- The global insect-based animal feed market is valued at USD 0.7 billion in 2025.

- The market is projected to grow at a CAGR of 12.7% during the forecast period of 2026 to 2035.

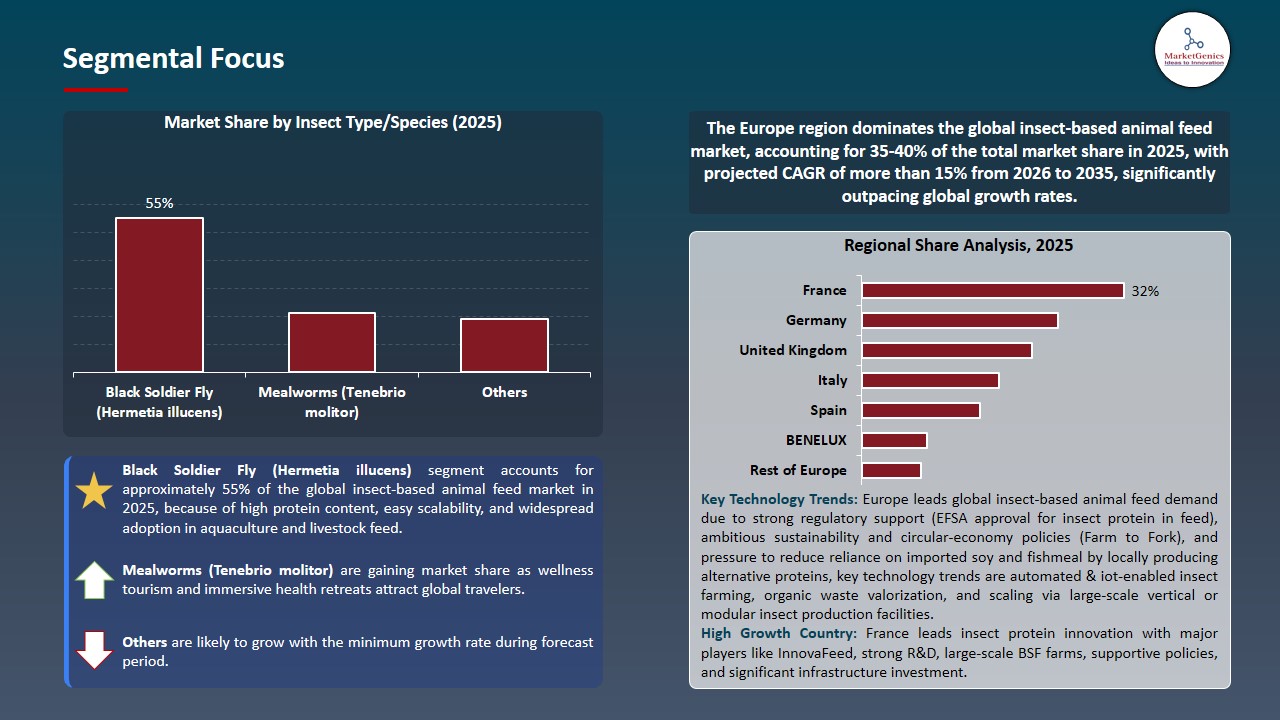

- The black soldier fly (hermetia illucens) segment holds major share ~55% in the global insect-based animal feed market, due to high protein content, easy scalability, and widespread adoption in aquaculture and livestock feed.

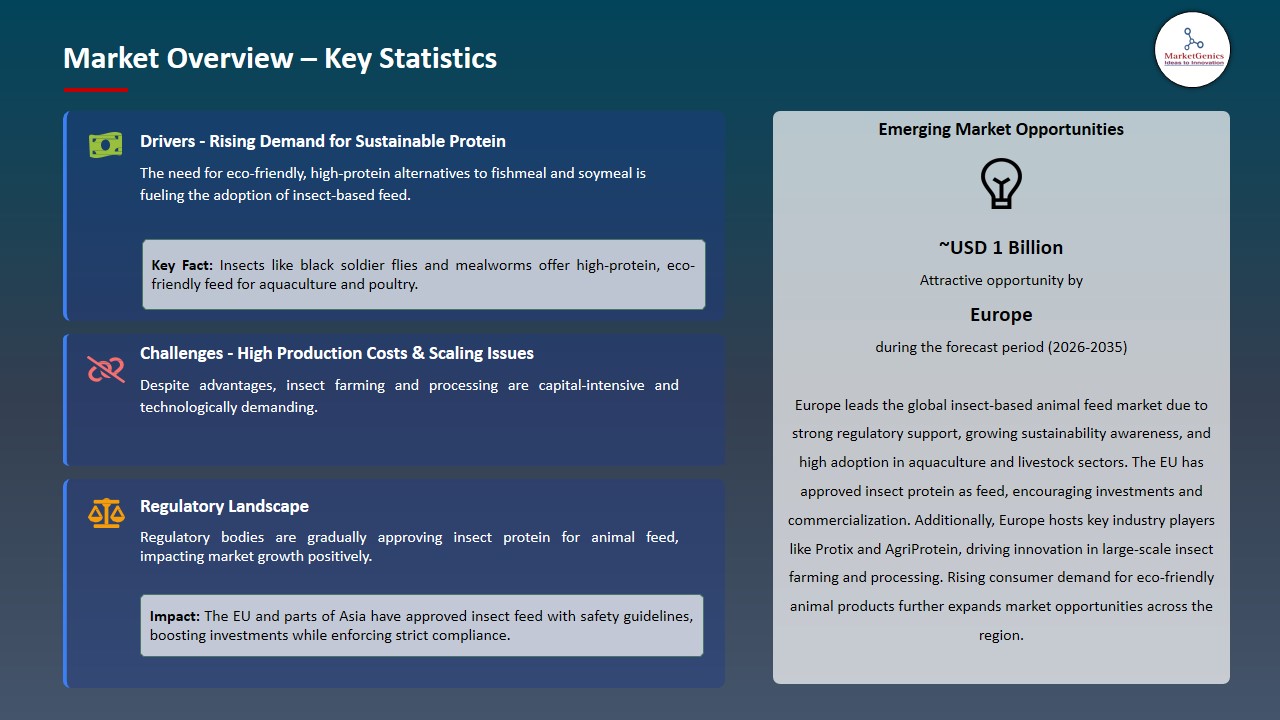

- The insect-based animal feed market growing due to increasing demand for insect protein in fish and shrimp feed as a sustainable, high‑nutrition alternative to fishmeal.

- The insect-based animal feed market is driven by organic waste is increasingly used as substrate for insect farming, aligning with sustainability goals.

- The top five players accounting for nearly 40% of the global insect-based animal feed market share in 2025.

- In February 2025, Insectika Biotech launched “YuM Pro” and “YuM TuM” insect-protein fish feeds in collaboration with CIBA, reducing dependence on traditional fish meal.

- In August 2024, Agroloop partnered with WEDA to scale its BSF larva facility using automated systems for efficient by‑product conversion into insect protein.

- Global Insect-Based Animal Feed Market is likely to create the total forecasting opportunity of ~USD 2 Bn till 2035.

- Europe is most attractive region due to EFSA-approved insect protein, strong sustainability and circular‑economy policies, and efforts to reduce reliance on imported soy and fishmeal through local alternative protein production.

-

The global insect-based animal feed market growth is due to increasing need of sustainable sources of proteins in aquaculture as the producers strive to lessen reliance on fishmeal and soy linked to environmental and supply-chain hazards. Insect proteins provide nutritional benefits that are high-quality and have lower environmental costs, use regulation-oriented strategies, and brand resilience in the growing fish and shrimp sectors.

- For instance, in September 2025, Innovafeed signed a strategic alliance with BioMar Group and Auchan Retail to incorporate black soldier fly larvae insect-meal in commercial shrimp feed in Ecuador, the first-ever large-scale roll-out in the aquaculture value chain. This collaboration accelerates mass incorporation of insect protein in aquaculture feed, strengthening commercial validation and supply-chain confidence.

- This is strengthening the role of insects as a scalable, low-carbon feed ingredient in aquaculture, which puts the market in the position to become cost-competitive and expand its application in a wider range of mainstream feeds.

-

The global insect-based animal feed market expansion is limited by the requirement of financial viability and scale because costs of production are still more than conventional proteins, including soymeal and fishmeal, limiting infiltration into large-volume livestock and aquaculture feeds markets. For example, the production cost is higher than the commodity feed levels, which undermines the margins and reduces investor confidence.

- Moreover, scaling production of insects needs huge amounts in capital investments on specialized equipment, automation, and substrate logistics, and feedstock and regulatory restrictions add complexity and expense to operations. For instance, in 2024, Ynsect announced cash-flow-related problems and slow expansion plans contribute to the hindrance of industrial-scale implementation, with the company launching a safeguard plan because of financial difficulties.

- Insect-meal adoption is likely to remain concentrated in higher-value segments due to the increased production costs and scale-up risks, which will postpone cost parity with conventional feed proteins.

-

The global insect-based animal feed market presents an opportunity through commercialization of frass as a high-energy organic fertilizer and the establishment of waste-to-value collaborations with food processing, offering low-cost animal feed and adding to sustainability advantages and establishing new sources of revenue to optimize operational economics.

- For instance, in February 2024, Innovafeed presenting Hilucia Frass, a commercialized insect-derived waste, a pelletized organic soil amendment. Frass commercialization will generate additional sources of revenue as well as improving sustainability and operational efficiency.

- Additionally, manufacturers of high-end pet-foods are starting to embrace the use of insect proteins in hypoallergenic, high-digestibility, and environmentally-friendly formulations. This increasing demand justifies increased price achievement, nutritional achievements, and market penetration of insect-based ingredients in all sectors of global companion-animal nutrition segments.

- The increase in the use of insect proteins in high-end pet food leads to revenue growth, market growth, and a widening acceptance of sustainable and high-quality feed materials.

-

The global insect-based animal feed market is becoming more influenced by automation and digitalization which allows the scaleable, efficient and traceable production of animal feeds. The major companies, like Buhler Insect Technology Solutions, are implementing entirely automated chains of processes with the feed-stock handling, insect rearing, separation and extraction, thus decreasing labour intensity, improving traceability and making production at large scale.

- Additionally, insect production systems are also being streamlined into precision farming technologies like controlled nutrient delivery, automated environmental management and using data-driven growth modelling to enhance consistency, productivity and resource efficiency.

- For instance, precision-farming adoption in insect production the system of insect production that has adopted the use of precision-farming is the Entosight Neo optical dosing system. The technology involves automated sensor networks and computer vision in order to deliver neonate larvae into trays of rearing facilities with high accuracy, maximizing the stocking density and growth uniformity.

- The automation, digitalization, and precision-farming technologies are eliminating fundamental production limitations and are allowing the supply of insect-based feed markets to scale, be efficient, and sustainable at scale.

-

The black soldier fly (hermetia illucens) segment dominates the global insect-based animal feed market because of the high protein and lipid content of black soldier fly (hermetia illucens) larvae, combined with the significant feed-conversion efficiency, means that the insect is a preferred ingredient in aquaculture, poultry and pet-food feed.

- For instance, in January 2024, European Investment Bank loaned Protix 37 million Euro to construct a large Black Soldier Fly manufacturing site in Poland, greatly increasing its protein production based on BSF. Increased production in BSF enhances the supply and boost production in aquaculture and pet-food markets.

- Additionally, black soldier fly larvae can be reared through organic waste streams in a sustainable manner, which eliminates environmental impact, offers cost-efficient, circular-feedstock solutions and further increases market demand.

- The sustainable black soldier, raised on organic waste, decreases environmental impact, boosts cost efficiency, and expands market reach.

-

Europe leads the global insect-based animal feed market is because of European consumers increasingly prefer of sustainably produced animal products, which causes producers of feed to incorporate insect protein into the feed of livestock. For instance, in May 2025, Volare increased its BSF production in Finland to serve European salmon farms as a response to the eco-friendly market trends.

- Moreover, the progressive regulatory systems and approval systems of insect-derived proteins in aquaculture and poultry feed in Europe make its uptake. For instance, in 2024, the European Commission authorized increased use of Black Soldier Fly protein in chicken food, allowing such companies as Protix and Innovafeed to expand throughout the EU.

- Furthermore, large-scale production plants of insect farming products enhance grace of supply chains and lower unit costs, which allow the market to grow. For instance, in December 2024, Agroloop inaugurated one of the most significant alternative animal feed protein facilities in Hungary with a €30 million investment to transform byproducts of the food-industry into protein, oil, and organic fertilizer produced BSF.

- Strong legislation, high consumer demand, and targeted investments are driving Europe's supremacy in the worldwide insect-based animal feed sector.

-

In February 2025, Insectika Biotech (India/Israel) in partnership with CIBA launched its first insect-protein-based fish feed products in Asian sea bass (as YuM Pro) and ornamental aquarium (as YuM TuM) to offer a sustainable alternative to traditional fish meal.

- In August 2024, Agroloop collaborated with WEDA to construct its BSF larva rearing facility, a German technology supplier, utilizing automated mixing and feed kitchen systems to convert feed-grade byproducts into insect protein.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Agronutris

- Aspire Food Group

- Beta Hatch

- Enterra Feed Corporation

- Entobel

- Entocube

- Entomo Farms

- Entomotech

- EnviroFlight (Darling Ingredients)

- Hexafly

- Hipromine

- Innovafeed

- Nutrition Technologies

- Proti-Farm

- NextProtein

- Tebrio

- Ÿnsect

- Protix

- Other Key Players

- Black Soldier Fly (Hermetia illucens)

- Larvae

- Prepupae

- Dried whole insects

- Others

- Mealworms (Tenebrio molitor)

- Yellow mealworm

- Giant mealworm

- Crickets

- House cricket (Acheta domesticus)

- Banded cricket (Gryllodes sigillatus)

- Silkworms (Bombyx mori)

- Locusts and Grasshoppers

- Flies (Housefly/Musca domestica)

- Others

- Whole Dried Insects

- Insect Meal/Powder

- Insect Protein Concentrate

- Insect Oil/Fat

- Frozen Insects

- Live Insects

- Insect Protein Hydrolysate

- Frass

- Aquaculture Feed

- Fish feed

- Shrimp feed

- Other aquatic species

- Poultry Feed

- Broilers

- Layers

- Breeding stock

- Others

- Swine Feed

- Piglets

- Growers

- Sows

- Others

- Pet Food

- Dogs

- Cats

- Exotic pets

- Reptiles

- Others

- Cattle Feed

- Equine Feed

- Others (Zoo animals, Wildlife)

- Conventional/Industrial Scale

- Automated systems

- Semi-automated systems

- Organic Production

- Vertical Farming

- Container-Based Production

- Traditional/Small-Scale

- Drying Technology

- Freeze drying

- Spray drying

- Hot air drying

- Solar drying

- Others

- Defatting Process

- Mechanical pressing

- Grinding/Milling

- Extrusion

- Fermentation

- Enzymatic Hydrolysis

- High Protein (>60%)

- Medium Protein (40-60%)

- Low Protein (<40%)

- Protein Enriched

- Direct Sales

- Distributors/Wholesalers

- Online/E-commerce Platforms

- Retail Stores

- Feed Integrators

- Organic Waste

- Food waste

- Agricultural waste

- Brewery waste

- Grain-Based Substrates

- By-Products

- Vegetable waste

- Fruit waste

- Certified Organic Substrates

- Mixed Substrates

- Bulk Packaging

- Bags (25-50 kg)

- Small Retail Packs (<10 kg)

- Intermediate Bulk Containers (IBC)

- Vacuum-Sealed Packaging

- Complete Feed Formulation

- Feed Supplement/Additive

- Protein Replacement

- Nutritional Enrichment

- Treat/Reward

- Others

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Insect-Based Animal Feed Market Outlook

- 2.1.1. Insect-Based Animal Feed Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Insect-Based Animal Feed Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Agriculture Industry Overview, 2025

- 3.1.1. Agriculture Industry Ecosystem Analysis

- 3.1.2. Key Trends for Agriculture Industry

- 3.1.3. Regional Distribution for Agriculture Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Agriculture Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for sustainable and alternative protein sources in animal feed

- 4.1.1.2. Circular economy potential by converting organic waste into insect biomass

- 4.1.1.3. Technological advancements in insect farming and processing

- 4.1.2. Restraints

- 4.1.2.1. High initial investment and production scaling challenges

- 4.1.2.2. Regulatory uncertainty and complex approval frameworks

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Insect-Based Animal Feed Manufacturers

- 4.4.3. Distribution & Supply Chain

- 4.4.4. End-Users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Insect-Based Animal Feed Market Demand

- 4.7.1. Historical Market Size –Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size –Value (US$ Bn), 2026–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Insect-Based Animal Feed Market Analysis, by Insect Type/Species

- 6.1. Key Segment Analysis

- 6.2. Insect-Based Animal Feed Market Size (Value - US$ Bn), Analysis, and Forecasts, by Insect Type/Species, 2021-2035

- 6.2.1. Black Soldier Fly (Hermetia illucens)

- 6.2.1.1. Larvae

- 6.2.1.2. Prepupae

- 6.2.1.3. Dried whole insects

- 6.2.1.4. Others

- 6.2.2. Mealworms (Tenebrio molitor)

- 6.2.2.1. Yellow mealworm

- 6.2.2.2. Giant mealworm

- 6.2.3. Crickets

- 6.2.3.1. House cricket (Acheta domesticus)

- 6.2.3.2. Banded cricket (Gryllodes sigillatus)

- 6.2.4. Silkworms (Bombyx mori)

- 6.2.5. Locusts and Grasshoppers

- 6.2.6. Flies (Housefly/Musca domestica)

- 6.2.7. Others

- 6.2.1. Black Soldier Fly (Hermetia illucens)

- 7. Global Insect-Based Animal Feed Market Analysis, by Product Form

- 7.1. Key Segment Analysis

- 7.2. Insect-Based Animal Feed Market Size (Value - US$ Bn), Analysis, and Forecasts, by Product Form, 2021-2035

- 7.2.1. Whole Dried Insects

- 7.2.2. Insect Meal/Powder

- 7.2.3. Insect Protein Concentrate

- 7.2.4. Insect Oil/Fat

- 7.2.5. Frozen Insects

- 7.2.6. Live Insects

- 7.2.7. Insect Protein Hydrolysate

- 7.2.8. Frass

- 8. Global Insect-Based Animal Feed Market Analysis, by Animal Type

- 8.1. Key Segment Analysis

- 8.2. Insect-Based Animal Feed Market Size (Value - US$ Bn), Analysis, and Forecasts, by Animal Type, 2021-2035

- 8.2.1. Aquaculture Feed

- 8.2.1.1. Fish feed

- 8.2.1.2. Shrimp feed

- 8.2.1.3. Other aquatic species

- 8.2.2. Poultry Feed

- 8.2.2.1. Broilers

- 8.2.2.2. Layers

- 8.2.2.3. Breeding stock

- 8.2.2.4. Others

- 8.2.3. Swine Feed

- 8.2.3.1. Piglets

- 8.2.3.2. Growers

- 8.2.3.3. Sows

- 8.2.3.4. Others

- 8.2.4. Pet Food

- 8.2.4.1. Dogs

- 8.2.4.2. Cats

- 8.2.4.3. Exotic pets

- 8.2.4.4. Reptiles

- 8.2.4.5. Others

- 8.2.5. Cattle Feed

- 8.2.6. Equine Feed

- 8.2.7. Others (Zoo animals, Wildlife)

- 8.2.1. Aquaculture Feed

- 9. Global Insect-Based Animal Feed Market Analysis, by Production Method

- 9.1. Key Segment Analysis

- 9.2. Insect-Based Animal Feed Market Size (Value - US$ Bn), Analysis, and Forecasts, by Production Method, 2021-2035

- 9.2.1. Conventional/Industrial Scale

- 9.2.1.1. Automated systems

- 9.2.1.2. Semi-automated systems

- 9.2.2. Organic Production

- 9.2.3. Vertical Farming

- 9.2.4. Container-Based Production

- 9.2.5. Traditional/Small-Scale

- 9.2.1. Conventional/Industrial Scale

- 10. Global Insect-Based Animal Feed Market Analysis, by Processing Technology

- 10.1. Key Segment Analysis

- 10.2. Insect-Based Animal Feed Market Size (Value - US$ Bn), Analysis, and Forecasts, by Processing Technology, 2021-2035

- 10.2.1. Drying Technology

- 10.2.1.1. Freeze drying

- 10.2.1.2. Spray drying

- 10.2.1.3. Hot air drying

- 10.2.1.4. Solar drying

- 10.2.1.5. Others

- 10.2.2. Defatting Process

- 10.2.2.1. Mechanical pressing

- 10.2.2.2. Grinding/Milling

- 10.2.3. Extrusion

- 10.2.4. Fermentation

- 10.2.5. Enzymatic Hydrolysis

- 10.2.1. Drying Technology

- 11. Global Insect-Based Animal Feed Market Analysis, by Protein Content

- 11.1. Key Segment Analysis

- 11.2. Insect-Based Animal Feed Market Size (Value - US$ Bn), Analysis, and Forecasts, by Protein Content, 2021-2035

- 11.2.1. High Protein (>60%)

- 11.2.2. Medium Protein (40-60%)

- 11.2.3. Low Protein (<40%)

- 11.2.4. Protein Enriched

- 12. Global Insect-Based Animal Feed Market Analysis, by Distribution Channel

- 12.1. Key Segment Analysis

- 12.2. Insect-Based Animal Feed Market Size (Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 12.2.1. Direct Sales

- 12.2.2. Distributors/Wholesalers

- 12.2.3. Online/E-commerce Platforms

- 12.2.4. Retail Stores

- 12.2.5. Feed Integrators

- 13. Global Insect-Based Animal Feed Market Analysis, by Feed Substrate/Feedstock Used

- 13.1. Key Segment Analysis

- 13.2. Insect-Based Animal Feed Market Size (Value - US$ Bn), Analysis, and Forecasts, by Feed Substrate/Feedstock Used, 2021-2035

- 13.2.1. Organic Waste

- 13.2.1.1. Food waste

- 13.2.1.2. Agricultural waste

- 13.2.1.3. Brewery waste

- 13.2.2. Grain-Based Substrates

- 13.2.3. By-Products

- 13.2.3.1. Vegetable waste

- 13.2.3.2. Fruit waste

- 13.2.4. Certified Organic Substrates

- 13.2.5. Mixed Substrates

- 13.2.1. Organic Waste

- 14. Global Insect-Based Animal Feed Market Analysis, by Packaging Type

- 14.1. Key Segment Analysis

- 14.2. Insect-Based Animal Feed Market Size (Value - US$ Bn), Analysis, and Forecasts, by Packaging Type, 2021-2035

- 14.2.1. Bulk Packaging

- 14.2.2. Bags (25-50 kg)

- 14.2.3. Small Retail Packs (<10 kg)

- 14.2.4. Intermediate Bulk Containers (IBC)

- 14.2.5. Vacuum-Sealed Packaging

- 15. Global Insect-Based Animal Feed Market Analysis, by Application

- 15.1. Key Segment Analysis

- 15.2. Insect-Based Animal Feed Market Size (Value - US$ Bn), Analysis, and Forecasts, by Application, 2021-2035

- 15.2.1. Complete Feed Formulation

- 15.2.2. Feed Supplement/Additive

- 15.2.3. Protein Replacement

- 15.2.4. Nutritional Enrichment

- 15.2.5. Treat/Reward

- 15.2.6. Others

- 16. Global Insect-Based Animal Feed Market Analysis and Forecasts, by Region

- 16.1. Key Findings

- 16.2. Insect-Based Animal Feed Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 16.2.1. North America

- 16.2.2. Europe

- 16.2.3. Asia Pacific

- 16.2.4. Middle East

- 16.2.5. Africa

- 16.2.6. South America

- 17. North America Insect-Based Animal Feed Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. North America Insect-Based Animal Feed Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Insect Type/Species

- 17.3.2. Product Form

- 17.3.3. Animal Type

- 17.3.4. Production Method

- 17.3.5. Processing Technology

- 17.3.6. Protein Content

- 17.3.7. Distribution Channel

- 17.3.8. Feed Substrate/Feedstock Used

- 17.3.9. Packaging Type

- 17.3.10. Application

- 17.3.11. Country

- 17.3.11.1. USA

- 17.3.11.2. Canada

- 17.3.11.3. Mexico

- 17.4. USA Insect-Based Animal Feed Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Insect Type/Species

- 17.4.3. Product Form

- 17.4.4. Animal Type

- 17.4.5. Production Method

- 17.4.6. Processing Technology

- 17.4.7. Protein Content

- 17.4.8. Distribution Channel

- 17.4.9. Feed Substrate/Feedstock Used

- 17.4.10. Packaging Type

- 17.4.11. Application

- 17.5. Canada Insect-Based Animal Feed Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Insect Type/Species

- 17.5.3. Product Form

- 17.5.4. Animal Type

- 17.5.5. Production Method

- 17.5.6. Processing Technology

- 17.5.7. Protein Content

- 17.5.8. Distribution Channel

- 17.5.9. Feed Substrate/Feedstock Used

- 17.5.10. Packaging Type

- 17.5.11. Application

- 17.6. Mexico Insect-Based Animal Feed Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Insect Type/Species

- 17.6.3. Product Form

- 17.6.4. Animal Type

- 17.6.5. Production Method

- 17.6.6. Processing Technology

- 17.6.7. Protein Content

- 17.6.8. Distribution Channel

- 17.6.9. Feed Substrate/Feedstock Used

- 17.6.10. Packaging Type

- 17.6.11. Application

- 18. Europe Insect-Based Animal Feed Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Europe Insect-Based Animal Feed Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Insect Type/Species

- 18.3.2. Product Form

- 18.3.3. Animal Type

- 18.3.4. Production Method

- 18.3.5. Processing Technology

- 18.3.6. Protein Content

- 18.3.7. Distribution Channel

- 18.3.8. Feed Substrate/Feedstock Used

- 18.3.9. Packaging Type

- 18.3.10. Application

- 18.3.11. Country

- 18.3.11.1. Germany

- 18.3.11.2. United Kingdom

- 18.3.11.3. France

- 18.3.11.4. Italy

- 18.3.11.5. Spain

- 18.3.11.6. Netherlands

- 18.3.11.7. Nordic Countries

- 18.3.11.8. Poland

- 18.3.11.9. Russia & CIS

- 18.3.11.10. Rest of Europe

- 18.4. Germany Insect-Based Animal Feed Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Insect Type/Species

- 18.4.3. Product Form

- 18.4.4. Animal Type

- 18.4.5. Production Method

- 18.4.6. Processing Technology

- 18.4.7. Protein Content

- 18.4.8. Distribution Channel

- 18.4.9. Feed Substrate/Feedstock Used

- 18.4.10. Packaging Type

- 18.4.11. Application

- 18.5. United Kingdom Insect-Based Animal Feed Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Insect Type/Species

- 18.5.3. Product Form

- 18.5.4. Animal Type

- 18.5.5. Production Method

- 18.5.6. Processing Technology

- 18.5.7. Protein Content

- 18.5.8. Distribution Channel

- 18.5.9. Feed Substrate/Feedstock Used

- 18.5.10. Packaging Type

- 18.5.11. Application

- 18.6. France Insect-Based Animal Feed Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Insect Type/Species

- 18.6.3. Product Form

- 18.6.4. Animal Type

- 18.6.5. Production Method

- 18.6.6. Processing Technology

- 18.6.7. Protein Content

- 18.6.8. Distribution Channel

- 18.6.9. Feed Substrate/Feedstock Used

- 18.6.10. Packaging Type

- 18.6.11. Application

- 18.7. Italy Insect-Based Animal Feed Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Insect Type/Species

- 18.7.3. Product Form

- 18.7.4. Animal Type

- 18.7.5. Production Method

- 18.7.6. Processing Technology

- 18.7.7. Protein Content

- 18.7.8. Distribution Channel

- 18.7.9. Feed Substrate/Feedstock Used

- 18.7.10. Packaging Type

- 18.7.11. Application

- 18.8. Spain Insect-Based Animal Feed Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Insect Type/Species

- 18.8.3. Product Form

- 18.8.4. Animal Type

- 18.8.5. Production Method

- 18.8.6. Processing Technology

- 18.8.7. Protein Content

- 18.8.8. Distribution Channel

- 18.8.9. Feed Substrate/Feedstock Used

- 18.8.10. Packaging Type

- 18.8.11. Application

- 18.9. Netherlands Insect-Based Animal Feed Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Insect Type/Species

- 18.9.3. Product Form

- 18.9.4. Animal Type

- 18.9.5. Production Method

- 18.9.6. Processing Technology

- 18.9.7. Protein Content

- 18.9.8. Distribution Channel

- 18.9.9. Feed Substrate/Feedstock Used

- 18.9.10. Packaging Type

- 18.9.11. Application

- 18.10. Nordic Countries Insect-Based Animal Feed Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Insect Type/Species

- 18.10.3. Product Form

- 18.10.4. Animal Type

- 18.10.5. Production Method

- 18.10.6. Processing Technology

- 18.10.7. Protein Content

- 18.10.8. Distribution Channel

- 18.10.9. Feed Substrate/Feedstock Used

- 18.10.10. Packaging Type

- 18.10.11. Application

- 18.11. Poland Insect-Based Animal Feed Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Insect Type/Species

- 18.11.3. Product Form

- 18.11.4. Animal Type

- 18.11.5. Production Method

- 18.11.6. Processing Technology

- 18.11.7. Protein Content

- 18.11.8. Distribution Channel

- 18.11.9. Feed Substrate/Feedstock Used

- 18.11.10. Packaging Type

- 18.11.11. Application

- 18.12. Russia & CIS Insect-Based Animal Feed Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Insect Type/Species

- 18.12.3. Product Form

- 18.12.4. Animal Type

- 18.12.5. Production Method

- 18.12.6. Processing Technology

- 18.12.7. Protein Content

- 18.12.8. Distribution Channel

- 18.12.9. Feed Substrate/Feedstock Used

- 18.12.10. Packaging Type

- 18.12.11. Application

- 18.13. Rest of Europe Insect-Based Animal Feed Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Insect Type/Species

- 18.13.3. Product Form

- 18.13.4. Animal Type

- 18.13.5. Production Method

- 18.13.6. Processing Technology

- 18.13.7. Protein Content

- 18.13.8. Distribution Channel

- 18.13.9. Feed Substrate/Feedstock Used

- 18.13.10. Packaging Type

- 18.13.11. Application

- 19. Asia Pacific Insect-Based Animal Feed Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Asia Pacific Insect-Based Animal Feed Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Insect Type/Species

- 19.3.2. Product Form

- 19.3.3. Animal Type

- 19.3.4. Production Method

- 19.3.5. Processing Technology

- 19.3.6. Protein Content

- 19.3.7. Distribution Channel

- 19.3.8. Feed Substrate/Feedstock Used

- 19.3.9. Packaging Type

- 19.3.10. Application

- 19.3.11. Country

- 19.3.11.1. China

- 19.3.11.2. India

- 19.3.11.3. Japan

- 19.3.11.4. South Korea

- 19.3.11.5. Australia and New Zealand

- 19.3.11.6. Indonesia

- 19.3.11.7. Malaysia

- 19.3.11.8. Thailand

- 19.3.11.9. Vietnam

- 19.3.11.10. Rest of Asia Pacific

- 19.4. China Insect-Based Animal Feed Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Insect Type/Species

- 19.4.3. Product Form

- 19.4.4. Animal Type

- 19.4.5. Production Method

- 19.4.6. Processing Technology

- 19.4.7. Protein Content

- 19.4.8. Distribution Channel

- 19.4.9. Feed Substrate/Feedstock Used

- 19.4.10. Packaging Type

- 19.4.11. Application

- 19.5. India Insect-Based Animal Feed Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Insect Type/Species

- 19.5.3. Product Form

- 19.5.4. Animal Type

- 19.5.5. Production Method

- 19.5.6. Processing Technology

- 19.5.7. Protein Content

- 19.5.8. Distribution Channel

- 19.5.9. Feed Substrate/Feedstock Used

- 19.5.10. Packaging Type

- 19.5.11. Application

- 19.6. Japan Insect-Based Animal Feed Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Insect Type/Species

- 19.6.3. Product Form

- 19.6.4. Animal Type

- 19.6.5. Production Method

- 19.6.6. Processing Technology

- 19.6.7. Protein Content

- 19.6.8. Distribution Channel

- 19.6.9. Feed Substrate/Feedstock Used

- 19.6.10. Packaging Type

- 19.6.11. Application

- 19.7. South Korea Insect-Based Animal Feed Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Insect Type/Species

- 19.7.3. Product Form

- 19.7.4. Animal Type

- 19.7.5. Production Method

- 19.7.6. Processing Technology

- 19.7.7. Protein Content

- 19.7.8. Distribution Channel

- 19.7.9. Feed Substrate/Feedstock Used

- 19.7.10. Packaging Type

- 19.7.11. Application

- 19.8. Australia and New Zealand Insect-Based Animal Feed Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Insect Type/Species

- 19.8.3. Product Form

- 19.8.4. Animal Type

- 19.8.5. Production Method

- 19.8.6. Processing Technology

- 19.8.7. Protein Content

- 19.8.8. Distribution Channel

- 19.8.9. Feed Substrate/Feedstock Used

- 19.8.10. Packaging Type

- 19.8.11. Application

- 19.9. Indonesia Insect-Based Animal Feed Market

- 19.9.1. Country Segmental Analysis

- 19.9.2. Insect Type/Species

- 19.9.3. Product Form

- 19.9.4. Animal Type

- 19.9.5. Production Method

- 19.9.6. Processing Technology

- 19.9.7. Protein Content

- 19.9.8. Distribution Channel

- 19.9.9. Feed Substrate/Feedstock Used

- 19.9.10. Packaging Type

- 19.9.11. Application

- 19.10. Malaysia Insect-Based Animal Feed Market

- 19.10.1. Country Segmental Analysis

- 19.10.2. Insect Type/Species

- 19.10.3. Product Form

- 19.10.4. Animal Type

- 19.10.5. Production Method

- 19.10.6. Processing Technology

- 19.10.7. Protein Content

- 19.10.8. Distribution Channel

- 19.10.9. Feed Substrate/Feedstock Used

- 19.10.10. Packaging Type

- 19.10.11. Application

- 19.11. Thailand Insect-Based Animal Feed Market

- 19.11.1. Country Segmental Analysis

- 19.11.2. Insect Type/Species

- 19.11.3. Product Form

- 19.11.4. Animal Type

- 19.11.5. Production Method

- 19.11.6. Processing Technology

- 19.11.7. Protein Content

- 19.11.8. Distribution Channel

- 19.11.9. Feed Substrate/Feedstock Used

- 19.11.10. Packaging Type

- 19.11.11. Application

- 19.12. Vietnam Insect-Based Animal Feed Market

- 19.12.1. Country Segmental Analysis

- 19.12.2. Insect Type/Species

- 19.12.3. Product Form

- 19.12.4. Animal Type

- 19.12.5. Production Method

- 19.12.6. Processing Technology

- 19.12.7. Protein Content

- 19.12.8. Distribution Channel

- 19.12.9. Feed Substrate/Feedstock Used

- 19.12.10. Packaging Type

- 19.12.11. Application

- 19.13. Rest of Asia Pacific Insect-Based Animal Feed Market

- 19.13.1. Country Segmental Analysis

- 19.13.2. Insect Type/Species

- 19.13.3. Product Form

- 19.13.4. Animal Type

- 19.13.5. Production Method

- 19.13.6. Processing Technology

- 19.13.7. Protein Content

- 19.13.8. Distribution Channel

- 19.13.9. Feed Substrate/Feedstock Used

- 19.13.10. Packaging Type

- 19.13.11. Application

- 20. Middle East Insect-Based Animal Feed Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Middle East Insect-Based Animal Feed Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Insect Type/Species

- 20.3.2. Product Form

- 20.3.3. Animal Type

- 20.3.4. Production Method

- 20.3.5. Processing Technology

- 20.3.6. Protein Content

- 20.3.7. Distribution Channel

- 20.3.8. Feed Substrate/Feedstock Used

- 20.3.9. Packaging Type

- 20.3.10. Application

- 20.3.11. Country

- 20.3.11.1. Turkey

- 20.3.11.2. UAE

- 20.3.11.3. Saudi Arabia

- 20.3.11.4. Israel

- 20.3.11.5. Rest of Middle East

- 20.4. Turkey Insect-Based Animal Feed Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Insect Type/Species

- 20.4.3. Product Form

- 20.4.4. Animal Type

- 20.4.5. Production Method

- 20.4.6. Processing Technology

- 20.4.7. Protein Content

- 20.4.8. Distribution Channel

- 20.4.9. Feed Substrate/Feedstock Used

- 20.4.10. Packaging Type

- 20.4.11. Application

- 20.5. UAE Insect-Based Animal Feed Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Insect Type/Species

- 20.5.3. Product Form

- 20.5.4. Animal Type

- 20.5.5. Production Method

- 20.5.6. Processing Technology

- 20.5.7. Protein Content

- 20.5.8. Distribution Channel

- 20.5.9. Feed Substrate/Feedstock Used

- 20.5.10. Packaging Type

- 20.5.11. Application

- 20.6. Saudi Arabia Insect-Based Animal Feed Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Insect Type/Species

- 20.6.3. Product Form

- 20.6.4. Animal Type

- 20.6.5. Production Method

- 20.6.6. Processing Technology

- 20.6.7. Protein Content

- 20.6.8. Distribution Channel

- 20.6.9. Feed Substrate/Feedstock Used

- 20.6.10. Packaging Type

- 20.6.11. Application

- 20.7. Israel Insect-Based Animal Feed Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Insect Type/Species

- 20.7.3. Product Form

- 20.7.4. Animal Type

- 20.7.5. Production Method

- 20.7.6. Processing Technology

- 20.7.7. Protein Content

- 20.7.8. Distribution Channel

- 20.7.9. Feed Substrate/Feedstock Used

- 20.7.10. Packaging Type

- 20.7.11. Application

- 20.8. Rest of Middle East Insect-Based Animal Feed Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Insect Type/Species

- 20.8.3. Product Form

- 20.8.4. Animal Type

- 20.8.5. Production Method

- 20.8.6. Processing Technology

- 20.8.7. Protein Content

- 20.8.8. Distribution Channel

- 20.8.9. Feed Substrate/Feedstock Used

- 20.8.10. Packaging Type

- 20.8.11. Application

- 21. Africa Insect-Based Animal Feed Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. Africa Insect-Based Animal Feed Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Insect Type/Species

- 21.3.2. Product Form

- 21.3.3. Animal Type

- 21.3.4. Production Method

- 21.3.5. Processing Technology

- 21.3.6. Protein Content

- 21.3.7. Distribution Channel

- 21.3.8. Feed Substrate/Feedstock Used

- 21.3.9. Packaging Type

- 21.3.10. Application

- 21.3.11. Country

- 21.3.11.1. South Africa

- 21.3.11.2. Egypt

- 21.3.11.3. Nigeria

- 21.3.11.4. Algeria

- 21.3.11.5. Rest of Africa

- 21.4. South Africa Insect-Based Animal Feed Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Insect Type/Species

- 21.4.3. Product Form

- 21.4.4. Animal Type

- 21.4.5. Production Method

- 21.4.6. Processing Technology

- 21.4.7. Protein Content

- 21.4.8. Distribution Channel

- 21.4.9. Feed Substrate/Feedstock Used

- 21.4.10. Packaging Type

- 21.4.11. Application

- 21.5. Egypt Insect-Based Animal Feed Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Insect Type/Species

- 21.5.3. Product Form

- 21.5.4. Animal Type

- 21.5.5. Production Method

- 21.5.6. Processing Technology

- 21.5.7. Protein Content

- 21.5.8. Distribution Channel

- 21.5.9. Feed Substrate/Feedstock Used

- 21.5.10. Packaging Type

- 21.5.11. Application

- 21.6. Nigeria Insect-Based Animal Feed Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Insect Type/Species

- 21.6.3. Product Form

- 21.6.4. Animal Type

- 21.6.5. Production Method

- 21.6.6. Processing Technology

- 21.6.7. Protein Content

- 21.6.8. Distribution Channel

- 21.6.9. Feed Substrate/Feedstock Used

- 21.6.10. Packaging Type

- 21.6.11. Application

- 21.7. Algeria Insect-Based Animal Feed Market

- 21.7.1. Country Segmental Analysis

- 21.7.2. Insect Type/Species

- 21.7.3. Product Form

- 21.7.4. Animal Type

- 21.7.5. Production Method

- 21.7.6. Processing Technology

- 21.7.7. Protein Content

- 21.7.8. Distribution Channel

- 21.7.9. Feed Substrate/Feedstock Used

- 21.7.10. Packaging Type

- 21.7.11. Application

- 21.8. Rest of Africa Insect-Based Animal Feed Market

- 21.8.1. Country Segmental Analysis

- 21.8.2. Insect Type/Species

- 21.8.3. Product Form

- 21.8.4. Animal Type

- 21.8.5. Production Method

- 21.8.6. Processing Technology

- 21.8.7. Protein Content

- 21.8.8. Distribution Channel

- 21.8.9. Feed Substrate/Feedstock Used

- 21.8.10. Packaging Type

- 21.8.11. Application

- 22. South America Insect-Based Animal Feed Market Analysis

- 22.1. Key Segment Analysis

- 22.2. Regional Snapshot

- 22.3. South America Insect-Based Animal Feed Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 22.3.1. Insect Type/Species

- 22.3.2. Product Form

- 22.3.3. Animal Type

- 22.3.4. Production Method

- 22.3.5. Processing Technology

- 22.3.6. Protein Content

- 22.3.7. Distribution Channel

- 22.3.8. Feed Substrate/Feedstock Used

- 22.3.9. Packaging Type

- 22.3.10. Application

- 22.3.11. Country

- 22.3.11.1. Brazil

- 22.3.11.2. Argentina

- 22.3.11.3. Rest of South America

- 22.4. Brazil Insect-Based Animal Feed Market

- 22.4.1. Country Segmental Analysis

- 22.4.2. Insect Type/Species

- 22.4.3. Product Form

- 22.4.4. Animal Type

- 22.4.5. Production Method

- 22.4.6. Processing Technology

- 22.4.7. Protein Content

- 22.4.8. Distribution Channel

- 22.4.9. Feed Substrate/Feedstock Used

- 22.4.10. Packaging Type

- 22.4.11. Application

- 22.5. Argentina Insect-Based Animal Feed Market

- 22.5.1. Country Segmental Analysis

- 22.5.2. Insect Type/Species

- 22.5.3. Product Form

- 22.5.4. Animal Type

- 22.5.5. Production Method

- 22.5.6. Processing Technology

- 22.5.7. Protein Content

- 22.5.8. Distribution Channel

- 22.5.9. Feed Substrate/Feedstock Used

- 22.5.10. Packaging Type

- 22.5.11. Application

- 22.6. Rest of South America Insect-Based Animal Feed Market

- 22.6.1. Country Segmental Analysis

- 22.6.2. Insect Type/Species

- 22.6.3. Product Form

- 22.6.4. Animal Type

- 22.6.5. Production Method

- 22.6.6. Processing Technology

- 22.6.7. Protein Content

- 22.6.8. Distribution Channel

- 22.6.9. Feed Substrate/Feedstock Used

- 22.6.10. Packaging Type

- 22.6.11. Application

- 23. Key Players/ Company Profile

- 23.1. Agronutris

- 23.1.1. Company Details/ Overview

- 23.1.2. Company Financials

- 23.1.3. Key Customers and Competitors

- 23.1.4. Business/ Industry Portfolio

- 23.1.5. Product Portfolio/ Specification Details

- 23.1.6. Pricing Data

- 23.1.7. Strategic Overview

- 23.1.8. Recent Developments

- 23.2. Aspire Food Group

- 23.3. Beta Hatch

- 23.4. Enterra Feed Corporation

- 23.5. Entobel

- 23.6. Entocube

- 23.7. Entomo Farms

- 23.8. Entomotech

- 23.9. EnviroFlight (Darling Ingredients)

- 23.10. Hexafly

- 23.11. Hipromine

- 23.12. Innovafeed

- 23.13. NextProtein

- 23.14. Nutrition Technologies

- 23.15. Proti-Farm

- 23.16. Protix

- 23.17. Tebrio

- 23.18. Ÿnsect

- 23.19. Other Key Players

- 23.1. Agronutris

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insect-Based Animal Feed Market by Insect Type/Species, Product Form, Animal Type, Production Method, Processing Technology, Protein Content, Distribution Channel, Feed Substrate/Feedstock Used, Packaging Type, Application, and Geography

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Insect-Based Animal Feed Market Size, Share & Trends Analysis Report by Insect Type/Species (Black Soldier Fly, Mealworms, Silkworms, Locusts and Grasshoppers, Flies, Others), Product Form, Animal Type, Production Method, Processing Technology, Protein Content, Distribution Channel, Feed Substrate/Feedstock Used, Packaging Type, Application, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Insect-Based Animal Feed Market Size, Share, and Growth

The global insect-based animal feed market is experiencing robust growth, with its estimated value of USD 0.7 billion in the year 2025 and USD 2.3 billion by the period 2035, registering a CAGR of 12.7%, during the forecast period. The global insect-based animal feed market demand driven by the push for sustainable, high-protein ingredients, reduced environmental impact compared to traditional feed sources, strong nutritional benefits for aquaculture and pets, growing regulations supporting alternative proteins, and rising consumer pressure on livestock producers to adopt eco-friendly feed solutions.

Sanaa Abouzaid, IFC regional manager for Central America said, "IFC is delighted to support ProNuvo's growth and commitment to innovation, sustainability and competitiveness, as global industry catalysts, we seek to foster circularity and demonstrate the industrial-scale commercial viability of the project."

The global insect-based animal feed market growth is motivated by the high protein/lipid ratio and feed-conversion efficiency of insects especially black soldier fly larvae and their upcycling of food and agricultural by-products into useful nutrition, which cut landfill quantities and direct emissions on integrated producers. As an example, in June 2024, ProNuvo of Costa Rica obtained a US $2 million investment in International Finance Corporation to increase the manufacture of insect-based food additives using black soldier fly larvae. Insect protein is being applied in high-value feeds through increased scale and cost-efficiency rapid progress.

In addition, the development of the insect animal feed market is also driven by rising demand in aquaculture and luxury pet food as a non-GMO sustainable source of protein and the industrial expansion of new facilities and integrated financing and partnerships, which lower costs and ensure consistent supply of feedstock. For instance, the Loopworm in India, which was given regulatory acceptance to commercially market its insect-based proteins in aquaculture feed to allow it to penetrate any regulated fish-feed markets. This is reinforcing the movement of lower-carbon protein sources of high-value feed applications in circular directions.

Adjacent opportunities include insect-based pet food, organic fertilizer from frass, insect-derived bioactive for animal health, waste-management and by-product valorization services, and insect-oil applications in aquafeed and specialty livestock diets. These segments use identical production system and sustainability platforms to increase business reach. Different revenue streams will speed up the pace of scale, cost and mainstream acceptance of insect protein.

Insect Based Animal Feed Market Dynamics and Trends

Driver: Rising Demand for Sustainable Protein Sources in Aquaculture

Restraint: Financial Viability and Scale Constraints Challenge Rapid Commercial Expansion Globally

Opportunity: Frass, Waste-to-Value and Pet-Food Expansion

Key Trend: Automation, Digitalization and Precision Farming Adoption

Insect-Based-Animal-Feed-Market Analysis and Segmental Data

Black Soldier Fly (Hermetia illucens) Dominate Global Insect-Based Animal Feed Market

Europe Leads Global Insect-Based Animal Feed Market Demand

Insect-Based-Animal-Feed-Market Ecosystem

The global insect-based animal feed market is moderately consolited, with high concentration among key players such as Protix, InnovaFeed, Ÿnsect, EnviroFlight, and Entomo Farms, who dominate through large-scale production capacity, proprietary rearing technologies, strategic partnerships, and established offtake agreements with aquaculture, poultry, and pet-food manufacturers. For instance, in 2023, Protix announced a strategic tie up with Tyson Foods in which Tyson made a minimal equity investment and will co-build an insect ingredients plant in the U.S. that will expand the scale of Protix to manufacture its ProteinX line of ingredients used in aquaculture, pet care, and livestock feed.

The consolidation of markets, increased reliability of supply, and increased rate of adoption of insect-derived ingredients in aquaculture, poultry and pet-food industries are made possible through such strategic partnerships and high scale capacity expansions.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 0.7 Bn |

|

Market Forecast Value in 2035 |

USD 2.3 Bn |

|

Growth Rate (CAGR) |

12.7% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Insect-Based-Animal-Feed-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Insect-Based Animal Feed Market, By Insect Type/Species |

|

|

Insect-Based Animal Feed Market, By Product Form |

|

|

Insect-Based Animal Feed Market, By Animal Type |

|

|

Insect-Based Animal Feed Market, By Production Method |

|

|

Insect-Based Animal Feed Market, By Processing Technology

|

|

|

Insect-Based Animal Feed Market, By Protein Content

|

|

|

Insect-Based Animal Feed Market, By Distribution Channel |

|

|

Insect-Based Animal Feed Market, By Feed Substrate/Feedstock Used |

|

|

Insect-Based Animal Feed Market, By Packaging Type |

|

|

Insect-Based Animal Feed Market, By Application |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation