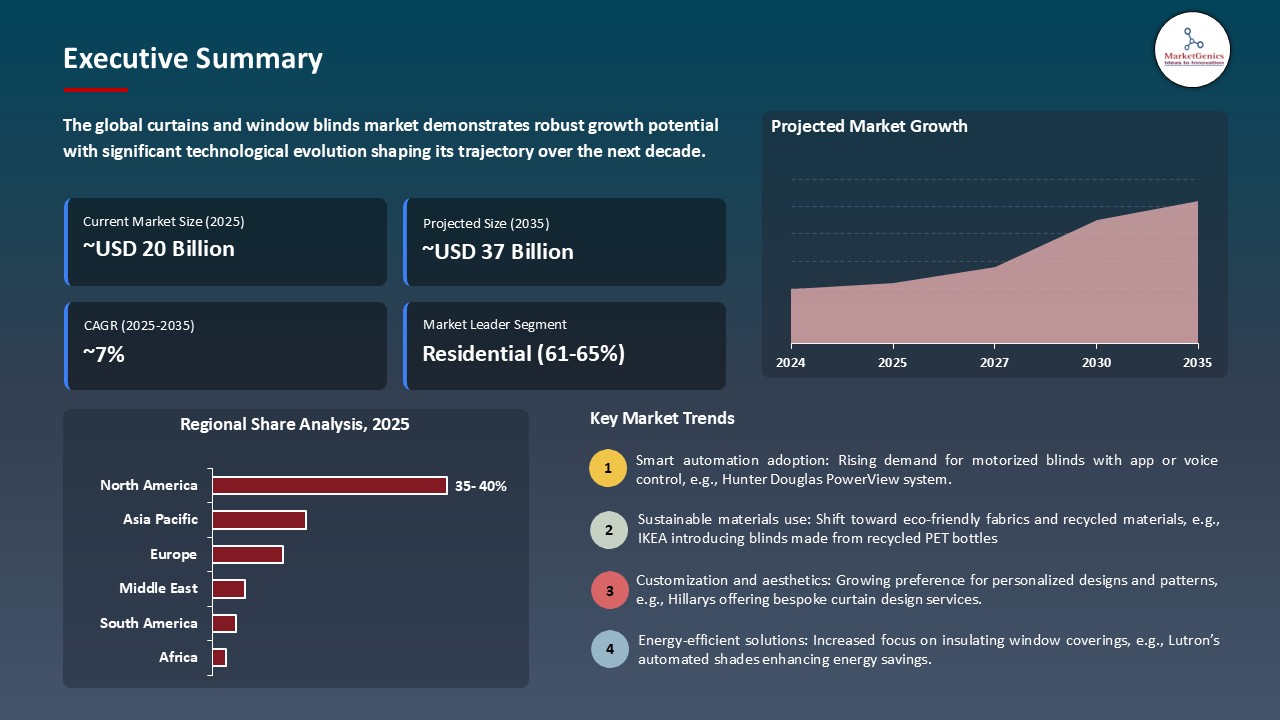

- The global curtains and window blinds market is valued at USD 19.8 billion in 2025.

- The market is projected to grow at a CAGR of 6.5% during the forecast period of 2026 to 2035.

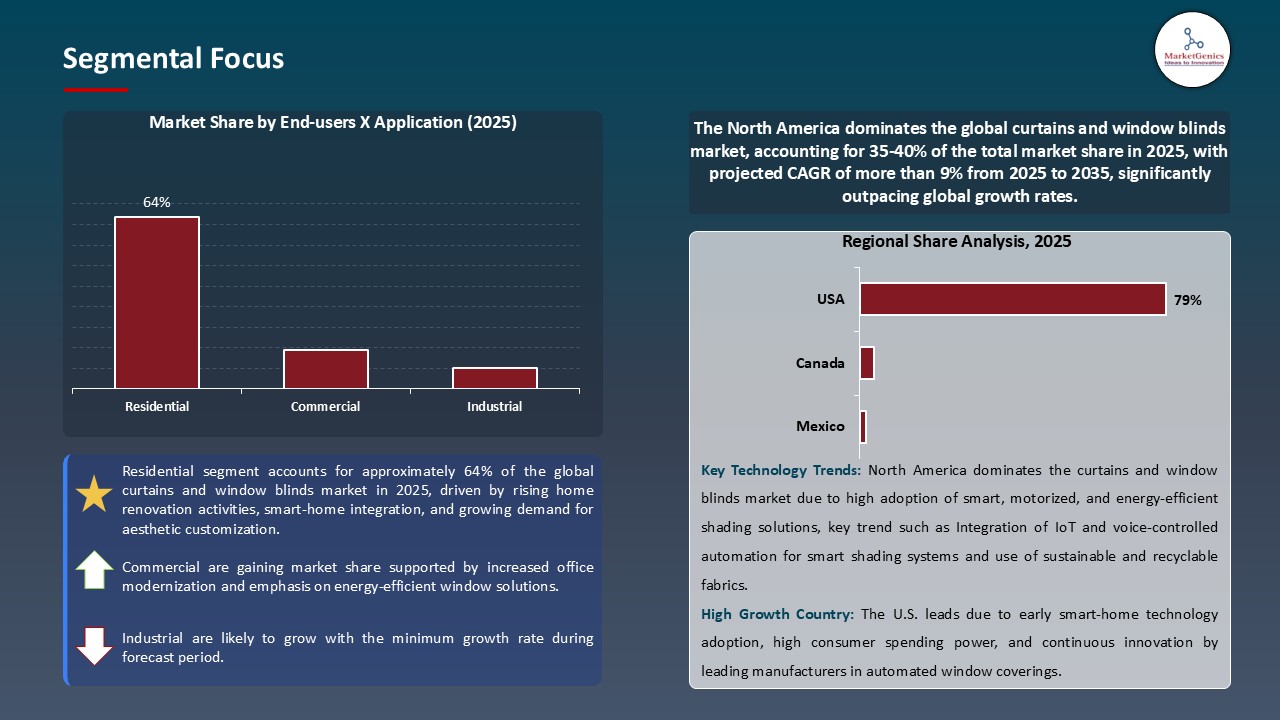

- The residential segment holds major share ~64% in the global curtains and window blinds market, driven by demand for energy-efficient, automated, and aesthetically appealing window treatments. Innovations in smart-motorized systems, sustainable materials, and customizable designs are boosting adoption across homes, retail, and e-commerce channels.

- Growing smart-home adoption: Increasing consumer preference for automated and energy-efficient window treatments is fueling demand for curtains and blinds globally.

- Sustainability and customization: Advances in eco-friendly materials, low-VOC finishes, and bespoke design options are enhancing functionality, aesthetics, and overall appeal of curtains and window blinds.

- The top five player’s accounts for over 25% of the global curtains and window blinds market in 2025.

- In January 2025, Mzuri Group partnered with Illumin8 to expand its product portfolio with soft furnishings and leverage expertise in bespoke manufacturing, fabrics, and global distribution.

- In June 2025, TWOPAGES launched a new line of custom motorised window treatments for smart homes, featuring seamless automation integration, cordless operation, and premium finishes.

- Global Curtains and Window Blinds Market is likely to create the total forecasting opportunity of ~USD 17 Bn till 2035.

- North America holds a leading position in the global curtains and window blinds market, driven by high disposable incomes, advanced housing and renovation activity, strong smart‑home adoption, and well‑established distribution networks.

- The residential and commercial construction activity is expanding globally leading to a sustained demand of window treatment solutions. Increasing population in emerging economies is driving mass housing projects and commercial infrastructural construction that are driving the demand to install extensive window coverings. The increase in high-rise apartments, sleek office buildings, and broad glass frontages has increased the size of the market that can be approached by high-quality window treatment.

- Large commercial ventures are now becoming more specifications of quality, tailor-made window-treatment systems to fulfill aesthetic, functional and security needs. For instance, in July 2025, Waverley was commissioned to develop a high-spec blind-control system in a premium office fit-out at The Kensington Building in London demonstrating how extensive standards of glazing and design are defining demand.

- Government infrastructural projects and increased demands of consumers on efficient and attractive solutions, coupled with the building boom, are creating high levels of underpinning growth in the residential and commercial markets.

- Energy-efficient window coverings are becoming an essential element in new buildings, driving global curtains and window blinds market growth.

- The curtains and window blinds market are experiencing intense pressure on the margin because of the penetration of cheap imported goods. These substitutes, generally manufactured with little quality oversight and rudimentary materials, generate a negative effect on pricing in the market, compelling current manufactories to produce quality products, support of installation and warranty offers, and still hold high positioning.

- The mid-market segment has been more impacted with price-sensitive consumers shifting towards low-priced and prepared foods. This has increased competition and commoditization of the basic window treatments, lessening any differentiation in terms of quality or service, and compelling the manufacturers to seek other means of value addition. Companies are investing in premium features, smart technology integration, and value-added features in order to keep up with the competition.

- Smaller regional manufacturers, on the other hand, face significant challenges and reduced profitability as a result of overall pricing pressure, which limits innovation and creates barriers to viable business models for producers who rely on local production.

- The increased use of smart home technologies is also providing major opportunities to the window treatment industry. Automated and motorized blinds and curtains, with automation systems, voice assistants, and smartphone applications are becoming more of a mass expectation, especially among technology-aware and younger customers. This combination allows routines to use maximum light, privacy and energy efficiency.

- Firms are now providing intelligent shading systems to address the growing needs. For instance, in March 2025, SwitchBot introduced its Adjustable Smart Roller Shades, which can be integrated with Matter and are compatible with Apple Home, Google Home, and Amazon Alexa ecosystems. The system was designed to be retrofitted easily, providing intelligent control and convenience to residential users and is a response to the trend of affordable user-friendly smart shading systems. Incentives and utility rebates on energy consumption in areas that experience high cooling expenses also promote the adoption.

- Multifamily housing, commercial buildings, hospitality, healthcare, and education are now specifying automated treatments, resulting in targeted markets and revenue from recurrent maintenance and system updates.

- The curtains and window blinds market are witnessing a transformation of material choice, production methods and product placement. The consumers are becoming more and more concerned with recycled products, natural fibers, and non-toxic ingredients with millennial and Gen Z buyers leading the promotion of brand sustainability attributes. Achieving sustainable products through the introduction of eco-friendly product lines by companies is on the rise as a result of consumer demand on environmentally friendly products.

- For instnace, in September 2025, Blinhdome announced a new range of GRS-qualified greener blinds and shades that are manufactured using recycled fabrics and that the process of custom-order is simplified and highlighted the home-furnishing as being sustainable. Manufacturers are also now embracing the principles of the circle economy, take-back programs, making their designs easy to disassemble, and getting certifications like Cradle to Cradle, GREENGUARD, and OEKO-TEX Standard 100.

- The present sustainability initiative encourages the use of biodegradable materials, water-based colors, and energy-saving processes, all of which provide a marketing advantage and assist ensure high-end positioning in the home and commercial markets.

- The residential segment of the curtains and window blinds market is dominated by residential segment due to the popularisation of high quality, customisable and automated window treatments in the homes. This is an indication of increasing consumer preference of convenience, beauty and smart-home.

- Producers are designing to satisfy the changing home requirements. For instnace, in June 2024, Budget Blinds announced cordless and motorised treatments that met child-safety standards; and Springs Window Fashions had released its Vitale custom shade line, which was based on the demand of safe, stylish and easy-to-use residential offerings.

- Growth in residential segment is also facilitated by high levels of consumer awareness, good housing and renovation, favourable regulation and focus on high-end, energy-efficient, and sustainable window treatments; such that manufacturers are able to target both the mainstream and the niche high-end consumer.

- North America leads the global curtains and window blinds market, because of high disposable income, developed home and renovation projects, well-developed smart-home use, and developed system of distribution. High-end and automated window treatments are highly in demand, and the region has been a key market value driver and innovator.

- North America has high retail penetration, and numerous offerings exist in the form of regular retailers, specialty stores, and e-commerce. The desire to use energy-saving and sustainable and customisable alternatives is growing, and motorised and smart blinds are becoming the norm, as the region prefers convenient, technology-integration and aesthetical solutions.

- Innovation leadership is high, and there is the introduction of next-generation products by major companies that have added design features, functionality features, and sustainability features. For instance, in June 2025, Hunter Douglas introduced Spring 2025 upgrades to its PowerView platform in North America, such as arch and angle shades, the Pirouette A 2 Deux system and installer-friendly LightLock 4 Flex, which emphasizes the emphasis on high-end, smart-home compatible products in the region.

- In January 2025, Mzuri Group entered into a strategic investment agreement with Illumin8, a specialist in made-to-measure window blinds and curtains. The partnership will enhance Mzuri product range by offering soft furnishings and its worldwide presence. Illumin8 brings in the experience in fabrics, digital printing, custom production and global distribution support to the expansion strategy of Mzuri and strengthen its presence in the window-coverings industry.

- In June 2025, TWOPAGES launched a new range of fully motorised window treatments which are to be used in a modern, smart home. The introduction is focused on smooth operation with home automation, safe and cordless operation, and high-end design finishes.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Altex Industries Limited

- American Blinds & Wallpaper Factory

- Silent Gliss

- Decora Blind Systems

- Draper Inc.

- Elite Window Fashions

- Everhem

- Budget Blinds

- Griesser AG

- Hunter Douglas

- Lafayette Interior Fashions

- Springs Window Fashions

- Nien Made Enterprise Co., Ltd.

- Schenker Storen AG

- Skandia Window Fashion

- Ching Feng Home Fashions Co., Ltd

- Nichibei Co., Ltd.

- Fabricut

- Tachikawa Corporation

- TOSO Company Limited

- Other Key Players

- Curtains

- Sheer Curtains

- Blackout Curtains

- Thermal Curtains

- Decorative Curtains

- Shower Curtains

- Others

- Window Blinds

- Venetian Blinds

- Roller Blinds

- Vertical Blinds

- Roman Blinds

- Panel Blinds

- Pleated Blinds

- Others

- Shades

- Cellular/Honeycomb Shades

- Solar Shades

- Bamboo Shades

- Others

- Shutters

- Plantation Shutters

- Solid Shutters

- Others

- Fabric-based

- Cotton

- Polyester

- Linen

- Others

- Non-fabric

- Wood

- Faux Wood

- Aluminum

- Vinyl/PVC

- Others

- Manual Operation

- Cord Control

- Cordless

- Wand Control

- Rod Pocket

- Others

- Motorized/Automated

- Battery Operated

- Electric Powered

- Solar Powered

- Others

- Smart/Connected

- Inside Mount

- Outside Mount

- Ceiling Mount

- Track-mounted

- Tension-mounted

- Others

- Online

- Company Websites

- E-commerce Platforms

- Offline

- Specialty Stores

- Home Improvement Stores

- Department Stores

- Direct Sales/Dealers

- Others

- Residential

- Living Rooms

- Bedrooms

- Kitchens

- Bathrooms

- Home Offices

- Children's Rooms

- Dining Areas

- Others

- Commercial

- Corporate Offices

- Retail Stores

- Hospitality

- Healthcare

- Educational Institutions

- Government Buildings

- Others

- Industrial

- Warehouses

- Manufacturing Facilities

- Laboratories

- Clean Rooms

- Others

- Institutional

- Religious Institutions

- Community Centers

- Museums/Galleries

- Theaters/Auditoriums

- Others

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Curtains and Window Blinds Market Outlook

- 2.1.1. Curtains and Window Blinds Market Size Volume (Thousand Units) and Value (US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Curtains and Window Blinds Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Growing demand for energy-efficient and smart window covering solutions.

- 4.1.1.2. Rising residential and commercial construction activities worldwide.

- 4.1.1.3. Increasing consumer focus on interior aesthetics and home décor customization.

- 4.1.2. Restraints

- 4.1.2.1. High installation and maintenance costs of automated systems.

- 4.1.2.2. Fluctuations in raw material prices impacting overall production costs.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Component Suppliers

- 4.4.2. Manufacturing

- 4.4.3. Distribution

- 4.4.4. End-Use

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Curtains and Window Blinds Market Demand

- 4.9.1. Historical Market Size –Volume (Thousand Units) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size –Volume (Thousand Units) and Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Curtains and Window Blinds Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Curtains and Window Blinds Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Curtains

- 6.2.1.1. Sheer Curtains

- 6.2.1.2. Blackout Curtains

- 6.2.1.3. Thermal Curtains

- 6.2.1.4. Decorative Curtains

- 6.2.1.5. Shower Curtains

- 6.2.1.6. Others

- 6.2.2. Window Blinds

- 6.2.2.1. Venetian Blinds

- 6.2.2.2. Roller Blinds

- 6.2.2.3. Vertical Blinds

- 6.2.2.4. Roman Blinds

- 6.2.2.5. Panel Blinds

- 6.2.2.6. Pleated Blinds

- 6.2.2.7. Others

- 6.2.3. Shades

- 6.2.3.1. Cellular/Honeycomb Shades

- 6.2.3.2. Solar Shades

- 6.2.3.3. Bamboo Shades

- 6.2.3.4. Others

- 6.2.4. Shutters

- 6.2.4.1. Plantation Shutters

- 6.2.4.2. Solid Shutters

- 6.2.4.3. Others

- 6.2.1. Curtains

- 7. Global Curtains and Window Blinds Market Analysis, by Material Type

- 7.1. Key Segment Analysis

- 7.2. Curtains and Window Blinds Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, by Material Type, 2021-2035

- 7.2.1. Fabric-based

- 7.2.1.1. Cotton

- 7.2.1.2. Polyester

- 7.2.1.3. Linen

- 7.2.1.4. Others

- 7.2.2. Non-fabric

- 7.2.2.1. Wood

- 7.2.2.2. Faux Wood

- 7.2.2.3. Aluminum

- 7.2.2.4. Vinyl/PVC

- 7.2.2.5. Others

- 7.2.1. Fabric-based

- 8. Global Curtains and Window Blinds Market Analysis, by Operation Mechanism

- 8.1. Key Segment Analysis

- 8.2. Curtains and Window Blinds Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, by Operation Mechanism, 2021-2035

- 8.2.1. Manual Operation

- 8.2.1.1. Cord Control

- 8.2.1.2. Cordless

- 8.2.1.3. Wand Control

- 8.2.1.4. Rod Pocket

- 8.2.1.5. Others

- 8.2.2. Motorized/Automated

- 8.2.2.1. Battery Operated

- 8.2.2.2. Electric Powered

- 8.2.2.3. Solar Powered

- 8.2.2.4. Others

- 8.2.3. Smart/Connected

- 8.2.1. Manual Operation

- 9. Global Curtains and Window Blinds Market Analysis, by Installation Type

- 9.1. Key Segment Analysis

- 9.2. Curtains and Window Blinds Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, by Installation Type, 2021-2035

- 9.2.1. Inside Mount

- 9.2.2. Outside Mount

- 9.2.3. Ceiling Mount

- 9.2.4. Track-mounted

- 9.2.5. Tension-mounted

- 9.2.6. Others

- 10. Global Curtains and Window Blinds Market Analysis, by Distribution Channel

- 10.1. Key Segment Analysis

- 10.2. Curtains and Window Blinds Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 10.2.1. Online

- 10.2.1.1. Company Websites

- 10.2.1.2. E-commerce Platforms

- 10.2.2. Offline

- 10.2.2.1. Specialty Stores

- 10.2.2.2. Home Improvement Stores

- 10.2.2.3. Department Stores

- 10.2.2.4. Direct Sales/Dealers

- 10.2.2.5. Others

- 10.2.1. Online

- 11. Global Curtains and Window Blinds Market Analysis, by End-users X Application

- 11.1. Key Segment Analysis

- 11.2. Curtains and Window Blinds Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, by End-users X Application, 2021-2035

- 11.2.1. Residential

- 11.2.1.1. Living Rooms

- 11.2.1.2. Bedrooms

- 11.2.1.3. Kitchens

- 11.2.1.4. Bathrooms

- 11.2.1.5. Home Offices

- 11.2.1.6. Children's Rooms

- 11.2.1.7. Dining Areas

- 11.2.1.8. Others

- 11.2.2. Commercial

- 11.2.2.1. Corporate Offices

- 11.2.2.2. Retail Stores

- 11.2.2.3. Hospitality

- 11.2.2.4. Healthcare

- 11.2.2.5. Educational Institutions

- 11.2.2.6. Government Buildings

- 11.2.2.7. Others

- 11.2.3. Industrial

- 11.2.3.1. Warehouses

- 11.2.3.2. Manufacturing Facilities

- 11.2.3.3. Laboratories

- 11.2.3.4. Clean Rooms

- 11.2.3.5. Others

- 11.2.4. Institutional

- 11.2.4.1. Religious Institutions

- 11.2.4.2. Community Centers

- 11.2.4.3. Museums/Galleries

- 11.2.4.4. Theaters/Auditoriums

- 11.2.4.5. Others

- 11.2.1. Residential

- 12. Global Curtains and Window Blinds Market Analysis and Forecasts, by Region

- 12.1. Key Findings

- 12.2. Curtains and Window Blinds Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 12.2.1. North America

- 12.2.2. Europe

- 12.2.3. Asia Pacific

- 12.2.4. Middle East

- 12.2.5. Africa

- 12.2.6. South America

- 13. North America Curtains and Window Blinds Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. North America Curtains and Window Blinds Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Product Type

- 13.3.2. Material Type

- 13.3.3. Operation Mechanism

- 13.3.4. Installation Type

- 13.3.5. Distribution Channel

- 13.3.6. End-users X Application

- 13.3.7. Country

- 13.3.7.1. USA

- 13.3.7.2. Canada

- 13.3.7.3. Mexico

- 13.4. USA Curtains and Window Blinds Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Product Type

- 13.4.3. Material Type

- 13.4.4. Operation Mechanism

- 13.4.5. Installation Type

- 13.4.6. Distribution Channel

- 13.4.7. End-users X Application

- 13.5. Canada Curtains and Window Blinds Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Product Type

- 13.5.3. Material Type

- 13.5.4. Operation Mechanism

- 13.5.5. Installation Type

- 13.5.6. Distribution Channel

- 13.5.7. End-users X Application

- 13.6. Mexico Curtains and Window Blinds Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Product Type

- 13.6.3. Material Type

- 13.6.4. Operation Mechanism

- 13.6.5. Installation Type

- 13.6.6. Distribution Channel

- 13.6.7. End-users X Application

- 14. Europe Curtains and Window Blinds Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Europe Curtains and Window Blinds Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Material Type

- 14.3.3. Operation Mechanism

- 14.3.4. Installation Type

- 14.3.5. Distribution Channel

- 14.3.6. End-users X Application

- 14.3.7. Country

- 14.3.7.1. Germany

- 14.3.7.2. United Kingdom

- 14.3.7.3. France

- 14.3.7.4. Italy

- 14.3.7.5. Spain

- 14.3.7.6. Netherlands

- 14.3.7.7. Nordic Countries

- 14.3.7.8. Poland

- 14.3.7.9. Russia & CIS

- 14.3.7.10. Rest of Europe

- 14.4. Germany Curtains and Window Blinds Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Material Type

- 14.4.4. Operation Mechanism

- 14.4.5. Installation Type

- 14.4.6. Distribution Channel

- 14.4.7. End-users X Application

- 14.5. United Kingdom Curtains and Window Blinds Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Material Type

- 14.5.4. Operation Mechanism

- 14.5.5. Installation Type

- 14.5.6. Distribution Channel

- 14.5.7. End-users X Application

- 14.6. France Curtains and Window Blinds Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Material Type

- 14.6.4. Operation Mechanism

- 14.6.5. Installation Type

- 14.6.6. Distribution Channel

- 14.6.7. End-users X Application

- 14.7. Italy Curtains and Window Blinds Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Product Type

- 14.7.3. Material Type

- 14.7.4. Operation Mechanism

- 14.7.5. Installation Type

- 14.7.6. Distribution Channel

- 14.7.7. End-users X Application

- 14.8. Spain Curtains and Window Blinds Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Product Type

- 14.8.3. Material Type

- 14.8.4. Operation Mechanism

- 14.8.5. Installation Type

- 14.8.6. Distribution Channel

- 14.8.7. End-users X Application

- 14.9. Netherlands Curtains and Window Blinds Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Product Type

- 14.9.3. Material Type

- 14.9.4. Operation Mechanism

- 14.9.5. Installation Type

- 14.9.6. Distribution Channel

- 14.9.7. End-users X Application

- 14.10. Nordic Countries Curtains and Window Blinds Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Product Type

- 14.10.3. Material Type

- 14.10.4. Operation Mechanism

- 14.10.5. Installation Type

- 14.10.6. Distribution Channel

- 14.10.7. End-users X Application

- 14.11. Poland Curtains and Window Blinds Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Product Type

- 14.11.3. Material Type

- 14.11.4. Operation Mechanism

- 14.11.5. Installation Type

- 14.11.6. Distribution Channel

- 14.11.7. End-users X Application

- 14.12. Russia & CIS Curtains and Window Blinds Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Product Type

- 14.12.3. Material Type

- 14.12.4. Operation Mechanism

- 14.12.5. Installation Type

- 14.12.6. Distribution Channel

- 14.12.7. End-users X Application

- 14.13. Rest of Europe Curtains and Window Blinds Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Product Type

- 14.13.3. Material Type

- 14.13.4. Operation Mechanism

- 14.13.5. Installation Type

- 14.13.6. Distribution Channel

- 14.13.7. End-users X Application

- 15. Asia Pacific Curtains and Window Blinds Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Asia Pacific Curtains and Window Blinds Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Material Type

- 15.3.3. Operation Mechanism

- 15.3.4. Installation Type

- 15.3.5. Distribution Channel

- 15.3.6. End-users X Application

- 15.3.7. Country

- 15.3.7.1. China

- 15.3.7.2. India

- 15.3.7.3. Japan

- 15.3.7.4. South Korea

- 15.3.7.5. Australia and New Zealand

- 15.3.7.6. Indonesia

- 15.3.7.7. Malaysia

- 15.3.7.8. Thailand

- 15.3.7.9. Vietnam

- 15.3.7.10. Rest of Asia Pacific

- 15.4. China Curtains and Window Blinds Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Material Type

- 15.4.4. Operation Mechanism

- 15.4.5. Installation Type

- 15.4.6. Distribution Channel

- 15.4.7. End-users X Application

- 15.5. India Curtains and Window Blinds Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Material Type

- 15.5.4. Operation Mechanism

- 15.5.5. Installation Type

- 15.5.6. Distribution Channel

- 15.5.7. End-users X Application

- 15.6. Japan Curtains and Window Blinds Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Material Type

- 15.6.4. Operation Mechanism

- 15.6.5. Installation Type

- 15.6.6. Distribution Channel

- 15.6.7. End-users X Application

- 15.7. South Korea Curtains and Window Blinds Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Material Type

- 15.7.4. Operation Mechanism

- 15.7.5. Installation Type

- 15.7.6. Distribution Channel

- 15.7.7. End-users X Application

- 15.8. Australia and New Zealand Curtains and Window Blinds Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Material Type

- 15.8.4. Operation Mechanism

- 15.8.5. Installation Type

- 15.8.6. Distribution Channel

- 15.8.7. End-users X Application

- 15.9. Indonesia Curtains and Window Blinds Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Product Type

- 15.9.3. Material Type

- 15.9.4. Operation Mechanism

- 15.9.5. Installation Type

- 15.9.6. Distribution Channel

- 15.9.7. End-users X Application

- 15.10. Malaysia Curtains and Window Blinds Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Product Type

- 15.10.3. Material Type

- 15.10.4. Operation Mechanism

- 15.10.5. Installation Type

- 15.10.6. Distribution Channel

- 15.10.7. End-users X Application

- 15.11. Thailand Curtains and Window Blinds Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Product Type

- 15.11.3. Material Type

- 15.11.4. Operation Mechanism

- 15.11.5. Installation Type

- 15.11.6. Distribution Channel

- 15.11.7. End-users X Application

- 15.12. Vietnam Curtains and Window Blinds Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Product Type

- 15.12.3. Material Type

- 15.12.4. Operation Mechanism

- 15.12.5. Installation Type

- 15.12.6. Distribution Channel

- 15.12.7. End-users X Application

- 15.13. Rest of Asia Pacific Curtains and Window Blinds Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Product Type

- 15.13.3. Material Type

- 15.13.4. Operation Mechanism

- 15.13.5. Installation Type

- 15.13.6. Distribution Channel

- 15.13.7. End-users X Application

- 16. Middle East Curtains and Window Blinds Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Middle East Curtains and Window Blinds Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Material Type

- 16.3.3. Operation Mechanism

- 16.3.4. Installation Type

- 16.3.5. Distribution Channel

- 16.3.6. End-users X Application

- 16.3.7. Country

- 16.3.7.1. Turkey

- 16.3.7.2. UAE

- 16.3.7.3. Saudi Arabia

- 16.3.7.4. Israel

- 16.3.7.5. Rest of Middle East

- 16.4. Turkey Curtains and Window Blinds Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Material Type

- 16.4.4. Operation Mechanism

- 16.4.5. Installation Type

- 16.4.6. Distribution Channel

- 16.4.7. End-users X Application

- 16.5. UAE Curtains and Window Blinds Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Material Type

- 16.5.4. Operation Mechanism

- 16.5.5. Installation Type

- 16.5.6. Distribution Channel

- 16.5.7. End-users X Application

- 16.6. Saudi Arabia Curtains and Window Blinds Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Material Type

- 16.6.4. Operation Mechanism

- 16.6.5. Installation Type

- 16.6.6. Distribution Channel

- 16.6.7. End-users X Application

- 16.7. Israel Curtains and Window Blinds Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Material Type

- 16.7.4. Operation Mechanism

- 16.7.5. Installation Type

- 16.7.6. Distribution Channel

- 16.7.7. End-users X Application

- 16.8. Rest of Middle East Curtains and Window Blinds Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Material Type

- 16.8.4. Operation Mechanism

- 16.8.5. Installation Type

- 16.8.6. Distribution Channel

- 16.8.7. End-users X Application

- 17. Africa Curtains and Window Blinds Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Africa Curtains and Window Blinds Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Material Type

- 17.3.3. Operation Mechanism

- 17.3.4. Installation Type

- 17.3.5. Distribution Channel

- 17.3.6. End-users X Application

- 17.3.7. Country

- 17.3.7.1. South Africa

- 17.3.7.2. Egypt

- 17.3.7.3. Nigeria

- 17.3.7.4. Algeria

- 17.3.7.5. Rest of Africa

- 17.4. South Africa Curtains and Window Blinds Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Material Type

- 17.4.4. Operation Mechanism

- 17.4.5. Installation Type

- 17.4.6. Distribution Channel

- 17.4.7. End-users X Application

- 17.5. Egypt Curtains and Window Blinds Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Material Type

- 17.5.4. Operation Mechanism

- 17.5.5. Installation Type

- 17.5.6. Distribution Channel

- 17.5.7. End-users X Application

- 17.6. Nigeria Curtains and Window Blinds Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Material Type

- 17.6.4. Operation Mechanism

- 17.6.5. Installation Type

- 17.6.6. Distribution Channel

- 17.6.7. End-users X Application

- 17.7. Algeria Curtains and Window Blinds Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Material Type

- 17.7.4. Operation Mechanism

- 17.7.5. Installation Type

- 17.7.6. Distribution Channel

- 17.7.7. End-users X Application

- 17.8. Rest of Africa Curtains and Window Blinds Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Material Type

- 17.8.4. Operation Mechanism

- 17.8.5. Installation Type

- 17.8.6. Distribution Channel

- 17.8.7. End-users X Application

- 18. South America Curtains and Window Blinds Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. South America Curtains and Window Blinds Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Material Type

- 18.3.3. Operation Mechanism

- 18.3.4. Installation Type

- 18.3.5. Distribution Channel

- 18.3.6. End-users X Application

- 18.3.7. Country

- 18.3.7.1. Brazil

- 18.3.7.2. Argentina

- 18.3.7.3. Rest of South America

- 18.4. Brazil Curtains and Window Blinds Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Material Type

- 18.4.4. Operation Mechanism

- 18.4.5. Installation Type

- 18.4.6. Distribution Channel

- 18.4.7. End-users X Application

- 18.5. Argentina Curtains and Window Blinds Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Material Type

- 18.5.4. Operation Mechanism

- 18.5.5. Installation Type

- 18.5.6. Distribution Channel

- 18.5.7. End-users X Application

- 18.6. Rest of South America Curtains and Window Blinds Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Material Type

- 18.6.4. Operation Mechanism

- 18.6.5. Installation Type

- 18.6.6. Distribution Channel

- 18.6.7. End-users X Application

- 19. Key Players/ Company Profile

- 19.1. Altex Industries Limited.

- 19.1.1. Company Details/ Overview

- 19.1.2. Company Financials

- 19.1.3. Key Customers and Competitors

- 19.1.4. Business/ Industry Portfolio

- 19.1.5. Product Portfolio/ Specification Details

- 19.1.6. Pricing Data

- 19.1.7. Strategic Overview

- 19.1.8. Recent Developments

- 19.2. American Blinds & Wallpaper Factory

- 19.3. Budget Blinds

- 19.4. Ching Feng Home Fashions Co., Ltd.

- 19.5. Decora Blind Systems

- 19.6. Draper Inc.

- 19.7. Elite Window Fashions

- 19.8. Everhem

- 19.9. Fabricut

- 19.10. Griesser AG

- 19.11. Hunter Douglas

- 19.12. Lafayette Interior Fashions

- 19.13. Nichibei Co., Ltd.

- 19.14. Nien Made Enterprise Co., Ltd.

- 19.15. Schenker Storen AG

- 19.16. Silent Gliss

- 19.17. Skandia Window Fashion

- 19.18. Springs Window Fashions

- 19.19. Tachikawa Corporation

- 19.20. TOSO Company Limited

- 19.21. Other Key Players

- 19.1. Altex Industries Limited.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Curtains and Window Blinds Market Size, Share & Trends Analysis Report by Product Type (Curtains, Window Blinds, Shades, Shutters), Material Type, Operation Mechanism, Installation Type, Distribution Channel, End-users X Application, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Curtains and Window Blinds Market Size, Share, and Growth

The global curtains and window blinds market is experiencing robust growth, with its estimated value of USD 19.8 billion in the year 2025 and USD 37.2 billion by 2035, registering a CAGR of 6.5%, during the forecast period. The global curtains and window blinds market is rising due to the growth of urbanization, more residential and commercial buildings, and the introduction of smart home technologies. Customers are preferring convenient and energy efficient automated systems of window treatment that are more comfortable, convenient, efficient and appealing to the eye.

Andrew Einaudi, Founder and CEO of Mado Dynamic, said,

"At Mado, we believe that automated shades should be affordable and easy to order and install. Bringing style, comfort, and privacy with effortless control to you and your entire family, these new window shades are just the beginning of our commitment to delivering practical, innovative, and eco-friendly solutions to the market."

The global curtains and window blinds market is being driven by the increasing demand in energy-efficient building solutions and smart homes automation. Automated window coverings are becoming more popular with their ability to maximize HVAC performance, control the indoor environment and minimize energy usage to achieve increased sustainability and comfort in homes and commercial structures in response to increasing demands of sustainability and comfort. For instance, in January 2025, Mado Dynamic unveiled a new category of AI-based, energy-efficient smart roller shades that have solar-powered motors, are compatible with Matter protocol, and can be controlled to adjust to sunlight, heat, and occupancy, indicating the transition of motorized window treatments to mainstream use.

Manufacturers are producing environmentally friendly and power saving products like automated shading, environmentally friendly materials like recycled fabrics with UV blocking features. These innovations are aesthetically attractive in addition to being efficient in operation and meet with the requirements of green building certifications and regulatory requirements that promote environmentally friendly construction.

The smart glass with electrochromic tinting, advanced window films, and built-in automated shading systems are additional growth opportunities that can be capitalized on. These technologies can supplement the curtains and window blinds market by improving building energy management, making occupants feel more comfortable, and facilitating smooth architectural integration that will help these technologies be adopted and expand their market share across the world in the long term.

Curtains and Window Blinds Market Dynamics and Trends

Driver: Rapid Growth in Construction and Real Estate Development

Restraint: Intense Price Competition from Low-Cost Imports

Opportunity: Smart Home Integration and Motorization Adoption

Key Trend: Sustainability and Eco-Friendly Material Innovation

Curtains-and-Window-Blinds-Market Analysis and Segmental Data

Residential Dominate Global Curtains and Window Blinds Market

North America Leads Global Curtains and Window Blinds Market Demand

Curtains-and-Window-Blinds-Market Ecosystem

The curtains and window blinds market are moderately fragmented, and the main competitors and actors in this market include Hunter-Douglas, Springs Window Fashions, Budget Blinds, Silent Gliss and Decora Blind Systems using innovation, large distribution channels, and strong brands as their competitive advantages. Smaller players are niche or price-sensitive players, local fabricators and import distributors cater to local markets.

The value chain comprises of textile sourcing, component fabrication, custom production, professional installation and maintenance. Major players in the industry tend to seek vertical integration and strategic alliances to improve their capacities, including the ability to integrate their homes into smart homes and compatibility with voice controls and smart lighting.

For instance, the release of PowerView Gen 3 by Hunter Douglas illustrates the success of managing both the hardware and software ecosystem, which allows end-users to have easy experiences, faster feature integration, and extensive platform integration. This is a combination strategy that propels ongoing breakthrough in materials, mechanisms, and digital solutions to help with premium differentiation in a competitive market.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 19.8 Bn |

|

Market Forecast Value in 2035 |

USD 32.2 Bn |

|

Growth Rate (CAGR) |

6.5% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Thousand Units |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Curtains-and-Window-Blinds-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Curtains and Window Blinds Market, By Product Type |

|

|

Curtains and Window Blinds Market, By Material Type |

|

|

Curtains and Window Blinds Market, By Operation Mechanism |

|

|

Curtains and Window Blinds Market, By Installation Type |

|

|

Curtains and Window Blinds Market, Distribution Channel |

|

|

Curtains and Window Blinds Market, By End-users X Application |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation