Robotic Lawn Mower Market Size, Share & Trends Analysis Report by Product Type (Fully Autonomous Robotic Mowers, Semi-Autonomous Robotic Mowers, Professional Robotic Mowers), Power Source, Cutting Width, Blade Type, Drive System, Terrain Compatibility, Price Range, Distribution Channel, Applications, End-Users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Robotic Lawn Mower Market Size, Share, and Growth

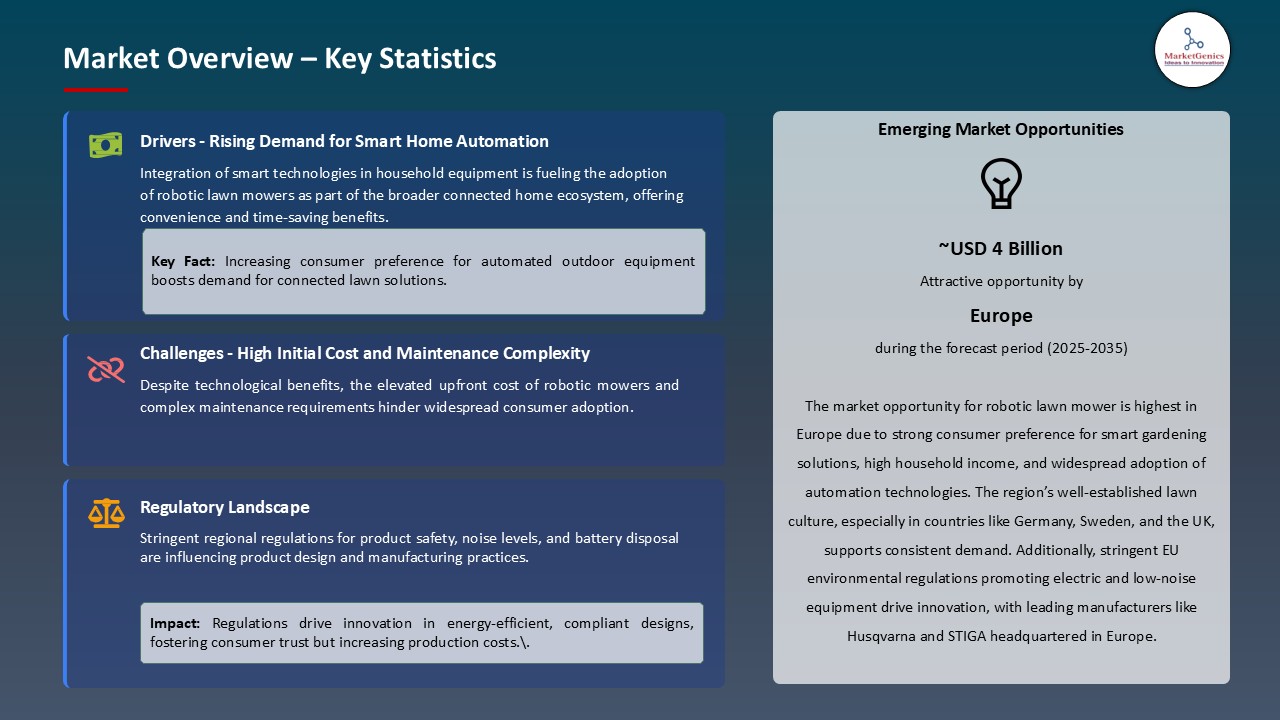

The global robotic lawn mower market is experiencing robust growth, with its estimated value of USD 4.6 billion in the year 2025 and USD 16.5 billion by the period 2035, registering a CAGR of 13.6%, during the forecast period. The robotic lawn mower market growth is driven by rising adoption of smart home technologies, growing preference for automated lawn maintenance, and increasing labor costs. Enhanced battery efficiency, GPS-assisted navigation, and smartphone connectivity further boost consumer interest, while environmental benefits such as reduced emissions and noise strengthen their appeal in both residential and commercial sectors.

Glen Instone, President, Husqvarna Forest & Garden said, “Husqvarna Group has produced robotic lawn mowers for almost 30 years and to continue leading the industry we constantly need to keep pushing our innovation capabilities, secure the highest level of quality, and deliver a smarter lawn care experience whilst minimizing emissions. With the new NERA models, we aim to reach an even broader audience and continue driving the shift from petrol-to-battery within garden care”

The global robotic lawn mower market is driven by the suitable increase in adoption of boundary-wire-free, GNSS/EPOS, and app-connected navigation systems that facilitates installation, improve operational accuracy, and supports edge-cutting optimized performance, providing convenience and increased product penetration within residential and commercial uses. For example, in March 2024, Husqvarna Group announced two new models of Husqvarna Automower for medium-sized gardens – the Automower 310E NERA and the Automower 410XE NERA, which can be paired with Husqvarna's EPOS1 satellite navigation system and the new EdgeCut technology to ensure a clean-cut lawn edge.

Furthermore, the expansion of the global robotic lawn mower market is being fueled by the increased demand for high-capacity, long-duration mowers with modular attachments, such as advanced sensors, batteries, and other accessories, allowing manufacturers to appropriately meet the needs of larger residential lawns and commercial spaces. For example, in 2024, Segway introduced Navimow X3 series in the US market, which has a function to mow larger acreages, utilizing a more advanced mapping and navigation functionality with optional add-ons. These developments are resulting in more rapid premiumization and adoption among both residential and commercial categories, driving growth and competitive product development in the market.

The key market opportunities of the global robotic lawn mower market include smart garden equipment, autonomous outdoor cleaning robots, and AI-driven landscape management systems integrating IoT connectivity and predictive maintenance. These sectors also expand product ecosystems and cross-selling opportunities, leading to increased adoption of smart home products and long-term market scalability.

Robotic Lawn Mower Market Dynamics and Trends

Driver: Advancements in AI-Based Navigation and Autonomous Capabilities

- The global robotic lawn mower market is considerably led by the presence of artificial intelligence (AI), machine learning, and vision-based navigation systems that create a system with enhanced moving accuracy, adjustability, and real-time obstacle detection. Modern robotic mowers are capable of mapping the lawn, detecting grass growth level, and being adjusted to mow without any human interaction resulting in a vaster overall user experience and efficiency. For example, in January 2025, Mammotion introduced at CES 2025 its UltraSense AI Vision system embedded in its next-generation mower series. This system enables auto-mapping of lawns up to 10,000 m², zero-distance edge-cutting, and virtual-fence set-up via vision and inertial systems rather than traditional boundary wires.

- Moreover, these advancements are revolutionizing automated lawn care through improved operational accuracy, reducing human intervention, and improving energy efficiency. The usage of AI & vision-based navigation are creating smarter and more user-focused mowing solutions that will help support the transition of reliance on new product technologies for mowing, on both residential and commercial levels while perpetuating market growth and technology competition.

Restraint: High Initial Cost and Limited Affordability in Emerging Economies

- Improvements are being made in the technology, high up-front costs have hindered market growth throughout the regions, especially in price sensitive areas. The advanced robotic mowers with GPS-enabled vision systems and smart connectivity are too much for the average homeowner to deal with or afford, especially in developing markets, where disposable income is much less than in developed areas.

- Moreover, ongoing maintenance and replacement battery costs add to total cost of ownership. For example, Honda Motor Co., Ltd. has developed a high-end line of robotic mowers aimed at higher income users which is ultimately slowing penetration into middle-income markets in Asia and Latin America. Certainly, several brands are focusing on compact and/or entry-level models, however, there still exists somewhat of a gap between price and performance that will affect mass adoption by many consumers.

- Thus, high up-front and maintenance costs are hampering adoption for the consumer market, especially in emerging economies which limits market growth and penetration into anything other than premium products. The prices inhibit overall momentum of the segment and create the need for scalable solutions that are economically friendly to create new accessibility and build a large consumer base around the globe.

Opportunity: Integration with Renewable Energy and Smart Charging Systems

- The robotic lawn mower market is expected to grow, as a major growth opportunity exists in developing robotic lawn mowers to pair with renewable energy and smart charging technology that supports sustainable lawn maintenance. Robotic lawn mower manufacturers are pursuing solar-powered docking stations, low-energy brushless motors, and other the use of eco-efficient batteries to cut down on environmental impact. For instance, in 2024, Greenworks launched battery powered and smart charging technology for residential homes along with commercial landscape contractors. Greenworks has a robust innovation pipeline that will bring forth multiple new products into the market within the next few months, which include Electric Vehicle Charger, four Zero-Turn Mowers, Power Stations in four different battery platforms, the AiConic Robotic Mower, ChargeLink Battery Charging System, e-transportation, and more.

- Moreover, this aligns with global trends of sustainability mandates and increased consumer awareness regarding green technologies. By coupling energy efficiency with convenience, these innovations may appeal to environmentally-minded homeowners and municipalities looking to establish a history of adoption of sustainable landscaping options. Thus, this confluence of the adoption of renewable technologies will shift robotic mowers into the category of environmentally sustainable options and expand the potential consumption of the market appealing to adopters of green technologies.

Key Trend: Expansion of Connected Ecosystems and Voice-Control Integration

- A notable development in the robotic lawn mower market is the increased integration of connected IoT ecosystems supporting voice control, app-based scheduling, and remote diagnostics. Manufacturers are improving user experience through compatibility with smart home assistants, real-time cloud diagnostics, and monitoring. For instance, in December 2024, UBHOME unveiled intelligent service robot with Qualcomm Technologies, Inc. The Robotic Mower M10 is a new smart lawn mower introduced during the 2025 International Consumer Electronics Show (CES) in the United States.

- Moreover, global robotic lawn mower market is also being spurred by connected ecosystems and voice-control connectivity. The connection to smart homes provides users with the capability to set app schedules, use voice commands, and conduct remote diagnostics if applicable. For example, LUBA 2 AWD 3000X Robot Lawn Mower will eventually provide Amazon Alexa/Google Assistant support, 4G connectivity, and full app-monitoring in the Mammotion ecosystem, with a view to being available in 2024-25. The increased level of connectivity is resulting in greater differentiation of product features, plus more convenience to the customer, and more rapid penetration of tech-savvy markets.

Robotic Lawn Mower Market Analysis and Segmental Data

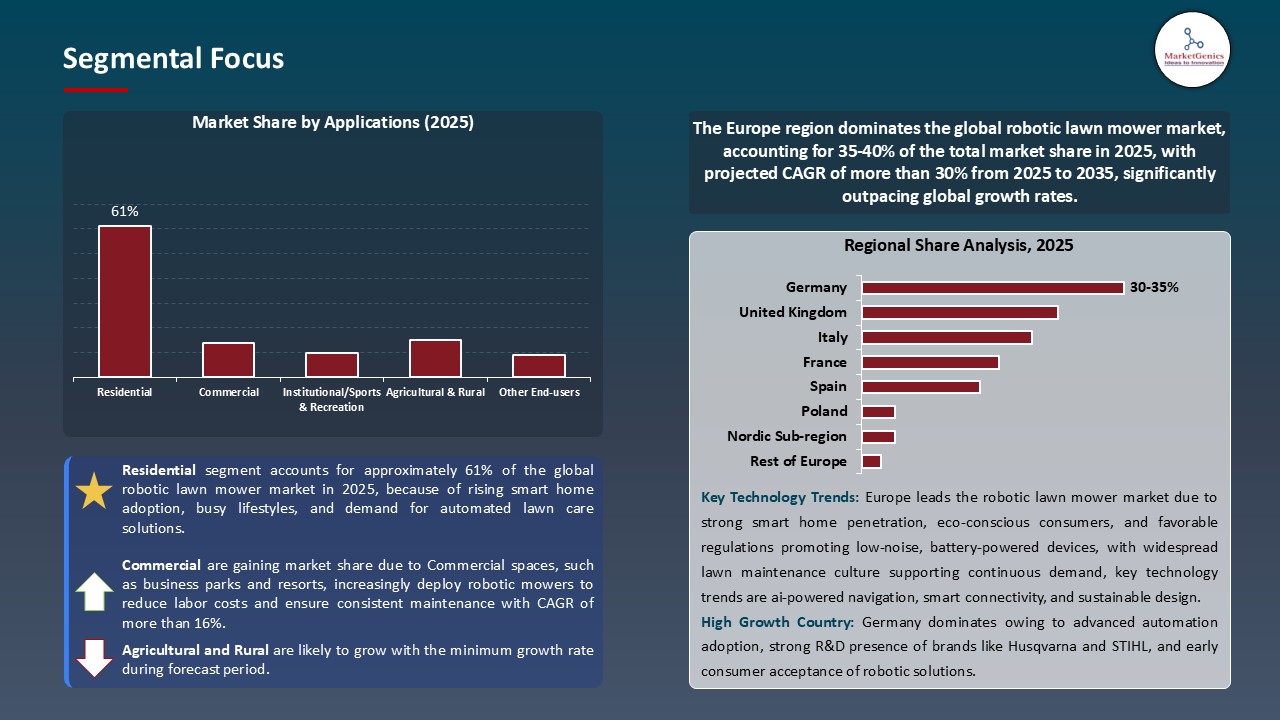

Residential Vaporizers Dominate Global Robotic Lawn Mower Market

- The residential segment holds the largest share in the global robotic lawn mower market due to consumer interest in smart home automation and convenience. Robotic mowers appeal to homeowners because they can save time, decrease physical labor, and allow homeowners to achieve an optimal and manicured lawn without having to supervise the task. With the advancement in AI and application-based scheduling, there are robotic mowers that do not need a boundary wire and follow a guide, today’s robotic mowers are affordable and appealing to many suburban and urban household types. In addition, as disposable income goes up and sustainability is focused on and preferred by many consumers, robotic mowers are known to produce a low noise footprint, are less energy consumptive, and specifically do not have any point-source GHG emissions, adding to the appeal for consumers.

- In addition, for instance, in 2025, Husqvarna launched its Automower 520H EPOS, a robot designed for residential use with wireless installation, GPS-assisted navigation, and app control to facilitate lawn management. These features position robotic mowers perfectly for modern connected homes.

- Increase in residential adoption is also accelerating market growth, together with technological innovation, and is cementing robotic mowers as an everyday household appliance.

Europe Leads Global Robotic Lawn Mower Market Demand

- Europe dominates the global robotic lawn mower market, because of its strong gardening culture, extensive exposure to smart home technologies and labor costs that drive consumers to find cost-effective solutions to replace labor. Countries like Germany, Sweden, the UK, and Netherlands have an increasing number of consumers of autonomous mowers for ease of maintaining their own private lawn and public green. More specifically, the region has a focus on sustainability, low-noise and low (or no) carbon emissions that has led consumers to choose robotic mowers as low-impact alternatives to gasoline mowers.

- In addition, supportive government policies regarding the adoption of electric and battery powered garden machinery is aiding market acceptance. For instance, in 2025, STIHL successfully launched its iMOW 7 and iMOW 7 EVO robotic mower models, equipped with an app interface, GPS routing, conditions, and other sensors for safety and usage conditions, across several key European markets as a climate lawn mower suitable for the European climate.

- As automation knowledge continues to grow, consumers become more sustainable behaviorist, and technologic developments continue to rollout smart technology, Europe will continue to solidify its position as the leading region in the global robotic lawn mower market.

Robotic-Lawn-Mower-Market Ecosystem

The global robotic lawn mower market is moderately fragmented, with high concentration among key players such as Husqvarna Group, STIHL, Honda Motor Co., Ltd., Deere & Company, and Robert Bosch GmbH, who dominate through continuous product innovation, advanced automation technologies, and strong brand equity. These companies leverage extensive distribution networks, strategic partnerships, and sustained investments in R&D to enhance autonomous navigation, connectivity, and energy efficiency in their product portfolios. For instance, in March 2025, Husqvarna introduced its AI-ready Automower EPOS platform, reinforcing upstream technology integration and downstream service ecosystem alignment to strengthen competitive positioning.

Recent Development and Strategic Overview:

- In March 2025, Kärcher introduced its new series of smart robotic lawn mowers with connected features, a mobile app, and integration with the Kärcher Home & Garden ecosystem. This development demonstrates the company's strategic objective of expansion into automated solutions for outdoor cleaning and maintenance with an emphasis on digital ecosystem integration and diversification of products.

- In January 2025, Deere & Company announced the advancement of its autonomous lawn care solutions through the incorporation of AI-based technology for planned paths and smart collision avoidance systems in its new robotic mower product line, with the intention of greater precision in the mowing operation and less manual labor in both the residential and commercial landscape.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 4.6 Bn |

|

Market Forecast Value in 2035 |

USD 16.5 Bn |

|

Growth Rate (CAGR) |

13.6% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Robotic-Lawn-Mower-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Robotic Lawn Mower Market, By Product Type |

|

|

Robotic Lawn Mower Market, By Power Source |

|

|

Robotic Lawn Mower Market, By Cutting Width |

|

|

Robotic Lawn Mower Market, By Blade Type |

|

|

Robotic Lawn Mower Market, By Drive System

|

|

|

Robotic Lawn Mower Market, By Terrain Compatibility

|

|

|

Robotic Lawn Mower Market, By Price Range |

|

|

Robotic Lawn Mower Market, By Distribution Channel |

|

|

Robotic Lawn Mower Market, By Applications |

|

Frequently Asked Questions

The global robotic lawn mower market was valued at USD 4.6 Bn in 2025.

The global robotic lawn mower market industry is expected to grow at a CAGR of 13.6% from 2025 to 2035.

The robotic lawn mower market is driven by increasing consumer preference for smart home automation, rising labor costs, and growing interest in sustainable and time-saving lawn maintenance solutions.

In terms of applications, residential are the segment accounted for the major share in 2025

Europe is a more attractive region for vendors.

Key players in the global robotic lawn mower market include AL-KO Geräte GmbH, Deere & Company, Ecovacs Robotics, EGO Power+, Greenworks Tools, Honda Motor Co., Ltd., Husqvarna Group, Kärcher, Mammotion, MTD Products Inc., Robert Bosch GmbH, Segway-Ninebot, STIGA S.p.A., STIHL, Techtronic Industries, The Toro Company, Yard Force, Zucchetti Centro Sistemi S.p.A., and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Robotic Lawn Mower Market Outlook

- 2.1.1. Robotic Lawn Mower Market Size (Volume - Units & Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Robotic Lawn Mower Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Robotic Lawn Mower Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Robotic Lawn Mower Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Growing demand for automation and smart home technologies

- 4.1.1.2. Labor shortages and rising labor costs for lawn maintenance

- 4.1.1.3. Advancements in AI, GPS, and sensor technologies improving mowing efficiency

- 4.1.2. Restraints

- 4.1.2.1. High initial purchase and maintenance costs

- 4.1.2.2. Limited performance on uneven or complex terrains

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Component Suppliers

- 4.4.2. Robotic Lawn Mower Manufacturers

- 4.4.3. Distributors/ Suppliers

- 4.4.4. End-users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Robotic Lawn Mower Market Demand

- 4.7.1. Historical Market Size - (Volume - Units & Value - US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - (Volume - Units & Value - US$ Bn), 2025–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Robotic Lawn Mower Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Robotic Lawn Mower Market Size (Volume - Units & Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Fully Autonomous Robotic Mowers

- 6.2.1.1. GPS-enabled models

- 6.2.1.2. Boundary wire-based models

- 6.2.1.3. Hybrid navigation models

- 6.2.2. Semi-Autonomous Robotic Mowers

- 6.2.2.1. Remote-controlled models

- 6.2.2.2. App-controlled models

- 6.2.3. Professional Robotic Mowers

- 6.2.3.1. Large-area commercial models

- 6.2.3.2. Industrial-grade models

- 6.2.1. Fully Autonomous Robotic Mowers

- 7. Global Robotic Lawn Mower Market Analysis, by Power Source

- 7.1. Key Segment Analysis

- 7.2. Robotic Lawn Mower Market Size (Volume - Units & Value - US$ Bn), Analysis, and Forecasts, by Power Source, 2021-2035

- 7.2.1. Battery-Powered

- 7.2.1.1. Lithium-ion battery

- 7.2.1.2. Nickel-metal hydride battery

- 7.2.1.3. Lead-acid battery

- 7.2.1.4. Others

- 7.2.2. Solar-Powered

- 7.2.3. Hybrid solar-battery models

- 7.2.4. Pure solar models

- 7.2.5. Corded Electric

- 7.2.1. Battery-Powered

- 8. Global Robotic Lawn Mower Market Analysis and Forecasts, by Cutting Width

- 8.1. Key Findings

- 8.2. Robotic Lawn Mower Market Size (Volume - Units & Value - US$ Bn), Analysis, and Forecasts, by Cutting Width, 2021-2035

- 8.2.1. Up to 20 cm

- 8.2.2. 21-30 cm

- 8.2.3. 31-45 cm

- 8.2.4. Above 45 cm

- 9. Global Robotic Lawn Mower Market Analysis and Forecasts, by Blade Type

- 9.1. Key Findings

- 9.2. Robotic Lawn Mower Market Size (Volume - Units & Value - US$ Bn), Analysis, and Forecasts, by Blade Type, 2021-2035

- 9.2.1. Pivoting Blades

- 9.2.2. Fixed Blades

- 9.2.3. Mulching Blades

- 9.2.4. Razor Blades

- 10. Global Robotic Lawn Mower Market Analysis and Forecasts, by Drive System

- 10.1. Key Findings

- 10.2. Robotic Lawn Mower Market Size (Volume - Units & Value - US$ Bn), Analysis, and Forecasts, by Drive System, 2021-2035

- 10.2.1. Two-Wheel Drive

- 10.2.2. Four-Wheel Drive

- 10.2.3. All-Wheel Drive

- 11. Global Robotic Lawn Mower Market Analysis and Forecasts, by Terrain Compatibility

- 11.1. Key Findings

- 11.2. Robotic Lawn Mower Market Size (Volume - Units & Value - US$ Bn), Analysis, and Forecasts, by Terrain Compatibility, 2021-2035

- 11.2.1. Flat Terrain

- 11.2.2. Sloped Terrain

- 11.2.3. Steep Terrain

- 11.2.4. Multi-Terrain Capable

- 12. Global Robotic Lawn Mower Market Analysis and Forecasts, by Price Range

- 12.1. Key Findings

- 12.2. Robotic Lawn Mower Market Size (Volume - Units & Value - US$ Bn), Analysis, and Forecasts, by Price Range, 2021-2035

- 12.2.1. Economy

- 12.2.2. Mid-Range

- 12.2.3. Premium

- 13. Global Robotic Lawn Mower Market Analysis and Forecasts, by Distribution Channel

- 13.1. Key Findings

- 13.2. Robotic Lawn Mower Market Size (Volume - Units & Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 13.2.1. Online Sales

- 13.2.1.1. Company websites

- 13.2.1.2. E-commerce platforms

- 13.2.1.3. Others

- 13.2.2. Offline Sales

- 13.2.2.1. Specialty stores

- 13.2.2.2. Direct sales

- 13.2.2.3. Dealers and distributors

- 13.2.2.4. Others

- 13.2.1. Online Sales

- 14. Global Robotic Lawn Mower Market Analysis and Forecasts, by Applications

- 14.1. Key Findings

- 14.2. Robotic Lawn Mower Market Size (Volume - Units & Value - US$ Bn), Analysis, and Forecasts, by Applications, 2021-2035

- 14.2.1. Residential

- 14.2.1.1. Small Gardens

- 14.2.1.2. Medium-Sized Lawns

- 14.2.1.3. Large Private Estates

- 14.2.1.4. Others

- 14.2.2. Commercial

- 14.2.2.1. Corporate Campuses

- 14.2.2.2. Hotels and Resorts

- 14.2.2.3. Shopping Centers and Malls

- 14.2.2.4. Restaurants and Cafes

- 14.2.2.5. Others

- 14.2.3. Institutional

- 14.2.3.1. Educational Institutions

- 14.2.3.2. Healthcare Facilities

- 14.2.3.3. Government Buildings

- 14.2.3.4. Others

- 14.2.4. Sports and Recreation

- 14.2.4.1. Golf Courses

- 14.2.4.2. Sports Stadiums

- 14.2.4.3. Parks and Recreation Areas

- 14.2.4.4. Others

- 14.2.5. Landscaping and Facilities Management

- 14.2.6. Agricultural and Rural

- 14.2.7. Other End-users

- 14.2.1. Residential

- 15. Global Robotic Lawn Mower Market Analysis and Forecasts, by Region

- 15.1. Key Findings

- 15.2. Robotic Lawn Mower Market Size (Volume - Units & Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 15.2.1. North America

- 15.2.2. Europe

- 15.2.3. Asia Pacific

- 15.2.4. Middle East

- 15.2.5. Africa

- 15.2.6. South America

- 16. North America Robotic Lawn Mower Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. North America Robotic Lawn Mower Market Size (Volume - Units & Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Power Source

- 16.3.3. Cutting Width

- 16.3.4. Blade Type

- 16.3.5. Drive System

- 16.3.6. Terrain Compatibility

- 16.3.7. Price Range

- 16.3.8. Distribution Channel

- 16.3.9. Applications

- 16.3.10. Country

- 16.3.10.1. USA

- 16.3.10.2. Canada

- 16.3.10.3. Mexico

- 16.4. USA Robotic Lawn Mower Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Power Source

- 16.4.4. Cutting Width

- 16.4.5. Blade Type

- 16.4.6. Drive System

- 16.4.7. Terrain Compatibility

- 16.4.8. Price Range

- 16.4.9. Distribution Channel

- 16.4.10. Applications

- 16.5. Canada Robotic Lawn Mower Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Power Source

- 16.5.4. Cutting Width

- 16.5.5. Blade Type

- 16.5.6. Drive System

- 16.5.7. Terrain Compatibility

- 16.5.8. Price Range

- 16.5.9. Distribution Channel

- 16.5.10. Applications

- 16.6. Mexico Robotic Lawn Mower Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Power Source

- 16.6.4. Cutting Width

- 16.6.5. Blade Type

- 16.6.6. Drive System

- 16.6.7. Terrain Compatibility

- 16.6.8. Price Range

- 16.6.9. Distribution Channel

- 16.6.10. Applications

- 17. Europe Robotic Lawn Mower Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Europe Robotic Lawn Mower Market Size (Volume - Units & Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Power Source

- 17.3.3. Cutting Width

- 17.3.4. Blade Type

- 17.3.5. Drive System

- 17.3.6. Terrain Compatibility

- 17.3.7. Price Range

- 17.3.8. Distribution Channel

- 17.3.9. Applications

- 17.3.10. Country

- 17.3.10.1. Germany

- 17.3.10.2. United Kingdom

- 17.3.10.3. France

- 17.3.10.4. Italy

- 17.3.10.5. Spain

- 17.3.10.6. Netherlands

- 17.3.10.7. Nordic Countries

- 17.3.10.8. Poland

- 17.3.10.9. Russia & CIS

- 17.3.10.10. Rest of Europe

- 17.4. Germany Robotic Lawn Mower Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Power Source

- 17.4.4. Cutting Width

- 17.4.5. Blade Type

- 17.4.6. Drive System

- 17.4.7. Terrain Compatibility

- 17.4.8. Price Range

- 17.4.9. Distribution Channel

- 17.4.10. Applications

- 17.5. United Kingdom Robotic Lawn Mower Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Power Source

- 17.5.4. Cutting Width

- 17.5.5. Blade Type

- 17.5.6. Drive System

- 17.5.7. Terrain Compatibility

- 17.5.8. Price Range

- 17.5.9. Distribution Channel

- 17.5.10. Applications

- 17.6. France Robotic Lawn Mower Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Power Source

- 17.6.4. Cutting Width

- 17.6.5. Blade Type

- 17.6.6. Drive System

- 17.6.7. Terrain Compatibility

- 17.6.8. Price Range

- 17.6.9. Distribution Channel

- 17.6.10. Applications

- 17.7. Italy Robotic Lawn Mower Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Power Source

- 17.7.4. Cutting Width

- 17.7.5. Blade Type

- 17.7.6. Drive System

- 17.7.7. Terrain Compatibility

- 17.7.8. Price Range

- 17.7.9. Distribution Channel

- 17.7.10. Applications

- 17.8. Spain Robotic Lawn Mower Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Power Source

- 17.8.4. Cutting Width

- 17.8.5. Blade Type

- 17.8.6. Drive System

- 17.8.7. Terrain Compatibility

- 17.8.8. Price Range

- 17.8.9. Distribution Channel

- 17.8.10. Applications

- 17.9. Netherlands Robotic Lawn Mower Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Product Type

- 17.9.3. Power Source

- 17.9.4. Cutting Width

- 17.9.5. Blade Type

- 17.9.6. Drive System

- 17.9.7. Terrain Compatibility

- 17.9.8. Price Range

- 17.9.9. Distribution Channel

- 17.9.10. Applications

- 17.10. Nordic Countries Robotic Lawn Mower Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Product Type

- 17.10.3. Power Source

- 17.10.4. Cutting Width

- 17.10.5. Blade Type

- 17.10.6. Drive System

- 17.10.7. Terrain Compatibility

- 17.10.8. Price Range

- 17.10.9. Distribution Channel

- 17.10.10. Applications

- 17.11. Poland Robotic Lawn Mower Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Product Type

- 17.11.3. Power Source

- 17.11.4. Cutting Width

- 17.11.5. Blade Type

- 17.11.6. Drive System

- 17.11.7. Terrain Compatibility

- 17.11.8. Price Range

- 17.11.9. Distribution Channel

- 17.11.10. Applications

- 17.12. Russia & CIS Robotic Lawn Mower Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Product Type

- 17.12.3. Power Source

- 17.12.4. Cutting Width

- 17.12.5. Blade Type

- 17.12.6. Drive System

- 17.12.7. Terrain Compatibility

- 17.12.8. Price Range

- 17.12.9. Distribution Channel

- 17.12.10. Applications

- 17.13. Rest of Europe Robotic Lawn Mower Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Product Type

- 17.13.3. Power Source

- 17.13.4. Cutting Width

- 17.13.5. Blade Type

- 17.13.6. Drive System

- 17.13.7. Terrain Compatibility

- 17.13.8. Price Range

- 17.13.9. Distribution Channel

- 17.13.10. Applications

- 18. Asia Pacific Robotic Lawn Mower Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. East Asia Robotic Lawn Mower Market Size (Volume - Units & Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Power Source

- 18.3.3. Cutting Width

- 18.3.4. Blade Type

- 18.3.5. Drive System

- 18.3.6. Terrain Compatibility

- 18.3.7. Price Range

- 18.3.8. Distribution Channel

- 18.3.9. Applications

- 18.3.10. Country

- 18.3.10.1. China

- 18.3.10.2. India

- 18.3.10.3. Japan

- 18.3.10.4. South Korea

- 18.3.10.5. Australia and New Zealand

- 18.3.10.6. Indonesia

- 18.3.10.7. Malaysia

- 18.3.10.8. Thailand

- 18.3.10.9. Vietnam

- 18.3.10.10. Rest of Asia Pacific

- 18.4. China Robotic Lawn Mower Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Power Source

- 18.4.4. Cutting Width

- 18.4.5. Blade Type

- 18.4.6. Drive System

- 18.4.7. Terrain Compatibility

- 18.4.8. Price Range

- 18.4.9. Distribution Channel

- 18.4.10. Applications

- 18.5. India Robotic Lawn Mower Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Power Source

- 18.5.4. Cutting Width

- 18.5.5. Blade Type

- 18.5.6. Drive System

- 18.5.7. Terrain Compatibility

- 18.5.8. Price Range

- 18.5.9. Distribution Channel

- 18.5.10. Applications

- 18.6. Japan Robotic Lawn Mower Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Power Source

- 18.6.4. Cutting Width

- 18.6.5. Blade Type

- 18.6.6. Drive System

- 18.6.7. Terrain Compatibility

- 18.6.8. Price Range

- 18.6.9. Distribution Channel

- 18.6.10. Applications

- 18.7. South Korea Robotic Lawn Mower Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Power Source

- 18.7.4. Cutting Width

- 18.7.5. Blade Type

- 18.7.6. Drive System

- 18.7.7. Terrain Compatibility

- 18.7.8. Price Range

- 18.7.9. Distribution Channel

- 18.7.10. Applications

- 18.8. Australia and New Zealand Robotic Lawn Mower Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Power Source

- 18.8.4. Cutting Width

- 18.8.5. Blade Type

- 18.8.6. Drive System

- 18.8.7. Terrain Compatibility

- 18.8.8. Price Range

- 18.8.9. Distribution Channel

- 18.8.10. Applications

- 18.9. Indonesia Robotic Lawn Mower Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Product Type

- 18.9.3. Power Source

- 18.9.4. Cutting Width

- 18.9.5. Blade Type

- 18.9.6. Drive System

- 18.9.7. Terrain Compatibility

- 18.9.8. Price Range

- 18.9.9. Distribution Channel

- 18.9.10. Applications

- 18.10. Malaysia Robotic Lawn Mower Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Product Type

- 18.10.3. Power Source

- 18.10.4. Cutting Width

- 18.10.5. Blade Type

- 18.10.6. Drive System

- 18.10.7. Terrain Compatibility

- 18.10.8. Price Range

- 18.10.9. Distribution Channel

- 18.10.10. Applications

- 18.11. Thailand Robotic Lawn Mower Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Product Type

- 18.11.3. Power Source

- 18.11.4. Cutting Width

- 18.11.5. Blade Type

- 18.11.6. Drive System

- 18.11.7. Terrain Compatibility

- 18.11.8. Price Range

- 18.11.9. Distribution Channel

- 18.11.10. Applications

- 18.12. Vietnam Robotic Lawn Mower Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Product Type

- 18.12.3. Power Source

- 18.12.4. Cutting Width

- 18.12.5. Blade Type

- 18.12.6. Drive System

- 18.12.7. Terrain Compatibility

- 18.12.8. Price Range

- 18.12.9. Distribution Channel

- 18.12.10. Applications

- 18.13. Rest of Asia Pacific Robotic Lawn Mower Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Product Type

- 18.13.3. Power Source

- 18.13.4. Cutting Width

- 18.13.5. Blade Type

- 18.13.6. Drive System

- 18.13.7. Terrain Compatibility

- 18.13.8. Price Range

- 18.13.9. Distribution Channel

- 18.13.10. Applications

- 19. Middle East Robotic Lawn Mower Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Middle East Robotic Lawn Mower Market Size (Volume - Units & Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Power Source

- 19.3.3. Cutting Width

- 19.3.4. Blade Type

- 19.3.5. Drive System

- 19.3.6. Terrain Compatibility

- 19.3.7. Price Range

- 19.3.8. Distribution Channel

- 19.3.9. Applications

- 19.3.10. Country

- 19.3.10.1. Turkey

- 19.3.10.2. UAE

- 19.3.10.3. Saudi Arabia

- 19.3.10.4. Israel

- 19.3.10.5. Rest of Middle East

- 19.4. Turkey Robotic Lawn Mower Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Power Source

- 19.4.4. Cutting Width

- 19.4.5. Blade Type

- 19.4.6. Drive System

- 19.4.7. Terrain Compatibility

- 19.4.8. Price Range

- 19.4.9. Distribution Channel

- 19.4.10. Applications

- 19.5. UAE Robotic Lawn Mower Market

- 19.5.1. Product Type

- 19.5.2. Power Source

- 19.5.3. Cutting Width

- 19.5.4. Blade Type

- 19.5.5. Drive System

- 19.5.6. Terrain Compatibility

- 19.5.7. Price Range

- 19.5.8. Distribution Channel

- 19.5.9. Applications

- 19.6. Saudi Arabia Robotic Lawn Mower Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Power Source

- 19.6.4. Cutting Width

- 19.6.5. Blade Type

- 19.6.6. Drive System

- 19.6.7. Terrain Compatibility

- 19.6.8. Price Range

- 19.6.9. Distribution Channel

- 19.6.10. Applications

- 19.7. Israel Robotic Lawn Mower Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Power Source

- 19.7.4. Cutting Width

- 19.7.5. Blade Type

- 19.7.6. Drive System

- 19.7.7. Terrain Compatibility

- 19.7.8. Price Range

- 19.7.9. Distribution Channel

- 19.7.10. Applications

- 19.8. Rest of Middle East Robotic Lawn Mower Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Power Source

- 19.8.4. Cutting Width

- 19.8.5. Blade Type

- 19.8.6. Drive System

- 19.8.7. Terrain Compatibility

- 19.8.8. Price Range

- 19.8.9. Distribution Channel

- 19.8.10. Applications

- 20. Africa Robotic Lawn Mower Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Africa Robotic Lawn Mower Market Size (Volume - Units & Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Power Source

- 20.3.3. Cutting Width

- 20.3.4. Blade Type

- 20.3.5. Drive System

- 20.3.6. Terrain Compatibility

- 20.3.7. Price Range

- 20.3.8. Distribution Channel

- 20.3.9. Applications

- 20.3.10. Country

- 20.3.10.1. South Africa

- 20.3.10.2. Egypt

- 20.3.10.3. Nigeria

- 20.3.10.4. Algeria

- 20.3.10.5. Rest of Africa

- 20.4. South Africa Robotic Lawn Mower Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Power Source

- 20.4.4. Cutting Width

- 20.4.5. Blade Type

- 20.4.6. Drive System

- 20.4.7. Terrain Compatibility

- 20.4.8. Price Range

- 20.4.9. Distribution Channel

- 20.4.10. Applications

- 20.5. Egypt Robotic Lawn Mower Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Power Source

- 20.5.4. Cutting Width

- 20.5.5. Blade Type

- 20.5.6. Drive System

- 20.5.7. Terrain Compatibility

- 20.5.8. Price Range

- 20.5.9. Distribution Channel

- 20.5.10. Applications

- 20.6. Nigeria Robotic Lawn Mower Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Power Source

- 20.6.4. Cutting Width

- 20.6.5. Blade Type

- 20.6.6. Drive System

- 20.6.7. Terrain Compatibility

- 20.6.8. Price Range

- 20.6.9. Distribution Channel

- 20.6.10. Applications

- 20.7. Algeria Robotic Lawn Mower Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Product Type

- 20.7.3. Power Source

- 20.7.4. Cutting Width

- 20.7.5. Blade Type

- 20.7.6. Drive System

- 20.7.7. Terrain Compatibility

- 20.7.8. Price Range

- 20.7.9. Distribution Channel

- 20.7.10. Applications

- 20.8. Rest of Africa Robotic Lawn Mower Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Product Type

- 20.8.3. Power Source

- 20.8.4. Cutting Width

- 20.8.5. Blade Type

- 20.8.6. Drive System

- 20.8.7. Terrain Compatibility

- 20.8.8. Price Range

- 20.8.9. Distribution Channel

- 20.8.10. Applications

- 21. South America Robotic Lawn Mower Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. Central and South Africa Robotic Lawn Mower Market Size (Volume - Units & Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Product Type

- 21.3.2. Power Source

- 21.3.3. Cutting Width

- 21.3.4. Blade Type

- 21.3.5. Drive System

- 21.3.6. Terrain Compatibility

- 21.3.7. Price Range

- 21.3.8. Distribution Channel

- 21.3.9. Applications

- 21.3.10. Country

- 21.3.10.1. Brazil

- 21.3.10.2. Argentina

- 21.3.10.3. Rest of South America

- 21.4. Brazil Robotic Lawn Mower Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Product Type

- 21.4.3. Power Source

- 21.4.4. Cutting Width

- 21.4.5. Blade Type

- 21.4.6. Drive System

- 21.4.7. Terrain Compatibility

- 21.4.8. Price Range

- 21.4.9. Distribution Channel

- 21.4.10. Applications

- 21.5. Argentina Robotic Lawn Mower Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Product Type

- 21.5.3. Power Source

- 21.5.4. Cutting Width

- 21.5.5. Blade Type

- 21.5.6. Drive System

- 21.5.7. Terrain Compatibility

- 21.5.8. Price Range

- 21.5.9. Distribution Channel

- 21.5.10. Applications

- 21.6. Rest of South America Robotic Lawn Mower Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Product Type

- 21.6.3. Power Source

- 21.6.4. Cutting Width

- 21.6.5. Blade Type

- 21.6.6. Drive System

- 21.6.7. Terrain Compatibility

- 21.6.8. Price Range

- 21.6.9. Distribution Channel

- 21.6.10. Applications

- 22. Key Players/ Company Profile

- 22.1. AL-KO Geräte GmbH

- 22.1.1. Company Details/ Overview

- 22.1.2. Company Financials

- 22.1.3. Key Customers and Competitors

- 22.1.4. Business/ Industry Portfolio

- 22.1.5. Product Portfolio/ Specification Details

- 22.1.6. Pricing Data

- 22.1.7. Strategic Overview

- 22.1.8. Recent Developments

- 22.2. Deere & Company

- 22.3. Ecovacs Robotics

- 22.4. EGO Power+

- 22.5. Greenworks Tools

- 22.6. Honda Motor Co., Ltd.

- 22.7. Husqvarna Group

- 22.8. Kärcher

- 22.9. Mammotion

- 22.10. MTD Products Inc.

- 22.11. Robert Bosch GmbH

- 22.12. Segway-Ninebot

- 22.13. STIGA S.p.A.

- 22.14. STIHL

- 22.15. Techtronic Industries

- 22.16. The Toro Company

- 22.17. Yard Force

- 22.18. Zucchetti Centro Sistemi S.p.A.

- 22.19. Other Key Players

- 22.1. AL-KO Geräte GmbH

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data