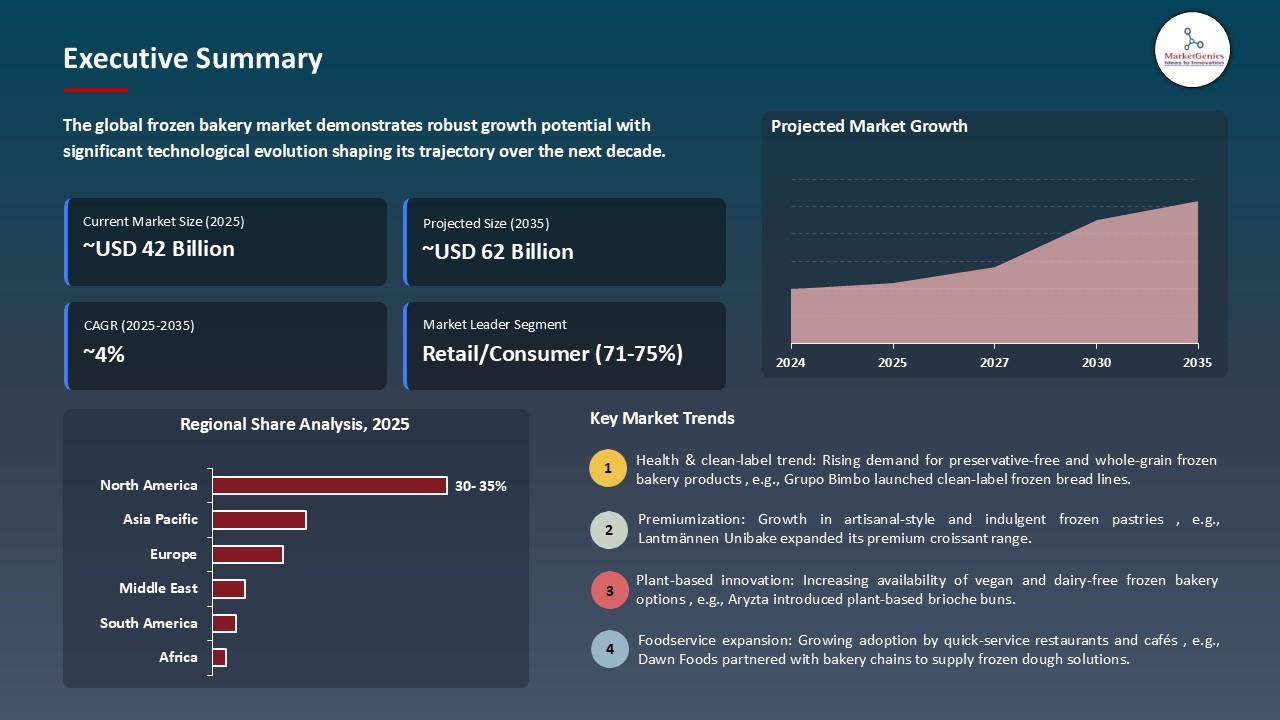

- The global frozen bakery market is valued at USD 42.4 billion in 2025.

- The market is projected to grow at a CAGR of 3.8% during the forecast period of 2026 to 2035.

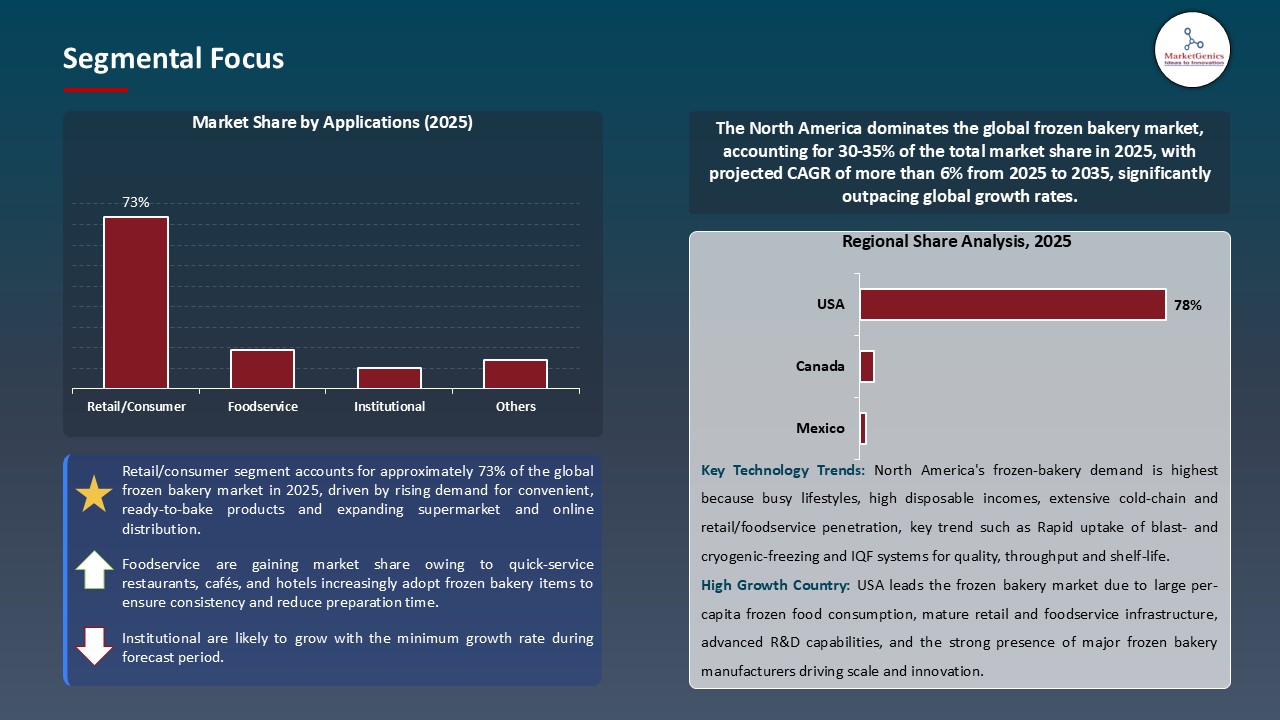

- The retail/consumer segment holds major share ~73% in the global frozen bakery market, driven by widespread supermarket and hypermarket availability and strong consumer preference for convenient, ready-to-bake products.

- Rising demand for health-focused bakery products: Growing consumer awareness and preference for clean-label, gluten-free, and high-fiber frozen bakery items are driving global adoption.

- Production and formulation innovations: Advances in frozen dough technology, bake-off systems, and ingredient solutions are enhancing product quality, consistency, and scalability across industrial and retail applications.

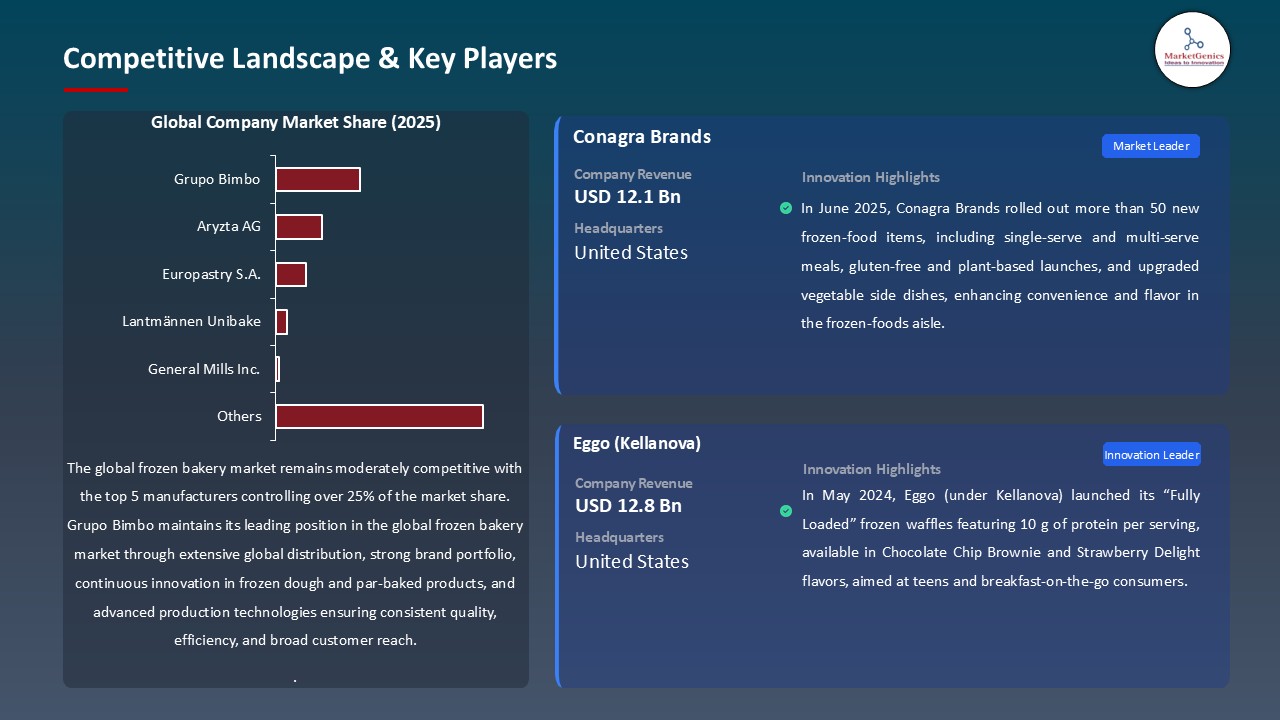

- The top five player’s accounts for over 25% of the global frozen-bakery-market in 2025.

- In January 2025, Ferrero launched its Nutella Bakery Range in Australia, featuring frozen croissants and muffins for direct baking, expanding Nutella into the frozen bakery segment.

- In December 2024, Furlani Foods acquired Cole’s Quality Foods, creating a leading frozen garlic‑bread provider for retail and foodservice.

- Global Frozen Bakery Market is likely to create the total forecasting opportunity of ~USD 19 Bn till 2035.

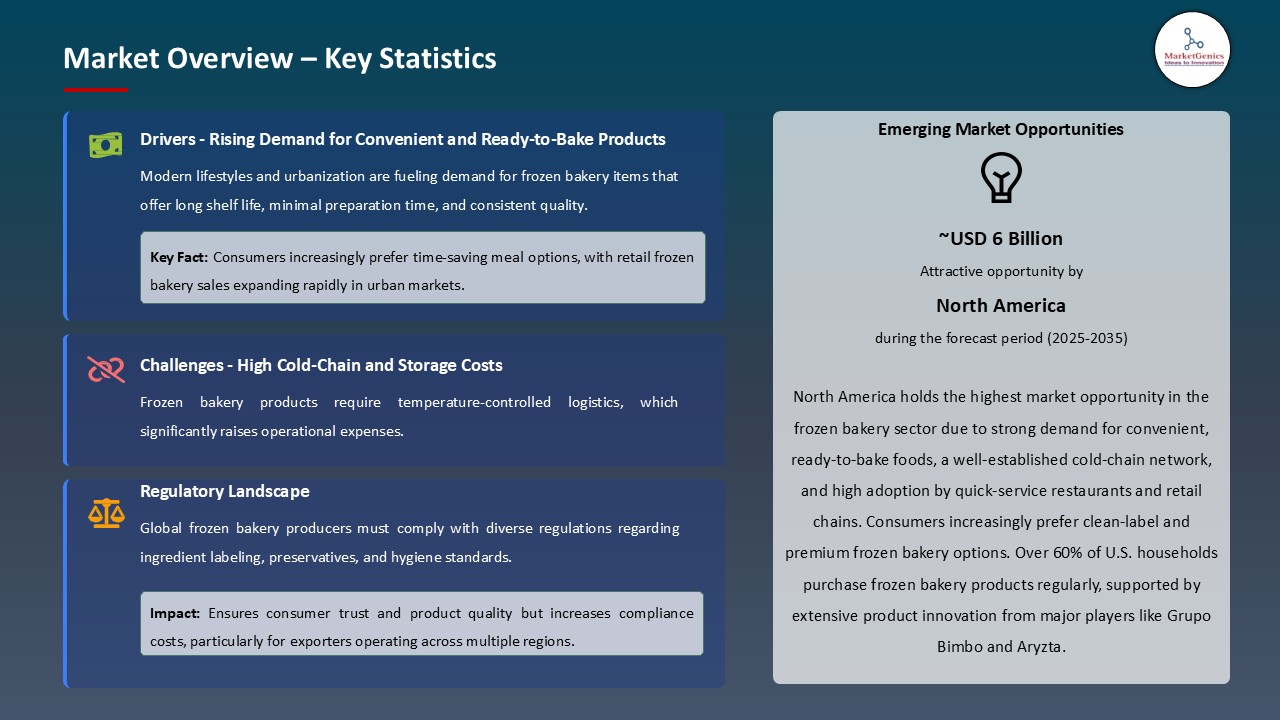

- North America leads the frozen bakery market, driven by health-conscious consumers, demand for clean-label, plant-based, and gluten-free products, and advanced cold-chain distribution.

- The global frozen bakery market is becoming more and more influenced by labour shortage and the wage pressure in foodservice and retail bakery operations. Fully-baked and par-baked frozen foods eliminate the need to rely on skilled workers, with the same consistency of quality, which makes them a cost-effective alternative to scratch baked products. The shift of workforce in the post-pandemic era, where more experienced bakers retire and younger workers are less motivated to work early-morning shifts, further enhances the popularity of frozen bakery solutions.

- Rising labor expenses and labor supply issues are compelling foodservice operators to embrace solutions that will minimize the use of trained bakers. For instance, with respect to the expanding use of frozen bakery solutions, Panera Bread shifted to frozen dough products in 2025, reducing on-site labor, enhancing efficiency, and ensuring product consistency.

- The economic argument in favor of adopting frozen bakery gets support through increases in minimum wages and living wage laws in some markets such as California and in large cities in Europe. Together with ongoing challenges in hiring and retaining talented bakers, these factors make frozen bakery a strategic operational choice and cause ongoing increase in demand in all foodservice, in-store bakery, and quick-service restaurant markets.

- The frozen bakery market is still struggling with the major headwinds that come in the form of consumer perceptions that frozen products are less quality and more industrialized with artificial ingredients. Such impressions limit the positioning of products as high-end and restrict their usage by those consumers who are quality conscious and can pay more to gain perceived authenticity and craftsmanship.

- High percentage of consumers consider fresh-baked products to be superior by default and will pay high premiums on be-baked fresh claims, highlighting a long-standing perception gap that limits market development. As a result, manufacturers of frozen bakery products tend to drive marketing on convenience, value, and long shelf-life over quality differentiation, despite the technology that has enabled taste, texture, and consistency to match or even surpass the traditional bakery products.

- Competition between artisanal bakeries seeking to focus on traditional baking, old grains, long fermented, and local sourcing is also increasing. Such operators set quality standards and set high prices, making further entry into high-end markets difficult with frozen bakery and penetrate only with convenience-driven customers.

- Specialty diets specialty diets offer the frozen bakery market outstanding growth prospects in terms of health consciousness, food intolerances, and lifestyle dietary trends such as gluten-free, plant-based/vegan, low-carbohydrate/keto, organic, and ancient grain formulations. These niche products have high prices, establish brand differentiation, reach a high income, health-conscious population with high brand loyalty and readiness to pay to obtain products that satisfy specific needs or match values.

- Specialty diet niches, including gluten-free and plant-based frozen bakery products with high-pricing power and consumer loyalty, are increasing in the frozen bakery market. In August 2025, Rudi’s Rocky Mountain Bakery introduced gluten-free Sandos with Justin Peanut Butter, aiming at the convenience snacking and lunchbox categories. This introduction underscores the growing need to have premium and health-centric frozen bakery products.

- This emphasis on specialty diets and high-end formulations has sustained sustainable growth and high margins and consumer loyalty, which shields manufacturers against price-based competition that is characteristic of the traditional frozen bakery products.

- The frozen bakery market is experiencing a technological revolution due to the high level of automation, the quality control provided by artificial intelligence and the IoT-based systems of smart bakery. Such innovations increase the consistency of products, minimize waste, maximize energy use, and allow mass customization that was available in the past only through craftsmanship, to offer competitive advantages in terms of operational effectiveness and speedy reaction to evolving consumer trends.

- Under this larger automation, the German unit of ARYZTA automated its packaging lines with new case erector and case sealer equipment of Lantech to replace old equipment in a small area. This indicates the trend in the industry to adopt smart, space-saving solutions in various production lines.

- Automation also enables personalization of products at industrial scale and limited-edition products. The flexibility of production lines, robots in the decorating process, and the development of the system of depositing allow responding quickly to changes in the season, the specificities of this or that region, and marketing campaigns, which is why the traditional trade-off between handwork and industry efficiency is eliminated.

- Automation, AI, and connectivity are revolutionizing frozen bread production to compete on quality, convenience, and value, while also supporting sustainability goals.

- The retail / consumer segment dominates the global frozen bakery market due to the high level of popularity of ready-to-eat or ready-to-bake frozen bakery products, the development of modern retail infrastructure (supermarkets, hypermarkets, online retail) and increased disposable incomes across the emerging regions.

- Manufacturers are launching more frozen bakery products that are targeted at consumers in retail outlets, new product formats, healthier formulations, and convenient packaging options. These actions indicate the trend of the high-value, consumer-friendly frozen bakery products that are attractive to health- and convenience-conscious shoppers.

- The retail channel is also dominant due to the favourable regulatory environment that governs frozen foods, retailer investments in cold-chain and frozen display, and the wider e-commerce delivery model of frozen bakery penetration.

- These aspects assure manufacturers to scale up production, introduce high-end versions, and exploit domestic consumption trends worldwide.

- North America leads the global frozen bakery market, because of high consumer health consciousness, great purchasing power, good regulatory frameworks, and the existence of major manufacturers and research centers. The market focuses on the quality of the products, innovation, and clean-label certifications, which stimulate a high uptake of frozen bakery products.

- Large companies are still increasing their product lines to meet the rising demand. For instance, in August 2024, Lancaster Colony Corporation, via its subsidiary New York Bakery, released its first gluten−free line of frozen bread in the U.S., Garlic Texas Toast and Five Cheese Texas Toast, using a patent pending dough formulation that preserves the feel and the volume of normal breads.

- This shows the move towards high end customer friendly bakery formats that cater to the health-conscious customers. High cold-chain logistics, high penetration between retail and foodservice and the robust R&D infrastructure serve to support the leadership of the region even more.

- North America leads the industry in frozen bakery product value and uptake due to its ability to ensure consistent product quality, maximize shelf-life, and innovate.

- In January 2025, Ferrero is introduced a Nutella Bakery Range in Australia, comprising Nutella Croissants and Nutella Muffins. The Muffins are prepared using sourdough and yoghurt to make them soft whereas the Croissants are crisp and buttery, and are frozen to be baked directly in the freezer. Such products are served through foodservice distributors Campbells Wholesale and PFD Foods, with the aim of accessing convenience and developing Nutella into the frozen bakery sector.

- In December 2024, Furlani Foods purchased Cole's Quality Foods to merge two big brands of frozen garlic-bread. The merger will establish a major provider of frozen garlic bread to retail and foodservice with the benefits of combined production capacity, innovation and supply-chain competencies.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Associated British Foods plc

- Bridgford Foods Corporation

- Cérélia Group

- Conagra Brands Inc.

- CSM Bakery Solutions

- Dawn Food Products Inc.

- Flowers Foods Inc.

- General Mills Inc.

- George Weston Limited

- Grupo Bimbo

- Europastry S.A.

- Kellogg Company

- Lantmännen Unibake

- Nestlé S.A.

- Palermo Villa Inc.

- Puratos Group

- Rich Products Corporation

- Aryzta AG

- Schwan's Company

- Vandemoortele NV

- Other Key Players

- Frozen Bread

- Frozen Cakes

- Frozen Pastries

- Frozen Pizza Crusts

- Frozen Cookies

- Frozen Doughnuts

- Frozen Muffins

- Frozen Pies & Tarts

- Others

- Leavened Dough

- Unleavened Dough

- Laminated Dough

- Choux Pastry Dough

- Others

- Par-baked

- Fully-baked

- Unbaked/Proof & Bake

- Ready-to-bake

- Online Retail

- Company Websites

- E-commerce Platforms

- Offline Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Discount Stores

- Others

- Foodservice

- Institutional

- Others

- Pouches

- Boxes

- Trays

- Bags

- Vacuum Sealed

- Modified Atmosphere Packaging (MAP)

- Conventional

- Organic

- Gluten-free

- Vegan

- Sugar-free

- Others

- Retail/Consumer

- Home Consumption

- Snacking

- Breakfast Solutions

- Dessert Applications

- Party & Celebration

- Others

- Foodservice

- Restaurant Service

- Hotel & Hospitality

- Café & Coffee Shops

- Catering Events

- In-flight Catering

- Cruise Line Services

- Others

- Institutional

- Healthcare Facilities

- Educational Institutions

- Corporate Offices

- Government Facilities

- Military & Defense

- Others

- Industrial/Manufacturing

- Food Processing Companies

- Sandwich Manufacturers

- Meal Kit Companies

- Private Label Manufacturing

- Others

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Frozen Bakery Market Outlook

- 2.1.1. Frozen Bakery Market Size Value (US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Frozen Bakery Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Food & Beverages Industry Overview, 2025

- 3.1.1. Food & Beverages Industry Ecosystem Analysis

- 3.1.2. Key Trends for Food & Beverages Industry

- 3.1.3. Regional Distribution for Food & Beverages Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Food & Beverages Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for convenient ready-to-eat / ready-to-bake bakery products.

- 4.1.1.2. Expansion of retail & foodservice channels plus improved cold-chain infrastructure.

- 4.1.1.3. Product innovation (clean-label, health/plant-based formats) and growth of online/food-delivery channels.

- 4.1.2. Restraints

- 4.1.2.1. High cold-chain, storage and transportation (energy) costs.

- 4.1.2.2. Supply-chain disruptions and fluctuating raw-material prices plus some consumer preference for freshly baked goods.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Manufacturing

- 4.4.3. Distribution

- 4.4.4. End-Use

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Frozen Bakery Market Demand

- 4.9.1. Historical Market Size – Volume (Tons) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Volume (Tons) and Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Frozen Bakery Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Frozen Bakery Market Size Value (US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Frozen Bread

- 6.2.2. Frozen Cakes

- 6.2.3. Frozen Pastries

- 6.2.4. Frozen Pizza Crusts

- 6.2.5. Frozen Cookies

- 6.2.6. Frozen Doughnuts

- 6.2.7. Frozen Muffins

- 6.2.8. Frozen Pies & Tarts

- 6.2.9. Others

- 7. Global Frozen Bakery Market Analysis, by Dough Type

- 7.1. Key Segment Analysis

- 7.2. Frozen Bakery Market Size Value (US$ Bn), Analysis, and Forecasts, by Dough Type, 2021-2035

- 7.2.1. Leavened Dough

- 7.2.2. Unleavened Dough

- 7.2.3. Laminated Dough

- 7.2.4. Choux Pastry Dough

- 7.2.5. Others

- 8. Global Frozen Bakery Market Analysis, by Processing Method

- 8.1. Key Segment Analysis

- 8.2. Frozen Bakery Market Size Value (US$ Bn), Analysis, and Forecasts, by Processing Method, 2021-2035

- 8.2.1. Par-baked

- 8.2.2. Fully-baked

- 8.2.3. Unbaked/Proof & Bake

- 8.2.4. Ready-to-bake

- 9. Global Frozen Bakery Market Analysis, by Distribution Channel

- 9.1. Key Segment Analysis

- 9.2. Frozen Bakery Market Size Value (US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 9.2.1. Online Retail

- 9.2.1.1. Company Websites

- 9.2.1.2. E-commerce Platforms

- 9.2.2. Offline Retail

- 9.2.2.1. Supermarkets/Hypermarkets

- 9.2.2.2. Convenience Stores

- 9.2.2.3. Specialty Stores

- 9.2.2.4. Discount Stores

- 9.2.2.5. Others

- 9.2.3. Foodservice

- 9.2.4. Institutional

- 9.2.5. Others

- 9.2.1. Online Retail

- 10. Global Frozen Bakery Market Analysis, by Packaging Type

- 10.1. Key Segment Analysis

- 10.2. Frozen Bakery Market Size Value (US$ Bn), Analysis, and Forecasts, by Packaging Type, 2021-2035

- 10.2.1. Pouches

- 10.2.2. Boxes

- 10.2.3. Trays

- 10.2.4. Bags

- 10.2.5. Vacuum Sealed

- 10.2.6. Modified Atmosphere Packaging (MAP)

- 11. Global Frozen Bakery Market Analysis, by Ingredient Type

- 11.1. Key Segment Analysis

- 11.2. Frozen Bakery Market Size Value (US$ Bn), Analysis, and Forecasts, by Ingredient Type, 2021-2035

- 11.2.1. Conventional

- 11.2.2. Organic

- 11.2.3. Gluten-free

- 11.2.4. Vegan

- 11.2.5. Sugar-free

- 11.2.6. Others

- 12. Global Frozen Bakery Market Analysis, by Applications

- 12.1. Key Segment Analysis

- 12.2. Frozen Bakery Market Size Value (US$ Bn), Analysis, and Forecasts, by Applications, 2021-2035

- 12.2.1. Retail/Consumer

- 12.2.1.1. Home Consumption

- 12.2.1.2. Snacking

- 12.2.1.3. Breakfast Solutions

- 12.2.1.4. Dessert Applications

- 12.2.1.5. Party & Celebration

- 12.2.1.6. Others

- 12.2.2. Foodservice

- 12.2.2.1. Restaurant Service

- 12.2.2.2. Hotel & Hospitality

- 12.2.2.3. Café & Coffee Shops

- 12.2.2.4. Catering Events

- 12.2.2.5. In-flight Catering

- 12.2.2.6. Cruise Line Services

- 12.2.2.7. Others

- 12.2.3. Institutional

- 12.2.3.1. Healthcare Facilities

- 12.2.3.2. Educational Institutions

- 12.2.3.3. Corporate Offices

- 12.2.3.4. Government Facilities

- 12.2.3.5. Military & Defense

- 12.2.3.6. Others

- 12.2.4. Industrial/Manufacturing

- 12.2.4.1. Food Processing Companies

- 12.2.4.2. Sandwich Manufacturers

- 12.2.4.3. Meal Kit Companies

- 12.2.4.4. Private Label Manufacturing

- 12.2.4.5. Others

- 12.2.1. Retail/Consumer

- 13. Global Frozen Bakery Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Frozen Bakery Market Size Value (US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Frozen Bakery Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Frozen Bakery Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Dough Type

- 14.3.3. Processing Method

- 14.3.4. Distribution Channel

- 14.3.5. Packaging Type

- 14.3.6. Ingredient Type

- 14.3.7. Applications

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Frozen Bakery Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Dough Type

- 14.4.4. Processing Method

- 14.4.5. Distribution Channel

- 14.4.6. Packaging Type

- 14.4.7. Ingredient Type

- 14.4.8. Applications

- 14.5. Canada Frozen Bakery Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Dough Type

- 14.5.4. Processing Method

- 14.5.5. Distribution Channel

- 14.5.6. Packaging Type

- 14.5.7. Ingredient Type

- 14.5.8. Applications

- 14.6. Mexico Frozen Bakery Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Dough Type

- 14.6.4. Processing Method

- 14.6.5. Distribution Channel

- 14.6.6. Packaging Type

- 14.6.7. Ingredient Type

- 14.6.8. Applications

- 15. Europe Frozen Bakery Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Frozen Bakery Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Dough Type

- 15.3.3. Processing Method

- 15.3.4. Distribution Channel

- 15.3.5. Packaging Type

- 15.3.6. Ingredient Type

- 15.3.7. Applications

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Frozen Bakery Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Dough Type

- 15.4.4. Processing Method

- 15.4.5. Distribution Channel

- 15.4.6. Packaging Type

- 15.4.7. Ingredient Type

- 15.4.8. Applications

- 15.5. United Kingdom Frozen Bakery Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Dough Type

- 15.5.4. Processing Method

- 15.5.5. Distribution Channel

- 15.5.6. Packaging Type

- 15.5.7. Ingredient Type

- 15.5.8. Applications

- 15.6. France Frozen Bakery Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Dough Type

- 15.6.4. Processing Method

- 15.6.5. Distribution Channel

- 15.6.6. Packaging Type

- 15.6.7. Ingredient Type

- 15.6.8. Applications

- 15.7. Italy Frozen Bakery Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Dough Type

- 15.7.4. Processing Method

- 15.7.5. Distribution Channel

- 15.7.6. Packaging Type

- 15.7.7. Ingredient Type

- 15.7.8. Applications

- 15.8. Spain Frozen Bakery Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Dough Type

- 15.8.4. Processing Method

- 15.8.5. Distribution Channel

- 15.8.6. Packaging Type

- 15.8.7. Ingredient Type

- 15.8.8. Applications

- 15.9. Netherlands Frozen Bakery Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Product Type

- 15.9.3. Dough Type

- 15.9.4. Processing Method

- 15.9.5. Distribution Channel

- 15.9.6. Packaging Type

- 15.9.7. Ingredient Type

- 15.9.8. Applications

- 15.10. Nordic Countries Frozen Bakery Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Product Type

- 15.10.3. Dough Type

- 15.10.4. Processing Method

- 15.10.5. Distribution Channel

- 15.10.6. Packaging Type

- 15.10.7. Ingredient Type

- 15.10.8. Applications

- 15.11. Poland Frozen Bakery Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Product Type

- 15.11.3. Dough Type

- 15.11.4. Processing Method

- 15.11.5. Distribution Channel

- 15.11.6. Packaging Type

- 15.11.7. Ingredient Type

- 15.11.8. Applications

- 15.12. Russia & CIS Frozen Bakery Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Product Type

- 15.12.3. Dough Type

- 15.12.4. Processing Method

- 15.12.5. Distribution Channel

- 15.12.6. Packaging Type

- 15.12.7. Ingredient Type

- 15.12.8. Applications

- 15.13. Rest of Europe Frozen Bakery Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Product Type

- 15.13.3. Dough Type

- 15.13.4. Processing Method

- 15.13.5. Distribution Channel

- 15.13.6. Packaging Type

- 15.13.7. Ingredient Type

- 15.13.8. Applications

- 16. Asia Pacific Frozen Bakery Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Asia Pacific Frozen Bakery Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Dough Type

- 16.3.3. Processing Method

- 16.3.4. Distribution Channel

- 16.3.5. Packaging Type

- 16.3.6. Ingredient Type

- 16.3.7. Applications

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Frozen Bakery Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Dough Type

- 16.4.4. Processing Method

- 16.4.5. Distribution Channel

- 16.4.6. Packaging Type

- 16.4.7. Ingredient Type

- 16.4.8. Applications

- 16.5. India Frozen Bakery Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Dough Type

- 16.5.4. Processing Method

- 16.5.5. Distribution Channel

- 16.5.6. Packaging Type

- 16.5.7. Ingredient Type

- 16.5.8. Applications

- 16.6. Japan Frozen Bakery Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Dough Type

- 16.6.4. Processing Method

- 16.6.5. Distribution Channel

- 16.6.6. Packaging Type

- 16.6.7. Ingredient Type

- 16.6.8. Applications

- 16.7. South Korea Frozen Bakery Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Dough Type

- 16.7.4. Processing Method

- 16.7.5. Distribution Channel

- 16.7.6. Packaging Type

- 16.7.7. Ingredient Type

- 16.7.8. Applications

- 16.8. Australia and New Zealand Frozen Bakery Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Dough Type

- 16.8.4. Processing Method

- 16.8.5. Distribution Channel

- 16.8.6. Packaging Type

- 16.8.7. Ingredient Type

- 16.8.8. Applications

- 16.9. Indonesia Frozen Bakery Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Dough Type

- 16.9.4. Processing Method

- 16.9.5. Distribution Channel

- 16.9.6. Packaging Type

- 16.9.7. Ingredient Type

- 16.9.8. Applications

- 16.10. Malaysia Frozen Bakery Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Dough Type

- 16.10.4. Processing Method

- 16.10.5. Distribution Channel

- 16.10.6. Packaging Type

- 16.10.7. Ingredient Type

- 16.10.8. Applications

- 16.11. Thailand Frozen Bakery Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Dough Type

- 16.11.4. Processing Method

- 16.11.5. Distribution Channel

- 16.11.6. Packaging Type

- 16.11.7. Ingredient Type

- 16.11.8. Applications

- 16.12. Vietnam Frozen Bakery Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Dough Type

- 16.12.4. Processing Method

- 16.12.5. Distribution Channel

- 16.12.6. Packaging Type

- 16.12.7. Ingredient Type

- 16.12.8. Applications

- 16.13. Rest of Asia Pacific Frozen Bakery Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Dough Type

- 16.13.4. Processing Method

- 16.13.5. Distribution Channel

- 16.13.6. Packaging Type

- 16.13.7. Ingredient Type

- 16.13.8. Applications

- 17. Middle East Frozen Bakery Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Frozen Bakery Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Dough Type

- 17.3.3. Processing Method

- 17.3.4. Distribution Channel

- 17.3.5. Packaging Type

- 17.3.6. Ingredient Type

- 17.3.7. Applications

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Frozen Bakery Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Dough Type

- 17.4.4. Processing Method

- 17.4.5. Distribution Channel

- 17.4.6. Packaging Type

- 17.4.7. Ingredient Type

- 17.4.8. Applications

- 17.5. UAE Frozen Bakery Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Dough Type

- 17.5.4. Processing Method

- 17.5.5. Distribution Channel

- 17.5.6. Packaging Type

- 17.5.7. Ingredient Type

- 17.5.8. Applications

- 17.6. Saudi Arabia Frozen Bakery Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Dough Type

- 17.6.4. Processing Method

- 17.6.5. Distribution Channel

- 17.6.6. Packaging Type

- 17.6.7. Ingredient Type

- 17.6.8. Applications

- 17.7. Israel Frozen Bakery Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Dough Type

- 17.7.4. Processing Method

- 17.7.5. Distribution Channel

- 17.7.6. Packaging Type

- 17.7.7. Ingredient Type

- 17.7.8. Applications

- 17.8. Rest of Middle East Frozen Bakery Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Dough Type

- 17.8.4. Processing Method

- 17.8.5. Distribution Channel

- 17.8.6. Packaging Type

- 17.8.7. Ingredient Type

- 17.8.8. Applications

- 18. Africa Frozen Bakery Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Frozen Bakery Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Dough Type

- 18.3.3. Processing Method

- 18.3.4. Distribution Channel

- 18.3.5. Packaging Type

- 18.3.6. Ingredient Type

- 18.3.7. Applications

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Frozen Bakery Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Dough Type

- 18.4.4. Processing Method

- 18.4.5. Distribution Channel

- 18.4.6. Packaging Type

- 18.4.7. Ingredient Type

- 18.4.8. Applications

- 18.5. Egypt Frozen Bakery Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Dough Type

- 18.5.4. Processing Method

- 18.5.5. Distribution Channel

- 18.5.6. Packaging Type

- 18.5.7. Ingredient Type

- 18.5.8. Applications

- 18.6. Nigeria Frozen Bakery Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Dough Type

- 18.6.4. Processing Method

- 18.6.5. Distribution Channel

- 18.6.6. Packaging Type

- 18.6.7. Ingredient Type

- 18.6.8. Applications

- 18.7. Algeria Frozen Bakery Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Dough Type

- 18.7.4. Processing Method

- 18.7.5. Distribution Channel

- 18.7.6. Packaging Type

- 18.7.7. Ingredient Type

- 18.7.8. Applications

- 18.8. Rest of Africa Frozen Bakery Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Dough Type

- 18.8.4. Processing Method

- 18.8.5. Distribution Channel

- 18.8.6. Packaging Type

- 18.8.7. Ingredient Type

- 18.8.8. Applications

- 19. South America Frozen Bakery Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. South America Frozen Bakery Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Dough Type

- 19.3.3. Processing Method

- 19.3.4. Distribution Channel

- 19.3.5. Packaging Type

- 19.3.6. Ingredient Type

- 19.3.7. Applications

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Frozen Bakery Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Dough Type

- 19.4.4. Processing Method

- 19.4.5. Distribution Channel

- 19.4.6. Packaging Type

- 19.4.7. Ingredient Type

- 19.4.8. Applications

- 19.5. Argentina Frozen Bakery Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Dough Type

- 19.5.4. Processing Method

- 19.5.5. Distribution Channel

- 19.5.6. Packaging Type

- 19.5.7. Ingredient Type

- 19.5.8. Applications

- 19.6. Rest of South America Frozen Bakery Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Dough Type

- 19.6.4. Processing Method

- 19.6.5. Distribution Channel

- 19.6.6. Packaging Type

- 19.6.7. Ingredient Type

- 19.6.8. Applications

- 20. Key Players/ Company Profile

- 20.1. Aryzta AG

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Associated British Foods plc

- 20.3. Bridgford Foods Corporation

- 20.4. Cérélia Group

- 20.5. Conagra Brands Inc.

- 20.6. CSM Bakery Solutions

- 20.7. Dawn Food Products Inc.

- 20.8. Europastry S.A.

- 20.9. Flowers Foods Inc.

- 20.10. General Mills Inc.

- 20.11. George Weston Limited

- 20.12. Grupo Bimbo

- 20.13. Kellogg Company

- 20.14. Lantmännen Unibake

- 20.15. Nestlé S.A.

- 20.16. Palermo Villa Inc.

- 20.17. Puratos Group

- 20.18. Rich Products Corporation

- 20.19. Schwan's Company

- 20.20. Vandemoortele NV

- 20.21. Other Key Players

- 20.1. Aryzta AG

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Frozen Bakery Market Size, Share & Trends Analysis Report by Product Type (Frozen Bread, Frozen Cakes, Frozen Pastries, Frozen Pizza Crusts, Frozen Cookies, Frozen Doughnuts, Frozen Muffins, Frozen Pies & Tarts, Others), Dough Type, Processing Method, Distribution Channel, Packaging Type, Ingredient Type, Applications, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Frozen Bakery Market Size, Share, and Growth

The global frozen bakery market is experiencing robust growth, with its estimated value of USD 42.4 billion in the year 2025 and USD 61.6 billion by the period 2035, registering a CAGR of 3.8%, during the forecast period. The global frozen bakery market is expanding because of the increased health awareness and the need to have natural and clean label products. Low-sugar, gluten-free and whole-grain products, as well as increased distribution, are driving the adoption throughout the world.

Edita Frozen Food Industries said, This new frozen bakery line builds on the success of Molto Forni, our flagship consumer brand. Molto Forni has become recognized for its range of frozen croissants, puff pastries, pizzas, and sweet pies, with our frozen pizza now the market leader in Egypt. These products are available nationwide across all governorates and leading modern trade outlets, allowing consumers convenient access to high-quality frozen bakery options.

The frozen bakery market is fuelled by the increasing consumer demand on convenience without sacrificing the quality and growth of the out-of-home consumption channels. There is a growing demand among the modern consumer of bakery products that are artisan in quality, fresh in taste and convenient at home, retail and foodservice. For instance, in October 2025, Magnolia Table introduced a frozen baked-goods brand in the U.S. grocery chain, which consisted of buttermilk biscuits, chocolate-chip cookies, cinnamon rolls, and banana bread, as a product that would recreate the quality of homemade bakeries with the convenience of the freezer and oven.

Ongoing advances in technology in the freezing, dough conditioning and bake-off systems have reduced the quality differences between frozen and fresh baked products, providing operational efficiency and retained sensory properties. These developments lower skills and time to production, making it possible to produce high-quality output in large quantities.

The market is also advantageous with adjacent opportunities in frozen desserts, high-end ice-cream, frozen breakfast, specialty diet bakery products (gluten-free, keto, plant-based) and foodservice equipment. These complementary segments generate ecosystem synergies, enabling frozen bakery producers to face the various consumption situations, dietary choices and operating conditions, whether at home kitchens or commercial bakery and restaurants.

Frozen Bakery Market Dynamics and Trends

Driver: Labor Shortages and Cost Pressures in Foodservice Operations

Restraint: Consumer Perception and Artisanal Bakery Competition

Opportunity: Health-Conscious and Specialty Diet Product Innovation

Key Trend: Automation, AI-Driven Quality Control, and Smart Bakeries

Frozen Bakery Market Analysis and Segmental Data

Retail/Consumer Dominate Global Frozen Bakery Market

North America Leads Global Frozen Bakery Market Demand

Frozen-Bakery-Market Ecosystem

The frozen bakery market is moderately concentrated with a distinct regional specialization and different levels of vertical integration across the whole industry. Large global companies such as Grupo Bimbo, Aryzta AG, Europastry S.A., Lantmännen Unibake and General Mills Inc. are dominant by large production networks, diversified product lines, technological developments as well as the relationships with major retailers and foodservice providers. These companies efficiently position themselves close to ingredient suppliers and target markets so that sourcing and delivering are easy, and they invest in research and development, customer research and technical assistance to streamline bake-off operations and menu customization.

Regional experts, ingredient suppliers, and own label manufacturers specialize in product categories, geographies or channel, and compete based on specialized knowledge instead of volume. The value chain extends to ingredient sourcing, dough development, shaping, proofing, par-baking, freezing, packaging and cold-chain distribution and automation and tight control of processes has become increasingly important.

Market leaders are further differentiated by incorporation of technology. As an example, the strategic collaboration between Aryzta and Microsoft is based on predictive maintenance and optimization of processes using AI, which improves operational efficiency and quality of products.

The entry barriers resulting from the combination of capital-intensive facilities, requirement of technical expertise, complex logistics, and the established customer relations make the market stable and undergo further consolidation of smaller, less-scaled players.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 42.2 Bn |

|

Market Forecast Value in 2035 |

USD 61.6 Bn |

|

Growth Rate (CAGR) |

3.8% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Frozen-Bakery-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Frozen Bakery Market, By Product Type |

|

|

Frozen Bakery Market, By Dough Type |

|

|

Frozen Bakery Market, By Processing Method |

|

|

Frozen Bakery Market, By Distribution Channel |

|

|

Frozen Bakery Market, By Packaging Type |

|

|

Frozen Bakery Market, By Ingredient Type |

|

|

Frozen Bakery Market, By Applications |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation