- The global federated learning platforms market is valued at USD 0.1 billion in 2025.

- The market is projected to grow at a CAGR of 27.3% during the forecast period of 2026 to 2035.

- The telecom & IoT segment accounts for ~34% of the global federated learning platforms market in 2025, driven by the requirement to facilitate secure, on-device AI model training throughout extensive IoT networks, minimize latency, and safeguard sensitive user information without central aggregation.

- The increasing focus on privacy-preserving machine learning is boosting the implementation of federated learning, allowing AI models to train without revealing raw data.

- Decentralized model training enabled by secure aggregation, edge intelligence, and multi-party cooperation is improving AI capabilities in healthcare, finance, telecommunications, and automotive sectors.

- The global federated-learning-platforms-market is highly consolidated, with the top five players accounting for nearly 70% of the market share in 2025.

- In August 2025, researchers unveiled FLEET, a federated learning emulation and evaluation testbed that merges a configurable network emulator with framework-agnostic learning components.

- In August 2025, FedGenAI-IJCAI’25 workshop that was mainly about the collaboration of generative AI with federated learning.

- Global federated learning platforms market is likely to create the total forecasting opportunity of USD 1.4 Bn till 2035

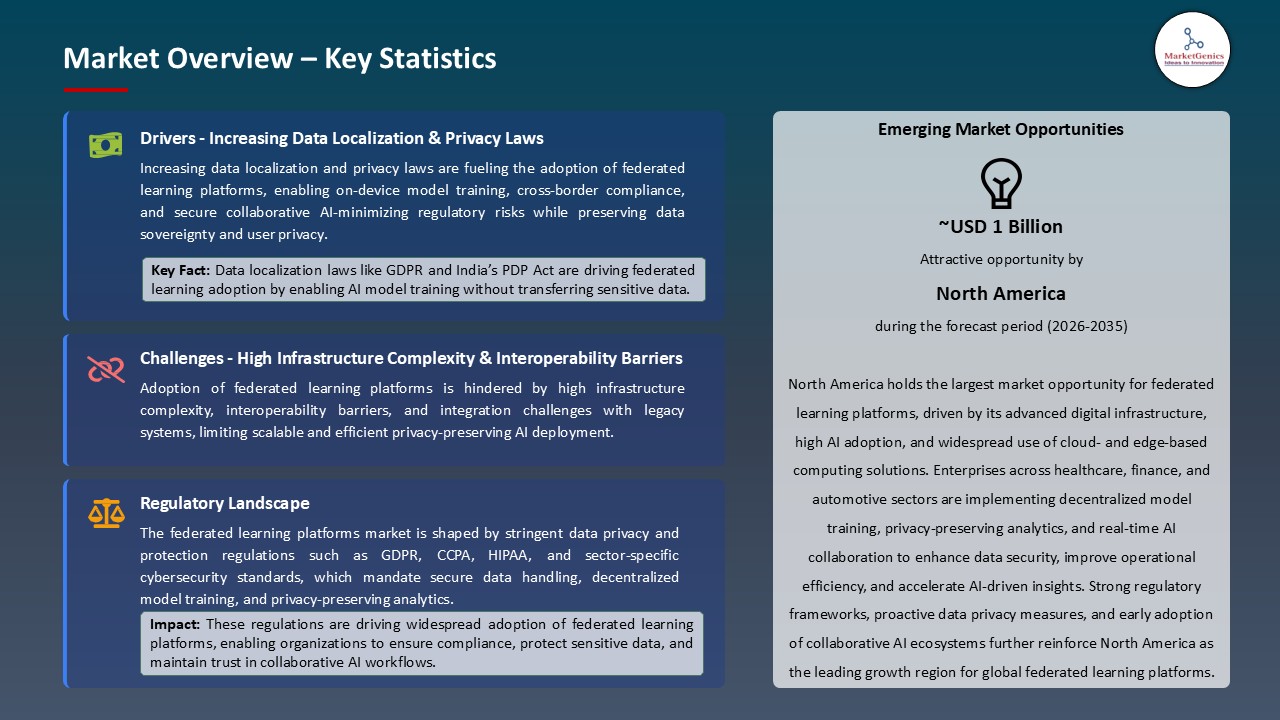

- North America is most attractive region, attributed to the presence of several factors such as hyperscale cloud providers, AI research laboratories, and enterprise technology companies that are technology early adopters especially in healthcare, finance, and telecom sectors.

- The growth of worldwide federated learning platforms market due to the privacy rules, such as the EU's GDPR, China's PIPL, India's DPDP Act 2023, and U.S. state-level privacy regulations, is a major challenge for enterprises. To meet these challenges, enterprises are compelled to adopt data-minimizing AI architectures. Owing to which, there is an increasing number of federated learning platforms that facilitate model training without the need for data to be transferred from local environments.

- Federated learning is increasingly used as a method of compliance in sectors that deal with extremely sensitive data such as healthcare, autonomous systems, and smart mobility. These sectors use federated learning to meet strict data residency requirements, decrease the risk of centralized data exposure, and keep the AI pipelines traceable. Notably, The European Data Protection Supervisor published a TechDispatch in June 2025 explaining how federated learning is compatible with GDPR principles as it reduces data sharing and keeps personal data local.

- For instance, in 2025, a research paper presented DP‑RTFL, a federated learning framework incorporating differential privacy and resilience features, intended for regulated sectors such as banking and healthcare to ensure data privacy and compliance. Therefore, a vast amount of IoT, edge, and sensor data from telecom networks is a challenge that can be met only with privacy-preserving analytics. Such analytics are necessary for device-level intelligence and form the basis for the further federated learning adoption that is happening in the 5G, V2X, and industrial automation ecosystems.

- Federated learning systems on the edge need lots of different components - orchestration frameworks, secure aggregation protocols, and coordination of devices with different capabilities - so the integration is expensive for enterprises that have limited ML engineering capacity. For example, Nexus Labs (2025) combined Paillier homomorphic encryption and SMPC across hospital nodes to implement end-to-end encryption in their federated learning deployment for medical imaging - thus, solving both privacy and communication challenges.

- Performance bottlenecks occur when models are aligned across distributed nodes that have different computational capabilities, data quality levels, and connectivity conditions - thus, it is a problem specially for large-scale telecom, automotive, and industrial environments. A recent paper proposed "FedSelect‑ME", a multi-edge federated learning framework, which implements adaptive client scoring and secure aggregation (homomorphic encryption + differential privacy) to enhance scalability and security over heterogeneous devices.

- The absence of standards for federated learning protocols, differential privacy configurations, and secure communication layers usually leads to vendor lock-in, thus, enterprises slow down the adoption of federated learning as they are looking for interoperable and cloud-agnostic solutions.

- Federated learning is being adopted by hospitals, clinical research institutions, and pharmaceuticals to train diagnostic and predictive models collaboratively while abiding by HIPAA, MDR, and global medical data governance standards. This move is creating a significant commercial opportunity for FL vendors. A 2025 engineering journal article (International Journal of Computer Trends and Technology) elaborates on the use of federated edge computing in healthcare and IoT. It describes how models are being trained on local patient data from wearables and edge devices to ensure privacy and compliance with health data regulations.

- Further, the autonomous mobility sector (AVs, ADAS, smart traffic infrastructure) is heavily dependent on distributed learning across millions of edge devices, thus allowing for real-time model enhancement without centralizing raw driving data. A recent study narrated a blockchain‑enabled preserving second-order federated edge learning in personalized healthcare. The system employs secure model aggregation on Ethereum and federated "second‑order" updates to manage heterogeneous medical data.

- With the introduction of edge AI architectures in enterprises within manufacturing, energy, and smart cities sectors, federated learning platforms are becoming highly instrumental as secure and scalable tools for predictive maintenance, anomaly detection, and real-time operational insights.

- Federated learning is gradually being mixed up with secure computation methods like homomorphic encryption, secure multi-party computation, and trusted execution environments (TEEs) to make model confidentiality from end to end and regulatory compliance more visible. A publication from TechnoFit Academic Publishers LLC; records a combination of federated learning with blockchain and SMPC to form a healthcare system that is able to aggregate in a tamper-proof manner and verify model integrity.

- The implementation of adaptive and personalized federated learning is not limited to the increase by which models are enabled to self-optimize on-device for user behavior, industrial conditions, or network constraints without privacy being compromised. For instance, TechDispatch from the European Data Protection Supervisor informs that federated learning is presently identified as one of the main” privacy-enhancing technologies” (PET), thus being more acceptable to regulated sectors and data-protection-conscious organizations.

- The telecom & IoT segment is the main contributor to the global federated learning platforms market, which is witnessing the integration of edge AI, 5G networks, and increasing privacy demands. Federated learning allows devices to locally train AI models and share only model updates instead of raw data, thus saving bandwidth and ensuring that sensitive information remains on the device. This feature is very important for telecom operators and IoT providers who have to deal with millions of connected devices, in which the reduction of latency and communication overhead is a must for real-time analytics and autonomous decision-making.

- The changes that have been made recently can be considered as evidence of this trend. One such example is found in 2025 when Edge-FLGuard and similar frameworks showed how federated learning could be used for the detection of real-time anomalies across 5G-enabled IoT networks, thus achieving a combination of edge intelligence and privacy-preserving protocols.

- Furthermore, attributed to the differences in compute, memory, and connectivity capabilities of IoT devices, federated learning is a perfect solution that allows all devices to make a contribution to global AI model improvement without performance being compromised. By enabling the implementation of data-minimization principles contained in privacy regulations, federated learning becomes even more advantageous to telecom and IoT operators who want to securely deploy AI at scale.

- North America is the leading federated learning platforms market globally, attributed to the presence of several factors such as hyperscale cloud providers, AI research laboratories, and enterprise technology companies that are technology early adopters especially in healthcare, finance, and telecom sectors. The region is full of strict data privacy and security regulations such as HIPAA and several state-level data protection laws which motivate organizations to deploy privacy-preserving AI solutions. Besides, hefty investments in edge computing, IoT, and 5G are paving the way for large federated learning deployments over distributed devices.

- The major implementations include Google’s Gboard federated learning for mobile AI, IBM’s frameworks for healthcare and finance, and NVIDIA’s FL-enabled edge AI solutions, which is a strong indication of the region’s technological leadership.

- Moreover, in the finance sector, federated learning is utilized for creating risk models that are explainable. This is evidenced in the 2025 study where a cross-state explainable federated learning system for the prediction of financial distress in the U.S. was introduced, thus pointing out the secure and regulation-compliant AI adoption.

- In August 2025, researchers unveiled FLEET, a federated learning emulation and evaluation testbed that merges a configurable network emulator with framework-agnostic learning components. The platform allows to study how realistic network conditions - for instance latency, packet loss, and bandwidth variation - affect FL convergence and performance. Thus, it makes federated system research more trustworthy and reproducible.

- In August 2025, FedGenAI-IJCAI’25 workshop that was mainly about the collaboration of generative AI with federated learning. The leading talks at this workshop emphasized the progress in aggregation strategies and communication-efficient training for large models - thus, they were a clear indication of increasing industry interest in the combination of FL with generative and large‑scale AI applications.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Alibaba Cloud

- Amazon Web Services (AWS)

- Oracle Corporation

- Cloudera

- DataRobot

- Fetch.ai

- Baidu

- Fetch.ai

- Owkin

- Tencent Cloud

- Hewlett Packard Enterprise (HPE)

- Philips (Healthcare)

- Huawei Technologies

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- NVIDIA Corporation

- OpenMined (community & tooling)

- Samsung Research / Samsung Electronics

- Siemens Healthineers

- Other Key Players

- Federated Learning Frameworks / SDKs

- Orchestration & Coordinator Services

- Client / Edge Agents (on-device SDKs)

- Secure Aggregation & Cryptographic Modules

- Model Management & Versioning

- Data Connectors & Preprocessing Pipelines

- Monitoring, Telemetry & Explainability Tools

- APIs & Integration Middleware

- Others

- Cloud-Based

- On-Premises

- Hybrid

- Software Platforms

- Cryptographic Engines & Libraries

- Hardware-Based Secure Processors

- Cloud Services

- APIs & SDKs

- Integration Middleware

- Managed Privacy Services

- Consulting & Implementation Services

- Others

- Centralized orchestration (server-client)

- Hierarchical / multi-tier orchestration

- Peer-to-peer / gossip-based FL

- Split learning / collaborative model partitioning

- Others

- Federated averaging (FedAvg) & variants

- Federated optimization (FedProx, FedOpt)

- Split learning

- Vertical federated learning (feature-partitioned)

- Transfer learning + personalization (meta-learning)

- Federated multi-task learning

- Others

- Secure aggregation only

- MPC-enabled aggregation

- Homomorphic encryption support

- Differential privacy integration

- Attestation / trusted execution environment (TEE) support

- Audit trails & tamper-evidence

- Others

- Tabular / structured enterprise data

- Time-series / sensor & telemetry data

- Image & medical imaging data

- Text / natural language data

- Audio / speech data

- Multi-modal data

- Others

- Native ML framework support (TensorFlow, PyTorch, JAX)

- MLOps & CI/CD pipeline integrations

- Data catalog & governance connectors

- Identity / access management (SSO, IAM)

- Model serving & deployment integrations

- Others

- Healthcare & life sciences

- Financial services & banking

- Telecom & IoT

- Automotive

- Retail & advertising

- Public sector & defense

- Manufacturing & industrial analytics

- Others

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Federated Learning Platforms Market Outlook

- 2.1.1. Federated Learning Platforms Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Federated Learning Platforms Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Information Technology & Media Ecosystem Overview, 2025

- 3.1.1. Information Technology & Media Industry Analysis

- 3.1.2. Key Trends for Information Technology & Media Industry

- 3.1.3. Regional Distribution for Information Technology & Media Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.1. Global Information Technology & Media Ecosystem Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for privacy-preserving AI model training and secure data collaboration across enterprises

- 4.1.1.2. Growing adoption of AI- and ML-driven federated learning solutions for analytics, personalization, and predictive insights

- 4.1.1.3. Increasing regulatory requirements for data privacy, localization, and compliance with GDPR, HIPAA, and other regional laws

- 4.1.2. Restraints

- 4.1.2.1. High deployment and operational costs of federated learning infrastructure and platforms

- 4.1.2.2. Challenges in integrating federated learning frameworks with legacy IT systems, heterogeneous data sources, and multi-cloud environments

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Data Suppliers/ Edge Devices Providers

- 4.4.2. System Integrators/ Technology Providers

- 4.4.3. Federated Learning Platforms Providers

- 4.4.4. End Users

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Federated Learning Platforms Market Demand

- 4.9.1. Historical Market Size –Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size –Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Federated Learning Platforms Market Analysis, by Component

- 6.1. Key Segment Analysis

- 6.2. Federated Learning Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Component, 2021-2035

- 6.2.1. Federated Learning Frameworks / SDKs

- 6.2.2. Orchestration & Coordinator Services

- 6.2.3. Client / Edge Agents (on-device SDKs)

- 6.2.4. Secure Aggregation & Cryptographic Modules

- 6.2.5. Model Management & Versioning

- 6.2.6. Data Connectors & Preprocessing Pipelines

- 6.2.7. Monitoring, Telemetry & Explainability Tools

- 6.2.8. APIs & Integration Middleware

- 6.2.9. Others

- 7. Global Federated Learning Platforms Market Analysis, by Deployment Mode

- 7.1. Key Segment Analysis

- 7.2. Federated Learning Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Deployment Mode, 2021-2035

- 7.2.1. Cloud-Based

- 7.2.2. On-Premises

- 7.2.3. Hybrid

- 8. Global Federated Learning Platforms Market Analysis, by Architecture/ Topology

- 8.1. Key Segment Analysis

- 8.2. Federated Learning Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Architecture/ Topology, 2021-2035

- 8.2.1. Centralized orchestration (server-client)

- 8.2.2. Hierarchical / multi-tier orchestration

- 8.2.3. Peer-to-peer / gossip-based FL

- 8.2.4. Split learning / collaborative model partitioning

- 8.2.5. Others

- 9. Global Federated Learning Platforms Market Analysis, by Learning Type/ Algorithm

- 9.1. Key Segment Analysis

- 9.2. Federated Learning Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Learning Type/ Algorithm, 2021-2035

- 9.2.1. Federated averaging (FedAvg) & variants

- 9.2.2. Federated optimization (FedProx, FedOpt)

- 9.2.3. Split learning

- 9.2.4. Vertical federated learning (feature-partitioned)

- 9.2.5. Transfer learning + personalization (meta-learning)

- 9.2.6. Federated multi-task learning

- 9.2.7. Others

- 10. Global Federated Learning Platforms Market Analysis, by Privacy & Security Capability

- 10.1. Key Segment Analysis

- 10.2. Federated Learning Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Privacy & Security Capability, 2021-2035

- 10.2.1. Secure aggregation only

- 10.2.2. MPC-enabled aggregation

- 10.2.3. Homomorphic encryption support

- 10.2.4. Differential privacy integration

- 10.2.5. Attestation / trusted execution environment (TEE) support

- 10.2.6. Audit trails & tamper-evidence

- 10.2.7. Others

- 11. Global Federated Learning Platforms Market Analysis, by Data Type

- 11.1. Key Segment Analysis

- 11.2. Federated Learning Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Data Type, 2021-2035

- 11.2.1. Tabular / structured enterprise data

- 11.2.2. Time-series / sensor & telemetry data

- 11.2.3. Image & medical imaging data

- 11.2.4. Text / natural language data

- 11.2.5. Audio / speech data

- 11.2.6. Multi-modal data

- 11.2.7. Others

- 12. Global Federated Learning Platforms Market Analysis, by Integration & Interoperability

- 12.1. Key Segment Analysis

- 12.2. Federated Learning Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Integration & Interoperability, 2021-2035

- 12.2.1. Native ML framework support (TensorFlow, PyTorch, JAX)

- 12.2.2. MLOps & CI/CD pipeline integrations

- 12.2.3. Data catalog & governance connectors

- 12.2.4. Identity / access management (SSO, IAM)

- 12.2.5. Model serving & deployment integrations

- 12.2.6. Others

- 13. Global Federated Learning Platforms Market Analysis, by Industry Vertical / Use Case

- 13.1. Key Segment Analysis

- 13.2. Federated Learning Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Industry Vertical / Use Case, 2021-2035

- 13.2.1. Healthcare & life sciences

- 13.2.2. Financial services & banking

- 13.2.3. Telecom & IoT

- 13.2.4. Automotive

- 13.2.5. Retail & advertising

- 13.2.6. Public sector & defense

- 13.2.7. Manufacturing & industrial analytics

- 13.2.8. Others

- 14. Global Federated Learning Platforms Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Federated Learning Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Federated Learning Platforms Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Federated Learning Platforms Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Component

- 15.3.2. Deployment Mode

- 15.3.3. Architecture/ Topology

- 15.3.4. Learning Type/ Algorithm

- 15.3.5. Privacy & Security Capability

- 15.3.6. Data Type

- 15.3.7. Integration & Interoperability

- 15.3.8. Industry Vertical / Use Case

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Federated Learning Platforms Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Component

- 15.4.3. Deployment Mode

- 15.4.4. Architecture/ Topology

- 15.4.5. Learning Type/ Algorithm

- 15.4.6. Privacy & Security Capability

- 15.4.7. Data Type

- 15.4.8. Integration & Interoperability

- 15.4.9. Industry Vertical / Use Case

- 15.5. Canada Federated Learning Platforms Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Component

- 15.5.3. Deployment Mode

- 15.5.4. Architecture/ Topology

- 15.5.5. Learning Type/ Algorithm

- 15.5.6. Privacy & Security Capability

- 15.5.7. Data Type

- 15.5.8. Integration & Interoperability

- 15.5.9. Industry Vertical / Use Case

- 15.6. Mexico Federated Learning Platforms Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Component

- 15.6.3. Deployment Mode

- 15.6.4. Architecture/ Topology

- 15.6.5. Learning Type/ Algorithm

- 15.6.6. Privacy & Security Capability

- 15.6.7. Data Type

- 15.6.8. Integration & Interoperability

- 15.6.9. Industry Vertical / Use Case

- 16. Europe Federated Learning Platforms Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Federated Learning Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Component

- 16.3.2. Deployment Mode

- 16.3.3. Architecture/ Topology

- 16.3.4. Learning Type/ Algorithm

- 16.3.5. Privacy & Security Capability

- 16.3.6. Data Type

- 16.3.7. Integration & Interoperability

- 16.3.8. Industry Vertical / Use Case

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Federated Learning Platforms Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Component

- 16.4.3. Deployment Mode

- 16.4.4. Architecture/ Topology

- 16.4.5. Learning Type/ Algorithm

- 16.4.6. Privacy & Security Capability

- 16.4.7. Data Type

- 16.4.8. Integration & Interoperability

- 16.4.9. Industry Vertical / Use Case

- 16.5. United Kingdom Federated Learning Platforms Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Component

- 16.5.3. Deployment Mode

- 16.5.4. Architecture/ Topology

- 16.5.5. Learning Type/ Algorithm

- 16.5.6. Privacy & Security Capability

- 16.5.7. Data Type

- 16.5.8. Integration & Interoperability

- 16.5.9. Industry Vertical / Use Case

- 16.6. France Federated Learning Platforms Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Component

- 16.6.3. Deployment Mode

- 16.6.4. Architecture/ Topology

- 16.6.5. Learning Type/ Algorithm

- 16.6.6. Privacy & Security Capability

- 16.6.7. Data Type

- 16.6.8. Integration & Interoperability

- 16.6.9. Industry Vertical / Use Case

- 16.7. Italy Federated Learning Platforms Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Component

- 16.7.3. Deployment Mode

- 16.7.4. Architecture/ Topology

- 16.7.5. Learning Type/ Algorithm

- 16.7.6. Privacy & Security Capability

- 16.7.7. Data Type

- 16.7.8. Integration & Interoperability

- 16.7.9. Industry Vertical / Use Case

- 16.8. Spain Federated Learning Platforms Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Component

- 16.8.3. Deployment Mode

- 16.8.4. Architecture/ Topology

- 16.8.5. Learning Type/ Algorithm

- 16.8.6. Privacy & Security Capability

- 16.8.7. Data Type

- 16.8.8. Integration & Interoperability

- 16.8.9. Industry Vertical / Use Case

- 16.9. Netherlands Federated Learning Platforms Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Component

- 16.9.3. Deployment Mode

- 16.9.4. Architecture/ Topology

- 16.9.5. Learning Type/ Algorithm

- 16.9.6. Privacy & Security Capability

- 16.9.7. Data Type

- 16.9.8. Integration & Interoperability

- 16.9.9. Industry Vertical / Use Case

- 16.10. Nordic Countries Federated Learning Platforms Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Component

- 16.10.3. Deployment Mode

- 16.10.4. Architecture/ Topology

- 16.10.5. Learning Type/ Algorithm

- 16.10.6. Privacy & Security Capability

- 16.10.7. Data Type

- 16.10.8. Integration & Interoperability

- 16.10.9. Industry Vertical / Use Case

- 16.11. Poland Federated Learning Platforms Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Component

- 16.11.3. Deployment Mode

- 16.11.4. Architecture/ Topology

- 16.11.5. Learning Type/ Algorithm

- 16.11.6. Privacy & Security Capability

- 16.11.7. Data Type

- 16.11.8. Integration & Interoperability

- 16.11.9. Industry Vertical / Use Case

- 16.12. Russia & CIS Federated Learning Platforms Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Component

- 16.12.3. Deployment Mode

- 16.12.4. Architecture/ Topology

- 16.12.5. Learning Type/ Algorithm

- 16.12.6. Privacy & Security Capability

- 16.12.7. Data Type

- 16.12.8. Integration & Interoperability

- 16.12.9. Industry Vertical / Use Case

- 16.13. Rest of Europe Federated Learning Platforms Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Component

- 16.13.3. Deployment Mode

- 16.13.4. Architecture/ Topology

- 16.13.5. Learning Type/ Algorithm

- 16.13.6. Privacy & Security Capability

- 16.13.7. Data Type

- 16.13.8. Integration & Interoperability

- 16.13.9. Industry Vertical / Use Case

- 17. Asia Pacific Federated Learning Platforms Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Asia Pacific Federated Learning Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Component

- 17.3.2. Deployment Mode

- 17.3.3. Architecture/ Topology

- 17.3.4. Learning Type/ Algorithm

- 17.3.5. Privacy & Security Capability

- 17.3.6. Data Type

- 17.3.7. Integration & Interoperability

- 17.3.8. Industry Vertical / Use Case

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Federated Learning Platforms Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Component

- 17.4.3. Deployment Mode

- 17.4.4. Architecture/ Topology

- 17.4.5. Learning Type/ Algorithm

- 17.4.6. Privacy & Security Capability

- 17.4.7. Data Type

- 17.4.8. Integration & Interoperability

- 17.4.9. Industry Vertical / Use Case

- 17.5. India Federated Learning Platforms Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Component

- 17.5.3. Deployment Mode

- 17.5.4. Architecture/ Topology

- 17.5.5. Learning Type/ Algorithm

- 17.5.6. Privacy & Security Capability

- 17.5.7. Data Type

- 17.5.8. Integration & Interoperability

- 17.5.9. Industry Vertical / Use Case

- 17.6. Japan Federated Learning Platforms Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Component

- 17.6.3. Deployment Mode

- 17.6.4. Architecture/ Topology

- 17.6.5. Learning Type/ Algorithm

- 17.6.6. Privacy & Security Capability

- 17.6.7. Data Type

- 17.6.8. Integration & Interoperability

- 17.6.9. Industry Vertical / Use Case

- 17.7. South Korea Federated Learning Platforms Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Component

- 17.7.3. Deployment Mode

- 17.7.4. Architecture/ Topology

- 17.7.5. Learning Type/ Algorithm

- 17.7.6. Privacy & Security Capability

- 17.7.7. Data Type

- 17.7.8. Integration & Interoperability

- 17.7.9. Industry Vertical / Use Case

- 17.8. Australia and New Zealand Federated Learning Platforms Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Component

- 17.8.3. Deployment Mode

- 17.8.4. Architecture/ Topology

- 17.8.5. Learning Type/ Algorithm

- 17.8.6. Privacy & Security Capability

- 17.8.7. Data Type

- 17.8.8. Integration & Interoperability

- 17.8.9. Industry Vertical / Use Case

- 17.9. Indonesia Federated Learning Platforms Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Component

- 17.9.3. Deployment Mode

- 17.9.4. Architecture/ Topology

- 17.9.5. Learning Type/ Algorithm

- 17.9.6. Privacy & Security Capability

- 17.9.7. Data Type

- 17.9.8. Integration & Interoperability

- 17.9.9. Industry Vertical / Use Case

- 17.10. Malaysia Federated Learning Platforms Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Component

- 17.10.3. Deployment Mode

- 17.10.4. Architecture/ Topology

- 17.10.5. Learning Type/ Algorithm

- 17.10.6. Privacy & Security Capability

- 17.10.7. Data Type

- 17.10.8. Integration & Interoperability

- 17.10.9. Industry Vertical / Use Case

- 17.11. Thailand Federated Learning Platforms Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Component

- 17.11.3. Deployment Mode

- 17.11.4. Architecture/ Topology

- 17.11.5. Learning Type/ Algorithm

- 17.11.6. Privacy & Security Capability

- 17.11.7. Data Type

- 17.11.8. Integration & Interoperability

- 17.11.9. Industry Vertical / Use Case

- 17.12. Vietnam Federated Learning Platforms Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Component

- 17.12.3. Deployment Mode

- 17.12.4. Architecture/ Topology

- 17.12.5. Learning Type/ Algorithm

- 17.12.6. Privacy & Security Capability

- 17.12.7. Data Type

- 17.12.8. Integration & Interoperability

- 17.12.9. Industry Vertical / Use Case

- 17.13. Rest of Asia Pacific Federated Learning Platforms Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Component

- 17.13.3. Deployment Mode

- 17.13.4. Architecture/ Topology

- 17.13.5. Learning Type/ Algorithm

- 17.13.6. Privacy & Security Capability

- 17.13.7. Data Type

- 17.13.8. Integration & Interoperability

- 17.13.9. Industry Vertical / Use Case

- 18. Middle East Federated Learning Platforms Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Federated Learning Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Component

- 18.3.2. Deployment Mode

- 18.3.3. Architecture/ Topology

- 18.3.4. Learning Type/ Algorithm

- 18.3.5. Privacy & Security Capability

- 18.3.6. Data Type

- 18.3.7. Integration & Interoperability

- 18.3.8. Industry Vertical / Use Case

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Federated Learning Platforms Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Component

- 18.4.3. Deployment Mode

- 18.4.4. Architecture/ Topology

- 18.4.5. Learning Type/ Algorithm

- 18.4.6. Privacy & Security Capability

- 18.4.7. Data Type

- 18.4.8. Integration & Interoperability

- 18.4.9. Industry Vertical / Use Case

- 18.5. UAE Federated Learning Platforms Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Component

- 18.5.3. Deployment Mode

- 18.5.4. Architecture/ Topology

- 18.5.5. Learning Type/ Algorithm

- 18.5.6. Privacy & Security Capability

- 18.5.7. Data Type

- 18.5.8. Integration & Interoperability

- 18.5.9. Industry Vertical / Use Case

- 18.6. Saudi Arabia Federated Learning Platforms Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Component

- 18.6.3. Deployment Mode

- 18.6.4. Architecture/ Topology

- 18.6.5. Learning Type/ Algorithm

- 18.6.6. Privacy & Security Capability

- 18.6.7. Data Type

- 18.6.8. Integration & Interoperability

- 18.6.9. Industry Vertical / Use Case

- 18.7. Israel Federated Learning Platforms Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Component

- 18.7.3. Deployment Mode

- 18.7.4. Architecture/ Topology

- 18.7.5. Learning Type/ Algorithm

- 18.7.6. Privacy & Security Capability

- 18.7.7. Data Type

- 18.7.8. Integration & Interoperability

- 18.7.9. Industry Vertical / Use Case

- 18.8. Rest of Middle East Federated Learning Platforms Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Component

- 18.8.3. Deployment Mode

- 18.8.4. Architecture/ Topology

- 18.8.5. Learning Type/ Algorithm

- 18.8.6. Privacy & Security Capability

- 18.8.7. Data Type

- 18.8.8. Integration & Interoperability

- 18.8.9. Industry Vertical / Use Case

- 19. Africa Federated Learning Platforms Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Federated Learning Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Component

- 19.3.2. Deployment Mode

- 19.3.3. Architecture/ Topology

- 19.3.4. Learning Type/ Algorithm

- 19.3.5. Privacy & Security Capability

- 19.3.6. Data Type

- 19.3.7. Integration & Interoperability

- 19.3.8. Industry Vertical / Use Case

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Federated Learning Platforms Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Component

- 19.4.3. Deployment Mode

- 19.4.4. Architecture/ Topology

- 19.4.5. Learning Type/ Algorithm

- 19.4.6. Privacy & Security Capability

- 19.4.7. Data Type

- 19.4.8. Integration & Interoperability

- 19.4.9. Industry Vertical / Use Case

- 19.5. Egypt Federated Learning Platforms Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Component

- 19.5.3. Deployment Mode

- 19.5.4. Architecture/ Topology

- 19.5.5. Learning Type/ Algorithm

- 19.5.6. Privacy & Security Capability

- 19.5.7. Data Type

- 19.5.8. Integration & Interoperability

- 19.5.9. Industry Vertical / Use Case

- 19.6. Nigeria Federated Learning Platforms Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Component

- 19.6.3. Deployment Mode

- 19.6.4. Architecture/ Topology

- 19.6.5. Learning Type/ Algorithm

- 19.6.6. Privacy & Security Capability

- 19.6.7. Data Type

- 19.6.8. Integration & Interoperability

- 19.6.9. Industry Vertical / Use Case

- 19.7. Algeria Federated Learning Platforms Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Component

- 19.7.3. Deployment Mode

- 19.7.4. Architecture/ Topology

- 19.7.5. Learning Type/ Algorithm

- 19.7.6. Privacy & Security Capability

- 19.7.7. Data Type

- 19.7.8. Integration & Interoperability

- 19.7.9. Industry Vertical / Use Case

- 19.8. Rest of Africa Federated Learning Platforms Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Component

- 19.8.3. Deployment Mode

- 19.8.4. Architecture/ Topology

- 19.8.5. Learning Type/ Algorithm

- 19.8.6. Privacy & Security Capability

- 19.8.7. Data Type

- 19.8.8. Integration & Interoperability

- 19.8.9. Industry Vertical / Use Case

- 20. South America Federated Learning Platforms Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. South America Federated Learning Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Component

- 20.3.2. Deployment Mode

- 20.3.3. Architecture/ Topology

- 20.3.4. Learning Type/ Algorithm

- 20.3.5. Privacy & Security Capability

- 20.3.6. Data Type

- 20.3.7. Integration & Interoperability

- 20.3.8. Industry Vertical / Use Case

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Federated Learning Platforms Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Component

- 20.4.3. Deployment Mode

- 20.4.4. Architecture/ Topology

- 20.4.5. Learning Type/ Algorithm

- 20.4.6. Privacy & Security Capability

- 20.4.7. Data Type

- 20.4.8. Integration & Interoperability

- 20.4.9. Industry Vertical / Use Case

- 20.5. Argentina Federated Learning Platforms Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Component

- 20.5.3. Deployment Mode

- 20.5.4. Architecture/ Topology

- 20.5.5. Learning Type/ Algorithm

- 20.5.6. Privacy & Security Capability

- 20.5.7. Data Type

- 20.5.8. Integration & Interoperability

- 20.5.9. Industry Vertical / Use Case

- 20.6. Rest of South America Federated Learning Platforms Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Component

- 20.6.3. Deployment Mode

- 20.6.4. Architecture/ Topology

- 20.6.5. Learning Type/ Algorithm

- 20.6.6. Privacy & Security Capability

- 20.6.7. Data Type

- 20.6.8. Integration & Interoperability

- 20.6.9. Industry Vertical / Use Case

- 21. Key Players/ Company Profile

- 21.1. Alibaba Cloud

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Amazon Web Services (AWS)

- 21.3. Baidu

- 21.4. Cloudera

- 21.5. DataRobot

- 21.6. Fetch.ai

- 21.7. Google

- 21.8. Hewlett Packard Enterprise (HPE)

- 21.9. Huawei Technologies

- 21.10. IBM Corporation

- 21.11. Intel Corporation

- 21.12. Microsoft Corporation

- 21.13. NVIDIA Corporation

- 21.14. OpenMined (community & tooling)

- 21.15. Oracle Corporation

- 21.16. Owkin

- 21.17. Philips (Healthcare)

- 21.18. Samsung Research / Samsung Electronics

- 21.19. Siemens Healthineers

- 21.20. Tencent Cloud

- 21.21. Others Key Players

- 21.1. Alibaba Cloud

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Federated Learning Platforms Market by Component, Deployment Mode, Architecture/ Topology, Learning Type/ Algorithm, Privacy & Security Capability, Data Type, Integration & Interoperability, Industry Vertical / Use Case and Geography

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Federated Learning Platforms Market Size, Share & Trends Analysis Report by Component (Federated Learning Frameworks/ SDKs, Orchestration & Coordinator Services, Client/ Edge Agents (on-device SDKs), Secure Aggregation & Cryptographic Modules, Model Management & Versioning, Data Connectors & Preprocessing Pipelines, Monitoring, Telemetry & Explainability Tools, APIs & Integration Middleware and Others), Deployment Mode, Architecture/ Topology, Learning Type/ Algorithm, Privacy & Security Capability, Data Type, Integration & Interoperability, Industry Vertical / Use Case and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Federated Learning Platforms Market Size, Share, and Growth

The global federated learning platforms market is experiencing robust growth, with its estimated value of USD 0.1 billion in the year 2025 and USD 1.6 billion by the period 2035, registering a CAGR of 27.3% during the forecast period.

According to Google researcher Brendan McMahan, who co-introduced federated learning in 2017, in Google’s official publications, federated learning enables AI to improve without transferring user data off the device. Google's article states that inherently decentralized training improves privacy because raw data does not need to be collected and used for training centrally, emphasizing on the approach - increasingly impacted with the growth of mobile, IoT, and edge ecosystems and allowing high-quality AI experiences without sacrificing privacy.

The federated learning platforms market is rapidly growing all over the world, which is largely attributed to the key factors such as the quest for privacy-preserving AI and the need for secure utilization of distributed data. After Google initially implemented federated learning in Gboard in 2017, the company has been continuously upgrading the method to enhance on-device language and prediction models without the need to collect raw user data - thus, proving the decentralized training is both reliable and scalable. Besides, to facilitate secure, device-level machine-learning updates, major technology providers like NVIDIA, Apple, and IBM, have also launched frameworks leading to an increased trust of the industry in federated architectures.

Huge volumes of data from smartphones, IoT ecosystems, and edge devices have made the problem of model training in a collaborative way without compromising privacy or data-sovereignty rules even more pressing. Furthermore, regulatory frameworks such as GDPR and HIPAA impose strict regulations on organizations in healthcare, finance, and telecom sectors forcing them to use secure and privacy-enhancing AI techniques, for example, federated learning. The combination of technological innovation, regulatory pressure, and the rise of edge intelligence is driving the global federated learning platforms market at a fast pace and is also contributing to the production of trustworthy AI systems.

Moreover, the federated learning platforms market is advantaged by nearby options such as secure multi-party computation, differential privacy tools, privacy-preserving analytics pipelines, encrypted model aggregation, and edge-AI optimization services. By exploiting these adjacent segments, technology providers can not only build up the privacy-centric AI ecosystems but also increase their revenue within the broader trusted-AI and edge computing landscape.

Federated Learning Platforms Market Dynamics and Trends

Driver: Increasing Data Localization & Privacy Laws Accelerating Federated Learning Adoption

Restraint: High Infrastructure Complexity & Interoperability Barriers Limiting Federated Learning Platforms Adoption

Opportunity: Rapid Expansion in Healthcare, Autonomous Systems & Edge AI Deployments

Key Trend: Convergence of Federated Learning with Secure Computing & Edge Intelligence

Federated Learning Platforms Market Analysis and Segmental Data

“Telecom & IoT Leads Global Federated Learning Platforms Market amid Rising Edge‑AI, 5G Integration, and Privacy Demands"

“North America Dominates Federated Learning Platforms Market with Advanced AI Ecosystem, Regulatory Compliance, and Early Enterprise Adoption"

Federated-Learning-Platforms-Market Ecosystem

The global federated learning platforms market is becoming highly consolidated. The main players, with the technologies and the broad partnerships of their ecosystems, are Google, NVIDIA, IBM, Microsoft, Intel, and Owkin. To keep their competitive advantage, these leaders operate hyperscale cloud infrastructure, GPU‑accelerated edge AI frameworks, and secure aggregation protocols.

These corporations constantly direct their efforts to highly differentiated targets: e.g., NVIDIA’s FLARE environment is aimed at scalable and secure cross-organizational AI, Google's TensorFlow Federated is focused on privacy-aware research, IBM’s Granite models are designed to support multi-party trusted AI, Microsoft through Azure provides FL for regulated industries, Intel is delivering the best hardware for FL on IoT devices, and Owkin implements federated learning for drug-discovery in healthcare.

Federated learning is also a priority for central and local governments, higher education establishments, and scientific research institutions. In March 2025, Duality Technologies announced version 4.3 of its platform incorporating NVIDIA FLARE, Google Cloud’s confidential environment, and an in-built differential privacy feature-signaling a real-world, regulation-compliant data collaboration scenario. Simultaneously, in October 2025, researchers unveiled the Adaptive Fair Federated Learning framework that lowers the number of communication rounds by 60–70% and that results in fairness improvements at a large number of healthcare institutions.

These large vendors are extending their portfolios of products to keep the lead in the market: they provide integrated federated-analytics suites, edge-to-cloud orchestration, and secure compute toolkits that enhance productivity and lower the operational risk in industries such as finance, healthcare, and manufacturing.

Recent Development and Strategic Overview:

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 0.1 Bn |

|

Market Forecast Value in 2035 |

USD 1.6 Bn |

|

Growth Rate (CAGR) |

27.3% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

USD Bn for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Federated-Learning-Platforms-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Federated Learning Platforms Market, By Component |

|

|

Federated Learning Platforms Market, By Deployment Mode |

|

|

Federated Learning Platforms Market, By Component |

|

|

Federated Learning Platforms Market, By Architecture/ Topology |

|

|

Federated Learning Platforms Market, By Learning Type/ Algorithm |

|

|

Federated Learning Platforms Market, By Privacy & Security Capability |

|

|

Federated Learning Platforms Market, By Data Type |

|

|

Federated Learning Platforms Market, By Integration & Interoperability |

|

|

Federated Learning Platforms Market, By Industry Vertical / Use Case |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation