Wooden Toy Market Size, Share & Trends Analysis Report by Product Type (Building Blocks & Construction Sets, Educational Toys, Pull & Push Toys, Dolls & Figurines, Musical Instruments, Vehicles & Transportation Games & Activities, Other Product Types), Age Group, Wood Type, Distribution Channel, Manufacturing Process, Design Theme, End-Users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Wooden Toy Market Size, Share, and Growth

The global wooden toy market is experiencing robust growth, with its estimated value of USD 27.8 billion in the year 2025 and USD 41.5 billion by 2035, registering a CAGR of 4.1%, during the forecast period. The wooden toy market is driven by rising consumer preference for eco-friendly, non-toxic products, increasing parental focus on child safety and education, the durability and timeless appeal of wooden toys, and growing demand for sustainable, premium, and personalized play options globally.

Peter Handstein, CEO of Hape said,

“The company is dedicated to creating a positive impact for children, families, and society as a whole. Despite children being just 20 percent of the global population, they represent our entire future. We believe that by creating a sustainable growth environment for them, they will naturally shape their own brilliant future.”

The global wooden toy market is motivated by the increasing environmental issues of plastic contamination and increasing parental inclination to screen-free, educational toys that promote creativity, imagination, and motor abilities growth. As an example, in September 2025, Fisher price released the Wood Montessori Collection in partnership with the American Montessori Society, of FSC certified, non-toxic wooden toys, based on the Montessori principles. This introduction strengthens this market trend of sustainable, educative and developmental wooden toys.

Additionally, the wooden toy market is favored by consumer habits towards minimalism, high heirloom-quality items and conscious consumption, where fewer and better-quality toys are purchased instead of many low-end products of plastic. This behavior mirrors broader purchasing patterns seen in categories such as wooden furniture, where durability, craftsmanship, and long product life cycles are prioritized over disposability. For instance, in 2025 Forestoy introduced a new range of high-end wooden toys that focused on the idea of craftsmanship, FSC-certified wood, and waste-cutting, environmentally friendly production. The introduction of this new product supports the transition of the market to sustainable, high-quality and environmentally friendly wooden toys.

The key adjacent opportunities to the global wooden toy market are eco-friendly educational games, Montessori and STEM kits, artisanal puzzles, sustainable baby products, and creative craft kit opportunities. These segments are complements to wooden toys and are designed to appeal to the conscious consumer who desires developmental, high quality and environmentally responsible play solutions. The diversification and premium growth in these areas can be fueled by an expansion.

Wooden Toy Market Dynamics and Trends

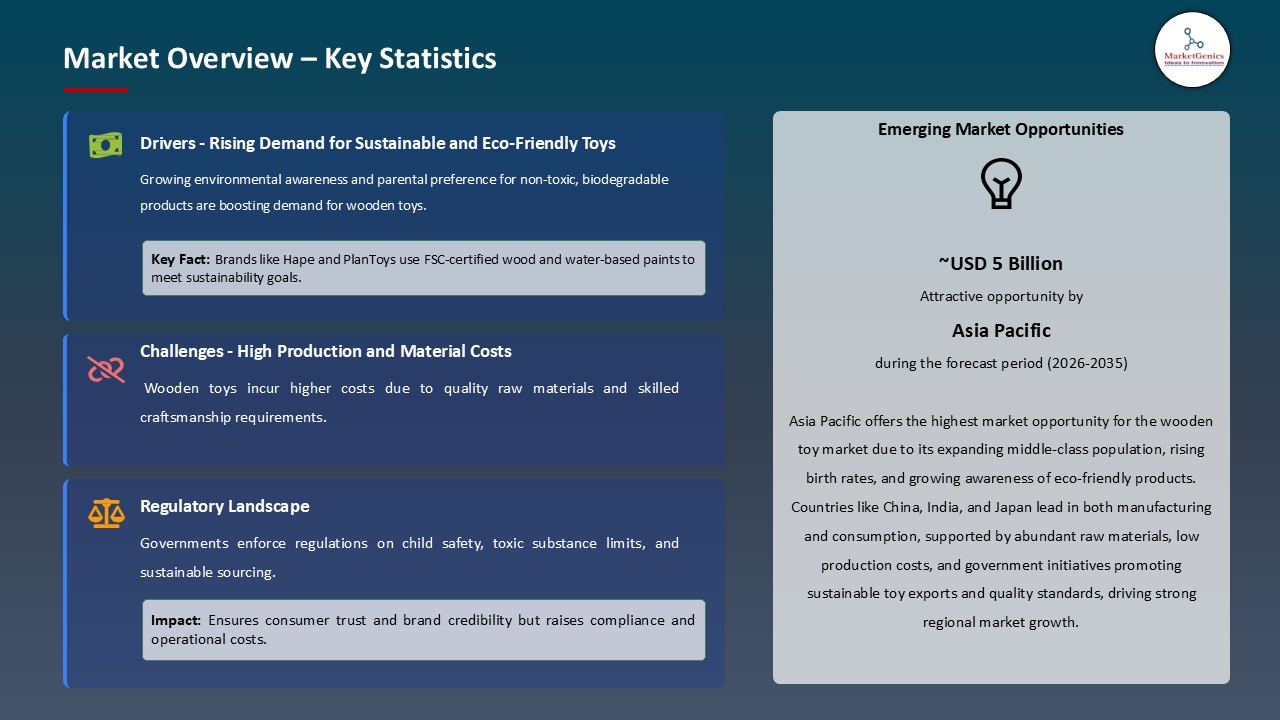

Driver: Sustainability Consciousness and Plastic-Free Parenting Movement

- The wooden toys market is growing remarkably, and primarily due to the growing trend of plastic-free parenting, during which environmentally-conscious parents shun plastic toys because of their potential to expose children to chemicals, produce microplastic, and pollute the environment. Wooden toys are sustainable substitutes that offer high quality and thus align with the values-based purchasing patterns of the modern and well-compensated consumers in the marketplace.

- For instance, in September 2024, Fisher-Price introduced its new Wood line, which restores its historical tradition of wooden toys to provide sustainable, creativity-oriented products to support the development of children. This introduction strengthens the change in the market to a clean, better-quality wooden toys that will serve values conscious, environmentally conscious customers.

- Moreover, the regulatory restrictions on some plastics and chemicals in children products gives a structural benefit to wooden toys. In January 2025, Toy Safety Directive by the EU further restricted the number of phthalates and lead, increasing compliance expenses of plastic toys and leaving wood alternatives uninvolved.

- The resilient growth in the wooden toy market is structurally supported by the environmental awareness, health concerns, sustainability demand, and favorable regulations.

Restraint: Higher Price Points and Limited Electronic Features

- The wooden toy market is limited by the premium prices of retailing against the plastic alternatives, premium materials, hand-work production and the low scale manufacturing that lacks the mass-production economies. These price premiums restrict adoption to only those who are higher income level and values important buyers who are interested in sustainability and quality rather than cost.

- Additionally, wooden toys are naturally restricted in the ability to imitate electronic characteristics (lights, sounds, and interactivity) which are more and more demanded by kids used to digital entertainment. Whereas supporters point to these drawbacks as developing imagination, the market trend is moving towards more high-tech interactive toys, which challenges more traditional wooden ones.

- Wooden toys are only accessible to affluent and values-conscious consumers (Montessori-oriented families, environmentally-conscious professionals, and high-end gift purchasers), limiting their adoption in mass-markets despite significant aspirational demand.

Opportunity: Educational Market and Montessori School Adoption

- The wooden toy market has a high growth potential in the educational institutions such as Montessori and Waldorf schools, preschools, and daycare facilities where the growth potential is encouraged by the developmental advantages, durability, safety and pedagogical suitability of the wooden toy. Institutional purchases provide recession-proof revenue and strengthen the brand presence because parents can interact with the products in the classroom.

- Additionally, the therapeutic industry, including occupational therapy, speech therapy, and special education, is a niche market where the sensory qualities of wooden toys, open-ended design, and flexibility to different ability levels have their unique functional advantages. Woods are commonly used because therapists find them more tactile, weight-appropriate and naturally endowed to promote sensory integration. The educational and therapeutic markets provide a diversification opportunity for consumer retail due to their competitiveness and price sensitivity.

- Institutional acceptance can increase parental awareness and trust in product quality and developmental suitability, potentially leading to retail purchases.

Key Trend: Artisan Craftsmanship and Personalization

- The artisan, handcrafted and customized segments are experiencing significant growth in the wooden toy industry with individual artisans and small-scale manufacturers creating limited edition and customizable toys that attract higher prices, being sold through Etsy, boutique retailers and direct-to-consumer approaches. The market sector is responsive to customer needs for unique, meaningful items, as well as possibly responsive to small businesses and local economic activity.

- Additionally, the artisan trend enables direct contact with the customer, enabling storytelling that emphasizes the identity of the maker and its skill, and the ability to create customized products, which large-scale manufacturers cannot. Several artisan manufacturers put in place more emphasis on local wood, antique methods, and environmentalist responsibility and deliver convincing sustainability stories that resonate with consumers who are growing more skeptical of greenwashing by corporations. The artisan industry that produces wooden toys creates a unique niche in the children's goods, home decor, giftware, and crafts markets.

- This presents opportunities for business models and pricing strategies that are not possible with plastic toys, which are tied to mass-production and lack the authenticity needed for premium positioning.

Wooden Toy Market Analysis and Segmental Data

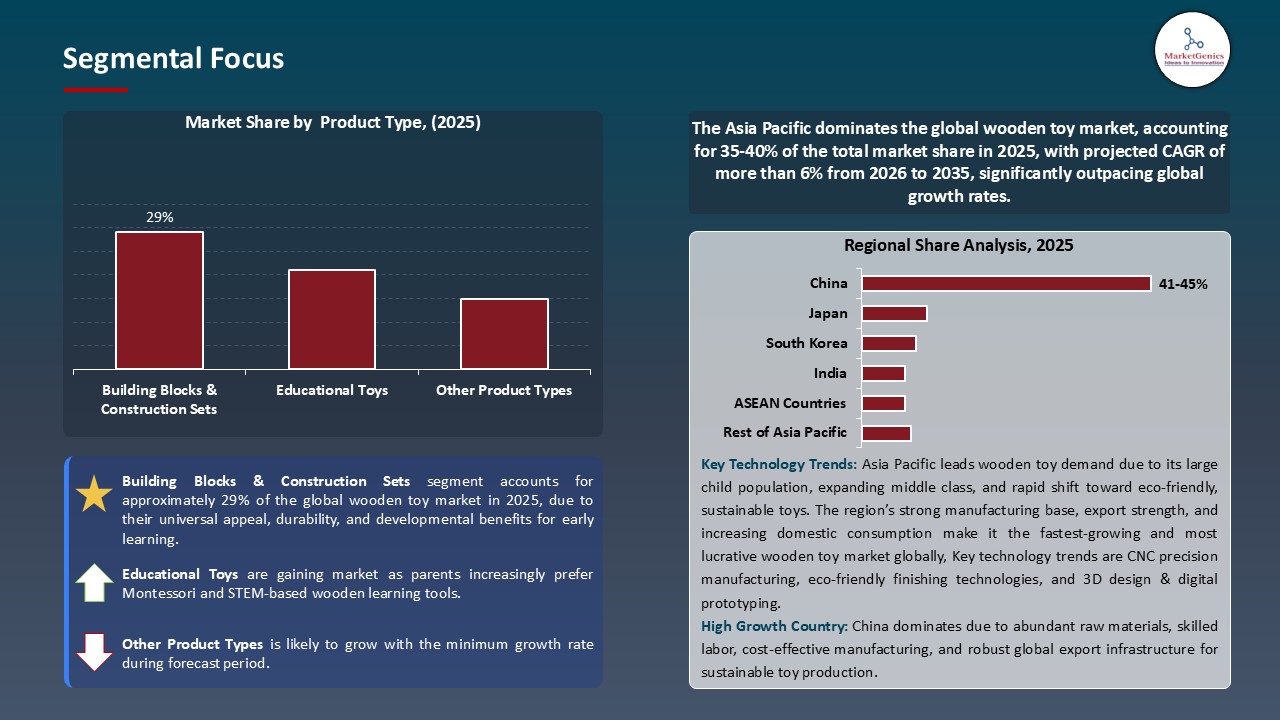

Building Blocks & Construction Sets Dominate Global Wooden Toy Market

- The building blocks & construction sets segment leads the global wooden toy market, driven by an appeal to all age groups because of the universal quality of blocks, open-ended play that promotes creativity and spatial abilities, compatibility with STEM education, and perennial designs that are not dependent on character licensing trends. Wooden blocks are the classic category that has the highest presence and recognition of the market.

- As an example, in January 2024, HABA was awarded the ToyAward in the Baby and Infant category with its Basic Building Blocks set, which made it clear that the industry still values and recognizes block-based wooden toys. The award supports the market leadership and long-term consumer attraction of the segment.

- Additionally, the construction of toys is highly compatible with Montessori and Waldorf philosophies of education that focus on hands-on study, natural materials, unrestricted discovery, and free business in children. A large number of preschools and childcare facilities have collections of wooden blocks as essential learning resources, reinforcing their role alongside other toddler products & accessories used in early childhood development environments, and this institutional demand supplements the consumer retail sales.

- The segment has the advantages of multigenerational appeal, capturing children of all ages and adults, which offers long-term household utility, justifying premium pricing.

Asia Pacific Leads Global Wooden Toy Market Demand

- Asia Pacific leads the global wooden toy market due to the large and growing youth population in Asia Pacific is fueling strong demand in educational and developmental toys including wooden toys in the urban centers and in the emerging markets. As an example, in Vietnam, domestic toy producers are concentrating on the wooden toy product lines due to increased parental preference on the high-quality and safer products as opposed to the low-cost plastic toys.

- The Asia Pacific governmental systems are also facilitating the market of wooden toys based on the regulatory systems and safety standards. India has the Toys (Quality Control) Order, which is enforced by Vietnam through the STAMEQ, and Asia Toy and Play Association, where regional authorities seem to enforce the international standards.

- These initiatives increase the safety and quality of toys, and export preparedness, which allows domestic manufacturers to expand as household needs expand with better-quality, eco-friendly wooden toys.

- These factors improve Asia-Pacific's position in the wooden toy market, leading to sustainable growth, increased consumer confidence, and prospects for local manufacturers.

Wooden-Toy-Market Ecosystem

The global wooden toy market is moderately fragmented, with high concentration among key players such as Melissa & Doug, Hape International, PlanToys, Brio AB, and Janod, who dominate through strong brand name, network distribution, product innovation and attention to quality, safety and sustainable materials. For instance, in 2025, PlanToys introduced its new collection, Eco Play, with FSC-certified wood, non-toxic paint, and STEM-oriented designs, which strengthened its image of sustainability in the market by innovative and sustainable approaches and educational content. This introduction emphasizes the competitive superiority of market leaders, and how innovation and sustainability generate leadership and preference of consumers in the wooden toy product.

Recent Development and Strategic Overview:

- In September 2025, Fisher‑Price again ramped its push with a collaboration with American Montessori Society to launch a Montessori‑inspired wooden‑toy collection, earning the first‑ever AMS Montessori Seal of Excellence.

- In October 2025, wood-toy producers in the Yunhe County, Zhejiang, used e-commerce websites such as Shein and AliExpress to make more than 3,000 cross-border orders and distributed their items to over 150 countries and regions.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 27.8 Bn |

|

Market Forecast Value in 2035 |

USD 41.5 Bn |

|

Growth Rate (CAGR) |

4.1% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Wooden-Toy-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Wooden Toy Market, By Product Type |

|

|

Wooden Toy Market, By Age Group |

|

|

Wooden Toy Market, By Wood Type |

|

|

Wooden Toy Market, By Distribution Channel |

|

|

Wooden Toy Market, By Manufacturing Process

|

|

|

Wooden Toy Market, By Design Theme

|

|

|

Wooden Toy Market, By End-Users

|

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Wooden Toy Market Outlook

- 2.1.1. Wooden Toy Market Size (Volume - Million Units and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Wooden Toy Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising preference for eco-friendly and sustainable toys made from natural materials

- 4.1.1.2. Increasing parental focus on child development and educational play value

- 4.1.1.3. Growth of artisanal and premium handcrafted toy segments supported by e-commerce expansion

- 4.1.2. Restraints

- 4.1.2.1. Higher production costs compared to plastic toys limiting mass-market adoption

- 4.1.2.2. Safety compliance challenges and inconsistent quality standards across regions

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Wooden Toy Manufacturers

- 4.4.3. Dealers/ Distributors

- 4.4.4. End-Users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Wooden Toy Market Demand

- 4.9.1. Historical Market Size – Volume (Million Units) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Volume (Million Units) and Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Wooden Toy Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Wooden Toy Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Building Blocks & Construction Sets

- 6.2.2. Educational Toys

- 6.2.2.1. Alphabet & number toys

- 6.2.2.2. Shape sorters

- 6.2.2.3. Counting & math toys

- 6.2.2.4. Puzzle toys

- 6.2.2.5. Others

- 6.2.3. Pull & Push Toys

- 6.2.3.1. Animal-shaped pull toys

- 6.2.3.2. Vehicles with push handles

- 6.2.3.3. Walking & rolling toys

- 6.2.3.4. Others

- 6.2.4. Dolls & Figurines

- 6.2.5. Musical Instruments

- 6.2.5.1. Xylophones

- 6.2.5.2. Drums

- 6.2.5.3. Maracas & rattles

- 6.2.5.4. Pianos

- 6.2.5.5. Others

- 6.2.6. Dolls & Figurines

- 6.2.6.1. Vehicles & Transportation

- 6.2.6.2. Pretend Play Sets

- 6.2.6.3. Kitchen sets

- 6.2.6.4. Tool sets

- 6.2.6.5. Doctor kits

- 6.2.6.6. Others

- 6.2.7. Games & Activities

- 6.2.8. Other Product Types

- 7. Global Wooden Toy Market Analysis, by Age Group

- 7.1. Key Segment Analysis

- 7.2. Wooden Toy Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Age Group, 2021-2035

- 7.2.1. Infants

- 7.2.2. Toddlers

- 7.2.3. Preschoolers

- 7.2.4. Early Elementary

- 7.2.5. Older Children

- 8. Global Wooden Toy Market Analysis, by Wood Type

- 8.1. Key Segment Analysis

- 8.2. Wooden Toy Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Wood Type, 2021-2035

- 8.2.1. Hardwood

- 8.2.1.1. Beech wood

- 8.2.1.2. Maple wood

- 8.2.1.3. Oak wood

- 8.2.1.4. Others

- 8.2.2. Softwood

- 8.2.3. Plywood

- 8.2.4. Bamboo

- 8.2.5. Rubberwood

- 8.2.6. Mixed wood composites

- 8.2.1. Hardwood

- 9. Global Wooden Toy Market Analysis, by Distribution Channel

- 9.1. Key Segment Analysis

- 9.2. Wooden Toy Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 9.2.1. Online Channels

- 9.2.1.1. E-commerce platforms

- 9.2.1.2. Company websites

- 9.2.1.3. Online specialty toy stores

- 9.2.2. Offline Channels

- 9.2.2.1. Specialty toy stores

- 9.2.2.2. Supermarkets & hypermarkets

- 9.2.2.3. Department stores

- 9.2.2.4. Baby & children's stores

- 9.2.2.5. Others

- 9.2.1. Online Channels

- 10. Global Wooden Toy Market Analysis, by Manufacturing Process

- 10.1. Key Segment Analysis

- 10.2. Wooden Toy Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Manufacturing Process, 2021-2035

- 10.2.1. Handcrafted

- 10.2.2. Machine-made

- 10.2.3. Semi-automated

- 10.2.4. Mass-produced

- 11. Global Wooden Toy Market Analysis, by Design Theme

- 11.1. Key Segment Analysis

- 11.2. Wooden Toy Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Design Theme, 2021-2035

- 11.2.1. Classic/Traditional

- 11.2.2. Modern/Contemporary

- 11.2.3. Montessori-inspired

- 11.2.4. Waldorf-inspired

- 11.2.5. Fantasy/Fairytale-themed

- 12. Global Wooden Toy Market Analysis, by End-Users

- 12.1. Key Segment Analysis

- 12.2. Wooden Toy Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by End-Users, 2021-2035

- 12.2.1. Residential/Household

- 12.2.1.1. Home play & entertainment

- 12.2.1.2. Skill development at home

- 12.2.1.3. Family bonding activities

- 12.2.1.4. Gift giving

- 12.2.1.5. Others

- 12.2.2. Educational Institutions

- 12.2.3. Childcare Centers

- 12.2.4. Healthcare Facilities

- 12.2.5. Commercial Venues

- 12.2.6. Retail & Gifting

- 12.2.7. Other End-users

- 12.2.1. Residential/Household

- 13. Global Wooden Toy Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Wooden Toy Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Wooden Toy Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Wooden Toy Market Size Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Age Group

- 14.3.3. Wood Type

- 14.3.4. Distribution Channel

- 14.3.5. Manufacturing Process

- 14.3.6. Design Theme

- 14.3.7. End-Users

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Wooden Toy Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Age Group

- 14.4.4. Wood Type

- 14.4.5. Distribution Channel

- 14.4.6. Manufacturing Process

- 14.4.7. Design Theme

- 14.4.8. End-Users

- 14.5. Canada Wooden Toy Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Age Group

- 14.5.4. Wood Type

- 14.5.5. Distribution Channel

- 14.5.6. Manufacturing Process

- 14.5.7. Design Theme

- 14.5.8. End-Users

- 14.6. Mexico Wooden Toy Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Age Group

- 14.6.4. Wood Type

- 14.6.5. Distribution Channel

- 14.6.6. Manufacturing Process

- 14.6.7. Design Theme

- 14.6.8. End-Users

- 15. Europe Wooden Toy Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Wooden Toy Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Age Group

- 15.3.3. Wood Type

- 15.3.4. Distribution Channel

- 15.3.5. Manufacturing Process

- 15.3.6. Design Theme

- 15.3.7. End-Users

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Wooden Toy Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Age Group

- 15.4.4. Wood Type

- 15.4.5. Distribution Channel

- 15.4.6. Manufacturing Process

- 15.4.7. Design Theme

- 15.4.8. End-Users

- 15.5. United Kingdom Wooden Toy Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Age Group

- 15.5.4. Wood Type

- 15.5.5. Distribution Channel

- 15.5.6. Manufacturing Process

- 15.5.7. Design Theme

- 15.5.8. End-Users

- 15.6. France Wooden Toy Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Age Group

- 15.6.4. Wood Type

- 15.6.5. Distribution Channel

- 15.6.6. Manufacturing Process

- 15.6.7. Design Theme

- 15.6.8. End-Users

- 15.7. Italy Wooden Toy Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Age Group

- 15.7.4. Wood Type

- 15.7.5. Distribution Channel

- 15.7.6. Manufacturing Process

- 15.7.7. Design Theme

- 15.7.8. End-Users

- 15.8. Spain Wooden Toy Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Age Group

- 15.8.4. Wood Type

- 15.8.5. Distribution Channel

- 15.8.6. Manufacturing Process

- 15.8.7. Design Theme

- 15.8.8. End-Users

- 15.9. Netherlands Wooden Toy Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Product Type

- 15.9.3. Age Group

- 15.9.4. Wood Type

- 15.9.5. Distribution Channel

- 15.9.6. Manufacturing Process

- 15.9.7. Design Theme

- 15.9.8. End-Users

- 15.10. Nordic Countries Wooden Toy Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Product Type

- 15.10.3. Age Group

- 15.10.4. Wood Type

- 15.10.5. Distribution Channel

- 15.10.6. Manufacturing Process

- 15.10.7. Design Theme

- 15.10.8. End-Users

- 15.11. Poland Wooden Toy Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Product Type

- 15.11.3. Age Group

- 15.11.4. Wood Type

- 15.11.5. Distribution Channel

- 15.11.6. Manufacturing Process

- 15.11.7. Design Theme

- 15.11.8. End-Users

- 15.12. Russia & CIS Wooden Toy Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Product Type

- 15.12.3. Age Group

- 15.12.4. Wood Type

- 15.12.5. Distribution Channel

- 15.12.6. Manufacturing Process

- 15.12.7. Design Theme

- 15.12.8. End-Users

- 15.13. Rest of Europe Wooden Toy Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Product Type

- 15.13.3. Age Group

- 15.13.4. Wood Type

- 15.13.5. Distribution Channel

- 15.13.6. Manufacturing Process

- 15.13.7. Design Theme

- 15.13.8. End-Users

- 16. Asia Pacific Wooden Toy Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Asia Pacific Wooden Toy Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Age Group

- 16.3.3. Wood Type

- 16.3.4. Distribution Channel

- 16.3.5. Manufacturing Process

- 16.3.6. Design Theme

- 16.3.7. End-Users

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Wooden Toy Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Age Group

- 16.4.4. Wood Type

- 16.4.5. Distribution Channel

- 16.4.6. Manufacturing Process

- 16.4.7. Design Theme

- 16.4.8. End-Users

- 16.5. India Wooden Toy Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Age Group

- 16.5.4. Wood Type

- 16.5.5. Distribution Channel

- 16.5.6. Manufacturing Process

- 16.5.7. Design Theme

- 16.5.8. End-Users

- 16.6. Japan Wooden Toy Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Age Group

- 16.6.4. Wood Type

- 16.6.5. Distribution Channel

- 16.6.6. Manufacturing Process

- 16.6.7. Design Theme

- 16.6.8. End-Users

- 16.7. South Korea Wooden Toy Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Age Group

- 16.7.4. Wood Type

- 16.7.5. Distribution Channel

- 16.7.6. Manufacturing Process

- 16.7.7. Design Theme

- 16.7.8. End-Users

- 16.8. Australia and New Zealand Wooden Toy Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Age Group

- 16.8.4. Wood Type

- 16.8.5. Distribution Channel

- 16.8.6. Manufacturing Process

- 16.8.7. Design Theme

- 16.8.8. End-Users

- 16.9. Indonesia Wooden Toy Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Age Group

- 16.9.4. Wood Type

- 16.9.5. Distribution Channel

- 16.9.6. Manufacturing Process

- 16.9.7. Design Theme

- 16.9.8. End-Users

- 16.10. Malaysia Wooden Toy Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Age Group

- 16.10.4. Wood Type

- 16.10.5. Distribution Channel

- 16.10.6. Manufacturing Process

- 16.10.7. Design Theme

- 16.10.8. End-Users

- 16.11. Thailand Wooden Toy Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Age Group

- 16.11.4. Wood Type

- 16.11.5. Distribution Channel

- 16.11.6. Manufacturing Process

- 16.11.7. Design Theme

- 16.11.8. End-Users

- 16.12. Vietnam Wooden Toy Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Age Group

- 16.12.4. Wood Type

- 16.12.5. Distribution Channel

- 16.12.6. Manufacturing Process

- 16.12.7. Design Theme

- 16.12.8. End-Users

- 16.13. Rest of Asia Pacific Wooden Toy Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Age Group

- 16.13.4. Wood Type

- 16.13.5. Distribution Channel

- 16.13.6. Manufacturing Process

- 16.13.7. Design Theme

- 16.13.8. End-Users

- 17. Middle East Wooden Toy Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Wooden Toy Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Age Group

- 17.3.3. Wood Type

- 17.3.4. Distribution Channel

- 17.3.5. Manufacturing Process

- 17.3.6. Design Theme

- 17.3.7. End-Users

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Wooden Toy Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Age Group

- 17.4.4. Wood Type

- 17.4.5. Distribution Channel

- 17.4.6. Manufacturing Process

- 17.4.7. Design Theme

- 17.4.8. End-Users

- 17.5. UAE Wooden Toy Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Age Group

- 17.5.4. Wood Type

- 17.5.5. Distribution Channel

- 17.5.6. Manufacturing Process

- 17.5.7. Design Theme

- 17.5.8. End-Users

- 17.6. Saudi Arabia Wooden Toy Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Age Group

- 17.6.4. Wood Type

- 17.6.5. Distribution Channel

- 17.6.6. Manufacturing Process

- 17.6.7. Design Theme

- 17.6.8. End-Users

- 17.7. Israel Wooden Toy Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Age Group

- 17.7.4. Wood Type

- 17.7.5. Distribution Channel

- 17.7.6. Manufacturing Process

- 17.7.7. Design Theme

- 17.7.8. End-Users

- 17.8. Rest of Middle East Wooden Toy Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Age Group

- 17.8.4. Wood Type

- 17.8.5. Distribution Channel

- 17.8.6. Manufacturing Process

- 17.8.7. Design Theme

- 17.8.8. End-Users

- 18. Africa Wooden Toy Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Wooden Toy Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Age Group

- 18.3.3. Wood Type

- 18.3.4. Distribution Channel

- 18.3.5. Manufacturing Process

- 18.3.6. Design Theme

- 18.3.7. End-Users

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Wooden Toy Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Age Group

- 18.4.4. Wood Type

- 18.4.5. Distribution Channel

- 18.4.6. Manufacturing Process

- 18.4.7. Design Theme

- 18.4.8. End-Users

- 18.5. Egypt Wooden Toy Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Age Group

- 18.5.4. Wood Type

- 18.5.5. Distribution Channel

- 18.5.6. Manufacturing Process

- 18.5.7. Design Theme

- 18.5.8. End-Users

- 18.6. Nigeria Wooden Toy Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Age Group

- 18.6.4. Wood Type

- 18.6.5. Distribution Channel

- 18.6.6. Manufacturing Process

- 18.6.7. Design Theme

- 18.6.8. End-Users

- 18.7. Algeria Wooden Toy Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Age Group

- 18.7.4. Wood Type

- 18.7.5. Distribution Channel

- 18.7.6. Manufacturing Process

- 18.7.7. Design Theme

- 18.7.8. End-Users

- 18.8. Rest of Africa Wooden Toy Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Age Group

- 18.8.4. Wood Type

- 18.8.5. Distribution Channel

- 18.8.6. Manufacturing Process

- 18.8.7. Design Theme

- 18.8.8. End-Users

- 19. South America Wooden Toy Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. South America Wooden Toy Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Age Group

- 19.3.3. Wood Type

- 19.3.4. Distribution Channel

- 19.3.5. Manufacturing Process

- 19.3.6. Design Theme

- 19.3.7. End-Users

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Wooden Toy Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Age Group

- 19.4.4. Wood Type

- 19.4.5. Distribution Channel

- 19.4.6. Manufacturing Process

- 19.4.7. Design Theme

- 19.4.8. End-Users

- 19.5. Argentina Wooden Toy Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Age Group

- 19.5.4. Wood Type

- 19.5.5. Distribution Channel

- 19.5.6. Manufacturing Process

- 19.5.7. Design Theme

- 19.5.8. End-Users

- 19.6. Rest of South America Wooden Toy Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Age Group

- 19.6.4. Wood Type

- 19.6.5. Distribution Channel

- 19.6.6. Manufacturing Process

- 19.6.7. Design Theme

- 19.6.8. End-Users

- 20. Key Players/ Company Profile

- 20.1. BeginAgain Toys

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Bigjigs Toys

- 20.3. Brio AB

- 20.4. Classic World

- 20.5. EverEarth

- 20.6. Green Toys

- 20.7. Grimm's Spiel und Holz Design

- 20.8. Guidecraft

- 20.9. Haba

- 20.10. Hape International

- 20.11. Janod

- 20.12. KidKraft

- 20.13. Le Toy Van

- 20.14. Manhattan Toy

- 20.15. Melissa & Doug

- 20.16. PlanToys

- 20.17. Small Foot Design

- 20.18. Tegu

- 20.19. Tooky Toy

- 20.20. Woodyland

- 20.21. Other Key Players

- 20.1. BeginAgain Toys

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation