Tartaric Acid Market Size, Share & Trends Analysis Report by Source Type (Natural, Synthetic), Type, Purity Level, Functionality, Form, Applications, Distribution Channel, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025 – 2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Tartaric Acid Market Size, Share, and Growth

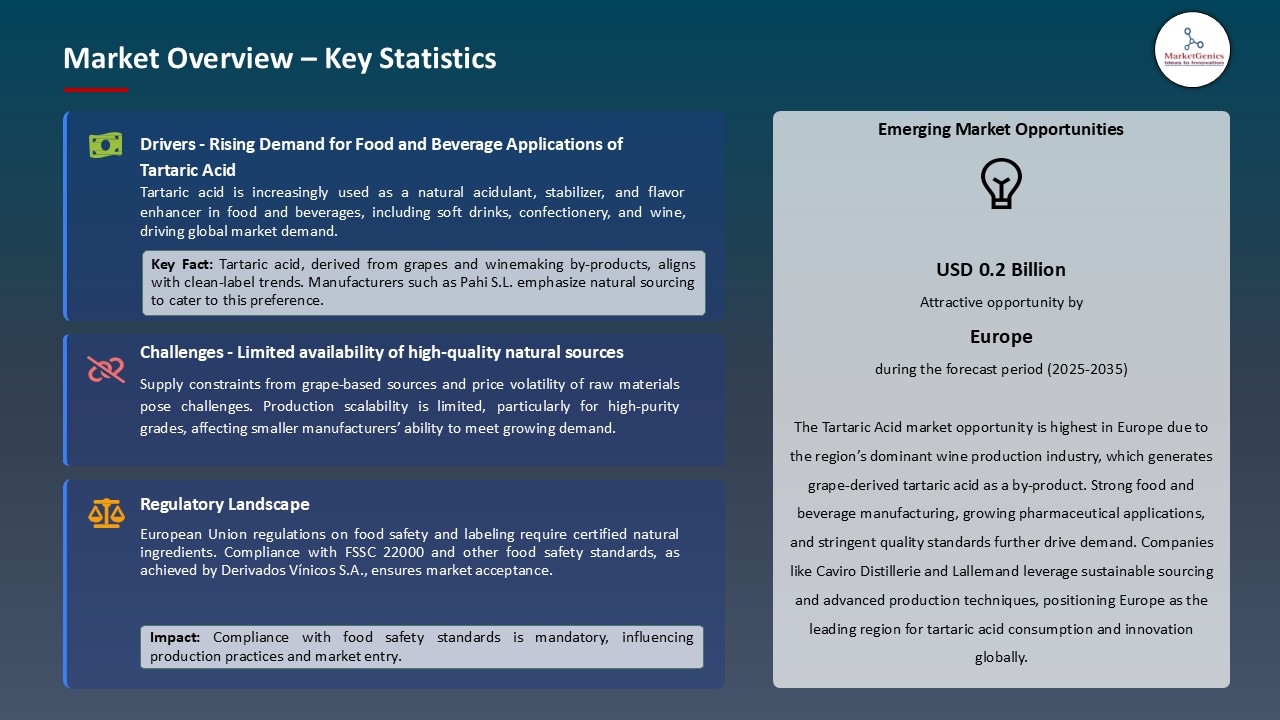

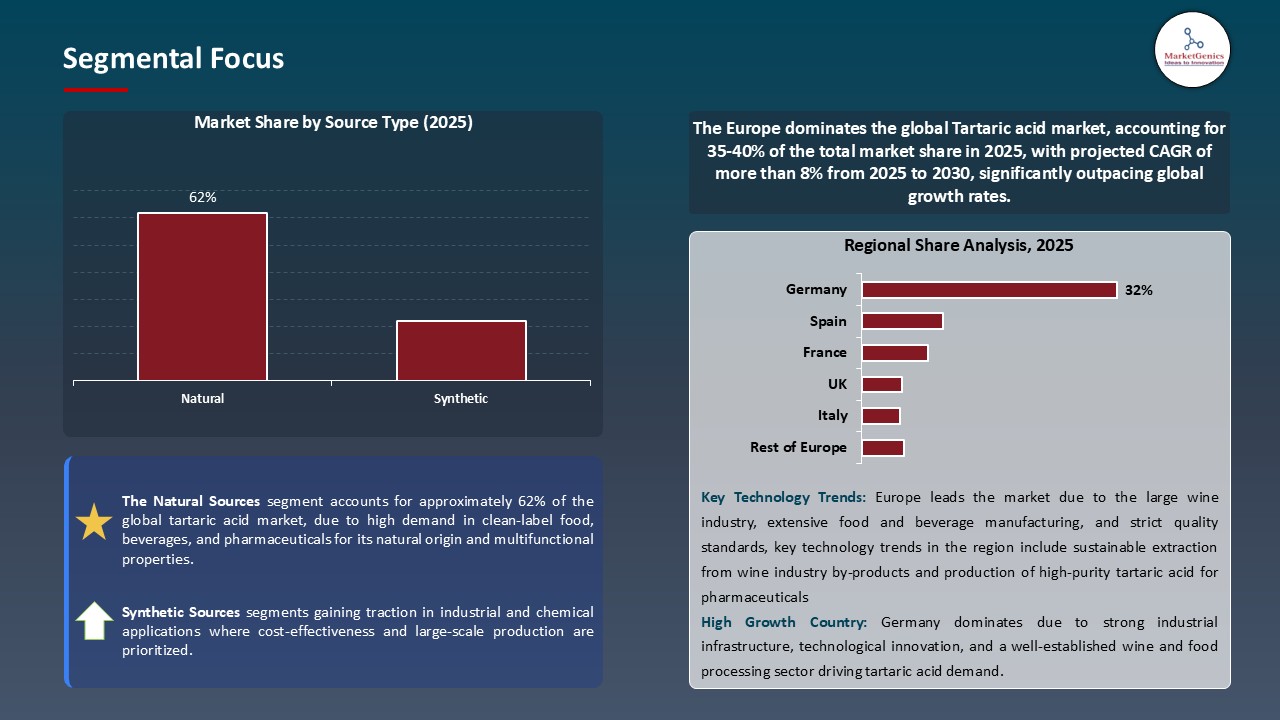

The global tartaric acid market is experiencing robust growth, with its estimated value of USD 0.4 billion in the year 2025 and USD 0.8 billion by the period 2035, registering a CAGR of 7.6%. Europe leads the market with market share of 38.2% with USD 0.2 billion revenue.

RANDI GROUP, under the leadership of CEO Randi Zhang, is expanding its tartaric acid production and distribution networks into emerging markets, aiming to meet the increasing demand in Asia and Latin America.

The tartaric acid market is growing strongly with its tremendous applications in different industries. Tartaric acid is used as a key acidulant and a stabilizer in the food and beverage industry to increase the quality and shelf life of foodstuffs such as wines, baked goods, and effervescent beverages. The pharmaceutical industry is another significant contributor to the market using tartaric acid as an active pharmaceutical ingredient and excipient.

In addition, the cosmetics market exploits its antioxidant effects in the skincare products. The immediate events also reinforce the growth of the market. As an example, in 2025, Tarac Technologies introduced a new series of tartaric acid derivatives to enhance the texture and stability of plant-based food items to meet the needs of an increasingly vegan and vegetarian target group. Furthermore, in 2024, Caviro Distillerie Srl increased its capacity in Italy to produce tartaric acid to satisfy the growing demand of wine product especially in the European market. Such examples underscore the industry sensitivity to changing consumer tastes and preferences in the market. The trend of the market shows that it is on a healthy growth curve, and the applications and innovations are on the rise.

The worldwide tartaric acid market has opportunities in related markets like natural food preservatives, pharmaceutical organic acids, biodegradable packaging additives, natural beverage stabilizers, and natural cosmetic formulation enhancers. The growth of applications in these fields will enable manufacturers to increase revenue streams and product innovation. These cross-industry integrations are sure to lead to sustained growth in the market.

Tartaric Acid Market Dynamics and Trends

Driver: Growing Demand for Natural and Organic Food Products

- The growing demand among consumers on natural and organic food products is greatly affecting the world tartaric acid market. The rise of awareness of health and wellness is reflected in the shift towards products of clean labeling with limited chemical additives. Tartaric acid is a natural product that meets these consumer needs and this makes it a favorite ingredient in the food and beverage industry.

- As an example, in 2024, Tarac Technologies unveiled a new family of tartaric acid derivatives which would enhance the texture and stability of plant-based food products, to meet the increasing demand of vegan and vegetarian consumers. This initiative underscores the sensitivity of the industry to evolving consumer needs and the market.

- The increasing trend towards natural food is likely to drive the market of tartaric acid to expand.

Restraint: Rising Raw Material Costs and Supply Chain Challenges

- The challenges facing the global tartaric acid market are associated with increasing the prices of raw materials and disruption of the supply chain. Grapes are the natural products and most sources of tartaric acid and its production is likely to face fluctuation in agricultural output and weather conditions. Provisionally, the demand and the strengthening trade tensions with China in April 2025, the price of tartaric acid in the U.S market would have been 10 times more expensive, and the production cost would be even greater.

- This type of price volatility can put pressure on the manufacturers, especially those who depend on imported raw materials, and can lead to increased consumer prices. Furthermore, the supply chain interruptions might result in shortages and delays in the manufacture, therefore, putting additional strain on the budget due to the geopolitical tensions or natural disasters.

- The above factors present serious threats to the stability and profitability of the tartaric acid market.

Opportunity: Expansion of Tartaric Acid Applications in Pharmaceuticals

- The market of tartaric acid has a great prospect in the pharmaceutical industry. Tartaric acid is also used in the development of active pharmaceutical ingredients and excipients and can improve the solubility and stability of drugs, with purity and stereochemistry typically validated using high-performance liquid chromatography. The increasing use of generic drugs and the increasing popularity of low-cost healthcare-related services are adding to the need to use effective and reliable excipients.

- In 2024, Caviro Distillerie Srl increased its production capacity in Italy to satisfy the rising demand of tartaric acid in the pharmaceutical products industry especially in the European market. This expansion highlights the potential of tartaric acid in the context of a valuable component in pharmaceutical preparations.

- With the pharmaceutical sector worldwide growing steadily, the need of tartaric acid will consequently increase, providing the manufacturer with a profitable growth and diversification opportunity.

Key Trend: Sustainable and Eco-Friendly Production Practices

- The emergence of more significant environmental concerns and regulatory pressures is making sustainability a trend in the manufacturing of tartaric acid. To minimize their impact on the environment, manufacturers are moving towards greener production processes, including the use of renewable energy sources and minimization of waste.

- A case in point is Tarac Technologies launching a new tartaric acid-based range of products in 2025 to improve the texture and stability of plant-based foodstuffs due to the growing vegan and vegetarian consumer base. This project shows that the industry cares about sustainability and is aligned with consumer preferences towards products that are environmentally friendly.

- The environmental value relates not only to the fact that the tendency to sustainable production practice can be beneficial to the environment, but also to the brand image of the manufacturers which can lead to consumer loyalty and market share.

Tartaric Acid Market Analysis and Segmental Data

Natural Tartaric Acid: Meeting Consumer Demand for Clean Label Ingredients

- Natural tartaric acid is in high demand as it complies with the increasing health awareness of consumers toward clean-label and organic products. Health-conscious people and environmental concerns have led to the growing demand by consumers of food and beverage products that contain natural additives. The natural tartaric acid available as a by-product of grapes satisfies these requirements and offers an alternative to synthetic acids that is biodegradable and environmental friendly.

- Caviro Distillerie Srl increased its production of natural tartaric acid in Italy in 2024 to satisfy the growing needs of natural tartaric acid in the wine sector, especially in the European market. This kind of gesture underscores the sensitivity of the industry to the evolving tastes and preferences of consumers and market forces.

- The move towards natural ingredients has not only been a trend but a major shift in the market that has affected product formulations in different industries.

Europe's Dominance in Tartaric Acid Production Driven by Wine Industry

- Europe dominates the global tartaric acid market, mostly due to its strong wine industry, especially in such nations as Italy, France and Spain. The countries are some of the largest wine producers in the world and they produce large amounts of grape by-products, a vital source of tartaric acid. In 2024, Caviro Distillerie Srl, which was in Italy, had to handle over 110,000 tons of winemaking by-products to obtain high value products like tartaric acid, bioethanol, biofuels and alcohol which is a pointer that tartaric acid production has been integrated in wine industry.

- The production of tartaric acid and wine in Europe is synergized to produce and supply the raw materials as needed, which makes the production processes cost-effective and sustainable. This integration does not only support the local economy but also makes Europe a major participant in the tartaric acid market. Sustainability and innovation also help in boosting the competitiveness of the region in the industry.

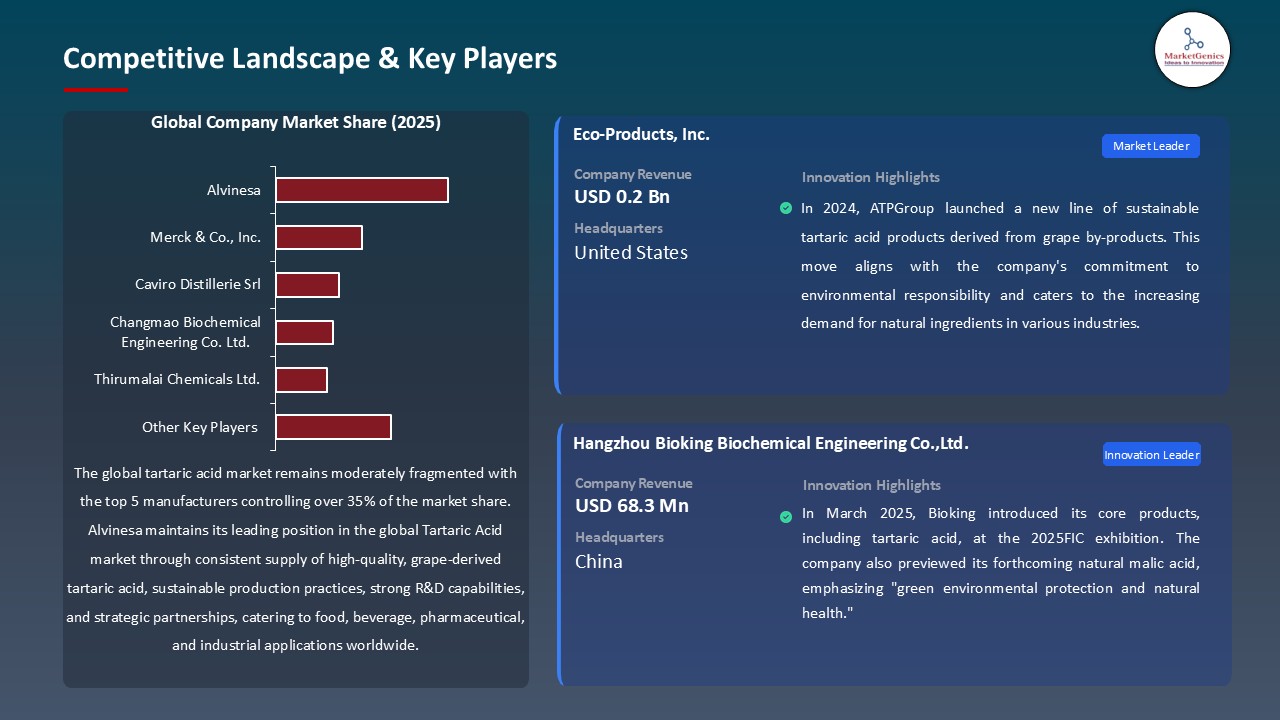

Tartaric Acid Market Ecosystem

The global tartaric acid market exhibits a moderately fragmented structure, with Tier 1 players like Merck & Co., Caviro Distillerie Srl, and Changmao Biochemical Engineering Co. Ltd. holding significant influence, while Tier 2 and Tier 3 companies, including Tarac Technologies Pty Ltd and Alvinesa, operate regionally. Buyer concentration is moderate, as key industries such as food and pharmaceuticals rely on multiple suppliers. Supplier concentration is relatively high, with limited large-scale producers controlling raw material availability, influencing pricing and supply stability.

Recent Development and Strategic Overview:

- In May 2025, Alvinesa participated in Vitafoods Europe in Barcelona, showcasing their premium grape-derived ingredients, including natural tartaric acid. This move underscores their commitment to clean-label and sustainable products, aligning with the growing demand for natural additives in the food and beverage industry.

- In July 2024, Adani Wilmar acquired 67% stake in speciality chemical company Omkar Chemicals, which operates a manufacturing plant in Gujarat, India, with a production capacity of approximately 20,000 tonnes/year of surfactants. The acquisition was a strategic step for Adani Wilmar as it looked to establish a strong production footprint in the speciality chemicals market, which included sectors such as home and personal care products, food additives, plastics and polymers, agrochemicals, and lubricants and petrochemicals.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 0.4 Bn |

|

Market Forecast Value in 2035 |

USD 0.8 Bn |

|

Growth Rate (CAGR) |

7.6% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value

|

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Tartaric Acid Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Source Type |

|

|

By Type |

|

|

By Purity Level |

|

|

By Functionality |

|

|

By Form |

|

|

By Applications |

|

|

By Distribution Channel |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Tartaric Acid Market Outlook

- 2.1.1. Tartaric Acid Market Size (Value – US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Tartaric Acid Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Chemicals & Materials Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Chemicals & Materials Industry

- 3.1.3. Regional Distribution for Chemicals & Materials Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Chemicals & Materials Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand in food and beverage as a natural acidulant.

- 4.1.1.2. Growing pharmaceutical and cosmetic applications.

- 4.1.1.3. Expanding industrial and chemical usage.

- 4.1.2. Restraints

- 4.1.2.1. Price volatility of raw materials.

- 4.1.2.2. Strict environmental and regulatory compliance requirements

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Tartaric Acid Producers

- 4.4.3. Distributors/ Suppliers

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Tartaric Acid Market Demand

- 4.9.1. Historical Market Size - in Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - in Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Tartaric Acid Market Analysis, by Source Type

- 6.1. Key Segment Analysis

- 6.2. Tartaric Acid Market Size (Value - US$ Bn), Analysis, and Forecasts, by Source Type, 2021-2035

- 6.2.1. Natural

- 6.2.2. Synthetic

- 7. Global Tartaric Acid Market Analysis, by Type

- 7.1. Key Segment Analysis

- 7.2. Tartaric Acid Market Size (Value - US$ Bn), Analysis, and Forecasts, by Type, 2021-2035

- 7.2.1. L(+)-Tartaric Acid

- 7.2.2. D(-)-Tartaric Acid

- 7.2.3. DL-Tartaric Acid (Racemic)

- 8. Global Tartaric Acid Market Analysis, by Purity Level

- 8.1. Key Segment Analysis

- 8.2. Tartaric Acid Market Size (Value - US$ Bn), Analysis, and Forecasts, by Purity Level, 2021-2035

- 8.2.1. Food Grade

- 8.2.2. Pharmaceutical Grade

- 8.2.3. Industrial Grade

- 9. Global Tartaric Acid Market Analysis, by Functionality

- 9.1. Key Segment Analysis

- 9.2. Tartaric Acid Market Size (Value - US$ Bn), Analysis, and Forecasts, by Functionality, 2021-2035

- 9.2.1. Acidulant

- 9.2.2. Antioxidant

- 9.2.3. Chelating Agent

- 9.2.4. Leavening Agent

- 9.2.5. Stabilizer

- 9.2.6. Preservative

- 9.2.7. Others

- 10. Global Tartaric Acid Market Analysis, by Form

- 10.1. Key Segment Analysis

- 10.2. Tartaric Acid Market Size (Value - US$ Bn), Analysis, and Forecasts, by Form, 2021-2035

- 10.2.1. Powder

- 10.2.2. Crystals

- 10.2.3. Granules

- 10.2.4. Liquid/Solution

- 11. Global Tartaric Acid Market Analysis, by Applications

- 11.1. Key Segment Analysis

- 11.2. Tartaric Acid Market Size (Value - US$ Bn), Analysis, and Forecasts, by Applications, 2021-2035

- 11.2.1. Food & Beverages

- 11.2.2. Pharmaceuticals & Nutraceuticals

- 11.2.3. Cosmetics & Personal Care

- 11.2.4. Industrial & Construction

- 11.2.5. Chemicals & Analytical Laboratories

- 11.2.6. Agriculture

- 11.2.7. Others

- 12. Global Tartaric Acid Market Analysis, by Distribution Channel

- 12.1. Key Segment Analysis

- 12.2. Tartaric Acid Market Size (Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 12.2.1. Direct Sales

- 12.2.2. Distributors & Suppliers

- 12.2.3. E-commerce / Online Chemical Marketplaces

- 12.2.4. Third-party Industrial Traders

- 13. Global Tartaric Acid Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Tartaric Acid Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Tartaric Acid Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Tartaric Acid Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Source Type

- 14.3.2. Type

- 14.3.3. Purity Level

- 14.3.4. Functionality

- 14.3.5. Form

- 14.3.6. Applications

- 14.3.7. Distribution Channel

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Tartaric Acid Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Source Type

- 14.4.3. Type

- 14.4.4. Purity Level

- 14.4.5. Functionality

- 14.4.6. Form

- 14.4.7. Applications

- 14.4.8. Distribution Channel

- 14.5. Canada Tartaric Acid Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Source Type

- 14.5.3. Type

- 14.5.4. Purity Level

- 14.5.5. Functionality

- 14.5.6. Form

- 14.5.7. Applications

- 14.5.8. Distribution Channel

- 14.6. Mexico Tartaric Acid Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Source Type

- 14.6.3. Type

- 14.6.4. Purity Level

- 14.6.5. Functionality

- 14.6.6. Form

- 14.6.7. Applications

- 14.6.8. Distribution Channel

- 15. Europe Tartaric Acid Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Tartaric Acid Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Source Type

- 15.3.2. Type

- 15.3.3. Purity Level

- 15.3.4. Functionality

- 15.3.5. Form

- 15.3.6. Applications

- 15.3.7. Distribution Channel

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Tartaric Acid Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Source Type

- 15.4.3. Type

- 15.4.4. Purity Level

- 15.4.5. Functionality

- 15.4.6. Form

- 15.4.7. Applications

- 15.4.8. Distribution Channel

- 15.5. United Kingdom Tartaric Acid Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Source Type

- 15.5.3. Type

- 15.5.4. Purity Level

- 15.5.5. Functionality

- 15.5.6. Form

- 15.5.7. Applications

- 15.5.8. Distribution Channel

- 15.6. France Tartaric Acid Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Source Type

- 15.6.3. Type

- 15.6.4. Purity Level

- 15.6.5. Functionality

- 15.6.6. Form

- 15.6.7. Applications

- 15.6.8. Distribution Channel

- 15.7. Italy Tartaric Acid Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Source Type

- 15.7.3. Type

- 15.7.4. Purity Level

- 15.7.5. Functionality

- 15.7.6. Form

- 15.7.7. Applications

- 15.7.8. Distribution Channel

- 15.8. Spain Tartaric Acid Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Source Type

- 15.8.3. Type

- 15.8.4. Purity Level

- 15.8.5. Functionality

- 15.8.6. Form

- 15.8.7. Applications

- 15.8.8. Distribution Channel

- 15.9. Netherlands Tartaric Acid Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Source Type

- 15.9.3. Type

- 15.9.4. Purity Level

- 15.9.5. Functionality

- 15.9.6. Form

- 15.9.7. Applications

- 15.9.8. Distribution Channel

- 15.10. Nordic Countries Tartaric Acid Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Source Type

- 15.10.3. Type

- 15.10.4. Purity Level

- 15.10.5. Functionality

- 15.10.6. Form

- 15.10.7. Applications

- 15.10.8. Distribution Channel

- 15.11. Poland Tartaric Acid Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Source Type

- 15.11.3. Type

- 15.11.4. Purity Level

- 15.11.5. Functionality

- 15.11.6. Form

- 15.11.7. Applications

- 15.11.8. Distribution Channel

- 15.12. Russia & CIS Tartaric Acid Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Source Type

- 15.12.3. Type

- 15.12.4. Purity Level

- 15.12.5. Functionality

- 15.12.6. Form

- 15.12.7. Applications

- 15.12.8. Distribution Channel

- 15.13. Rest of Europe Tartaric Acid Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Source Type

- 15.13.3. Type

- 15.13.4. Purity Level

- 15.13.5. Functionality

- 15.13.6. Form

- 15.13.7. Applications

- 15.13.8. Distribution Channel

- 16. Asia Pacific Tartaric Acid Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. East Asia Tartaric Acid Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Source Type

- 16.3.2. Type

- 16.3.3. Purity Level

- 16.3.4. Functionality

- 16.3.5. Form

- 16.3.6. Applications

- 16.3.7. Distribution Channel

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Tartaric Acid Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Source Type

- 16.4.3. Type

- 16.4.4. Purity Level

- 16.4.5. Functionality

- 16.4.6. Form

- 16.4.7. Applications

- 16.4.8. Distribution Channel

- 16.5. India Tartaric Acid Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Source Type

- 16.5.3. Type

- 16.5.4. Purity Level

- 16.5.5. Functionality

- 16.5.6. Form

- 16.5.7. Applications

- 16.5.8. Distribution Channel

- 16.6. Japan Tartaric Acid Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Source Type

- 16.6.3. Type

- 16.6.4. Purity Level

- 16.6.5. Functionality

- 16.6.6. Form

- 16.6.7. Applications

- 16.6.8. Distribution Channel

- 16.7. South Korea Tartaric Acid Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Source Type

- 16.7.3. Type

- 16.7.4. Purity Level

- 16.7.5. Functionality

- 16.7.6. Form

- 16.7.7. Applications

- 16.7.8. Distribution Channel

- 16.8. Australia and New Zealand Tartaric Acid Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Source Type

- 16.8.3. Type

- 16.8.4. Purity Level

- 16.8.5. Functionality

- 16.8.6. Form

- 16.8.7. Applications

- 16.8.8. Distribution Channel

- 16.9. Indonesia Tartaric Acid Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Source Type

- 16.9.3. Type

- 16.9.4. Purity Level

- 16.9.5. Functionality

- 16.9.6. Form

- 16.9.7. Applications

- 16.9.8. Distribution Channel

- 16.10. Malaysia Tartaric Acid Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Source Type

- 16.10.3. Type

- 16.10.4. Purity Level

- 16.10.5. Functionality

- 16.10.6. Form

- 16.10.7. Applications

- 16.10.8. Distribution Channel

- 16.11. Thailand Tartaric Acid Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Source Type

- 16.11.3. Type

- 16.11.4. Purity Level

- 16.11.5. Functionality

- 16.11.6. Form

- 16.11.7. Applications

- 16.11.8. Distribution Channel

- 16.12. Vietnam Tartaric Acid Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Source Type

- 16.12.3. Type

- 16.12.4. Purity Level

- 16.12.5. Functionality

- 16.12.6. Form

- 16.12.7. Applications

- 16.12.8. Distribution Channel

- 16.13. Rest of Asia Pacific Tartaric Acid Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Source Type

- 16.13.3. Type

- 16.13.4. Purity Level

- 16.13.5. Functionality

- 16.13.6. Form

- 16.13.7. Applications

- 16.13.8. Distribution Channel

- 17. Middle East Tartaric Acid Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Tartaric Acid Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Source Type

- 17.3.2. Type

- 17.3.3. Purity Level

- 17.3.4. Functionality

- 17.3.5. Form

- 17.3.6. Applications

- 17.3.7. Distribution Channel

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Tartaric Acid Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Source Type

- 17.4.3. Type

- 17.4.4. Purity Level

- 17.4.5. Functionality

- 17.4.6. Form

- 17.4.7. Applications

- 17.4.8. Distribution Channel

- 17.5. UAE Tartaric Acid Market

- 17.5.1. Raw Material Source

- 17.5.2. Source Type

- 17.5.3. Type

- 17.5.4. Purity Level

- 17.5.5. Functionality

- 17.5.6. Form

- 17.5.7. Applications

- 17.5.8. Distribution Channel

- 17.6. Saudi Arabia Tartaric Acid Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Source Type

- 17.6.3. Type

- 17.6.4. Purity Level

- 17.6.5. Functionality

- 17.6.6. Form

- 17.6.7. Applications

- 17.6.8. Distribution Channel

- 17.7. Israel Tartaric Acid Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Source Type

- 17.7.3. Type

- 17.7.4. Purity Level

- 17.7.5. Functionality

- 17.7.6. Form

- 17.7.7. Applications

- 17.7.8. Distribution Channel

- 17.8. Rest of Middle East Tartaric Acid Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Source Type

- 17.8.3. Type

- 17.8.4. Purity Level

- 17.8.5. Functionality

- 17.8.6. Form

- 17.8.7. Applications

- 17.8.8. Distribution Channel

- 18. Africa Tartaric Acid Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Tartaric Acid Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Source Type

- 18.3.2. Type

- 18.3.3. Purity Level

- 18.3.4. Functionality

- 18.3.5. Form

- 18.3.6. Applications

- 18.3.7. Distribution Channel

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Tartaric Acid Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Source Type

- 18.4.3. Type

- 18.4.4. Purity Level

- 18.4.5. Functionality

- 18.4.6. Form

- 18.4.7. Applications

- 18.4.8. Distribution Channel

- 18.5. Egypt Tartaric Acid Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Source Type

- 18.5.3. Type

- 18.5.4. Purity Level

- 18.5.5. Functionality

- 18.5.6. Form

- 18.5.7. Applications

- 18.5.8. Distribution Channel

- 18.6. Nigeria Tartaric Acid Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Source Type

- 18.6.3. Type

- 18.6.4. Purity Level

- 18.6.5. Functionality

- 18.6.6. Form

- 18.6.7. Applications

- 18.6.8. Distribution Channel

- 18.7. Algeria Tartaric Acid Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Source Type

- 18.7.3. Type

- 18.7.4. Purity Level

- 18.7.5. Functionality

- 18.7.6. Form

- 18.7.7. Applications

- 18.7.8. Distribution Channel

- 18.8. Rest of Africa Tartaric Acid Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Source Type

- 18.8.3. Type

- 18.8.4. Purity Level

- 18.8.5. Functionality

- 18.8.6. Form

- 18.8.7. Applications

- 18.8.8. Distribution Channel

- 19. South America Tartaric Acid Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Central and South Africa Tartaric Acid Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Source Type

- 19.3.2. Type

- 19.3.3. Purity Level

- 19.3.4. Functionality

- 19.3.5. Form

- 19.3.6. Applications

- 19.3.7. Distribution Channel

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Tartaric Acid Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Source Type

- 19.4.3. Type

- 19.4.4. Purity Level

- 19.4.5. Functionality

- 19.4.6. Form

- 19.4.7. Applications

- 19.4.8. Distribution Channel

- 19.5. Argentina Tartaric Acid Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Source Type

- 19.5.3. Type

- 19.5.4. Purity Level

- 19.5.5. Functionality

- 19.5.6. Form

- 19.5.7. Applications

- 19.5.8. Distribution Channel

- 19.6. Rest of South America Tartaric Acid Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Source Type

- 19.6.3. Type

- 19.6.4. Purity Level

- 19.6.5. Functionality

- 19.6.6. Form

- 19.6.7. Applications

- 19.6.8. Distribution Channel

- 20. Key Players/ Company Profile

- 20.1. Alvinesa

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. ATP Group, Merck & Co. Inc.

- 20.3. Merck & Co., Inc.

- 20.4. Caviro Distillerie Srl

- 20.5. Changmao Biochemical Engineering Co. Ltd.

- 20.6. The Chemical Company

- 20.7. Comercial Química Sarasa S.L.

- 20.8. Derivados Vínicos S.A.

- 20.9. Distillerie Bonollo S.p.A.

- 20.10. Henriette’s Herbal

- 20.11. Industria Chimica Valenzana S.P.A.

- 20.12. Legre-Mante S.A.

- 20.13. Pahi SL

- 20.14. Tarac Technologies Pty Ltd

- 20.15. Tártaros Gonzalo Castello, SL

- 20.16. Thirumalai Chemicals Ltd.

- 20.17. U.S. Chemicals LLC

- 20.18. Other Key Players

- 20.1. Alvinesa

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation