Biopesticides Market Size, Share & Trends Analysis Report by Product Type (Bioinsecticides, Biofungicides, Bioherbicides, Bionematicides), Source/Origin, Mode of Application, Formulation Type, Farming Method, Distribution Channel, Target Pest/Disease, Active Ingredient Concentration, Packaging Type, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Biopesticides Market Size, Share, and Growth

The global biopesticides market is experiencing robust growth, with its estimated value of USD 6.9 billion in the year 2025 and USD 24.7 billion by the period 2035, registering a CAGR of 13.6%, during the forecast period. The global biopesticides market demand is driven by growing organic farming, tighter chemical pesticide regulations, rising resistance to synthetic chemicals, increasing preference for residue-free produce, and the broader shift toward sustainable, environmentally safe crop protection solutions.

Erik Fyrwald, CEO of IFF said, “We are very excited about the collaboration with BASF to jointly unlock new potential in enzyme and polymer technologies, our partnership enables us to develop market-driven solutions that create sustainable value for both the industry and the environment.”

The global biopesticides market demand is rising because of farmers are becoming more inclined toward employing solutions that will improve the presence of beneficial microbial action, the strengthening of soil biodiversity and arousing the sustainability of agriculture in the long term. For instance, in December 2024, UPL introduced NIMAXXA is a triple-strain biological seed treat that exploits nematode-controlling and biostimulant Bacillus strains to colonize roots and develop a protective layer of microbes. This shift is increasing the pace of using progressive biological seed treatments that enhance the hardiness and condition of the soil.

Moreover, global biopesticides market development is being sustained by the development of encapsulation, nano-formulations and liquid fermentation technologies that contribute greatly to product stability and shelf life. For instance, in May 2025, Super Growers launched Omnicide IPM which is a nano-emulsion biopesticide that penetrated deeper and offered a longer duration of pest, fungal and spore control. This development is leading to the use of more effective and sustainable biological crop protection remedies.

Adjacent to the global biopesticides market, key opportunities include biofertilizers, plant growth regulators, microbial inoculants, organic soil amendments, and biostimulants. These industries supplement pest management by making crops healthy, increasing their yields, and making them sustainable. Developing these markets can be integrated faster, expand product lines, and increase dependence of farmers on environmentally-friendly solutions.

Biopesticides Market Dynamics and Trends

Driver: Increasing Consumer Demand for Organic and Residue-Free Produce

- The global biopesticides market is expanding due to the increasing demand on chemical-free and nutritious products among consumers, which causes farmers to switch to biological solutions that allow them to guarantee no residues in their crops and meet food safety regulations.

- For instance, in 2025, BASF has joined a strategic partnership with an agricultural research facility to build on the creation of the next generation of microbial biopesticides, highlighting its investment in the organic and residue-free crop protection market. This partnership will help BASF enhance its leadership in the sustainable and residue-free crop protection solutions.

- Additionally, the adoption of biopesticides is being fuelled by the export-oriented farmers with a desire to have the strict international pesticide residue levels and standard food safety requirements across the globe. For instance, in 2025, Indian mango exporters were applying more Trichoderma-based biopesticides to achieve EU pesticide residue limits.

- These trends are fostering the global movement towards sustainable protein-free crop protection at an accelerated rate allowing farmers and companies to fulfill consumer demand and global regulations as well as enhancing leadership in biopesticides.

Restraint: Limited Shelf Life and Storage Challenges

- The global biopesticides market experiences the challenge through the sensitivity of the biological products whose effectiveness can be ruined by temperature, humidity, light, or contamination, which shortens their shelf life and makes production and distribution difficult.

- In addition, to maintain product efficacy and consistent field performance, storage frequently necessitates controlled conditions, such as cold chains and specialized packaging, which raise costs and complexity.

- Moreover, improper storage may lead to the loss of potency or complete inactivation of biopesticides which will have a direct impact on crop protection. The farmers can face a lower effectiveness when the products decay before the application, causing the economic losses and possible crop damages.

- These storage issues also affect the market adoption, especially to the small-scale or remote farmers in developing areas who may lack access to adequate facilities. The problem of shelf life and storage constraints is, thus, critical to the development of the market of biopesticides globally and the stability of the performance in the area.

Opportunity: Regulatory Support and Accelerated Approval Pathways

- The global biopesticides market growth is being supported by governments implementing accelerated and simplified regulations approval channels, decreasing time taken to market and encouraging investment in biological crop protection methods.

- For instance, in December 2024, the U.S. EPA suggested a condensed registration examination of a few low-danger biopesticides, not requiring any further evaluation. This is a regulatory reform that allows a speedy entry of biopesticides in the market to increase the uptake and investment in sustainable crop protection solutions.

- Additionally, biopesticides market is experiencing growth due to regulatory pressures to adopt them, such as subsidies, grants, and support schemes that promote sustainable management of pests and improve market penetration among farmers.

- For instance, India’s the National Mission on Natural Farming and Paramparagat Krishi Vikas Yojana (PKVY) subsidizes farmers to apply bio-inputs, such as biopesticides. These efforts are increasing the use of biopesticides in India, which is encouraging sustainable agriculture and enhancing crop safety and yield.

- These regulatory changes and monetary stimulus are driving the adoption of bio-pesticides across the globe and India, sustainable agriculture, market expansion, and crop security.

Key Trend: Development of Next-Generation Microbial Consortia and RNA-Based Products

- The global biopesticides market growth is being driven by next-generation microbial consortia and RNA-based products, which offer specific, multi-pathway pest and disease control and exhibits greater efficacy than the traditional single-strain or chemical solutions.

- For instance, in April 2025, GreenLight announced a significant development in its RNA-based bioherbicide program is a foliar spray that uses RNAi to target critical weed genes, providing a non-GMO, species-specific weed control solution. This invention makes it possible to control weeds precisely, sustainably, and extremely effectively.

- Moreover, the high demand of consumers and regulatory focus on sustainable and residue-free agricultural products are driving the use of the newer microbial and RNA-based biopesticides in modern agriculture.

- These trends are also fueling tremendous market growth and the next generation biopesticides are becoming a key goal to sustainable and effective crop protection globally.

Biopesticides-Market Analysis and Segmental Data

Bioinsecticides Dominate Global Biopesticides Market

- The bioinsecticides segment dominates the global biopesticides market because of increasing demand of environmentally friendly and residue less crop protection technology is increasing the use of bioinsecticides globally. For instance, plant-growth-promoting microorganisms (PGPM), such as bacteria and fungi are emerging in the hydroponic systems both as growth regulators and as biological control agents.

- Moreover, there is the increasing regulatory restraint on chemical insecticides, which is encouraging agricultural producers to implement biologically targeted pest management solutions, which are safer. For instance, the EU’s 2024 ban on certain neonicotinoids has led farmers to adopt bioinsecticides for crop protection.

- These trends are creating a popularity of bioinsecticides, which will be placing the hydroponic and sustainable farming system in the better place of safer, efficient, and environmentally friendly crop protection.

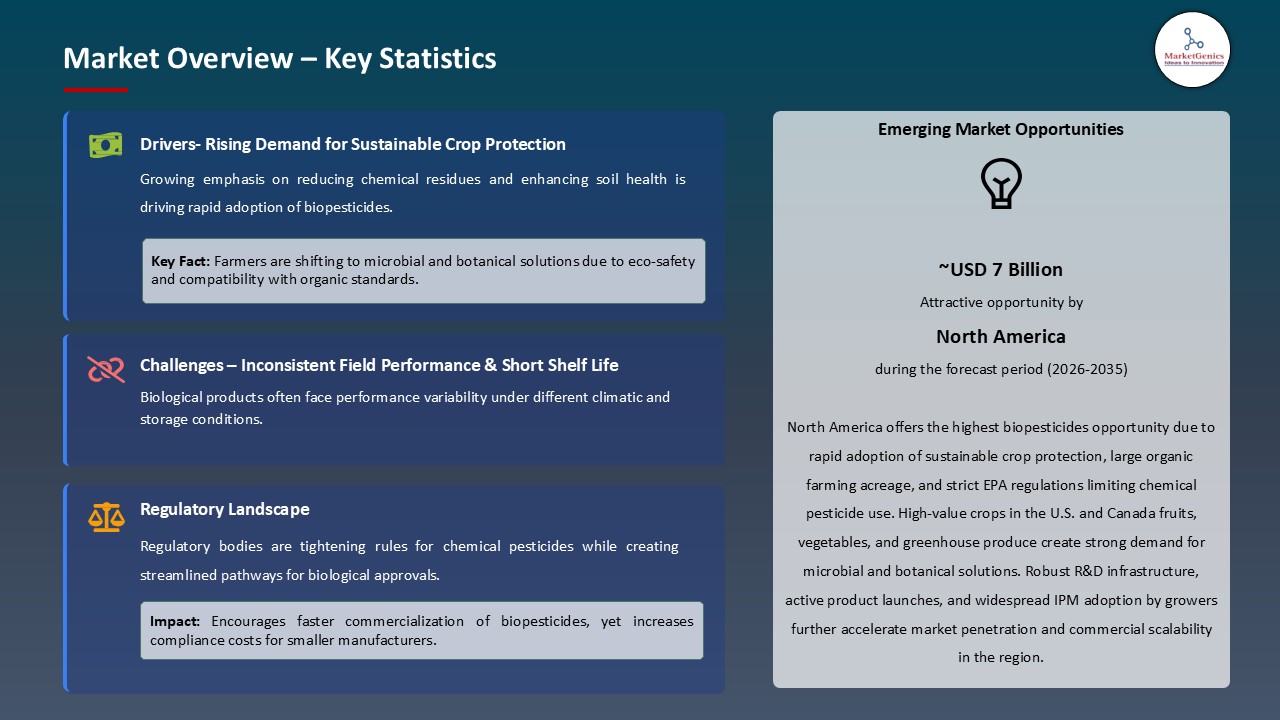

North America Leads Global Biopesticides Market Demand

- North America leads the global biopesticides market is due to the presence of strong regulatory policies and incentives to sustainable agricultural practices in North America are increasing the use of biopesticides. Farmers are being urged to use comparatively safer and environmentally-friendly biopesticides instead of using chemical pesticides due to the supportive policies and funds.

- For instance, in 2024, the U.S. Department of Agriculture's, Sustainable Agriculture Incentives Program offer technical assistance to farmers adopting biopesticides, accelerate their transition from chemical to biological pesticides. This program is positively driving the implementation of sustainable and green biopesticides in agriculture in North America.

- The region has experienced a rise in the utilization of biopesticides due to growing consumer demand for environmentally friendly and residue-free produce. Retailers and food producers are prioritizing crops grown with safer, environmentally friendly pest management techniques as a result of this trend. To satisfy consumer demand, producers of biopesticides are increasing production and creating new formulations.

- These factors are strengthening regional market expansion, increasing investment in biological solutions, and establishing North America as the primary center for the development and commercialization of biopesticides.

Biopesticides-Market Ecosystem

The global biopesticides market is moderately fragmented, with high concentration among key players such as BASF SE, Syngenta AG, Corteva Agriscience, Bayer AG (Bayer CropScience), and Koppert Biological Systems, who dominate through extensive product portfolios, strong R&D pipelines, and integrated distribution networks. Their leadership is reinforced by strategic collaborations, acquisitions, and rapid commercialization of advanced microbial and botanical biopesticides, enabling them to capture larger market share and influence global adoption trends.

Recent Development and Strategic Overview:

- In November 2025, Corteva launched its first broad-spectrum bioinsecticide (nature-inspired microbial solution) to protect major row and specialty crops, signalling a shift by major agrichemicals into higher-value biological insect control and faster commercialisation of microbiome-based actives.

- In Jun 2025, Koppert announced a major manufacturing expansion plan (≈$200M) to build biocontrol production capacity in Brazil, reflecting regional scaling to meet LATAM demand and shorten supply chains for live-microbe products.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 6.9 Bn |

|

Market Forecast Value in 2035 |

USD 24.7 Bn |

|

Growth Rate (CAGR) |

13.6% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Tons for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Biopesticides-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Biopesticides Market, By Product Type |

|

|

Biopesticides Market, By Source/Origin |

|

|

Biopesticides Market, By Mode of Application |

|

|

Biopesticides Market, By Formulation Type |

|

|

Biopesticides Market, By Farming Method

|

|

|

Biopesticides Market, By Distribution Channel

|

|

|

Biopesticides Market, By Target Pest/Disease |

|

|

Biopesticides Market, By Active Ingredient Concentration |

|

|

Biopesticides Market, By Packaging Type |

|

|

Biopesticides Market, By End-users |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Biopesticides Market Outlook

- 2.1.1. Biopesticides Market Size (Volume - Tons and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Biopesticides Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Agriculture Industry Overview, 2025

- 3.1.1. Agriculture Industry Ecosystem Analysis

- 3.1.2. Key Trends for Agriculture Industry

- 3.1.3. Regional Distribution for Agriculture Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Agriculture Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for organic and residue-free food

- 4.1.1.2. Stringent regulations / phase‑out of synthetic chemical pesticides

- 4.1.1.3. Technological innovation in biopesticide formulation (e.g., microbial research, RNAi)

- 4.1.2. Restraints

- 4.1.2.1. High cost of biopesticide development and production

- 4.1.2.2. Inconsistent field performance/ shorter shelf life due to environmental sensitivity

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Biopesticides Manufacturers

- 4.4.3. Distribution & Logistics

- 4.4.4. End-Users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Biopesticides Market Demand

- 4.9.1. Historical Market Size – Volume (Tons) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Volume (Tons) and Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Biopesticides Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Biopesticides Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Bioinsecticides

- 6.2.1.1. Bacillus thuringiensis (Bt)

- 6.2.1.2. Beauveria bassiana

- 6.2.1.3. Metarhizium anisopliae

- 6.2.1.4. Nuclear Polyhedrosis Virus (NPV)

- 6.2.1.5. Others

- 6.2.2. Biofungicides

- 6.2.2.1. Trichoderma

- 6.2.2.2. Bacillus subtilis

- 6.2.2.3. Ampelomyces quisqualis

- 6.2.2.4. Pseudomonas fluorescens

- 6.2.2.5. Others

- 6.2.3. Bioherbicides

- 6.2.3.1. Phytophthora palmivora

- 6.2.3.2. Alternaria destruens

- 6.2.3.3. Colletotrichum gloeosporioides

- 6.2.3.4. Others

- 6.2.4. Bionematicides

- 6.2.4.1. Paecilomyces lilacinus

- 6.2.4.2. Bacillus firmus

- 6.2.4.3. Purpureocillium lilacinum

- 6.2.4.4. Others

- 6.2.1. Bioinsecticides

- 7. Global Biopesticides Market Analysis, by Source/Origin

- 7.1. Key Segment Analysis

- 7.2. Biopesticides Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, by Source/Origin, 2021-2035

- 7.2.1. Microbial Biopesticides

- 7.2.1.1. Bacterial

- 7.2.1.2. Fungal

- 7.2.1.3. Viral

- 7.2.1.4. Protozoan

- 7.2.1.5. Others

- 7.2.2. Biochemical Biopesticides

- 7.2.2.1. Plant Extracts

- 7.2.2.2. Insect Pheromones

- 7.2.2.3. Essential Oils

- 7.2.2.4. Fatty Acids

- 7.2.2.5. Others

- 7.2.3. Beneficial Insects

- 7.2.3.1. Predators

- 7.2.3.2. Parasitoids

- 7.2.3.3. Others

- 7.2.1. Microbial Biopesticides

- 8. Global Biopesticides Market Analysis, by Mode of Application

- 8.1. Key Segment Analysis

- 8.2. Biopesticides Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, by Mode of Application, 2021-2035

- 8.2.1. Foliar Spray

- 8.2.2. Seed Treatment

- 8.2.3. Soil Treatment

- 8.2.4. Post-Harvest Treatment

- 8.2.5. Trunk Injection

- 8.2.6. Others

- 9. Global Biopesticides Market Analysis, by Formulation Type

- 9.1. Key Segment Analysis

- 9.2. Biopesticides Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, by Formulation Type, 2021-2035

- 9.2.1. Liquid Formulations

- 9.2.1.1. Suspension Concentrates

- 9.2.1.2. Soluble Liquids

- 9.2.1.3. Emulsifiable Concentrates

- 9.2.1.4. Others

- 9.2.2. Dry Formulations

- 9.2.2.1. Wettable Powders

- 9.2.2.2. Water Dispersible Granules

- 9.2.2.3. Dust

- 9.2.2.4. Others

- 9.2.3. Granular Formulations

- 9.2.1. Liquid Formulations

- 10. Global Biopesticides Market Analysis, by Farming Method

- 10.1. Key Segment Analysis

- 10.2. Biopesticides Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, by Farming Method, 2021-2035

- 10.2.1. Organic Farming

- 10.2.2. Conventional Farming

- 10.2.3. Integrated Pest Management (IPM)

- 10.2.4. Sustainable/Regenerative Farming

- 10.2.5. Others

- 11. Global Biopesticides Market Analysis, by Distribution Channel

- 11.1. Key Segment Analysis

- 11.2. Biopesticides Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 11.2.1. Direct Sales

- 11.2.2. Distributors & Wholesalers

- 11.2.3. Retail Stores

- 11.2.3.1. Agricultural Cooperatives

- 11.2.3.2. Specialty Stores

- 11.2.3.3. Others

- 11.2.4. Online Platforms

- 11.2.5. Government Schemes & Programs

- 12. Global Biopesticides Market Analysis, by Target Pest/Disease

- 12.1. Key Segment Analysis

- 12.2. Biopesticides Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, by Target Pest/Disease, 2021-2035

- 12.2.1. Insects & Pests

- 12.2.1.1. Lepidoptera

- 12.2.1.2. Coleoptera

- 12.2.1.3. Hemiptera

- 12.2.1.4. Aphids & Whiteflies

- 12.2.1.5. Others

- 12.2.2. Fungal Diseases

- 12.2.2.1. Powdery Mildew

- 12.2.2.2. Rust

- 12.2.2.3. Blight

- 12.2.2.4. Root Rot

- 12.2.2.5. Others

- 12.2.3. Weeds

- 12.2.3.1. Broadleaf Weeds

- 12.2.3.2. Grassy Weeds

- 12.2.3.3. Others

- 12.2.4. Nematodes

- 12.2.5. Others

- 12.2.1. Insects & Pests

- 13. Global Biopesticides Market Analysis, by Active Ingredient Concentration

- 13.1. Key Segment Analysis

- 13.2. Biopesticides Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, by Active Ingredient Concentration, 2021-2035

- 13.2.1. Low Concentration (<5%)

- 13.2.2. Medium Concentration (5-15%)

- 13.2.3. High Concentration (>15%)

- 14. Global Biopesticides Market Analysis, by Packaging Type

- 14.1. Key Segment Analysis

- 14.2. Biopesticides Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, by Packaging Type, 2021-2035

- 14.2.1. Small Packs (<1 kg/L)

- 14.2.2. Medium Packs (1-5 kg/L)

- 14.2.3. Large Packs (>5 kg/L)

- 14.2.4. Bulk Packaging

- 15. Global Biopesticides Market Analysis, by End-users

- 15.1. Key Segment Analysis

- 15.2. Biopesticides Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 15.2.1. Agriculture Industry

- 15.2.1.1. Field Crops Protection

- 15.2.1.2. Horticulture Crop Protection

- 15.2.1.3. Plantation Crop Protection

- 15.2.1.4. Greenhouse Applications

- 15.2.1.5. Nursery Applications

- 15.2.1.6. Others

- 15.2.2. Forestry Industry

- 15.2.2.1. Forest Pest Management

- 15.2.2.2. Timber Protection

- 15.2.2.3. Reforestation Programs

- 15.2.2.4. Others

- 15.2.3. Turf & Ornamentals

- 15.2.3.1. Lawn Care

- 15.2.3.2. Golf Courses

- 15.2.3.3. Parks & Gardens

- 15.2.3.4. Landscape Management

- 15.2.3.5. Sports Fields

- 15.2.3.6. Others

- 15.2.4. Home & Garden (Residential)

- 15.2.4.1. Home Gardening

- 15.2.4.2. Indoor Plants Protection

- 15.2.4.3. Kitchen Gardens

- 15.2.4.4. Ornamental Plants

- 15.2.4.5. Others

- 15.2.5. Commercial/Industrial

- 15.2.5.1. Food Processing Facilities

- 15.2.5.2. Storage Facilities

- 15.2.5.3. Public Health Vector Control

- 15.2.5.4. Urban Pest Management

- 15.2.5.5. Others

- 15.2.1. Agriculture Industry

- 16. Global Biopesticides Market Analysis and Forecasts, by Region

- 16.1. Key Findings

- 16.2. Biopesticides Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 16.2.1. North America

- 16.2.2. Europe

- 16.2.3. Asia Pacific

- 16.2.4. Middle East

- 16.2.5. Africa

- 16.2.6. South America

- 17. North America Biopesticides Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. North America Biopesticides Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Source/Origin

- 17.3.3. Mode of Application

- 17.3.4. Formulation Type

- 17.3.5. Farming Method

- 17.3.6. Distribution Channel

- 17.3.7. Target Pest/Disease

- 17.3.8. Active Ingredient Concentration

- 17.3.9. Packaging Type

- 17.3.10. End-users

- 17.3.11. Country

- 17.3.11.1. USA

- 17.3.11.2. Canada

- 17.3.11.3. Mexico

- 17.4. USA Biopesticides Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Source/Origin

- 17.4.4. Mode of Application

- 17.4.5. Formulation Type

- 17.4.6. Farming Method

- 17.4.7. Distribution Channel

- 17.4.8. Target Pest/Disease

- 17.4.9. Active Ingredient Concentration

- 17.4.10. Packaging Type

- 17.4.11. End-users

- 17.5. Canada Biopesticides Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Source/Origin

- 17.5.4. Mode of Application

- 17.5.5. Formulation Type

- 17.5.6. Farming Method

- 17.5.7. Distribution Channel

- 17.5.8. Target Pest/Disease

- 17.5.9. Active Ingredient Concentration

- 17.5.10. Packaging Type

- 17.5.11. End-users

- 17.6. Mexico Biopesticides Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Source/Origin

- 17.6.4. Mode of Application

- 17.6.5. Formulation Type

- 17.6.6. Farming Method

- 17.6.7. Distribution Channel

- 17.6.8. Target Pest/Disease

- 17.6.9. Active Ingredient Concentration

- 17.6.10. Packaging Type

- 17.6.11. End-users

- 18. Europe Biopesticides Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Europe Biopesticides Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Source/Origin

- 18.3.3. Mode of Application

- 18.3.4. Formulation Type

- 18.3.5. Farming Method

- 18.3.6. Distribution Channel

- 18.3.7. Target Pest/Disease

- 18.3.8. Active Ingredient Concentration

- 18.3.9. Packaging Type

- 18.3.10. End-users Country

- 18.3.10.1. Germany

- 18.3.10.2. United Kingdom

- 18.3.10.3. France

- 18.3.10.4. Italy

- 18.3.10.5. Spain

- 18.3.10.6. Netherlands

- 18.3.10.7. Nordic Countries

- 18.3.10.8. Poland

- 18.3.10.9. Russia & CIS

- 18.3.10.10. Rest of Europe

- 18.4. Germany Biopesticides Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Source/Origin

- 18.4.4. Mode of Application

- 18.4.5. Formulation Type

- 18.4.6. Farming Method

- 18.4.7. Distribution Channel

- 18.4.8. Target Pest/Disease

- 18.4.9. Active Ingredient Concentration

- 18.4.10. Packaging Type

- 18.4.11. End-users

- 18.5. United Kingdom Biopesticides Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Source/Origin

- 18.5.4. Mode of Application

- 18.5.5. Formulation Type

- 18.5.6. Farming Method

- 18.5.7. Distribution Channel

- 18.5.8. Target Pest/Disease

- 18.5.9. Active Ingredient Concentration

- 18.5.10. Packaging Type

- 18.5.11. End-users

- 18.6. France Biopesticides Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Source/Origin

- 18.6.4. Mode of Application

- 18.6.5. Formulation Type

- 18.6.6. Farming Method

- 18.6.7. Distribution Channel

- 18.6.8. Target Pest/Disease

- 18.6.9. Active Ingredient Concentration

- 18.6.10. Packaging Type

- 18.6.11. End-users

- 18.7. Italy Biopesticides Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Source/Origin

- 18.7.4. Mode of Application

- 18.7.5. Formulation Type

- 18.7.6. Farming Method

- 18.7.7. Distribution Channel

- 18.7.8. Target Pest/Disease

- 18.7.9. Active Ingredient Concentration

- 18.7.10. Packaging Type

- 18.7.11. End-users

- 18.8. Spain Biopesticides Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Source/Origin

- 18.8.4. Mode of Application

- 18.8.5. Formulation Type

- 18.8.6. Farming Method

- 18.8.7. Distribution Channel

- 18.8.8. Target Pest/Disease

- 18.8.9. Active Ingredient Concentration

- 18.8.10. Packaging Type

- 18.8.11. End-users

- 18.9. Netherlands Biopesticides Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Product Type

- 18.9.3. Source/Origin

- 18.9.4. Mode of Application

- 18.9.5. Formulation Type

- 18.9.6. Farming Method

- 18.9.7. Distribution Channel

- 18.9.8. Target Pest/Disease

- 18.9.9. Active Ingredient Concentration

- 18.9.10. Packaging Type

- 18.9.11. End-users

- 18.10. Nordic Countries Biopesticides Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Product Type

- 18.10.3. Source/Origin

- 18.10.4. Mode of Application

- 18.10.5. Formulation Type

- 18.10.6. Farming Method

- 18.10.7. Distribution Channel

- 18.10.8. Target Pest/Disease

- 18.10.9. Active Ingredient Concentration

- 18.10.10. Packaging Type

- 18.10.11. End-users

- 18.11. Poland Biopesticides Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Product Type

- 18.11.3. Source/Origin

- 18.11.4. Mode of Application

- 18.11.5. Formulation Type

- 18.11.6. Farming Method

- 18.11.7. Distribution Channel

- 18.11.8. Target Pest/Disease

- 18.11.9. Active Ingredient Concentration

- 18.11.10. Packaging Type

- 18.11.11. End-users

- 18.12. Russia & CIS Biopesticides Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Product Type

- 18.12.3. Source/Origin

- 18.12.4. Mode of Application

- 18.12.5. Formulation Type

- 18.12.6. Farming Method

- 18.12.7. Distribution Channel

- 18.12.8. Target Pest/Disease

- 18.12.9. Active Ingredient Concentration

- 18.12.10. Packaging Type

- 18.12.11. End-users

- 18.13. Rest of Europe Biopesticides Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Product Type

- 18.13.3. Source/Origin

- 18.13.4. Mode of Application

- 18.13.5. Formulation Type

- 18.13.6. Farming Method

- 18.13.7. Distribution Channel

- 18.13.8. Target Pest/Disease

- 18.13.9. Active Ingredient Concentration

- 18.13.10. Packaging Type

- 18.13.11. End-users

- 19. Asia Pacific Biopesticides Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Asia Pacific Biopesticides Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Source/Origin

- 19.3.3. Mode of Application

- 19.3.4. Formulation Type

- 19.3.5. Farming Method

- 19.3.6. Distribution Channel

- 19.3.7. Target Pest/Disease

- 19.3.8. Active Ingredient Concentration

- 19.3.9. Packaging Type

- 19.3.10. End-users

- 19.3.11. Country

- 19.3.11.1. China

- 19.3.11.2. India

- 19.3.11.3. Japan

- 19.3.11.4. South Korea

- 19.3.11.5. Australia and New Zealand

- 19.3.11.6. Indonesia

- 19.3.11.7. Malaysia

- 19.3.11.8. Thailand

- 19.3.11.9. Vietnam

- 19.3.11.10. Rest of Asia Pacific

- 19.4. China Biopesticides Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Source/Origin

- 19.4.4. Mode of Application

- 19.4.5. Formulation Type

- 19.4.6. Farming Method

- 19.4.7. Distribution Channel

- 19.4.8. Target Pest/Disease

- 19.4.9. Active Ingredient Concentration

- 19.4.10. Packaging Type

- 19.4.11. End-users

- 19.5. India Biopesticides Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Source/Origin

- 19.5.4. Mode of Application

- 19.5.5. Formulation Type

- 19.5.6. Farming Method

- 19.5.7. Distribution Channel

- 19.5.8. Target Pest/Disease

- 19.5.9. Active Ingredient Concentration

- 19.5.10. Packaging Type

- 19.5.11. End-users

- 19.6. Japan Biopesticides Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Source/Origin

- 19.6.4. Mode of Application

- 19.6.5. Formulation Type

- 19.6.6. Farming Method

- 19.6.7. Distribution Channel

- 19.6.8. Target Pest/Disease

- 19.6.9. Active Ingredient Concentration

- 19.6.10. Packaging Type

- 19.6.11. End-users

- 19.7. South Korea Biopesticides Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Source/Origin

- 19.7.4. Mode of Application

- 19.7.5. Formulation Type

- 19.7.6. Farming Method

- 19.7.7. Distribution Channel

- 19.7.8. Target Pest/Disease

- 19.7.9. Active Ingredient Concentration

- 19.7.10. Packaging Type

- 19.7.11. End-users

- 19.8. Australia and New Zealand Biopesticides Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Source/Origin

- 19.8.4. Mode of Application

- 19.8.5. Formulation Type

- 19.8.6. Farming Method

- 19.8.7. Distribution Channel

- 19.8.8. Target Pest/Disease

- 19.8.9. Active Ingredient Concentration

- 19.8.10. Packaging Type

- 19.8.11. End-users

- 19.9. Indonesia Biopesticides Market

- 19.9.1. Country Segmental Analysis

- 19.9.2. Product Type

- 19.9.3. Source/Origin

- 19.9.4. Mode of Application

- 19.9.5. Formulation Type

- 19.9.6. Farming Method

- 19.9.7. Distribution Channel

- 19.9.8. Target Pest/Disease

- 19.9.9. Active Ingredient Concentration

- 19.9.10. Packaging Type

- 19.9.11. End-users

- 19.10. Malaysia Biopesticides Market

- 19.10.1. Country Segmental Analysis

- 19.10.2. Product Type

- 19.10.3. Source/Origin

- 19.10.4. Mode of Application

- 19.10.5. Formulation Type

- 19.10.6. Farming Method

- 19.10.7. Distribution Channel

- 19.10.8. Target Pest/Disease

- 19.10.9. Active Ingredient Concentration

- 19.10.10. Packaging Type

- 19.10.11. End-users

- 19.11. Thailand Biopesticides Market

- 19.11.1. Country Segmental Analysis

- 19.11.2. Product Type

- 19.11.3. Source/Origin

- 19.11.4. Mode of Application

- 19.11.5. Formulation Type

- 19.11.6. Farming Method

- 19.11.7. Distribution Channel

- 19.11.8. Target Pest/Disease

- 19.11.9. Active Ingredient Concentration

- 19.11.10. Packaging Type

- 19.11.11. End-users

- 19.12. Vietnam Biopesticides Market

- 19.12.1. Country Segmental Analysis

- 19.12.2. Product Type

- 19.12.3. Source/Origin

- 19.12.4. Mode of Application

- 19.12.5. Formulation Type

- 19.12.6. Farming Method

- 19.12.7. Distribution Channel

- 19.12.8. Target Pest/Disease

- 19.12.9. Active Ingredient Concentration

- 19.12.10. Packaging Type

- 19.12.11. End-users

- 19.13. Rest of Asia Pacific Biopesticides Market

- 19.13.1. Country Segmental Analysis

- 19.13.2. Product Type

- 19.13.3. Source/Origin

- 19.13.4. Mode of Application

- 19.13.5. Formulation Type

- 19.13.6. Farming Method

- 19.13.7. Distribution Channel

- 19.13.8. Target Pest/Disease

- 19.13.9. Active Ingredient Concentration

- 19.13.10. Packaging Type

- 19.13.11. End-users

- 20. Middle East Biopesticides Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Middle East Biopesticides Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Source/Origin

- 20.3.3. Mode of Application

- 20.3.4. Formulation Type

- 20.3.5. Farming Method

- 20.3.6. Distribution Channel

- 20.3.7. Target Pest/Disease

- 20.3.8. Active Ingredient Concentration

- 20.3.9. Packaging Type

- 20.3.10. End-users

- 20.3.11. Country

- 20.3.11.1. Turkey

- 20.3.11.2. UAE

- 20.3.11.3. Saudi Arabia

- 20.3.11.4. Israel

- 20.3.11.5. Rest of Middle East

- 20.4. Turkey Biopesticides Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Source/Origin

- 20.4.4. Mode of Application

- 20.4.5. Formulation Type

- 20.4.6. Farming Method

- 20.4.7. Distribution Channel

- 20.4.8. Target Pest/Disease

- 20.4.9. Active Ingredient Concentration

- 20.4.10. Packaging Type

- 20.4.11. End-users

- 20.5. UAE Biopesticides Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Source/Origin

- 20.5.4. Mode of Application

- 20.5.5. Formulation Type

- 20.5.6. Farming Method

- 20.5.7. Distribution Channel

- 20.5.8. Target Pest/Disease

- 20.5.9. Active Ingredient Concentration

- 20.5.10. Packaging Type

- 20.5.11. End-users

- 20.6. Saudi Arabia Biopesticides Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Source/Origin

- 20.6.4. Mode of Application

- 20.6.5. Formulation Type

- 20.6.6. Farming Method

- 20.6.7. Distribution Channel

- 20.6.8. Target Pest/Disease

- 20.6.9. Active Ingredient Concentration

- 20.6.10. Packaging Type

- 20.6.11. End-users

- 20.7. Israel Biopesticides Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Product Type

- 20.7.3. Source/Origin

- 20.7.4. Mode of Application

- 20.7.5. Formulation Type

- 20.7.6. Farming Method

- 20.7.7. Distribution Channel

- 20.7.8. Target Pest/Disease

- 20.7.9. Active Ingredient Concentration

- 20.7.10. Packaging Type

- 20.7.11. End-users

- 20.8. Rest of Middle East Biopesticides Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Product Type

- 20.8.3. Source/Origin

- 20.8.4. Mode of Application

- 20.8.5. Formulation Type

- 20.8.6. Farming Method

- 20.8.7. Distribution Channel

- 20.8.8. Target Pest/Disease

- 20.8.9. Active Ingredient Concentration

- 20.8.10. Packaging Type

- 20.8.11. End-users

- 21. Africa Biopesticides Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. Africa Biopesticides Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Product Type

- 21.3.2. Source/Origin

- 21.3.3. Mode of Application

- 21.3.4. Formulation Type

- 21.3.5. Farming Method

- 21.3.6. Distribution Channel

- 21.3.7. Target Pest/Disease

- 21.3.8. Active Ingredient Concentration

- 21.3.9. Packaging Type

- 21.3.10. End-users

- 21.3.11. Country

- 21.3.11.1. South Africa

- 21.3.11.2. Egypt

- 21.3.11.3. Nigeria

- 21.3.11.4. Algeria

- 21.3.11.5. Rest of Africa

- 21.4. South Africa Biopesticides Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Product Type

- 21.4.3. Source/Origin

- 21.4.4. Mode of Application

- 21.4.5. Formulation Type

- 21.4.6. Farming Method

- 21.4.7. Distribution Channel

- 21.4.8. Target Pest/Disease

- 21.4.9. Active Ingredient Concentration

- 21.4.10. Packaging Type

- 21.4.11. End-users

- 21.5. Egypt Biopesticides Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Product Type

- 21.5.3. Source/Origin

- 21.5.4. Mode of Application

- 21.5.5. Formulation Type

- 21.5.6. Farming Method

- 21.5.7. Distribution Channel

- 21.5.8. Target Pest/Disease

- 21.5.9. Active Ingredient Concentration

- 21.5.10. Packaging Type

- 21.5.11. End-users

- 21.6. Nigeria Biopesticides Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Product Type

- 21.6.3. Source/Origin

- 21.6.4. Mode of Application

- 21.6.5. Formulation Type

- 21.6.6. Farming Method

- 21.6.7. Distribution Channel

- 21.6.8. Target Pest/Disease

- 21.6.9. Active Ingredient Concentration

- 21.6.10. Packaging Type

- 21.6.11. End-users

- 21.7. Algeria Biopesticides Market

- 21.7.1. Country Segmental Analysis

- 21.7.2. Product Type

- 21.7.3. Source/Origin

- 21.7.4. Mode of Application

- 21.7.5. Formulation Type

- 21.7.6. Farming Method

- 21.7.7. Distribution Channel

- 21.7.8. Target Pest/Disease

- 21.7.9. Active Ingredient Concentration

- 21.7.10. Packaging Type

- 21.7.11. End-users

- 21.8. Rest of Africa Biopesticides Market

- 21.8.1. Country Segmental Analysis

- 21.8.2. Product Type

- 21.8.3. Source/Origin

- 21.8.4. Mode of Application

- 21.8.5. Formulation Type

- 21.8.6. Farming Method

- 21.8.7. Distribution Channel

- 21.8.8. Target Pest/Disease

- 21.8.9. Active Ingredient Concentration

- 21.8.10. Packaging Type

- 21.8.11. End-users

- 22. South America Biopesticides Market Analysis

- 22.1. Key Segment Analysis

- 22.2. Regional Snapshot

- 22.3. South America Biopesticides Market Size (Volume - Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 22.3.1. Product Type

- 22.3.2. Source/Origin

- 22.3.3. Mode of Application

- 22.3.4. Formulation Type

- 22.3.5. Farming Method

- 22.3.6. Distribution Channel

- 22.3.7. Target Pest/Disease

- 22.3.8. Active Ingredient Concentration

- 22.3.9. Packaging Type

- 22.3.10. End-users

- 22.3.11. Country

- 22.3.11.1. Brazil

- 22.3.11.2. Argentina

- 22.3.11.3. Rest of South America

- 22.4. Brazil Biopesticides Market

- 22.4.1. Country Segmental Analysis

- 22.4.2. Product Type

- 22.4.3. Source/Origin

- 22.4.4. Mode of Application

- 22.4.5. Formulation Type

- 22.4.6. Farming Method

- 22.4.7. Distribution Channel

- 22.4.8. Target Pest/Disease

- 22.4.9. Active Ingredient Concentration

- 22.4.10. Packaging Type

- 22.4.11. End-users

- 22.5. Argentina Biopesticides Market

- 22.5.1. Country Segmental Analysis

- 22.5.2. Product Type

- 22.5.3. Source/Origin

- 22.5.4. Mode of Application

- 22.5.5. Formulation Type

- 22.5.6. Farming Method

- 22.5.7. Distribution Channel

- 22.5.8. Target Pest/Disease

- 22.5.9. Active Ingredient Concentration

- 22.5.10. Packaging Type

- 22.5.11. End-users

- 22.6. Rest of South America Biopesticides Market

- 22.6.1. Country Segmental Analysis

- 22.6.2. Product Type

- 22.6.3. Source/Origin

- 22.6.4. Mode of Application

- 22.6.5. Formulation Type

- 22.6.6. Farming Method

- 22.6.7. Distribution Channel

- 22.6.8. Target Pest/Disease

- 22.6.9. Active Ingredient Concentration

- 22.6.10. Packaging Type

- 22.6.11. End-users

- 23. Key Players/ Company Profile

- 23.1. BASF SE

- 23.1.1. Company Details/ Overview

- 23.1.2. Company Financials

- 23.1.3. Key Customers and Competitors

- 23.1.4. Business/ Industry Portfolio

- 23.1.5. Product Portfolio/ Specification Details

- 23.1.6. Pricing Data

- 23.1.7. Strategic Overview

- 23.1.8. Recent Developments

- 23.2. Agrinos AS

- 23.3. Andermatt Biocontrol AG

- 23.4. Bayer AG (Bayer CropScience)

- 23.5. BioWorks Inc.

- 23.6. Camson Bio Technologies Limited

- 23.7. Certis USA LLC

- 23.8. Chr. Hansen Holding A/S

- 23.9. Corteva Agriscience

- 23.10. FMC Corporation

- 23.11. Isagro SpA

- 23.12. Koppert Biological Systems

- 23.13. Marrone Bio Innovations

- 23.14. Novozymes A/S

- 23.15. Nufarm Limited

- 23.16. Som Phytopharma India Limited

- 23.17. Stockton Bio-Ag

- 23.18. Syngenta AG

- 23.19. UPL Limited

- 23.20. Valent BioSciences LLC

- 23.21. Vegalab SA

- 23.22. Other Key Players

- 23.1. BASF SE

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation