Allulose Market Size, Share & Trends Analysis Report by Product Type (D-Allulose (D-Psicose), Crystalline Allulose, Liquid/Syrup Allulose, Powdered Allulose), Purity Level, Source, Production Method, Form, Application, Distribution Channel, Packaging Type, Function, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Allulose Market Size, Share, and Growth

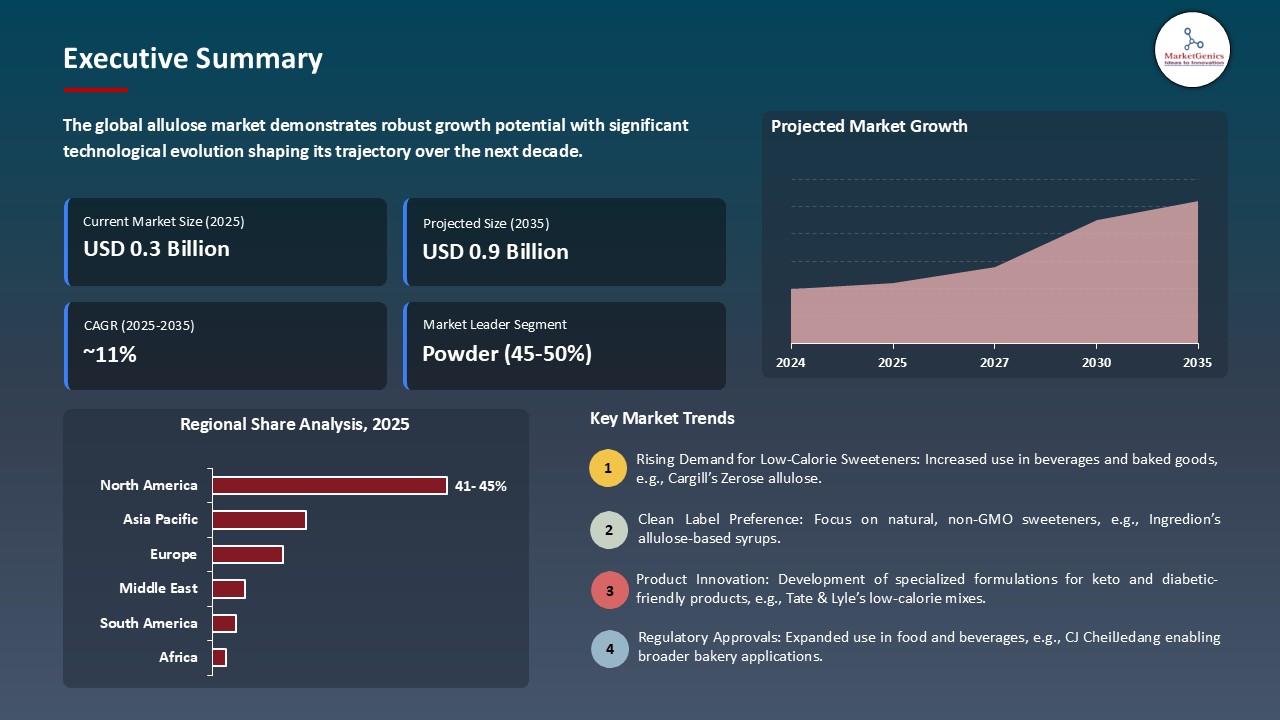

The global allulose market is experiencing robust growth, with its estimated value of USD 0.3 billion in the year 2025 and USD 0.9 billion by the period 2035, registering a CAGR of 11.4%, during the forecast period. The global allulose market is expanding owing to the increase in health consciousness, low-calorie foods and clean label foods, and a fast-paced lifestyle. Advances in production technologies, fermentation, enzyme platforms, and distribution channels are driving global market expansion.

Shota Atsumi, professor of chemistry at UC Davis said, “Allulose is a great alternative to sugar, but we have not had a cost-effective way to manufacture it. Our new method is efficient, economically feasible and could be scaled up for commercial production.

The growing consumer interest in low-calorie, reduced sugar and clean-label foods is compelling manufacturers to explore new high-tech allulose manufacturing methods and expand their use in bakery, beverages, dairy and confectionery. For instance, in July 2025, the National Health Commission (NHC) of China authorized the approval of 20 additional food substances, such as D-Allulose, and allowed its use in the bakery, beverages and functional foods. This regulatory approval helps in quicker market penetration, enhanced consumer confidence and market penetration into clean-label, naturally sweetened product segments.

Market commercialization and adoption is being gained through strategic partnerships and regulatory approvals. Key players are also engaging in agreements with ingredient suppliers, research institutions, and food producers to increase production, quality, and new formulas. These endorsements help to enter the market faster, increase consumer confidence, and extend clean-label, naturally sweetened and sugar-reduced products opportunities. Together with the increasing consumer preference towards low-calorie, functional, and health-oriented foods, these trends are spurring more investment into the allulose market and the diversification of products into various food and beverage segments.

Allulose manufacturing is becoming efficient, consistent, and cost-effective with the help of automation, fermentation, and production platforms based on enzymes. The high-yield enzyme systems, scalable bioprocessing, and optimization of fermentation systems are increasing the production capacities and decreasing operation costs. These technological advancements coupled with a supportive policy and regulatory environment across the world are stimulating the growth of the market, diversifying products, and enhancing competitive advantages in the global allulose market.

Allulose Market Dynamics and Trends

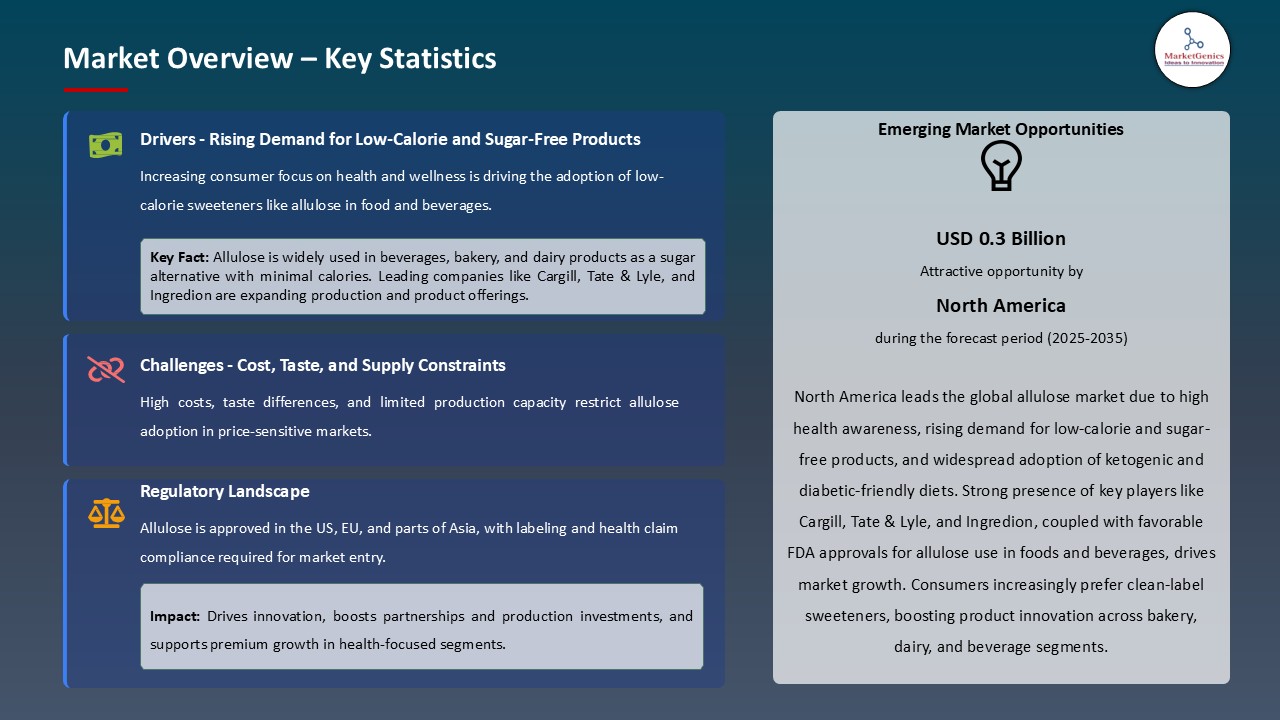

Driver: Rising Demand for Low-Calorie and Keto-Friendly Products

- Rising demand in low-calorie and keto-friendly sweeteners due to the rise in health-conscious consumers and the increasing prevalence of lifestyle-related diseases, including obesity and diabetes, is making allulose a prominent ingredient of choice in any contemporary food and beverage innovation. Key players are developing new production techniques and also making strategic alliances to broaden the allulose usage in the bakery, confectionery, dairy, beverage and nutritional products.

- For instance, in June 2023, Ginkgo Bioworks and Ambrosia Bio announced a partnership to design a scalable enzyme-based procedure to convert allulose into a final product, more affordable and accessible around the globe, enabling brands to offer high-quality, low-calorie products to a broader consumer base. These initiatives enhance brand positioning, promote the higher end products, create consumer confidence, and speed up implementation globally, especially in North America, Europe, and emerging health-conscious markets, influencing the future of sugar-reduced formulations.

- The growing interest in low-glycemic and clean-label solutions is also propelling the global allulose market expansion and fostering the wider adoption of allulose in the world.

Restraint: High Production Costs and Supply Constraints Limit Market Expansion

- High production costs, which are mainly caused by enzyme conversion reactions and a lack of rare sugar substrates, are significant challenges affecting the allulose market. Such expenses render allulose products more costly than traditional sweeteners, restricting its reach to price-conscious consumers and small-to-medium manufacturers.

- Supply constraints are also factors that limit widespread adoption because existing production capabilities are not enough to satisfy the fast-rising demand around the globe. Scarcity of raw materials and complicated processing methods lead to production bottlenecks, increased lead times and intermittent delivery to the various regions especially in the emerging markets.

- Moreover, the lack of scalability and the use of special enzymes impede mass production and introduce regional differences in the supply of products. All these contribute to sluggish market growth, inhibit the launch of allulose in new lines of products, and pose a threat to the competitiveness of manufacturers in relation to traditional sweeteners and other low-calorie options.

Opportunity: Integration of Allulose in Functional and Specialty Products

- The rising consumer demand of functional and specialty foods poses a good growth potential of allulose. Consumers want products that are indulging and health-promoting, including gut-friendly food, protein bars, dairy-free options, and cognitive-support drinks. Allulose allows manufacturers to be more innovative than traditionally sweetening their products with its low-calorie, low-glycemic, and clean-label characteristics.

- The increasing popularity of personalized nutrition and wellness diets is stimulating corporations to create specialty foods depending on special health requirements. Meal supplements, fortified dairy items, and snacks with added protein are growing in popularity as people are starting to demand foods that give them flavor and additional health advantages.

- Allulose is gaining momentum to be used in designing new products that can meet new consumer needs in health conscious, functional and indulgent foods. For instance, in April 2025, Two Spoons Creamery introduced a GLP-1 compatible, high-protein ice cream with 30g of protein per serving, no added sugar, and allulose as its sweetener.

- These launches assist manufacturers to differentiate offerings, attract high-margin segments and speed up adoption of allulose globally.

Key Trend: Incorporation of Allulose in Clean-Label and Natural Products

- The allulose market is shifting more to clean-label and naturally derived formulations as consumers seek transparency, natural ingredients, and minimized chemical additives. The development of extraction and fermentation technologies allows to produce allulose in scale and with minimal processing, which can be used in beverages, bakery and dairy products with clean labels.

- Key players are also moving to include allulose in clean-label products to position their products and distinguish themselves against competitors to serve changing consumer expectations. For instance, in September 2025, Nexus Ingredient approved ALLIOSWEET Allulose that can be used in Australia and New Zealand as an ingredient in bakery items, yogurts, and desserts, as a low-calorie, naturally sweetened alternative. This enables the brands to develop clean-label, low sugar products without compromising functionality and flavor.

- Incorporation of allulose into clean-label formulations helps in providing consistent sweetness, preserving the texture of products and increasing consumer belief on naturally obtained products. This tendency is reinforcing the global allulose market as it helps to achieve the product differentiation, premium positioning and expansion of the product range to natural and minimally processed products.

Allulose Market Analysis and Segmental Data

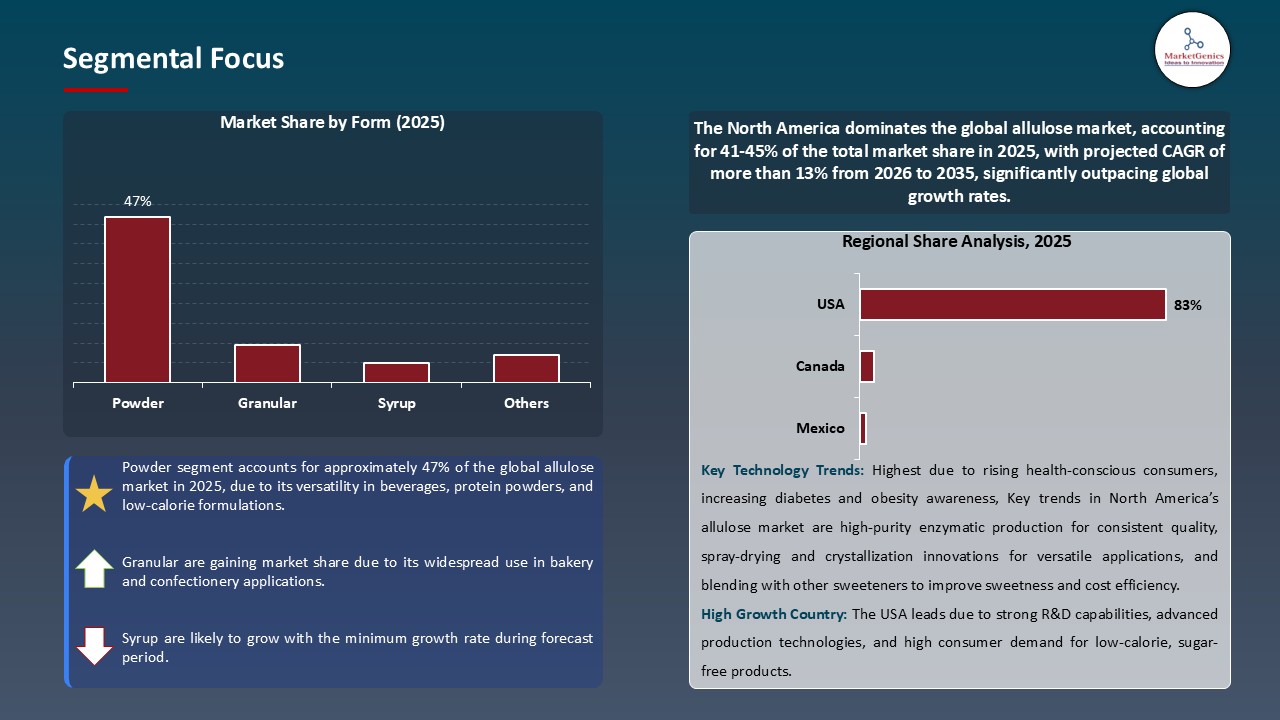

Powder Dominate Global Allulose Market

- The powder segment dominates the global allulose market through its flexibility, stability and convenience in bakery, dairy, beverages as well as in confectionery products. Allulose powder allows accurate formulation, consistent sweetness and a long shelf life and, therefore, is much favored by the manufacturers. Solubility, functionality and product safety are boosted by advanced production technologies such as spray drying, crystallization and high-purity processing.

- Innovation within the powder segment is being driven by the increasing demand of the low-calorie, sugar-replacement products. The manufacturers are improving solubility, stability and multi-purpose capable of use in bakery, beverages, dairy and confectionery. Special emphasis on functional performance and flexibility of formulation guarantees uniform quality of the product. Partnerships and customized solutions can be used to accelerate commercialization and implementation on a larger scale internationally.

- The dominance of the segment is strengthened by regulatory acceptance, scale production, and knowledge among the manufacturers, which allow the quick commercialization, tailored formulations and adjustment to changes in consumer preferences globally.

North America Leads Global Allulose Market Demand

- North America leads the global allulose market because of the high consumer demand of low-calorie, clean-label, and functional sweeteners, combined with high disposable incomes and established retail and e-commerce systems. The U.S. is the frontrunner in the region, especially in bakery, beverage, dairy and confectionery uses, whereas Canada demonstrates a stable assimilation in organic and fortified products.

- The area has the advantage of high manufacturing base and infrastructure of cutting-edge food technology, making speedy innovation. For instance, in March 2024, Scotty, the creator of Everyday (USA), released its Allulose and Monk Fruit Zero Calorie Sugar Replacement, a gluten-free and no-sugar-added baking mix sugar-substitute in powder form, which is a convenient and calorie-free 1:1 sugar-substitute. This illustrates the consumer oriented, science based innovation of North America.

- Supportive government regulation, well-defined FDA GRAS, and strategic alliances between ingredient suppliers and producers further stimulate adoption, and scalable production and research and development pipelines support North America leading in global allulose market.

Allulose-Market Ecosystem

Allulose market is moderately fragmented globally with the top players like Anderson Advanced Ingredients, Apura Ingredients, Bonumose Inc., CJ CheilJedang Corporation, and Samyang Corporation Incorporated dominating the market with advanced enzymatic conversion, high purity crystallization and scalable production technologies. These manufacturers are using process optimization, proprietary enzyme and fermentation methods to sustain competitive advantages and keep up with increasing consumer demand of low-calorie sweeteners.

Major players are targeting niche solutions in order to improve product functionality and product differentiation. For instance, Cargill has come up with allulose-based blends that are specifically designed to be used in the bakery and dairy industries, whereas Bonumose Inc. manufactures high-purity allulose produced by enzymes with clean-label properties. CJ CheilJedang has also proposed speciality formulations as a combination of allulose with prebiotics to improve the digester image and to improve the sweetness profile.

Product diversification, portfolio expansion, and integrated solutions are also being focused on by the companies to enhance efficiency and sustainability in operating. Tate & Lyle PLC, broadened its allulose product range to feature functional sweetener blends in beverages, bakery and frozen desserts. DuePont has recently developed an AI-based system of optimization of the enzyme process, boosting production efficiency by 15% and decreasing energy use, and proving the importance of smart technologies in scaling and sustainability.

Recent Development and Strategic Overview:

- In September 2025, Samyang Corporation’s allulose brand Nexweet Allulose received official novel food approval in China from the National Health Commission (NHC) and the China National Center for Food Safety Risk Assessment (CFSA), making Samyang the first non‑Chinese manufacturer to achieve this clearance. This approval allows the company to directly supply allulose to China’s growing consumer market and enables Korean food companies using Nexweet Allulose to export products into China.

- In October 2024, 1‑2-Taste received the FSSAI approval to import and commercially promote the rare sugar Allulose in India under the name allSWEET in partnership with Anderson Advanced Ingredients, becoming the first Indian company to be authorised to sell the low-calorie sugar substitute.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 0.3 Bn |

|

Market Forecast Value in 2035 |

USD 0.9 Bn |

|

Growth Rate (CAGR) |

11.4% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Tons for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Allulose-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Allulose Market, By Product Type |

|

|

Allulose Market, By Purity Level |

|

|

Allulose Market, By Source |

|

|

Allulose Market, By Production Method |

|

|

Allulose Market, Form |

|

|

Allulose Market, By Application |

|

|

Allulose Market, By Distribution Channel |

|

|

Allulose Market, By Packaging Type |

|

|

Allulose Market, By Function |

|

Frequently Asked Questions

The global allulose market was valued at USD 0.3 Bn in 2025.

The global allulose market industry is expected to grow at a CAGR of 11.4% from 2026 to 2035.

The allulose market is driven by rising consumer demand for low-calorie, sugar-reduced, and keto-friendly products, along with growing health consciousness. Increasing adoption in functional, clean-label, and naturally derived foods, combined with technological innovations, strategic partnerships, and wider availability through retail and e-commerce channels, is accelerating global market growth.

In terms of form, the powder segment accounted for the major share in 2025.

Key players in the global allulose market include prominent companies such as Anderson Global Group, Apura Ingredients, Bonumose Inc., Cargill, Incorporated, Celanese Corporation, CJ CheilJedang Corporation, Dancheng Caixin Sugar Industry Co., Ltd., Dengfeng Gelong Food Co., Ltd., DuPont de Nemours, Inc., Evergreen Sweeteners, Farmland Food Co., Ltd., Futaste Pharmaceutical Co., Ltd., Guangdong Food Industry Institute Co., Ltd., Hebei Huaxu Pharmaceutical Co., Ltd., Icon Foods, Ingredion Incorporated, Matsutani Chemical Industry Co., Ltd., Samyang Corporation, Tate & Lyle PLC, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Allulose Market Outlook

- 2.1.1. Allulose Market Size (Volume - Tons and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Allulose Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Allulose Industry Overview, 2025

- 3.1.1. Food & Beverages Industry Ecosystem Analysis

- 3.1.2. Key Trends for Food & Beverages Industry

- 3.1.3. Regional Distribution for Food & Beverages Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Allulose Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising consumer demand for low-calorie and sugar-replacement products

- 4.1.1.2. Growing health awareness and preference for clean-label, functional foods

- 4.1.1.3. Technological advancements in production, such as enzymatic conversion and high-purity processing

- 4.1.2. Restraints

- 4.1.2.1. High production costs compared to conventional sweeteners

- 4.1.2.2. Regulatory challenges and varying approval processes across regions

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Allulose Manufacturer

- 4.4.3. Dealers/ Distributors

- 4.4.4. End-Users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Allulose Market Demand

- 4.9.1. Historical Market Size – Volume (Tons) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - Volume (Tons) and Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Allulose Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Allulose Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. D-Allulose (D-Psicose)

- 6.2.2. Crystalline Allulose

- 6.2.3. Liquid/Syrup Allulose

- 6.2.4. Powdered Allulose

- 7. Global Allulose Market Analysis, by Purity Level

- 7.1. Key Segment Analysis

- 7.2. Allulose Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, by Purity Level, 2021-2035

- 7.2.1. High Purity (>95%)

- 7.2.2. Standard Purity (90-95%)

- 7.2.3. Low Purity (<90%)

- 8. Global Allulose Market Analysis, by Source

- 8.1. Key Segment Analysis

- 8.2. Allulose Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, by Source, 2021-2035

- 8.2.1. Corn-derived

- 8.2.2. Sugar-derived (Sucrose)

- 8.2.3. Wheat-derived

- 8.2.4. Other Sources

- 9. Global Allulose Market Analysis, by Production Method

- 9.1. Key Segment Analysis

- 9.2. Allulose Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, by Production Method, 2021-2035

- 9.2.1. Enzymatic Conversion

- 9.2.2. Chemical Synthesis

- 9.2.3. Fermentation-based

- 9.2.4. Extraction Process

- 9.2.5. Others

- 10. Global Allulose Market Analysis, by Form

- 10.1. Key Segment Analysis

- 10.2. Allulose Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, by Form, 2021-2035

- 10.2.1. Granular

- 10.2.2. Powder

- 10.2.3. Syrup

- 10.2.4. Crystals

- 11. Global Allulose Market Analysis, by Application

- 11.1. Key Segment Analysis

- 11.2. Allulose Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, by Application, 2021-2035

- 11.2.1. Beverages

- 11.2.2. Bakery & Confectionery

- 11.2.3. Dairy & Frozen Desserts

- 11.2.4. Pharmaceuticals

- 11.2.5. Nutraceuticals & Dietary Supplements

- 11.2.6. Personal Care Products

- 11.2.7. Processed Foods

- 11.2.8. Snacks & Cereals

- 11.2.9. Others

- 12. Global Allulose Market Analysis, by Distribution Channel

- 12.1. Key Segment Analysis

- 12.2. Allulose Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 12.2.1. Direct Sales (B2B)

- 12.2.2. Distributors & Wholesalers

- 12.2.3. Online Retail

- 12.2.4. Specialty Stores

- 12.2.5. Supermarkets & Hypermarkets

- 13. Global Allulose Market Analysis, by Packaging Type

- 13.1. Key Segment Analysis

- 13.2. Allulose Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, by Packaging Type, 2021-2035

- 13.2.1. Bulk Packaging

- 13.2.2. Retail Packaging

- 13.2.3. Sachets

- 13.2.4. Industrial Containers

- 13.2.5. Others

- 14. Global Allulose Market Analysis, by Function

- 14.1. Key Segment Analysis

- 14.2. Allulose Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, by Function, 2021-2035

- 14.2.1. Sweetener

- 14.2.2. Bulking Agent

- 14.2.3. Texturizer

- 14.2.4. Flavor Enhancer

- 14.2.5. Moisture Retainer

- 14.2.6. Browning Agent

- 14.2.7. Others

- 15. Global Allulose Market Analysis and Forecasts, by Region

- 15.1. Key Findings

- 15.2. Allulose Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 15.2.1. North America

- 15.2.2. Europe

- 15.2.3. Asia Pacific

- 15.2.4. Middle East

- 15.2.5. Africa

- 15.2.6. South America

- 16. North America Allulose Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. North America Allulose Market Size Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Purity Level

- 16.3.3. Source

- 16.3.4. Production Method

- 16.3.5. Form

- 16.3.6. Application

- 16.3.7. Distribution Channel

- 16.3.8. Packaging Type

- 16.3.9. Function

- 16.3.10. Country

- 16.3.10.1. USA

- 16.3.10.2. Canada

- 16.3.10.3. Mexico

- 16.4. USA Allulose Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Purity Level

- 16.4.4. Source

- 16.4.5. Production Method

- 16.4.6. Form

- 16.4.7. Application

- 16.4.8. Distribution Channel

- 16.4.9. Packaging Type

- 16.4.10. Function

- 16.5. Canada Allulose Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Purity Level

- 16.5.4. Source

- 16.5.5. Production Method

- 16.5.6. Form

- 16.5.7. Application

- 16.5.8. Distribution Channel

- 16.5.9. Packaging Type

- 16.5.10. Function

- 16.6. Mexico Allulose Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Purity Level

- 16.6.4. Source

- 16.6.5. Production Method

- 16.6.6. Form

- 16.6.7. Application

- 16.6.8. Distribution Channel

- 16.6.9. Packaging Type

- 16.6.10. Function

- 17. Europe Allulose Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Europe Allulose Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Purity Level

- 17.3.3. Source

- 17.3.4. Production Method

- 17.3.5. Form

- 17.3.6. Application

- 17.3.7. Distribution Channel

- 17.3.8. Packaging Type

- 17.3.9. Function

- 17.3.10. Country

- 17.3.10.1. Germany

- 17.3.10.2. United Kingdom

- 17.3.10.3. France

- 17.3.10.4. Italy

- 17.3.10.5. Spain

- 17.3.10.6. Netherlands

- 17.3.10.7. Nordic Countries

- 17.3.10.8. Poland

- 17.3.10.9. Russia & CIS

- 17.3.10.10. Rest of Europe

- 17.4. Germany Allulose Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Purity Level

- 17.4.4. Source

- 17.4.5. Production Method

- 17.4.6. Form

- 17.4.7. Application

- 17.4.8. Distribution Channel

- 17.4.9. Packaging Type

- 17.4.10. Function

- 17.5. United Kingdom Allulose Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Purity Level

- 17.5.4. Source

- 17.5.5. Production Method

- 17.5.6. Form

- 17.5.7. Application

- 17.5.8. Distribution Channel

- 17.5.9. Packaging Type

- 17.5.10. Function

- 17.6. France Allulose Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Purity Level

- 17.6.4. Source

- 17.6.5. Production Method

- 17.6.6. Form

- 17.6.7. Application

- 17.6.8. Distribution Channel

- 17.6.9. Packaging Type

- 17.6.10. Function

- 17.7. Italy Allulose Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Purity Level

- 17.7.4. Source

- 17.7.5. Production Method

- 17.7.6. Form

- 17.7.7. Application

- 17.7.8. Distribution Channel

- 17.7.9. Packaging Type

- 17.7.10. Function

- 17.8. Spain Allulose Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Purity Level

- 17.8.4. Source

- 17.8.5. Production Method

- 17.8.6. Form

- 17.8.7. Application

- 17.8.8. Distribution Channel

- 17.8.9. Packaging Type

- 17.8.10. Function

- 17.9. Netherlands Allulose Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Product Type

- 17.9.3. Purity Level

- 17.9.4. Source

- 17.9.5. Production Method

- 17.9.6. Form

- 17.9.7. Application

- 17.9.8. Distribution Channel

- 17.9.9. Packaging Type

- 17.9.10. Function

- 17.10. Nordic Countries Allulose Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Product Type

- 17.10.3. Purity Level

- 17.10.4. Source

- 17.10.5. Production Method

- 17.10.6. Form

- 17.10.7. Application

- 17.10.8. Distribution Channel

- 17.10.9. Packaging Type

- 17.10.10. Function

- 17.11. Poland Allulose Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Product Type

- 17.11.3. Purity Level

- 17.11.4. Source

- 17.11.5. Production Method

- 17.11.6. Form

- 17.11.7. Application

- 17.11.8. Distribution Channel

- 17.11.9. Packaging Type

- 17.11.10. Function

- 17.12. Russia & CIS Allulose Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Product Type

- 17.12.3. Purity Level

- 17.12.4. Source

- 17.12.5. Production Method

- 17.12.6. Form

- 17.12.7. Application

- 17.12.8. Distribution Channel

- 17.12.9. Packaging Type

- 17.12.10. Function

- 17.13. Rest of Europe Allulose Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Product Type

- 17.13.3. Purity Level

- 17.13.4. Source

- 17.13.5. Production Method

- 17.13.6. Form

- 17.13.7. Application

- 17.13.8. Distribution Channel

- 17.13.9. Packaging Type

- 17.13.10. Function

- 18. Asia Pacific Allulose Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Asia Pacific Allulose Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Purity Level

- 18.3.3. Source

- 18.3.4. Production Method

- 18.3.5. Form

- 18.3.6. Application

- 18.3.7. Distribution Channel

- 18.3.8. Packaging Type

- 18.3.9. Function

- 18.3.10. Country

- 18.3.10.1. China

- 18.3.10.2. India

- 18.3.10.3. Japan

- 18.3.10.4. South Korea

- 18.3.10.5. Australia and New Zealand

- 18.3.10.6. Indonesia

- 18.3.10.7. Malaysia

- 18.3.10.8. Thailand

- 18.3.10.9. Vietnam

- 18.3.10.10. Rest of Asia Pacific

- 18.4. China Allulose Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Purity Level

- 18.4.4. Source

- 18.4.5. Production Method

- 18.4.6. Form

- 18.4.7. Application

- 18.4.8. Distribution Channel

- 18.4.9. Packaging Type

- 18.4.10. Function

- 18.5. India Allulose Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Purity Level

- 18.5.4. Source

- 18.5.5. Production Method

- 18.5.6. Form

- 18.5.7. Application

- 18.5.8. Distribution Channel

- 18.5.9. Packaging Type

- 18.5.10. Function

- 18.6. Japan Allulose Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Purity Level

- 18.6.4. Source

- 18.6.5. Production Method

- 18.6.6. Form

- 18.6.7. Application

- 18.6.8. Distribution Channel

- 18.6.9. Packaging Type

- 18.6.10. Function

- 18.7. South Korea Allulose Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Purity Level

- 18.7.4. Source

- 18.7.5. Production Method

- 18.7.6. Form

- 18.7.7. Application

- 18.7.8. Distribution Channel

- 18.7.9. Packaging Type

- 18.7.10. Function

- 18.8. Australia and New Zealand Allulose Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Purity Level

- 18.8.4. Source

- 18.8.5. Production Method

- 18.8.6. Form

- 18.8.7. Application

- 18.8.8. Distribution Channel

- 18.8.9. Packaging Type

- 18.8.10. Function

- 18.9. Indonesia Allulose Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Product Type

- 18.9.3. Purity Level

- 18.9.4. Source

- 18.9.5. Production Method

- 18.9.6. Form

- 18.9.7. Application

- 18.9.8. Distribution Channel

- 18.9.9. Packaging Type

- 18.9.10. Function

- 18.10. Malaysia Allulose Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Product Type

- 18.10.3. Purity Level

- 18.10.4. Source

- 18.10.5. Production Method

- 18.10.6. Form

- 18.10.7. Application

- 18.10.8. Distribution Channel

- 18.10.9. Packaging Type

- 18.10.10. Function

- 18.11. Thailand Allulose Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Product Type

- 18.11.3. Purity Level

- 18.11.4. Source

- 18.11.5. Production Method

- 18.11.6. Form

- 18.11.7. Application

- 18.11.8. Distribution Channel

- 18.11.9. Packaging Type

- 18.11.10. Function

- 18.12. Vietnam Allulose Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Product Type

- 18.12.3. Purity Level

- 18.12.4. Source

- 18.12.5. Production Method

- 18.12.6. Form

- 18.12.7. Application

- 18.12.8. Distribution Channel

- 18.12.9. Packaging Type

- 18.12.10. Function

- 18.13. Rest of Asia Pacific Allulose Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Product Type

- 18.13.3. Purity Level

- 18.13.4. Source

- 18.13.5. Production Method

- 18.13.6. Form

- 18.13.7. Application

- 18.13.8. Distribution Channel

- 18.13.9. Packaging Type

- 18.13.10. Function

- 19. Middle East Allulose Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Middle East Allulose Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Purity Level

- 19.3.3. Source

- 19.3.4. Production Method

- 19.3.5. Form

- 19.3.6. Application

- 19.3.7. Distribution Channel

- 19.3.8. Packaging Type

- 19.3.9. Function

- 19.3.10. Country

- 19.3.10.1. Turkey

- 19.3.10.2. UAE

- 19.3.10.3. Saudi Arabia

- 19.3.10.4. Israel

- 19.3.10.5. Rest of Middle East

- 19.4. Turkey Allulose Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Purity Level

- 19.4.4. Source

- 19.4.5. Production Method

- 19.4.6. Form

- 19.4.7. Application

- 19.4.8. Distribution Channel

- 19.4.9. Packaging Type

- 19.4.10. Function

- 19.5. UAE Allulose Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Purity Level

- 19.5.4. Source

- 19.5.5. Production Method

- 19.5.6. Form

- 19.5.7. Application

- 19.5.8. Distribution Channel

- 19.5.9. Packaging Type

- 19.5.10. Function

- 19.6. Saudi Arabia Allulose Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Purity Level

- 19.6.4. Source

- 19.6.5. Production Method

- 19.6.6. Form

- 19.6.7. Application

- 19.6.8. Distribution Channel

- 19.6.9. Packaging Type

- 19.6.10. Function

- 19.7. Israel Allulose Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Purity Level

- 19.7.4. Source

- 19.7.5. Production Method

- 19.7.6. Form

- 19.7.7. Application

- 19.7.8. Distribution Channel

- 19.7.9. Packaging Type

- 19.7.10. Function

- 19.8. Rest of Middle East Allulose Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Purity Level

- 19.8.4. Source

- 19.8.5. Production Method

- 19.8.6. Form

- 19.8.7. Application

- 19.8.8. Distribution Channel

- 19.8.9. Packaging Type

- 19.8.10. Function

- 20. Africa Allulose Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Africa Allulose Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Purity Level

- 20.3.3. Source

- 20.3.4. Production Method

- 20.3.5. Form

- 20.3.6. Application

- 20.3.7. Distribution Channel

- 20.3.8. Packaging Type

- 20.3.9. Function

- 20.3.10. Country

- 20.3.10.1. South Africa

- 20.3.10.2. Egypt

- 20.3.10.3. Nigeria

- 20.3.10.4. Algeria

- 20.3.10.5. Rest of Africa

- 20.4. South Africa Allulose Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Purity Level

- 20.4.4. Source

- 20.4.5. Production Method

- 20.4.6. Form

- 20.4.7. Application

- 20.4.8. Distribution Channel

- 20.4.9. Packaging Type

- 20.4.10. Function

- 20.5. Egypt Allulose Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Purity Level

- 20.5.4. Source

- 20.5.5. Production Method

- 20.5.6. Form

- 20.5.7. Application

- 20.5.8. Distribution Channel

- 20.5.9. Packaging Type

- 20.5.10. Function

- 20.6. Nigeria Allulose Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Purity Level

- 20.6.4. Source

- 20.6.5. Production Method

- 20.6.6. Form

- 20.6.7. Application

- 20.6.8. Distribution Channel

- 20.6.9. Packaging Type

- 20.6.10. Function

- 20.7. Algeria Allulose Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Product Type

- 20.7.3. Purity Level

- 20.7.4. Source

- 20.7.5. Production Method

- 20.7.6. Form

- 20.7.7. Application

- 20.7.8. Distribution Channel

- 20.7.9. Packaging Type

- 20.7.10. Function

- 20.8. Rest of Africa Allulose Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Product Type

- 20.8.3. Purity Level

- 20.8.4. Source

- 20.8.5. Production Method

- 20.8.6. Form

- 20.8.7. Application

- 20.8.8. Distribution Channel

- 20.8.9. Packaging Type

- 20.8.10. Function

- 21. South America Allulose Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. South Africa Allulose Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Product Type

- 21.3.2. Purity Level

- 21.3.3. Source

- 21.3.4. Production Method

- 21.3.5. Form

- 21.3.6. Application

- 21.3.7. Distribution Channel

- 21.3.8. Packaging Type

- 21.3.9. Function

- 21.3.10. Country

- 21.3.10.1. Brazil

- 21.3.10.2. Argentina

- 21.3.10.3. Rest of South America

- 21.4. Brazil Allulose Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Product Type

- 21.4.3. Purity Level

- 21.4.4. Source

- 21.4.5. Production Method

- 21.4.6. Form

- 21.4.7. Application

- 21.4.8. Distribution Channel

- 21.4.9. Packaging Type

- 21.4.10. Function

- 21.5. Argentina Allulose Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Product Type

- 21.5.3. Purity Level

- 21.5.4. Source

- 21.5.5. Production Method

- 21.5.6. Form

- 21.5.7. Application

- 21.5.8. Distribution Channel

- 21.5.9. Packaging Type

- 21.5.10. Function

- 21.6. Rest of South America Allulose Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Product Type

- 21.6.3. Purity Level

- 21.6.4. Source

- 21.6.5. Production Method

- 21.6.6. Form

- 21.6.7. Application

- 21.6.8. Distribution Channel

- 21.6.9. Packaging Type

- 21.6.10. Function

- 22. Key Players/ Company Profile

- 22.1. Anderson Global Group

- 22.1.1. Company Details/ Overview

- 22.1.2. Company Financials

- 22.1.3. Key Customers and Competitors

- 22.1.4. Business/ Industry Portfolio

- 22.1.5. Product Portfolio/ Specification Details

- 22.1.6. Pricing Data

- 22.1.7. Strategic Overview

- 22.1.8. Recent Developments

- 22.2. Apura Ingredients

- 22.3. Bonumose Inc.

- 22.4. Cargill, Incorporated

- 22.5. Celanese Corporation

- 22.6. CJ CheilJedang Corporation

- 22.7. Dancheng Caixin Sugar Industry Co., Ltd.

- 22.8. Dengfeng Gelong Food Co., Ltd.

- 22.9. DuPont de Nemours, Inc.

- 22.10. Evergreen Sweeteners

- 22.11. Farmland Food Co., Ltd.

- 22.12. Futaste Pharmaceutical Co., Ltd.

- 22.13. Guangdong Food Industry Institute Co., Ltd.

- 22.14. Hebei Huaxu Pharmaceutical Co., Ltd.

- 22.15. Icon Foods

- 22.16. Ingredion Incorporated

- 22.17. Matsutani Chemical Industry Co., Ltd.

- 22.18. Samyang Corporation

- 22.19. Tate & Lyle PLC

- 22.20. Other Key Players

- 22.1. Anderson Global Group

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data