Dietary Fibers Market Size, Share & Trends Analysis Report by Type/Source (Soluble Dietary Fibers, Insoluble Dietary Fibers, Prebiotic Fibers), Raw Material Source, Form, Function, Application, Distribution Channel, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Dietary Fibers Market Size, Share, and Growth

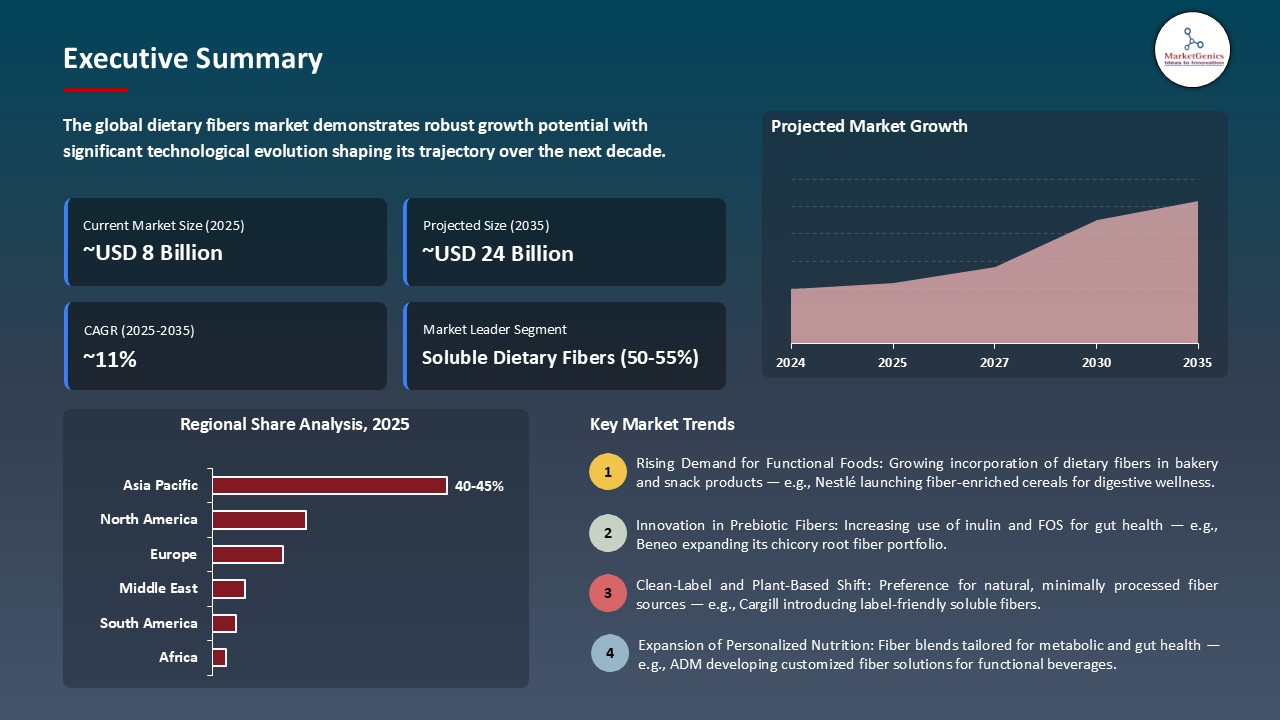

The global dietary fibers market is experiencing robust growth, with its estimated value of USD 8.3 billion in the year 2025 and USD 23.8 billion by the period 2035, registering a CAGR of 11.1%, during the forecast period. The global dietary fibers market is expanding as people have growing awareness of their health, increased urbanization, and rising demand of functional, enriched foods with fibers that help to maintain a healthy gut and wellness. Recent innovations in extraction technology and clean-label are also contributing to market growth in a wide variety of food uses.

Joana Carneiro-Wakefield, Ph.D., Chief Executive Officer of NutriLeads, said the positive EFSA opinion marks a major milestone for the company and the dietary supplement industry. She noted that Benicaros SF Pure P offers a clinically validated, plant-based ingredient for gut and immune health, now strengthened by EFSA’s safety endorsement, encouraging manufacturers to prepare for swift market entry once EU approval is finalized.

The increasing consumer demand in quality, convenient and nutritional foods is driving dietary-fiber ingredients manufacturers to invest in new manufacturing technologies and to expand sourcing of the raw materials. The increasing lifestyles in cities, greater interest in digestive and gut health, metabolism and sustainability pressures are pushing manufacturers into alternative fibre platforms, up-cycled streams, fibre blends and precisely processed fibre fractions with the aim of providing high-quality functional fibre solutions.

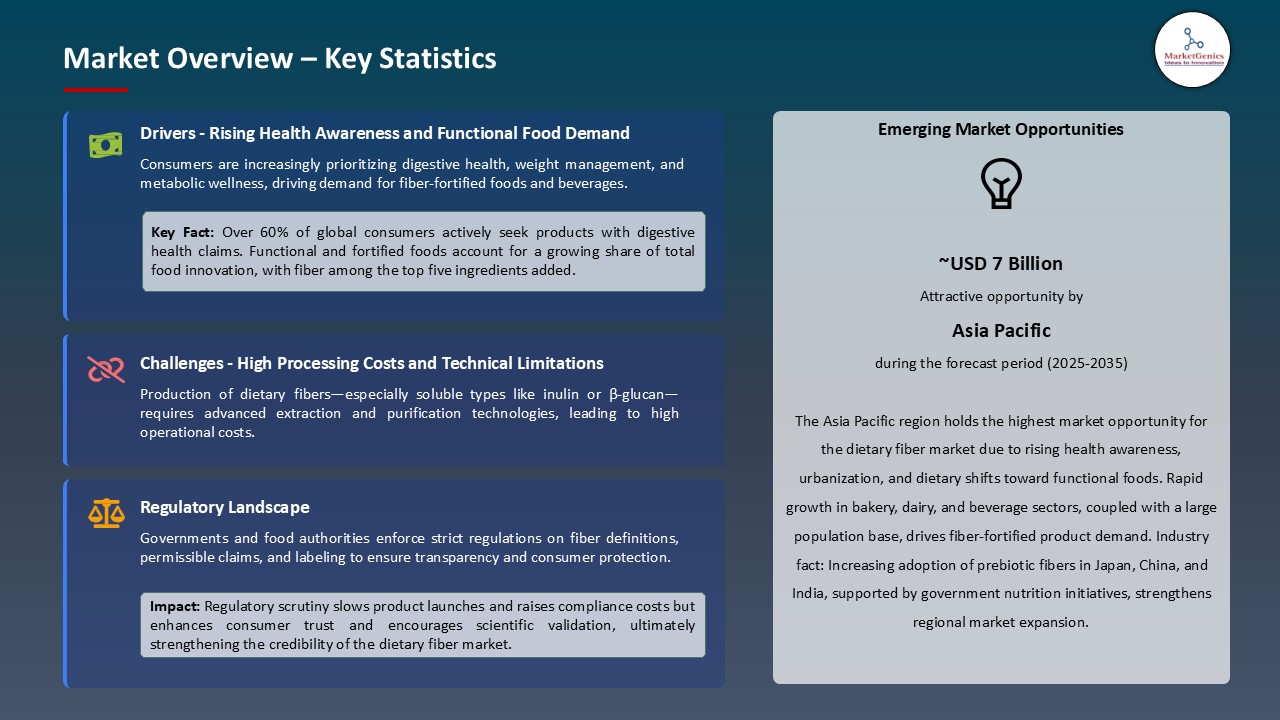

The market entry and product diversification are being explored through strategic alliances and regulatory frameworks. Changes in regulation, including the permission granted by the European Food Safety Authority (EFSA) of health claims relating to fibre under Regulation (EC) No 1924/2006, are increasing product credibility and transparency. These actions prompt manufacturers to align novelty to confirmed clinical results endorsing the development of viable and suitable fibre-based recipes.

Consistency and scalability is promoted by the use of technological sophistication such as refined fibre fractionation and enzymatic conversion of plant by-products. In tandem with these developments, changing regulations and trends of functional foods are increasing the use of fibre beyond digestion to satiety, microbiome and clean-label claims. For instance, in 2023, NUTRAVA Citrus Fibre by CP Kelco is up-cycled citrus peels used to enhance texture, stability in baked goods, beverages and meat alternatives, which points to the connection between fibre innovation and sustainability.

Dietary Fibers Market Dynamics and Trends

Driver: Rising Health Awareness Boosts Dietary Fibers Demand

- The dietary fibers market is grwoing fast with more consumers becoming aware of the added value of dietary fibers which include better digestion, sugar control, cholesterol levels and weight loss. The adoption of fiber-enriched diets is being propelled by awareness campaigns, nutrition education and research that connects the importance of taking fibres in averting diseases. This emerging health awareness makes dietary fibers a major functional ingredient, which is influencing market growth.

- Manufacturers are also reacting to this demand by coming up with novel fiber solutions. For instance, in July 2024, Ingredion Incorporated introduced FIBERTEX CF 500 & CF 100 citrus-fiber ingredients in the EMEA region, these fibers are up-cycled, citrus-based, up-cycled, include minimal processing, and include texturizing, emulsifying, and thickening functionality along with support for source of dietary fiber claims.

- Altogether, the increase in health awareness and dietary changes to fiber enriched foods remain a catalyst that will further expand markets and build demand across the globe.

Restraint: High Cost and Formulation Challenges Limit Adoption

- The dietary fibers market is highly restrained by high cost and technical formulation limitations. Specialty fibers, notably soluble and functional fiber, are costly to source and process and restricting their utilization in price sensitive markets as well as low margin product lines.

- Advanced processing technologies and expert knowledge of formulation are also necessary factors in the incorporation of fibers into beverages, dairy alternatives, snacks, and bakery products with no impact on taste, texture, solubility, or appearance. These complications make production challenging, increase the development process, and postpone the commercialization of products, making manufacturers to scale fiber-enriched products more challenging.

- Thus, the expensive cost of ingredients and formulation issues greatly limit the wider use of dietary fibers and hamper market penetration, showing a severe impediment to global dietary fibers market expansion.

Opportunity: Sustainable and By-Product-Based Fibers Drive Innovation

- The dietary fibers market is driven by great growth potential because of sustainable fibers based on the agricultural by-products, including fruit peels, cereal husks, and pulse residues. These fibers offer functional benefits such as enhanced digestion and satiety, and also comply with the rising consumer preference of clean-label and eco-friendliness.

- Manufacturers are also coming up with new solutions to utilize these sustainable sources. For instance, in August 2025, CarobWay GmbH introduced a prebiotic dietary fiber named CarobBiome that is made using upcycled carob pulp. The ingredient is composed of about 85% total fiber (soluble and insoluble), it has been minimally processed so as to preserve polyphenols and gives a neutral flavor profile and is stable to heat and low-pH conditions. This illustrates the potential of the application of up-cycled, multifunctional fibers to fulfill the sustainability and functional requirements in the food and beverage industries.

- In general, sustainable and multifunctional fibers offers an attractive high growth opportunity, allowing the differentiation of the product, serving environmentally-aware users, and increasing a global market presence.

Key Trend: Clean-Label and Plant-Based Fibre Integration

- The dietary fibers market is witnessing an upward trend of consumer demand for clean-label and plant-based options. Consumers are increasingly favoring natural, minimally processed and clear-cut ingredients, which allow manufacturers to add functional fibers made of pulses, cereals, fruits and vegetables into beverages, dairy substitutes, bakery products and nutritional supplements.

- Manufacturers are responding to this demand by releasing new fiber-based solutions derived using plants. For instance, in July 2025, Comet Bio presented its prebiotic fiber ingredient Arrabina, based on wheat, which is manufactured using recycled wheat prebiotic fibers, at IFT First. An ingredient derived by using the residue of wheat crops, it is completely soluble and does not require a low-pH or heat stability, is designed to be used in gut-health applications, and shows that clean-label and plant-based fibers can be used to provide functional properties and help ensure sustainability.

- Adding plant-based, clean-label fibers improves product functionality, consumer trust, and sustainability in the global dietary fibers market over time.

Dietary-Fibers-Market Analysis and Segmental Data

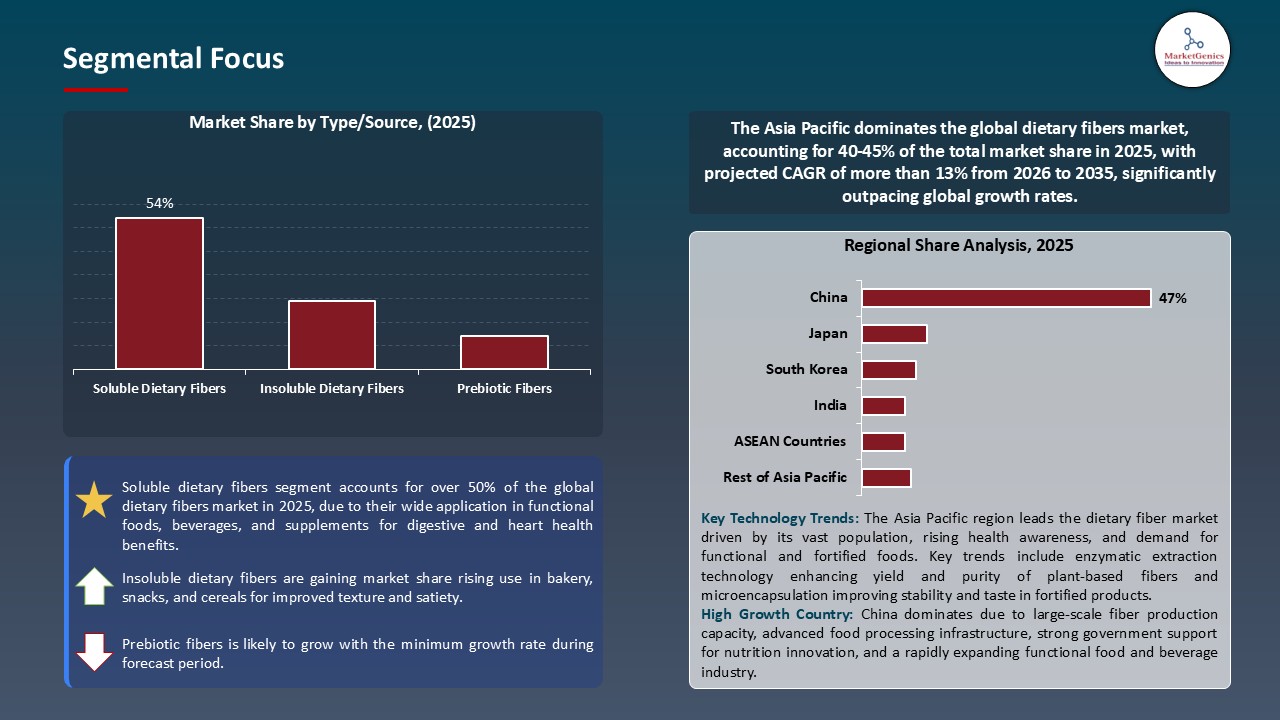

Soluble Dietary Fibers Dominate Global Dietary Fibers Market

- The soluble dietary fibers segment dominates the world dietary fibers market as it has a wide range of markets in beverages, functional foods, and nutritional supplements. Soluble fibers are good in the gut, blood sugar and satiety and are therefore of high preference by health conscious consumers. Solvability, stability, bioavailability are improved by technological advances, including enzymatic extraction, microencapsulation, and fermentation, making it possible to use in a variety of products.

- Primary suppliers of ingredients are increasing their supplies to match demand. For instance, in March 2025, Icon Foods introduced its FibRefine 3.0 and future product Organic FibRefine 3.5 (soluble tapioca fiber, chicory root inulin, polydextrose), two types of functional fibers offering clean-label options to food companies and a shift towards a more science-based, consumer-oriented innovation policy.

- The segment's dominance is strengthened by consumer awareness of digestive health advantages, regulatory transparency, and scalable production technology.

Asia Pacific Leads Global Dietary Fibers Market Demand

- Asia Pacific region leads global dietary fibers market, due to growing disposable income, urbanization and growing interests in digestive health and functional nutrition. China is the largest consumer market that has robust nutrition policies and is increasingly moving towards more probiotic-enhanced and fiber-enhanced foods, and India, Japan and Indonesia are incorporating more plant-based and fortified products.

- The high manufacturing foundation and developed dairy- science centres in China, Japan and South Korea contribute to fast product development and localisation. In 2025, Tate & Lyle PLC also introduced its Sensation formulation tool in Singapore to enable food and beverage manufacturers to translate mouthfeel preferences of consumers to unique ingredient solutions, such as fibres, to accelerate innovation and commercialization.

- Government nutrition programs, thriving e-commerce, and partnerships between international and national businesses facilitate entry and reach consumers in the market. High-quality science-based dietary fibres are the key assets of a region, which is supported by strategic investments and domestic pipelines of R&D, to enhance the diversification and innovation of functional foods.

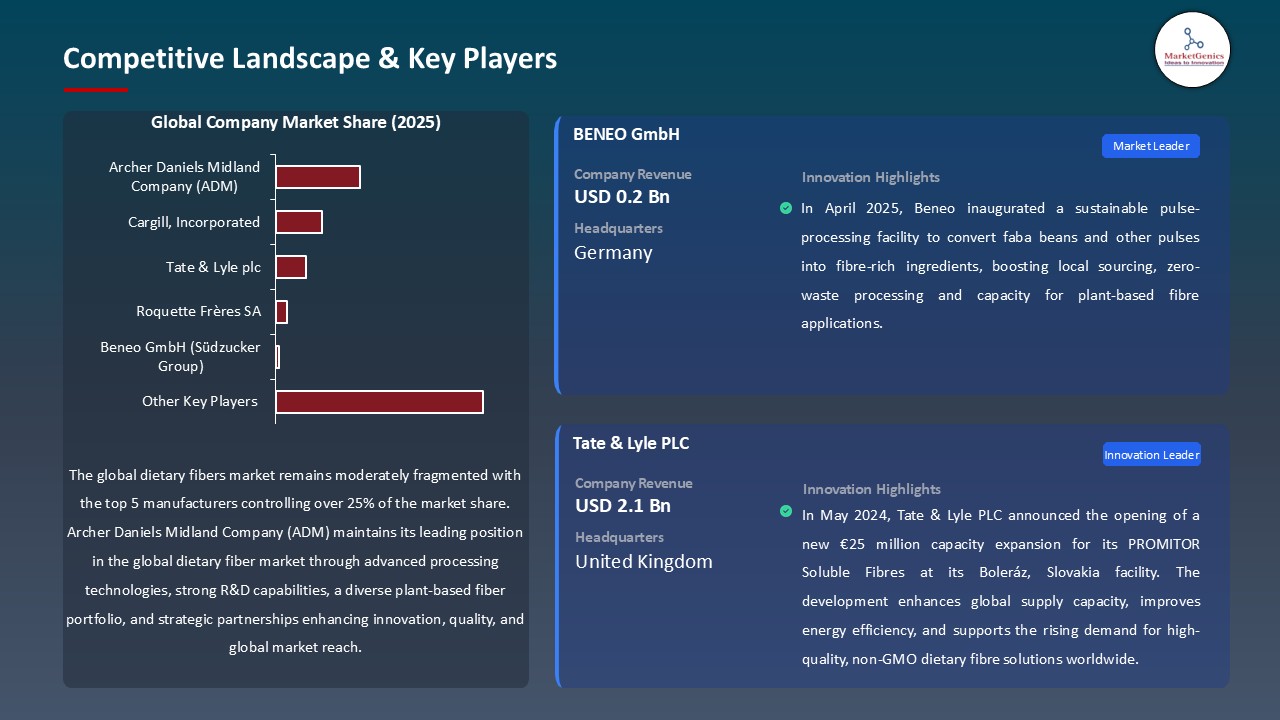

Dietary-Fibers-Market Ecosystem

The dietary-fiber market is moderately fragmented with major ingredient producers, including Archer Daniels Midland Company (ADM), Cargill, Incorporated, Tate and Lyle plc, Roquette Freres SA and Beneo GmbH (Suzeker Group) that use proprietary extraction, enzymatic and purification systems to protect scale economies and customer relations.

These strategic participants are seeking more niche, high-value solutions, such as prebiotic fibres, clean-label soluble fibres and application-specific texturants, provided through specialised pilot plants, clinical validation services and co-development alliances that have scaled down product-to-market timelines.

Active enablers include government organizations, funding organizations and R&D consortia, in October 2024, Innovate UK and BBSRC had committed a 13-project package of early-stage food innovation projects and allocated up to 2.5m to help create and develop fibre-enhanced mainstream foods. EU Horizon calls (2024) are also steering grant capital towards sustainable, fibre-rich value-chain projects. These interventions de-risk R&D in industries and mobilise SMEs into fibre-fortified NPD.

Recent Development and Strategic Overview:

- In June 2025, Barentz declared an alliance with InterFiber to distribute high-quality insoluble fibre based on wheat, oat, and bamboo in North America. The partnership enhances the clean-label ingredients portfolio, developed by Barentz, to bakery, beverage, and pet-food uses to respond to the growing dietary requirements of natural and fibre-enhanced solutions of bakery, beverages and sustainability of food.

- In February 2024, Manitoba Harvest collaborated with Brightseed to introduce Bioactive Fiber, a product derived as an up-cycled hulled hemp enriched with bioactives promoting gut health. The ingredient promotes digestive health and sustainability and aims at mainstream retail outlets such as Whole Foods Market, indicating the convergence of clean-label and functional nutrition trends.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 8.3 Bn |

|

Market Forecast Value in 2035 |

USD 23.8 Bn |

|

Growth Rate (CAGR) |

11.1% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Kilo Tons for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Dietary-Fibers-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Dietary Fibers Market, By Type/Source |

|

|

Dietary Fibers Market, By Raw Material Source |

|

|

Dietary Fibers Market, By Form |

|

|

Dietary Fibers Market, By Function |

|

|

Dietary Fibers Market, By Application |

|

|

Dietary Fibers Market, By Distribution Channel |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Dietary Fibers Market Outlook

- 2.1.1. Dietary Fibers Market Size (Volume - Kilo Tons and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Dietary Fibers Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Food & Beverages Industry Overview, 2025

- 3.1.1. Food & Beverages Industry Ecosystem Analysis

- 3.1.2. Key Trends for Food & Beverages Industry

- 3.1.3. Regional Distribution for Food & Beverages Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Food & Beverages Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising consumer awareness about gut health and digestive wellness

- 4.1.1.2. Growing demand for functional and fortified food and beverage products

- 4.1.1.3. Increasing prevalence of lifestyle-related diseases such as obesity and diabetes

- 4.1.2. Restraints

- 4.1.2.1. High production and processing costs of specialty dietary fibers

- 4.1.2.2. Taste, texture, and formulation challenges in product integration

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Dietary Fibers Manufacturers

- 4.4.3. Dealers/ Distributors

- 4.4.4. End-Users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Dietary Fibers Market Demand

- 4.9.1. Historical Market Size – Volume (Kilo Tons) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Volume (Kilo Tons) and Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Dietary Fibers Market Analysis, by Type/Source

- 6.1. Key Segment Analysis

- 6.2. Dietary Fibers Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Type/Source, 2021-2035

- 6.2.1. Soluble Dietary Fibers

- 6.2.1.1. Inulin

- 6.2.1.2. Pectin

- 6.2.1.3. Beta-glucan

- 6.2.1.4. Polydextrose

- 6.2.1.5. Resistant Starch

- 6.2.1.6. Others

- 6.2.2. Insoluble Dietary Fibers

- 6.2.2.1. Cellulose

- 6.2.2.2. Hemicellulose

- 6.2.2.3. Lignin

- 6.2.2.4. Chitin and Chitosan

- 6.2.2.5. Others

- 6.2.3. Prebiotic Fibers

- 6.2.3.1. Fructo-oligosaccharides (FOS)

- 6.2.3.2. Galacto-oligosaccharides (GOS)

- 6.2.3.3. Xylo-oligosaccharides (XOS)

- 6.2.3.4. Others

- 6.2.1. Soluble Dietary Fibers

- 7. Global Dietary Fibers Market Analysis, by Raw Material Source

- 7.1. Key Segment Analysis

- 7.2. Dietary Fibers Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Raw Material Source, 2021-2035

- 7.2.1. Fruits & Vegetables

- 7.2.1.1. Apple

- 7.2.1.2. Citrus

- 7.2.1.3. Banana

- 7.2.1.4. Potato

- 7.2.1.5. Others

- 7.2.2. Cereals & Grains

- 7.2.2.1. Wheat

- 7.2.2.2. Oat

- 7.2.2.3. Corn

- 7.2.2.4. Barley

- 7.2.2.5. Others

- 7.2.3. Legumes & Nuts

- 7.2.3.1. Seeds

- 7.2.3.2. Psyllium

- 7.2.3.3. Flaxseed

- 7.2.3.4. Chia seeds

- 7.2.3.5. Others

- 7.2.4. Synthetic/Modified Fibers

- 7.2.1. Fruits & Vegetables

- 8. Global Dietary Fibers Market Analysis, by Form

- 8.1. Key Segment Analysis

- 8.2. Dietary Fibers Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Form, 2021-2035

- 8.2.1. Powder

- 8.2.2. Liquid/Syrup

- 8.2.3. Granules

- 8.2.4. Capsules/Tablets

- 8.2.5. Others

- 9. Global Dietary Fibers Market Analysis, by Function

- 9.1. Key Segment Analysis

- 9.2. Dietary Fibers Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Function, 2021-2035

- 9.2.1. Bulking Agent

- 9.2.2. Thickening Agent

- 9.2.3. Gelling Agent

- 9.2.4. Fat Replacement

- 9.2.5. Stabilizing Agent

- 9.2.6. Water Retention

- 9.2.7. Texturizing Agent

- 9.2.8. Others

- 10. Global Dietary Fibers Market Analysis, by Application

- 10.1. Key Segment Analysis

- 10.2. Dietary Fibers Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Application, 2021-2035

- 10.2.1. Food & Beverages

- 10.2.1.1. Bakery & Confectionery

- 10.2.1.1.1. Bread

- 10.2.1.1.2. Cakes & Pastries

- 10.2.1.1.3. Biscuits & Cookies

- 10.2.1.1.4. Chocolates & Candies

- 10.2.1.1.5. Others

- 10.2.1.2. Dairy & Frozen Desserts

- 10.2.1.2.1. Yogurt

- 10.2.1.2.2. Ice Cream

- 10.2.1.2.3. Cheese

- 10.2.1.2.4. Milk-based Beverages

- 10.2.1.2.5. Others

- 10.2.1.3. Beverages

- 10.2.1.3.1. Functional Drinks

- 10.2.1.3.2. Fruit Juices

- 10.2.1.3.3. Sports & Energy Drinks

- 10.2.1.3.4. Ready-to-Drink Beverages

- 10.2.1.3.5. Others

- 10.2.1.4. Meat & Meat Alternatives

- 10.2.1.4.1. Processed Meat

- 10.2.1.4.2. Plant-based Meat

- 10.2.1.4.3. Sausages & Burgers

- 10.2.1.4.4. Others

- 10.2.1.5. Snacks & Cereals

- 10.2.1.5.1. Breakfast Cereals

- 10.2.1.5.2. Nutrition Bars

- 10.2.1.5.3. Extruded Snacks

- 10.2.1.5.4. Others

- 10.2.1.6. Sauces, Dressings & Condiments

- 10.2.1.7. Others

- 10.2.1.1. Bakery & Confectionery

- 10.2.2. Nutraceutical & Dietary Supplement

- 10.2.2.1. Weight Management Supplements

- 10.2.2.2. Digestive Health Supplements

- 10.2.2.3. Functional Foods

- 10.2.2.4. Others

- 10.2.3. Animal Nutrition

- 10.2.3.1. Pet Food

- 10.2.3.2. Livestock Feed

- 10.2.3.3. Others

- 10.2.4. Pharmaceuticals

- 10.2.4.1. Drug Delivery Systems

- 10.2.4.2. Therapeutic Applications

- 10.2.4.3. Others

- 10.2.5. Cosmetics & Personal Care

- 10.2.6. Other Applications

- 10.2.1. Food & Beverages

- 11. Global Dietary Fibers Market Analysis, by Distribution Channel

- 11.1. Key Segment Analysis

- 11.2. Dietary Fibers Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 11.2.1. Business-to-Business (B2B)

- 11.2.1.1. Direct Sales

- 11.2.1.2. Distributors

- 11.2.1.3. Wholesalers

- 11.2.1.4. Others

- 11.2.2. Business-to-Consumer (B2C)

- 11.2.2.1. Supermarkets/Hypermarkets

- 11.2.2.2. Convenience Stores

- 11.2.2.3. Specialty Stores

- 11.2.2.4. Online Retail

- 11.2.2.5. Pharmacies

- 11.2.2.6. Others

- 11.2.1. Business-to-Business (B2B)

- 12. Global Dietary Fibers Market Analysis and Forecasts, by Region

- 12.1. Key Findings

- 12.2. Dietary Fibers Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 12.2.1. North America

- 12.2.2. Europe

- 12.2.3. Asia Pacific

- 12.2.4. Middle East

- 12.2.5. Africa

- 12.2.6. South America

- 13. North America Dietary Fibers Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. North America Dietary Fibers Market Size Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Type/Source

- 13.3.2. Raw Material Source

- 13.3.3. Form

- 13.3.4. Function

- 13.3.5. Application

- 13.3.6. Distribution Channel

- 13.3.7. Country

- 13.3.7.1. USA

- 13.3.7.2. Canada

- 13.3.7.3. Mexico

- 13.4. USA Dietary Fibers Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Type/Source

- 13.4.3. Raw Material Source

- 13.4.4. Form

- 13.4.5. Function

- 13.4.6. Application

- 13.4.7. Distribution Channel

- 13.5. Canada Dietary Fibers Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Type/Source

- 13.5.3. Raw Material Source

- 13.5.4. Form

- 13.5.5. Function

- 13.5.6. Application

- 13.5.7. Distribution Channel

- 13.6. Mexico Dietary Fibers Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Type/Source

- 13.6.3. Raw Material Source

- 13.6.4. Form

- 13.6.5. Function

- 13.6.6. Application

- 13.6.7. Distribution Channel

- 14. Europe Dietary Fibers Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Europe Dietary Fibers Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Type/Source

- 14.3.2. Raw Material Source

- 14.3.3. Form

- 14.3.4. Function

- 14.3.5. Application

- 14.3.6. Distribution Channel

- 14.3.7. Country

- 14.3.7.1. Germany

- 14.3.7.2. United Kingdom

- 14.3.7.3. France

- 14.3.7.4. Italy

- 14.3.7.5. Spain

- 14.3.7.6. Netherlands

- 14.3.7.7. Nordic Countries

- 14.3.7.8. Poland

- 14.3.7.9. Russia & CIS

- 14.3.7.10. Rest of Europe

- 14.4. Germany Dietary Fibers Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Type/Source

- 14.4.3. Raw Material Source

- 14.4.4. Form

- 14.4.5. Function

- 14.4.6. Application

- 14.4.7. Distribution Channel

- 14.5. United Kingdom Dietary Fibers Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Type/Source

- 14.5.3. Raw Material Source

- 14.5.4. Form

- 14.5.5. Function

- 14.5.6. Application

- 14.5.7. Distribution Channel

- 14.6. France Dietary Fibers Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Type/Source

- 14.6.3. Raw Material Source

- 14.6.4. Form

- 14.6.5. Function

- 14.6.6. Application

- 14.6.7. Distribution Channel

- 14.7. Italy Dietary Fibers Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Type/Source

- 14.7.3. Raw Material Source

- 14.7.4. Form

- 14.7.5. Function

- 14.7.6. Application

- 14.7.7. Distribution Channel

- 14.8. Spain Dietary Fibers Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Type/Source

- 14.8.3. Raw Material Source

- 14.8.4. Form

- 14.8.5. Function

- 14.8.6. Application

- 14.8.7. Distribution Channel

- 14.9. Netherlands Dietary Fibers Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Type/Source

- 14.9.3. Raw Material Source

- 14.9.4. Form

- 14.9.5. Function

- 14.9.6. Application

- 14.9.7. Distribution Channel

- 14.10. Nordic Countries Dietary Fibers Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Type/Source

- 14.10.3. Raw Material Source

- 14.10.4. Form

- 14.10.5. Function

- 14.10.6. Application

- 14.10.7. Distribution Channel

- 14.11. Poland Dietary Fibers Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Type/Source

- 14.11.3. Raw Material Source

- 14.11.4. Form

- 14.11.5. Function

- 14.11.6. Application

- 14.11.7. Distribution Channel

- 14.12. Russia & CIS Dietary Fibers Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Type/Source

- 14.12.3. Raw Material Source

- 14.12.4. Form

- 14.12.5. Function

- 14.12.6. Application

- 14.12.7. Distribution Channel

- 14.13. Rest of Europe Dietary Fibers Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Type/Source

- 14.13.3. Raw Material Source

- 14.13.4. Form

- 14.13.5. Function

- 14.13.6. Application

- 14.13.7. Distribution Channel

- 15. Asia Pacific Dietary Fibers Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Asia Pacific Dietary Fibers Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Type/Source

- 15.3.2. Raw Material Source

- 15.3.3. Form

- 15.3.4. Function

- 15.3.5. Application

- 15.3.6. Distribution Channel

- 15.3.7. Country

- 15.3.7.1. China

- 15.3.7.2. India

- 15.3.7.3. Japan

- 15.3.7.4. South Korea

- 15.3.7.5. Australia and New Zealand

- 15.3.7.6. Indonesia

- 15.3.7.7. Malaysia

- 15.3.7.8. Thailand

- 15.3.7.9. Vietnam

- 15.3.7.10. Rest of Asia Pacific

- 15.4. China Dietary Fibers Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Type/Source

- 15.4.3. Raw Material Source

- 15.4.4. Form

- 15.4.5. Function

- 15.4.6. Application

- 15.4.7. Distribution Channel

- 15.5. India Dietary Fibers Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Type/Source

- 15.5.3. Raw Material Source

- 15.5.4. Form

- 15.5.5. Function

- 15.5.6. Application

- 15.5.7. Distribution Channel

- 15.6. Japan Dietary Fibers Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Type/Source

- 15.6.3. Raw Material Source

- 15.6.4. Form

- 15.6.5. Function

- 15.6.6. Application

- 15.6.7. Distribution Channel

- 15.7. South Korea Dietary Fibers Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Type/Source

- 15.7.3. Raw Material Source

- 15.7.4. Form

- 15.7.5. Function

- 15.7.6. Application

- 15.7.7. Distribution Channel

- 15.8. Australia and New Zealand Dietary Fibers Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Type/Source

- 15.8.3. Raw Material Source

- 15.8.4. Form

- 15.8.5. Function

- 15.8.6. Application

- 15.8.7. Distribution Channel

- 15.9. Indonesia Dietary Fibers Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Type/Source

- 15.9.3. Raw Material Source

- 15.9.4. Form

- 15.9.5. Function

- 15.9.6. Application

- 15.9.7. Distribution Channel

- 15.10. Malaysia Dietary Fibers Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Type/Source

- 15.10.3. Raw Material Source

- 15.10.4. Form

- 15.10.5. Function

- 15.10.6. Application

- 15.10.7. Distribution Channel

- 15.11. Thailand Dietary Fibers Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Type/Source

- 15.11.3. Raw Material Source

- 15.11.4. Form

- 15.11.5. Function

- 15.11.6. Application

- 15.11.7. Distribution Channel

- 15.12. Vietnam Dietary Fibers Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Type/Source

- 15.12.3. Raw Material Source

- 15.12.4. Form

- 15.12.5. Function

- 15.12.6. Application

- 15.12.7. Distribution Channel

- 15.13. Rest of Asia Pacific Dietary Fibers Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Type/Source

- 15.13.3. Raw Material Source

- 15.13.4. Form

- 15.13.5. Function

- 15.13.6. Application

- 15.13.7. Distribution Channel

- 16. Middle East Dietary Fibers Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Middle East Dietary Fibers Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Type/Source

- 16.3.2. Raw Material Source

- 16.3.3. Form

- 16.3.4. Function

- 16.3.5. Application

- 16.3.6. Distribution Channel

- 16.3.7. Country

- 16.3.7.1. Turkey

- 16.3.7.2. UAE

- 16.3.7.3. Saudi Arabia

- 16.3.7.4. Israel

- 16.3.7.5. Rest of Middle East

- 16.4. Turkey Dietary Fibers Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Type/Source

- 16.4.3. Raw Material Source

- 16.4.4. Form

- 16.4.5. Function

- 16.4.6. Application

- 16.4.7. Distribution Channel

- 16.5. UAE Dietary Fibers Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Type/Source

- 16.5.3. Raw Material Source

- 16.5.4. Form

- 16.5.5. Function

- 16.5.6. Application

- 16.5.7. Distribution Channel

- 16.6. Saudi Arabia Dietary Fibers Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Type/Source

- 16.6.3. Raw Material Source

- 16.6.4. Form

- 16.6.5. Function

- 16.6.6. Application

- 16.6.7. Distribution Channel

- 16.7. Israel Dietary Fibers Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Type/Source

- 16.7.3. Raw Material Source

- 16.7.4. Form

- 16.7.5. Function

- 16.7.6. Application

- 16.7.7. Distribution Channel

- 16.8. Rest of Middle East Dietary Fibers Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Type/Source

- 16.8.3. Raw Material Source

- 16.8.4. Form

- 16.8.5. Function

- 16.8.6. Application

- 16.8.7. Distribution Channel

- 17. Africa Dietary Fibers Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Africa Dietary Fibers Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Type/Source

- 17.3.2. Raw Material Source

- 17.3.3. Form

- 17.3.4. Function

- 17.3.5. Application

- 17.3.6. Distribution Channel

- 17.3.7. Country

- 17.3.7.1. South Africa

- 17.3.7.2. Egypt

- 17.3.7.3. Nigeria

- 17.3.7.4. Algeria

- 17.3.7.5. Rest of Africa

- 17.4. South Africa Dietary Fibers Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Type/Source

- 17.4.3. Raw Material Source

- 17.4.4. Form

- 17.4.5. Function

- 17.4.6. Application

- 17.4.7. Distribution Channel

- 17.5. Egypt Dietary Fibers Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Type/Source

- 17.5.3. Raw Material Source

- 17.5.4. Form

- 17.5.5. Function

- 17.5.6. Application

- 17.5.7. Distribution Channel

- 17.6. Nigeria Dietary Fibers Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Type/Source

- 17.6.3. Raw Material Source

- 17.6.4. Form

- 17.6.5. Function

- 17.6.6. Application

- 17.6.7. Distribution Channel

- 17.7. Algeria Dietary Fibers Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Type/Source

- 17.7.3. Raw Material Source

- 17.7.4. Form

- 17.7.5. Function

- 17.7.6. Application

- 17.7.7. Distribution Channel

- 17.8. Rest of Africa Dietary Fibers Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Type/Source

- 17.8.3. Raw Material Source

- 17.8.4. Form

- 17.8.5. Function

- 17.8.6. Application

- 17.8.7. Distribution Channel

- 18. South America Dietary Fibers Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. South Africa Dietary Fibers Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Type/Source

- 18.3.2. Raw Material Source

- 18.3.3. Form

- 18.3.4. Function

- 18.3.5. Application

- 18.3.6. Distribution Channel

- 18.3.7. Country

- 18.3.7.1. Brazil

- 18.3.7.2. Argentina

- 18.3.7.3. Rest of South America

- 18.4. Brazil Dietary Fibers Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Type/Source

- 18.4.3. Raw Material Source

- 18.4.4. Form

- 18.4.5. Function

- 18.4.6. Application

- 18.4.7. Distribution Channel

- 18.5. Argentina Dietary Fibers Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Type/Source

- 18.5.3. Raw Material Source

- 18.5.4. Form

- 18.5.5. Function

- 18.5.6. Application

- 18.5.7. Distribution Channel

- 18.6. Rest of South America Dietary Fibers Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Type/Source

- 18.6.3. Raw Material Source

- 18.6.4. Form

- 18.6.5. Function

- 18.6.6. Application

- 18.6.7. Distribution Channel

- 19. Key Players/ Company Profile

- 19.1. Archer Daniels Midland Company (ADM)

- 19.1.1. Company Details/ Overview

- 19.1.2. Company Financials

- 19.1.3. Key Customers and Competitors

- 19.1.4. Business/ Industry Portfolio

- 19.1.5. Product Portfolio/ Specification Details

- 19.1.6. Pricing Data

- 19.1.7. Strategic Overview

- 19.1.8. Recent Developments

- 19.2. Beneo GmbH (Südzucker Group)

- 19.3. Cargill, Incorporated

- 19.4. Cosucra Groupe Warcoing SA

- 19.5. DuPont de Nemours, Inc.

- 19.6. Emsland Group

- 19.7. Farbest Brands

- 19.8. Fiberstar, Inc.

- 19.9. Grain Processing Corporation

- 19.10. Ingredion Incorporated

- 19.11. J. Rettenmaier & Söhne GmbH + Co KG (JRS)

- 19.12. Kerry Group plc

- 19.13. Lonza Group AG

- 19.14. Matsutani Chemical Industry Co., Ltd.

- 19.15. Nexira

- 19.16. Nutritech International Corporation

- 19.17. Roquette Frères

- 19.18. Sensus (Royal Cosun)

- 19.19. SunOpta Inc.

- 19.20. Tate & Lyle PLC

- 19.21. Tereos

- 19.22. Other Key Players

- 19.1. Archer Daniels Midland Company (ADM)

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation