Wearable AI Market Size, Share & Trends Analysis Report by Type (Hardware, Software, Services), Device Type, Technology, Deployment Model, Form Factor, Operating System/ Platform, Application, End-User Industry and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025 – 2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Wearable AI Market Size, Share, and Growth

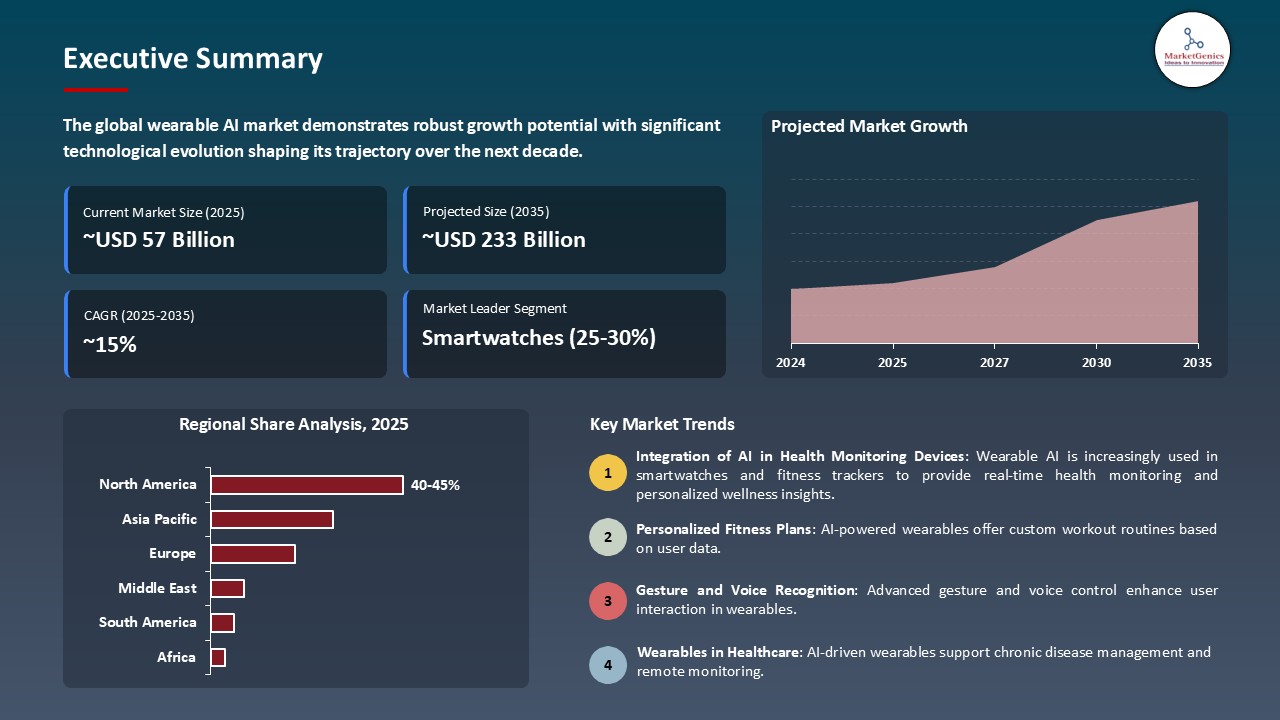

The global wearable AI market is experiencing robust growth, with its estimated value of USD 57.1 billion in the year 2025 and USD 233.5 billion by the period 2035, registering a CAGR of 15.1% during the forecast period.

According to Garmin's Chief Technology Officer, John Smith, he said that, ""Our newest health platform, which is powered by artificial intelligence or AI, will allow users to get the most out of their fitness journeys through personalized insights and real-time recommendations. Our goal is to take health tracking to a new level by integrating Garmin's cutting-edge wearable technology with AI-powered analytics to improve user engagement and boost the adoption of smart wellness solutions."

Artificial intelligence into wearable technology is accelerating through the need for real-time assessments of health status, predictive analytics, and adaptive experiences for users. Companies' wearables, such as smartwatches and fitness trackers, as well as augmented or virtual reality wearables, utilize AI to assess biometric data, identify health anomalies, and provide recommendations that are actionable to improve user health while increasing customer engagement and loyalty.

In 2024, machine learning algorithms are used in the Fitbit Sense 2, an industry-leading wearable, that analyzed over 10 million heart rates and sleep patterns daily with its AI framework to provide personalized health assessments for users. This also reduced health care risk alert notifications by 25% in the product users. Likewise, the Apple Watch Series 9 integrated a rich AI-based activity and sleep tracking feature that incorporates deep learning models to assess irregular heart rhythms and enhance the daily fitness experience for users.

Moreover, wearable AI solutions are benefitted by privacy and interoperability frameworks, while sensor fusion, adaptive feedback, and personalized coaching (upon request) apps have proliferated in response to the demand for individualized experiences. Inclusive regulatory frameworks around health data handling drive manufacturers toward more innovative AI capabilities, while also maintaining safety and compliance.

Examples of adjacent wearables in the AI space include smart health monitoring platforms, AI fitness and wellness apps, real-time workplace productivity tracking, AR/VR assisted training wearables, and biometric authentication. Collectively, the applications enhance user engagement, operational efficiency and provide personalized experience in the digital transformation era.

Wearable AI Market Dynamics and Trends

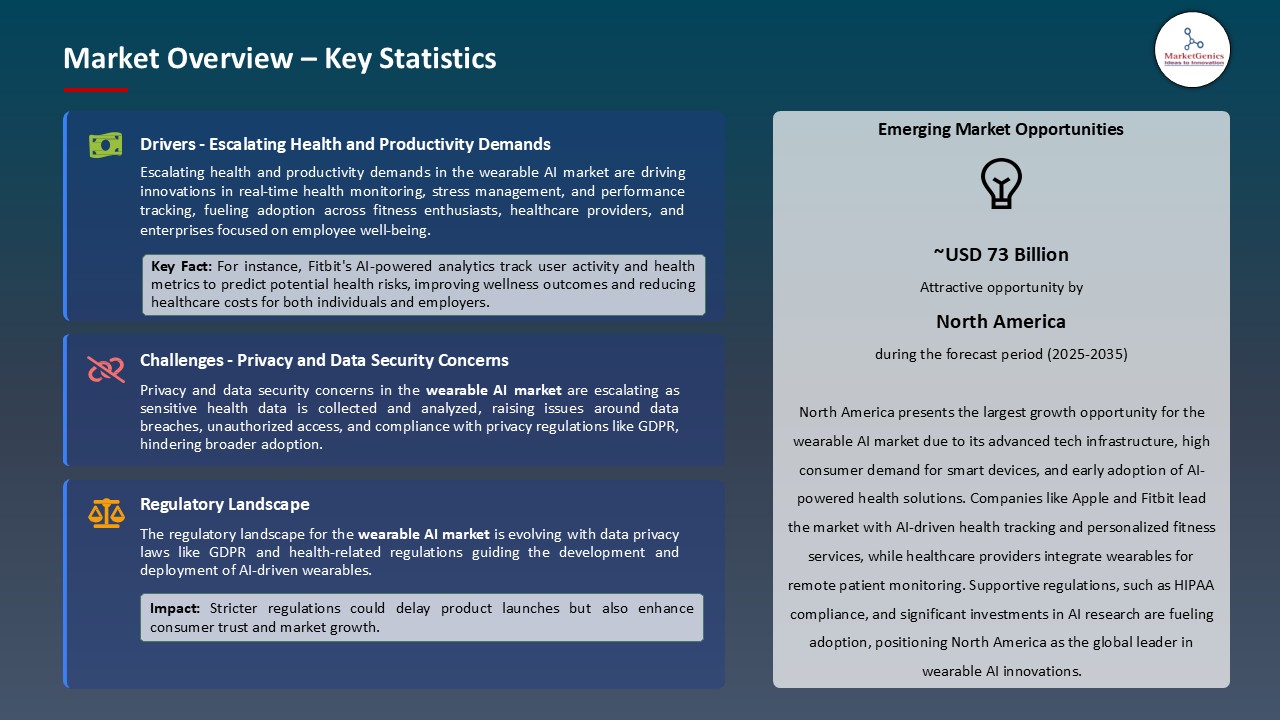

Driver: Escalating Health and Productivity Demands Driving AI-Powered Wearables

- The wearable AI market is seeing increased demand as health consciousness becomes more prevalent, chronic diseases become more widespread, and businesses seek ways to increase productivity. Consumers and organizations are looking for wearable devices with actionable insight and instantaneous tracking of vital signs, activity levels, and work patterns.

- Wearable AI algorithms would track heart rate, sleep patterns, physical activity, and stress indicators, while learning from historical data to develop personalized recommendations to improve lifestyles, minimize preventive care, and enhance productivity. For instance, between 2023 and 2024, the Fitbit Sense 2 began leveraging AI-based predictive health analytics across millions of daily users, recognizing when they were experiencing irregular heart rates or sleep disturbances, and therefore decreasing the health risks associated with these issues by approximately 20% through proactive notifications.

- Furthermore, the ability of AI wearables to measurably improve health and productivity, along with the corresponding ROI for enterprises and consumers, is driving the adoption and integration of intelligent capabilities into wearable ecosystems.

Restraint: Privacy and Data Security Concerns Slowing Adoption of AI Wearable

- Wearable AI devices rely on sensitive personal and biometric data collection, so they raise privacy and regulatory issues; consumers will trust businesses that purposefully comply with statutory data protection requirements like GDPR and HIPAA.

- Notably, in 2024 several new AI-mounted health monitoring wearables were halted from commercialization in some jurisdictions because they required an audit for compliance with new technical regulations regarding the use of health care grade data.

- The overarching concern about security (including the costs of a data breach and the use of sensitive health data) will remain a key limit to wider adoption of wearable AI; hence there is a pressing need for secure encryption of all data, anonymization of usage.

Opportunity: Expansion of Enterprise and Healthcare Applications Supporting Wearable AI Industry

- The expansion of corporate wellness programs and remote monitoring of patients will create considerable opportunities for AI-enabled wearables. Corporations are utilizing wearables to monitor employee productivity and wellness, and healthcare organizations are using AI-enabled devices for continuous monitoring of patients with chronic diseases to act sooner when there are significant changes.

- For instance, commenced in 2024, Omron’s AI-enabled blood pressure monitors were used in hospitals to monitor patients’ cardiovascular health, automatically alert clinicians and nurses about sudden changes, and minimize unnecessary visits to the emergency room.

- The growth of corporate wellness programs, the increasing use of telehealth services, and insurance companies providing financial incentives for wearables continues to reinforce the potential for wearable AI solution providers to grow globally.

Key Trend: Generative AI Enhancing Personalization and User Engagement

- Wearable experiences are being transformed by generative AI through hyper-personalized insights, adaptive health plans, and dynamic lifestyle recommendations. End-users can take advantage of AI-generated coaching, simulations, and predictive alerts that are shaped by personal behaviors and biometric patterns.

- For example, in 2024, Apple Watch introduced generative AI to provide activity coaching that resulted in thousands of personalized exercise protocols and strategies for improving sleep for individual users based on their own historical behaviors and performance analytics.

- Generative AI is also being utilized to implement professional wellness and rehabilitation programs, by creating interactive, adaptive content for physical therapy, mental health coaching, or personalized fitness plans that increases user engagement, limits the need for human intervention and improves outcomes.

Wearable AI Market Analysis and Segmental Data

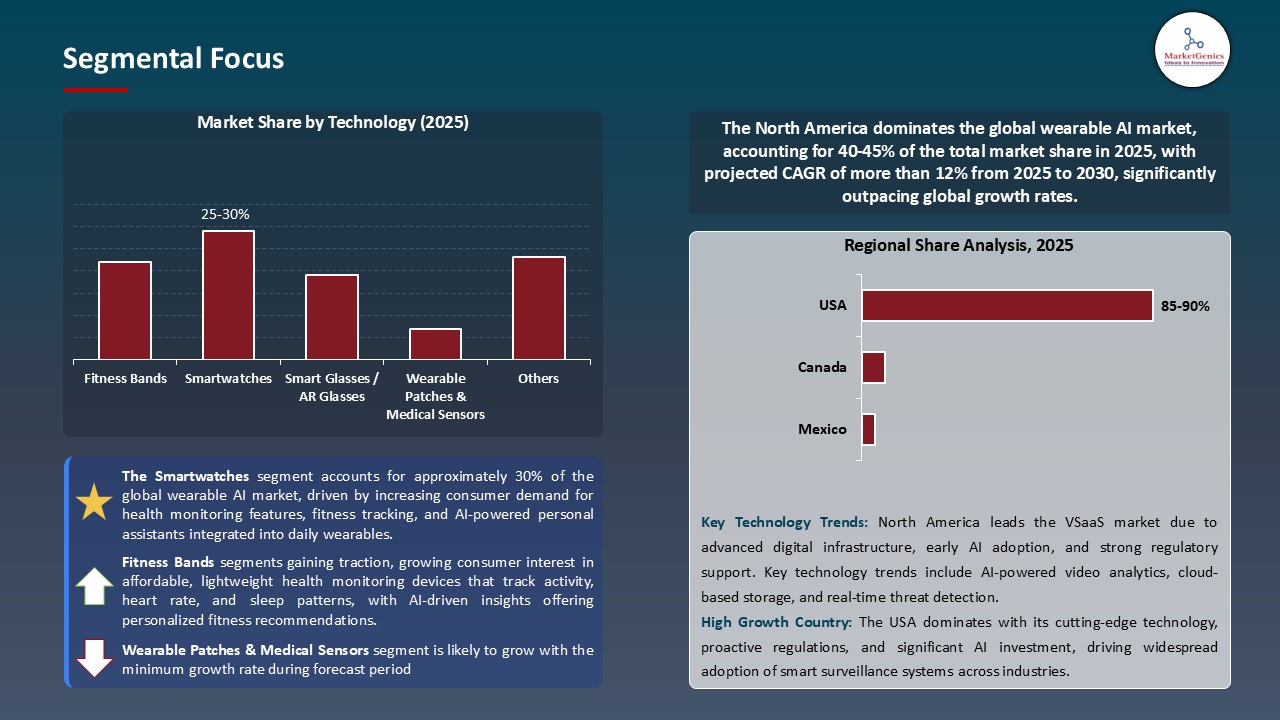

Smartwatches Dominates the Wearable AI Industry

- The quick uptake of smartwatches in the global wearable AI market is primarily driven by the life-changing effect at scale that smartwatches have on health and lifestyle monitoring. Major brands such as Apple and Fitbit have already incorporated advanced AI and machine learning algorithms into the smartwatch architecture of their platforms. For example, Apple Watch Series 9 utilizes advanced analytics and individual alerting to monitor heart rate irregularities, sleep quality, and activity levels, while giving the user actionable advice to proactively improve their health and wellness. Enhancing user engagement and wellness are both top-of-mind in the Wearable AI sector.

- AI in smartwatches can also be extended to optimizing fitness, managing stress, and providing individualized notifications. Smartwatches also constantly refine machine learning models based on user behaviors and biometric data, which provides users adaptive recommendations and predictive insights that improve overall lifestyle management and productivity in daily life.

- Moreover, the above factors drive smartwatch manufacturers to actively invest in AI technologies to sustain #1 and/or retain existing market share, but also to meet the increasing demand from consumers, who want personalized insights and experiences while having real-time insight into their health, fitness, and lifestyle, fueling growth and innovation within the wearable AI industry.

North American Dominance in Wearable AI Market

- The wearable AI market is dominated by North America, which has an abundance of core technology firms (Apple, Fitbit, and Garmin) that develop and market consumer wearables, high consumer adoption rates, and a healthy regulatory and innovation framework. In 2024, the US government (FDA) offered greater clarity on the regulatory pathway for monitoring devices based on AI, which will likely catalyze further investment and product development.

- For instance, Apple used AI as a tool for health and fitness for millions of Apple Watch users through capturing users' health metrics, positive trends, or recommendations in real-time. This ecosystem enables users to track their heart health, activity levels, and sleeping patterns sustainably, while also facilitating billions of revenues and adoption by increasing user engagement. Additionally, North American health and fitness infrastructures provide ample data and connectivity, creating a credible environment for product testing of AI algorithms in real-world settings.

- Further, due to significant strategic investments, partnerships (AI technologies or others) and strong uptake from consumers and the healthcare system, North America remains a global leader in wearable AI, setting global standards, and providing momentum for innovation in health, fitness, and lifestyle applications.

Wearable-AI-Market Ecosystem

The wearable AI market is led by top companies such as Apple Inc., Garmin Ltd., Samsung Electronics Co., Ltd., and Google (Fitbit). These types of organizations have developed advanced technologies such as AI, IoT, and machine learning that enable groundbreaking wearable devices. The products of these firms enable ledgers these firms lead were the category by using AI to build their own products that facilitate monitoring or improving health, fitness, or productivity.

These major companies concentrate on specialized solutions to spur innovation. For example, Apple uses AI in its Apple Watch in order to deliver personalized health insights; other examples include Garmin, which uses AI to develop strategies and analysis of fitness training devices; developments that are very different solutions for the athlete niche market. These focused innovations help extend the capability of wearables to niche aspects of life.

The regulatory environment, specifically districts or federal governmental agencies or global research; are factors to the growth of the wearable AI market. As an example, in May 2024 the FDA approved another AI-based wearable health and fitness device for remote health monitoring, which initiated a formal process into the availability of another health-related AI-based wearable solution that could be rapidly deployed in order to develop consumer acceptances of AI-based health solutions.

Developing sustainable and productive concepts such as an energy-efficient AI component for wearable devices has attracted companies, e.g. Samsung, to deploy monitoring health features while using green technologies to produce consumer wearable devices. A notable example of innovation and development occurred in April 2024 was Whoop, which launched an AI-based sleep tracking system that improved the accuracy of sleep patterns by 30%. This is consistent with other developments and review of impact of growth of AI wearables in personal health management.

Recent Development and Strategic Overview:

- In March 2025, Apple announced its AI-based health coaching system built into the Apple Watch, which offers personalized guidance for fitness and wellness habits based on current biometric feedback. The system autonomously modifies recommendations for workouts, sleep behavior, and activity goals for the best health and performance outcome for the user.

- In July 2025, Garmin launched an AI-based health monitoring platform that can use continuous physiological data to identify early signs of stress or fatigue for its smartwatches. The platform scans the user's data and provides modifications for workouts or personalized exercises designed to help relieve stress and/or fatigue, enhancing health and performance outcomes for both athletes and the general population.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 57.1 Bn |

|

Market Forecast Value in 2035 |

USD 233.5 Bn |

|

Growth Rate (CAGR) |

15.1% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

USD Bn for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Wearable-AI-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Wearable AI Market, By Type |

|

|

Wearable AI Market, By Device Type |

|

|

Wearable AI Market, By Technology |

|

|

Wearable AI Market, By Deployment Model |

|

|

Wearable AI Market, By Form Factor |

|

|

Wearable AI Market, By Operating System/ Platform |

|

|

Wearable AI Market, By Application |

|

|

Wearable AI Market, By End-User Industry |

|

Frequently Asked Questions

The global wearable AI market was valued at USD 57.1 Bn in 2025

The global wearable AI market industry is expected to grow at a CAGR of 15.1% from 2025 to 2035

The key factors driving demand for the wearable AI market include increasing health awareness, personalized fitness tracking, advancements in AI technology, and growing consumer demand for real-time health monitoring and lifestyle optimization.

In terms of data types, the smartwatches segment accounted for the major share in 2025

North America is a more attractive region for vendors

Key players in the global wearable AI market include prominent companies such as Abbott Laboratories, Apple Inc., Bose Corporation, Fossil Group, Inc., Garmin Ltd., Google (Fitbit), Huami Corporation (Amazfit), Huawei Technologies Co., Ltd., Magic Leap, Inc., Medtronic plc, Meta Platforms, Inc. (Reality Labs), Microsoft Corporation, Oura Health Ltd., Polar Electro Oy, Qualcomm Technologies, Inc., Samsung Electronics Co., Ltd., Sony Corporation, STMicroelectronics N.V., Whoop, Inc., Xiaomi Corporation, and several other key players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Wearable AI Market Outlook

- 2.1.1. Wearable AI Market Size (Volume - Million Units and Value - USD Mn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Wearable AI Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Information Technology & Media Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Information Technology & Media Industry

- 3.1.3. Regional Distribution for Information Technology & Media Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Information Technology & Media Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Growing demand for health and fitness monitoring through AI-powered wearable devices.

- 4.1.1.2. Increasing integration of voice assistants and smart sensors for enhanced user experience.

- 4.1.1.3. Rising adoption of IoT and 5G connectivity supporting real-time data processing in wearables.

- 4.1.2. Restraints

- 4.1.2.1. High cost and limited battery life of AI-enabled wearable devices.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis/ Ecosystem Analysis

- 4.4.1. Component Suppliers

- 4.4.2. Technology Providers/ System Integrators

- 4.4.3. Wearable AI Device Manufacturers

- 4.4.4. End Users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Wearable AI Market Demand

- 4.9.1. Historical Market Size – (Volume - Million Units and Value - USD Mn), 2020-2024

- 4.9.2. Current and Future Market Size - (Volume - Million Units and Value - USD Mn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Wearable AI Market Analysis, by Type

- 6.1. Key Segment Analysis

- 6.2. Wearable AI Market Size (Volume - Million Units and Value - USD Mn), Analysis, and Forecasts, by Type, 2021-2035

- 6.2.1. Hardware

- 6.2.1.1. Sensors

- 6.2.1.2. Processors / AI Chips

- 6.2.1.3. Power Management Units / Batteries

- 6.2.1.4. Display Modules

- 6.2.1.5. Connectivity Modules

- 6.2.1.5.1. Bluetooth / BLE

- 6.2.1.5.2. Wi-Fi

- 6.2.1.5.3. Cellular (4G/5G)

- 6.2.1.5.4. LPWAN (NB-IoT, LTE-M)

- 6.2.1.5.5. Offline / Standalone

- 6.2.1.5.6. Others

- 6.2.1.6. Microphones & Cameras

- 6.2.1.7. Haptic Feedback Modules

- 6.2.1.8. Others

- 6.2.2. Software

- 6.2.2.1. AI Algorithms

- 6.2.2.2. Operating Systems

- 6.2.2.3. Application Software

- 6.2.2.4. Cloud-based Analytics & Data Management Platforms

- 6.2.2.5. Security & Privacy Management Software

- 6.2.2.6. Others

- 6.2.3. Services

- 6.2.3.1. Integration & Deployment Services

- 6.2.3.2. Maintenance & Support Services

- 6.2.3.3. Cloud Storage & Data Management Services

- 6.2.3.4. AI Training & Personalization Services

- 6.2.3.5. Consulting & Managed Services

- 6.2.3.6. Others

- 6.2.1. Hardware

- 7. Global Wearable AI Market Analysis, by Device Type

- 7.1. Key Segment Analysis

- 7.2. Wearable AI Market Size (Volume - Million Units and Value - USD Mn), Analysis, and Forecasts, by Device Type, 2021-2035

- 7.2.1. Smartwatches

- 7.2.2. Fitness Bands

- 7.2.3. Smart Glasses / AR Glasses

- 7.2.4. Smart Clothing / E-textiles

- 7.2.5. Earwear (Hearables / Smart Earbuds)

- 7.2.6. Smart Rings

- 7.2.7. Wearable Patches & Medical Sensors

- 7.2.8. Others

- 8. Global Wearable AI Market Analysis, by Technology

- 8.1. Key Segment Analysis

- 8.2. Wearable AI Market Size (Value - USD Mn), Analysis, and Forecasts, by Technology, 2021-2035

- 8.2.1. On-device AI (Edge AI)

- 8.2.2. Cloud-based AI

- 8.2.3. Hybrid AI (Edge + Cloud)

- 8.2.4. Computer Vision

- 8.2.5. Natural Language Processing (NLP)

- 8.2.6. Machine Learning / Deep Learning

- 8.2.7. Sensor Fusion & Contextual AI

- 8.2.8. Others

- 9. Global Wearable AI Market Analysis, by Deployment Model

- 9.1. Key Segment Analysis

- 9.2. Wearable AI Market Size (Value - USD Mn), Analysis, and Forecasts, by Deployment Model, 2021-2035

- 9.2.1. OEM / Embedded Solutions

- 9.2.2. Standalone Consumer Devices

- 9.2.3. Enterprise Solutions (B2B)

- 9.2.4. Healthcare Provider Platforms (B2B2C)

- 10. Global Wearable AI Market Analysis, by Form Factor

- 10.1. Key Segment Analysis

- 10.2. Wearable AI Market Size (Volume - Million Units and Value - USD Mn), Analysis, and Forecasts, by Form Factor, 2021-2035

- 10.2.1. Wrist-worn

- 10.2.2. Head-worn

- 10.2.3. Body-worn (torso, chest, back)

- 10.2.4. Clothing-integrated

- 10.2.5. Ear-worn

- 10.2.6. Finger-worn

- 10.2.7. Others

- 11. Global Wearable AI Market Analysis and Forecasts, by Operating System/ Platform

- 11.1. Key Findings

- 11.2. Wearable AI Market Size (Value - USD Mn), Analysis, and Forecasts, by Operating System/ Platform, 2021-2035

- 11.2.1. Proprietary OS

- 11.2.2. Wear OS / Android-based

- 11.2.3. RTOS (Real-Time Operating Systems)

- 11.2.4. iOS-compatible / iPhone-integrated

- 11.2.5. Custom Embedded Platforms

- 11.2.6. Others

- 12. Global Wearable AI Market Analysis and Forecasts, by Application

- 12.1. Key Findings

- 12.2. Wearable AI Market Size (Value - USD Mn), Analysis, and Forecasts, by Application, 2021-2035

- 12.2.1. Health & Fitness Monitoring

- 12.2.2. Remote Patient Monitoring & Diagnostics

- 12.2.3. Augmented Reality / Immersive Experiences

- 12.2.4. Workforce Productivity & Safety

- 12.2.5. Navigation & Location-based Services

- 12.2.6. Personalized Notifications & Smart Assistance

- 12.2.7. Entertainment & Gaming

- 12.2.8. Others

- 13. Global Wearable AI Market Analysis and Forecasts, by End-User Industry

- 13.1. Key Findings

- 13.2. Wearable AI Market Size (Value - USD Mn), Analysis, and Forecasts, by End-User Industry, 2021-2035

- 13.2.1. Healthcare & Telemedicine

- 13.2.2. Consumer Electronics

- 13.2.3. Sports & Fitness

- 13.2.4. Enterprise / Industrial (Manufacturing, Construction)

- 13.2.5. Retail & Hospitality

- 13.2.6. Defense & Public Safety

- 13.2.7. Automotive

- 13.2.8. Others

- 14. Global Wearable AI Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Wearable AI Market Size (Volume - Million Units and Value - USD Mn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Wearable AI Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Wearable AI Market Size Volume - Million Units and Value - USD Mn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Type

- 15.3.2. Device Type

- 15.3.3. Technology

- 15.3.4. Deployment Model

- 15.3.5. Form Factor

- 15.3.6. Operating System/ Platform

- 15.3.7. Application

- 15.3.8. End-User Industry

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Wearable AI Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Type

- 15.4.3. Device Type

- 15.4.4. Technology

- 15.4.5. Deployment Model

- 15.4.6. Form Factor

- 15.4.7. Operating System/ Platform

- 15.4.8. Application

- 15.4.9. End-User Industry

- 15.5. Canada Wearable AI Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Type

- 15.5.3. Device Type

- 15.5.4. Technology

- 15.5.5. Deployment Model

- 15.5.6. Form Factor

- 15.5.7. Operating System/ Platform

- 15.5.8. Application

- 15.5.9. End-User Industry

- 15.6. Mexico Wearable AI Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Type

- 15.6.3. Device Type

- 15.6.4. Technology

- 15.6.5. Deployment Model

- 15.6.6. Form Factor

- 15.6.7. Operating System/ Platform

- 15.6.8. Application

- 15.6.9. End-User Industry

- 16. Europe Wearable AI Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Wearable AI Market Size (Volume - Million Units and Value - USD Mn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Type

- 16.3.2. Device Type

- 16.3.3. Technology

- 16.3.4. Deployment Model

- 16.3.5. Form Factor

- 16.3.6. Operating System/ Platform

- 16.3.7. Application

- 16.3.8. End-User Industry

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Wearable AI Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Type

- 16.4.3. Device Type

- 16.4.4. Technology

- 16.4.5. Deployment Model

- 16.4.6. Form Factor

- 16.4.7. Operating System/ Platform

- 16.4.8. Application

- 16.4.9. End-User Industry

- 16.5. United Kingdom Wearable AI Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Type

- 16.5.3. Device Type

- 16.5.4. Technology

- 16.5.5. Deployment Model

- 16.5.6. Form Factor

- 16.5.7. Operating System/ Platform

- 16.5.8. Application

- 16.5.9. End-User Industry

- 16.6. France Wearable AI Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Type

- 16.6.3. Device Type

- 16.6.4. Technology

- 16.6.5. Deployment Model

- 16.6.6. Form Factor

- 16.6.7. Operating System/ Platform

- 16.6.8. Application

- 16.6.9. End-User Industry

- 16.7. Italy Wearable AI Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Type

- 16.7.3. Device Type

- 16.7.4. Technology

- 16.7.5. Deployment Model

- 16.7.6. Form Factor

- 16.7.7. Operating System/ Platform

- 16.7.8. Application

- 16.7.9. End-User Industry

- 16.8. Spain Wearable AI Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Type

- 16.8.3. Device Type

- 16.8.4. Technology

- 16.8.5. Deployment Model

- 16.8.6. Form Factor

- 16.8.7. Operating System/ Platform

- 16.8.8. Application

- 16.8.9. End-User Industry

- 16.9. Netherlands Wearable AI Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Type

- 16.9.3. Device Type

- 16.9.4. Technology

- 16.9.5. Deployment Model

- 16.9.6. Form Factor

- 16.9.7. Operating System/ Platform

- 16.9.8. Application

- 16.9.9. End-User Industry

- 16.10. Nordic Countries Wearable AI Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Type

- 16.10.3. Device Type

- 16.10.4. Technology

- 16.10.5. Deployment Model

- 16.10.6. Form Factor

- 16.10.7. Operating System/ Platform

- 16.10.8. Application

- 16.10.9. End-User Industry

- 16.11. Poland Wearable AI Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Type

- 16.11.3. Device Type

- 16.11.4. Technology

- 16.11.5. Deployment Model

- 16.11.6. Form Factor

- 16.11.7. Operating System/ Platform

- 16.11.8. Application

- 16.11.9. End-User Industry

- 16.12. Russia & CIS Wearable AI Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Type

- 16.12.3. Device Type

- 16.12.4. Technology

- 16.12.5. Deployment Model

- 16.12.6. Form Factor

- 16.12.7. Operating System/ Platform

- 16.12.8. Application

- 16.12.9. End-User Industry

- 16.13. Rest of Europe Wearable AI Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Type

- 16.13.3. Device Type

- 16.13.4. Technology

- 16.13.5. Deployment Model

- 16.13.6. Form Factor

- 16.13.7. Operating System/ Platform

- 16.13.8. Application

- 16.13.9. End-User Industry

- 17. Asia Pacific Wearable AI Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. East Asia Wearable AI Market Size (Volume - Million Units and Value - USD Mn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Type

- 17.3.2. Device Type

- 17.3.3. Technology

- 17.3.4. Deployment Model

- 17.3.5. Form Factor

- 17.3.6. Operating System/ Platform

- 17.3.7. Application

- 17.3.8. End-User Industry

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Wearable AI Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Type

- 17.4.3. Device Type

- 17.4.4. Technology

- 17.4.5. Deployment Model

- 17.4.6. Form Factor

- 17.4.7. Operating System/ Platform

- 17.4.8. Application

- 17.4.9. End-User Industry

- 17.5. India Wearable AI Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Type

- 17.5.3. Device Type

- 17.5.4. Technology

- 17.5.5. Deployment Model

- 17.5.6. Form Factor

- 17.5.7. Operating System/ Platform

- 17.5.8. Application

- 17.5.9. End-User Industry

- 17.6. Japan Wearable AI Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Type

- 17.6.3. Device Type

- 17.6.4. Technology

- 17.6.5. Deployment Model

- 17.6.6. Form Factor

- 17.6.7. Operating System/ Platform

- 17.6.8. Application

- 17.6.9. End-User Industry

- 17.7. South Korea Wearable AI Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Type

- 17.7.3. Device Type

- 17.7.4. Technology

- 17.7.5. Deployment Model

- 17.7.6. Form Factor

- 17.7.7. Operating System/ Platform

- 17.7.8. Application

- 17.7.9. End-User Industry

- 17.8. Australia and New Zealand Wearable AI Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Type

- 17.8.3. Device Type

- 17.8.4. Technology

- 17.8.5. Deployment Model

- 17.8.6. Form Factor

- 17.8.7. Operating System/ Platform

- 17.8.8. Application

- 17.8.9. End-User Industry

- 17.9. Indonesia Wearable AI Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Type

- 17.9.3. Device Type

- 17.9.4. Technology

- 17.9.5. Deployment Model

- 17.9.6. Form Factor

- 17.9.7. Operating System/ Platform

- 17.9.8. Application

- 17.9.9. End-User Industry

- 17.10. Malaysia Wearable AI Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Type

- 17.10.3. Device Type

- 17.10.4. Technology

- 17.10.5. Deployment Model

- 17.10.6. Form Factor

- 17.10.7. Operating System/ Platform

- 17.10.8. Application

- 17.10.9. End-User Industry

- 17.11. Thailand Wearable AI Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Type

- 17.11.3. Device Type

- 17.11.4. Technology

- 17.11.5. Deployment Model

- 17.11.6. Form Factor

- 17.11.7. Operating System/ Platform

- 17.11.8. Application

- 17.11.9. End-User Industry

- 17.12. Vietnam Wearable AI Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Type

- 17.12.3. Device Type

- 17.12.4. Technology

- 17.12.5. Deployment Model

- 17.12.6. Form Factor

- 17.12.7. Operating System/ Platform

- 17.12.8. Application

- 17.12.9. End-User Industry

- 17.13. Rest of Asia Pacific Wearable AI Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Component

- 17.13.3. Technology

- 17.13.4. Application

- 17.13.5. End-users

- 17.13.6. Deployment Mode

- 17.13.7. Data Type

- 18. Middle East Wearable AI Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Wearable AI Market Size (Volume - Million Units and Value - USD Mn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Type

- 18.3.2. Device Type

- 18.3.3. Technology

- 18.3.4. Deployment Model

- 18.3.5. Form Factor

- 18.3.6. Operating System/ Platform

- 18.3.7. Application

- 18.3.8. End-User Industry

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Wearable AI Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Type

- 18.4.3. Device Type

- 18.4.4. Technology

- 18.4.5. Deployment Model

- 18.4.6. Form Factor

- 18.4.7. Operating System/ Platform

- 18.4.8. Application

- 18.4.9. End-User Industry

- 18.5. UAE Wearable AI Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Type

- 18.5.3. Device Type

- 18.5.4. Technology

- 18.5.5. Deployment Model

- 18.5.6. Form Factor

- 18.5.7. Operating System/ Platform

- 18.5.8. Application

- 18.5.9. End-User Industry

- 18.6. Saudi Arabia Wearable AI Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Type

- 18.6.3. Device Type

- 18.6.4. Technology

- 18.6.5. Deployment Model

- 18.6.6. Form Factor

- 18.6.7. Operating System/ Platform

- 18.6.8. Application

- 18.6.9. End-User Industry

- 18.7. Israel Wearable AI Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Type

- 18.7.3. Device Type

- 18.7.4. Technology

- 18.7.5. Deployment Model

- 18.7.6. Form Factor

- 18.7.7. Operating System/ Platform

- 18.7.8. Application

- 18.7.9. End-User Industry

- 18.8. Rest of Middle East Wearable AI Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Type

- 18.8.3. Device Type

- 18.8.4. Technology

- 18.8.5. Deployment Model

- 18.8.6. Form Factor

- 18.8.7. Operating System/ Platform

- 18.8.8. Application

- 18.8.9. End-User Industry

- 19. Africa Wearable AI Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Wearable AI Market Size (Volume - Million Units and Value - USD Mn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Type

- 19.3.2. Device Type

- 19.3.3. Technology

- 19.3.4. Deployment Model

- 19.3.5. Form Factor

- 19.3.6. Operating System/ Platform

- 19.3.7. Application

- 19.3.8. End-User Industry

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Wearable AI Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Type

- 19.4.3. Device Type

- 19.4.4. Technology

- 19.4.5. Deployment Model

- 19.4.6. Form Factor

- 19.4.7. Operating System/ Platform

- 19.4.8. Application

- 19.4.9. End-User Industry

- 19.5. Egypt Wearable AI Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Type

- 19.5.3. Device Type

- 19.5.4. Technology

- 19.5.5. Deployment Model

- 19.5.6. Form Factor

- 19.5.7. Operating System/ Platform

- 19.5.8. Application

- 19.5.9. End-User Industry

- 19.6. Nigeria Wearable AI Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Type

- 19.6.3. Device Type

- 19.6.4. Technology

- 19.6.5. Deployment Model

- 19.6.6. Form Factor

- 19.6.7. Operating System/ Platform

- 19.6.8. Application

- 19.6.9. End-User Industry

- 19.7. Algeria Wearable AI Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Type

- 19.7.3. Device Type

- 19.7.4. Technology

- 19.7.5. Deployment Model

- 19.7.6. Form Factor

- 19.7.7. Operating System/ Platform

- 19.7.8. Application

- 19.7.9. End-User Industry

- 19.8. Rest of Africa Wearable AI Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Type

- 19.8.3. Device Type

- 19.8.4. Technology

- 19.8.5. Deployment Model

- 19.8.6. Form Factor

- 19.8.7. Operating System/ Platform

- 19.8.8. Application

- 19.8.9. End-User Industry

- 20. South America Wearable AI Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Central and South Africa Wearable AI Market Size (Volume - Million Units and Value - USD Mn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Type

- 20.3.2. Device Type

- 20.3.3. Technology

- 20.3.4. Deployment Model

- 20.3.5. Form Factor

- 20.3.6. Operating System/ Platform

- 20.3.7. Application

- 20.3.8. End-User Industry

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Wearable AI Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Type

- 20.4.3. Device Type

- 20.4.4. Technology

- 20.4.5. Deployment Model

- 20.4.6. Form Factor

- 20.4.7. Operating System/ Platform

- 20.4.8. Application

- 20.4.9. End-User Industry

- 20.5. Argentina Wearable AI Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Type

- 20.5.3. Device Type

- 20.5.4. Technology

- 20.5.5. Deployment Model

- 20.5.6. Form Factor

- 20.5.7. Operating System/ Platform

- 20.5.8. Application

- 20.5.9. End-User Industry

- 20.6. Rest of South America Wearable AI Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Type

- 20.6.3. Device Type

- 20.6.4. Technology

- 20.6.5. Deployment Model

- 20.6.6. Form Factor

- 20.6.7. Operating System/ Platform

- 20.6.8. Application

- 20.6.9. End-User Industry

- 21. Key Players/ Company Profile

- 21.1. Abbott Laboratories

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Apple Inc.

- 21.3. Bose Corporation

- 21.4. Fossil Group, Inc.

- 21.5. Garmin Ltd.

- 21.6. Google (Fitbit)

- 21.7. Huami Corporation (Amazfit)

- 21.8. Huawei Technologies Co., Ltd.

- 21.9. Magic Leap, Inc.

- 21.10. Medtronic plc

- 21.11. Meta Platforms, Inc. (Reality Labs)

- 21.12. Microsoft Corporation

- 21.13. Oura Health Ltd.

- 21.14. Polar Electro Oy

- 21.15. Qualcomm Technologies, Inc.

- 21.16. Samsung Electronics Co., Ltd.

- 21.17. Sony Corporation

- 21.18. STMicroelectronics N.V.

- 21.19. Whoop, Inc.

- 21.20. Xiaomi Corporation

- 21.21. Others Key Players

- 21.1. Abbott Laboratories

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data