Food Starch Market Size, Share, Growth Opportunity Analysis Report by Starch Type (Native Starch, Modified Starch, Resistant Starch and Others), Functionality/ Application Purpose, Form & Physical Properties, Packaging Format, Distribution Channel, End-Use Application and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035.

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Food Starch Market Size, Share, and Growth

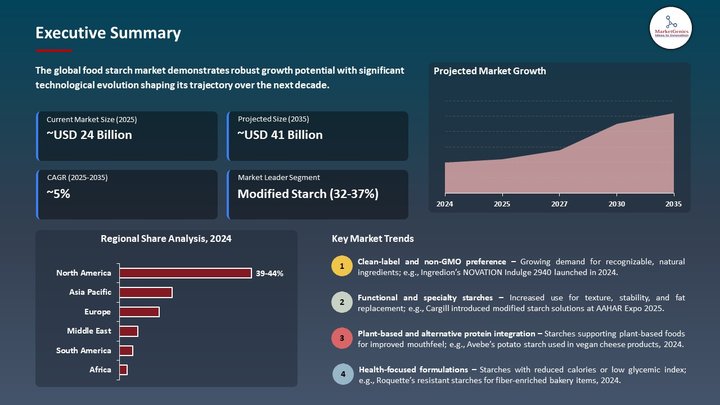

The worldwide food starch market is expanding from USD 24.7 billion in 2025 to USD 41.8 billion by the year 2035, showing a CAGR of 4.9% over the forecast period. Interest around clean-label and natural food additive products is forever on the rise amongst consumers. Starches, modified starches, and resistant starches provide a bouquet of functional benefits-from texture to fat replacement or shelf-life considerations.

In early 2025, Tate & Lyle introduced CLARIA G, a next-generation European clean-label corn starch that performs in keeping with claria gelling and heat stabilities while reducing carbon emission by 34% and water usage by 35%. Initially, the starch consisted of three variants: Essential, Plus, and Elite. CLARIA G intends to serve food processors in dairy, sauces, and ready-meals, who regard ingredients as part of their sustainability agenda. This launch stands as proof of Tate & Lyle's commitment to green innovations in starch, offering manufacturers high-performance clean-label solutions that also feed into corporate environmental objectives, increasingly among the harder criteria in ingredients' selection.

In March 2024, Ingredion Incorporated came up with a completely-new range of clean-label functional starches-NOVATION brand-that respond to clean-label trends within the ready meals and dairy sectors. This development demonstrated how top companies are leaning towards product development with regard to the consumer demand for transparent and health-oriented foods.

Plant-based and gluten-free diets, promoted more and more, opened the doors for food starches to be in the limelight as thickening, texturizing, and fat-replacing agents in the formulation of alternative foods. February 2024 saw Cargill enhancing its portfolio of native starches, SimPure, further to serve meat alternative and dairy-free products which require stability and texture. This act draws into focus the fast-widening panorama of starch application amid shifting dietary trends.

Food Starch Market Dynamics and Trends

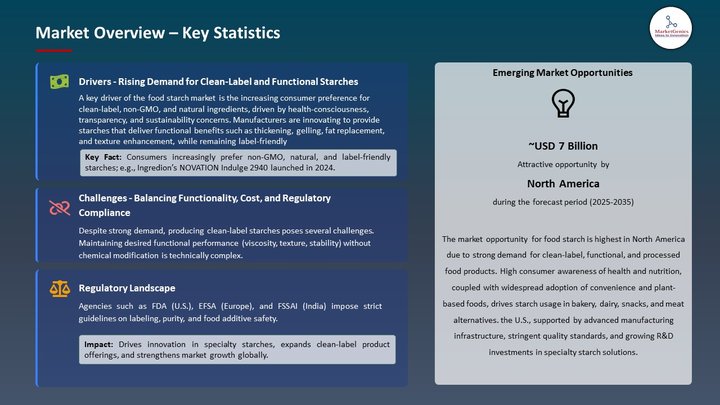

Driver: Rising Demand for Clean-Label and Functional Ingredients

- Food starch markets are thus subject to a huge influence from the demand for clean-label and functional starches. Consumers are increasingly demanding food ingredient transparency and are thus experimenting with natural or minimally processed starches versus chemically modified ones. This trend is further cemented by dietary awareness and the pressure from regulators for transparent labeling. Accordingly, manufacturers of leading brands.

- For instance, in December 2024, Ingredion Incorporated launched NOVATION Indulge 2940 starch for clean label applications in dairy and dairy alternatives, a corn starch said to be non-GMO. It exhibits excellent film-forming and gelling capabilities without downgrading the product on the label. Consumer demand for the clean-label segment accounts for over 30% of starch demand, especially in North America and Europe. Functional starches find application in ready meals, soups, and sauces to modify texture.

- A departure from those synthetic substances and modifications is forcing food processors to embrace the locally functional ones that maintain taste, shelf life, and viscosity-the very dimensions that outsiders fancy to hold high standards in product purity. The emergence of a disruptive force that challenges almost all traditional supply chains offers the stakeholders of the packaged-food sector a rare opportunity to separate their brand value from their value proposition.

Driver: Expansion of Plant-Based and Gluten-Free Food Markets

- A rise in various starches is fostered by the growth of the plant-based and gluten-free food markets. As manufacturers try to enter the burgeoning market of meat and gluten-free alternatives, potato, tapioca, corn, and pea starches come into the picture in textural and mouthfeel considerations. Functionally they require gelling, water retention, and elasticity, especially in meat analogs and bakery applications.

- In early 2024, the SimPure portfolio of functional native starches for plant-based applications got further extended by Cargill. These starches contribute to improved freeze-thaw stability, better binding capacity, and less syneresis in meat substitutes and plant-based dairy. Conversely, the gluten-free trend has given a much-needed shot in the arm to the demand for wheat starch substitutes in bakery, breakfast cereals, and snack applications. Players in this space provide regional products such as tapioca in Asia-Pacific and potato starch in Europe to ensure local supply chains mitigated from allergenic risks, thus marking a significant growth driver in the global food starch market

Restraint: Volatility in Raw Material Prices and Supply Chain Disruptions

- Some important restraints are the month-to-month availability and price fluctuation behaviors of the raw materials, mainly corn, wheat, potatoes, and cassava. These raw materials are quite sensitive to climatic conditions, geopolitical frictions, or any changes in agricultural policy. From mid-2024, climate-induced crop failures in some Asian and European regions caused an upward surge of nearly 15%-18% in global prices of corn and potato, thereby directly hitting the starch manufacturers. ADM and Avebe had also gone public in announcing pricing adjustments and renegotiating contracts in light of raw materials price inflation. Besides this, even the ongoing trade war between the EU and Russia has made the sourcing of cassava and wheat starch a challenge, aggravating their realization with higher lead time and logistics cost. For many moderately-sized and contract manufacturers in developing countries, such disruptions deeply disturb profit margins. The high dependence on agricultural produce, without enough crop diversification, continues to expose the starch industry to huge supply chain risks that deter scalability of operations, constrain the launch time of products, and, more or less, act as an impediment to strategic forecasting.

Opportunity: Innovation in Starch Derivatives for Nutraceuticals and Functional Foods

- With more consumers demanding health-associated and multifunctional food items, starch derivatives serve as a profitable platform for innovation. Modified, special starches are now developed for advanced functionalities such as encapsulation and controlled-release systems in a fast-growing nutraceutical and functional foods sector.

- Roquette and Novozymes unveiled novel cyclodextrin-based starch derivatives for flavor and vitamin encapsulation in January of 2025. This starch formulation provides an extended shelf life while protecting the bioactive agents from heating and oxidation, thus making it fit for fortified drinks and dietary supplements. As starch derivative-based packaging materials and edible films also receive regulatory and commercial attention, value-added starch-based manufacturers can complain less about commodity issues, capitalize on premium pricing, diversify portfolio bases, and enhance their environmental attitudes, which poses a promising future for both B2B and consumer markets.

Key Trend: Adoption of Digitalization and Smart Manufacturing for Starch Production

- One of the emerging trends in the food starch industry is digital integration of tools, smart manufacturing working along the whole value chain. AI, IoT, machine learning tools are provided for real-time monitoring, predictive quality control, and automated blending in starch manufacturing plants.

- Following up on the trend, in the fourth quarter of 2024, Cargill unveiled a pilot for AI-based yield optimization and traceability modules for its starch plant in the Netherlands. These modules observe the quality of the input materials, adjust the processing parameters automatically and provide the advantage of remote troubleshooting, minimizing waste to uphold consistency batch after batch. On a little deeper thought, such digital enhancements reduce operational costs, help companies adjust to ever-changing regulatory and sustainability standards. Smart logistics and blockchain-led supply chains further contribute to better efficiency and transparency in clean-label, organic-certified starch production. With an increase in digital maturity, at a big stage now, starch producers embedding every gemstone of Industry 4.0 are ready to ride the competitive wave of efficiency, traceability, and speeding up go-to-market journeys.

Food Starch Market Analysis and Segmental Data

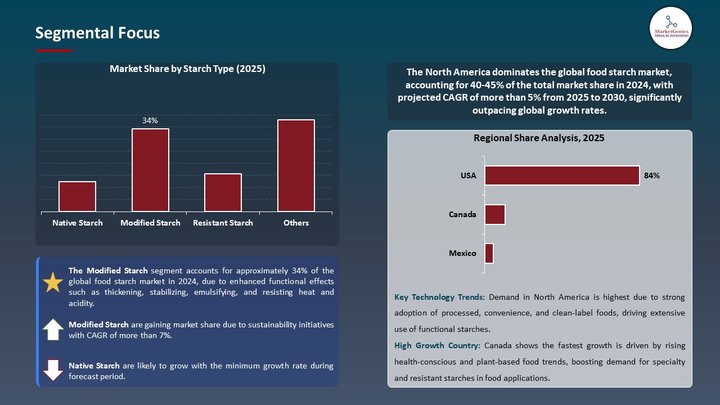

Based on Starch Type, the modified starch segment retains the largest share

- The modified starch segment holds major share ~34% in the global food starch market. High demand exists for modified starches in the global food starch market due to enhanced functional effects such as thickening, stabilizing, emulsifying, and resisting heat and acidity. Modified starch is popular with processed food product manufacturers for soups, sauces, bakery fillings, and dairy products, wherein native starch cannot provide consistency under industrial processing conditions. This particular grade is very much in favor of good shelf-life, texture, and performance that relate closely to the ongoing surge in the consumption of convenience and ready-to-eat foods.

- With the approval from the regulators plus advancement in technology, the use of modified starch in health-promoting and gluten-free formulary options is accelerating. Corn, tapioca, and potato modified starches are also aligned with clean-label and non-GMO trends.

- For example, in May 2024, Tate & Lyle introduced lines of modified tapioca starches to improve freeze-thaw stability and sensory texture in dairy and bakery applications. Such innovations assist manufacturers in catering to evolving consumer tastes without further operational inefficiency, thereby enhancing the dominance of modified starch in the global food industry.

Bakery & Confectionery Expected to Be Top by End-Use Application Through Forecast Period

- Growing demand for bakery and confectionery products is indicative of accelerated growth globally in the starch industry from starches that mainly impinge upon the texture, volume, and shelf life of products. Starch molecules pose a barrier to moisture loss in baked products; hence they act as stabilizers in fillings and confectionery coatings. With starches being in higher demand for gluten-free and clean label bakery products, modified and native starches are increasingly used as flour substitutes. Developing a label-friendly potato starch for bakery applications, the company emphasizes crumb softness, freeze-thaw stability, consumer acceptability, and processability: This was during a press conference in February 2024.

- Rapid urbanization and changing lifestyles follow peculiar trends that help promote the increasing demand for packaged and premium bakeries in developing countries. Thus, starch secondary lowers cost and meets sensory demands. Conversely, in April 2024, a new line of corn starches was released by ADM for confectionery companies to impart a better texture to gummies and jellies. This would only further accelerate the starch market as there is a sudden thrust on innovation and reskinning of products within bakery and confectionery categories, due to which food manufacturers are jockeying for multifunctional ingredients to meet new consumer demands.

North America Dominates Global Food Starch Market in 2024 and Beyond

- Due to their wide usage in processed foods, frozen foods, and dairy products, food starches witness maximum demand in North America where hectic lifestyles prevail. Amongst all the starch consumers, the U.S. leads for high formation of corn starches and their application in sauces, gravies, bakery, and other ready-to-eat foods. In March 2024, with increased demand for clean-label thickeners and texture modifiers, especially for plant-based and processed food, Ingredion Inc. expanded pea starch production in Nebraska.

- The regional demand for modified starches and native starches instead of conventional flours is further supported by the simultaneous rise in gluten-free and functional foods trends. These starches promise greater mouthfeel and shelf life for the consumers' products. In April 2024, taking to this trend, Tate & Lyle launched a new line of clean-label starches targeted at the North American snack and dairy markets. These activities are aligned with consumers' preference and demand for food ingredients that are healthier, transparent, and of high performance, and therefore strengthen the position of this region as the leader in starch demand.

Food Starch Market Ecosystem

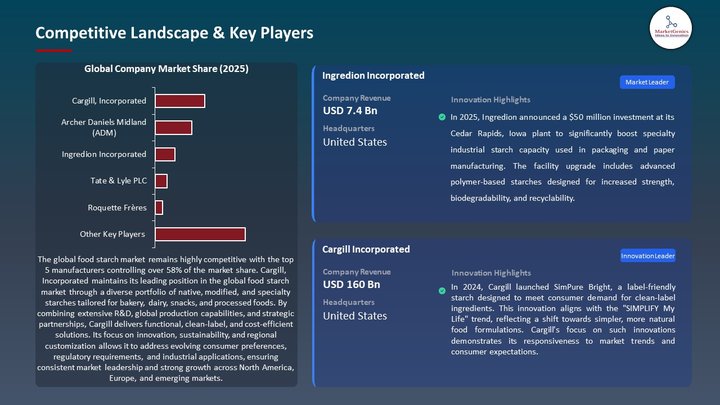

Key players in the global food starch market include prominent companies such as Cargill Incorporated, Archer Daniels Midland (ADM), Ingredion Incorporated, Tate & Lyle PLC, Roquette Frères and Other Key Players.

The global food starch market is moderately consolidated, dominated by Tier-I players such as Cargill, ADM, Roquette Frères, Ingredion, and Tate & Lyle. They control a major portion of the market by virtue of their enormous production capacities and worldwide distribution networks. Tier-II and Tier-III companies mainly cater to regional markets and special applications, thus maintaining the country's competitive health. Buyer concentration is moderate, with food manufacturers and industrial consumers having some power to negotiate, while supplier concentration is low to moderate since many sources of raw starches are available. This ecosystem encourages innovation and partnerships and enables the market to grow steadily.

Recent Development and Strategic Overview:

- In February 2024, Ingredion has introduced NOVATION Indulge 2940, a non-GMO functional native corn starch which offers premium gelling and mouthfeel in clean-label formulations across dairy, plant-based, and dessert-oriented finished goods. Keeping in line with this new consumer expectation of label-friendly ingredients, the ingredient will still maintain texture in heat-treated goods. By providing a natural option that performs well and is also cost effective, Ingredion enables food processors to simultaneously meet clean-label demands (79% of global consumers want ingredients they can recognize) and financial goals (an additional $6.1 M revenue per 100,000 MT of finished products). This rather strategic launch emphasizes Ingredion's stature as a premier solution for clean-label ingredients.

- In March 2025, Starch-based innovations for bakery, confectionery, snacks, dairy, and freezing desserts were launched by Cargill at the AAHAR Expo 2025 held on the 4th of March 2025. It was a product right for the region: modified starch from dent corn to give superior color and texture to the sauce, pectin substitutes for gummies, bake-stable filling systems, and starches that reduce oil uptake in fried snacks. These solutions perfectly fit the growing demand in India for healthier yet more indulgent food, highlighting Cargill's ability to perform on a functional pedestal and practically reduce production cost across categories.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 24.7 Bn |

|

Market Forecast Value in 2035 |

USD 41.8 Bn |

|

Growth Rate (CAGR) |

4.9% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Food Starch Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Starch Type |

|

|

By Functionality/ Application Purpose |

|

|

By Form & Physical Properties |

|

|

By Packaging Format |

|

|

By Distribution Channel |

|

|

By End-Use Application |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Food Starch Market Outlook

- 2.1.1. Food Starch Market Size (Value - US$ Bn), and Forecasts, 2020-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Food Starch Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Food Starch Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Food Starch Industry

- 3.1.3. Regional Distribution for Food Starch

- 3.2. Supplier Customer Data

- 3.3. Functionality/ Application Purpose Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the Raw material sourcing

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Food Starch Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for processed and convenience foods globally.

- 4.1.1.2. Increased usage of modified starches in bakery and dairy applications.

- 4.1.1.3. Expanding use of starch in non-food industries such as textiles, paper, and bio-plastics

- 4.1.2. Restraints

- 4.1.2.1. Fluctuating raw material prices, especially corn and tapioca, impacting production costs and margins

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Sourcing

- 4.4.2. Food Starch Processing/ Manufacturers

- 4.4.3. Packaging and Distributions

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Food Starch Market Demand

- 4.9.1. Historical Market Size - in Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - in Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Food Starch Market Analysis, by Starch Type

- 6.1. Key Segment Analysis

- 6.2. Food Starch Market Size (Value - US$ Bn), Analysis, and Forecasts, by Starch Type, 2020-2035

- 6.2.1. Native Starch

- 6.2.1.1. Corn (Maize) Starch

- 6.2.1.2. Potato Starch

- 6.2.1.3. Tapioca (Cassava) Starch

- 6.2.1.4. Wheat Starch

- 6.2.1.5. Rice Starch

- 6.2.1.6. Others (Arrowroot, Barley, Pea)

- 6.2.2. Modified Starch

- 6.2.2.1. Acid-Modified (Hydrolyzed)

- 6.2.2.2. Cross-Linked

- 6.2.2.3. Oxidized

- 6.2.2.4. Pregelatinized (Instant)

- 6.2.2.5. Enzymatically Modified

- 6.2.3. Resistant Starch

- 6.2.3.1. RS1: Physically Inaccessible

- 6.2.3.2. RS2: Granular (e.g. high-amylose maize)

- 6.2.3.3. RS3: Retrograded (cooked & cooled)

- 6.2.3.4. RS4: Chemically Modified

- 6.2.4. Others

- 6.2.1. Native Starch

- 7. Global Food Starch Market Analysis, by Functionality/ Application Purpose

- 7.1. Key Segment Analysis

- 7.2. Food Starch Market Size (Value - US$ Bn), Analysis, and Forecasts, by Functionality/ Application Purpose, 2020-2035

- 7.2.1. Thickening

- 7.2.1.1. Soups

- 7.2.1.2. Sauces

- 7.2.1.3. Gravies

- 7.2.1.4. Others

- 7.2.2. Stabilizing & Emulsifying

- 7.2.2.1. Dressings

- 7.2.2.2. Dairy

- 7.2.2.3. Others

- 7.2.3. Gelling

- 7.2.3.1. Jams

- 7.2.3.2. Desserts

- 7.2.3.3. Others

- 7.2.4. Binding

- 7.2.4.1. Meat Products

- 7.2.4.2. Bakery Fillings

- 7.2.4.3. Others

- 7.2.5. Fat Replacing

- 7.2.5.1. Low-fat Dressings

- 7.2.5.2. Dairy

- 7.2.5.3. Others

- 7.2.6. Texturizing & Mouthfeel Enhancement

- 7.2.6.1. Beverages

- 7.2.6.2. Confectionery

- 7.2.6.3. Others

- 7.2.7. Moisture Retention & Shelf-Life Extension

- 7.2.7.1. Bakery

- 7.2.7.2. Snacks

- 7.2.7.3. Others

- 7.2.8. Anti-caking

- 7.2.8.1. Powdered Mixes

- 7.2.8.2. Seasonings

- 7.2.8.3. Others

- 7.2.9. Others

- 7.2.1. Thickening

- 8. Global Food Starch Market Analysis, by Form & Physical Properties

- 8.1. Key Segment Analysis

- 8.2. Food Starch Market Size (Value - US$ Bn), Analysis, and Forecasts, by Form & Physical Properties, 2020-2035

- 8.2.1. Powdered Granules

- 8.2.2. Pre-gelatinized Flakes/Powders

- 8.2.3. Slurries/Solutions

- 8.2.4. Custom Blends (e.g., starch + gum systems)

- 8.2.5. Others

- 9. Global Food Starch Market Analysis, by Packaging Format

- 9.1. Key Segment Analysis

- 9.2. Food Starch Market Size (Value - US$ Bn), Analysis, and Forecasts, by Packaging Format, 2020-2035

- 9.2.1. Bulk Bags (500–1,000 kg)

- 9.2.2. Multi-wall Paper Bags (25 kg)

- 9.2.3. Corrugated Boxes (10–20 kg)

- 9.2.4. Flexible Intermediate Bulk Containers (FIBCs)

- 9.2.5. Liquid Tankers (for slurry)

- 9.2.6. Others

- 10. Global Food Starch Market Analysis, by Distribution Channel

- 10.1. Key Segment Analysis

- 10.2. Food Starch Market Size (Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2020-2035

- 10.2.1. Food Ingredient Distributors & Wholesalers

- 10.2.2. Direct OEM Sales (to food manufacturers)

- 10.2.3. Online B2B Portals & Marketplaces

- 10.2.4. Specialty Chemical Suppliers

- 10.2.5. Others

- 11. Global Food Starch Market Analysis, by End-Use Application

- 11.1. Key Segment Analysis

- 11.2. Food Starch Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-Use Application, 2020-2035

- 11.2.1. Bakery & Confectionery

- 11.2.1.1. Bread, cakes, pastries

- 11.2.1.2. Fillings, frostings, icings

- 11.2.1.3. Confectionery (gummies, candies)

- 11.2.2. Dairy & Frozen Desserts

- 11.2.2.1. Yogurts, puddings, custards

- 11.2.2.2. Ice creams, frozen novelties

- 11.2.3. Soups, Sauces & Gravies

- 11.2.3.1. Instant soup mixes

- 11.2.3.2. Ready sauces & gravy packets

- 11.2.4. Processed & Convenience Foods

- 11.2.4.1. Ready meals, TV dinners

- 11.2.4.2. Instant noodles, pasta

- 11.2.4.3. Ready-to-eat snacks

- 11.2.5. Meat, Seafood & Poultry

- 11.2.5.1. Sausages, meatballs, nuggets

- 11.2.5.2. Seafood batter & coatings

- 11.2.6. Beverages

- 11.2.6.1. Functional drinks (stabilizer)

- 11.2.6.2. Suspended solids (fruit nectar, protein shakes)

- 11.2.7. Infant & Clinical Nutrition

- 11.2.7.1. Baby cereals, formula thickeners

- 11.2.7.2. Medical nutrition powders

- 11.2.8. Snacks & Extruded Products

- 11.2.8.1. Extruded chips & puffs

- 11.2.8.2. Coatings for nuts & seeds

- 11.2.9. Others

- 11.2.1. Bakery & Confectionery

- 12. Global Food Starch Market Analysis and Forecasts, by Region

- 12.1. Key Findings

- 12.2. Food Starch Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2020-2035

- 12.2.1. North America

- 12.2.2. Europe

- 12.2.3. Asia Pacific

- 12.2.4. Middle East

- 12.2.5. Africa

- 12.2.6. South America

- 13. North America Food Starch Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. North America Food Starch Market Size Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 13.3.1. Starch Type

- 13.3.2. Functionality/ Application Purpose

- 13.3.3. Form & Physical Properties

- 13.3.4. Packaging Format

- 13.3.5. Distribution Channel

- 13.3.6. End-Use Application

- 13.3.7. Country

- 13.3.7.1. USA

- 13.3.7.2. Canada

- 13.3.7.3. Mexico

- 13.4. USA Food Starch Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Starch Type

- 13.4.3. Functionality/ Application Purpose

- 13.4.4. Form & Physical Properties

- 13.4.5. Packaging Format

- 13.4.6. Distribution Channel

- 13.4.7. End-Use Application

- 13.5. Canada Food Starch Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Starch Type

- 13.5.3. Functionality/ Application Purpose

- 13.5.4. Form & Physical Properties

- 13.5.5. Packaging Format

- 13.5.6. Distribution Channel

- 13.5.7. End-Use Application

- 13.6. Mexico Food Starch Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Starch Type

- 13.6.3. Functionality/ Application Purpose

- 13.6.4. Form & Physical Properties

- 13.6.5. Packaging Format

- 13.6.6. Distribution Channel

- 13.6.7. End-Use Application

- 14. Europe Food Starch Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Europe Food Starch Market Size (Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 14.3.1. Starch Type

- 14.3.2. Functionality/ Application Purpose

- 14.3.3. Form & Physical Properties

- 14.3.4. Packaging Format

- 14.3.5. Distribution Channel

- 14.3.6. End-Use Application

- 14.3.7. Country

- 14.3.7.1. Germany

- 14.3.7.2. United Kingdom

- 14.3.7.3. France

- 14.3.7.4. Italy

- 14.3.7.5. Spain

- 14.3.7.6. Netherlands

- 14.3.7.7. Nordic Countries

- 14.3.7.8. Poland

- 14.3.7.9. Russia & CIS

- 14.3.7.10. Rest of Europe

- 14.4. Germany Food Starch Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Starch Type

- 14.4.3. Functionality/ Application Purpose

- 14.4.4. Form & Physical Properties

- 14.4.5. Packaging Format

- 14.4.6. Distribution Channel

- 14.4.7. End-Use Application

- 14.5. United Kingdom Food Starch Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Starch Type

- 14.5.3. Functionality/ Application Purpose

- 14.5.4. Form & Physical Properties

- 14.5.5. Packaging Format

- 14.5.6. Distribution Channel

- 14.5.7. End-Use Application

- 14.6. France Food Starch Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Starch Type

- 14.6.3. Functionality/ Application Purpose

- 14.6.4. Form & Physical Properties

- 14.6.5. Packaging Format

- 14.6.6. Distribution Channel

- 14.6.7. End-Use Application

- 14.7. Italy Food Starch Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Starch Type

- 14.7.3. Functionality/ Application Purpose

- 14.7.4. Form & Physical Properties

- 14.7.5. Packaging Format

- 14.7.6. Distribution Channel

- 14.7.7. End-Use Application

- 14.8. Spain Food Starch Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Starch Type

- 14.8.3. Functionality/ Application Purpose

- 14.8.4. Form & Physical Properties

- 14.8.5. Packaging Format

- 14.8.6. Distribution Channel

- 14.8.7. End-Use Application

- 14.9. Netherlands Food Starch Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Starch Type

- 14.9.3. Functionality/ Application Purpose

- 14.9.4. Form & Physical Properties

- 14.9.5. Packaging Format

- 14.9.6. Distribution Channel

- 14.9.7. End-Use Application

- 14.10. Nordic Countries Food Starch Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Starch Type

- 14.10.3. Functionality/ Application Purpose

- 14.10.4. Form & Physical Properties

- 14.10.5. Packaging Format

- 14.10.6. Distribution Channel

- 14.10.7. End-Use Application

- 14.11. Poland Food Starch Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Starch Type

- 14.11.3. Functionality/ Application Purpose

- 14.11.4. Form & Physical Properties

- 14.11.5. Packaging Format

- 14.11.6. Distribution Channel

- 14.11.7. End-Use Application

- 14.12. Russia & CIS Food Starch Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Starch Type

- 14.12.3. Functionality/ Application Purpose

- 14.12.4. Form & Physical Properties

- 14.12.5. Packaging Format

- 14.12.6. Distribution Channel

- 14.12.7. End-Use Application

- 14.13. Rest of Europe Food Starch Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Starch Type

- 14.13.3. Functionality/ Application Purpose

- 14.13.4. Form & Physical Properties

- 14.13.5. Packaging Format

- 14.13.6. Distribution Channel

- 14.13.7. End-Use Application

- 15. Asia Pacific Food Starch Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. East Asia Food Starch Market Size (Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 15.3.1. Starch Type

- 15.3.2. Functionality/ Application Purpose

- 15.3.3. Form & Physical Properties

- 15.3.4. Packaging Format

- 15.3.5. Distribution Channel

- 15.3.6. End-Use Application

- 15.3.7. Country

- 15.3.7.1. China

- 15.3.7.2. India

- 15.3.7.3. Japan

- 15.3.7.4. South Korea

- 15.3.7.5. Australia and New Zealand

- 15.3.7.6. Indonesia

- 15.3.7.7. Malaysia

- 15.3.7.8. Thailand

- 15.3.7.9. Vietnam

- 15.3.7.10. Rest of Asia Pacific

- 15.4. China Food Starch Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Starch Type

- 15.4.3. Functionality/ Application Purpose

- 15.4.4. Form & Physical Properties

- 15.4.5. Packaging Format

- 15.4.6. Distribution Channel

- 15.4.7. End-Use Application

- 15.5. India Food Starch Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Starch Type

- 15.5.3. Functionality/ Application Purpose

- 15.5.4. Form & Physical Properties

- 15.5.5. Packaging Format

- 15.5.6. Distribution Channel

- 15.5.7. End-Use Application

- 15.6. Japan Food Starch Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Starch Type

- 15.6.3. Functionality/ Application Purpose

- 15.6.4. Form & Physical Properties

- 15.6.5. Packaging Format

- 15.6.6. Distribution Channel

- 15.6.7. End-Use Application

- 15.7. South Korea Food Starch Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Starch Type

- 15.7.3. Functionality/ Application Purpose

- 15.7.4. Form & Physical Properties

- 15.7.5. Packaging Format

- 15.7.6. Distribution Channel

- 15.7.7. End-Use Application

- 15.8. Australia and New Zealand Food Starch Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Starch Type

- 15.8.3. Functionality/ Application Purpose

- 15.8.4. Form & Physical Properties

- 15.8.5. Packaging Format

- 15.8.6. Distribution Channel

- 15.8.7. End-Use Application

- 15.9. Indonesia Food Starch Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Starch Type

- 15.9.3. Functionality/ Application Purpose

- 15.9.4. Form & Physical Properties

- 15.9.5. Packaging Format

- 15.9.6. Distribution Channel

- 15.9.7. End-Use Application

- 15.10. Malaysia Food Starch Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Starch Type

- 15.10.3. Functionality/ Application Purpose

- 15.10.4. Form & Physical Properties

- 15.10.5. Packaging Format

- 15.10.6. Distribution Channel

- 15.10.7. End-Use Application

- 15.11. Thailand Food Starch Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Starch Type

- 15.11.3. Functionality/ Application Purpose

- 15.11.4. Form & Physical Properties

- 15.11.5. Packaging Format

- 15.11.6. Distribution Channel

- 15.11.7. End-Use Application

- 15.12. Vietnam Food Starch Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Starch Type

- 15.12.3. Functionality/ Application Purpose

- 15.12.4. Form & Physical Properties

- 15.12.5. Packaging Format

- 15.12.6. Distribution Channel

- 15.12.7. End-Use Application

- 15.13. Rest of Asia Pacific Food Starch Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Starch Type

- 15.13.3. Functionality/ Application Purpose

- 15.13.4. Form & Physical Properties

- 15.13.5. Packaging Format

- 15.13.6. Distribution Channel

- 15.13.7. End-Use Application

- 16. Middle East Food Starch Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Middle East Food Starch Market Size (Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 16.3.1. Starch Type

- 16.3.2. Functionality/ Application Purpose

- 16.3.3. Form & Physical Properties

- 16.3.4. Packaging Format

- 16.3.5. Distribution Channel

- 16.3.6. End-Use Application

- 16.3.7. Country

- 16.3.7.1. Turkey

- 16.3.7.2. UAE

- 16.3.7.3. Saudi Arabia

- 16.3.7.4. Israel

- 16.3.7.5. Rest of Middle East

- 16.4. Turkey Food Starch Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Starch Type

- 16.4.3. Functionality/ Application Purpose

- 16.4.4. Form & Physical Properties

- 16.4.5. Packaging Format

- 16.4.6. Distribution Channel

- 16.4.7. End-Use Application

- 16.5. UAE Food Starch Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Starch Type

- 16.5.3. Functionality/ Application Purpose

- 16.5.4. Form & Physical Properties

- 16.5.5. Packaging Format

- 16.5.6. Distribution Channel

- 16.5.7. End-Use Application

- 16.6. Saudi Arabia Food Starch Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Starch Type

- 16.6.3. Functionality/ Application Purpose

- 16.6.4. Form & Physical Properties

- 16.6.5. Packaging Format

- 16.6.6. Distribution Channel

- 16.6.7. End-Use Application

- 16.7. Israel Food Starch Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Starch Type

- 16.7.3. Functionality/ Application Purpose

- 16.7.4. Form & Physical Properties

- 16.7.5. Packaging Format

- 16.7.6. Distribution Channel

- 16.7.7. End-Use Application

- 16.8. Rest of Middle East Food Starch Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Starch Type

- 16.8.3. Functionality/ Application Purpose

- 16.8.4. Form & Physical Properties

- 16.8.5. Packaging Format

- 16.8.6. Distribution Channel

- 16.8.7. End-Use Application

- 17. Africa Food Starch Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Africa Food Starch Market Size (Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 17.3.1. Starch Type

- 17.3.2. Functionality/ Application Purpose

- 17.3.3. Form & Physical Properties

- 17.3.4. Packaging Format

- 17.3.5. Distribution Channel

- 17.3.6. End-Use Application

- 17.3.7. Country

- 17.3.7.1. South Africa

- 17.3.7.2. Egypt

- 17.3.7.3. Nigeria

- 17.3.7.4. Algeria

- 17.3.7.5. Rest of Africa

- 17.4. South Africa Food Starch Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Starch Type

- 17.4.3. Functionality/ Application Purpose

- 17.4.4. Form & Physical Properties

- 17.4.5. Packaging Format

- 17.4.6. Distribution Channel

- 17.4.7. End-Use Application

- 17.5. Egypt Food Starch Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Starch Type

- 17.5.3. Functionality/ Application Purpose

- 17.5.4. Form & Physical Properties

- 17.5.5. Packaging Format

- 17.5.6. Distribution Channel

- 17.5.7. End-Use Application

- 17.6. Nigeria Food Starch Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Starch Type

- 17.6.3. Functionality/ Application Purpose

- 17.6.4. Form & Physical Properties

- 17.6.5. Packaging Format

- 17.6.6. Distribution Channel

- 17.6.7. End-Use Application

- 17.7. Algeria Food Starch Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Starch Type

- 17.7.3. Functionality/ Application Purpose

- 17.7.4. Form & Physical Properties

- 17.7.5. Packaging Format

- 17.7.6. Distribution Channel

- 17.7.7. End-Use Application

- 17.8. Rest of Africa Food Starch Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Starch Type

- 17.8.3. Functionality/ Application Purpose

- 17.8.4. Form & Physical Properties

- 17.8.5. Packaging Format

- 17.8.6. Distribution Channel

- 17.8.7. End-Use Application

- 18. South America Food Starch Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Central and South Africa Food Starch Market Size (Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 18.3.1. Starch Type

- 18.3.2. Functionality/ Application Purpose

- 18.3.3. Form & Physical Properties

- 18.3.4. Packaging Format

- 18.3.5. Distribution Channel

- 18.3.6. End-Use Application

- 18.3.7. Country

- 18.3.7.1. Brazil

- 18.3.7.2. Argentina

- 18.3.7.3. Rest of South America

- 18.4. Brazil Food Starch Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Starch Type

- 18.4.3. Functionality/ Application Purpose

- 18.4.4. Form & Physical Properties

- 18.4.5. Packaging Format

- 18.4.6. Distribution Channel

- 18.4.7. End-Use Application

- 18.5. Argentina Food Starch Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Starch Type

- 18.5.3. Functionality/ Application Purpose

- 18.5.4. Form & Physical Properties

- 18.5.5. Packaging Format

- 18.5.6. Distribution Channel

- 18.5.7. End-Use Application

- 18.6. Rest of South America Food Starch Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Starch Type

- 18.6.3. Functionality/ Application Purpose

- 18.6.4. Form & Physical Properties

- 18.6.5. Packaging Format

- 18.6.6. Distribution Channel

- 18.6.7. End-Use Application

- 19. Key Players/ Company Profile

- 19.1. AGRANA Beteiligungs-AG

- 19.1.1. Company Details/ Overview

- 19.1.2. Company Financials

- 19.1.3. Key Customers and Competitors

- 19.1.4. Business/ Industry Portfolio

- 19.1.5. Product Portfolio/ Specification Details

- 19.1.6. Pricing Data

- 19.1.7. Strategic Overview

- 19.1.8. Recent Developments

- 19.2. Angel Starch & Food Pvt. Ltd.

- 19.3. Archer Daniels Midland Company (ADM)

- 19.4. Avebe U.A.

- 19.5. Cargill, Incorporated

- 19.6. China National Starch & Chemical Co.

- 19.7. Emsland Group

- 19.8. Grain Processing Corporation (GPC)

- 19.9. Gulshan Polyols Ltd.

- 19.10. Ingredion Incorporated

- 19.11. JP & SB International

- 19.12. KMC (Kartoffelmelcentralen)

- 19.13. Manildra Group

- 19.14. Roquette Frères

- 19.15. SPAC Starch Products (India) Ltd.

- 19.16. Südzucker AG (via BENEO GmbH)

- 19.17. Tate & Lyle PLC

- 19.18. Tereos Group

- 19.19. Universal Starch-Chem Allied Ltd.

- 19.20. Zhucheng Xingmao Corn Developing Co., Ltd.

- 19.21. Other Key Players

- 19.1. AGRANA Beteiligungs-AG

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation