Plastic Pallets Market Size, Share, Growth Opportunity Analysis Report by Product Type (Nestable Pallets, Rackable Pallets, Stackable Pallets, Display Pallets and Others), Material Type, End Use Industry, Sales Channel and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Plastic Pallets Market Size, Share, and Growth

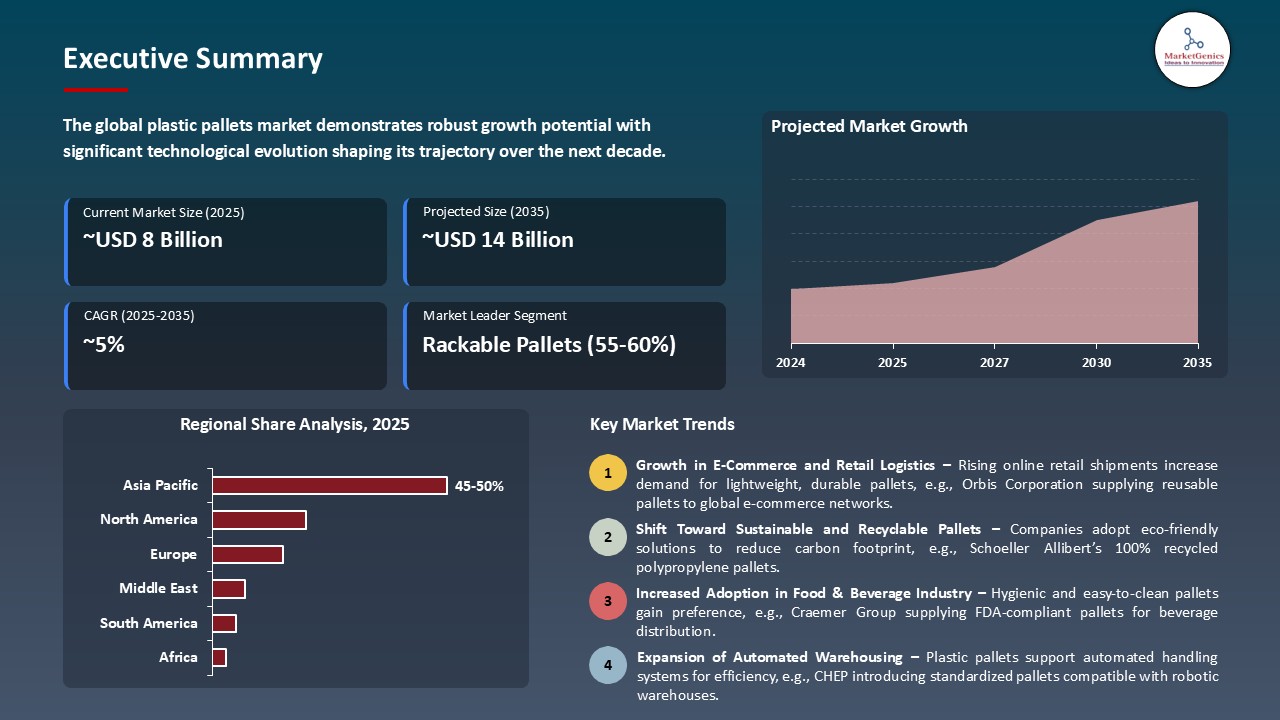

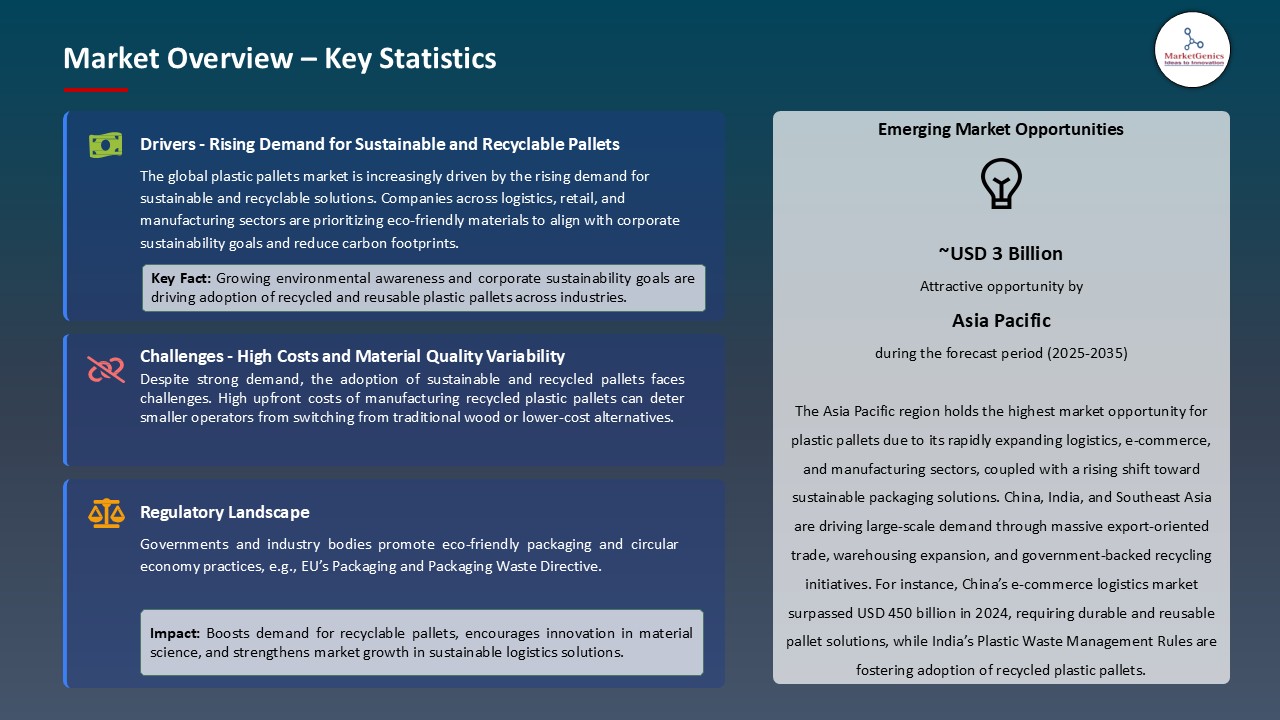

The global plastic pallets market is expanding from USD 8.1 Billion in 2025 to USD 14.0 Billion by the year 2035, showing a CAGR of 5.1% over the forecast period. Major drivers and barriers contributing to market growth include environmental issues and a growing e-commerce logistics industry. For one, producers develop 100% recyclable HDPE pallets using post-consumer and industrial plastics; for instance, Orbis introduced a range of reusable, recyclable plastic pallets in March 2024 to strengthen its sustainability-related product offerings.

"In April 2024, Greystone Logistics, under the leadership of CEO Warren Kruger, announced a strategic expansion of its recycled plastic pallet production capacity at its manufacturing facility in Bettendorf, Iowa. The move includes the addition of new proprietary molds and robotic automation systems aimed at meeting growing demand from retail and beverage clients for durable, eco-friendly pallets highlighting the company’s commitment to sustainability and scalability in logistics solutions."

Smart packaging solutions, recycled plastic resin manufacturing, and automated material handling system represent key prospects for the global market for plastic pallets. These industries facilitate the evolution of track-and-trace processes, sustainable raw materials acquiring, and the ability to interface with the robotics realm. Such adjacent markets increase the value of the product, ensuring long-term growth and competitive advantage for the plastic pallets industry.

Plastic Pallets Market Dynamics and Trends

Driver: Rising Warehouse Automation & E‑commerce Expansion

- Automation and e-commerce worldwide are major growth accelerators. Plastic pallets are preferred in automated storage and retrieval systems because of the standard dimensions and hardwood is not compatible with robotics attributes. IFCO launched its ultra-lightweight “Nestor” pallet at Fruit Attraction in Madrid last December 2024: weighing just 14 kg, with an integrated Bluetooth Low Energy/GPS/QR tracking system, it supports 1 ton, servicing highly automated fresh-food supply chains.

- This is a good example of how automation centers generate the demand for smart and standardized pallets, which promote logistical efficiency and real-time visibility. As e-commerce volumes and robotics-driven warehouses grow, plastic pallets become critical, greatly driving the market.

Restraint: Higher Initial Investment & Recycling Challenges

- Despite long-term advantages, the plastic pallets face certain hurdles in upfront cost and end-of-life handling. Purchase prices of at least $25 to $150 compared to $5-wood alternatives sometimes deter SMEs. Furthermore, plastics such as HDPE and PP are oil-based, thus making raw material prices volatile and the recycling schemes substandard in many parts of the world.

- In regions that lack efficient recycling programs, for example, used pallets become hard to reclaim, hence eroding sustainability gains and adding to end-of-life waste. Though plastic pallets provide a longer service life, smaller or cost-sensitive operations face unacceptable cost and logistical barriers to their adoption.

Opportunity: Recycled‑Material & Bio‑Plastic Innovation

- Both eco-centric materials and modular designs are present with market potential. Manufacturers rely on this; recycled and bioplastic materials constitute the basis of everything in order to comply with sustainability standards and regulations. Greystone Logistics (USA), in mid-March 2024, acquired Paradigm Plastic Pallets and reopened on robotics in their HDPE recycling lines in Indiana; this allowed the making of fully recyclable pallets and decreasing carbon footprints.

- Smart pallets embedded with RFID or IoT provide traceability and lifecycle data and cater to pharma and perishables. These green modular solutions are ripe for emerging markets in Asia-Latin America. The intersection of the circular economy and the technologically advanced pallet is a lucrative growth avenue.

Key Trend: Smart & RFID‑Enabled Pallets for Traceability

- The incorporation of IoT and RFID on pallets is changing the landscape of supply chain transparency and efficiency. In March 2024, Pallet LOOP commenced a UK rollout of RFID-tagged reusable green pallets in a bid to monitor pallet movements and substantiate sustainability reporting. The production figure soon may hit a million-plus units. These smart pallets can communicate real-time data regarding their location, environment, or how they have been handled.

- In a very practical sense, industries like pharma and perishables monetize such kinds of visibility, loss reduction, inventory optimization, and compliance as it stands. As supply chain intelligence gains demand, this technology will continue to lead the future plastic pallet market toward providers armed with data-enriched IoT-enabled solutions.

Plastic Pallets Market Analysis and Segmental Data

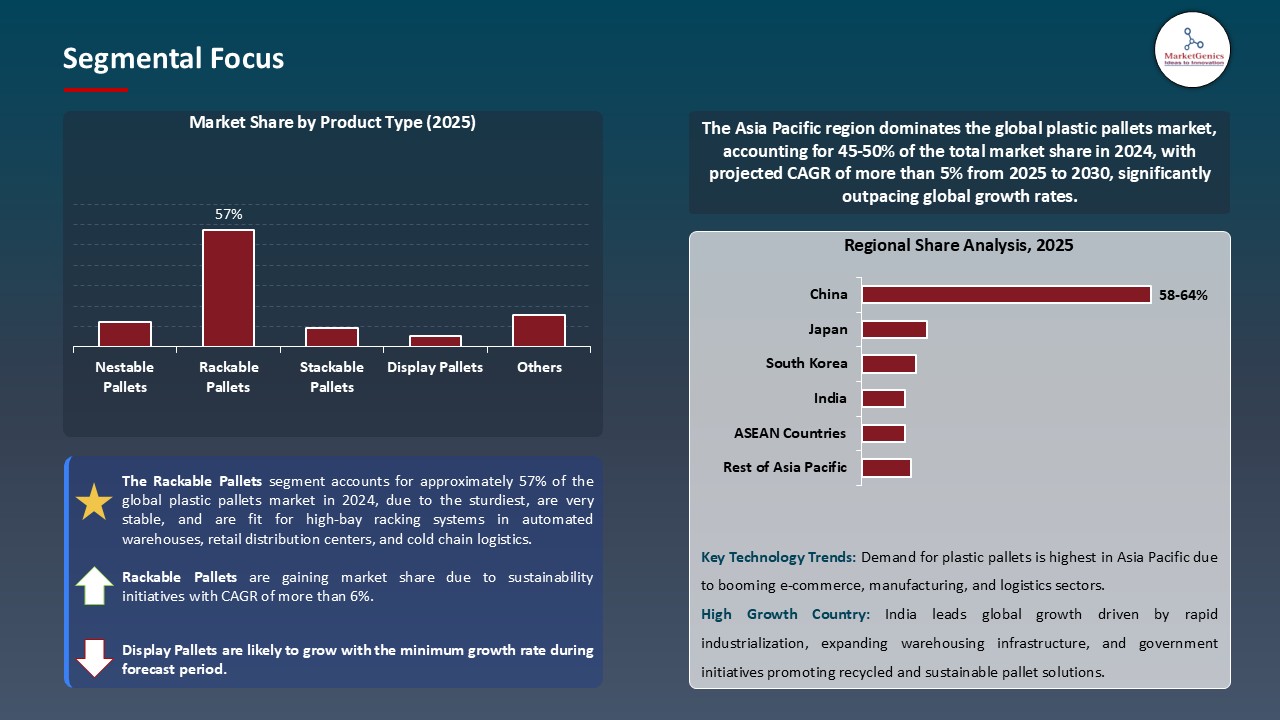

Based on Product Type, the Rackable Pallets Segment Retains the Largest Share

- The rackable pallets segment holds major share ~57% in the global plastic pallets market. Rackable-style pallets experience the highest demand in the global plastic pallets market, since they are the sturdiest, are very stable, and are fit for high-bay racking systems in automated warehouses, retail distribution centers, and cold chain logistics. Rackable pallets are designed to bear heavy loads, and they are preferred in closed-loop supply chains where they need to be durable and hygienic. In an effort to meet growing demand for reusable pallet systems that are robust, ORBIS Corp. announced a new line of heavy-duty rackable plastic pallets for use in the food and pharmaceutical sectors in February 2024 that are compatible with robotic handling systems and FDA-compliant.

- Rackable pallets thus contribute toward reducing warehouse damage to products and maximizing warehouse space usage, supporting warehouse automation and vertical storage optimization. In regulated environments, their removal from moisture, pests, and contamination hazards makes them superior. With the reduction of maintenance costs and improvement of operational efficiency in mind, rackable pallets have grown into a component used in all modern logistics strategies.

- The rise in automation and hygiene-sensitive industries is making rackable pallets a cornerstone of scalable, efficient, and compliant supply chain infrastructures.

Food & Beverage Expected to Be Top by End Use Industry Through Forecast Period

- Food & beverage industry experiences the highest growth in the global plastic pallets Market due to the strict hygiene regulations, requirement for contamination-free handling, and ever-growing logistics for cold chain. Because of their being non-porous, easy to sanitize, and resistance to mold, plastic pallets form an ideal choice in food processing and distribution. A demonstration of such specific needs being addressed was manifested in January 2024 by CABKA Group when they launched a new hygienic plastic pallet series for meat and dairy industries in Europe, which offers resistance to high-pressure wash and meets EU food safety standards.

- With such strict food safety requirements and increasing consumption globally, plastic pallets are becoming the prime choice in F&B logistics, which in turn fuels segment-specific innovation and growth.

Asia Pacific Dominates Global Plastic Pallets Market in 2025 and Beyond

- Rapid industrialization, growing export-based manufacturing base with higher importance being given to hygiene and sustainability will continue to have a greater demand for plastic pallets in the Asia Pacific region. FMCG industries, pharmaceuticals, and automotive production are skyrocketing in China, India, and Vietnam, further creating demand for standardized pallet solutions that are hygienic and reusable.

- In March 2024, Loscam extended its plastic pallet rental business in Southeast Asia by launching a new injection-molded pallet line for high volume cross-border logistics in Thailand, thereby confirming the acceptance of plastic pallet systems for rugged and efficient transport in this region.

- In the Asia Pacific region, with the growth of manufacturing coupled with hygiene and logistics modernization, it can be seen as the most vibrant and demanding region for adopting plastic pallets.

Plastic Pallets Market Ecosystem

Key players in the global plastic pallets market include prominent companies such as Schoeller Allibert, ORBIS Corporation, Loscam, CABKA Group, Rehrig Pacific and Other Key Players.

Due to the large-scale production and distribution rights of Tier-1 category companies (including Schoeller Allibert, Orbis Corporation, and Craemer Group), the global plastic pallets market is somewhat fragmented. Tier-2 and Tier-3 organizations, on the other hand, cater to regional markets and niche designs for pallets. Buyer concentration is moderate to the extent that manufacturers and logistics companies procure supplies from various suppliers for reasons of cost and reliability. Having a low-to-moderate level of concentration in the supplier space, the lack of a sole supplier for resin and polymer promotes competitive pricing and innovations regarding material quality, durability, and sustainability.

Recent Development and Strategic Overview:

- In March 2025, LATAM Cargo Group has announced that Chilean operations will be changed for the first time ever from wood pallets to recycled plastic ones, since production of over 100,000 units is revamped every year. The move resonates with the heightened focus on regional perceptions about sustainability while imparting utmost efficiency to cargo handling.

- In January 2024, PTT Global Chemical partnered with some local partners to set up Thailand's first industrial-scale line for recycled-plastic pallet manufacturing. The project converts post-consumer wastes into strong pallets and in doing so takes a major leap toward circular-economy manufacturing.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 8.1 Bn |

|

Market Forecast Value in 2035 |

USD 14.0 Bn |

|

Growth Rate (CAGR) |

5.1% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Plastic Pallets Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Product Type |

|

|

By Material Type |

|

|

By End Use Industry |

|

|

By Sales Channel |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Plastic Pallets Market Outlook

- 2.1.1. Plastic Pallets Market Size (Volume - Million Units & Value - US$ Billion), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End Use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Plastic Pallets Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Packaging Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Packaging Industry

- 3.1.3. Regional Distribution for Packaging

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.1. Global Packaging Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for durable, reusable, and hygienic material handling solutions in food, pharmaceuticals, and logistics.

- 4.1.1.2. Growing emphasis on sustainable supply chain practices and circular economy models.

- 4.1.1.3. Increasing adoption of automation in warehouses and compatibility of plastic pallets with robotic systems.

- 4.1.2. Restraints

- 4.1.2.1. High initial cost of plastic pallets compared to wooden alternatives limits adoption among small and medium enterprises.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Plastic Pallets Manufacturers

- 4.4.3. Dealers and Distributors

- 4.4.4. End User/ Customer

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Plastic Pallets Market Demand

- 4.9.1. Historical Market Size - in Value (Volume - Million Units & Value - US$ Billion), 2021-2024

- 4.9.2. Current and Future Market Size - in Value (Volume - Million Units & Value - US$ Billion), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Plastic Pallets Market Analysis, by Material Type

- 6.1. Key Segment Analysis

- 6.2. Plastic Pallets Market Size (Volume - Million Units & Value - US$ Billion), Analysis, and Forecasts, by Material Type, 2021-2035

- 6.2.1. High-Density Polyethylene (HDPE)

- 6.2.2. Polypropylene (PP)

- 6.2.3. Polyethylene Terephthalate (PET)

- 6.2.4. Others

- 7. Global Plastic Pallets Market Analysis, by Product Type

- 7.1. Key Segment Analysis

- 7.2. Plastic Pallets Market Size (Volume - Million Units & Value - US$ Billion), Analysis, and Forecasts, by Product Type, 2021-2035

- 7.2.1. Nestable Pallets

- 7.2.2. Rackable Pallets

- 7.2.3. Stackable Pallets

- 7.2.4. Display Pallets

- 7.2.5. Others

- 8. Global Plastic Pallets Market Analysis, by End Use Industry

- 8.1. Key Segment Analysis

- 8.2. Plastic Pallets Market Size (Volume - Million Units & Value - US$ Billion), Analysis, and Forecasts, by End Use Industry, 2021-2035

- 8.2.1. Food & Beverage

- 8.2.2. Pharmaceuticals

- 8.2.3. Chemical Industry

- 8.2.4. Retail & Consumer Goods

- 8.2.5. Automotive

- 8.2.6. Agriculture

- 8.2.7. Logistics & Transportation

- 8.2.8. Others

- 9. Global Plastic Pallets Market Analysis, by Sales Channel

- 9.1. Key Segment Analysis

- 9.2. Plastic Pallets Market Size (Volume - Million Units & Value - US$ Billion), Analysis, and Forecasts, by Sales Channel, 2021-2035

- 9.2.1. OEM

- 9.2.2. Aftermarket

- 10. Global Plastic Pallets Market Analysis and Forecasts, by Region

- 10.1. Key Findings

- 10.2. Plastic Pallets Market Size (Volume - Million Units & Value - US$ Billion), Analysis, and Forecasts, by Region, 2021-2035

- 10.2.1. North America

- 10.2.2. Europe

- 10.2.3. Asia Pacific

- 10.2.4. Middle East

- 10.2.5. Africa

- 10.2.6. South America

- 11. North America Plastic Pallets Market Analysis

- 11.1. Key Segment Analysis

- 11.2. Regional Snapshot

- 11.3. North America Plastic Pallets Market Size Volume - Million Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 11.3.1. Material Type

- 11.3.2. Product Type

- 11.3.3. End Use Industry

- 11.3.4. Sales Channel

- 11.3.5. Country

- 11.3.5.1. USA

- 11.3.5.2. Canada

- 11.3.5.3. Mexico

- 11.4. USA Plastic Pallets Market

- 11.4.1. Country Segmental Analysis

- 11.4.2. Material Type

- 11.4.3. Product Type

- 11.4.4. End Use Industry

- 11.4.5. Sales Channel

- 11.5. Canada Plastic Pallets Market

- 11.5.1. Country Segmental Analysis

- 11.5.2. Material Type

- 11.5.3. Product Type

- 11.5.4. End Use Industry

- 11.5.5. Sales Channel

- 11.6. Mexico Plastic Pallets Market

- 11.6.1. Country Segmental Analysis

- 11.6.2. Material Type

- 11.6.3. Product Type

- 11.6.4. End Use Industry

- 11.6.5. Sales Channel

- 12. Europe Plastic Pallets Market Analysis

- 12.1. Key Segment Analysis

- 12.2. Regional Snapshot

- 12.3. Europe Plastic Pallets Market Size (Volume - Million Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 12.3.1. Material Type

- 12.3.2. Product Type

- 12.3.3. End Use Industry

- 12.3.4. Sales Channel

- 12.3.5. Country

- 12.3.5.1. Germany

- 12.3.5.2. United Kingdom

- 12.3.5.3. France

- 12.3.5.4. Italy

- 12.3.5.5. Spain

- 12.3.5.6. Netherlands

- 12.3.5.7. Nordic Countries

- 12.3.5.8. Poland

- 12.3.5.9. Russia & CIS

- 12.3.5.10. Rest of Europe

- 12.4. Germany Plastic Pallets Market

- 12.4.1. Country Segmental Analysis

- 12.4.2. Material Type

- 12.4.3. Product Type

- 12.4.4. End Use Industry

- 12.4.5. Sales Channel

- 12.5. United Kingdom Plastic Pallets Market

- 12.5.1. Country Segmental Analysis

- 12.5.2. Material Type

- 12.5.3. Product Type

- 12.5.4. End Use Industry

- 12.5.5. Sales Channel

- 12.6. France Plastic Pallets Market

- 12.6.1. Country Segmental Analysis

- 12.6.2. Material Type

- 12.6.3. Product Type

- 12.6.4. End Use Industry

- 12.6.5. Sales Channel

- 12.7. Italy Plastic Pallets Market

- 12.7.1. Country Segmental Analysis

- 12.7.2. Material Type

- 12.7.3. Product Type

- 12.7.4. End Use Industry

- 12.7.5. Sales Channel

- 12.8. Spain Plastic Pallets Market

- 12.8.1. Country Segmental Analysis

- 12.8.2. Material Type

- 12.8.3. Product Type

- 12.8.4. End Use Industry

- 12.8.5. Sales Channel

- 12.9. Netherlands Plastic Pallets Market

- 12.9.1. Country Segmental Analysis

- 12.9.2. Material Type

- 12.9.3. Product Type

- 12.9.4. End Use Industry

- 12.9.5. Sales Channel

- 12.10. Nordic Countries Plastic Pallets Market

- 12.10.1. Country Segmental Analysis

- 12.10.2. Material Type

- 12.10.3. Product Type

- 12.10.4. End Use Industry

- 12.10.5. Sales Channel

- 12.11. Poland Plastic Pallets Market

- 12.11.1. Country Segmental Analysis

- 12.11.2. Material Type

- 12.11.3. Product Type

- 12.11.4. End Use Industry

- 12.11.5. Sales Channel

- 12.12. Russia & CIS Plastic Pallets Market

- 12.12.1. Country Segmental Analysis

- 12.12.2. Material Type

- 12.12.3. Product Type

- 12.12.4. End Use Industry

- 12.12.5. Sales Channel

- 12.13. Rest of Europe Plastic Pallets Market

- 12.13.1. Country Segmental Analysis

- 12.13.2. Material Type

- 12.13.3. Product Type

- 12.13.4. End Use Industry

- 12.13.5. Sales Channel

- 13. Asia Pacific Plastic Pallets Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. East Asia Plastic Pallets Market Size (Volume - Million Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 13.3.1. Material Type

- 13.3.2. Product Type

- 13.3.3. End Use Industry

- 13.3.4. Sales Channel

- 13.3.5. Country

- 13.3.5.1. China

- 13.3.5.2. India

- 13.3.5.3. Japan

- 13.3.5.4. South Korea

- 13.3.5.5. Australia and New Zealand

- 13.3.5.6. Indonesia

- 13.3.5.7. Malaysia

- 13.3.5.8. Thailand

- 13.3.5.9. Vietnam

- 13.3.5.10. Rest of Asia Pacific

- 13.4. China Plastic Pallets Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Material Type

- 13.4.3. Product Type

- 13.4.4. End Use Industry

- 13.4.5. Sales Channel

- 13.5. India Plastic Pallets Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Material Type

- 13.5.3. Product Type

- 13.5.4. End Use Industry

- 13.5.5. Sales Channel

- 13.6. Japan Plastic Pallets Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Material Type

- 13.6.3. Product Type

- 13.6.4. End Use Industry

- 13.6.5. Sales Channel

- 13.7. South Korea Plastic Pallets Market

- 13.7.1. Country Segmental Analysis

- 13.7.2. Material Type

- 13.7.3. Product Type

- 13.7.4. End Use Industry

- 13.7.5. Sales Channel

- 13.8. Australia and New Zealand Plastic Pallets Market

- 13.8.1. Country Segmental Analysis

- 13.8.2. Material Type

- 13.8.3. Product Type

- 13.8.4. End Use Industry

- 13.8.5. Sales Channel

- 13.9. Indonesia Plastic Pallets Market

- 13.9.1. Country Segmental Analysis

- 13.9.2. Material Type

- 13.9.3. Product Type

- 13.9.4. End Use Industry

- 13.9.5. Sales Channel

- 13.10. Malaysia Plastic Pallets Market

- 13.10.1. Country Segmental Analysis

- 13.10.2. Material Type

- 13.10.3. Product Type

- 13.10.4. End Use Industry

- 13.10.5. Sales Channel

- 13.11. Thailand Plastic Pallets Market

- 13.11.1. Country Segmental Analysis

- 13.11.2. Material Type

- 13.11.3. Product Type

- 13.11.4. End Use Industry

- 13.11.5. Sales Channel

- 13.12. Vietnam Plastic Pallets Market

- 13.12.1. Country Segmental Analysis

- 13.12.2. Material Type

- 13.12.3. Product Type

- 13.12.4. End Use Industry

- 13.12.5. Sales Channel

- 13.13. Rest of Asia Pacific Plastic Pallets Market

- 13.13.1. Country Segmental Analysis

- 13.13.2. Material Type

- 13.13.3. Product Type

- 13.13.4. End Use Industry

- 13.13.5. Sales Channel

- 14. Middle East Plastic Pallets Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Middle East Plastic Pallets Market Size (Volume - Million Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 14.3.1. Material Type

- 14.3.2. Product Type

- 14.3.3. End Use Industry

- 14.3.4. Sales Channel

- 14.3.5. Country

- 14.3.5.1. Turkey

- 14.3.5.2. UAE

- 14.3.5.3. Saudi Arabia

- 14.3.5.4. Israel

- 14.3.5.5. Rest of Middle East

- 14.4. Turkey Plastic Pallets Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Material Type

- 14.4.3. Product Type

- 14.4.4. End Use Industry

- 14.4.5. Sales Channel

- 14.5. UAE Plastic Pallets Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Material Type

- 14.5.3. Product Type

- 14.5.4. End Use Industry

- 14.5.5. Sales Channel

- 14.6. Saudi Arabia Plastic Pallets Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Material Type

- 14.6.3. Product Type

- 14.6.4. End Use Industry

- 14.6.5. Sales Channel

- 14.7. Israel Plastic Pallets Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Material Type

- 14.7.3. Product Type

- 14.7.4. End Use Industry

- 14.7.5. Sales Channel

- 14.8. Rest of Middle East Plastic Pallets Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Material Type

- 14.8.3. Product Type

- 14.8.4. End Use Industry

- 14.8.5. Sales Channel

- 15. Africa Plastic Pallets Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Africa Plastic Pallets Market Size (Volume - Million Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 15.3.1. Material Type

- 15.3.2. Product Type

- 15.3.3. End Use Industry

- 15.3.4. Sales Channel

- 15.3.5. Country

- 15.3.5.1. South Africa

- 15.3.5.2. Egypt

- 15.3.5.3. Nigeria

- 15.3.5.4. Algeria

- 15.3.5.5. Rest of Africa

- 15.4. South Africa Plastic Pallets Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Material Type

- 15.4.3. Product Type

- 15.4.4. End Use Industry

- 15.4.5. Sales Channel

- 15.5. Egypt Plastic Pallets Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Material Type

- 15.5.3. Product Type

- 15.5.4. End Use Industry

- 15.5.5. Sales Channel

- 15.6. Nigeria Plastic Pallets Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Material Type

- 15.6.3. Product Type

- 15.6.4. End Use Industry

- 15.6.5. Sales Channel

- 15.7. Algeria Plastic Pallets Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Material Type

- 15.7.3. Product Type

- 15.7.4. End Use Industry

- 15.7.5. Sales Channel

- 15.8. Rest of Africa Plastic Pallets Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Material Type

- 15.8.3. Product Type

- 15.8.4. End Use Industry

- 15.8.5. Sales Channel

- 16. South America Plastic Pallets Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Central and South Africa Plastic Pallets Market Size (Volume - Million Units & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 16.3.1. Material Type

- 16.3.2. Product Type

- 16.3.3. End Use Industry

- 16.3.4. Sales Channel

- 16.3.5. Country

- 16.3.5.1. Brazil

- 16.3.5.2. Argentina

- 16.3.5.3. Rest of South America

- 16.4. Brazil Plastic Pallets Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Material Type

- 16.4.3. Product Type

- 16.4.4. End Use Industry

- 16.4.5. Sales Channel

- 16.5. Argentina Plastic Pallets Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Material Type

- 16.5.3. Product Type

- 16.5.4. End Use Industry

- 16.5.5. Sales Channel

- 16.6. Rest of South America Plastic Pallets Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Material Type

- 16.6.3. Product Type

- 16.6.4. End Use Industry

- 16.6.5. Sales Channel

- 17. Key Players/ Company Profile

- 17.1. Allied Plastics, Inc.

- 17.1.1. Company Details/ Overview

- 17.1.2. Company Financials

- 17.1.3. Key Customers and Competitors

- 17.1.4. Business/ Industry Portfolio

- 17.1.5. Product Portfolio/ Specification Details

- 17.1.6. Pricing Data

- 17.1.7. Strategic Overview

- 17.1.8. Recent Developments

- 17.2. AsiaPac Plastics

- 17.3. Brambles (CHEP)

- 17.4. Buckhorn

- 17.5. CABKA Group

- 17.6. Durapal

- 17.7. EcoPallet International

- 17.8. Faber Halbertsma Group

- 17.9. Global Pallet Systems

- 17.10. Greystone Logistics

- 17.11. Kamps Pallets

- 17.12. Monoflo International

- 17.13. ORBIS Corporation

- 17.14. PalletTech Global

- 17.15. Perfect Pallet, Inc.

- 17.16. Polymer Solutions International Inc.

- 17.17. Rehrig Pacific Company

- 17.18. Schoeller‑Allibert

- 17.19. TMF Corporation

- 17.20. TranPak, Inc.

- 17.21. Other key Players

- 17.1. Allied Plastics, Inc.

Note* - This is just tentative list of players. While providing the report, we will cover a greater number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation