Wooden Furniture Market Size, Share & Trends Analysis Report by Product Type (Tables, Chairs & Seating, Beds & Bedroom Furniture, Storage Furniture, Outdoor Furniture, Others), Wood Type, Design Style Distribution Channel, End-User Type, Manufacturing Type, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Wooden Furniture Market Size, Share, and Growth

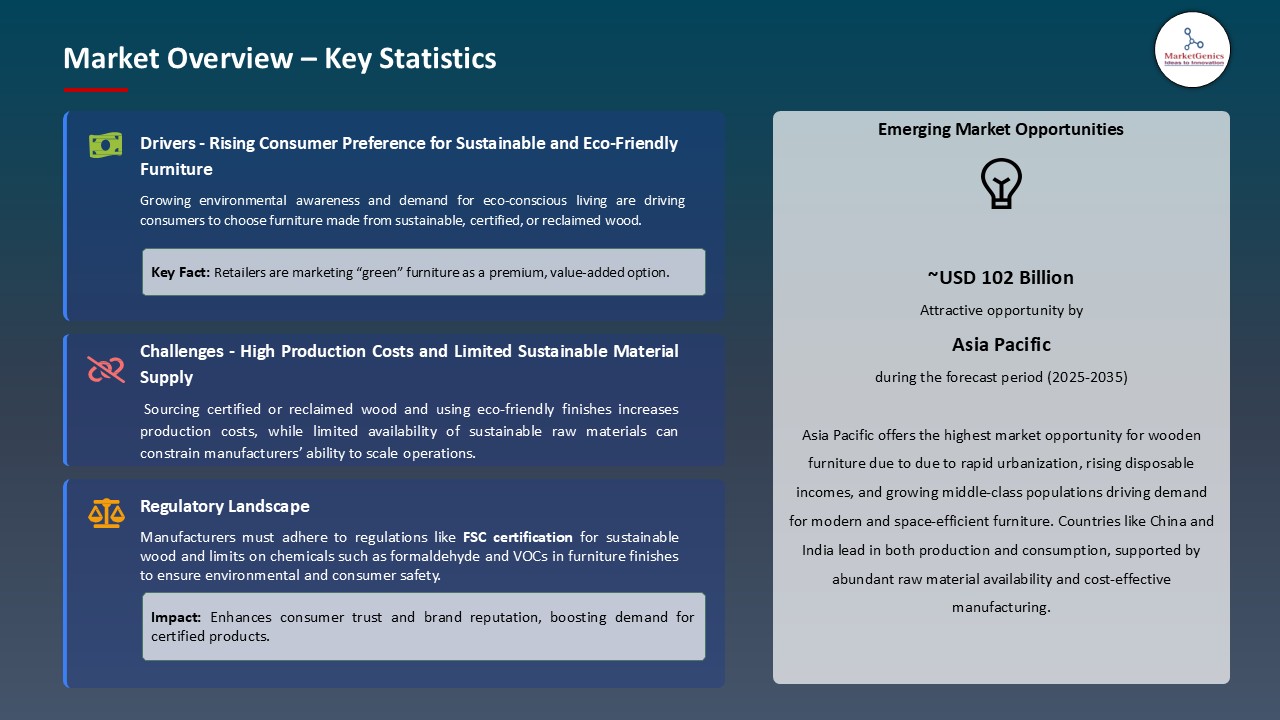

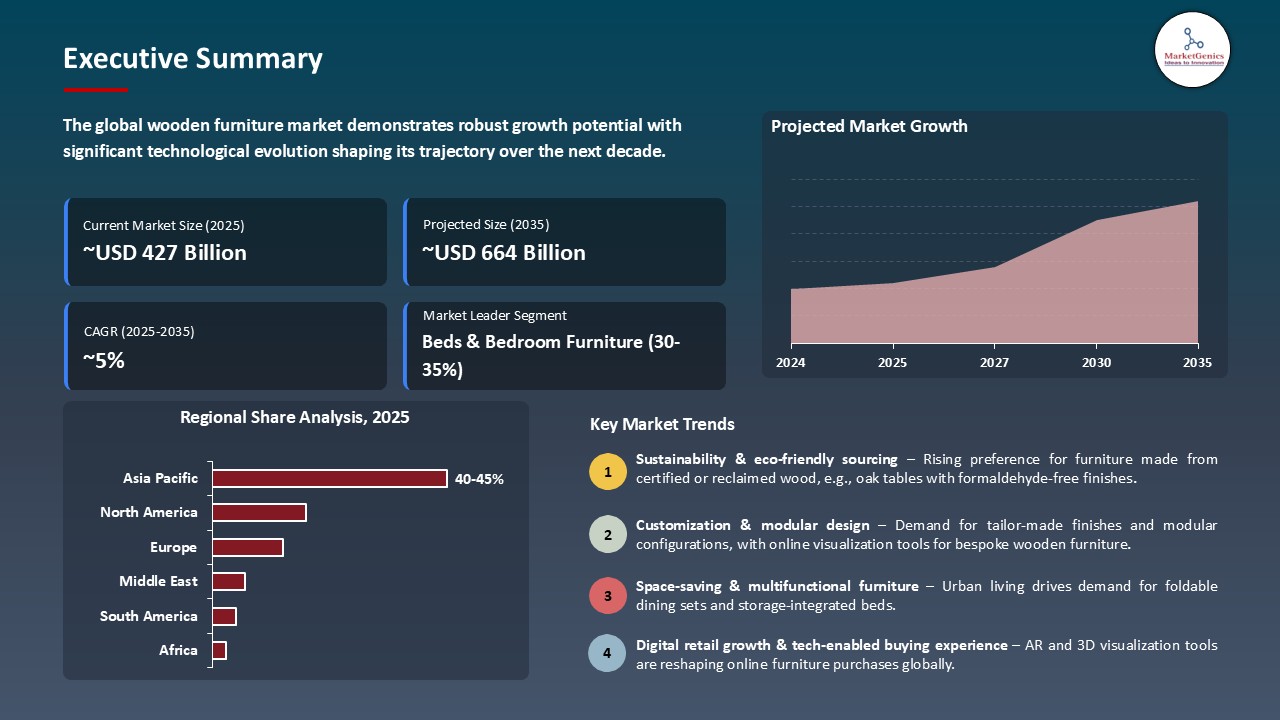

The global wooden furniture market is experiencing robust growth, with its estimated value of USD 427.3 billion in the year 2025 and USD 663.6 billion by 2035, registering a CAGR of 4.5%, during the forecast period. The demand for wooden furniture is driven by rising consumer preference for durable, eco-friendly, and aesthetically appealing home decor, increasing disposable incomes, and growing urbanization, which fuels housing and interior design trends.

Faheem Shamsi, Founder & CEO, Wooden Twist said,

“We are incredibly proud of the milestones we've achieved, but what truly inspires us is the impact we've made on the lives of our artisans. Expanding to the UAE allows us to continue our mission while fostering collaboration with local talent. We believe this partnership will create exceptional furniture pieces that resonate with both UAE residents and design enthusiasts worldwide.”

The rise in urbanization and the middle-income in the emerging economies is the driving force of the wooden furniture market. Increasing disposable income and home ownership in Asia Pacific, Latin America and sections of Africa are driving the demand of more durable and aesthetically pleasing furniture, where wood is favored due to its natural beauty, warmth, durability and perceived quality over synthetic products, while complementary interior elements such as curtains and window blinds enhance the overall aesthetic coherence of living spaces. For instance, in September 2024, Wooden Twist has established a strategic alliance with local craftsmen in the UAE, opened its first retail outlet in Dubai, and concentrated on marketing hand-crafted, eco-friendly wooden furniture designs.

In addition, the wooden furniture industry is supported by increasing level of sustainability consciousness, which contributes to the push towards using natural and renewable materials instead of plastics and metals, engineered wood innovation, certified sustainable forestry and modular furniture, which maintains the aesthetic and functional value of wood. As an example, in 2025, WS Wood Group introduced high-level manufacturing technologies, such as reclaimed timber use, zero waste manufacturing, and automated furniture manufacturing. These environmentally friendly activities promote competitiveness and growth through the satisfaction of the consumers to the high quality of environmentally friendly wooden furniture.

The global wooden furniture market offers adjacent opportunities in an environmentally friendly home furnishings, modular office furniture, smart furniture, integrating IoT, sustainable outdoor furniture and garden furniture, and high-end custom cabinetry. These segments are capitalizing on consumer need of functionality, sustainability and personalization, which are encouraging the growth of the market.

Wooden Furniture Market Dynamics and Trends

Driver: Remote Work and Home Living Space Transformation

- The wooden furniture market is rising with strong intensity due to the introduction of remote working and spending more time at home, which has increased the demand of comfortable, functional, and aesthetically pleasing living and home office areas. As an example, in 2025, ITOKI Corporation released its new furniture brand, NII, and presented it at ORGATEC TOKYO 2025, aimed at modern remote and hybrid workplaces.

- Additionally, multi-purpose furniture designs that can maximize space utilization are becoming popular as homes are increasingly used in various ways all through the day. They can be wooden dining tables that serve as workstations, convertible guest rooms that act as offices, and furniture in the living room that supports both entertainment and workspace purposes, which are examples of changing design needs due to the changing nature of lifestyle needs.

- The move to home-based living and heightened sensitivity to furniture as a means of productivity, comfort, and wellbeing is creating long-term demand trends of high-quality wooden furniture even than those of pre-pandemic discretionary expenditure.

Restraint: Raw Material Costs and Sustainable Sourcing Challenges

- The wooden furniture market is limited by the variability of prices of hardwood lumber, disruption of the supply chain, and high standards of sustainability forestry certification regulation that limits the availability of raw material and increases their cost. These aspects compress the margins of manufacturers, require price changes, which can influence consumer ability and introduce supply uncertainties, making production planning and inventory control difficult.

- Moreover, the use of certified sustainable wood by the suppliers of FSC or PEFC certification is becoming a necessity, where retailers, corporate purchasers, and green consumers demand assurance of responsible forestry management. However, certified timber is often costlier and in small supply, which places strain on costs and supply issues, especially upon manufacturers within a highly competitive market segment.

- The persistent volatility of raw material costs, availability, and complicated certification issues are still straining profitability and efficiency of operation especially to the small producers who do not have the scale or direct forestry affiliations that bigger organizations use to obtain desirable supply prices.

Opportunity: E-Commerce and Direct-to-Consumer Business Models

- The wooden furniture market is being grown through e-commerce and direct-to-consumer business models that decrease retail middlemen and retailing expenditures without compromising quality. Online sales are rising faster due to the effects of the pandemic and assisted by home delivery, easy returns, AR visualization, and customer reviews, which require less in-store shopping.

- For instance, in in 2025, WoodenStreet (India) aims to increase its revenue fourfold within the next three years, using its strong online sales basis, and increase its store network, which is a strategic emphasis on direct-to-consumer and omni-channel development of retailing. These online and direct-to-consumer approaches improve the market penetration, stimulate the sales increase, and increase the level of consumer interest in the wooden furniture industry.

- Moreover, augmented reality applications where one can position virtual furniture into room pictures reduce doubts about buying a product because of people can check the size, proportions and design fit. Applications such as the Place by IKEA and View in Room 3D by Wayfair are popular, especially among more technologically-minded consumers who are comfortable to make big online decisions.

- These digital innovations and AR-powered applications increase consumer trust, speed up internet purchases, and enhance brand loyalty in the furniture industry.

Key Trend: Sustainable Materials and Circular Economy Models

- The wooden furniture market is experiencing a sustainability shift toward responsible sourcing of forests, non-toxic finishes, waste minimization, and recycling, rental, refurbishment, or recycling, with consumer demands, regulatory demands, and long-term business sustainability.

- For instance, in April 2025, Wood Capitol committed to use only responsible sourcing of wood by certified FSC supply chains, legal harvesting and certified labor standards, and introduce reuse and resurfacing initiatives to its solid-wood furniture. These sustainability programs increase the brand image, satisfy the governmental requirements and fuel a long-term development in the wooden furniture market.

- Moreover, rental furniture initiatives and subscriptions aimed at urban professionals, those who have to relocate regularly, and environmentally minded consumers focus on access that enables the manufacturer to realize the value of product lifecycle. The adoption rates in urban centres such as Feather and Fernish services are encouraging because of mobility and space limitation in favour of rental services.

- These sustainability practices and rental-based business models increase market opportunities, consumer loyalty and long-term profitability in the wooden furniture industry.

Wooden-Furniture-Market Analysis and Segmental Data

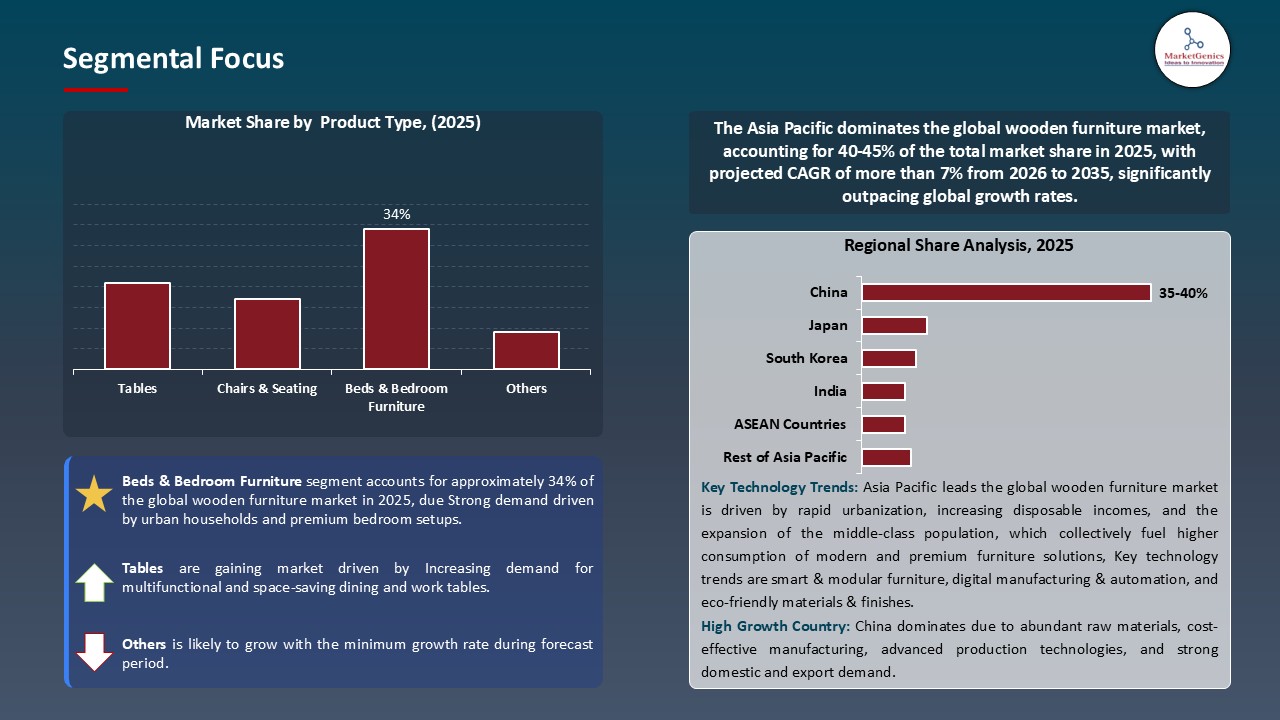

Beds & Bedroom Furniture Dominate Global Wooden Furniture Market

- The beds & bedroom furniture segment dominates the global wooden furniture market due to the rising consumer demand of comfortable, durable and aesthetic bedroom furniture due to the growing interest in personal living space, while competing categories such as metal furniture continue to influence material choice and design preferences across residential interiors. As an example, in 2024, Pottery Barn partnered with Michael Graves Design to introduced bedroom furniture collection that included some accessibility-oriented features in its design, yet retained a fashionable look.

- Further, the growth in urban housing and increased disposable income in the emerging and developed markets increase the purchases of bedroom furniture, which further affirms its leadership in the world furniture market made of wood. For instance, in 2024, BDI introduced its Kava bedroom line, which is the second full bedroom line and mirrors the rapid expansion in the bed and bedroom furniture segment.

- Therefore, these trends and strategic product launch support the leadership of the beds and bedroom furniture segment, increase the revenues, broaden the range of consumer choice, and support investment in the production of high-quality wooden furniture in the global industry.

Asia Pacific Leads Global Wooden Furniture Market Demand

- Asia Pacific continues a dominant position in the global wooden furniture market with a high number of consumers, urbanization, and increasing middle-class incomes to fuel the demand of furniture. The region’s strong manufacturing potential is directed to the domestic and export market and the preference towards wood as a culture renders it an indication of quality, status and relationship with nature.

- For instance, in September 2025, ITOKI Corporation and CONDE HOUSE declared a strategic partnership to create furniture, made of timber and manufacturing residues sourced in Hokkaido, and distribution nationwide in Japan. This partnership will consolidate sustainable manufacturing, increase regional market dominance, and increase the distribution within the Japanese wooden furniture segment across the country.

- In addition, the manufacturing leadership of the Asia Pacific offers the efficiencies of the supply chain, the cost benefits and the combined design-to-manufacture operations, which enables the pricing to be competitive, yet the quality remains high. The local producers are also moving towards design-based branded products in both local domestic high-end markets and global markets that want sustainable sourcing and high craftsmanship.

- The demographic size, the growing middle-income segment, manufacturing dominance, material resources, and the cultural inclination of Asia Pacific towards wood furniture makes the region the largest market current and the key driver to the growth of the wooden furniture industry in the predictable future.

Wooden-Furniture-Market Ecosystem

The global wooden furniture market is highly fragmented, with high concentration among key players such as IKEA, Ashley Furniture Industries, Bassett Furniture Industries, Durian Furniture and Ethan Allen Interiors, who dominate through strong brand loyalty, large product portfolio, high design and production capacity, high distribution channels and focused marketing programs.

For instance, in December 2024, Ashley Furniture Industries declared a profuse U.S manufacturing conversion to enhance its supply-chain strength and diversify its case goods collection, such as wooden furniture. The expansion contributes to the increase of production capacity, improvement of the position on the market, and the support of the competitiveness of Ashley Furniture in the global market of wooden furniture.

Recent Development and Strategic Overview:

- In April 2025, Living Shapes introduced a modern series of wooden furniture that was targeted at the modern city dwellers. The collection features multi-purpose, small-sized designs and is made of a combination of wood, steel, and long-lasting upholstery to offer practical space-saving solutions without sacrificing the style or durability.

- In March 2025, the INDIAWOOD 2025 trade fair, innovation and sustainability in the wooden furniture industry were emphasized, with India as a key production centre and 62% of total furniture in the country being wood based products.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 427.3 Bn |

|

Market Forecast Value in 2035 |

USD 663.6 Bn |

|

Growth Rate (CAGR) |

4.5% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Wooden-Furniture-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Wooden Furniture Market, By Product Type |

|

|

Wooden Furniture Market, By Wood Type |

|

|

Wooden Furniture Market, By Design Style |

|

|

Wooden Furniture Market, By Distribution Channel |

|

|

Wooden Furniture Market, By End-User Type

|

|

|

Wooden Furniture Market, By Manufacturing Type

|

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Wooden Furniture Market Outlook

- 2.1.1. Wooden Furniture Market Size (Volume - Million Units and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Wooden Furniture Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Wooden Furniture Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Ecosystem Analysis

- 3.1.2. Key Trends for Packaging Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Wooden Furniture Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for sustainable and eco-friendly furniture

- 4.1.1.2. Growth in residential and commercial construction boosting furniture demand

- 4.1.1.3. Increasing popularity of modern designs and customization options

- 4.1.2. Restraints

- 4.1.2.1. Volatility and rising cost of raw materials like timber

- 4.1.2.2. Competition from alternative materials (metal, plastic, engineered wood)

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Wooden Furniture Manufacturers

- 4.4.3. Distributors/ Suppliers

- 4.4.4. End-users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Wooden Furniture Market Demand

- 4.7.1. Historical Market Size - in (Volume - Million Units and Value - US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - in (Volume - Million Units and Value - US$ Bn), 2026–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Wooden Furniture Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Wooden Furniture Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Tables

- 6.2.1.1. Dining Tables

- 6.2.1.2. Coffee Tables

- 6.2.1.3. Console Tables

- 6.2.1.4. Side Tables

- 6.2.1.5. Study/Office Tables

- 6.2.1.6. Others

- 6.2.2. Chairs & Seating

- 6.2.2.1. Dining Chairs

- 6.2.2.2. Lounge Chairs

- 6.2.2.3. Office Chairs

- 6.2.2.4. Recliners

- 6.2.2.5. Benches & Stools

- 6.2.2.6. Others

- 6.2.3. Beds & Bedroom Furniture

- 6.2.3.1. Beds (Single, Double, Queen, King)

- 6.2.3.2. Wardrobes

- 6.2.3.3. Dressers

- 6.2.3.4. Nightstands

- 6.2.3.5. Bedroom Sets

- 6.2.3.6. Others

- 6.2.4. Storage Furniture

- 6.2.4.1. Cabinets

- 6.2.4.2. Shelving Units

- 6.2.4.3. Bookcases

- 6.2.4.4. Chest of Drawers

- 6.2.4.5. TV Stands

- 6.2.4.6. Others

- 6.2.5. Outdoor Furniture

- 6.2.5.1. Garden Chairs

- 6.2.5.2. Patio Tables

- 6.2.5.3. Benches

- 6.2.5.4. Loungers

- 6.2.5.5. Others

- 6.2.6. Others

- 6.2.6.1. Desks

- 6.2.6.2. Credenzas

- 6.2.6.3. Room Dividers

- 6.2.1. Tables

- 7. Global Wooden Furniture Market Analysis, by Wood Type

- 7.1. Key Segment Analysis

- 7.2. Wooden Furniture Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Wood Type , 2021-2035

- 7.2.1. Hardwood

- 7.2.1.1. Oak

- 7.2.1.2. Teak

- 7.2.1.3. Mahogany

- 7.2.1.4. Cherry

- 7.2.1.5. Others

- 7.2.2. Softwood

- 7.2.2.1. Pine

- 7.2.2.2. Cedar

- 7.2.2.3. Fir

- 7.2.2.4. Spruce

- 7.2.2.5. Others

- 7.2.3. Engineered Wood

- 7.2.3.1. Plywood

- 7.2.3.2. MDF

- 7.2.3.3. Particle Board

- 7.2.3.4. HDF

- 7.2.3.5. Others

- 7.2.4. Exotic Wood

- 7.2.1. Hardwood

- 8. Global Wooden Furniture Market Analysis and Forecasts, by Design Style

- 8.1. Key Findings

- 8.2. Wooden Furniture Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Design Style, 2021-2035

- 8.2.1. Traditional/Classic

- 8.2.2. Modern/Contemporary

- 8.2.3. Rustic/Farmhouse

- 8.2.4. Industrial

- 8.2.5. Vintage/Antique

- 9. Global Wooden Furniture Market Analysis and Forecasts, by Distribution Channel

- 9.1. Key Findings

- 9.2. Wooden Furniture Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 9.2.1. Online

- 9.2.1.1. E-commerce Platforms

- 9.2.1.2. Company Websites

- 9.2.1.3. Online Marketplaces

- 9.2.1.4. Others

- 9.2.2. Offline

- 9.2.2.1. Specialty Furniture Stores

- 9.2.2.2. Departmental Stores

- 9.2.2.3. Hypermarkets/Supermarkets

- 9.2.2.4. Others

- 9.2.3. Wholesale Distributors

- 9.2.1. Online

- 10. Global Wooden Furniture Market Analysis and Forecasts, by End-User Type

- 10.1. Key Findings

- 10.2. Wooden Furniture Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by End-User Type , 2021-2035

- 10.2.1. Residential

- 10.2.1.1. Individual Homeowners

- 10.2.1.2. Apartment Dwellers

- 10.2.1.3. Renters

- 10.2.1.4. Others

- 10.2.2. Commercial

- 10.2.2.1. Corporate Offices

- 10.2.2.2. Co-working Spaces

- 10.2.2.3. Retail Stores

- 10.2.2.4. Others

- 10.2.3. Hospitality

- 10.2.3.1. Hotels

- 10.2.3.2. Resorts

- 10.2.3.3. Restaurants & Cafés

- 10.2.3.4. Bars & Lounges

- 10.2.3.5. Others

- 10.2.4. Institutional

- 10.2.4.1. Educational Institutions

- 10.2.4.2. Healthcare Facilities

- 10.2.4.3. Government Buildings

- 10.2.4.4. Libraries

- 10.2.4.5. Others

- 10.2.5. Others

- 10.2.1. Residential

- 11. Global Wooden Furniture Market Analysis and Forecasts, by Manufacturing Type

- 11.1. Key Findings

- 11.2. Wooden Furniture Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Manufacturing Type, 2021-2035

- 11.2.1. Handcrafted/Artisanal

- 11.2.2. Machine-made/Mass Production

- 11.2.3. Semi-automated

- 11.2.4. Custom-made/Bespoke

- 12. Global Wooden Furniture Market Analysis and Forecasts, by Region

- 12.1. Key Findings

- 12.2. Wooden Furniture Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 12.2.1. North America

- 12.2.2. Europe

- 12.2.3. Asia Pacific

- 12.2.4. Middle East

- 12.2.5. Africa

- 12.2.6. South America

- 13. North America Wooden Furniture Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. North America Wooden Furniture Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Product Type

- 13.3.2. Wood Type

- 13.3.3. Design Style

- 13.3.4. Distribution Channel

- 13.3.5. End-User Type

- 13.3.6. Manufacturing Type

- 13.3.7. Country

- 13.3.7.1. USA

- 13.3.7.2. Canada

- 13.3.7.3. Mexico

- 13.4. USA Wooden Furniture Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Product Type

- 13.4.3. Wood Type

- 13.4.4. Design Style

- 13.4.5. Distribution Channel

- 13.4.6. End-User Type

- 13.4.7. Manufacturing Type

- 13.5. Canada Wooden Furniture Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Product Type

- 13.5.3. Wood Type

- 13.5.4. Design Style

- 13.5.5. Distribution Channel

- 13.5.6. End-User Type

- 13.5.7. Manufacturing Type

- 13.6. Mexico Wooden Furniture Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Product Type

- 13.6.3. Wood Type

- 13.6.4. Design Style

- 13.6.5. Distribution Channel

- 13.6.6. End-User Type

- 13.6.7. Manufacturing Type

- 14. Europe Wooden Furniture Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Europe Wooden Furniture Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Wood Type

- 14.3.3. Design Style

- 14.3.4. Distribution Channel

- 14.3.5. End-User Type

- 14.3.6. Manufacturing Type

- 14.3.7. Country

- 14.3.7.1. Germany

- 14.3.7.2. United Kingdom

- 14.3.7.3. France

- 14.3.7.4. Italy

- 14.3.7.5. Spain

- 14.3.7.6. Netherlands

- 14.3.7.7. Nordic Countries

- 14.3.7.8. Poland

- 14.3.7.9. Russia & CIS

- 14.3.7.10. Rest of Europe

- 14.4. Germany Wooden Furniture Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Wood Type

- 14.4.4. Design Style

- 14.4.5. Distribution Channel

- 14.4.6. End-User Type

- 14.4.7. Manufacturing Type

- 14.5. United Kingdom Wooden Furniture Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Wood Type

- 14.5.4. Design Style

- 14.5.5. Distribution Channel

- 14.5.6. End-User Type

- 14.5.7. Manufacturing Type

- 14.6. France Wooden Furniture Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Wood Type

- 14.6.4. Design Style

- 14.6.5. Distribution Channel

- 14.6.6. End-User Type

- 14.6.7. Manufacturing Type

- 14.7. Italy Wooden Furniture Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Product Type

- 14.7.3. Wood Type

- 14.7.4. Design Style

- 14.7.5. Distribution Channel

- 14.7.6. End-User Type

- 14.7.7. Manufacturing Type

- 14.8. Spain Wooden Furniture Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Product Type

- 14.8.3. Wood Type

- 14.8.4. Design Style

- 14.8.5. Distribution Channel

- 14.8.6. End-User Type

- 14.8.7. Manufacturing Type

- 14.9. Netherlands Wooden Furniture Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Product Type

- 14.9.3. Wood Type

- 14.9.4. Design Style

- 14.9.5. Distribution Channel

- 14.9.6. End-User Type

- 14.9.7. Manufacturing Type

- 14.10. Nordic Countries Wooden Furniture Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Product Type

- 14.10.3. Wood Type

- 14.10.4. Design Style

- 14.10.5. Distribution Channel

- 14.10.6. End-User Type

- 14.10.7. Manufacturing Type

- 14.11. Poland Wooden Furniture Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Product Type

- 14.11.3. Wood Type

- 14.11.4. Design Style

- 14.11.5. Distribution Channel

- 14.11.6. End-User Type

- 14.11.7. Manufacturing Type

- 14.12. Russia & CIS Wooden Furniture Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Product Type

- 14.12.3. Wood Type

- 14.12.4. Design Style

- 14.12.5. Distribution Channel

- 14.12.6. End-User Type

- 14.12.7. Manufacturing Type

- 14.13. Rest of Europe Wooden Furniture Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Product Type

- 14.13.3. Wood Type

- 14.13.4. Design Style

- 14.13.5. Distribution Channel

- 14.13.6. End-User Type

- 14.13.7. Manufacturing Type

- 15. Asia Pacific Wooden Furniture Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. East Asia Wooden Furniture Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Wood Type

- 15.3.3. Design Style

- 15.3.4. Distribution Channel

- 15.3.5. End-User Type

- 15.3.6. Manufacturing Type

- 15.3.7. Country

- 15.3.7.1. China

- 15.3.7.2. India

- 15.3.7.3. Japan

- 15.3.7.4. South Korea

- 15.3.7.5. Australia and New Zealand

- 15.3.7.6. Indonesia

- 15.3.7.7. Malaysia

- 15.3.7.8. Thailand

- 15.3.7.9. Vietnam

- 15.3.7.10. Rest of Asia Pacific

- 15.4. China Wooden Furniture Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Wood Type

- 15.4.4. Design Style

- 15.4.5. Distribution Channel

- 15.4.6. End-User Type

- 15.4.7. Manufacturing Type

- 15.5. India Wooden Furniture Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Wood Type

- 15.5.4. Design Style

- 15.5.5. Distribution Channel

- 15.5.6. End-User Type

- 15.5.7. Manufacturing Type

- 15.6. Japan Wooden Furniture Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Wood Type

- 15.6.4. Design Style

- 15.6.5. Distribution Channel

- 15.6.6. End-User Type

- 15.6.7. Manufacturing Type

- 15.7. South Korea Wooden Furniture Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Wood Type

- 15.7.4. Design Style

- 15.7.5. Distribution Channel

- 15.7.6. End-User Type

- 15.7.7. Manufacturing Type

- 15.8. Australia and New Zealand Wooden Furniture Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Wood Type

- 15.8.4. Design Style

- 15.8.5. Distribution Channel

- 15.8.6. End-User Type

- 15.8.7. Manufacturing Type

- 15.9. Indonesia Wooden Furniture Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Product Type

- 15.9.3. Wood Type

- 15.9.4. Design Style

- 15.9.5. Distribution Channel

- 15.9.6. End-User Type

- 15.9.7. Manufacturing Type

- 15.10. Malaysia Wooden Furniture Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Product Type

- 15.10.3. Wood Type

- 15.10.4. Design Style

- 15.10.5. Distribution Channel

- 15.10.6. End-User Type

- 15.10.7. Manufacturing Type

- 15.11. Thailand Wooden Furniture Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Product Type

- 15.11.3. Wood Type

- 15.11.4. Design Style

- 15.11.5. Distribution Channel

- 15.11.6. End-User Type

- 15.11.7. Manufacturing Type

- 15.12. Vietnam Wooden Furniture Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Product Type

- 15.12.3. Wood Type

- 15.12.4. Design Style

- 15.12.5. Distribution Channel

- 15.12.6. End-User Type

- 15.12.7. Manufacturing Type

- 15.13. Rest of Asia Pacific Wooden Furniture Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Product Type

- 15.13.3. Wood Type

- 15.13.4. Design Style

- 15.13.5. Distribution Channel

- 15.13.6. End-User Type

- 15.13.7. Manufacturing Type

- 16. Middle East Wooden Furniture Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Middle East Wooden Furniture Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Wood Type

- 16.3.3. Design Style

- 16.3.4. Distribution Channel

- 16.3.5. End-User Type

- 16.3.6. Manufacturing Type

- 16.3.7. Country

- 16.3.7.1. Turkey

- 16.3.7.2. UAE

- 16.3.7.3. Saudi Arabia

- 16.3.7.4. Israel

- 16.3.7.5. Rest of Middle East

- 16.4. Turkey Wooden Furniture Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Wood Type

- 16.4.4. Design Style

- 16.4.5. Distribution Channel

- 16.4.6. End-User Type

- 16.4.7. Manufacturing Type

- 16.5. UAE Wooden Furniture Market

- 16.5.1. Product Type

- 16.5.2. Wood Type

- 16.5.3. Design Style

- 16.5.4. Distribution Channel

- 16.5.5. End-User Type

- 16.5.6. Manufacturing Type

- 16.6. Saudi Arabia Wooden Furniture Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Wood Type

- 16.6.4. Design Style

- 16.6.5. Distribution Channel

- 16.6.6. End-User Type

- 16.6.7. Manufacturing Type

- 16.7. Israel Wooden Furniture Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Wood Type

- 16.7.4. Design Style

- 16.7.5. Distribution Channel

- 16.7.6. End-User Type

- 16.7.7. Manufacturing Type

- 16.8. Rest of Middle East Wooden Furniture Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Wood Type

- 16.8.4. Design Style

- 16.8.5. Distribution Channel

- 16.8.6. End-User Type

- 16.8.7. Manufacturing Type

- 17. Africa Wooden Furniture Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Africa Wooden Furniture Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Wood Type

- 17.3.3. Design Style

- 17.3.4. Distribution Channel

- 17.3.5. End-User Type

- 17.3.6. Manufacturing Type

- 17.3.7. Country

- 17.3.7.1. South Africa

- 17.3.7.2. Egypt

- 17.3.7.3. Nigeria

- 17.3.7.4. Algeria

- 17.3.7.5. Rest of Africa

- 17.4. South Africa Wooden Furniture Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Wood Type

- 17.4.4. Design Style

- 17.4.5. Distribution Channel

- 17.4.6. End-User Type

- 17.4.7. Manufacturing Type

- 17.5. Egypt Wooden Furniture Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Wood Type

- 17.5.4. Design Style

- 17.5.5. Distribution Channel

- 17.5.6. End-User Type

- 17.5.7. Manufacturing Type

- 17.6. Nigeria Wooden Furniture Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Wood Type

- 17.6.4. Design Style

- 17.6.5. Distribution Channel

- 17.6.6. End-User Type

- 17.6.7. Manufacturing Type

- 17.7. Algeria Wooden Furniture Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Wood Type

- 17.7.4. Design Style

- 17.7.5. Distribution Channel

- 17.7.6. End-User Type

- 17.7.7. Manufacturing Type

- 17.8. Rest of Africa Wooden Furniture Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Wood Type

- 17.8.4. Design Style

- 17.8.5. Distribution Channel

- 17.8.6. End-User Type

- 17.8.7. Manufacturing Type

- 18. South America Wooden Furniture Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Central and South Africa Wooden Furniture Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Wood Type

- 18.3.3. Design Style

- 18.3.4. Distribution Channel

- 18.3.5. End-User Type

- 18.3.6. Manufacturing Type

- 18.3.7. Country

- 18.3.7.1. Brazil

- 18.3.7.2. Argentina

- 18.3.7.3. Rest of South America

- 18.4. Brazil Wooden Furniture Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Wood Type

- 18.4.4. Design Style

- 18.4.5. Distribution Channel

- 18.4.6. End-User Type

- 18.4.7. Manufacturing Type

- 18.5. Argentina Wooden Furniture Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Wood Type

- 18.5.4. Design Style

- 18.5.5. Distribution Channel

- 18.5.6. End-User Type

- 18.5.7. Manufacturing Type

- 18.6. Rest of South America Wooden Furniture Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Wood Type

- 18.6.4. Design Style

- 18.6.5. Distribution Channel

- 18.6.6. End-User Type

- 18.6.7. Manufacturing Type

- 19. Key Players/ Company Profile

- 19.1. IKEA

- 19.1.1. Company Details/ Overview

- 19.1.2. Company Financials

- 19.1.3. Key Customers and Competitors

- 19.1.4. Business/ Industry Portfolio

- 19.1.5. Product Portfolio/ Specification Details

- 19.1.6. Pricing Data

- 19.1.7. Strategic Overview

- 19.1.8. Recent Developments

- 19.2. Ashley Furniture Industries

- 19.3. Bassett Furniture Industries

- 19.4. Bernhardt Furniture Company

- 19.5. Dorel Industries

- 19.6. Durian Furniture

- 19.7. Ethan Allen Interiors

- 19.8. Flexsteel Industries

- 19.9. Godrej & Boyce

- 19.10. Haworth

- 19.11. Herman Miller

- 19.12. HNI Corporation

- 19.13. Hooker Furniture Corporation

- 19.14. Inter IKEA Group

- 19.15. Knoll

- 19.16. La-Z-Boy Incorporated

- 19.17. Natuzzi

- 19.18. Nilkamal Limited

- 19.19. Rooms to Go

- 19.20. Steinhoff International

- 19.21. Williams-Sonoma

- 19.22. Other Key Players

- 19.1. IKEA

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation