Military Personal Protective Equipment Market Size, Share, Growth Opportunity Analysis Report by Product Type (Body Armor, Combat Helmets, Eye Protection (Goggles & Visors), Respiratory Protection, Hearing Protection, Gloves, Footwear, Ballistic Vests and Others), Material, Protection Level, Technology, Application, End Use, Distribution Channel and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Military Personal Protective Equipment Market Size, Share, and Growth

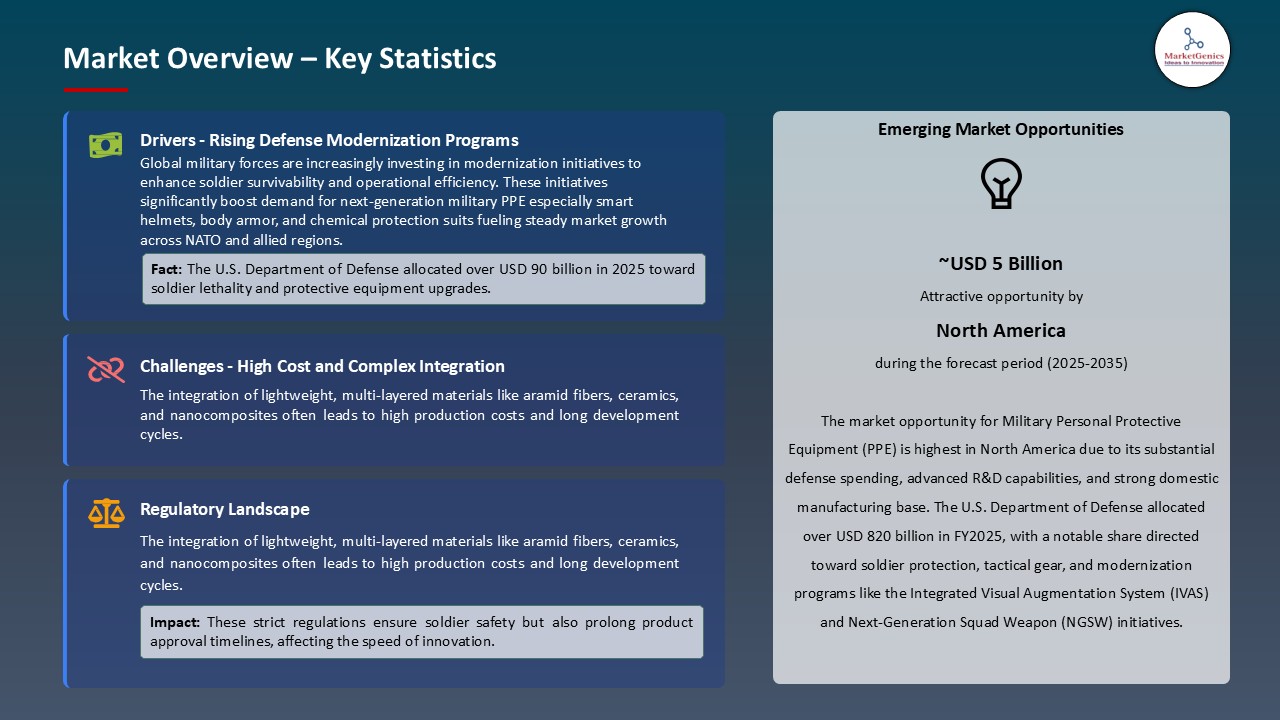

The global military personal protective equipment market is projected to grow from USD 14.3 Billion in 2025 to USD 26.2 Billion in 2035, with a strong CAGR of 6.2% during the forecasted period. North America leads the military personal protective equipment market with market share of 42.1% with USD 6.0 billion revenue.

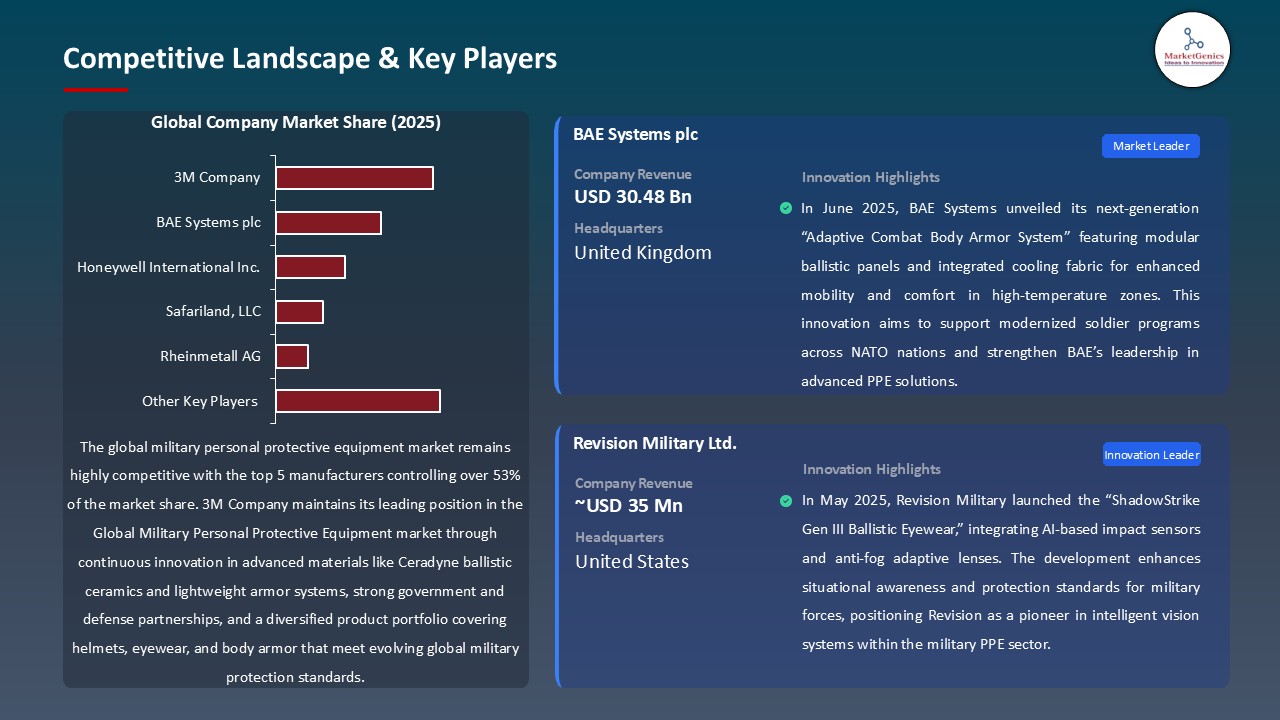

In June 2025, Rheinmetall AG introduced its “Sensing Armour” technology that integrates smart sensors within ballistic vests to monitor impact and armor integrity in real-time. This initiative, led by Armin Papperger (CEO), aims to enhance soldier safety and expand Rheinmetall’s presence in advanced military protective systems.

The military personal protection equipment market in the world context is characterized by the increased need to use sophisticated lightweight armor systems and to introduce the concept of smart usage of technologies in protection devices. For instance, in May 2025 Avon Protection plc released its new Ventis Tactical Helmet System that has an improved ballistic protection and is less weighty to enhance mobility.

For instance, Honeywell International Inc. announced Spectra Shield 6200, a next-generation ballistic material, in April 2025, which would enhance the durability of the material as well as its flexibility in military armour. These innovations are enhancing growth in the market by increasing the use of high-performance and tech-enabled PPE to the world defense forces.

The defense wearable technology market, soldier modernization systems, and autonomous battlefield support equipment are some of the key opportunities to the global military personal protective equipment market. These industries take advantage of intersecting material, sensor and connectivity innovations. The growth of this neighboring markets allows manufacturers to offer variety and increase revenues due to integrated defense protection ecosystem.

Military Personal Protective Equipment Market Dynamics and Trends

Driver: Rising Demand for Lightweight and Multi-Threat Protection Gear

- The global military personal protective equipment market is largely driven by the need to have lightweight and multi-threat armor. The current military activities demand soldiers to move more swiftly and work under versatile conditions, thus, the use of protective gears that are comfortable, flexible, and uphold the highest level of protection is required. The trend has directed the manufacturers towards the use of materials like ultra-high molecular weight polyethylene (UHMWPE), aramid fibers, hybrid composite, which have some ballistic resistance with less weight.

- For instance, in June 2025, DSM Dyneema presented its "Force Multiplier Technology" system intended to be used in helmets and vests that are a quarter the weight but offer greater protection against multi-threat ballistics. Due to its agility and minimization of fatigue when deployed in prolonged missions, governments are increasingly embracing such materials to improve the agility of troops. The movement towards high-performance lightweight PPE is ever gaining momentum as defence modernization programs are increasingly being felt world over.

- The military personal protective equipment market is expanding and the development of technologies is promoted by the increased demands on the light weaponry and multi threat protection.

Restraint: High Cost and Supply Chain Complexity of Advanced Materials

- The restraint factor of the global military personal protective equipment market is its high cost and difficulties in logistics in the production of advanced protective materials. The contemporary components of PPE including aramid fibers, ceramics, and composite armors demand precision engineering, high-quality control standards and special supply chains. These are the factors that increase the cost of production and procurement and present a challenge to both the manufacturers and the defense organizations who have limited budgets. As an example, in April 2025, the production of advanced ballistic helmets at Gentex Corporation was delayed because of the lack of supply of aramid fibers by Asian producers.

- Moreover, the high certification and testing of defense-grade PPE further lengthen the delivery periods and makes the spending even more. This high price can restrict the accessibility of premium protection to smaller armies and the developing countries, hindering worldwide access.

- The cost of production and supply of materials are high making its adoption challenging as well as slowing military personal protective equipment market penetration.

Opportunity: Integration of Smart Technologies and Communication Systems

- The introduction of intelligent technologies is one of the substantial opportunities of the global military personal protective equipment market. Situational awareness including the connection of systems to the army has turned the concept of defense with regard to soldiers into an active instead of a passive initiative. Smart fabrics and wearable sensors into the PPE have the potential to track physiological metrics, identify environmental risks, and support the real-time communication.

- In May 2025, BAE Systems plc unveiled its Smart Armor Concept, that incorporates both biometric sensors and a tactical data connection enabling soldiers to transmit live updates on their health and their positions to command units. The innovations enhance the coordination, mitigate risks in the battlefield, and improve the effectiveness of the mission. Additionally, collaborations between technology companies and defense contractors are boosting the creation of smart PPE environments. The smart PPE will be one of the primary facilitators of the effectiveness of modern warfare as armed forces shift towards digital transformation.

- Digital intelligence integration improves safety of operations and opens prospects of new technological development.

Key Trend: Sustainability and Recyclable Material Development

- The concept of sustainability is growing in popularity in the military personal protective equipment market across the globe as governments and military contractors prioritize minimizing the effects of production and waste disposal on the environment. The industry is changing towards sustainable production processes and recyclable materials. Green chemistry, bio-based fibers, and circular production systems are investments by manufacturers to meet the requirements of the defense sustainability.

- For instance, in March 2025 DuPont de Nemours, Inc. released an eco-optimized version of its Kevlar EXO material that is more protective and durable, in addition to emitting less carbon during its production. On the same note, other firms such as TenCate Advanced Armor are also in the process of making recyclable ballistic plates and green composite helmets. Not only does this trend facilitate the objectives of global sustainability of defense, but also boosts brand value in purchasing agencies that focus on environmental concern.

- Innovation through concentration on sustainable and recyclable PPE materials is in line with global defense sustainability goals.

Military Personal Protective Equipment Market Analysis and Segmental Data

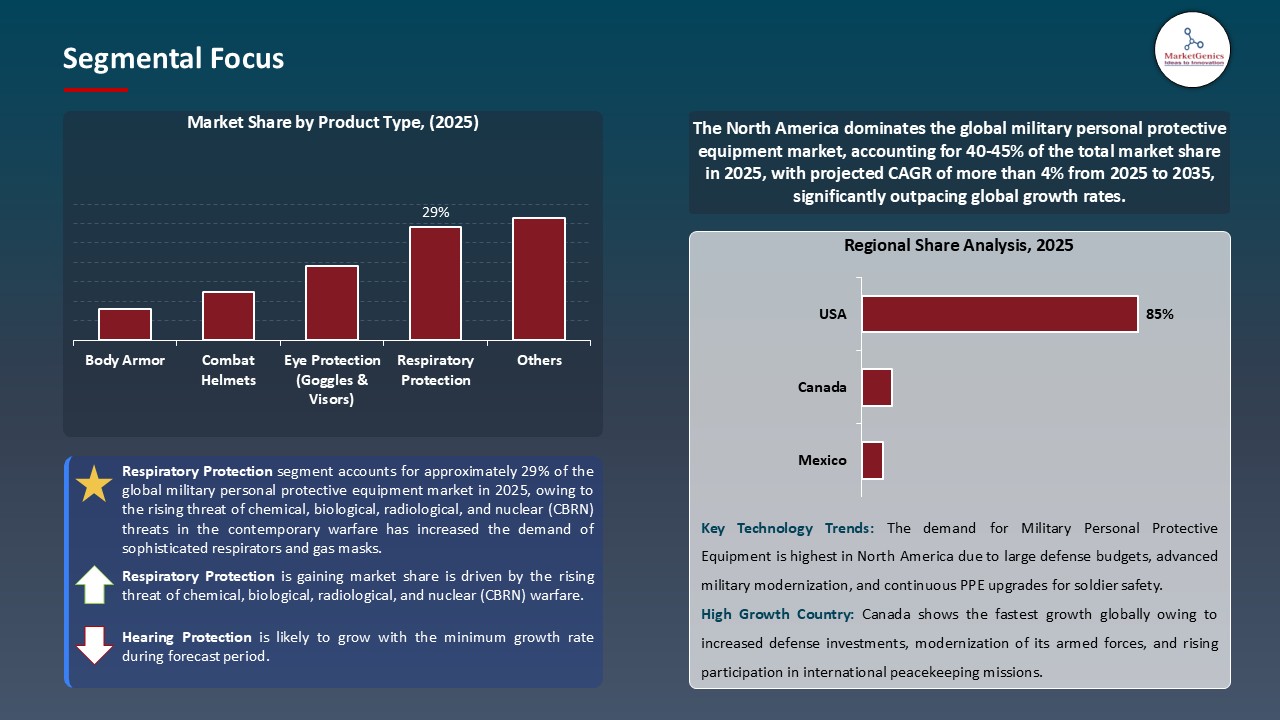

Based on Product Type, the Respiratory Protection Segment Retains the Largest Share

- The respiratory protection segment holds major share ~29% in the global military personal protective equipment market, owing to the rising threat of chemical, biological, radiological, and nuclear (CBRN) threats in the contemporary warfare has increased the demand of sophisticated respirators and gas masks. For instance, Avon Protection plc has recently reiterated its status as a world-leading provider of military-grade respiratory systems following an increase in interest as a result of defence forces struggling with the emerging CBRN threats.

- The respiratory systems are needed not only to the traditional battlefield threats, but also to the asymmetric warfare environment and urban operations where there are toxic industrial chemicals, smoke, and hazards of particulate in nature. This two-threat situation has transformed respiratory protection into a high-priority buying activity.

- High respiratory protection demand is also driving swift innovation and procurement investment, and this segment is one of the most rapidly growing in the military PPE.

North America Dominates Global Military Personal Protective Equipment Market in 2025 and Beyond

- North America region has the greatest need of military personal protective equipment market mainly based on the wide defense budget expenditure and the modernization programmes of the soldiers in the United States.

- For instance, in August 2025, the ReadyOne Industries won an 18.6 million sole-source, U.S. contract to manufacture next-generation chemical, biological, radiological and nuclear (CBRN) protective uniforms to the U.S. military, which explains why North American defence procurement is concentrated on updating protective equipment. The large military expenditures of the region annually require domestic and foreign PPE producers to consider this market as a priority.

- The existence of developed supply chains for defense, OEMs and R&D resources present in North America assist with a rapid uptake of advanced PPE solutions. For example, in September 2025, SupplyCore Inc. won a five-year U.S. Army IDIQ contract for provision of CBRN-related PPE which demonstrates the U.S. military's preference for reliable local suppliers and emerging rapidly. This ecosystem is an additional layer to North America’s dominant share of the global military PPE market.

- North America’s dominance is likely to facilitate supplier innovation and focus an increasingly large share of global contract volume in North America.

Military-Personal-Protective-Equipment-Market Ecosystem

The global military personal protective equipment market is a moderately consolidated with a few Tier-1 defence primes and specialist materials companies are significant players that capture a meaningful proportion of awards, while a myriad of Tier-2/Tier-3 supply partners capture niche and regional needs for their customer base. The Tier-1 players (e.g., BAE Systems, 3M/Ceradyne, Honeywell, Rheinmetall) excel in strategic contract procurement and systems integration; Tier-2 suppliers (e.g., Avon Protection, Safariland, Point Blank) represent the platform and program winner sphere of influence; and Tier-3 suppliers deliver textiles, fittings, and local assembly support across the value chain. The concentration is asymmetric between cohorts - high at the program-award and system-integration levels, low across commoditized components of the overall PPE landscape.

Value-chain nodes reflect supply of advanced materials (aramids, UHMWPE, ceramics) which serve ballistic performance and increased barriers to entry; and systems integration & aftermarket mechanics (assembly, testing, field maintenance, spares provisioning) which collectively define lifecycle value and contract stickiness.

For example, Avon Protection recently received a delivery order from the U.S. Department of Defense for universal respiratory protection PPE that was valued at approximately $18.3 million, reinforcing the Tier-2 impact on Tier-1 program outcomes.

Recent Development and Strategic Overview:

- In March 2025, DuPont de Nemours, Inc. announced that its next-gen aramid fibre “Kevlar EXO” was named one of the finalists in the Edison Awards’ Critical Safety Materials category, underscoring the company’s strategic pivot to ultra-lightweight, flexible ballistic fabrics for military PPE.

- In March 2025, Avon Protection plc was awarded two NATO contracts to supply advanced respirators and rebreather systems for European navies as well as for Ukrainian forces; this contract award exemplifies Avon's strategic push into chemical/biological-hazard protective gear, hopes to diversify away from traditional helmet and vest type solutions.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 14.3 Bn |

|

Market Forecast Value in 2035 |

USD 26.2 Bn |

|

Growth Rate (CAGR) |

6.2% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Thousand Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Military-Personal-Protective-Equipment-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Military Personal Protective Equipment Market, By Product Type |

|

|

Military Personal Protective Equipment Market, By Material |

|

|

Military Personal Protective Equipment Market, By Protection Level |

|

|

Military Personal Protective Equipment Market, By Technology |

|

|

Military Personal Protective Equipment Market, By Application |

|

|

Military Personal Protective Equipment Market, By End Use |

|

|

Military Personal Protective Equipment Market, By Distribution Channel |

|

Frequently Asked Questions

The global military personal protective equipment market was valued at USD 14.3 Bn in 2025.

The global military personal protective equipment market industry is expected to grow at a CAGR of 6.2% from 2025 to 2035.

Key factors driving the demand for the global Military Personal Protective Equipment (PPE) market include rising geopolitical tensions, increasing modernization of armed forces, and the growing need for advanced multi-threat protection against ballistic, chemical, and biological hazards. Additionally, technological advancements such as lightweight composite materials, smart sensor integration, and ergonomic designs are enhancing soldier mobility and comfort.

Respiratory protection contributed to the largest share of the military personal protective equipment market business in 2025, owing to the rising threat of chemical, biological, radiological, and nuclear (CBRN) threats in the contemporary warfare has increased the demand of sophisticated respirators and gas masks.

The Canada is among the fastest-growing countries globally.

3M Company, ArmorSource LLC, ArmorWorks Enterprises, LLC, Avon Protection plc, BAE Systems plc, Ceradyne, Inc. (a 3M Company), Craig International Ballistics Pty Ltd, DSM Dyneema, DuPont de Nemours, Inc., Eagle Industries Unlimited, Inc., Gentex Corporation, Honeywell International Inc., MKU Limited, Point-Blank Enterprises, Inc., Revision Military Ltd., Rheinmetall AG, Safariland, LLC, Sarkar Defence Solutions, Survitec Group Limited, TenCate Advanced Armor, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Military Personal Protective Equipment Market Outlook

- 2.1.1. Military Personal Protective Equipment Market Size (Volume - Thousand Units & Value - US$ Billion), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to-Market Strategy

- 2.5.1. Customer/ End Use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Military Personal Protective Equipment Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Aerospace & Defense Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Aerospace & Defense Industry

- 3.1.3. Regional Distribution for Aerospace & Defense

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.1. Global Aerospace & Defense Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising global defense expenditure and modernization programs.

- 4.1.1.2. Increasing threats from asymmetric warfare and terrorism.

- 4.1.1.3. Technological advancements in lightweight and high-strength protective materials.

- 4.1.2. Restraints

- 4.1.2.1. High costs associated with advanced protective equipment development and procurement.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis/ Ecosystem Analysis

- 4.4.1. Raw Material/ Component Suppliers

- 4.4.2. Military Personal Protective Equipment Manufacturers

- 4.4.3. Dealers and Distributors

- 4.4.4. End-users

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Porter’s Five Forces Analysis

- 4.7. PESTEL Analysis

- 4.8. Global Military Personal Protective Equipment Market Demand

- 4.8.1. Historical Market Size - in Value (Volume - Thousand Units & Value - US$ Billion), 2021-2024

- 4.8.2. Current and Future Market Size - in Value (Volume - Thousand Units & Value - US$ Billion), 2025–2035

- 4.8.2.1. Y-o-Y Growth Trends

- 4.8.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Military Personal Protective Equipment Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Military Personal Protective Equipment Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Body Armor

- 6.2.2. Combat Helmets

- 6.2.3. Eye Protection (Goggles & Visors)

- 6.2.4. Respiratory Protection

- 6.2.5. Hearing Protection

- 6.2.6. Gloves

- 6.2.7. Footwear

- 6.2.8. Ballistic Vests

- 6.2.9. Others

- 7. Global Military Personal Protective Equipment Market Analysis, by Material

- 7.1. Key Segment Analysis

- 7.2. Military Personal Protective Equipment Market Size (Value - US$ Billion), Analysis, and Forecasts, by Material, 2021-2035

- 7.2.1. Aramid Fibers

- 7.2.2. Ultra-High-Molecular-Weight Polyethylene (UHMWPE)

- 7.2.3. Carbon Fiber Composites

- 7.2.4. Steel and Titanium Alloys

- 7.2.5. Ceramics

- 7.2.6. Leather and Textiles

- 7.2.7. Others

- 8. Global Military Personal Protective Equipment Market Analysis, by Protection Level

- 8.1. Key Segment Analysis

- 8.2. Military Personal Protective Equipment Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Protection Level, 2021-2035

- 8.2.1. Soft Armor

- 8.2.2. Hard Armor

- 8.2.3. Hybrid Armor

- 9. Global Military Personal Protective Equipment Market Analysis, by Technology

- 9.1. Key Segment Analysis

- 9.2. Military Personal Protective Equipment Market Size (Value - US$ Billion), Analysis, and Forecasts, by Technology, 2021-2035

- 9.2.1. Smart Textiles and Wearables

- 9.2.2. Lightweight Composite Armor Systems

- 9.2.3. Integrated Communication Systems

- 9.2.4. Thermal and Weather Resistant Gear

- 9.2.5. Others

- 10. Global Military Personal Protective Equipment Market Analysis, by Application

- 10.1. Key Segment Analysis

- 10.2. Military Personal Protective Equipment Market Size (Value - US$ Billion), Analysis, and Forecasts, by Application, 2021-2035

- 10.2.1. Ground Forces

- 10.2.2. Air Forces

- 10.2.3. Naval Forces

- 10.2.4. Special Forces

- 10.2.5. Others

- 11. Global Military Personal Protective Equipment Market Analysis and Forecasts, by End Use

- 11.1. Key Findings

- 11.2. Military Personal Protective Equipment Market Size (Value - US$ Billion), Analysis, and Forecasts, by End Use, 2021-2035

- 11.2.1. Combat Operations

- 11.2.2. Training and Simulation

- 11.2.3. Explosive Ordnance Disposal (EOD)

- 11.2.4. Chemical and Biological Defense

- 11.2.5. Others

- 12. Global Military Personal Protective Equipment Market Analysis and Forecasts, by Distribution Channel

- 12.1. Key Findings

- 12.2. Military Personal Protective Equipment Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 12.2.1. Direct Government Procurement

- 12.2.2. Defense Contractors

- 12.2.3. Online and Third-Party Distributors

- 13. Global Military Personal Protective Equipment Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Military Personal Protective Equipment Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Military Personal Protective Equipment Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Military Personal Protective Equipment Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Material

- 14.3.3. Protection Level

- 14.3.4. Technology

- 14.3.5. Application

- 14.3.6. End Use

- 14.3.7. Distribution Channel

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Military Personal Protective Equipment Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Material

- 14.4.4. Protection Level

- 14.4.5. Technology

- 14.4.6. Application

- 14.4.7. End Use

- 14.4.8. Distribution Channel

- 14.5. Canada Military Personal Protective Equipment Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Material

- 14.5.4. Protection Level

- 14.5.5. Technology

- 14.5.6. Application

- 14.5.7. End Use

- 14.5.8. Distribution Channel

- 14.6. Mexico Military Personal Protective Equipment Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Material

- 14.6.4. Protection Level

- 14.6.5. Technology

- 14.6.6. Application

- 14.6.7. End Use

- 14.6.8. Distribution Channel

- 15. Europe Military Personal Protective Equipment Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Military Personal Protective Equipment Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Material

- 15.3.3. Protection Level

- 15.3.4. Technology

- 15.3.5. Application

- 15.3.6. End Use

- 15.3.7. Distribution Channel

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Military Personal Protective Equipment Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Material

- 15.4.4. Protection Level

- 15.4.5. Technology

- 15.4.6. Application

- 15.4.7. End Use

- 15.4.8. Distribution Channel

- 15.5. United Kingdom Military Personal Protective Equipment Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Material

- 15.5.4. Protection Level

- 15.5.5. Technology

- 15.5.6. Application

- 15.5.7. End Use

- 15.5.8. Distribution Channel

- 15.6. France Military Personal Protective Equipment Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Material

- 15.6.4. Protection Level

- 15.6.5. Technology

- 15.6.6. Application

- 15.6.7. End Use

- 15.6.8. Distribution Channel

- 15.7. Italy Military Personal Protective Equipment Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Material

- 15.7.4. Protection Level

- 15.7.5. Technology

- 15.7.6. Application

- 15.7.7. End Use

- 15.7.8. Distribution Channel

- 15.8. Spain Military Personal Protective Equipment Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Material

- 15.8.4. Protection Level

- 15.8.5. Technology

- 15.8.6. Application

- 15.8.7. End Use

- 15.8.8. Distribution Channel

- 15.9. Netherlands Military Personal Protective Equipment Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Product Type

- 15.9.3. Material

- 15.9.4. Protection Level

- 15.9.5. Technology

- 15.9.6. Application

- 15.9.7. End Use

- 15.9.8. Distribution Channel

- 15.10. Nordic Countries Military Personal Protective Equipment Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Product Type

- 15.10.3. Material

- 15.10.4. Protection Level

- 15.10.5. Technology

- 15.10.6. Application

- 15.10.7. End Use

- 15.10.8. Distribution Channel

- 15.11. Poland Military Personal Protective Equipment Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Product Type

- 15.11.3. Material

- 15.11.4. Protection Level

- 15.11.5. Technology

- 15.11.6. Application

- 15.11.7. End Use

- 15.11.8. Distribution Channel

- 15.12. Russia & CIS Military Personal Protective Equipment Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Product Type

- 15.12.3. Material

- 15.12.4. Protection Level

- 15.12.5. Technology

- 15.12.6. Application

- 15.12.7. End Use

- 15.12.8. Distribution Channel

- 15.13. Rest of Europe Military Personal Protective Equipment Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Product Type

- 15.13.3. Material

- 15.13.4. Protection Level

- 15.13.5. Technology

- 15.13.6. Application

- 15.13.7. End Use

- 15.13.8. Distribution Channel

- 16. Asia Pacific Military Personal Protective Equipment Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. East Asia Military Personal Protective Equipment Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Material

- 16.3.3. Protection Level

- 16.3.4. Technology

- 16.3.5. Application

- 16.3.6. End Use

- 16.3.7. Distribution Channel

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Military Personal Protective Equipment Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Material

- 16.4.4. Protection Level

- 16.4.5. Technology

- 16.4.6. Application

- 16.4.7. End Use

- 16.4.8. Distribution Channel

- 16.5. India Military Personal Protective Equipment Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Material

- 16.5.4. Protection Level

- 16.5.5. Technology

- 16.5.6. Application

- 16.5.7. End Use

- 16.5.8. Distribution Channel

- 16.6. Japan Military Personal Protective Equipment Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Material

- 16.6.4. Protection Level

- 16.6.5. Technology

- 16.6.6. Application

- 16.6.7. End Use

- 16.6.8. Distribution Channel

- 16.7. South Korea Military Personal Protective Equipment Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Material

- 16.7.4. Protection Level

- 16.7.5. Technology

- 16.7.6. Application

- 16.7.7. End Use

- 16.7.8. Distribution Channel

- 16.8. Australia and New Zealand Military Personal Protective Equipment Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Material

- 16.8.4. Protection Level

- 16.8.5. Technology

- 16.8.6. Application

- 16.8.7. End Use

- 16.8.8. Distribution Channel

- 16.9. Indonesia Military Personal Protective Equipment Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Material

- 16.9.4. Protection Level

- 16.9.5. Technology

- 16.9.6. Application

- 16.9.7. End Use

- 16.9.8. Distribution Channel

- 16.10. Malaysia Military Personal Protective Equipment Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Material

- 16.10.4. Protection Level

- 16.10.5. Technology

- 16.10.6. Application

- 16.10.7. End Use

- 16.10.8. Distribution Channel

- 16.11. Thailand Military Personal Protective Equipment Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Material

- 16.11.4. Protection Level

- 16.11.5. Technology

- 16.11.6. Application

- 16.11.7. End Use

- 16.11.8. Distribution Channel

- 16.12. Vietnam Military Personal Protective Equipment Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Material

- 16.12.4. Protection Level

- 16.12.5. Technology

- 16.12.6. Application

- 16.12.7. End Use

- 16.12.8. Distribution Channel

- 16.13. Rest of Asia Pacific Military Personal Protective Equipment Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Material

- 16.13.4. Protection Level

- 16.13.5. Technology

- 16.13.6. Application

- 16.13.7. End Use

- 16.13.8. Distribution Channel

- 17. Middle East Military Personal Protective Equipment Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Military Personal Protective Equipment Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Material

- 17.3.3. Protection Level

- 17.3.4. Technology

- 17.3.5. Application

- 17.3.6. End Use

- 17.3.7. Distribution Channel

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Military Personal Protective Equipment Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Material

- 17.4.4. Protection Level

- 17.4.5. Technology

- 17.4.6. Application

- 17.4.7. End Use

- 17.4.8. Distribution Channel

- 17.5. UAE Military Personal Protective Equipment Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Material

- 17.5.4. Protection Level

- 17.5.5. Technology

- 17.5.6. Application

- 17.5.7. End Use

- 17.5.8. Distribution Channel

- 17.6. Saudi Arabia Military Personal Protective Equipment Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Material

- 17.6.4. Protection Level

- 17.6.5. Technology

- 17.6.6. Application

- 17.6.7. End Use

- 17.6.8. Distribution Channel

- 17.7. Israel Military Personal Protective Equipment Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Material

- 17.7.4. Protection Level

- 17.7.5. Technology

- 17.7.6. Application

- 17.7.7. End Use

- 17.7.8. Distribution Channel

- 17.8. Rest of Middle East Military Personal Protective Equipment Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Material

- 17.8.4. Protection Level

- 17.8.5. Technology

- 17.8.6. Application

- 17.8.7. End Use

- 17.8.8. Distribution Channel

- 18. Africa Military Personal Protective Equipment Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Military Personal Protective Equipment Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Material

- 18.3.3. Protection Level

- 18.3.4. Technology

- 18.3.5. Application

- 18.3.6. End Use

- 18.3.7. Distribution Channel

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Military Personal Protective Equipment Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Material

- 18.4.4. Protection Level

- 18.4.5. Technology

- 18.4.6. Application

- 18.4.7. End Use

- 18.4.8. Distribution Channel

- 18.5. Egypt Military Personal Protective Equipment Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Material

- 18.5.4. Protection Level

- 18.5.5. Technology

- 18.5.6. Application

- 18.5.7. End Use

- 18.5.8. Distribution Channel

- 18.6. Nigeria Military Personal Protective Equipment Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Material

- 18.6.4. Protection Level

- 18.6.5. Technology

- 18.6.6. Application

- 18.6.7. End Use

- 18.6.8. Distribution Channel

- 18.7. Algeria Military Personal Protective Equipment Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Material

- 18.7.4. Protection Level

- 18.7.5. Technology

- 18.7.6. Application

- 18.7.7. End Use

- 18.7.8. Distribution Channel

- 18.8. Rest of Africa Military Personal Protective Equipment Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Material

- 18.8.4. Protection Level

- 18.8.5. Technology

- 18.8.6. Application

- 18.8.7. End Use

- 18.8.8. Distribution Channel

- 19. South America Military Personal Protective Equipment Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Central and South Africa Military Personal Protective Equipment Market Size (Volume - Thousand Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Material

- 19.3.3. Protection Level

- 19.3.4. Technology

- 19.3.5. Application

- 19.3.6. End Use

- 19.3.7. Distribution Channel

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Military Personal Protective Equipment Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Material

- 19.4.4. Protection Level

- 19.4.5. Technology

- 19.4.6. Application

- 19.4.7. End Use

- 19.4.8. Distribution Channel

- 19.5. Argentina Military Personal Protective Equipment Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Material

- 19.5.4. Protection Level

- 19.5.5. Technology

- 19.5.6. Application

- 19.5.7. End Use

- 19.5.8. Distribution Channel

- 19.6. Rest of South America Military Personal Protective Equipment Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Material

- 19.6.4. Protection Level

- 19.6.5. Technology

- 19.6.6. Application

- 19.6.7. End Use

- 19.6.8. Distribution Channel

- 20. Key Players/ Company Profile

- 20.1. 3M Company

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. ArmorSource LLC

- 20.3. ArmorWorks Enterprises, LLC

- 20.4. Avon Protection plc

- 20.5. BAE Systems plc

- 20.6. Ceradyne, Inc. (a 3M Company)

- 20.7. Craig International Ballistics Pty Ltd

- 20.8. DSM Dyneema

- 20.9. DuPont de Nemours, Inc.

- 20.10. Eagle Industries Unlimited, Inc.

- 20.11. Gentex Corporation

- 20.12. Honeywell International Inc.

- 20.13. MKU Limited

- 20.14. Point Blank Enterprises, Inc.

- 20.15. Revision Military Ltd.

- 20.16. Rheinmetall AG

- 20.17. Safariland, LLC

- 20.18. Sarkar Defence Solutions

- 20.19. Survitec Group Limited

- 20.20. TenCate Advanced Armor

- 20.21. Other Key Players

- 20.1. 3M Company

Note* - This is just tentative list of players. While providing the report, we will cover a greater number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data