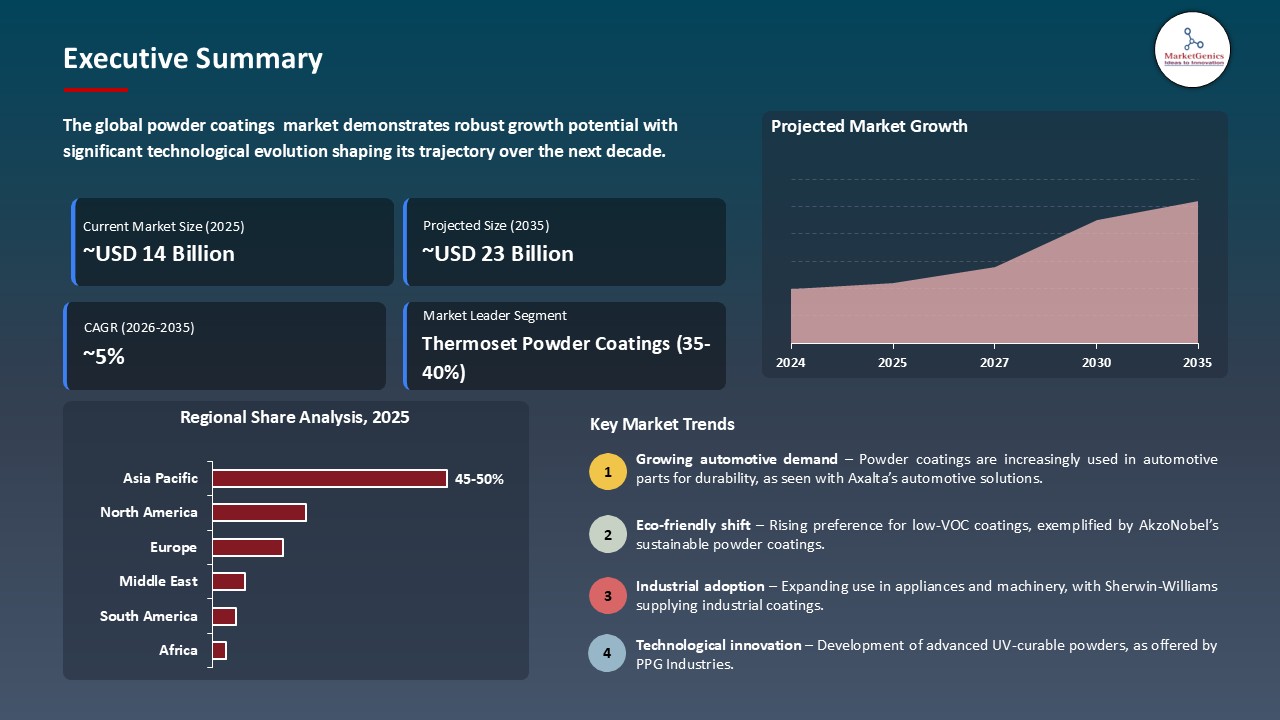

- The global powder coatings market is valued at USD 13.8 billion in 2025.

- The market is projected to grow at a CAGR of 5.1% during the forecast period of 2026 to 2035.

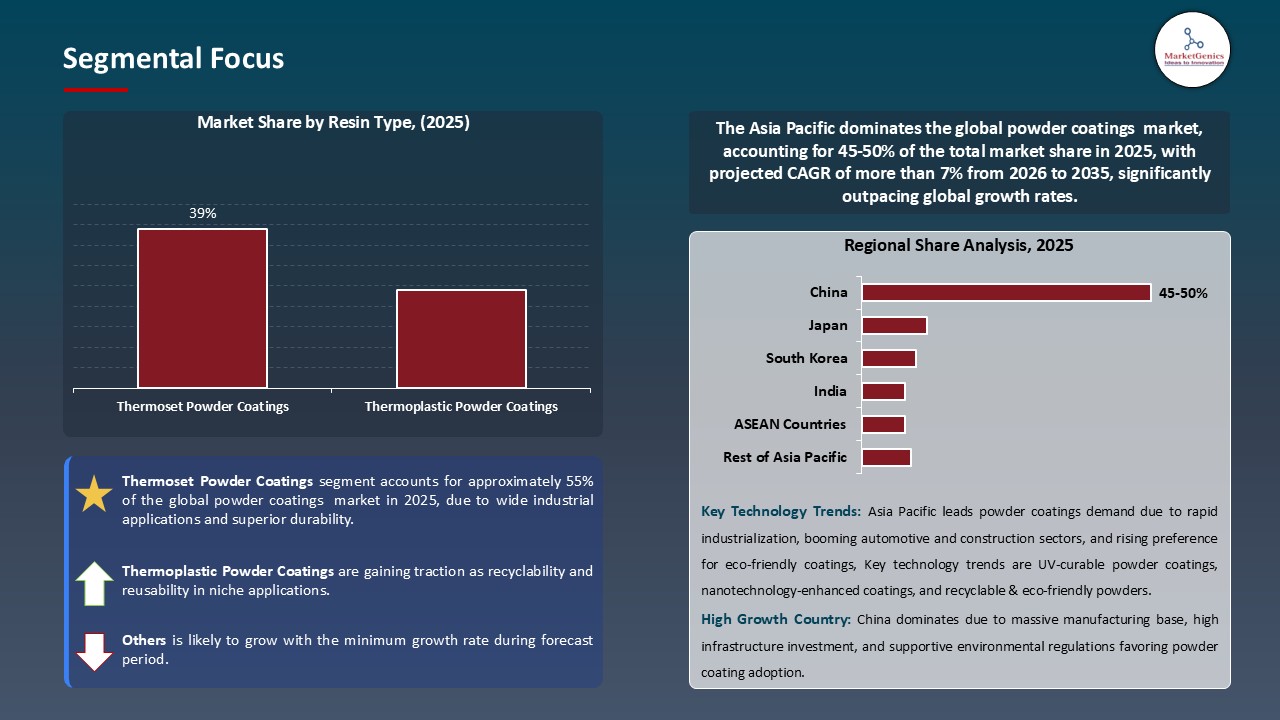

- The thermoset powder coatings segment holds major share ~39% in the global powder coatings market, due to wide industrial applications and superior durability.

- The powder coatings market growing due to rising electric vehicle production drives demand for dielectric and high-performance powders for battery components.

- The powder coatings market is driven by high material utilization and low waste make powder coatings attractive for cost and process efficiency improvements.

- The top five players accounting for over 25% of the global powder coatings market share in 2025.

- In November 2025, AkzoNobel and Axalta entered an all-stock merger to create a ~$25B coatings leader, enhancing powder-coating scale and unlocking major cost and innovation synergies across key markets.

- In October 2025, PPG launched ENVIROCRON Edge Plus and EnviroLuxe Plus powder coatings with improved edge protection, PFAS-free chemistries, and up to ~18% recycled content, advancing its sustainability strategy.

- Global Powder Coatings Market is likely to create the total forecasting opportunity of ~USD 9 Bn till 2035.

- Asia Pacific is most attractive region due to rapid industrialization, expanding automotive and construction sectors, and rising demand for durable, eco-friendly coatings.

- The global powder coatings market growth is supported by the rapid increase in the use of electric vehicles and energy-storage systems, creating the need to pursue new development of more powerful and efficient coatings that can provide electrical conductivity, thermal stability, corrosion resistance and good adhesion to lightweight aluminium and composite parts. Improved formulations specific to battery enclosures and EV structural components including aluminium alloys and carbon fiber composites that improve the efficiency of manufacture, allow thinner substrate design and pass the demanding requirements of safety and durability.

- For instance, in June 2025, Jotun’s announced that it had developed battery-specific powder-coating technologies, which allows suppliers to incorporate electrical protection and thermal management features into their products, therefore allowing OEMs to use lightweight structural materials without sacrificing safety and durability.

- Innovations in powder coatings enable electric car and energy-storage supply chains, driving higher adoption and market penetration. They also boost suppliers' competitiveness by shifting demand to technologically superior and specification-based coating solutions.

- The global powder coatings market is being restrained by the expectation of high curing temperatures necessary in conventional thermoset systems, preventing their direct use on heat-sensitive plastics, thin-gauge metals, and composite structures that are being used with an increasing frequency to obtain light weighting and material efficiency.

- Trade-offs in substrate selection, component design, and curing efficiency are then threatening manufacturers because low-temperature formulations or extra pre-treatment measures leads to higher complexity in operations and total cost of production. For instance, in May 2024, AkzoNobel unveiled its single-layer powder coating on two-wheelers exemplifies industry efforts to address these limitations, while it also highlights the sheer amount of engineering work needed to re-engineer powder technology towards thin-walled and lightweight parts.

- Next-generation powder coating production is hindered by emerging market segments, high production costs, and the need for low temperature curing and substrate compatibility.

- The global powder coatings market gains a strategic opportunity by conforming to the circular- economics, where recyclable and low-carbon coating systems will decrease the material waste and embodied emissions. Innovations in overspray recovery, feedstock recycle, and removal of the undesirable chemistries reinforce the adherence to the sustainability laws and add value to the environmentally conscious manufacturers and end users.

- In addition, recycled content certification, PFAS elimination and closed-loop recovery offers of recycled content suppliers provide extra value to OEMs seeking reduced scope-3 emissions and closed-loop manufacturing. For instance, in May 2025, PPG Industries product launched EnviroLuxe Plus powder coatings with up to 18% post-industrial recycled plastic and a PFAS-free formulation, which have a up to 30% reduced carbon footprint than traditional products.

- This opportunity supports the use of eco-efficient powder coatings, helping producers meet sustainability criteria, reduce lifecycle emissions, discover new consumers, and enable circular, low-carbon usage.

- The global powder coatings market benefits the increased digitalization and automation boosting the accuracy of application, curing efficacy and real time quality of the product. High-tech robotics, data-oriented process control and in-line inspection will minimize material wastage, human reliance, rework and enhance the throughput on intricate geometries. These technological advances reinforce manufacturing output and help with the uniform and high-quality finishing of various industrial end-use industries.

- For instance, in 2025, Ramseier Koatings is progressing in the implementation of intelligent automation, so the powder-coating line is equipped with robotics, IoT-controlled sensors and AI-driven process controls to improve the precision of the applications, real-time performance monitoring, and optimization of curing.

- Technology advancements improve production efficiencies and finish reliability, making powder coatings more competitive in high-tech manufacturing and more widely used in growing industries.

- The thermoset powder coatings segment dominates the global powder coatings market due to they have better mechanical strength, chemical resistance, and longevity hence, are the preferred ones in the industrial and architectural high-performance under harsh environmental conditions.

- For instance, in July 2024, AkzoNobel N.V. introduced a new thermoset powder-coating method for EV battery enclosures that combines durable resin systems with improved corrosion and thermal performance. These improvements strengthen the thermoset segment's technical leadership, maintain its market dominance, and broaden its application to other sectors requiring high-performance finishes.

- Thermoset systems are increasingly used in high-value applications such as architectural metals, HVAC units, and heavy machinery due to ongoing formulation innovation that improves weatherability, anti-corrosion, and aesthetic performance. For instance, In May 2024, Axalta Coating Systems Ltd. introduced high UV stability, exterior-grade, Qualicoat Class II, and AAMA2604 standards Alesta BioCore thermoset powder coatings to fulfill architectural demands.

- Innovations improve product distinctiveness and pricing value, leading to increased penetration in high-performance architectural and industrial industries.

- Asia Pacific leads the global powder coatings market, due to the explosive industrialization, and the ever-growing appliance, automotive and architectural metal production in China and India, the demand of powder-coating is still on the rise. The level of localized manufacturing increases the cost effectiveness and responsiveness of supply, which strengthens high regional adoption.

- For instance, in June 2025, JSW Paints declared an acquisition of around 74.8 percent of Akzo Nobel India Private Limited at an apparently 1.4 billion Euro, highlighting strategic investor attention to the Indian growth of the coating market. This investment brings production nearer to the high-growth end-markets, enhancing responsiveness and cost competitiveness and reaffirming the position of the region as the largest segment in the world.

- Additionally, Asian Pacific governments implement more stringent environmental regulations and encourage solventless technologies forcing manufacturers to switch to powder instead of liquid coatings. The rising urban environment and rising construction activity of the area require high-performance finishes on aluminium extrusions and facade systems with a preference to powder coating.

- The emphasis on scale and sustainability in manufacturing propels the Asia Pacific market to surpass other regions, and establish itself as the largest market in the world.

- In November 2025, AkzoNobel and Axalta declared an all-equity merger that produced a ~25B coatings enterprise, which would provide more power-coatings, combined technology platforms, and a presumed -600M in operational synergies to bolster competitiveness in the industrial and architectural sectors.

- In October 2025, PPG introduced ENVIROCRON Edge Plus and EnviroLuxe Plus powder coatings featuring advanced edge-corrosion resistance, PFAS-free formulations, and up to ~18% post-industrial recycled content, reinforcing the company’s sustainability-driven innovation in high-performance powder applications.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- AkzoNobel N.V.

- Axalta Coating Systems

- Beckers Group

- RPM International Inc.

- Chromaflo Technologies

- Forrest Technical Coatings

- Hempel A/S

- IFS Coatings

- Induron Coatings Inc.

- Jotun A/S

- Kansai Paint Co. Ltd.

- Nippon Paint Holdings

- Nortek Powder Coating

- Platinum Phase Sdn Bhd

- PPG Industries Inc.

- Teknos Group

- TIGER Drylac U.S.A. Inc.

- Vogel Paint Inc.

- Other Key Players

- Thermoset Powder Coatings

- Epoxy

- Polyester

- Pure Polyester

- Hybrid Polyester

- Epoxy-Polyester Hybrid

- Acrylic

- Polyurethane

- Others

- Thermoplastic Powder Coatings

- Polyvinyl Chloride (PVC)

- Nylon

- Polyolefin

- Polyvinylidene Fluoride (PVDF)

- Others

- Electrostatic Spray

- Fluidized Bed

- Electrostatic Fluidized Bed

- Flame Spray

- Others

- Metal

- Steel

- Aluminum

- Galvanized Steel

- Cast Iron

- Others

- Non-Metal

- Glass

- Ceramics

- MDF (Medium Density Fiberboard)

- Plastics

- Others

- Protective Coatings

- Decorative Coatings

- Functional Coatings

- Anti-Corrosion

- Anti-Microbial

- Heat Resistant

- Chemical Resistant

- Others

- Conventional Powder Coatings

- UV-Curable Powder Coatings

- Low-Temperature Curable Powder Coatings

- Nano Powder Coatings

- Below 10 Microns

- 10-30 Microns

- 30-50 Microns

- Above 50 Microns

- Automotive & Transportation

- Wheels & Rims

- Body Parts & Panels

- Engine Components

- Chassis & Frames

- Trims & Accessories

- Underbody Protection

- Others

- Architectural & Building

- Window & Door Frames

- Façade Cladding

- Roofing Systems

- Railings & Fencing

- Others

- Furniture

- Office Furniture

- Home Furniture

- Outdoor Furniture

- Metal Shelving & Racks

- Filing Cabinets

- Others

- Appliances & White Goods

- Refrigerators

- Washing Machines

- Dishwashers

- Ovens & Microwaves

- Air Conditioners

- Others

- General Industrial

- Machinery & Equipment

- Material Handling Equipment

- Storage Systems

- Agricultural Equipment

- Industrial Piping

- Others

- Electronics & Electrical

- Electrical Enclosures

- Control Panels

- Switchgear

- Transformers

- Cable Trays

- Others

- Oil & Gas

- Pipelines

- Valves & Fittings

- Storage Tanks

- Drilling Equipment

- Offshore Platforms

- Others

- Consumer Goods

- Sporting Goods

- Garden Equipment

- Lighting Fixtures

- Toys & Recreation

- Display Fixtures

- Others

- Other End-users

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Powder Coatings Market Outlook

- 2.1.1. Powder Coatings Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Powder Coatings Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Chemicals & Materials Industry Overview, 2025

- 3.1.1. Chemicals & Materials Industry Ecosystem Analysis

- 3.1.2. Key Trends for Chemicals & Materials Industry

- 3.1.3. Regional Distribution for Chemicals & Materials Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Chemicals & Materials Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for eco-friendly coatings due to low VOC emissions and stricter environmental regulations

- 4.1.1.2. Growing industrialization and construction activity, especially in emerging markets

- 4.1.1.3. Technological advancements such as low-temperature cure powders, UV-curable, and antimicrobial coatings

- 4.1.2. Restraints

- 4.1.2.1. High initial investment cost for specialized powder coating equipment

- 4.1.2.2. Raw material price volatility, particularly for resins and pigments

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Powder Coatings Manufacturers

- 4.4.3. Distribution & Logistics

- 4.4.4. Application & Implementation

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Powder Coatings Market Demand

- 4.9.1. Historical Market Size –Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size –Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Powder Coatings Market Analysis, by Resin Type

- 6.1. Key Segment Analysis

- 6.2. Powder Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, by Resin Type, 2021-2035

- 6.2.1. Thermoset Powder Coatings

- 6.2.1.1. Epoxy

- 6.2.1.2. Polyester

- 6.2.1.2.1. Pure Polyester

- 6.2.1.2.2. Hybrid Polyester

- 6.2.1.3. Epoxy-Polyester Hybrid

- 6.2.1.4. Acrylic

- 6.2.1.5. Polyurethane

- 6.2.1.6. Others

- 6.2.2. Thermoplastic Powder Coatings

- 6.2.2.1. Polyvinyl Chloride (PVC)

- 6.2.2.2. Nylon

- 6.2.2.3. Polyolefin

- 6.2.2.4. Polyvinylidene Fluoride (PVDF)

- 6.2.2.5. Others

- 6.2.1. Thermoset Powder Coatings

- 7. Global Powder Coatings Market Analysis, by Coating Method

- 7.1. Key Segment Analysis

- 7.2. Powder Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, by Coating Method, 2021-2035

- 7.2.1. Electrostatic Spray

- 7.2.2. Fluidized Bed

- 7.2.3. Electrostatic Fluidized Bed

- 7.2.4. Flame Spray

- 7.2.5. Others

- 8. Global Powder Coatings Market Analysis, by Substrate Type

- 8.1. Key Segment Analysis

- 8.2. Powder Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, by Substrate Type, 2021-2035

- 8.2.1. Metal

- 8.2.1.1. Steel

- 8.2.1.2. Aluminum

- 8.2.1.3. Galvanized Steel

- 8.2.1.4. Cast Iron

- 8.2.1.5. Others

- 8.2.2. Non-Metal

- 8.2.2.1. Glass

- 8.2.2.2. Ceramics

- 8.2.2.3. MDF (Medium Density Fiberboard)

- 8.2.2.4. Plastics

- 8.2.2.5. Others

- 8.2.1. Metal

- 9. Global Powder Coatings Market Analysis, by Functionality

- 9.1. Key Segment Analysis

- 9.2. Powder Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, by Functionality, 2021-2035

- 9.2.1. Protective Coatings

- 9.2.2. Decorative Coatings

- 9.2.3. Functional Coatings

- 9.2.3.1. Anti-Corrosion

- 9.2.3.2. Anti-Microbial

- 9.2.3.3. Heat Resistant

- 9.2.3.4. Chemical Resistant

- 9.2.3.5. Others

- 10. Global Powder Coatings Market Analysis, by Technology

- 10.1. Key Segment Analysis

- 10.2. Powder Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, by Technology, 2021-2035

- 10.2.1. Conventional Powder Coatings

- 10.2.2. UV-Curable Powder Coatings

- 10.2.3. Low-Temperature Curable Powder Coatings

- 10.2.4. Nano Powder Coatings

- 11. Global Powder Coatings Market Analysis, by Particle Size

- 11.1. Key Segment Analysis

- 11.2. Powder Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, by Particle Size, 2021-2035

- 11.2.1. Below 10 Microns

- 11.2.2. 10-30 Microns

- 11.2.3. 30-50 Microns

- 11.2.4. Above 50 Microns

- 12. Global Powder Coatings Market Analysis, by End-users

- 12.1. Key Segment Analysis

- 12.2. Powder Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 12.2.1. Automotive & Transportation

- 12.2.1.1. Wheels & Rims

- 12.2.1.2. Body Parts & Panels

- 12.2.1.3. Engine Components

- 12.2.1.4. Chassis & Frames

- 12.2.1.5. Trims & Accessories

- 12.2.1.6. Underbody Protection

- 12.2.1.7. Others

- 12.2.2. Architectural & Building

- 12.2.2.1. Window & Door Frames

- 12.2.2.2. Façade Cladding

- 12.2.2.3. Roofing Systems

- 12.2.2.4. Railings & Fencing

- 12.2.2.5. Others

- 12.2.3. Furniture

- 12.2.3.1. Office Furniture

- 12.2.3.2. Home Furniture

- 12.2.3.3. Outdoor Furniture

- 12.2.3.4. Metal Shelving & Racks

- 12.2.3.5. Filing Cabinets

- 12.2.3.6. Others

- 12.2.4. Appliances & White Goods

- 12.2.4.1. Refrigerators

- 12.2.4.2. Washing Machines

- 12.2.4.3. Dishwashers

- 12.2.4.4. Ovens & Microwaves

- 12.2.4.5. Air Conditioners

- 12.2.4.6. Others

- 12.2.5. General Industrial

- 12.2.5.1. Machinery & Equipment

- 12.2.5.2. Material Handling Equipment

- 12.2.5.3. Storage Systems

- 12.2.5.4. Agricultural Equipment

- 12.2.5.5. Industrial Piping

- 12.2.5.6. Others

- 12.2.6. Electronics & Electrical

- 12.2.6.1. Electrical Enclosures

- 12.2.6.2. Control Panels

- 12.2.6.3. Switchgear

- 12.2.6.4. Transformers

- 12.2.6.5. Cable Trays

- 12.2.6.6. Others

- 12.2.7. Oil & Gas

- 12.2.7.1. Pipelines

- 12.2.7.2. Valves & Fittings

- 12.2.7.3. Storage Tanks

- 12.2.7.4. Drilling Equipment

- 12.2.7.5. Offshore Platforms

- 12.2.7.6. Others

- 12.2.8. Consumer Goods

- 12.2.8.1. Sporting Goods

- 12.2.8.2. Garden Equipment

- 12.2.8.3. Lighting Fixtures

- 12.2.8.4. Toys & Recreation

- 12.2.8.5. Display Fixtures

- 12.2.8.6. Others

- 12.2.9. Other End-users

- 12.2.1. Automotive & Transportation

- 13. Global Powder Coatings Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Powder Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Powder Coatings Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Powder Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Resin Type

- 14.3.2. Coating Method

- 14.3.3. Substrate Type

- 14.3.4. Functionality

- 14.3.5. Technology

- 14.3.6. Particle Size

- 14.3.7. End-users

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Powder Coatings Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Resin Type

- 14.4.3. Coating Method

- 14.4.4. Substrate Type

- 14.4.5. Functionality

- 14.4.6. Technology

- 14.4.7. Particle Size

- 14.4.8. End-users

- 14.5. Canada Powder Coatings Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Resin Type

- 14.5.3. Coating Method

- 14.5.4. Substrate Type

- 14.5.5. Functionality

- 14.5.6. Technology

- 14.5.7. Particle Size

- 14.5.8. End-users

- 14.6. Mexico Powder Coatings Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Resin Type

- 14.6.3. Coating Method

- 14.6.4. Substrate Type

- 14.6.5. Functionality

- 14.6.6. Technology

- 14.6.7. Particle Size

- 14.6.8. End-users

- 15. Europe Powder Coatings Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Powder Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Resin Type

- 15.3.2. Coating Method

- 15.3.3. Substrate Type

- 15.3.4. Functionality

- 15.3.5. Technology

- 15.3.6. Particle Size

- 15.3.7. End-users

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Powder Coatings Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Resin Type

- 15.4.3. Coating Method

- 15.4.4. Substrate Type

- 15.4.5. Functionality

- 15.4.6. Technology

- 15.4.7. Particle Size

- 15.4.8. End-users

- 15.5. United Kingdom Powder Coatings Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Resin Type

- 15.5.3. Coating Method

- 15.5.4. Substrate Type

- 15.5.5. Functionality

- 15.5.6. Technology

- 15.5.7. Particle Size

- 15.5.8. End-users

- 15.6. France Powder Coatings Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Resin Type

- 15.6.3. Coating Method

- 15.6.4. Substrate Type

- 15.6.5. Functionality

- 15.6.6. Technology

- 15.6.7. Particle Size

- 15.6.8. End-users

- 15.7. Italy Powder Coatings Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Resin Type

- 15.7.3. Coating Method

- 15.7.4. Substrate Type

- 15.7.5. Functionality

- 15.7.6. Technology

- 15.7.7. Particle Size

- 15.7.8. End-users

- 15.8. Spain Powder Coatings Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Resin Type

- 15.8.3. Coating Method

- 15.8.4. Substrate Type

- 15.8.5. Functionality

- 15.8.6. Technology

- 15.8.7. Particle Size

- 15.8.8. End-users

- 15.9. Netherlands Powder Coatings Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Resin Type

- 15.9.3. Coating Method

- 15.9.4. Substrate Type

- 15.9.5. Functionality

- 15.9.6. Technology

- 15.9.7. Particle Size

- 15.9.8. End-users

- 15.10. Nordic Countries Powder Coatings Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Resin Type

- 15.10.3. Coating Method

- 15.10.4. Substrate Type

- 15.10.5. Functionality

- 15.10.6. Technology

- 15.10.7. Particle Size

- 15.10.8. End-users

- 15.11. Poland Powder Coatings Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Resin Type

- 15.11.3. Coating Method

- 15.11.4. Substrate Type

- 15.11.5. Functionality

- 15.11.6. Technology

- 15.11.7. Particle Size

- 15.11.8. End-users

- 15.12. Russia & CIS Powder Coatings Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Resin Type

- 15.12.3. Coating Method

- 15.12.4. Substrate Type

- 15.12.5. Functionality

- 15.12.6. Technology

- 15.12.7. Particle Size

- 15.12.8. End-users

- 15.13. Rest of Europe Powder Coatings Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Resin Type

- 15.13.3. Coating Method

- 15.13.4. Substrate Type

- 15.13.5. Functionality

- 15.13.6. Technology

- 15.13.7. Particle Size

- 15.13.8. End-users

- 16. Asia Pacific Powder Coatings Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Asia Pacific Powder Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Resin Type

- 16.3.2. Coating Method

- 16.3.3. Substrate Type

- 16.3.4. Functionality

- 16.3.5. Technology

- 16.3.6. Particle Size

- 16.3.7. End-users

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Powder Coatings Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Resin Type

- 16.4.3. Coating Method

- 16.4.4. Substrate Type

- 16.4.5. Functionality

- 16.4.6. Technology

- 16.4.7. Particle Size

- 16.4.8. End-users

- 16.5. India Powder Coatings Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Resin Type

- 16.5.3. Coating Method

- 16.5.4. Substrate Type

- 16.5.5. Functionality

- 16.5.6. Technology

- 16.5.7. Particle Size

- 16.5.8. End-users

- 16.6. Japan Powder Coatings Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Resin Type

- 16.6.3. Coating Method

- 16.6.4. Substrate Type

- 16.6.5. Functionality

- 16.6.6. Technology

- 16.6.7. Particle Size

- 16.6.8. End-users

- 16.7. South Korea Powder Coatings Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Resin Type

- 16.7.3. Coating Method

- 16.7.4. Substrate Type

- 16.7.5. Functionality

- 16.7.6. Technology

- 16.7.7. Particle Size

- 16.7.8. End-users

- 16.8. Australia and New Zealand Powder Coatings Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Resin Type

- 16.8.3. Coating Method

- 16.8.4. Substrate Type

- 16.8.5. Functionality

- 16.8.6. Technology

- 16.8.7. Particle Size

- 16.8.8. End-users

- 16.9. Indonesia Powder Coatings Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Resin Type

- 16.9.3. Coating Method

- 16.9.4. Substrate Type

- 16.9.5. Functionality

- 16.9.6. Technology

- 16.9.7. Particle Size

- 16.9.8. End-users

- 16.10. Malaysia Powder Coatings Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Resin Type

- 16.10.3. Coating Method

- 16.10.4. Substrate Type

- 16.10.5. Functionality

- 16.10.6. Technology

- 16.10.7. Particle Size

- 16.10.8. End-users

- 16.11. Thailand Powder Coatings Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Resin Type

- 16.11.3. Coating Method

- 16.11.4. Substrate Type

- 16.11.5. Functionality

- 16.11.6. Technology

- 16.11.7. Particle Size

- 16.11.8. End-users

- 16.12. Vietnam Powder Coatings Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Resin Type

- 16.12.3. Coating Method

- 16.12.4. Substrate Type

- 16.12.5. Functionality

- 16.12.6. Technology

- 16.12.7. Particle Size

- 16.12.8. End-users

- 16.13. Rest of Asia Pacific Powder Coatings Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Resin Type

- 16.13.3. Coating Method

- 16.13.4. Substrate Type

- 16.13.5. Functionality

- 16.13.6. Technology

- 16.13.7. Particle Size

- 16.13.8. End-users

- 17. Middle East Powder Coatings Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Powder Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Resin Type

- 17.3.2. Coating Method

- 17.3.3. Substrate Type

- 17.3.4. Functionality

- 17.3.5. Technology

- 17.3.6. Particle Size

- 17.3.7. End-users

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Powder Coatings Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Resin Type

- 17.4.3. Coating Method

- 17.4.4. Substrate Type

- 17.4.5. Functionality

- 17.4.6. Technology

- 17.4.7. Particle Size

- 17.4.8. End-users

- 17.5. UAE Powder Coatings Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Resin Type

- 17.5.3. Coating Method

- 17.5.4. Substrate Type

- 17.5.5. Functionality

- 17.5.6. Technology

- 17.5.7. Particle Size

- 17.5.8. End-users

- 17.6. Saudi Arabia Powder Coatings Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Resin Type

- 17.6.3. Coating Method

- 17.6.4. Substrate Type

- 17.6.5. Functionality

- 17.6.6. Technology

- 17.6.7. Particle Size

- 17.6.8. End-users

- 17.7. Israel Powder Coatings Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Resin Type

- 17.7.3. Coating Method

- 17.7.4. Substrate Type

- 17.7.5. Functionality

- 17.7.6. Technology

- 17.7.7. Particle Size

- 17.7.8. End-users

- 17.8. Rest of Middle East Powder Coatings Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Resin Type

- 17.8.3. Coating Method

- 17.8.4. Substrate Type

- 17.8.5. Functionality

- 17.8.6. Technology

- 17.8.7. Particle Size

- 17.8.8. End-users

- 18. Africa Powder Coatings Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Powder Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Resin Type

- 18.3.2. Coating Method

- 18.3.3. Substrate Type

- 18.3.4. Functionality

- 18.3.5. Technology

- 18.3.6. Particle Size

- 18.3.7. End-users

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Powder Coatings Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Resin Type

- 18.4.3. Coating Method

- 18.4.4. Substrate Type

- 18.4.5. Functionality

- 18.4.6. Technology

- 18.4.7. Particle Size

- 18.4.8. End-users

- 18.5. Egypt Powder Coatings Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Resin Type

- 18.5.3. Coating Method

- 18.5.4. Substrate Type

- 18.5.5. Functionality

- 18.5.6. Technology

- 18.5.7. Particle Size

- 18.5.8. End-users

- 18.6. Nigeria Powder Coatings Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Resin Type

- 18.6.3. Coating Method

- 18.6.4. Substrate Type

- 18.6.5. Functionality

- 18.6.6. Technology

- 18.6.7. Particle Size

- 18.6.8. End-users

- 18.7. Algeria Powder Coatings Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Resin Type

- 18.7.3. Coating Method

- 18.7.4. Substrate Type

- 18.7.5. Functionality

- 18.7.6. Technology

- 18.7.7. Particle Size

- 18.7.8. End-users

- 18.8. Rest of Africa Powder Coatings Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Resin Type

- 18.8.3. Coating Method

- 18.8.4. Substrate Type

- 18.8.5. Functionality

- 18.8.6. Technology

- 18.8.7. Particle Size

- 18.8.8. End-users

- 19. South America Powder Coatings Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. South America Powder Coatings Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Resin Type

- 19.3.2. Coating Method

- 19.3.3. Substrate Type

- 19.3.4. Functionality

- 19.3.5. Technology

- 19.3.6. Particle Size

- 19.3.7. End-users

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Powder Coatings Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Resin Type

- 19.4.3. Coating Method

- 19.4.4. Substrate Type

- 19.4.5. Functionality

- 19.4.6. Technology

- 19.4.7. Particle Size

- 19.4.8. End-users

- 19.5. Argentina Powder Coatings Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Resin Type

- 19.5.3. Coating Method

- 19.5.4. Substrate Type

- 19.5.5. Functionality

- 19.5.6. Technology

- 19.5.7. Particle Size

- 19.5.8. End-users

- 19.6. Rest of South America Powder Coatings Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Resin Type

- 19.6.3. Coating Method

- 19.6.4. Substrate Type

- 19.6.5. Functionality

- 19.6.6. Technology

- 19.6.7. Particle Size

- 19.6.8. End-users

- 20. Key Players/ Company Profile

- 20.1. AkzoNobel N.V.

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Axalta Coating Systems

- 20.3. Beckers Group

- 20.4. Chromaflo Technologies

- 20.5. Forrest Technical Coatings

- 20.6. Hempel A/S

- 20.7. IFS Coatings

- 20.8. Induron Coatings Inc.

- 20.9. Jotun A/S

- 20.10. Kansai Paint Co. Ltd.

- 20.11. Nippon Paint Holdings

- 20.12. Nortek Powder Coating

- 20.13. Platinum Phase Sdn Bhd

- 20.14. PPG Industries Inc.

- 20.15. Protech Powder Coatings Inc.

- 20.16. RPM International Inc.

- 20.17. Sherwin-Williams Company

- 20.18. Teknos Group

- 20.19. TIGER Drylac U.S.A. Inc.

- 20.20. Vogel Paint Inc.

- 20.21. Other Key Players

- 20.1. AkzoNobel N.V.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Powder Coatings Market Size, Share & Trends Analysis Report by Resin Type (Thermoset Powder Coatings, Thermoplastic Powder Coatings), Coating Method, Substrate Type, Functionality, Technology, Particle Size, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Powder Coatings Market Size, Share, and Growth

The global powder coatings market is experiencing robust growth, with its estimated value of USD 13.8 billion in the year 2025 and USD 22.7 billion by 2035, registering a CAGR of 5.1%, during the forecast period. The global powder coatings market is primarily driven by rising demand for durable, eco-friendly coatings that offer superior corrosion, chemical, and abrasion resistance with minimal VOC emissions. Growth in automotive, appliances, construction, and industrial manufacturing sectors is fueling adoption, supported by rapid urbanization, infrastructure investments, and increasing consumer preference for high-performance finishes.

Mehmet Ali Kamacıoğlu, Jotun’s Global Sales & Marketing Director for Powder Coatings said,

“Powder coatings can be used to coat various elements in a high voltage battery pack, which are subject to thousands of charge and discharge cycles over its lifetime under a wide range of environmental conditions, Our powder coating systems are engineered to provide more reliable electrical insulation, thermal management and corrosion protection to increase durability while also maintaining the integrity of the electrical circuit.”

The global powder coatings market is primarily propelled by robust growth in the industry and changing environmental regulations. To meet strict VOC policies and achieve a more comprehensive corporate sustainability goal, manufacturers are progressively moving towards solvent free powder coating processes to improve regulatory compliance and environmental responsibility. For instance, in June 2025, PPG industries launched its new advanced powder coating portfolio, with the focus more on the enhanced durability and energy-saving characteristic of the product used in automotive, industrial, and architecture sectors.

Moreover, the global powder coatings market is also driven by the rapid use of lightweight materials in automotive, appliances and consumer electronics as the powder coatings provide superior adhesion and impact resistance to substrates such as aluminium and composite and have minimum added weight. For example, in September 2024, AkzoNobel N.V. introduced its Interpon D Natural Metals collection a sustainable metallic powder coating specifically made to use on architectural metal finishes with no VOCs and enable overspray reuse. This provides manufacturers with a high-performance and light finishing solution which is propelling wider market adoption.

Adjacent opportunities to the global powder coatings market include advances in UV-curable coatings, heat-sensitive substrate coatings for plastics, smart/functional coatings such as anti-microbial surfaces, rapid-curing technologies for EV and aerospace components, and recyclable coating systems enabling circular manufacturing. These markets increase the growth opportunities beyond the conventional metal finishing markets.

Powder Coatings Market Dynamics and Trends

Driver: Accelerated Electrification Demands Specialized Coatings for Lightweight Electric Vehicle Components

Restraint: Limited Thermal Sensitivity and Substrate Compatibility Restrict Powder Coating Applications

Opportunity: Integration with Circular Economy Enables Recyclable and Low-Carbon Coating Systems

Key Trend: Digitalization and Automation Optimize Application, Curing, and Quality Control Processes

Powder-Coatings-Market Analysis and Segmental Data

Thermoset Powder Coatings Dominate Global Powder Coatings Market

Asia Pacific Leads Global Powder Coatings Market Demand

Powder-Coatings-Market Ecosystem

The global powder coatings market is moderately fragmented, with high concentration among key players such as AkzoNobel N.V., PPG Industries Inc., Axalta Coating Systems, The Sherwin-Williams Company, and Jotun A/S, who dominate through their strong concentration with their large distribution channels, wide product ranges and great penetration in the car manufacturing, appliances, architecture and industrial manufacturing. They also have a competitive advantage in the form of their high level of development of R&D, sustainability-oriented innovations, strategic acquisition, and growth of their capacity in the region which allows the reliable global supply and stable quality performance which smaller competitors cannot achieve often.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 13.8 Bn |

|

Market Forecast Value in 2035 |

USD 22.7 Bn |

|

Growth Rate (CAGR) |

5.1% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Powder-Coatings-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Powder Coatings Market, By Resin Type |

|

|

Powder Coatings Market, By Coating Method |

|

|

Powder Coatings Market, By Substrate Type |

|

|

Powder Coatings Market, By Functionality |

|

|

Powder Coatings Market, By Technology

|

|

|

Powder Coatings Market, By Particle Size

|

|

|

Powder Coatings Market, By End-users

|

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation