Solar Panel Coatings Market Size, Share, Growth Opportunity Analysis Report by Coating Type (Anti-reflective Coatings, Hydrophobic Coatings, Self-cleaning Coatings, Anti-soiling Coatings, Anti-abrasion Coatings, Conductive Coatings, UV-resistant Coatings and Others), Solar Panel Type, Material Type, Application Method, End Use, Distribution Channel and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Solar Panel Coatings Market Size, Share, and Growth

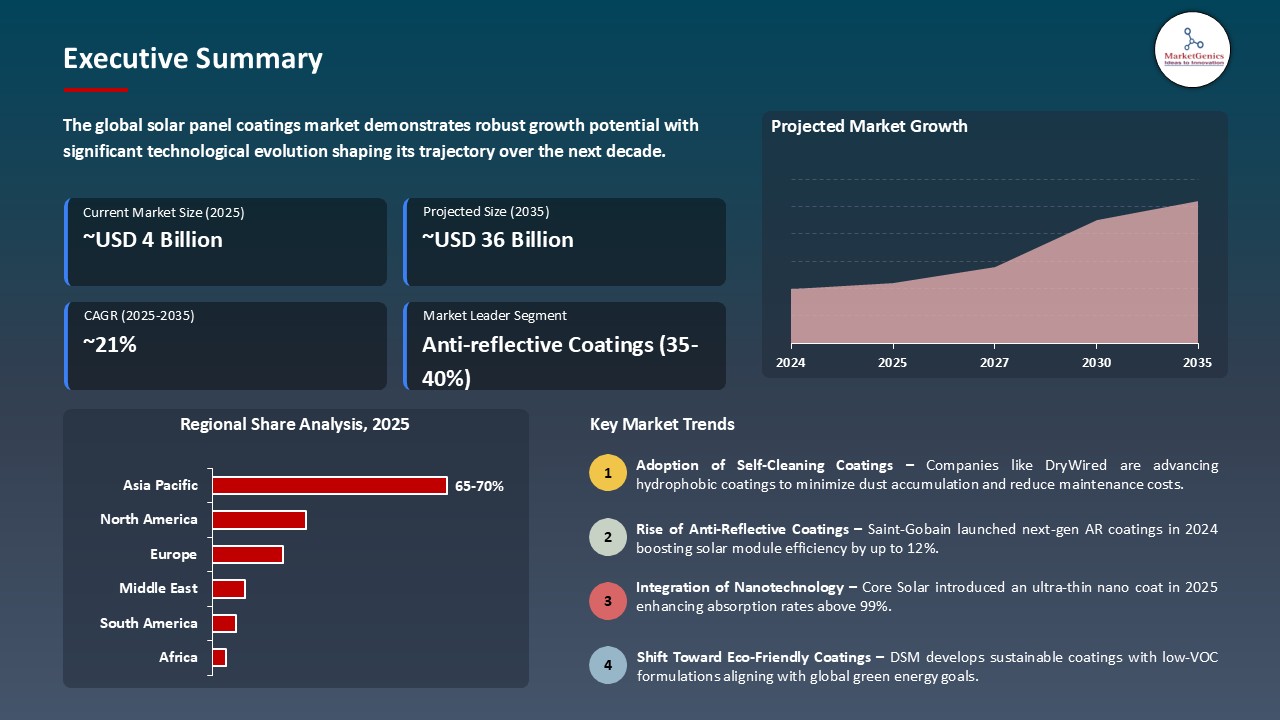

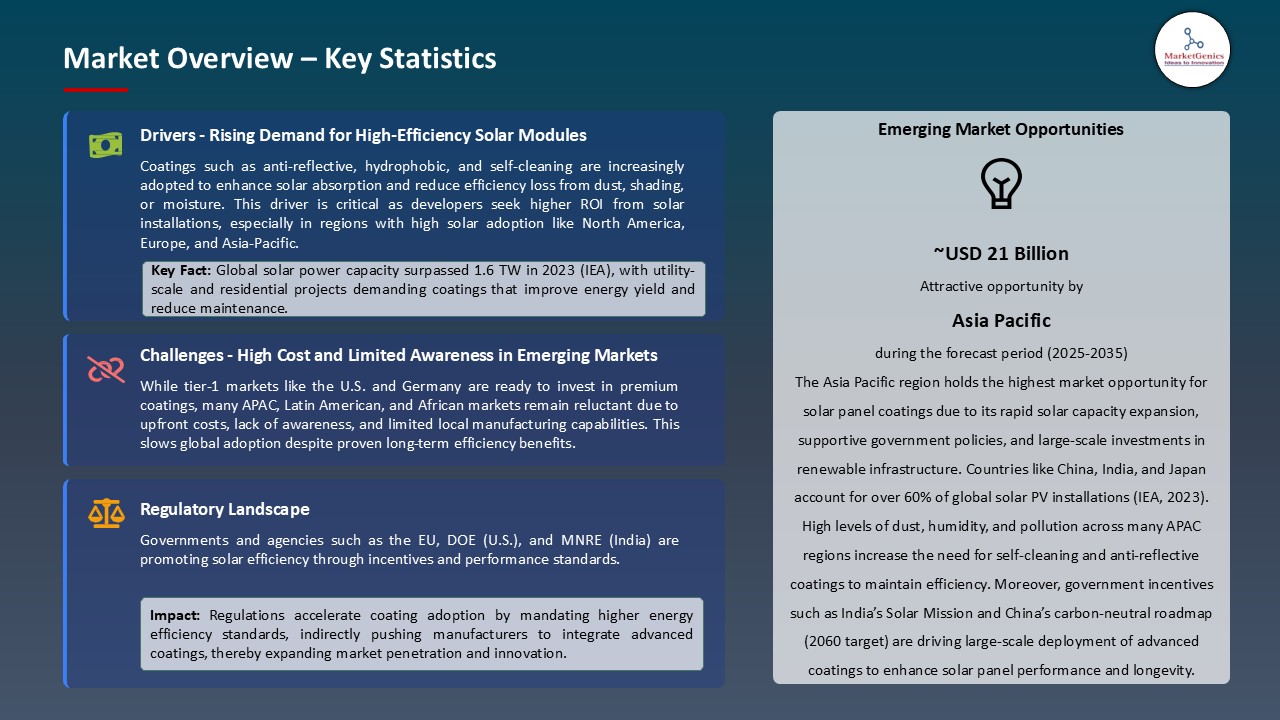

The global solar panel coatings market is expanding from USD 4.5 Billion in 2025 to USD 36.3 Billion by the year 2035, showing a CAGR of 20.8% over the forecast period. The quest to generate maximum energy from solar installations has fueled widescale adoption of advanced anti-reflective coatings. These coatings minimize light loss and improve panel efficiency by 10-12%.

In December 2024, Arkema a global specialty materials leader announced the rollout of ISCC PLUS mass-balance certified coating solutions, enabling coatings made with part-renewable or recycled feedstocks without compromising performance. Richard Jenkins, SVP Coating Solutions, stated, “Replacing virgin fossil feedstocks with biobased or recycled sources allows to accelerate this transition while keeping the same level of performance.” This strategic initiative not only aligns with global sustainability mandates but also appeals to eco-conscious solar module manufacturers aiming for lower carbon footprints.

In December 2024, Saint-Gobain introduced a next-generation anti-reflective coating to improve energy generation in utility-scale applications. From high-dust environments that hinder the energy production, self-cleaning and hydrophobic coatings are in demand that would hold less water and dirt accumulation. In October 2024, the company began coating JinkoSolar panels with a self-cleaning coat that cuts maintenance costs annually while boosting performance in desert installations.

Global solar panel coatings market working with anti-reflective coatings for building-integrated photovoltaics (BIPV), smart glass technologies in green buildings, and protective coatings for EV solar panels. Benefiting from shared innovations in nanocoating’s, UV protection, and self-cleaning technologies and emerging material additives such as graphene, these sectors engage in cross-market applications and commercialization.

Solar Panel Coatings Market Dynamics and Trends

Driver: Increasing Efficiency Demands in High-Temperature Solar Farms

- The solar panel coating industry is propelled greatly by the global urge to improve solar panel efficiency in extreme conditions, mainly arid and hot regions. Anti-reflective, hydrophobic, and thermo-resistive coatings are sought to optimally harness the solar energy in areas such as the Middle East, Australia, and North Africa. These coatings prevent a loss of light and shield against overheating and dust accumulation, which would further reduce the energy yield by approximately 20%. The determination of return on investment and sustainability in the long run directly converses about the coatings and their necessity rather than an option in large-scale solar power projects.

- In March 2025, Saint-Gobain Solar Gard announced the launch of its NanoCool series of advanced thermal control coatings for solar panels situated in deserts and tropic regions. The coatings got their first assignments in the 400 MW solar farm project in Abu Dhabi, where the temperature rises above 45°C. Testing in the field showed NanoCool coatings generating an enhancement in energy efficiency by 6% over uncoated panels.

Restraint: High Cost and Complex Application Processes

- Following the escalating benefits offered by solar panel coating, the market experiences restraint due to the higher cost and technical complexity of coating application. Precise uniform layering, long curing time, and environmental sensitivity of the application process add to operational costs, particularly for retrofitting older panels especially when compared with mature industrial coating routes such as powder coatings. Moreover, the incompatibility of some coating types with different panel technologies adds to the challenges faced by developers in search of a universal solution. Such costs usually tend to overcome the additional efficiency benefits, thereby preventing wider deployment of coated panels with smaller installations and residential users.

- In January 2025, 3M Solar Solutions halted a pilot project to retrofit rooftop panels in Eastern Europe with their new self-cleaning coating, SolarGuard Plus, because of inconsistent adhesion results and soaring labor costs. Coating more than 10,000 existing panels into a project was decided to be economically unviable, as the installation cost was more than the estimated energy savings over five years.

Opportunity: Growth of Floating Solar (Floatovoltaics) Systems

- With the continuous rise in floating solar installations, the coatings industry presents a potential emerging opportunity. These structures are situated in reservoirs, lakes, and offshore waters and suffer a unique set of environmental assaults in the forms of salt corrosion, microbial fouling, and humidity-related degradation. In such cases, the protection of panels by specialized coatings that offer anti-corrosive, anti-fouling, and moisture-resistant properties becomes extremely pertinent. With photovoltaics starting to see increased application owing to their slight edge in space optimization and efficiency enhancement through natural cooling, the demand for coatings designed for aquatic environments is likely to go soaring.

- Daikin Industries released a marine solar coating in February 2025, under the Aqua Shield line, specifically for floating solar. It was recently selected for a 75 MW floating solar facility on the Cirata Reservoir, Indonesia. The coating was found in pilot studies to boost the life span of the panels by more than 30% through anti-biofouling and corrosion resistance.

Key Trend: Rising Adoption of Bifacial Solar Panels with Coating Compatibility

- The fast adoption of bifacial solar panels created an essential trend in solar panel coatings markets. Bifacial panels produce electricity from two surfaces, capturing the stray reflected light. The panels' coatings must offer transparency from both sides while affording anti-reflective and anti-soiling treatment. This trend is driven by the panels having higher energy yields (up to 20% more than mono-facial panels) and increasing preference in large-scale utility projects in Asia-Pacific, Europe, and the U.S. Coatings manufacturers complement this trend by developing dual-side formulas.

- In April 2025, PPG Industries launched Sun Mirror X2, a bifacial-compatible coating for dual-glass panels. It found its first use in a 150 MW installation by Enel Green Power in northern Chile. The coating enhances light transmission and reduces reflection losses on both sides, which is reported to yield a 12% increase in panel output. Such developments reflect the larger trend in the industry toward coatings tailored to the emerging panel architectures and show how coating innovations are quickly keeping pace in tandem with PV module design advances.

Solar Panel Coatings Market Analysis and Segmental Data

Based on Coating Type, the Anti-Reflective Coatings Segment Retains the Largest Share

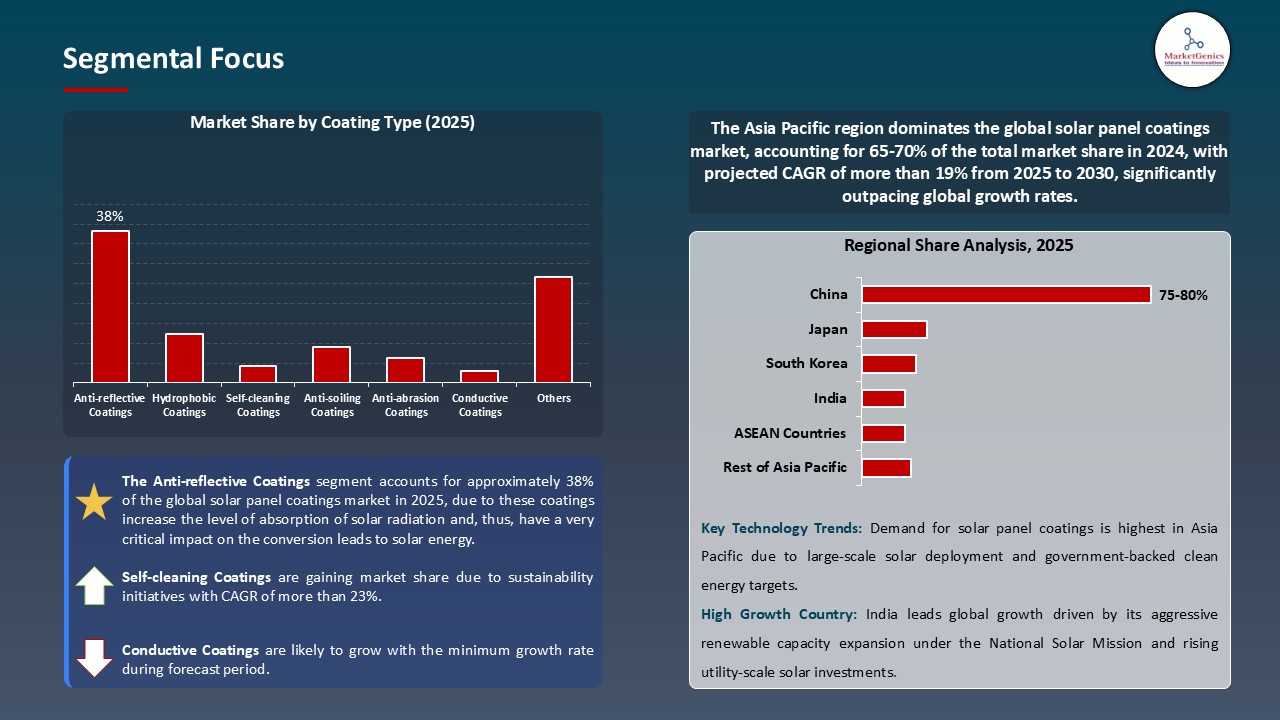

- The anti-reflective coatings segment holds major share ~38% in the global solar panel coatings market. These coatings that increase the level of absorption of solar radiation and, thus, have a very critical impact on the conversion leads to solar energy. The anti-reflective coating on glass helps reduce reflection losses so that early morning and late afternoon rays can reach the photovoltaic cells. Also, they tend to be able to increase power generation by up to 8%. These coatings, therefore, are central to both residential and commercial solar utility installations, especially in high radiation zones where the issue of efficiency remains paramount.

- In March 2025, DSM Advanced Solar delivered its Anti-Reflective Endurance Coating to a 250 MW solar farm in Rajasthan, India. Field results demonstrated a 7.4% increase in energy yield, which in turn encourages the trend of AR-coated panels in high-insolation markets.

Utility-scale Solar Farms Expected to Be Top by End Use Through Forecast Period

- Due to bigger area installations, utility solar farms have been enjoying the highest growth in the global solar panel coatings market. Coatings such as anti-reflective, hydrophobic, and anti-soiling lower the cost of maintenance and raise the revenue generated from power production, thus becoming a desirable financial benefit for a large-scale project. Also, since countries worldwide have been aggressively strengthening solar capacities to achieve renewable targets, utility projects stand at the forefront, thus contributing to the further adoption of the coatings.

- The First Solar Company had worked with Univergy Solar in 2025 to coat an operational 500 MW solar farm set up in Castilla-La Mancha, Spain, with the new, best-in-class coating UVGuard Coating. The coating here gave a 6% reduction in soiling losses, which translated into more energy yields and less operational expenses.

Asia Pacific Dominates Global Solar Panel Coatings Market in 2025 and Beyond

- The Asia-Pacific region holds the critical demand for solar panel coating, with aggressive deployment of solar energy and high solar irradiance multiple climatic challenges like dust, humidity, and pollution. In countries like China, India, and Japan, the rapid development of large-scale and small-scale solar power generation lays down less energy-security needs but more on energy-security needs in a climate scenario. Coatings having properties like being anti-soiling, anti-reflective, and resistant to corrosion are highly demanded so that the panels can maintain their efficiency under such harsh environmental conditions.

- In February 2025, Toho Chemical Industry Co., Ltd. supplied an advanced anti-pollution coating, SolReflex Ultra, to a 100 MW rooftop solar project in Guangzhou in southern China. The coating finds applications in highly polluted urban scenarios across Asia, wherein it reduced particulate buildup and realized a 5.6% improvement in panel output.

Solar Panel Coatings Market Ecosystem

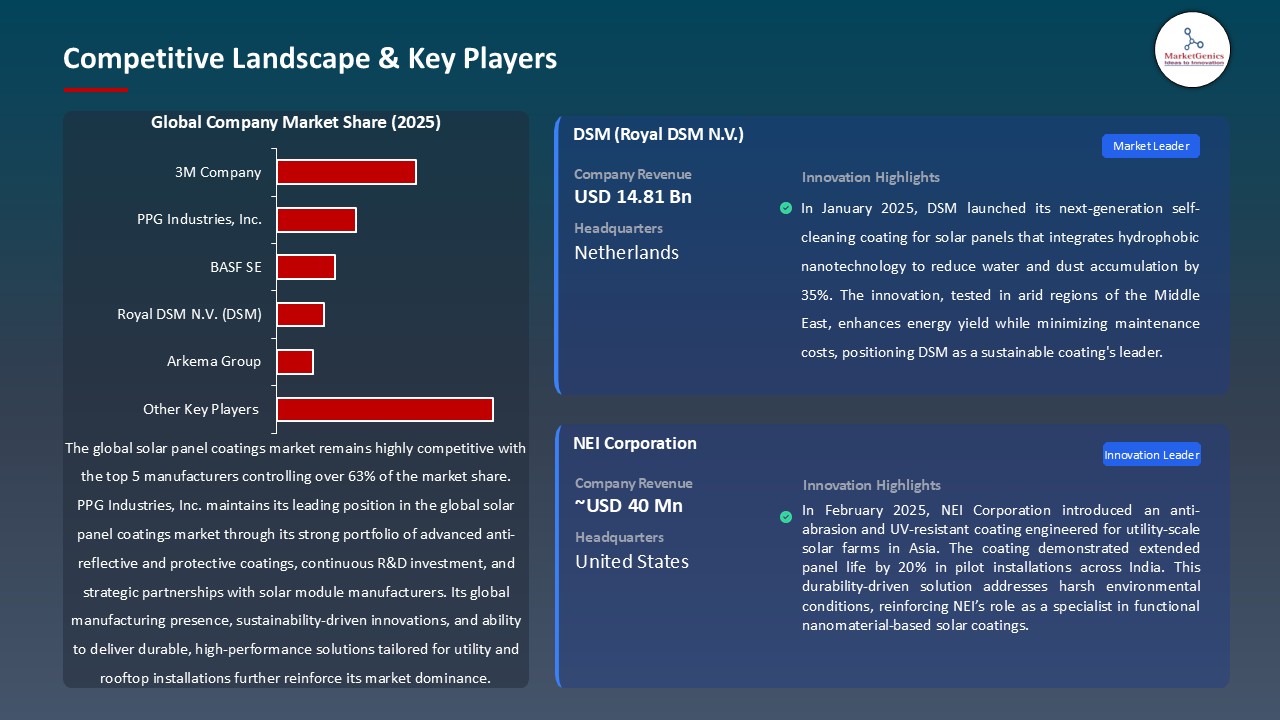

Key players in the global solar panel coatings market include prominent companies such as PPG Industries, Inc., BASF SE, Arkema Group, Royal DSM N.V. (DSM), 3M Company and Other Key Players.

The solar panel coating market can be moderately fragmented, the various players ranging-from the big-league multinationals (BASF SE, Arkema Group, PPG Industries, DSM, 3M Company) to rank theaters specialized outfits (Nanopool GmbH, NEI Corporation, Advanced Nanotech Lab, Optitune Oy), followed by rank 3 niche innovators (SolarSharc, DryWired, Unelko Corporation). Tier 1 successfully attains domination by virtue of global reach and R&D. Tier 2 and Tier 3 provide nanocoatings and functional inventions on a more specialized scale. Porter's Five Forces: Buyer concentration is medium because the solar manufacturers are on the rise; supplier concentration is on the lower side as the suppliers can tap raw materials from a diversified base.

Recent Development and Strategic Overview:

- In March 2025, an ultra-thin nano coat by Core Solar can make solar panels capable of generating power even during low-light and shade conditions. The combination of advanced nanostructures and AI-driven surface optimization gave the coating a solar absorption rate above 99%, in effect improving performance and durability in the cloudy environments of Europe.

- In December 2024, the new AR coating putting an energy efficiency increase of 12%. Saint-Gobain came out with a next-generation anti-reflective coating for solar modules, promising up to a 12% increase in energy yield. With such enhancement in their portfolio, the company stands to reap from the increased demand of superior coatings that are low maintenance for utility-scale and rooftop installations.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 4.5 Bn |

|

Market Forecast Value in 2035 |

USD 36.3 Bn |

|

Growth Rate (CAGR) |

20.8% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Solar Panel Coatings Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Coating Type |

|

|

By Solar Panel Type |

|

|

By Material Type |

|

|

By Application Method |

|

|

By End Use |

|

|

By Distribution Channel |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Solar Panel Coatings Market Outlook

- 2.1.1. Solar Panel Coatings Market Size (Value - US$ Billion), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End Use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Solar Panel Coatings Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Solar Panel Coatings Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Solar Panel Coatings Industry

- 3.1.3. Regional Distribution for Solar Panel Coatings

- 3.2. Supplier Customer Data

- 3.3. Solar Panel Type Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.1. Global Solar Panel Coatings Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Growing solar power installations across residential, commercial, and utility-scale sectors.

- 4.1.1.2. Rising need for efficiency-enhancing coatings like anti-reflective and self-cleaning layers.

- 4.1.1.3. Increasing government incentives and climate mandates promoting renewable energy adoption.

- 4.1.2. Restraints

- 4.1.2.1. High initial cost and limited awareness of advanced coating technologies in emerging markets.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Coating Manufacturers

- 4.4.3. Solar Panel Type Providers

- 4.4.4. Dealers and Distributors

- 4.4.5. End User/ Customer

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Solar Panel Coatings Market Demand

- 4.9.1. Historical Market Size - in Value (US$ Billion), 2021-2024

- 4.9.2. Current and Future Market Size - in Value (US$ Billion), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Solar Panel Coatings Market Analysis, by Coating Type

- 6.1. Key Segment Analysis

- 6.2. Solar Panel Coatings Market Size (Value - US$ Billion), Analysis, and Forecasts, by Coating Type, 2021-2035

- 6.2.1. Anti-reflective Coatings

- 6.2.2. Hydrophobic Coatings

- 6.2.3. Self-cleaning Coatings

- 6.2.4. Anti-soiling Coatings

- 6.2.5. Anti-abrasion Coatings

- 6.2.6. Conductive Coatings

- 6.2.7. UV-resistant Coatings

- 6.2.8. Others

- 7. Global Solar Panel Coatings Market Analysis, by Solar Panel Type

- 7.1. Key Segment Analysis

- 7.2. Solar Panel Coatings Market Size (Value - US$ Billion), Analysis, and Forecasts, by Solar Panel Type, 2021-2035

- 7.2.1. Monocrystalline Silicon Solar Panels

- 7.2.2. Polycrystalline Silicon Solar Panels

- 7.2.3. Thin-film Solar Panels

- 7.2.4. Perovskite Solar Panels

- 7.2.5. Concentrated Photovoltaic (CPV) Panels

- 7.2.6. Others

- 8. Global Solar Panel Coatings Market Analysis, by Material Type

- 8.1. Key Segment Analysis

- 8.2. Solar Panel Coatings Market Size (Value - US$ Billion), Analysis, and Forecasts, by Material Type, 2021-2035

- 8.2.1. Silicon Dioxide (SiO₂)

- 8.2.2. Titanium Dioxide (TiO₂)

- 8.2.3. Fluoropolymers

- 8.2.4. Polysiloxanes

- 8.2.5. Ceramic Nanoparticles

- 8.2.6. Others (e.g., Zinc Oxide, ITO)

- 9. Global Solar Panel Coatings Market Analysis, by Application Method

- 9.1. Key Segment Analysis

- 9.2. Solar Panel Coatings Market Size (Value - US$ Billion), Analysis, and Forecasts, by Application Method, 2021-2035

- 9.2.1. Spray Coating

- 9.2.2. Dip Coating

- 9.2.3. Roll-to-Roll Coating

- 9.2.4. Vacuum Deposition

- 9.2.5. Spin Coating

- 9.2.6. Others

- 10. Global Solar Panel Coatings Market Analysis, by End Use

- 10.1. Key Segment Analysis

- 10.2. Solar Panel Coatings Market Size (Value - US$ Billion), Analysis, and Forecasts, by End Use, 2021-2035

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.2.3. Industrial

- 10.2.4. Utility-scale Solar Farms

- 10.2.5. Space-based Solar Panels (Aerospace)

- 10.2.6. Others

- 11. Global Solar Panel Coatings Market Analysis, by Distribution Channel

- 11.1. Key Segment Analysis

- 11.2. Solar Panel Coatings Market Size (Value - US$ Billion), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 11.2.1. OEMs (Original Equipment Manufacturers)

- 11.2.2. Aftermarket / Retrofits

- 11.2.3. Distributors & Dealers

- 11.2.4. Direct Sales

- 12. Global Solar Panel Coatings Market Analysis and Forecasts, by Region

- 12.1. Key Findings

- 12.2. Solar Panel Coatings Market Size (Value - US$ Billion), Analysis, and Forecasts, by Region, 2021-2035

- 12.2.1. North America

- 12.2.2. Europe

- 12.2.3. Asia Pacific

- 12.2.4. Middle East

- 12.2.5. Africa

- 12.2.6. South America

- 13. North America Solar Panel Coatings Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. North America Solar Panel Coatings Market Size Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 13.3.1. Coating Type

- 13.3.2. Solar Panel Type

- 13.3.3. Material Type

- 13.3.4. Application Method

- 13.3.5. End Use

- 13.3.6. Distribution Channel

- 13.3.7. Country

- 13.3.7.1. USA

- 13.3.7.2. Canada

- 13.3.7.3. Mexico

- 13.4. USA Solar Panel Coatings Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Coating Type

- 13.4.3. Solar Panel Type

- 13.4.4. Material Type

- 13.4.5. Application Method

- 13.4.6. End Use

- 13.4.7. Distribution Channel

- 13.5. Canada Solar Panel Coatings Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Coating Type

- 13.5.3. Solar Panel Type

- 13.5.4. Material Type

- 13.5.5. Application Method

- 13.5.6. End Use

- 13.5.7. Distribution Channel

- 13.6. Mexico Solar Panel Coatings Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Coating Type

- 13.6.3. Solar Panel Type

- 13.6.4. Material Type

- 13.6.5. Application Method

- 13.6.6. End Use

- 13.6.7. Distribution Channel

- 14. Europe Solar Panel Coatings Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Europe Solar Panel Coatings Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 14.3.1. Coating Type

- 14.3.2. Solar Panel Type

- 14.3.3. Material Type

- 14.3.4. Application Method

- 14.3.5. End Use

- 14.3.6. Distribution Channel

- 14.3.7. Country

- 14.3.7.1. Germany

- 14.3.7.2. United Kingdom

- 14.3.7.3. France

- 14.3.7.4. Italy

- 14.3.7.5. Spain

- 14.3.7.6. Netherlands

- 14.3.7.7. Nordic Countries

- 14.3.7.8. Poland

- 14.3.7.9. Russia & CIS

- 14.3.7.10. Rest of Europe

- 14.4. Germany Solar Panel Coatings Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Coating Type

- 14.4.3. Solar Panel Type

- 14.4.4. Material Type

- 14.4.5. Application Method

- 14.4.6. End Use

- 14.4.7. Distribution Channel

- 14.5. United Kingdom Solar Panel Coatings Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Coating Type

- 14.5.3. Solar Panel Type

- 14.5.4. Material Type

- 14.5.5. Application Method

- 14.5.6. End Use

- 14.5.7. Distribution Channel

- 14.6. France Solar Panel Coatings Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Coating Type

- 14.6.3. Solar Panel Type

- 14.6.4. Material Type

- 14.6.5. Application Method

- 14.6.6. End Use

- 14.6.7. Distribution Channel

- 14.7. Italy Solar Panel Coatings Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Coating Type

- 14.7.3. Solar Panel Type

- 14.7.4. Material Type

- 14.7.5. Application Method

- 14.7.6. End Use

- 14.7.7. Distribution Channel

- 14.8. Spain Solar Panel Coatings Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Coating Type

- 14.8.3. Solar Panel Type

- 14.8.4. Material Type

- 14.8.5. Application Method

- 14.8.6. End Use

- 14.8.7. Distribution Channel

- 14.9. Netherlands Solar Panel Coatings Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Coating Type

- 14.9.3. Solar Panel Type

- 14.9.4. Material Type

- 14.9.5. Application Method

- 14.9.6. End Use

- 14.9.7. Distribution Channel

- 14.10. Nordic Countries Solar Panel Coatings Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Coating Type

- 14.10.3. Solar Panel Type

- 14.10.4. Material Type

- 14.10.5. Application Method

- 14.10.6. End Use

- 14.10.7. Distribution Channel

- 14.11. Poland Solar Panel Coatings Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Coating Type

- 14.11.3. Solar Panel Type

- 14.11.4. Material Type

- 14.11.5. Application Method

- 14.11.6. End Use

- 14.11.7. Distribution Channel

- 14.12. Russia & CIS Solar Panel Coatings Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Coating Type

- 14.12.3. Solar Panel Type

- 14.12.4. Material Type

- 14.12.5. Application Method

- 14.12.6. End Use

- 14.12.7. Distribution Channel

- 14.13. Rest of Europe Solar Panel Coatings Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Coating Type

- 14.13.3. Solar Panel Type

- 14.13.4. Material Type

- 14.13.5. Application Method

- 14.13.6. End Use

- 14.13.7. Distribution Channel

- 15. Asia Pacific Solar Panel Coatings Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. East Asia Solar Panel Coatings Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 15.3.1. Coating Type

- 15.3.2. Solar Panel Type

- 15.3.3. Material Type

- 15.3.4. Application Method

- 15.3.5. End Use

- 15.3.6. Distribution Channel

- 15.3.7. Country

- 15.3.7.1. China

- 15.3.7.2. India

- 15.3.7.3. Japan

- 15.3.7.4. South Korea

- 15.3.7.5. Australia and New Zealand

- 15.3.7.6. Indonesia

- 15.3.7.7. Malaysia

- 15.3.7.8. Thailand

- 15.3.7.9. Vietnam

- 15.3.7.10. Rest of Asia Pacific

- 15.4. China Solar Panel Coatings Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Coating Type

- 15.4.3. Solar Panel Type

- 15.4.4. Material Type

- 15.4.5. Application Method

- 15.4.6. End Use

- 15.4.7. Distribution Channel

- 15.5. India Solar Panel Coatings Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Coating Type

- 15.5.3. Solar Panel Type

- 15.5.4. Material Type

- 15.5.5. Application Method

- 15.5.6. End Use

- 15.5.7. Distribution Channel

- 15.6. Japan Solar Panel Coatings Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Coating Type

- 15.6.3. Solar Panel Type

- 15.6.4. Material Type

- 15.6.5. Application Method

- 15.6.6. End Use

- 15.6.7. Distribution Channel

- 15.7. South Korea Solar Panel Coatings Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Coating Type

- 15.7.3. Solar Panel Type

- 15.7.4. Material Type

- 15.7.5. Application Method

- 15.7.6. End Use

- 15.7.7. Distribution Channel

- 15.8. Australia and New Zealand Solar Panel Coatings Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Coating Type

- 15.8.3. Solar Panel Type

- 15.8.4. Material Type

- 15.8.5. Application Method

- 15.8.6. End Use

- 15.8.7. Distribution Channel

- 15.9. Indonesia Solar Panel Coatings Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Coating Type

- 15.9.3. Solar Panel Type

- 15.9.4. Material Type

- 15.9.5. Application Method

- 15.9.6. End Use

- 15.9.7. Distribution Channel

- 15.10. Malaysia Solar Panel Coatings Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Coating Type

- 15.10.3. Solar Panel Type

- 15.10.4. Material Type

- 15.10.5. Application Method

- 15.10.6. End Use

- 15.10.7. Distribution Channel

- 15.11. Thailand Solar Panel Coatings Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Coating Type

- 15.11.3. Solar Panel Type

- 15.11.4. Material Type

- 15.11.5. Application Method

- 15.11.6. End Use

- 15.11.7. Distribution Channel

- 15.12. Vietnam Solar Panel Coatings Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Coating Type

- 15.12.3. Solar Panel Type

- 15.12.4. Material Type

- 15.12.5. Application Method

- 15.12.6. End Use

- 15.12.7. Distribution Channel

- 15.13. Rest of Asia Pacific Solar Panel Coatings Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Coating Type

- 15.13.3. Solar Panel Type

- 15.13.4. Material Type

- 15.13.5. Application Method

- 15.13.6. End Use

- 15.13.7. Distribution Channel

- 16. Middle East Solar Panel Coatings Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Middle East Solar Panel Coatings Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 16.3.1. Coating Type

- 16.3.2. Solar Panel Type

- 16.3.3. Material Type

- 16.3.4. Application Method

- 16.3.5. End Use

- 16.3.6. Distribution Channel

- 16.3.7. Country

- 16.3.7.1. Turkey

- 16.3.7.2. UAE

- 16.3.7.3. Saudi Arabia

- 16.3.7.4. Israel

- 16.3.7.5. Rest of Middle East

- 16.4. Turkey Solar Panel Coatings Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Coating Type

- 16.4.3. Solar Panel Type

- 16.4.4. Material Type

- 16.4.5. Application Method

- 16.4.6. End Use

- 16.4.7. Distribution Channel

- 16.5. UAE Solar Panel Coatings Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Coating Type

- 16.5.3. Solar Panel Type

- 16.5.4. Material Type

- 16.5.5. Application Method

- 16.5.6. End Use

- 16.5.7. Distribution Channel

- 16.6. Saudi Arabia Solar Panel Coatings Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Coating Type

- 16.6.3. Solar Panel Type

- 16.6.4. Material Type

- 16.6.5. Application Method

- 16.6.6. End Use

- 16.6.7. Distribution Channel

- 16.7. Israel Solar Panel Coatings Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Coating Type

- 16.7.3. Solar Panel Type

- 16.7.4. Material Type

- 16.7.5. Application Method

- 16.7.6. End Use

- 16.7.7. Distribution Channel

- 16.8. Rest of Middle East Solar Panel Coatings Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Coating Type

- 16.8.3. Solar Panel Type

- 16.8.4. Material Type

- 16.8.5. Application Method

- 16.8.6. End Use

- 16.8.7. Distribution Channel

- 17. Africa Solar Panel Coatings Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Africa Solar Panel Coatings Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 17.3.1. Coating Type

- 17.3.2. Solar Panel Type

- 17.3.3. Material Type

- 17.3.4. Application Method

- 17.3.5. End Use

- 17.3.6. Distribution Channel

- 17.3.7. Country

- 17.3.7.1. South Africa

- 17.3.7.2. Egypt

- 17.3.7.3. Nigeria

- 17.3.7.4. Algeria

- 17.3.7.5. Rest of Africa

- 17.4. South Africa Solar Panel Coatings Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Coating Type

- 17.4.3. Solar Panel Type

- 17.4.4. Material Type

- 17.4.5. Application Method

- 17.4.6. End Use

- 17.4.7. Distribution Channel

- 17.5. Egypt Solar Panel Coatings Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Coating Type

- 17.5.3. Solar Panel Type

- 17.5.4. Material Type

- 17.5.5. Application Method

- 17.5.6. End Use

- 17.5.7. Distribution Channel

- 17.6. Nigeria Solar Panel Coatings Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Coating Type

- 17.6.3. Solar Panel Type

- 17.6.4. Material Type

- 17.6.5. Application Method

- 17.6.6. End Use

- 17.6.7. Distribution Channel

- 17.7. Algeria Solar Panel Coatings Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Coating Type

- 17.7.3. Solar Panel Type

- 17.7.4. Material Type

- 17.7.5. Application Method

- 17.7.6. End Use

- 17.7.7. Distribution Channel

- 17.8. Rest of Africa Solar Panel Coatings Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Coating Type

- 17.8.3. Solar Panel Type

- 17.8.4. Material Type

- 17.8.5. Application Method

- 17.8.6. End Use

- 17.8.7. Distribution Channel

- 18. South America Solar Panel Coatings Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Central and South Africa Solar Panel Coatings Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 18.3.1. Coating Type

- 18.3.2. Solar Panel Type

- 18.3.3. Material Type

- 18.3.4. Application Method

- 18.3.5. End Use

- 18.3.6. Distribution Channel

- 18.3.7. Country

- 18.3.7.1. Brazil

- 18.3.7.2. Argentina

- 18.3.7.3. Rest of South America

- 18.4. Brazil Solar Panel Coatings Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Coating Type

- 18.4.3. Solar Panel Type

- 18.4.4. Material Type

- 18.4.5. Application Method

- 18.4.6. End Use

- 18.4.7. Distribution Channel

- 18.5. Argentina Solar Panel Coatings Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Coating Type

- 18.5.3. Solar Panel Type

- 18.5.4. Material Type

- 18.5.5. Application Method

- 18.5.6. End Use

- 18.5.7. Distribution Channel

- 18.6. Rest of South America Solar Panel Coatings Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Coating Type

- 18.6.3. Solar Panel Type

- 18.6.4. Material Type

- 18.6.5. Application Method

- 18.6.6. End Use

- 18.6.7. Distribution Channel

- 19. Key Players/ Company Profile

- 19.1. 3M Company

- 19.1.1. Company Details/ Overview

- 19.1.2. Company Financials

- 19.1.3. Key Customers and Competitors

- 19.1.4. Business/ Industry Portfolio

- 19.1.5. Product Portfolio/ Specification Details

- 19.1.6. Pricing Data

- 19.1.7. Strategic Overview

- 19.1.8. Recent Developments

- 19.2. Advanced Nanotech Lab

- 19.3. Advenira Enterprises Inc.

- 19.4. Arkema Group

- 19.5. AVIC Sanxin Co., Ltd.

- 19.6. BASF SE

- 19.7. CelSian Glass & Solar B.V.

- 19.8. Crown Industrial Coatings

- 19.9. DryWired

- 19.10. DSM (Royal DSM N.V.)

- 19.11. Kisho Corporation Co., Ltd.

- 19.12. Nanopool GmbH

- 19.13. NEI Corporation

- 19.14. Optitune Oy

- 19.15. Phoebus Energy

- 19.16. PPG Industries, Inc.

- 19.17. SolarSharc

- 19.18. Tata Chemicals Ltd.

- 19.19. Tesla Nanocoatings Inc.

- 19.20. Unelko Corporation

- 19.21. Other Key Players

- 19.1. 3M Company

Note* - This is just tentative list of players. While providing the report, we will cover a greater number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation