Non-Alcoholic Beer Market Size, Share & Trends Analysis Report by Product Type (Alcohol-Free Beer (0.0% ABV), Low-Alcohol Beer (0.05% - 0.5% ABV), De-Alcoholized Beer (up to 0.5% ABV)), Brewing Method, Flavor Type, Ingredients, Consumer Demographic, End-users, Distribution Channel, Packaging Type, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Non-Alcoholic Beer Market Size, Share, and Growth

The global non-alcoholic beer market is experiencing robust growth, with its estimated value of USD 20.9 billion in the year 2025 and USD 41.5 billion by the period 2035, registering a CAGR of 7.1%, during the forecast period. The rising disposable incomes, urban living, and the growing popularity of wellness are driving the global non-alcoholic beer market. The global adoption and premiumization is also further propelled by innovations in brewing, flavour systems and distribution channels.

Gavin Hattersley, CEO of Molson Coors, stated, “Our strategic partnership with Fever-Tree in the U.S. is a meaningful step in building a winning portfolio of non-alc beverages. The U.S. is our biggest market, and this collaboration provides an opportunity to leverage our scale and expertise. I’m confident in the road ahead for Fever-Tree as part of Molson Coors’ growing non-alc offerings.

The rising need of non-alcoholic high-quality, flavorful and wellness-focused beers is making brewers invest into high-tech brewing systems, specially-crafted yeast, and better mouthfeel systems. Health-conscious and urban customers are stimulating the investigation of the low- and zero-alcohol formulations and botanical infusions. For instance, in April 2025, 10 Barrel Brewing released NA Apocalypse IPA, a non-alcoholic hearty craft IPA that has the full flavor of their daily bold and hop-driven IPA but is not intoxicated. These innovations are making non-alcoholic beer a high-end lifestyle product, increasing its growth and customer interest.

Strategic partnerships and brand collaborations are making it possible to have faster market adoption. Sports and entertainment partnerships can help non-alcoholic beer companies service proactive, health conscious target markets, increasing credibility and visibility. For instance, in July 2025, Athletic Brewing Company renewed its long-term agreement with Arsenal F.C. and became the club’s Official Non-Alcoholic Beer Partner at Emirates Stadium. This partnership offered access to thousands of fans, boosted in-stadium trial and sales and enhanced brand awareness among lifestyle- and wellness-conscious customers.

Increased product consistency, efficiency, and cost-effectiveness is being achieved through the application of precision brewing technologies, automated fermentation, and scalable low-alcohol production platforms. For instance, in September 2024, International Flavors and Fragrances Inc. introduced DIAZYME NOLO, a dedicated enzyme solution to create no- and low-alcohol beer, which enhances its mouthfeel, flavor retention, and consumes less resource (up to 37). These innovations coupled with favorable regulatory regimes in places like the EU, the US, and the Singapore are enhancing the quality of products, market penetration, and competitiveness in the international non-alcoholic beer market.

Non-Alcoholic Beer Market Dynamics and Trends

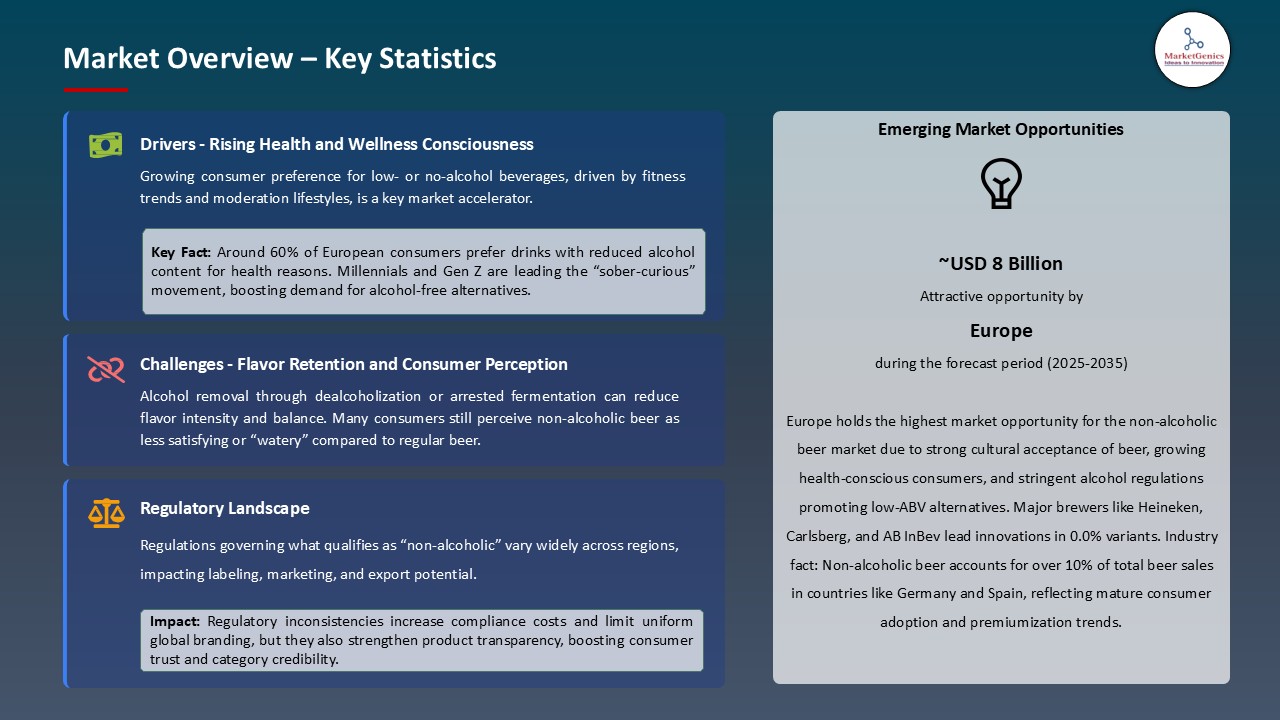

Driver Growing Health and Wellness Awareness Fuels Non-Alcoholic Beer Demand

- The non-alcoholic beer market is developing at a very high rate, since the consumers who are highly health conscious are opting for low or no-alcoholic drinks in recreational activities without affecting their wellness goals. The growing concern towards liver health, obesity and clarity of mind is propagating moderated drinking habits especially among the younger demographics. The sober-curious social movement and mindful drinking are also among the campaigns that place non-alcoholic beverages as a healthy alternative in daily life.

- The increasing demand is being met with enhancement of improved taste, aroma as well as quality of the non-alcoholic beers due to improved brewing technology. For instance, in June 2025, Fermentis introduced the yeast SafBrew LA-01, which will boost the flavor, aroma, and mouthfeel, allowing a brewer to produce non-alcoholic beers that will have a closer taste to traditional beers and will be more acceptable to the consumer.

- Given, the growing popularity of healthier lifestyles and technology to make beer taste better and healthier are contributing to the non-alcoholic beer market consumptions.

Restraint: Premium Pricing and Taste Perception Limit Market Penetration

- The higher production costs and the perception of poor taste by the consumers are some of the threats facing the non-alcoholic beer market. The use of specialized brewing processes, dealcoholization machines, and other high-quality ingredients make the manufacturing process highly expensive. These contribute to the higher cost of non-alcoholic beers compared to the conventional ones thus limiting availability in markets that are sensitive to price.

- Market growth is further impacted by consumer perception and taste problems. Even with adequate marketing, a number of non-alcoholic beer brands facing problem with retaining the customers who feel that non-alcoholic beers do not have a prestigious flavor or body. For instance, Beneficial Beer Co. was shutting down in August 2025, which is an illustration of the restricting effects of high pricing and low purchasing frequency on smaller breweries.

- Thus, the high prices and low consumer confidence reduce mass adoption, capping category and expansion in new markets.

Opportunity: Expanding Sports and Entertainment Partnerships Boost Market Reach

- Non-alcoholic beer brands have great growth opportunities in strategic partnerships with sports teams, festivals, and entertainment events. The partnerships assist brands to connect with active, health conscious consumers and increase their visibility and credibility in social environments that alcohol has long controlled.

- Brands are turning to sports and lifestyle affiliations to access a wider, wellness-oriented market and to popularize the use of non-alcoholic beer. For instance, in March 2025, Corona Cero was announced as the official global beer sponsor of the World Surf League, the first non-alcoholic beer sponsor of the league. This partnership provided the brand the opportunity to present its alcohol-free products in major surf competitions, reaching the consumers of wellness and outdoor lifestyle, and raising the trial among the audience.

- As a result, rising brand collaboration, notably in-sports and live entertainment areas can increase consumer engagement, trial expansion and market penetration, perceiving non-alcoholic beers aspirational and lifestyle drinks.

Key Trend: Innovation in Functional and Flavour-Enhanced Non-Alcoholic Beers

- Non-alcoholic beers are also being formulated using functional and flavour fortified formulations to accommodate changing consumer tastes. Manufacturers are fortifying beverages with adaptogens, nootropics and botanicals that offer wellness benefits like stress relief, hydration, or mental focus which falls in line with the larger functional beverage trend.

- The innovative approach to production and sustainability helps brands dissimilarize their product and appeal to conscious consumers. For instance, in April 2025, Carlsberg Sverige (Sweden) and Einride unveiled an alcohol-free, alcoholic drink, dubbed Electric Beer, which was brewed, produced, and shipped to consumers using 100 percent sustainable energy and electric logistics.

- Furthermore, the blend of improved flavor profile, functionality and sustainable process is transforming the non- alcoholic beer into lifestyle product by itself, which promotes the notion of premiumisation, broader consumer segments and promotes the long-term demand within the global markets.

Non-Alcoholic-Beer-Market Analysis and Segmental Data

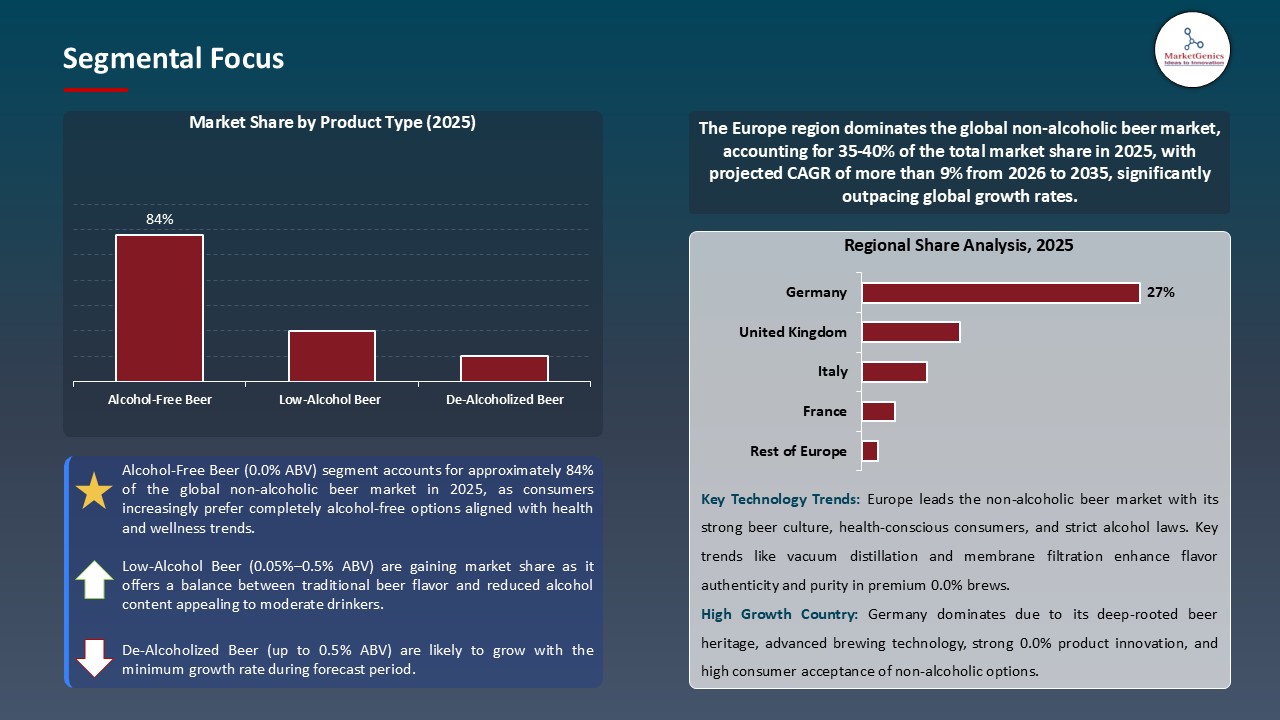

Alcohol-Free Beer (0.0% ABV) Dominate Global Non-Alcoholic Beer Market

- The global non-alcoholic beer market is dominated by the alcohol-free beer (0.0% ABV) segment because of high level of consumer acceptance, advanced brewing technologies, and increased health conscious trends. The use of high-tech techniques, such as vacuum distillation, reverse osmosis and limited fermentation, is also used to maintain flavour, aroma and body and eliminate alcohol, attracting both traditional and sober-curious beer drinkers.

- Major breweries are developing 0.0% ABV portfolios to satisfy demand. In March 2025, AB InBev (Belgium) introduced a 0.0% Corona that has improved dealcoholisation systems. Equally, Staropramen 0.0 by Molson Coors in the UK, Ireland and Central/Eastern Europe offers comprehensive malty and comes after two years of research.

- Exceptional brand recognition, rigorus standards and scalable brewing plants that make 0.0% ABV the most economical category that breweries can easily introduce craft brews, flavoured and premium brews without much struggle and meet the growing consumer tastes.

Europe Leads Global Non-Alcoholic Beer Market Demand

- Europe leads in global non-alcoholic beer market, due to the high health and wellness consumer trends, growing disposable incomes, urbanisation and the social attitude towards drink consumption. Germany poses the greatest consumer market with its strong beer culture, the well-established tradition of brewing and the growing popularity of low-alcohol and no-alcohol beer types. Other markets such as Spain, Poland and the UK are also increasingly taking up premium, craft-style and flavoured non-alcoholic beers.

- The manufacturing base and mature brewing-science centres in Germany, Spain and Belgium are a base in the region and facilitate fast product innovation and localisation. For instance, in March 2025, Edelweißbrauerei FARNY (Germany) acquired a GEA AromaPlus membrane-filtration system, which allows alcohol-free versions of the company’s Kristall-Weizen beer by eliminating alcohol through reverse osmosis without damaging aroma, clarity and texture.

- Government policies, regulatory encouragement on alcohol restrictions and expansion of retail and e-commerce avenues, participation of local and foreign brewers are increasing commercialization and consumer access. The region is enhancing its science-based non-alcoholic beer by making strategic investments and within-country research and development pipelines.

Non-Alcoholic-Beer-Market Ecosystem

The global non-alcoholic beer industry is moderately fragmented, and major companies, including Anheuser-Busch InBev, Heineken N.V., Carlsberg Group, Asahi Group Holdings, and Molson Coors Beverage Company, control the market with developed brewing systems and innovative production techniques. By using sophisticated dealcoholization techniques, accuracy fermentation and quality control systems these companies have ensured that they possess uniform taste and nutrition profile which have guaranteed their presence in the market.

The major players are also paying more attention to niche and specialized solutions to address changing consumer preferences. For instance, Athletic Brewing Company and Big Drop Brewing Co. launched non-alcoholic craft style, low-calorie and gluten-free beers, whereas Heineken (Buckler Brand) focuses on flavor-retention technologies, which can recreate the taste of beer without alcohol. These niche services lead to innovation and serve to attract health and lifestyle conscious consumers.

Diversification of portfolios and integrated solutions are also a focus of leading companies to enhance operational efficiency, sustainability and market penetration. For instance, in March 2025, Carlsberg Group implemented AI-based predictive brewing analytics to optimize fermentation and decrease energy usage, with a 12% increase in production efficiency. Other firms have comparable movements towards renewable energy consumption, automated quality analysis, and eco-friendly packaging.

Recent Development and Strategic Overview:

- In September 2025, Heineken raised its 0.0 draught to 10,000 European pubs, where the non-alcoholic beer started to appear in regular pubs. The implementation that included the UK, Spain, Ireland, France and Netherlands came with 14 new stores each day. This success shows more inclination towards high quality alcohol free products and control of the segment by Heineken.

- In April 2025, The Kansas City Current signed a deal with Athletic Brewing Company where the latter became the Official Non-Alcoholic Beer of the franchise. This collaboration will give Athletic a chance to sell the award-winning brews at the CPKC Stadium on home game days as a way of expanding their fan drinks.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 20.9 Bn |

|

Market Forecast Value in 2035 |

USD 41.5 Bn |

|

Growth Rate (CAGR) |

7.1% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Non-Alcoholic-Beer-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Non-Alcoholic Beer Market, By Product Type |

|

|

Non-Alcoholic Beer Market, By Brewing Method |

|

|

Non-Alcoholic Beer Market, By Flavor Type |

|

|

Non-Alcoholic Beer Market, By Ingredients |

|

|

Non-Alcoholic Beer Market, Consumer Demographic |

|

|

Non-Alcoholic Beer Market, By End-users |

|

|

Non-Alcoholic Beer Market, By Distribution Channel |

|

|

Non-Alcoholic Beer Market, By Packaging Type |

|

Frequently Asked Questions

The global non-alcoholic beer market was valued at USD 20.9 Bn in 2025.

The global non-alcoholic beer market industry is expected to grow at a CAGR of 7.1% from 2026 to 2035.

The demand for the non-alcoholic beer market is driven by rising health and wellness awareness, urban lifestyles, and growing disposable incomes. Innovations in brewing, flavor, and distribution channels, along with strategic brand partnerships, are further accelerating global market growth.

In terms of product type, the alcohol-free beer (0.0% ABV) segment accounted for the major share in 2025.

Key players in the global non-alcoholic beer market include prominent companies such as Anheuser-Busch InBev, Asahi Group Holdings, Athletic Brewing Company, Bavaria N.V., Big Drop Brewing Co., Bitburger Braugruppe, BrewDog, Brooklyn Brewery, Carlsberg Group, Clausthaler (Radeberger Group), Constellation Brands, Erdinger Weissbrau, Heineken (Buckler Brand), Heineken N.V., Kirin Holdings Company, Krombacher Brauerei, Molson Coors Beverage Company, Partake Brewing, San Miguel Brewery, Suntory Holdings Limited, Weihenstephan, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Non-Alcoholic Beer Market Outlook

- 2.1.1. Non-Alcoholic Beer Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Non-Alcoholic Beer Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Food & Beverages Industry Overview, 2025

- 3.1.1. Food & Beverages Industry Ecosystem Analysis

- 3.1.2. Key Trends for Food & Beverages Industry

- 3.1.3. Regional Distribution for Food & Beverages Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Food & Beverages Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising health consciousness and shift toward low- or no-alcohol lifestyles

- 4.1.1.2. Increasing product innovation in flavors, functional ingredients, and premium formulations

- 4.1.1.3. Expanding distribution through e-commerce and on-trade channels

- 4.1.2. Restraints

- 4.1.2.1. Limited consumer acceptance in traditional alcoholic beverage markets

- 4.1.2.2. High production costs and complex labeling regulations

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Non-Alcoholic Beer Manufactures

- 4.4.3. Dealers/ Distributors

- 4.4.4. End-Users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Non-Alcoholic Beer Market Demand

- 4.9.1. Historical Market Size – Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Non-Alcoholic Beer Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Non-Alcoholic Beer Market Size (Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Alcohol-Free Beer (0.0% ABV)

- 6.2.2. Low-Alcohol Beer (0.05% - 0.5% ABV)

- 6.2.3. De-Alcoholized Beer (up to 0.5% ABV)

- 7. Global Non-Alcoholic Beer Market Analysis, by Brewing Method

- 7.1. Key Segment Analysis

- 7.2. Non-Alcoholic Beer Market Size (Value - US$ Bn), Analysis, and Forecasts, by Brewing Method, 2021-2035

- 7.2.1. Restricted Fermentation

- 7.2.2. Dealcoholization Method

- 7.2.2.1. Heat Treatment/Distillation

- 7.2.2.2. Reverse Osmosis

- 7.2.2.3. Dialysis

- 7.2.2.4. Others

- 7.2.3. Dilution Method

- 7.2.4. Others

- 8. Global Non-Alcoholic Beer Market Analysis, by Flavor Type

- 8.1. Key Segment Analysis

- 8.2. Non-Alcoholic Beer Market Size (Value - US$ Bn), Analysis, and Forecasts, by Flavor Type, 2021-2035

- 8.2.1. Regular/Original

- 8.2.2. Flavored Non-Alcoholic Beer

- 8.2.2.1. Fruit Flavored

- 8.2.2.2. Herbal/Botanical

- 8.2.2.3. Spiced

- 8.2.2.4. Others

- 9. Global Non-Alcoholic Beer Market Analysis, by Ingredients

- 9.1. Key Segment Analysis

- 9.2. Non-Alcoholic Beer Market Size (Value - US$ Bn), Analysis, and Forecasts, by Ingredients, 2021-2035

- 9.2.1. Malted Barley

- 9.2.2. Wheat

- 9.2.3. Rice

- 9.2.4. Corn

- 9.2.5. Hops Varieties

- 9.2.6. Others (Oats, Rye, etc.)

- 10. Global Non-Alcoholic Beer Market Analysis, by Consumer Demographic

- 10.1. Key Segment Analysis

- 10.2. Non-Alcoholic Beer Market Size (Value - US$ Bn), Analysis, and Forecasts, by Consumer Demographic, 2021-2035

- 10.2.1. Millennials (25-40 years)

- 10.2.2. Gen Z (18-24 years)

- 10.2.3. Gen X (41-56 years)

- 10.2.4. Baby Boomers (57+ years)

- 11. Global Non-Alcoholic Beer Market Analysis, by End-users

- 11.1. Key Segment Analysis

- 11.2. Non-Alcoholic Beer Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 11.2.1. Individual Consumers

- 11.2.1.1. Health & Wellness

- 11.2.1.2. Social Drinking

- 11.2.1.3. Designated Driving

- 11.2.1.4. Pregnancy & Medical Restrictions

- 11.2.1.5. Others

- 11.2.2. HoReCa (Hotels, Restaurants, Cafés)

- 11.2.2.1. Restaurant Services

- 11.2.2.2. Bar & Pub Services

- 11.2.2.3. Hotel Services

- 11.2.2.4. Others

- 11.2.3. Sports & Fitness Centers

- 11.2.3.1. Post-Workout Recovery

- 11.2.3.2. Sports Events

- 11.2.3.3. Others

- 11.2.4. Corporate & Offices

- 11.2.5. Healthcare & Wellness Centers

- 11.2.6. Transportation & Travel

- 11.2.7. Retail & Supermarkets

- 11.2.8. Events & Entertainment

- 11.2.9. Other End-users

- 11.2.1. Individual Consumers

- 12. Global Non-Alcoholic Beer Market Analysis, by Distribution Channel

- 12.1. Key Segment Analysis

- 12.2. Non-Alcoholic Beer Market Size (Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 12.2.1. On-Trade

- 12.2.1.1. Bars & Pubs

- 12.2.1.2. Restaurants

- 12.2.1.3. Hotels

- 12.2.1.4. Cafes

- 12.2.1.5. Others

- 12.2.2. Off-Trade

- 12.2.2.1. Supermarkets/Hypermarkets

- 12.2.2.2. Convenience Stores

- 12.2.2.3. Specialty Stores

- 12.2.2.4. Online Retail/E-commerce

- 12.2.2.5. Liquor Stores

- 12.2.2.6. Others

- 12.2.1. On-Trade

- 13. Global Non-Alcoholic Beer Market Analysis, by Packaging Type

- 13.1. Key Segment Analysis

- 13.2. Non-Alcoholic Beer Market Size (Value - US$ Bn), Analysis, and Forecasts, by Packaging Type, 2021-2035

- 13.2.1. Bottles

- 13.2.1.1. Glass Bottles

- 13.2.1.2. PET Bottles

- 13.2.2. Cans

- 13.2.2.1. Standard Cans

- 13.2.2.2. Slim Cans

- 13.2.3. Kegs/Barrels

- 13.2.4. Tetra Packs

- 13.2.5. Others

- 13.2.1. Bottles

- 14. Global Non-Alcoholic Beer Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Non-Alcoholic Beer Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Non-Alcoholic Beer Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Non-Alcoholic Beer Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Brewing Method

- 15.3.3. Flavor Type

- 15.3.4. Ingredients

- 15.3.5. Consumer Demographic

- 15.3.6. End-users

- 15.3.7. Distribution Channel

- 15.3.8. Packaging Type

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Non-Alcoholic Beer Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Brewing Method

- 15.4.4. Flavor Type

- 15.4.5. Ingredients

- 15.4.6. Consumer Demographic

- 15.4.7. End-users

- 15.4.8. Distribution Channel

- 15.4.9. Packaging Type

- 15.5. Canada Non-Alcoholic Beer Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Brewing Method

- 15.5.4. Flavor Type

- 15.5.5. Ingredients

- 15.5.6. Consumer Demographic

- 15.5.7. End-users

- 15.5.8. Distribution Channel

- 15.5.9. Packaging Type

- 15.6. Mexico Non-Alcoholic Beer Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Brewing Method

- 15.6.4. Flavor Type

- 15.6.5. Ingredients

- 15.6.6. Consumer Demographic

- 15.6.7. End-users

- 15.6.8. Distribution Channel

- 15.6.9. Packaging Type

- 16. Europe Non-Alcoholic Beer Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Non-Alcoholic Beer Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Country Segmental Analysis

- 16.3.2. Product Type

- 16.3.3. Brewing Method

- 16.3.4. Flavor Type

- 16.3.5. Ingredients

- 16.3.6. Consumer Demographic

- 16.3.7. End-users

- 16.3.8. Distribution Channel

- 16.3.9. Packaging Type

- 16.3.10. Country

- 16.3.10.1. Germany

- 16.3.10.2. United Kingdom

- 16.3.10.3. France

- 16.3.10.4. Italy

- 16.3.10.5. Spain

- 16.3.10.6. Netherlands

- 16.3.10.7. Nordic Countries

- 16.3.10.8. Poland

- 16.3.10.9. Russia & CIS

- 16.3.10.10. Rest of Europe

- 16.4. Germany Non-Alcoholic Beer Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Brewing Method

- 16.4.4. Flavor Type

- 16.4.5. Ingredients

- 16.4.6. Consumer Demographic

- 16.4.7. End-users

- 16.4.8. Distribution Channel

- 16.4.9. Packaging Type

- 16.5. United Kingdom Non-Alcoholic Beer Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Brewing Method

- 16.5.4. Flavor Type

- 16.5.5. Ingredients

- 16.5.6. Consumer Demographic

- 16.5.7. End-users

- 16.5.8. Distribution Channel

- 16.5.9. Packaging Type

- 16.6. France Non-Alcoholic Beer Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Brewing Method

- 16.6.4. Flavor Type

- 16.6.5. Ingredients

- 16.6.6. Consumer Demographic

- 16.6.7. End-users

- 16.6.8. Distribution Channel

- 16.6.9. Packaging Type

- 16.7. Italy Non-Alcoholic Beer Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Brewing Method

- 16.7.4. Flavor Type

- 16.7.5. Ingredients

- 16.7.6. Consumer Demographic

- 16.7.7. End-users

- 16.7.8. Distribution Channel

- 16.7.9. Packaging Type

- 16.8. Spain Non-Alcoholic Beer Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Brewing Method

- 16.8.4. Flavor Type

- 16.8.5. Ingredients

- 16.8.6. Consumer Demographic

- 16.8.7. End-users

- 16.8.8. Distribution Channel

- 16.8.9. Packaging Type

- 16.9. Netherlands Non-Alcoholic Beer Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Brewing Method

- 16.9.4. Flavor Type

- 16.9.5. Ingredients

- 16.9.6. Consumer Demographic

- 16.9.7. End-users

- 16.9.8. Distribution Channel

- 16.9.9. Packaging Type

- 16.10. Nordic Countries Non-Alcoholic Beer Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Brewing Method

- 16.10.4. Flavor Type

- 16.10.5. Ingredients

- 16.10.6. Consumer Demographic

- 16.10.7. End-users

- 16.10.8. Distribution Channel

- 16.10.9. Packaging Type

- 16.11. Poland Non-Alcoholic Beer Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Brewing Method

- 16.11.4. Flavor Type

- 16.11.5. Ingredients

- 16.11.6. Consumer Demographic

- 16.11.7. End-users

- 16.11.8. Distribution Channel

- 16.11.9. Packaging Type

- 16.12. Russia & CIS Non-Alcoholic Beer Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Brewing Method

- 16.12.4. Flavor Type

- 16.12.5. Ingredients

- 16.12.6. Consumer Demographic

- 16.12.7. End-users

- 16.12.8. Distribution Channel

- 16.12.9. Packaging Type

- 16.13. Rest of Europe Non-Alcoholic Beer Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Brewing Method

- 16.13.4. Flavor Type

- 16.13.5. Ingredients

- 16.13.6. Consumer Demographic

- 16.13.7. End-users

- 16.13.8. Distribution Channel

- 16.13.9. Packaging Type

- 17. Asia Pacific Non-Alcoholic Beer Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Asia Pacific Non-Alcoholic Beer Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Country Segmental Analysis

- 17.3.2. Product Type

- 17.3.3. Brewing Method

- 17.3.4. Flavor Type

- 17.3.5. Ingredients

- 17.3.6. Consumer Demographic

- 17.3.7. End-users

- 17.3.8. Distribution Channel

- 17.3.9. Packaging Type

- 17.3.10. Country

- 17.3.10.1. China

- 17.3.10.2. India

- 17.3.10.3. Japan

- 17.3.10.4. South Korea

- 17.3.10.5. Australia and New Zealand

- 17.3.10.6. Indonesia

- 17.3.10.7. Malaysia

- 17.3.10.8. Thailand

- 17.3.10.9. Vietnam

- 17.3.10.10. Rest of Asia Pacific

- 17.4. China Non-Alcoholic Beer Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Brewing Method

- 17.4.4. Flavor Type

- 17.4.5. Ingredients

- 17.4.6. Consumer Demographic

- 17.4.7. End-users

- 17.4.8. Distribution Channel

- 17.4.9. Packaging Type

- 17.5. India Non-Alcoholic Beer Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Brewing Method

- 17.5.4. Flavor Type

- 17.5.5. Ingredients

- 17.5.6. Consumer Demographic

- 17.5.7. End-users

- 17.5.8. Distribution Channel

- 17.5.9. Packaging Type

- 17.6. Japan Non-Alcoholic Beer Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Brewing Method

- 17.6.4. Flavor Type

- 17.6.5. Ingredients

- 17.6.6. Consumer Demographic

- 17.6.7. End-users

- 17.6.8. Distribution Channel

- 17.6.9. Packaging Type

- 17.7. South Korea Non-Alcoholic Beer Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Brewing Method

- 17.7.4. Flavor Type

- 17.7.5. Ingredients

- 17.7.6. Consumer Demographic

- 17.7.7. End-users

- 17.7.8. Distribution Channel

- 17.7.9. Packaging Type

- 17.8. Australia and New Zealand Non-Alcoholic Beer Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Brewing Method

- 17.8.4. Flavor Type

- 17.8.5. Ingredients

- 17.8.6. Consumer Demographic

- 17.8.7. End-users

- 17.8.8. Distribution Channel

- 17.8.9. Packaging Type

- 17.9. Indonesia Non-Alcoholic Beer Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Product Type

- 17.9.3. Brewing Method

- 17.9.4. Flavor Type

- 17.9.5. Ingredients

- 17.9.6. Consumer Demographic

- 17.9.7. End-users

- 17.9.8. Distribution Channel

- 17.9.9. Packaging Type

- 17.10. Malaysia Non-Alcoholic Beer Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Product Type

- 17.10.3. Brewing Method

- 17.10.4. Flavor Type

- 17.10.5. Ingredients

- 17.10.6. Consumer Demographic

- 17.10.7. End-users

- 17.10.8. Distribution Channel

- 17.10.9. Packaging Type

- 17.11. Thailand Non-Alcoholic Beer Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Product Type

- 17.11.3. Brewing Method

- 17.11.4. Flavor Type

- 17.11.5. Ingredients

- 17.11.6. Consumer Demographic

- 17.11.7. End-users

- 17.11.8. Distribution Channel

- 17.11.9. Packaging Type

- 17.12. Vietnam Non-Alcoholic Beer Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Product Type

- 17.12.3. Brewing Method

- 17.12.4. Flavor Type

- 17.12.5. Ingredients

- 17.12.6. Consumer Demographic

- 17.12.7. End-users

- 17.12.8. Distribution Channel

- 17.12.9. Packaging Type

- 17.13. Rest of Asia Pacific Non-Alcoholic Beer Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Product Type

- 17.13.3. Brewing Method

- 17.13.4. Flavor Type

- 17.13.5. Ingredients

- 17.13.6. Consumer Demographic

- 17.13.7. End-users

- 17.13.8. Distribution Channel

- 17.13.9. Packaging Type

- 18. Middle East Non-Alcoholic Beer Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Non-Alcoholic Beer Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Country Segmental Analysis

- 18.3.2. Product Type

- 18.3.3. Brewing Method

- 18.3.4. Flavor Type

- 18.3.5. Ingredients

- 18.3.6. Consumer Demographic

- 18.3.7. End-users

- 18.3.8. Distribution Channel

- 18.3.9. Packaging Type

- 18.3.10. Country

- 18.3.10.1. Turkey

- 18.3.10.2. UAE

- 18.3.10.3. Saudi Arabia

- 18.3.10.4. Israel

- 18.3.10.5. Rest of Middle East

- 18.4. Turkey Non-Alcoholic Beer Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Brewing Method

- 18.4.4. Flavor Type

- 18.4.5. Ingredients

- 18.4.6. Consumer Demographic

- 18.4.7. End-users

- 18.4.8. Distribution Channel

- 18.4.9. Packaging Type

- 18.5. UAE Non-Alcoholic Beer Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Brewing Method

- 18.5.4. Flavor Type

- 18.5.5. Ingredients

- 18.5.6. Consumer Demographic

- 18.5.7. End-users

- 18.5.8. Distribution Channel

- 18.5.9. Packaging Type

- 18.6. Saudi Arabia Non-Alcoholic Beer Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Brewing Method

- 18.6.4. Flavor Type

- 18.6.5. Ingredients

- 18.6.6. Consumer Demographic

- 18.6.7. End-users

- 18.6.8. Distribution Channel

- 18.6.9. Packaging Type

- 18.7. Israel Non-Alcoholic Beer Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Brewing Method

- 18.7.4. Flavor Type

- 18.7.5. Ingredients

- 18.7.6. Consumer Demographic

- 18.7.7. End-users

- 18.7.8. Distribution Channel

- 18.7.9. Packaging Type

- 18.8. Rest of Middle East Non-Alcoholic Beer Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Brewing Method

- 18.8.4. Flavor Type

- 18.8.5. Ingredients

- 18.8.6. Consumer Demographic

- 18.8.7. End-users

- 18.8.8. Distribution Channel

- 18.8.9. Packaging Type

- 19. Africa Non-Alcoholic Beer Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Non-Alcoholic Beer Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Country Segmental Analysis

- 19.3.2. Product Type

- 19.3.3. Brewing Method

- 19.3.4. Flavor Type

- 19.3.5. Ingredients

- 19.3.6. Consumer Demographic

- 19.3.7. End-users

- 19.3.8. Distribution Channel

- 19.3.9. Packaging Type

- 19.3.10. Country

- 19.3.10.1. South Africa

- 19.3.10.2. Egypt

- 19.3.10.3. Nigeria

- 19.3.10.4. Algeria

- 19.3.10.5. Rest of Africa

- 19.4. South Africa Non-Alcoholic Beer Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Brewing Method

- 19.4.4. Flavor Type

- 19.4.5. Ingredients

- 19.4.6. Consumer Demographic

- 19.4.7. End-users

- 19.4.8. Distribution Channel

- 19.4.9. Packaging Type

- 19.5. Egypt Non-Alcoholic Beer Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Brewing Method

- 19.5.4. Flavor Type

- 19.5.5. Ingredients

- 19.5.6. Consumer Demographic

- 19.5.7. End-users

- 19.5.8. Distribution Channel

- 19.5.9. Packaging Type

- 19.6. Nigeria Non-Alcoholic Beer Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Brewing Method

- 19.6.4. Flavor Type

- 19.6.5. Ingredients

- 19.6.6. Consumer Demographic

- 19.6.7. End-users

- 19.6.8. Distribution Channel

- 19.6.9. Packaging Type

- 19.7. Algeria Non-Alcoholic Beer Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Brewing Method

- 19.7.4. Flavor Type

- 19.7.5. Ingredients

- 19.7.6. Consumer Demographic

- 19.7.7. End-users

- 19.7.8. Distribution Channel

- 19.7.9. Packaging Type

- 19.8. Rest of Africa Non-Alcoholic Beer Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Brewing Method

- 19.8.4. Flavor Type

- 19.8.5. Ingredients

- 19.8.6. Consumer Demographic

- 19.8.7. End-users

- 19.8.8. Distribution Channel

- 19.8.9. Packaging Type

- 20. South America Non-Alcoholic Beer Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. South America Non-Alcoholic Beer Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Brewing Method

- 20.3.3. Flavor Type

- 20.3.4. Ingredients

- 20.3.5. Consumer Demographic

- 20.3.6. End-users

- 20.3.7. Distribution Channel

- 20.3.8. Packaging Type

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Non-Alcoholic Beer Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Brewing Method

- 20.4.4. Flavor Type

- 20.4.5. Ingredients

- 20.4.6. Consumer Demographic

- 20.4.7. End-users

- 20.4.8. Distribution Channel

- 20.4.9. Packaging Type

- 20.5. Argentina Non-Alcoholic Beer Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Brewing Method

- 20.5.4. Flavor Type

- 20.5.5. Ingredients

- 20.5.6. Consumer Demographic

- 20.5.7. End-users

- 20.5.8. Distribution Channel

- 20.5.9. Packaging Type

- 20.6. Rest of South America Non-Alcoholic Beer Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Brewing Method

- 20.6.4. Flavor Type

- 20.6.5. Ingredients

- 20.6.6. Consumer Demographic

- 20.6.7. End-users

- 20.6.8. Distribution Channel

- 20.6.9. Packaging Type

- 21. Key Players/ Company Profile

- 21.1. Anheuser-Busch InBev

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Asahi Group Holdings

- 21.3. Athletic Brewing Company

- 21.4. Bavaria N.V.

- 21.5. Big Drop Brewing Co.

- 21.6. Bitburger Braugruppe

- 21.7. BrewDog

- 21.8. Brooklyn Brewery

- 21.9. Carlsberg Group

- 21.10. Clausthaler (Radeberger Group)

- 21.11. Constellation Brands

- 21.12. Erdinger Weissbrau

- 21.13. Heineken (Buckler Brand)

- 21.14. Heineken N.V.

- 21.15. Kirin Holdings Company

- 21.16. Krombacher Brauerei

- 21.17. Molson Coors Beverage Company

- 21.18. Partake Brewing

- 21.19. San Miguel Brewery

- 21.20. Suntory Holdings Limited

- 21.21. Weihenstephan

- 21.22. Other Key Players

- 21.1. Anheuser-Busch InBev

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data