.12.3. Platform/ Aircraft Type

- 13.12.4. Training Mode

- 13.12.5. Training Level

- 13.12.6. End User

- 13.13. Rest of Europe Military Flight Training School Market

- 13.13.1. Country Segmental Analysis

- 13.13.2. Training Type

- 13.13.3. Platform/ Aircraft Type

- 13.13.4. Training Mode

- 13.13.5. Training Level

- 13.13.6. End User

- 14. Asia Pacific Military Flight Training School Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. East Asia Military Flight Training School Market Size (Volume - Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 14.3.1. Training Type

- 14.3.2. Platform/ Aircraft Type

- 14.3.3. Training Mode

- 14.3.4. Training Level

- 14.3.5. End User

- 14.3.6. Country

- 14.3.6.1. China

- 14.3.6.2. India

- 14.3.6.3. Japan

- 14.3.6.4. South Korea

- 14.3.6.5. Australia and New Zealand

- 14.3.6.6. Indonesia

- 14.3.6.7. Malaysia

- 14.3.6.8. Thailand

- 14.3.6.9. Vietnam

- 14.3.6.10. Rest of Asia Pacific

- 14.4. China Military Flight Training School Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Training Type

- 14.4.3. Platform/ Aircraft Type

- 14.4.4. Training Mode

- 14.4.5. Training Level

- 14.4.6. End User

- 14.5. India Military Flight Training School Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Training Type

- 14.5.3. Platform/ Aircraft Type

- 14.5.4. Training Mode

- 14.5.5. Training Level

- 14.5.6. End User

- 14.6. Japan Military Flight Training School Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Training Type

- 14.6.3. Platform/ Aircraft Type

- 14.6.4. Training Mode

- 14.6.5. Training Level

- 14.6.6. End User

- 14.7. South Korea Military Flight Training School Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Training Type

- 14.7.3. Platform/ Aircraft Type

- 14.7.4. Training Mode

- 14.7.5. Training Level

- 14.7.6. End User

- 14.8. Australia and New Zealand Military Flight Training School Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Training Type

- 14.8.3. Platform/ Aircraft Type

- 14.8.4. Training Mode

- 14.8.5. Training Level

- 14.8.6. End User

- 14.9. Indonesia Military Flight Training School Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Training Type

- 14.9.3. Platform/ Aircraft Type

- 14.9.4. Training Mode

- 14.9.5. Training Level

- 14.9.6. End User

- 14.10. Malaysia Military Flight Training School Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Training Type

- 14.10.3. Platform/ Aircraft Type

- 14.10.4. Training Mode

- 14.10.5. Training Level

- 14.10.6. End User

- 14.11. Thailand Military Flight Training School Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Training Type

- 14.11.3. Platform/ Aircraft Type

- 14.11.4. Training Mode

- 14.11.5. Training Level

- 14.11.6. End User

- 14.12. Vietnam Military Flight Training School Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Training Type

- 14.12.3. Platform/ Aircraft Type

- 14.12.4. Training Mode

- 14.12.5. Training Level

- 14.12.6. End User

- 14.13. Rest of Asia Pacific Military Flight Training School Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Training Type

- 14.13.3. Platform/ Aircraft Type

- 14.13.4. Training Mode

- 14.13.5. Training Level

- 14.13.6. End User

- 15. Middle East Military Flight Training School Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Middle East Military Flight Training School Market Size (Volume - Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 15.3.1. Training Type

- 15.3.2. Platform/ Aircraft Type

- 15.3.3. Training Mode

- 15.3.4. Training Level

- 15.3.5. End User

- 15.3.6. Country

- 15.3.6.1. Turkey

- 15.3.6.2. UAE

- 15.3.6.3. Saudi Arabia

- 15.3.6.4. Israel

- 15.3.6.5. Rest of Middle East

- 15.4. Turkey Military Flight Training School Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Training Type

- 15.4.3. Platform/ Aircraft Type

- 15.4.4. Training Mode

- 15.4.5. Training Level

- 15.4.6. End User

- 15.5. UAE Military Flight Training School Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Training Type

- 15.5.3. Platform/ Aircraft Type

- 15.5.4. Training Mode

- 15.5.5. Training Level

- 15.5.6. End User

- 15.6. Saudi Arabia Military Flight Training School Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Training Type

- 15.6.3. Platform/ Aircraft Type

- 15.6.4. Training Mode

- 15.6.5. Training Level

- 15.6.6. End User

- 15.7. Israel Military Flight Training School Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Training Type

- 15.7.3. Platform/ Aircraft Type

- 15.7.4. Training Mode

- 15.7.5. Training Level

- 15.7.6. End User

- 15.8. Rest of Middle East Military Flight Training School Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Training Type

- 15.8.3. Platform/ Aircraft Type

- 15.8.4. Training Mode

- 15.8.5. Training Level

- 15.8.6. End User

- 16. Africa Military Flight Training School Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Africa Military Flight Training School Market Size (Volume - Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 16.3.1. Training Type

- 16.3.2. Platform/ Aircraft Type

- 16.3.3. Training Mode

- 16.3.4. Training Level

- 16.3.5. End User

- 16.3.6. Country

- 16.3.6.1. South Africa

- 16.3.6.2. Egypt

- 16.3.6.3. Nigeria

- 16.3.6.4. Algeria

- 16.3.6.5. Rest of Africa

- 16.4. South Africa Military Flight Training School Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Training Type

- 16.4.3. Platform/ Aircraft Type

- 16.4.4. Training Mode

- 16.4.5. Training Level

- 16.4.6. End User

- 16.5. Egypt Military Flight Training School Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Training Type

- 16.5.3. Platform/ Aircraft Type

- 16.5.4. Training Mode

- 16.5.5. Training Level

- 16.5.6. End User

- 16.6. Nigeria Military Flight Training School Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Training Type

- 16.6.3. Platform/ Aircraft Type

- 16.6.4. Training Mode

- 16.6.5. Training Level

- 16.6.6. End User

- 16.7. Algeria Military Flight Training School Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Training Type

- 16.7.3. Platform/ Aircraft Type

- 16.7.4. Training Mode

- 16.7.5. Training Level

- 16.7.6. End User

- 16.8. Rest of Africa Military Flight Training School Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Training Type

- 16.8.3. Platform/ Aircraft Type

- 16.8.4. Training Mode

- 16.8.5. Training Level

- 16.8.6. End User

- 17. South America Military Flight Training School Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Central and South Africa Military Flight Training School Market Size (Volume - Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 17.3.1. Training Type

- 17.3.2. Platform/ Aircraft Type

- 17.3.3. Training Mode

- 17.3.4. Training Level

- 17.3.5. End User

- 17.3.6. Country

- 17.3.6.1. Brazil

- 17.3.6.2. Argentina

- 17.3.6.3. Rest of South America

- 17.4. Brazil Military Flight Training School Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Training Type

- 17.4.3. Platform/ Aircraft Type

- 17.4.4. Training Mode

- 17.4.5. Training Level

- 17.4.6. End User

- 17.5. Argentina Military Flight Training School Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Training Type

- 17.5.3. Platform/ Aircraft Type

- 17.5.4. Training Mode

- 17.5.5. Training Level

- 17.5.6. End User

- 17.6. Rest of South America Military Flight Training School Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Training Type

- 17.6.3. Platform/ Aircraft Type

- 17.6.4. Training Mode

- 17.6.5. Training Level

- 17.6.6. End User

- 18. Key Players/ Company Profile

- 18.1. Airbus Defence and Space

- 18.1.1. Company Details/ Overview

- 18.1.2. Company Financials

- 18.1.3. Key Customers and Competitors

- 18.1.4. Business/ Industry Portfolio

- 18.1.5. Product Portfolio/ Specification Details

- 18.1.6. Pricing Data

- 18.1.7. Strategic Overview

- 18.1.8. Recent Developments

- 18.2. BAE Systems pl

- 18.3. Boeing Defense, Space & Security

- 18.4. Boeing–Saab

- 18.5. CAE Inc.

- 18.6. Cubic Corporation

- 18.7. Elbit Systems Ltd.

- 18.8. Embraer Defense & Security

- 18.9. Hindustan Aeronautics Limited (HAL)

- 18.10. Israel Aerospace Industries Ltd. (IAI)

- 18.11. Korea Aerospace Industries (KAI)

- 18.12. L3Harris Technologies, Inc.

- 18.13. Leonardo S.p.A.

- 18.14. Lockheed Martin Corporation

- 18.15. Northrop Grumman Corporation

- 18.16. Pilatus Aircraft Ltd.

- 18.17. Raytheon Technologies Corporation

- 18.18. Saab AB

- 18.19. Textron Aviation Defense LLC

- 18.20. Thales Group

- 18.21. Other Key Players

- 18.1. Airbus Defence and Space

Note* - This is just tentative list of players. While providing the report, we will cover a greater number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation