Brewing Additives Market Size, Share, Growth Opportunity Analysis Report by Product Type (Enzymes, Stabilizers, Fining agents, Flavor enhancers, Preservatives, Antifoaming agents, Colorants, Others), Source Material, Form, Application Function, Brewery Size (End User), Sales Channel, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Brewing Additives Market Size, Share, and Growth

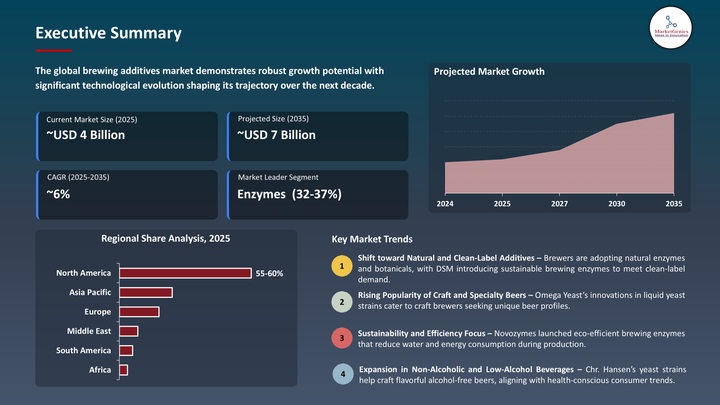

The global market for brewing additives is observed to ramp up at a compound annual growth rate (CAGR) of 6% from USD 3.8 billion in 2025 to USD 7.2 billion by 2035. The key aspects fueling the growth include raising expectations for beer and wine that boasts superior clarity, stability, and taste characteristics. As craft beverages and premium spirits grow in popularity, producers are searching for a more effective operating approach and improved product consistency by means of novel agents.

Launched early in 2024, the newest development in the brewing additives industry is transforming the way craft and commercial brewers improve efficiency, scent, and taste in the brewing process. Designed for improved solubility and stability, next-generation brewing additives provide brewers working in smaller as well as bigger brewhouses better performance, quicker dissolution, and longer shelf life. Targeted advantages of the next-generation brewing additives range from enhancements of hop flavoring and haze stability to improving the nutrient utilization for yeast.

Brewer additives are being applied differently than ever before to improve beer quality, stability and production efficacy within the context of cleaner and more sustainable brewing. Advances in enzyme engineering and microencapsulation technology are enabling the creation of more soluble, stable, and better performing additive products (hop extracts, fining agents, foam stabilizers) that provide improved flavor control, fermentation rates, aroma and mouth feel retention, particularly focusing on premium, low-alcohol, and non-alcoholic beer categories.

Due to a basic consumer desire for clean-label and eco-friendly ingredients, there is an interesting trend of increasing emphasis on using natural and sustainable additives. Further, as the market becomes increasingly mindful, sugar-free, gluten-free, and vegan-friendly brewer additives are being developed and marketed, particularly for functional and wellness-oriented beers. Additive offerings are also being packaged and marketed as multi-function products with two or more clarification, stabilization, and foaming products in one simple to use package.

Brewing Additives Market Dynamics and Trends

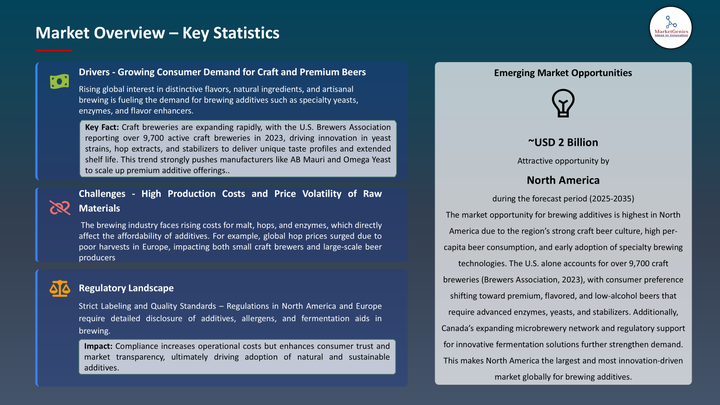

Market Drivers: Increasing Demand for Sustainable and Organic Alternatives

- The global brewing additives market is growing as many people are looking to plant-based wellness alternatives, and brewers are also looking to use natural clarifiers (bentonite, silica gel, Irish moss), as well as adopting oils and emulsions that come from hops that offer greater flavor with no artificial enhancer or high dose rates required, with the challenge of certainty with respect to consumer loyalty and brevity. Additives improves the consistency of processing, reduce waste, allow brewers to fulfill demand for transparency, sustainability, and labeling / allergen free.

- The government food safety agencies and brewing agencies in the U.S., EU, and Asia have endorsed the responsible use of brewing additives - especially those from natural or food grade sources. With agencies like the FDA (US) and the EFSA (European Union) these agencies are providing clarity and standards to regulate all uses, resulting in more brewers adopting additives both traditional and modern.

- Furthermore, following the increased clarity in ingredient regulation and food safety protocols, demand for additive-enhanced brewing has surged across various product formats including lagers, IPAs, alcohol-free beers, and craft beverages with botanical infusions. Today’s brewers rely on a wide range of solutions, including enzymes to accelerate fermentation, natural stabilizers to prevent haze, and hop-based flavor concentrates that help them meet consumer expectations for both quality and innovation.

Market Restraints: High Formulation Costs and its Technical Complexity affecting the Brewing Additives Market

- High formulation costs, especially for specialty or natural-based additives like vegan fining agents or microencapsulated hop oils, can dramatically increase the per-batch cost for brewers especially small- to mid-sized craft operations that work with very tight margins. Also, inconsistent availability of raw materials (i.e., ones that are regionally sourced or harvested seasonally, like carrageenan from seaweed or plant-derived stabilizers, etc.)

- Further, Technical complexity and variability in formulation create additional challenges to predictor performance. Unlike packaged beverages which are produced at mass, the brewing process has some variability across breweries in size, style, and fermentation methods, leading to unpredictable performances by the additives. Some enzymes will not perform as intended in high alcohol or cold fermentations. Some hop extracts or clarifiers can change the expected taste and/or clarity of beer if too much or too little is added. Any of these eventualities may lead to wasting product or needing to reprocess the beer.

Opportunity: Ramping demand for Crafted Beer and Clean-label demands

- Several leading manufacturers have started introducing multifunctional additives such as enzymes, natural clarifiers and flavoring modifiers from hop for improved efficiency, reduced manufacturing time and consistent quality. Reflecting a new generation of consumers aware of health and sustainability, newer formulas center on plant-based, allergen-free, and vegan substitutes for conventional agents.

- In 2024, Novozymes expanded its EcoBrew enzyme platform by adding heat-stable variants for energy-efficient brewing and DSM engaged craft brewers in Europe to pilot zero-waste additive systems to improve yield and reduce carbon footprint. These are indications that the industry shift from basic processing aids to next-level brewing technology focusing on sustainability, and premium differentiation is accelerating.

- As customized, clean-label, and functional beverages flourish, brewing additives are set to be strategically transformed from regular inputs into market-enabling, value-added technologies that will move product development towards the future, and realize our new visions for brewing.

Key Trend: Shift from Basic Processing Aids to Next-Gen Brewing Solutions

- The brewing additives industry is moving away from producing supplements for basic processing aids like clarifiers or stabilizer and moving toward next generation brewing adjuncts that are more complex and have greater capabilities. The complex adjuncts will not only help brewers with beer clarity or shelf stability but also improve a beer's flavour profile, brewing efficiency, sustainable brewing practices, and clean label or vegan claims. Brewers now have the ability to quickly and easily improve beer quality through the utilization of modern technology such as enzymes and micro-encapsulation and still satisfy modern consumer preferences for health, sustainability, and flavour variety.

- Additionally, the growing popularity of low-alcohol, functional, and handcrafted beers which need more accurate control over taste, visual appeal, and stability. New brewing technologies help brewers both big and little produce premium goods more regularly by working across several beer kinds and brewing techniques. Today's additives are becoming essential innovation instruments, enabling brewers to explore with new ingredients, increase output, and satisfy increasing need for unique, healthier drinks instead of simply solving simple problems.

Brewing Additives Market Analysis and Segmental Data

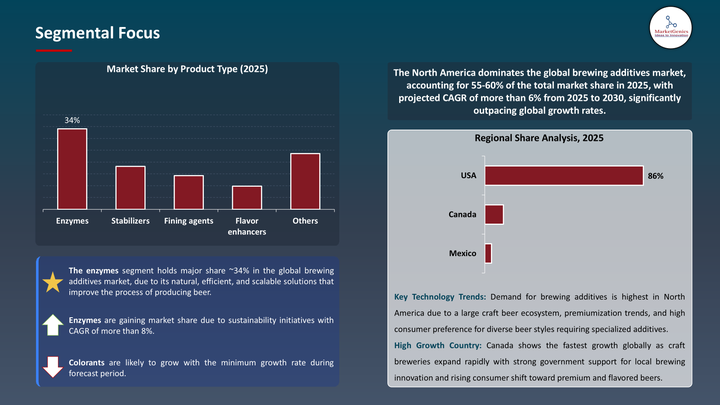

Based on Product Type, Enzymes-based Brewing Additives Reserves the Largest Share

- Enzyme-based brewing additives accounts for a significant portion of the global brewing additives market, due to its natural, efficient, and scalable solutions that improve the process of producing beer. These enzymes help accelerate and improve many processes, such as fermentation, filtration, and starch breakdown, and allow brewers to significantly reduce brewing time while improving yield, and achieving batch-to-batch flavor consistency.

- Enzyme solutions are used in commercial brewing and craft brewing and provide vastly more benefit in low-alcohol beers and gluten-reduced beers. Enzyme-based solutions provide an easy to dose, easily applicable brewing additive with low barriers to use, it does not usually involve major equipment changes and can be used for a variety of brewing styles or formulations. With the pressure for clean-label ingredients on the brewing industry and due to their plant-based origin, enzyme-based additives provide flavor, color, organoleptic, clarity, and stability benefits in a clean-label. Thus, likely to gain traction, aided by further development in the biotechnology space and explorations into more resource efficient brewing.

North America Dominates Brewing Additives Market across the Globe in 2025 and Beyond

- In North America, the demand for brewing additives is thriving, because of large part to the vast craft beer market and rising consumer preferences for clean-label, high-quality beverages. U.S. and Canadian brewers are utilizing enzymes, clarifiers, and natural stabilizers to optimize lead times, minimize waste, and meet rising demands for gluten-free, vegan, and low-alcohol beers. North American brewers have a commitment to innovation, and demonstrate a willingness to pursue new additive blends or brewing technologies.

- Moreover, the distribution systems, access to global suppliers, and a large number of craft and independent brewers in North America leads to the region being the largest producer of brewing additives globally from both a volume and value perspective. While tastes evolve, and sustainability becomes a requirement, North American brewers continue to demonstrate how appropriate, modern, additive-enhanced brewing has a healthy future.

Brewing Additives Market Ecosystem

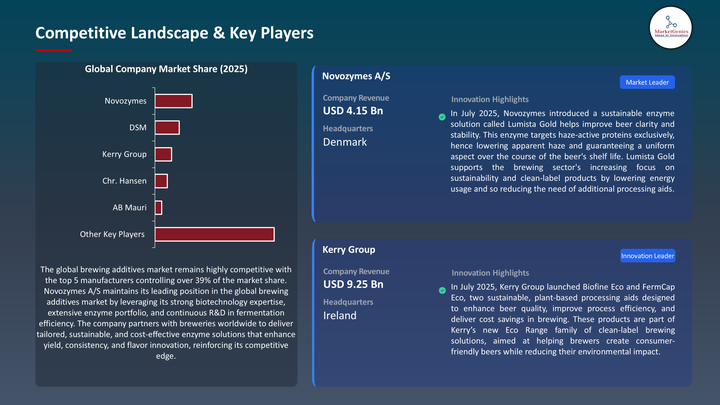

Key players in the global brewing additives market include prominent companies such as Novozymes A/S, DSM (Royal DSM), Kerry Group, Chr. Hansen Holding A/S, AB Mauri and Other Key Players.

The global brewing additives market is moderately fragmented, with a mid-level market consolidation. Tier 1 players, including ADM, BASF, DSM, DuPont, and Kerry Group, dominate through broad product portfolios and global reach. Tier 2 and Tier 3 players such as CP Kelco, Seppic, and Caloris Engineering provide specialized solutions with niche positioning. According to Porter’s Five Forces, buyer concentration is moderate due to the presence of large-scale breweries, while supplier concentration is relatively high given the limited number of advanced formulation providers.

Recent Development and Strategic Overview:

- In August 2024, AB Mauri North America made an important shift consolidating Omega Yeast Labs, an innovator in craft brewing liquid yeast, providing AB Mauri with global yeast and Omega with advanced strain innovation. The acquisition enables AB Biotek increased capacity to better serve craft brewers with fresh yeast solutions tailored to lagers, ales, and hard seltzers.

In November 2024, AB Biotek part of Associated British Foods, includes specialty yeast and enzymes reported double-digit profit growth across their fermentation and enzyme portfolio, highlighting demand in the alcoholic beverages and the bioethanol sectors in fermentation.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 3.8 Bn |

|

Market Forecast Value in 2035 |

USD 7.2 Bn |

|

Growth Rate (CAGR) |

6.0% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Brewing Additives Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Product Type |

|

|

By Source Material |

|

|

By Form |

|

|

By Application Function |

|

|

By Brewery Size (End User |

|

|

By Sales Channel |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Brewing Additives Market Outlook

- 2.1.1. Brewing Additives Market Size (Value - US$ Billion), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Brewing Additives Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Brewing Industry Overview, 2025

- 3.1.1. Food & Beverages Industry Ecosystem Analysis

- 3.1.2. Key Trends for Food & Beverages Industry

- 3.1.3. Regional Distribution for Food & Beverages Industry

- 3.2. Supplier Customer Data

- 3.3. Source Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.6. Raw Material Analysis

- 3.1. Brewing Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Increasing Demand for Sustainable and Organic Alternatives

- 4.1.2. Restraints

- 4.1.2.1. High Formulation Costs and its Technical Complexity affecting the Brewing Additives Market

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Sourcing

- 4.4.2. Manufacturing and Processing

- 4.4.3. Wholesalers/ E-commerce Platform

- 4.4.4. End-use/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Brewing Additives Market Demand

- 4.9.1. Historical Market Size - in Value (US$ Billion), 2021-2024

- 4.9.2. Current and Future Market Size - in Value (US$ Billion), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Brewing Additives Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Brewing Additives Market Size (Value - US$ Billion), Analysis, and Forecasts, by Product Type, 2021-2035

- Enzymes (e.g., amylase, protease, beta6.2.1. ‑glucanase, xylanase)

- 6.2.2. Stabilizers

- 6.2.3. Fining agents (e.g., bentonite, isinglass, silica gel)

- 6.2.4. Flavor enhancers

- 6.2.5. Preservatives

- 6.2.6. Antifoaming agents

- 6.2.7. Colorants

- 6.2.8. Others

- 7. Brewing Additives Market Analysis, by Source Material

- 7.1. Key Segment Analysis

- 7.2. Brewing Additives Market Size (Value - US$ Billion), Analysis, and Forecasts, by Source Material, 2021-2035

- 7.2.1. Malt extracts (including specialty malts)

- 7.2.2. Adjuncts/grains (flakes, flours, grits, starches, cereals)

- 7.2.3. Hops (Amarillo, Cascade, Centennial, etc.)

- 7.2.4. Yeasts (active dry, liquid)

- 7.2.5. Others

- 8. Brewing Additives Market Analysis, by Form

- 8.1. Key Segment Analysis

- 8.2. Brewing Additives Market Size (Value - US$ Billion), Analysis, and Forecasts, by Form, 2021-2035

- 8.2.1. Dry additives

- 8.2.2. Liquid additives

- 9. Brewing Additives Market Analysis, by Application Function

- 9.1. Key Segment Analysis

- 9.2. Brewing Additives Market Size (Value - US$ Billion), Analysis, and Forecasts, by Application Function, 2021-2035

- 9.2.1. Clarification/filtration

- 9.2.2. Flavor and aroma enhancement

- 9.2.3. Stability and preservation

- 9.2.4. Foam control

- 9.2.5. Color adjustment

- 9.2.6. Others

- 10. Brewing Additives Market Analysis, by Brewery Size (End User)

- 10.1. Key Segment Analysis

- 10.2. Brewing Additives Market Size (Value - US$ Billion), Analysis, and Forecasts, by Brewery Size (End User), 2021-2035

- 10.2.1. Macro breweries

- 10.2.2. Craft breweries

- 10.2.3. Microbreweries

- 10.2.4. Brewpubs

- 10.2.5. Contract breweries

- 10.2.6. Others

- 11. Brewing Additives Market Analysis, by Sales Channel

- 11.1. Key Segment Analysis

- 11.2. Brewing Additives Market Size (Value - US$ Billion), Analysis, and Forecasts, by Sales Channel, 2021-2035

- 11.2.1. B2B supply

- E11.2.2. ‑commerce

- 11.2.3. Retail

- 12. Brewing Additives Market Analysis and Forecasts, by Region

- 12.1. Key Findings

- 12.2. Brewing Additives Market Size (Value - US$ Billion), Analysis, and Forecasts, by Region, 2021-2035

- 12.2.1. North America

- 12.2.2. Europe

- 12.2.3. Asia Pacific

- 12.2.4. Middle East

- 12.2.5. Africa

- 12.2.6. South America

- 13. North America Brewing Additives Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. North America Brewing Additives Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 13.3.1. Product Type

- 13.3.2. Source Material

- 13.3.3. Form

- 13.3.4. Application Function

- 13.3.5. Brewery Size (End-User)

- 13.3.6. Sales Channel

- 13.3.7. Country

- 13.3.7.1. USA

- 13.3.7.2. Canada

- 13.3.7.3. Mexico

- 13.4. USA Brewing Additives Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Product Type

- 13.4.3. Source Material

- 13.4.4. Form

- 13.4.5. Application Function

- 13.4.6. Brewery Size (End-User)

- 13.4.7. Sales Channel

- 13.5. Canada Brewing Additives Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Product Type

- 13.5.3. Source Material

- 13.5.4. Form

- 13.5.5. Application Function

- 13.5.6. Brewery Size (End-User)

- 13.5.7. Sales Channel

- 13.6. Mexico Brewing Additives Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Product Type

- 13.6.3. Source Material

- 13.6.4. Form

- 13.6.5. Application Function

- 13.6.6. Brewery Size (End-User)

- 13.6.7. Sales Channel

- 14. Europe Brewing Additives Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Europe Brewing Additives Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Source Material

- 14.3.3. Form

- 14.3.4. Application Function

- 14.3.5. Brewery Size (End-User)

- 14.3.6. Sales Channel

- 14.3.7. Country

- 14.3.7.1. Germany

- 14.3.7.2. United Kingdom

- 14.3.7.3. France

- 14.3.7.4. Italy

- 14.3.7.5. Spain

- 14.3.7.6. Netherlands

- 14.3.7.7. Nordic Countries

- 14.3.7.8. Poland

- 14.3.7.9. Russia & CIS

- 14.3.7.10. Rest of Europe

- 14.4. Germany Brewing Additives Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Source Material

- 14.4.4. Form

- 14.4.5. Application Function

- 14.4.6. Brewery Size (End-User)

- 14.4.7. Sales Channel

- 14.5. United Kingdom Brewing Additives Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Source Material

- 14.5.4. Form

- 14.5.5. Application Function

- 14.5.6. Brewery Size (End-User)

- 14.5.7. Sales Channel

- 14.6. France Brewing Additives Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Source Material

- 14.6.4. Form

- 14.6.5. Application Function

- 14.6.6. Brewery Size (End-User)

- 14.6.7. Sales Channel

- 14.7. Italy Brewing Additives Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Product Type

- 14.7.3. Source Material

- 14.7.4. Form

- 14.7.5. Application Function

- 14.7.6. Brewery Size (End-User)

- 14.7.7. Sales Channel

- 14.8. Spain Brewing Additives Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Product Type

- 14.8.3. Source Material

- 14.8.4. Form

- 14.8.5. Application Function

- 14.8.6. Brewery Size (End-User)

- 14.8.7. Sales Channel

- 14.9. Netherlands Brewing Additives Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Product Type

- 14.9.3. Source Material

- 14.9.4. Form

- 14.9.5. Application Function

- 14.9.6. Brewery Size (End-User)

- 14.9.7. Sales Channel

- 14.10. Nordic Countries Brewing Additives Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Product Type

- 14.10.3. Source Material

- 14.10.4. Form

- 14.10.5. Application Function

- 14.10.6. Brewery Size (End-User)

- 14.10.7. Sales Channel

- 14.11. Poland Brewing Additives Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Product Type

- 14.11.3. Source Material

- 14.11.4. Form

- 14.11.5. Application Function

- 14.11.6. Brewery Size (End-User)

- 14.11.7. Sales Channel

- 14.12. Russia & CIS Brewing Additives Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Product Type

- 14.12.3. Source Material

- 14.12.4. Form

- 14.12.5. Application Function

- 14.12.6. Brewery Size (End-User)

- 14.12.7. Sales Channel

- 14.13. Rest of Europe Brewing Additives Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Product Type

- 14.13.3. Source Material

- 14.13.4. Form

- 14.13.5. Application Function

- 14.13.6. Brewery Size (End-User)

- 14.13.7. Sales Channel

- 15. Asia Pacific Brewing Additives Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. East Asia Brewing Additives Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Source Material

- 15.3.3. Form

- 15.3.4. Application Function

- 15.3.5. Brewery Size (End-User)

- 15.3.6. Sales Channel

- 15.3.7. Country

- 15.3.7.1. China

- 15.3.7.2. India

- 15.3.7.3. Japan

- 15.3.7.4. South Korea

- 15.3.7.5. Australia and New Zealand

- 15.3.7.6. Indonesia

- 15.3.7.7. Malaysia

- 15.3.7.8. Thailand

- 15.3.7.9. Vietnam

- 15.3.7.10. Rest of Asia-Pacific

- 15.4. China Brewing Additives Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Source Material

- 15.4.4. Form

- 15.4.5. Application Function

- 15.4.6. Brewery Size (End-User)

- 15.4.7. Sales Channel

- 15.5. India Brewing Additives Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Source Material

- 15.5.4. Form

- 15.5.5. Application Function

- 15.5.6. Brewery Size (End-User)

- 15.5.7. Sales Channel

- 15.6. Japan Brewing Additives Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Source Material

- 15.6.4. Form

- 15.6.5. Application Function

- 15.6.6. Brewery Size (End-User)

- 15.6.7. Sales Channel

- 15.7. South Korea Brewing Additives Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Source Material

- 15.7.4. Form

- 15.7.5. Application Function

- 15.7.6. Brewery Size (End-User)

- 15.7.7. Sales Channel

- 15.8. Australia and New Zealand Brewing Additives Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Source Material

- 15.8.4. Form

- 15.8.5. Application Function

- 15.8.6. Brewery Size (End-User)

- 15.8.7. Sales Channel

- 15.9. Indonesia Brewing Additives Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Product Type

- 15.9.3. Source Material

- 15.9.4. Form

- 15.9.5. Application Function

- 15.9.6. Brewery Size (End-User)

- 15.9.7. Sales Channel

- 15.10. Malaysia Brewing Additives Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Product Type

- 15.10.3. Source Material

- 15.10.4. Form

- 15.10.5. Application Function

- 15.10.6. Brewery Size (End-User)

- 15.10.7. Sales Channel

- 15.11. Thailand Brewing Additives Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Product Type

- 15.11.3. Source Material

- 15.11.4. Form

- 15.11.5. Application Function

- 15.11.6. Brewery Size (End-User)

- 15.11.7. Sales Channel

- 15.12. Vietnam Brewing Additives Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Product Type

- 15.12.3. Source Material

- 15.12.4. Form

- 15.12.5. Application Function

- 15.12.6. Brewery Size (End-User)

- 15.12.7. Sales Channel

- 15.13. Rest of Asia Pacific Brewing Additives Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Product Type

- 15.13.3. Source Material

- 15.13.4. Form

- 15.13.5. Application Function

- 15.13.6. Brewery Size (End-User)

- 15.13.7. Sales Channel

- 16. Middle East Brewing Additives Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Middle East Brewing Additives Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Source Material

- 16.3.3. Form

- 16.3.4. Application Function

- 16.3.5. Brewery Size (End-User)

- 16.3.6. Sales Channel

- 16.3.7. Country

- 16.3.7.1. Turkey

- 16.3.7.2. UAE

- 16.3.7.3. Saudi Arabia

- 16.3.7.4. Israel

- 16.3.7.5. Rest of Middle East

- 16.4. Turkey Brewing Additives Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Source Material

- 16.4.4. Form

- 16.4.5. Application Function

- 16.4.6. Brewery Size (End-User)

- 16.4.7. Sales Channel

- 16.5. UAE Brewing Additives Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Source Material

- 16.5.4. Form

- 16.5.5. Application Function

- 16.5.6. Brewery Size (End-User)

- 16.5.7. Sales Channel

- 16.6. Saudi Arabia Brewing Additives Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Source Material

- 16.6.4. Form

- 16.6.5. Application Function

- 16.6.6. Brewery Size (End-User)

- 16.6.7. Sales Channel

- 16.7. Israel Brewing Additives Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Source Material

- 16.7.4. Form

- 16.7.5. Application Function

- 16.7.6. Brewery Size (End-User)

- 16.7.7. Sales Channel

- 16.8. Rest of Middle East Brewing Additives Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Source Material

- 16.8.4. Form

- 16.8.5. Application Function

- 16.8.6. Brewery Size (End-User)

- 16.8.7. Sales Channel

- 17. Africa Brewing Additives Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Africa Brewing Additives Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Source Material

- 17.3.3. Form

- 17.3.4. Application Function

- 17.3.5. Brewery Size (End-User)

- 17.3.6. Sales Channel

- 17.3.7. Country

- 17.3.7.1. South Africa

- 17.3.7.2. Egypt

- 17.3.7.3. Nigeria

- 17.3.7.4. Algeria

- 17.3.7.5. Rest of Africa

- 17.4. South Africa Brewing Additives Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Source Material

- 17.4.4. Form

- 17.4.5. Application Function

- 17.4.6. Brewery Size (End-User)

- 17.4.7. Sales Channel

- 17.5. Egypt Brewing Additives Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Source Material

- 17.5.4. Form

- 17.5.5. Application Function

- 17.5.6. Brewery Size (End-User)

- 17.5.7. Sales Channel

- 17.6. Nigeria Brewing Additives Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Source Material

- 17.6.4. Form

- 17.6.5. Application Function

- 17.6.6. Brewery Size (End-User)

- 17.6.7. Sales Channel

- 17.7. Algeria Brewing Additives Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Source Material

- 17.7.4. Form

- 17.7.5. Application Function

- 17.7.6. Brewery Size (End-User)

- 17.7.7. Sales Channel

- 17.8. Rest of Africa Brewing Additives Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Source Material

- 17.8.4. Form

- 17.8.5. Application Function

- 17.8.6. Brewery Size (End-User)

- 17.8.7. Sales Channel

- 18. South America Brewing Additives Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Central and South Africa Brewing Additives Market Size ( Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Source Material

- 18.3.3. Form

- 18.3.4. Application Function

- 18.3.5. Brewery Size (End-User)

- 18.3.6. Sales Channel

- 18.3.7. Country

- 18.3.7.1. Brazil

- 18.3.7.2. Argentina

- 18.3.7.3. Rest of South America

- 18.4. Brazil Brewing Additives Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Source Material

- 18.4.4. Form

- 18.4.5. Application Function

- 18.4.6. Brewery Size (End-User)

- 18.4.7. Sales Channel

- 18.5. Argentina Brewing Additives Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Source Material

- 18.5.4. Form

- 18.5.5. Application Function

- 18.5.6. Brewery Size (End-User)

- 18.5.7. Sales Channel

- 18.6. Rest of South America Brewing Additives Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Source Material

- 18.6.4. Form

- 18.6.5. Application Function

- 18.6.6. Brewery Size (End-User)

- 18.6.7. Sales Channel

- 19. Key Players/ Company Profile

- 19.1. BASF SE

- 19.1.1. Company Details/ Overview

- 19.1.2. Company Financials

- 19.1.3. Key Customers and Competitors

- 19.1.4. Business/ Industry Portfolio

- 19.1.5. Product Portfolio/ Specification Details

- 19.1.6. Pricing Data

- 19.1.7. Strategic Overview

- 19.1.8. Recent Developments

- 19.2. AB Mauri

- 19.3. Archer Daniels Midland Company (ADM)

- 19.4. Associated British Foods (ABF)

- 19.5. Brenntag AG

- 19.6. Caloris Engineering

- 19.7. Cargill, Incorporated

- 19.8. Chr. Hansen Holding A/S

- 19.9. CP Kelco

- 19.10. De Smet Engineers & Contractors NV

- 19.11. DowDuPont (DuPont Nutrition & Biosciences)

- 19.12. DSM (Royal DSM)

- 19.13. Givaudan

- 19.14. Kerry Group

- 19.15. Lallemand Inc.

- 19.16. Novozymes A/S

- 19.17. Sensient Technologies Corporation

- 19.18. Seppic (Air Liquide)

- 19.19. Solvay S.A.

- 19.20. W.R. Grace & Co.

- 19.21. Other key Players

- 19.1. BASF SE

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation