Baby Car Seat Market Size, Share, Growth Opportunity Analysis Report by Product Type (Infant Car Seats, Convertible Car Seats, Booster Car Seats (High Back and Backless), Combination Car Seats and All-in-One Car Seats), Weight Group, Category, Price (USD), End User, Distribution Channel and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035.

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Baby Car Seat Market Size, Share, and Growth

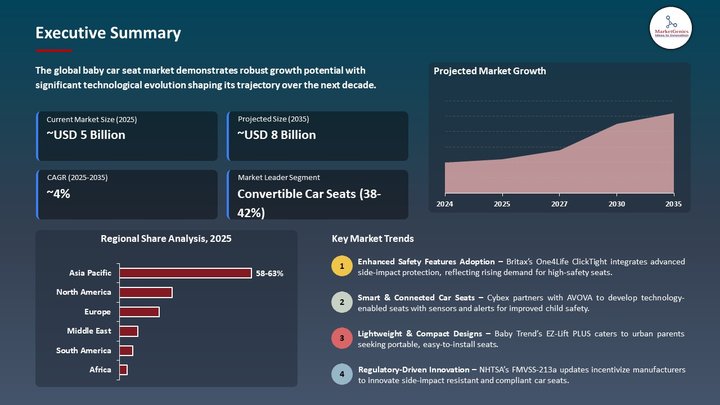

The worldwide baby car seat market is expanding from USD 5.2 billion in 2025 to USD 8.4 billion by the year 2035, showing a CAGR of 4.5% over the forecast period. The global baby car seats market is gaining strong momentum, chiefly because of the newer technology that ensures there is safety for the child along with the parent in a convenient manner. Smart car seats are now being manufactured that come with real-time monitoring, temperature control, and other connectivity features.

The launch of Anoris T i-Size marks Cybex's first introduction of a child car seat with a full-body, integrated baby car seat. In an innovative manner, this system can provide an extra 50% protection in frontal impacts over the traditional forward-facing seat. In front of the child, an baby car seat inflates within hundreds of a second, limiting forward motion by creating a C-shaped cushioned body and taking pressure away from the abdomen. This seat covers an extensive range of sizes and ages for children from 15 months to about 6 years; from 76 cm to 115 cm in height and weighing up to 21 kg. The carrier also provides enough legroom so that the kids remain comfortable for longer periods while travelling. The Anoris T i-Size has been recognized for its safety innovations and achieved excellent crash test results from credible independent institutions, namely Stiftung Warentest and ADAC.

An example can be cited of the Cybex Sirona M by Goodbaby International, which has incorporated the SensorSafe technology that warns parents if the child is unbuckling the harness or if the seat is abnormally hot, which may become potential hazards for the child's safety. Such innovations are very appealing to the tech-savvy crowd and shall lead to market growth.

The enforcement of strict government safety regulations concerning the utilization of children safety seats in vehicles is a factor. Countries around the globe are legislating that enforced law be in place regarding the use of appropriate car seats for children, thus increasing their demand. In Australia, such regulations affirm that car seats must be used for children under six months of age and that children aged between six months and four years must be provided with rear- or forward-facing seats with a harness. Such legislations have kept most parents bound to comply with laws, which results in the increase of demand within the car seat market

Baby Car Seat Market Dynamics and Trends

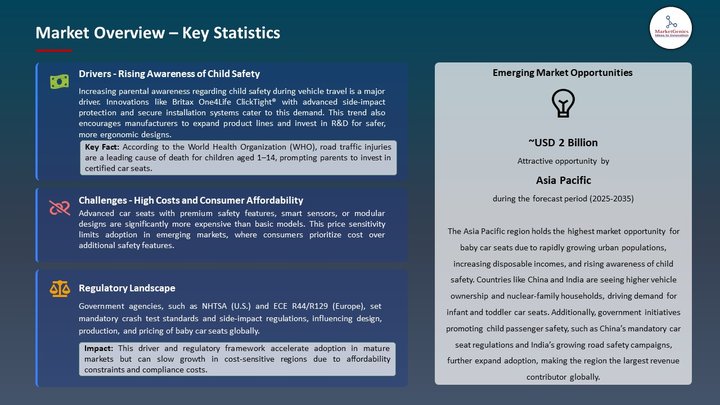

Driver: Rising Awareness of Child Safety and Regulatory Enforcement

- The growing consciousness surrounding child safety in vehicular travel is an eminent driver of the baby car seat market. Governments are putting stringent regulations all over the world, forcing parents to use child restraint systems so that the deaths and injury of children may be reduced. For instance, Regulation No. 129 (i-Size) of the European Union requires more protection for children, including testing for side impacts, while also making travel in the rear-facing position compulsory for infants up to 15 months. Such regulations increase the demand for car seats from parents due to their need to invest in ones that comply with standards. Manufacturers are being pressured to develop products complying with or exceeding these safety standards.

- For instance, CYBEX released the Anoris T i-Size car seat that adjusts to the child's growth, ranging from 15 months to about 6 years, to offer maximum safety in forward-facing positions. Such innovations help in compliance with regulations and in building consumer confidence, hence fostering further market growth.

Driver: Technological Advancements in Smart Car Seats

- Added technological innovation constitutes another force acting upon the baby car seat market to propel it further. Modern parents now prefer to buy smart technology products that offer safety and convenience. In response, manufacturers must integrate the newest technology in their Car Seats: sensors, Bluetooth, real-time monitoring, etc. For example, Goodbaby International, through one of its brands, Cybex, has developed the Sirona M model equipped with SensorSafe, a technology that warns the parent should the child unbuckle the harness or if the seat becomes too hot, thereby preventing potential safety hazards.

- These smart features endow the parent with peace of mind and, together with other factors, set the products apart in a competitive marketplace. With further development of technology, we will witness new innovations for child's safety and comfort, such as biometric monitoring and integration with vehicle safety systems. Such improvements should seize the attention of tech consumers and cause expansion of the market.

Restraint: Impact of Tariffs on Baby Car Seat Prices

- The increasing awareness of child safety during vehicular travel is a prime driver for the baby car seat market. Governments across the world are formulating stringent regulations with the aim of making child restraint systems necessary in order to bring down child fatalities and injuries. To cite, Regulation No. 129 (i-Size) in the European Union demands better protection for children by requiring side impact testing as well as insisting that infants remain rear-facing until 15 months of age. When these regulations go into effect, they must also commit parents to buying compliant car seats, thus pushing the market higher.

- Manufacturers are trying to innovate solutions that comply with or exceed the highest safety standards set by regulating authorities. For example, CYBEX's Anoris T i-Size car seat, which is engineered to provide the safest forward-facing protection possible as the child grows from 15 months to approximately 6 years, gives rise to such innovations that not only satisfy regulatory intent but also establish consumer confidence as another market driver.

Opportunity: Expansion in Emerging Markets

- Emerging markets, particularly in Asia-Pacific and Latin America, are reflecting the opportunities for baby car seat markets' growth. The factors that lead to this demand are such as per capita income, birth rate, and child safety awareness. Asia-Pacific particularly stands to gain by its rapid urbanization and lifestyle transformations.

- Manufacturers could take the opportunity to manufacture products based on the local consumer need and preference. These blog products structure features such as affordable and easy-to-install systems, compact design for smaller cars that are prevailing in the said markets. Associating with local distributors and advertising via e-commerce portals can actually help in penetrating the market well.

Key Trend: Emphasis on Sustainability and Eco-Friendly Materials

- A major trend in sustainability has been sweeping the baby car seat market, where consumers are steadily becoming more of the green-conscious sort. This consumer behavior has led manufacturers down a road of adaptation involved with using recycled and non-toxic materials in their products.

- In order to attract consumers working for the promotion of green issues, Maxi-Cosi, under Dorel Juvenile, launched the Mica Pro Eco car seat using fabrics made with 100% recycled PET bottles.

- Appealing to sustainability concerns has become a selling point for the environmentally aware consumer; it is consistent with the global concern of reducing environmental impact. We envision environmental reasons to continue shaping purchase decisions, thus encouraging more manufacturers to embrace sustainability in return shaping the market.

Baby Car Seat Market Analysis and Segmental Data

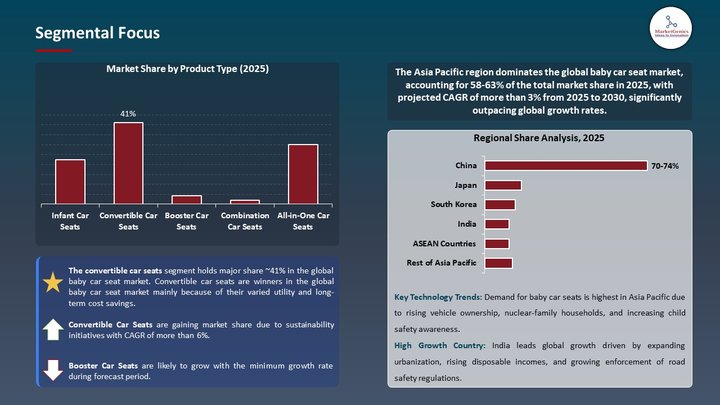

Based on Product Type, the convertible car seats segment retains the largest share

- The convertible car seats segment holds major share ~41% in the global baby car seat market. Convertible car seats are winners in the global baby car seat market mainly because of their varied utility and long-term cost savings. Convertible car seats usually change the mode of being rear-facing for infants to forward-facing for toddlers as they change in size. This one set of car seats finish all the accommodation offers parents, therefore, a practical and economical approach.

- Convertible car seat manufacturers keep enhancing their products to cater to the ever-changing taste for safety and comfort among consumers. Baby Jogger introduced the City Turn Convertible Car Seat with a one-hand 180-degree rotation while rear-facing, thus improving access and ease for parents. Innovations such as these not only offer convenience for the users but also emphasize child safety, all adding to how convertible car seats keep growing and leading the global market.

Asia Pacific Dominates Global Baby Car Seat Market in 2025 and Beyond

- Growing practically in lockstep with urban development, baby seats comprise an important safety strategy for growing awareness of child safety and rising incomes in Asia Pacific. As more families obtain vehicles in countries such as China and India, children's vehicle safety products, car seats included, have found greater demand. Government programs in favor of child safety also see to it that the demand is supported; for example, in India, governmental agencies have directed that all car manufacturers provide for child-seat installation. Along with the high birth rate, this in turn causes the pool of consumers to steadily grow and makes Asia Pacific a highly attractive market for baby car seats.

- Manufacturers have, in turn, developed products that suit the growing demand peculiar to the Asia Pacific market. For instance, "value-priced" car seats that one could easily install either by oneself or with minimal assistance into small, closely vehicle-like cars, are being produced. Faster distribution of these products through online and offline retail outlets has improved accessibility to the consumers as well. Consequently, the Asia Pacific baby car seat market is expected to continue along its path of rapid growth driven by demographic trends, economic development, and proactive safety measures.

Baby Car Seat Market Ecosystem

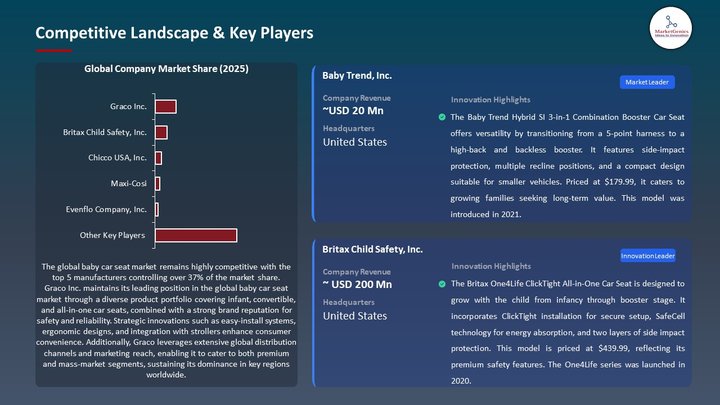

Key players in the global baby car seat market include prominent companies such as Graco Inc., Britax Child Safety, Inc., Chicco USA, Inc., Maxi-Cosi, Evenflo Company, Inc. and Other Key Players.

The global baby car seat market has a moderate level of consolidation. Tier 1 car seat companies, such as CYBEX, Graco, and Britax, have the largest market shares. Tier 2 and 3 companies, such as Clek, Joie, and Nuna, target the smaller market segments. The level of concentration in the market lies in the middle, indicating that there are both well-known established companies as well as newer companies. The level of concentration in buyers is in the middle, due to parents who are well-informed and looking for safety and other related features, whilst the level of concentration in suppliers is on the higher side due to the need for specialized technology and materials. Together, these aspects influence the level of competition, pricing, and innovation.

Recent Development and Strategic Overview:

- In May 2025, the National Highway Traffic Safety Administration had issued a proposed rule amending Federal Motor Vehicle Safety Standard (FMVSS) No. 213a: Accepting that a 30-mph side impact testing collision be required on child restraint systems for child weights up to 40 pounds. Manufacturers were given an extension under the New FMVSS-213a for compliance until December 5, 2026, providing them with more time to make adjustments. The enactment of this law further symbolizes a growing commitment by the U.S. Government towards child safety in side-impact crashes, while affording manufacturers an exciting opportunity to innovate in fulfilling these new standards.

- In April 2024, Cybex has entered into a strategic partnership with AVOVA towards developing leading solutions in child safety seating products. The partnership perfectly considers blending AVOVA's technology recreation from evolving standards and consumer demands with Cybex's decades of experience in child safety. In some respects, this collaboration symbolizes the larger trend of collaboration and creativity to tackle regulatory challenges in the baby car seat market.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 5.2 Bn |

|

Market Forecast Value in 2035 |

USD 8.4 Bn |

|

Growth Rate (CAGR) |

4.5% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Baby Car Seat Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Product Type |

|

|

By Weight Group |

|

|

By Category |

|

|

By Price (USD) |

|

|

By End User |

|

|

By Distribution Channel |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Baby Car Seat Market Outlook

- 2.1.1. Baby Car Seat Market Size (Volume – Mn Units and Value - US$ Bn), and Forecasts, 2020-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Baby Car Seat Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Baby Car Seat Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Baby Car Seat Industry

- 3.1.3. Regional Distribution for Baby Car Seat

- 3.2. Supplier Customer Data

- 3.3. Weight Group Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the Component & Raw Material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Baby Car Seat Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Stringent safety regulations and government mandates

- 4.1.1.2. Rising parental awareness and demand for advanced safety features

- 4.1.1.3. Technological innovations and product customization

- 4.1.2. Restraints

- 4.1.2.1. High costs due to tariffs and advanced features

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Component Suppliers

- 4.4.2. Baby Car Seat Manufacturers

- 4.4.3. Dealers/ Distributors

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Baby Car Seat Market Demand

- 4.9.1. Historical Market Size - in Volume (Mn Units) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - in Volume (Mn Units) and Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Baby Car Seat Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Baby Car Seat Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2020-2035

- 6.2.1. Infant Car Seats

- 6.2.2. Convertible Car Seats

- 6.2.3. Booster Car Seats

- 6.2.3.1. High Back

- 6.2.3.2. Backless

- 6.2.4. Combination Car Seats

- 6.2.5. All-in-One Car Seats

- 7. Global Baby Car Seat Market Analysis, by Weight Group

- 7.1. Key Segment Analysis

- 7.2. Baby Car Seat Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Weight Group, 2020-2035

- 7.2.1. Group 0: Up to 10 kg (0–9 months)

- 7.2.2. Group 0+: Up to 13 kg (0–15 months)

- 7.2.3. Group 1: 9–18 kg (9 months to 4 years)

- 7.2.4. Group 2: 15–25 kg (4 to 6 years)

- 7.2.5. Group 3: 22–36 kg (6 to 12 years)

- 8. Global Baby Car Seat Market Analysis, by Category

- 8.1. Key Segment Analysis

- 8.2. Baby Car Seat Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Category, 2020-2035

- 8.2.1. Economy

- 8.2.2. Mid-Range

- 8.2.3. Premium

- 8.2.4. Luxury

- 9. Global Baby Car Seat Market Analysis, by Price (USD)

- 9.1. Key Segment Analysis

- 9.2. Baby Car Seat Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Price (USD), 2020-2035

- 9.2.1. Below USD 50

- 9.2.2. USD 50-100

- 9.2.3. USD 100-200

- 9.2.4. USD 200-300

- 9.2.5. USD 300-400

- 9.2.6. Above USD 400

- 10. Global Baby Car Seat Market Analysis, by End User

- 10.1. Key Segment Analysis

- 10.2. Baby Car Seat Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by End User, 2020-2035

- 10.2.1. Personal Use

- 10.2.2. Commercial Use

- 10.2.2.1. Hospitals

- 10.2.2.2. Childcare centers

- 10.2.2.3. Car rental services

- 10.2.2.4. Ride-hailing and taxi fleets

- 11. Global Baby Car Seat Market Analysis, by Distribution Channel

- 11.1. Key Segment Analysis

- 11.2. Baby Car Seat Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2020-2035

- 11.2.1. Online

- 11.2.1.1. E-Commerce Websites

- 11.2.1.2. Company-Owned Websites

- 11.2.2. Offline/ Traditional Dealerships

- 11.2.2.1. Supermarket/ Hypermarket

- 11.2.2.2. Departmental Stores

- 11.2.2.3. Others

- 11.2.1. Online

- 12. Global Baby Car Seat Market Analysis and Forecasts, by Region

- 12.1. Key Findings

- 12.2. Baby Car Seat Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Region, 2020-2035

- 12.2.1. North America

- 12.2.2. Europe

- 12.2.3. Asia Pacific

- 12.2.4. Middle East

- 12.2.5. Africa

- 12.2.6. South America

- 13. North America Baby Car Seat Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. North America Baby Car Seat Market Size Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 13.3.1. Product Type

- 13.3.2. Weight Group

- 13.3.3. Category

- 13.3.4. Price (USD)

- 13.3.5. End User

- 13.3.6. Distribution Channel

- 13.3.7. Country

- 13.3.7.1. USA

- 13.3.7.2. Canada

- 13.3.7.3. Mexico

- 13.4. USA Baby Car Seat Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Product Type

- 13.4.3. Weight Group

- 13.4.4. Category

- 13.4.5. Price (USD)

- 13.4.6. End User

- 13.4.7. Distribution Channel

- 13.5. Canada Baby Car Seat Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Product Type

- 13.5.3. Weight Group

- 13.5.4. Category

- 13.5.5. Price (USD)

- 13.5.6. End User

- 13.5.7. Distribution Channel

- 13.6. Mexico Baby Car Seat Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Product Type

- 13.6.3. Weight Group

- 13.6.4. Category

- 13.6.5. Price (USD)

- 13.6.6. End User

- 13.6.7. Distribution Channel

- 14. Europe Baby Car Seat Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Europe Baby Car Seat Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 14.3.1. Product Type

- 14.3.2. Weight Group

- 14.3.3. Category

- 14.3.4. Price (USD)

- 14.3.5. End User

- 14.3.6. Distribution Channel

- 14.3.7. Country

- 14.3.7.1. Germany

- 14.3.7.2. United Kingdom

- 14.3.7.3. France

- 14.3.7.4. Italy

- 14.3.7.5. Spain

- 14.3.7.6. Netherlands

- 14.3.7.7. Nordic Countries

- 14.3.7.8. Poland

- 14.3.7.9. Russia & CIS

- 14.3.7.10. Rest of Europe

- 14.4. Germany Baby Car Seat Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Weight Group

- 14.4.4. Category

- 14.4.5. Price (USD)

- 14.4.6. End User

- 14.4.7. Distribution Channel

- 14.5. United Kingdom Baby Car Seat Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Weight Group

- 14.5.4. Category

- 14.5.5. Price (USD)

- 14.5.6. End User

- 14.5.7. Distribution Channel

- 14.6. France Baby Car Seat Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Weight Group

- 14.6.4. Category

- 14.6.5. Price (USD)

- 14.6.6. End User

- 14.6.7. Distribution Channel

- 14.7. Italy Baby Car Seat Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Product Type

- 14.7.3. Weight Group

- 14.7.4. Category

- 14.7.5. Price (USD)

- 14.7.6. End User

- 14.7.7. Distribution Channel

- 14.8. Spain Baby Car Seat Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Product Type

- 14.8.3. Weight Group

- 14.8.4. Category

- 14.8.5. Price (USD)

- 14.8.6. End User

- 14.8.7. Distribution Channel

- 14.9. Netherlands Baby Car Seat Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Product Type

- 14.9.3. Weight Group

- 14.9.4. Category

- 14.9.5. Price (USD)

- 14.9.6. End User

- 14.9.7. Distribution Channel

- 14.10. Nordic Countries Baby Car Seat Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Product Type

- 14.10.3. Weight Group

- 14.10.4. Category

- 14.10.5. Price (USD)

- 14.10.6. End User

- 14.10.7. Distribution Channel

- 14.11. Poland Baby Car Seat Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Product Type

- 14.11.3. Weight Group

- 14.11.4. Category

- 14.11.5. Price (USD)

- 14.11.6. End User

- 14.11.7. Distribution Channel

- 14.12. Russia & CIS Baby Car Seat Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Product Type

- 14.12.3. Weight Group

- 14.12.4. Category

- 14.12.5. Price (USD)

- 14.12.6. End User

- 14.12.7. Distribution Channel

- 14.13. Rest of Europe Baby Car Seat Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Product Type

- 14.13.3. Weight Group

- 14.13.4. Category

- 14.13.5. Price (USD)

- 14.13.6. End User

- 14.13.7. Distribution Channel

- 15. Asia Pacific Baby Car Seat Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. East Asia Baby Car Seat Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 15.3.1. Product Type

- 15.3.2. Weight Group

- 15.3.3. Category

- 15.3.4. Price (USD)

- 15.3.5. End User

- 15.3.6. Distribution Channel

- 15.3.7. Country

- 15.3.7.1. China

- 15.3.7.2. India

- 15.3.7.3. Japan

- 15.3.7.4. South Korea

- 15.3.7.5. Australia and New Zealand

- 15.3.7.6. Indonesia

- 15.3.7.7. Malaysia

- 15.3.7.8. Thailand

- 15.3.7.9. Vietnam

- 15.3.7.10. Rest of Asia Pacific

- 15.4. China Baby Car Seat Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Weight Group

- 15.4.4. Category

- 15.4.5. Price (USD)

- 15.4.6. End User

- 15.4.7. Distribution Channel

- 15.5. India Baby Car Seat Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Weight Group

- 15.5.4. Category

- 15.5.5. Price (USD)

- 15.5.6. End User

- 15.5.7. Distribution Channel

- 15.6. Japan Baby Car Seat Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Weight Group

- 15.6.4. Category

- 15.6.5. Price (USD)

- 15.6.6. End User

- 15.6.7. Distribution Channel

- 15.7. South Korea Baby Car Seat Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Weight Group

- 15.7.4. Category

- 15.7.5. Price (USD)

- 15.7.6. End User

- 15.7.7. Distribution Channel

- 15.8. Australia and New Zealand Baby Car Seat Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Weight Group

- 15.8.4. Category

- 15.8.5. Price (USD)

- 15.8.6. End User

- 15.8.7. Distribution Channel

- 15.9. Indonesia Baby Car Seat Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Product Type

- 15.9.3. Weight Group

- 15.9.4. Category

- 15.9.5. Price (USD)

- 15.9.6. End User

- 15.9.7. Distribution Channel

- 15.10. Malaysia Baby Car Seat Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Product Type

- 15.10.3. Weight Group

- 15.10.4. Category

- 15.10.5. Price (USD)

- 15.10.6. End User

- 15.10.7. Distribution Channel

- 15.11. Thailand Baby Car Seat Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Product Type

- 15.11.3. Weight Group

- 15.11.4. Category

- 15.11.5. Price (USD)

- 15.11.6. End User

- 15.11.7. Distribution Channel

- 15.12. Vietnam Baby Car Seat Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Product Type

- 15.12.3. Weight Group

- 15.12.4. Category

- 15.12.5. Price (USD)

- 15.12.6. End User

- 15.12.7. Distribution Channel

- 15.13. Rest of Asia Pacific Baby Car Seat Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Product Type

- 15.13.3. Weight Group

- 15.13.4. Category

- 15.13.5. Price (USD)

- 15.13.6. End User

- 15.13.7. Distribution Channel

- 16. Middle East Baby Car Seat Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Middle East Baby Car Seat Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 16.3.1. Product Type

- 16.3.2. Weight Group

- 16.3.3. Category

- 16.3.4. Price (USD)

- 16.3.5. End User

- 16.3.6. Distribution Channel

- 16.3.7. Country

- 16.3.7.1. Turkey

- 16.3.7.2. UAE

- 16.3.7.3. Saudi Arabia

- 16.3.7.4. Israel

- 16.3.7.5. Rest of Middle East

- 16.4. Turkey Baby Car Seat Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Weight Group

- 16.4.4. Category

- 16.4.5. Price (USD)

- 16.4.6. End User

- 16.4.7. Distribution Channel

- 16.5. UAE Baby Car Seat Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Weight Group

- 16.5.4. Category

- 16.5.5. Price (USD)

- 16.5.6. End User

- 16.5.7. Distribution Channel

- 16.6. Saudi Arabia Baby Car Seat Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Weight Group

- 16.6.4. Category

- 16.6.5. Price (USD)

- 16.6.6. End User

- 16.6.7. Distribution Channel

- 16.7. Israel Baby Car Seat Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Weight Group

- 16.7.4. Category

- 16.7.5. Price (USD)

- 16.7.6. End User

- 16.7.7. Distribution Channel

- 16.8. Rest of Middle East Baby Car Seat Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Weight Group

- 16.8.4. Category

- 16.8.5. Price (USD)

- 16.8.6. End User

- 16.8.7. Distribution Channel

- 17. Africa Baby Car Seat Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Africa Baby Car Seat Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 17.3.1. Product Type

- 17.3.2. Weight Group

- 17.3.3. Category

- 17.3.4. Price (USD)

- 17.3.5. End User

- 17.3.6. Distribution Channel

- 17.3.7. Country

- 17.3.7.1. South Africa

- 17.3.7.2. Egypt

- 17.3.7.3. Nigeria

- 17.3.7.4. Algeria

- 17.3.7.5. Rest of Africa

- 17.4. South Africa Baby Car Seat Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Weight Group

- 17.4.4. Category

- 17.4.5. Price (USD)

- 17.4.6. End User

- 17.4.7. Distribution Channel

- 17.5. Egypt Baby Car Seat Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Weight Group

- 17.5.4. Category

- 17.5.5. Price (USD)

- 17.5.6. End User

- 17.5.7. Distribution Channel

- 17.6. Nigeria Baby Car Seat Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Weight Group

- 17.6.4. Category

- 17.6.5. Price (USD)

- 17.6.6. End User

- 17.6.7. Distribution Channel

- 17.7. Algeria Baby Car Seat Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Weight Group

- 17.7.4. Category

- 17.7.5. Price (USD)

- 17.7.6. End User

- 17.7.7. Distribution Channel

- 17.8. Rest of Africa Baby Car Seat Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Weight Group

- 17.8.4. Category

- 17.8.5. Price (USD)

- 17.8.6. End User

- 17.8.7. Distribution Channel

- 18. South America Baby Car Seat Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Central and South Africa Baby Car Seat Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 18.3.1. Product Type

- 18.3.2. Weight Group

- 18.3.3. Category

- 18.3.4. Price (USD)

- 18.3.5. End User

- 18.3.6. Distribution Channel

- 18.3.7. Country

- 18.3.7.1. Brazil

- 18.3.7.2. Argentina

- 18.3.7.3. Rest of South America

- 18.4. Brazil Baby Car Seat Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Weight Group

- 18.4.4. Category

- 18.4.5. Price (USD)

- 18.4.6. End User

- 18.4.7. Distribution Channel

- 18.5. Argentina Baby Car Seat Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Weight Group

- 18.5.4. Category

- 18.5.5. Price (USD)

- 18.5.6. End User

- 18.5.7. Distribution Channel

- 18.6. Rest of South America Baby Car Seat Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Weight Group

- 18.6.4. Category

- 18.6.5. Price (USD)

- 18.6.6. End User

- 18.6.7. Distribution Channel

- 19. Key Players/ Company Profile

- 19.1. Baby Trend Inc.

- 19.1.1. Company Details/ Overview

- 19.1.2. Company Financials

- 19.1.3. Key Customers and Competitors

- 19.1.4. Business/ Industry Portfolio

- 19.1.5. Product Portfolio/ Specification Details

- 19.1.6. Pricing Data

- 19.1.7. Strategic Overview

- 19.1.8. Recent Developments

- 19.2. Britax Child Safety, Inc.

- 19.3. Chicco USA, Inc.

- 19.4. Clek Inc.

- 19.5. Combi Corporation

- 19.6. Cosco

- 19.7. CYBEX GmbH

- 19.8. Diono LLC

- 19.9. Doona

- 19.10. Evenflo Company, Inc.

- 19.11. Graco

- 19.12. Hauck GmbH & Co. KG

- 19.13. Joie

- 19.14. Maxi-Cosi

- 19.15. Monahan Products, LLC (UPPAbaby)

- 19.16. Nuna International B.V.

- 19.17. Peg Perego S.p.A.

- 19.18. Recaro

- 19.19. Safety 1st

- 19.20. Other Key Players

- 19.1. Baby Trend Inc.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation