Air Fryer Market Size, Share & Trends Analysis Report by Product Type (Basket Air Fryers, Oven Air Fryers, Paddle Air Fryers, Multi-Function Air Fryers, Toaster Oven Air Fryers), Capacity, Technology, Control Type, Distribution Channel, Power Rating, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Air Fryer Market Size, Share, and Growth

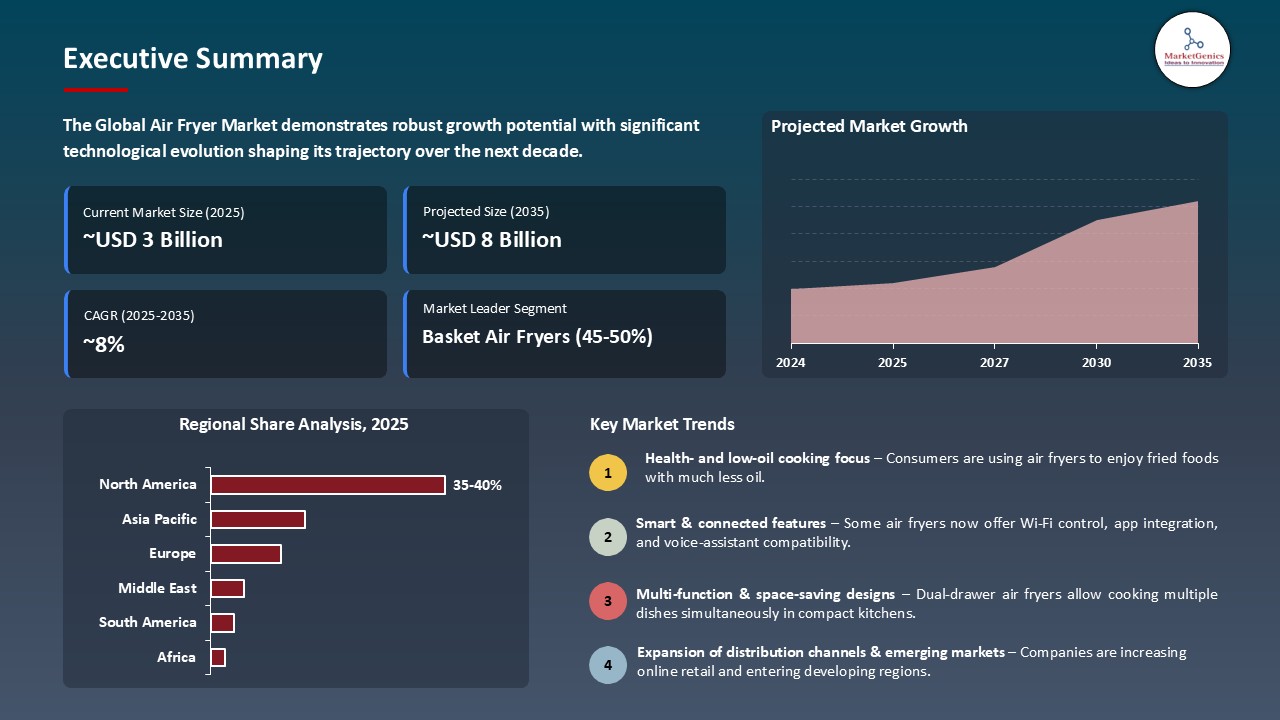

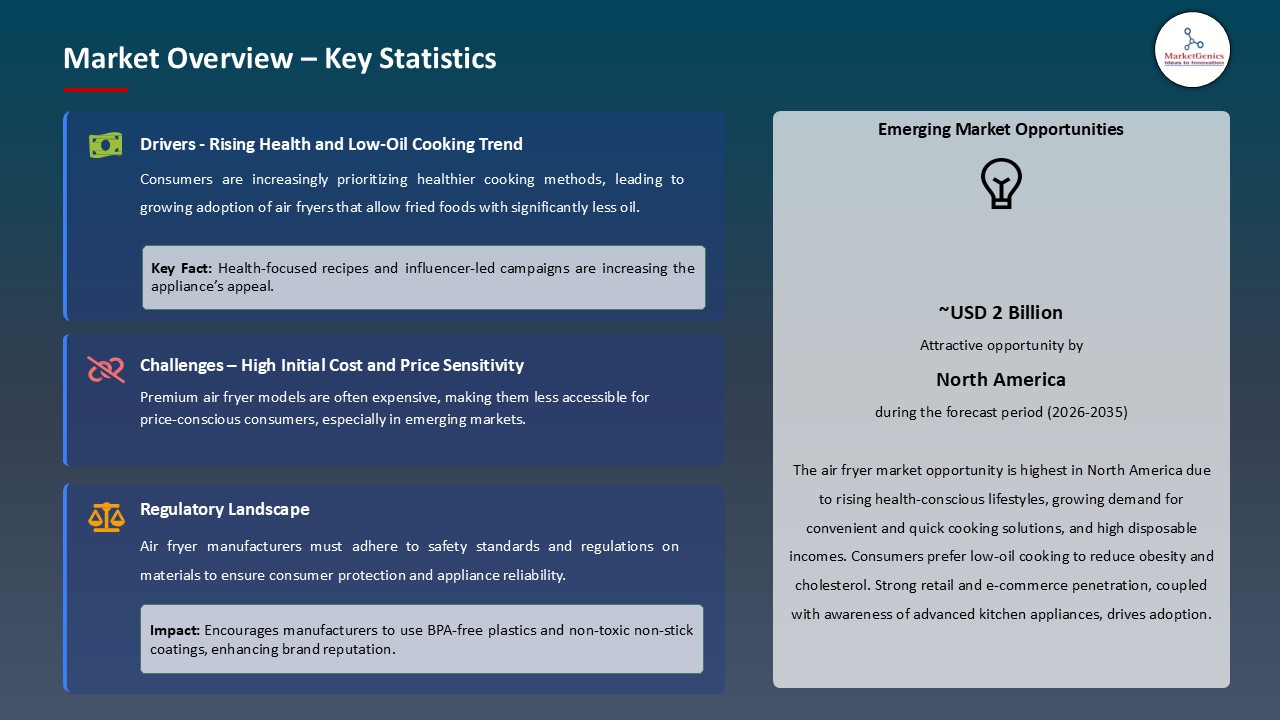

The global air fryer market is experiencing robust growth, with its estimated value of USD 3.1 billion in the year 2025 and USD 7.5 billion by 2035, registering a CAGR of 7.5%, during the forecast period. The demand for air fryers is driven by growing health consciousness, as consumers seek low-oil cooking alternatives that retain taste and texture. Rising urbanization, busy lifestyles, and the surge in home cooking further boost adoption, while product innovations such as digital controls, multi-functionality, and compact designs enhance convenience and appeal.

Mark Barrocas, Chief Executive Officer said,

“Our latest innovations deliver the high-tech features, market-leading performance, quality and extraordinary value Shark and Ninja products are known for, positively impacting people’s lives every day, in and outside their homes, around the world.”

The global air fryer market is driven by growing health awareness and the growing demand of convenient home cooking products, positioning air fryers as a core category within modern kitchenware. Air fryers recreate the plating and texture of deep-fried products with significantly reduced oil, which conforms to consumer choices of healthier lifestyles and conveniently cooked meals. For instance, in September 2024, SharkNinja, Inc. introduced the Ninja CRISPi Portable Cooking System, which has a handheld Power Pod and a glass container to perform in-built cooking, storing, and re-crisping of food.

Furthermore, the air fryer market is fueled by the ongoing innovation to broaden the product line beyond simple frying capabilities to include baking, roasting, grill, and dehydration features, thus making the multi-purpose devices the high-end products that take up a prime place in the contemporary kitchens. For instance, in 2023, Philips introduced the 6.2 L Air Fryer (NA130/00) with a transparent window and 14-in-1 technology to appeal to the increased demand of multifunctional and versatile kitchen appliances. The innovation also increases the consumer interest and solidifies the air fryer as a high end, multiple purpose kitchen appliance.

The adjacent opportunities of the global air fryer market are smart kitchen gadgets, internet-savvy cooking tools, nutritious frozen foodstuffs, small-sized countertop ovens, and environmentally friendly cookware. These segments support the changing lifestyles of consumers that consider convenience, health and sustainability. This growth enables the manufacturers to diversify and access a broader range of kitchen appliance demand.

Air Fryer Market Dynamics and Trends

Driver: Social Media Influence and Recipe Content Proliferation

- The air fryer market is experiencing rapid growth due to social media-based consumer interest. Social media including Tik Tok, Instagram, and YouTube platforms increase awareness by placing viral recipe content that emphasizes the versatility and convenience of air fryers as an important part of Netflix consumers among the younger, digitally driven population segment.

- For instance, in 2024 SharkNinja, Inc. launched the Ninja CRISPi portable glass-container air fryer, which achieved considerable publicity on TikTok and other social media platforms due to the large volumes of recipe-related content and influencer coverage. This user content provides manufacturers with an affordable marketing platform and shapes buying behavior by using credible peer reviews.

- Additionally, social media has brought the message of air fryers controlled by manufacturers onto the actual recommendation of their peers, which has increased awareness, consideration, and purchases of the product, especially among Millennials and Gen Z, who are highly sensitive to products being marketed via social media.

Restraint: Market Saturation and Kitchen Counter Space Competition

- The air fryer market is becoming more limited by saturation in the early-adopter markets, as well as a greater competition over limited kitchen counter space, where air fryers have to contest the other countertop appliances in order to secure a permanent position.

- Additionally, the growth of multi-purpose appliances, including toaster ovens with air fry features, multi-cookers with air fry, and microwave/air fryer combination models, have provided substitute products, which serve the same purpose but do not necessarily need a special appliance. These options appeal to space-conscious buyers and individuals who are unwilling to spend on purpose-specific products, thus splitting the possible sales into several product segments.

- Moreover, it is increasingly relying on adopting less-penetrated foreign markets, converting consumers of multi-function substitutes instead of continuing to rely on first-time buyers.

Opportunity: Premium and Smart Connected Appliance Segments

- The air fryer market presents a high-growth opportunity in the premium segment with larger capacity, multiple cooking areas, smart connections, and sophisticated cooking programs, targeting serious cookers, wealthy buyers, and families that look after high-performance appliances. As an example, at IFA 2025, Haier demonstrated its smart I-Master 3 air fryer, and Midea the Dual Zone that has independent dual cooking.

- Additionally, smart connectivity, which includes the ability to integrate recipes, remote monitoring, voice control, and tracking cooking data, can be used to differentiate products and has the possibility of the recurring revenue of subscription services, which resonates with technologically advanced consumers and the trend of smart houses.

- Moreover, premiumization enables manufacturers to increase profitability, serve consumers who demand more complex functions and connectivity, and create business models that are more sustainable and not as dependent on price battles and market saturation. For instance, in September 2024, SharkNinja, introduced the CRISPi, an ultra-expensive glass-enclosed air fryer that can both prepare, cook, serve, and store in a single unit, made of high-quality materials with elegant design.

Key Trend: Large Capacity and Multi-Zone Innovation

- The air fryer market is shifting toward larger capacities and multi-cooking areas, which allow cooking entire meals and makes air fryers the primary cooking device, which increases the frequency of use and justifies a high price. For instance, in October 2025, Gourmia is simplifying mealtime with its 11-Quart Double Decker Dual-Basket Air Fryer with Smart Finish, which gives quick and healthy cooking in a compact design, and is only available to Costco members.

- In addition, the market is expanding because of the expansion of toaster oven-sized air fryers, which feature large cavities, multiple rack levels, and multi-use cooking options that attract customers interested in space-saving, multi-purpose devices including emerging steam air fryer formats. These models are slightly larger than the inaugural models, but allow preparing full meals and a wider range of use, increasing the value of the house and promoting adoption.

- The growth of air fryers and their capabilities will change the market position of a niche appliance to a necessity in cooking, competing with ovens, microwaves, and multi-cookers and providing a point of upgrading to existing users.

Air Fryer Market Analysis and Segmental Data

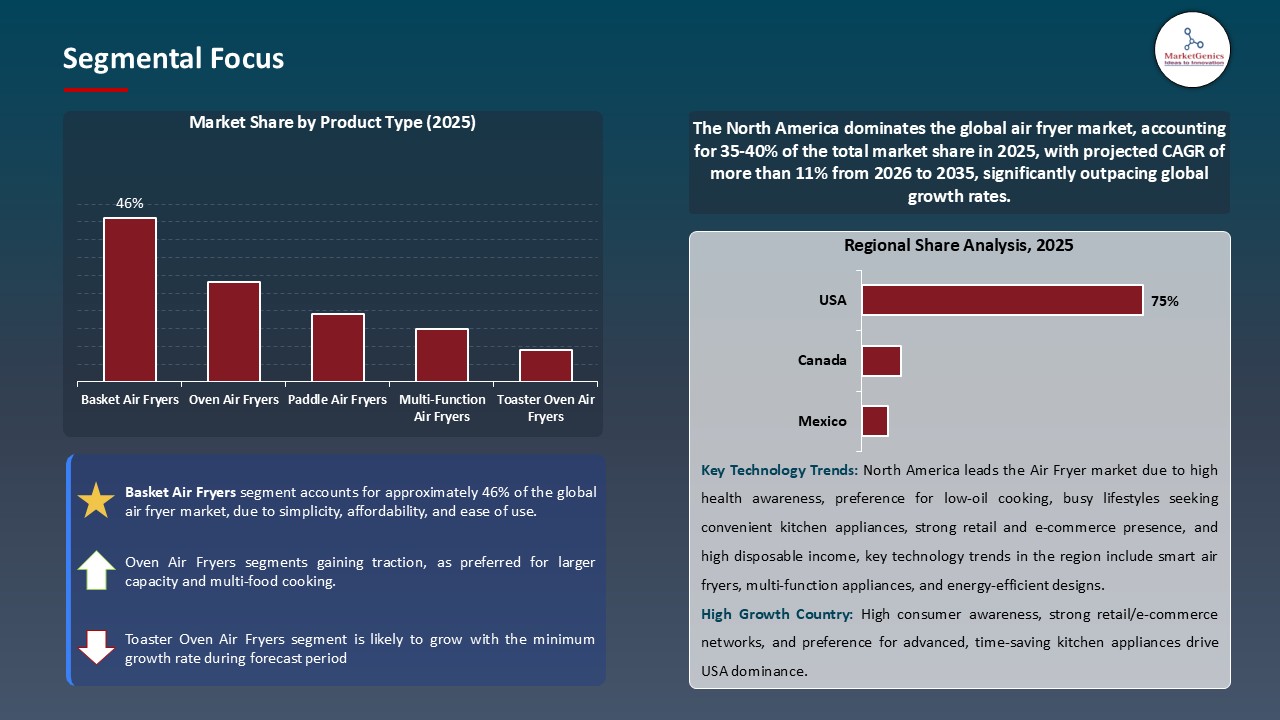

Basket Air Fryers Dominate Global Air Fryer Market

- The basket air fryers segment leads the global air fryer market, due to the convenience of preparation and ease of cooking, and the cleanup factor that makes basket air fryers an appealing option to meal preparations. For instance, in August 2024, Philips introduced the Dual Basket Air Fryer -3000 -Series in India. The basket-like machine allows cooking in two separate sections, which is more convenient and efficient among house cookers.

- Additionally, the introduction of basket-style air fryers with smart features and multiple functions capabilities reinforces consumer demand towards convenient, time-saving, and easy to clean appliances and causes the world to use basket air fryers. For instance, in September 2024, COSORI released the Smart 6 -Quart Air Fryer, a basket-style appliance with smart entertainment as an app and 10 cooking modes, which are more convenient and efficient to use.

- The market leadership of the basket air fryers and innovative dual-basket designs, along with smart and multi-functional features, has enhanced the leadership of the product in the marketplace.

North America Leads Global Air Fryer Market Demand

- North America leads the global air fryer market, driven by health-conscious, affluent consumers, advanced retail channels, and a strong food media ecosystem that promotes and encourages adoption. For instance, in 2025, Nestle S.A. increased its air-fryer-compatible food and seasoning portfolio throughout the Americas, including the U.S., as a way to promote greater product intake and usage.

- Furthermore, the region has highest average selling price in the world with high consumer willingness to spend in premium features, increased capacities, and branded product. This price benefit increases profitability of manufacturers, made it possible to invest in R&D and develop advanced food and seasoning products, which can be cooked in air fryers.

- North America’s air fryer market leadership and the high price realization are reinforcing the adoption of high-end air fryers, contributing to the growth of high revenue streams.

Air-Fryer-Market Ecosystem

The global air fryer market is moderately consolited, with high concentration among key players such as Philips Electronics, Ninja Kitchen (SharkNinja), Breville Group, Cuisinart (Conair Corp.), and GoWISE USA, who dominate through well-established brand, a broad product line, high-tech solutions, well-developed distribution networks, and focus marketing programs.

For instance, in October 2025, Cuisinart released two new high-technology fryer air-fryers, the 11-Quart Dual Basket Air Fryer Pro and the 15-in-1 Extra-Large Digital Air Fryer Oven as part of its expansion into larger capacity, multi-purpose appliances. The dominance of the market and product innovations of the leading players make the market tighten, consumer choice increase, and high power, multi- function air fryers adoption globally.

Recent Development and Strategic Overview:

- In October 2025, SharkNinja has launched the Ninja CRISPi PRO, with larger capacity, a more versatile cooking experience and more precise digital temperature regulation, continuing to emphasize the company philosophy of premium convenience and health-related innovation.

- In April 2025, McCain Foods India partnered with Philips to launch a series of frozen foods to be prepared on an air-fryer in India, with the specific formulation adjusted to meet the changing consumer demands of health-conscious and convenient food preparation.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 3.1 Bn |

|

Market Forecast Value in 2035 |

USD 7.5 Bn |

|

Growth Rate (CAGR) |

7.5% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Air-Fryer-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Air Fryer Market, By Product Type |

|

|

Air Fryer Market, By Capacity |

|

|

Air Fryer Market, By Technology |

|

|

Air Fryer Market, By Control Type |

|

|

Air Fryer Market, By Distribution Channel

|

|

|

Air Fryer Market, By Power Rating

|

|

|

Air Fryer Market, By End-users |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Air Fryer Market Outlook

- 2.1.1. Air Fryer Market Size (Volume - Million Units and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Air Fryer Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Air Fryer Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Air Fryer Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising health consciousness and preference for low-oil cooking

- 4.1.1.2. Increasing adoption of smart and multifunctional kitchen appliances

- 4.1.1.3. Busy lifestyles and growth of e-commerce making air fryers more accessible

- 4.1.2. Restraints

- 4.1.2.1. High initial price in price-sensitive markets

- 4.1.2.2. Limited awareness and penetration in emerging markets

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Component Suppliers

- 4.4.2. Air Fryer Manufacturers

- 4.4.3. Distributors/ Suppliers

- 4.4.4. End-users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Air Fryer Market Demand

- 4.7.1. Historical Market Size - in (Volume - Million Units and Value - US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - in (Volume - Million Units and Value - US$ Bn), 2026–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Air Fryer Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Air Fryer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Basket Air Fryers

- 6.2.2. Oven Air Fryers

- 6.2.3. Paddle Air Fryers

- 6.2.4. Multi-Function Air Fryers

- 6.2.5. Toaster Oven Air Fryers

- 7. Global Air Fryer Market Analysis, by Capacity

- 7.1. Key Segment Analysis

- 7.2. Air Fryer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Capacity, 2021-2035

- 7.2.1. Small (Less than 2 Liters)

- 7.2.2. Medium (2-4 Liters)

- 7.2.3. Large (4-6 Liters)

- 7.2.4. Extra Large (Above 6 Liters)

- 8. Global Air Fryer Market Analysis and Forecasts, by Technology

- 8.1. Key Findings

- 8.2. Air Fryer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Technology, 2021-2035

- 8.2.1. Rapid Air Technology

- 8.2.2. Hot Air Circulation Technology

- 8.2.3. Radiant Heat Technology

- 8.2.4. Infrared Technology

- 9. Global Air Fryer Market Analysis and Forecasts, by Control Type

- 9.1. Key Findings

- 9.2. Air Fryer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Control Type, 2021-2035

- 9.2.1. Manual Control

- 9.2.2. Digital Control

- 9.2.3. Smart/Wi-Fi Enabled Control

- 10. Global Air Fryer Market Analysis and Forecasts, by Distribution Channel

- 10.1. Key Findings

- 10.2. Air Fryer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel , 2021-2035

- 10.2.1. Online

- 10.2.1.1. E-commerce Platforms

- 10.2.1.2. Company Websites

- 10.2.1.3. Online Retail Stores

- 10.2.2. Offline

- 10.2.2.1. Hypermarkets/Supermarkets

- 10.2.2.2. Specialty Stores

- 10.2.2.3. Departmental Stores

- 10.2.3. Direct Sales

- 10.2.1. Online

- 11. Global Air Fryer Market Analysis and Forecasts, by Power Rating

- 11.1. Key Findings

- 11.2. Air Fryer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Power Rating , 2021-2035

- 11.2.1. Below 1000W

- 11.2.2. 1000W-1500W

- 11.2.3. 1500W-2000W

- 11.2.4. Above 2000W

- 12. Global Air Fryer Market Analysis and Forecasts, by End-users

- 12.1. Key Findings

- 12.2. Air Fryer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 12.2.1. Residential/Household

- 12.2.1.1. Daily Meal Preparation

- 12.2.1.2. Snack Making

- 12.2.1.3. Baking

- 12.2.1.4. Reheating Food

- 12.2.1.5. Others

- 12.2.2. Commercial

- 12.2.2.1. Restaurants & Quick Service Restaurants (QSR)

- 12.2.2.1.1. French Fries Preparation

- 12.2.2.1.2. Chicken Wings & Nuggets

- 12.2.2.1.3. Fast Food Items

- 12.2.2.1.4. Menu Diversification

- 12.2.2.1.5. Others

- 12.2.2.2. Hotels & Catering Services

- 12.2.2.2.1. Banquet Cooking

- 12.2.2.2.2. Room Service Preparation

- 12.2.2.2.3. Buffet Items

- 12.2.2.2.4. Others

- 12.2.2.3. Cafeterias & Food Courts

- 12.2.2.3.1. Quick Snacks

- 12.2.2.3.2. Meal Preparation

- 12.2.2.3.3. Others

- 12.2.2.4. Cloud Kitchens & Food Delivery Services

- 12.2.2.5. Institutional Kitchens

- 12.2.2.6. Others

- 12.2.2.1. Restaurants & Quick Service Restaurants (QSR)

- 12.2.1. Residential/Household

- 13. Global Air Fryer Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Air Fryer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Air Fryer Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Air Fryer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Capacity

- 14.3.3. Technology

- 14.3.4. Control Type

- 14.3.5. Distribution Channel

- 14.3.6. Power Rating

- 14.3.7. End-users

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Air Fryer Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Capacity

- 14.4.4. Technology

- 14.4.5. Control Type

- 14.4.6. Distribution Channel

- 14.4.7. Power Rating

- 14.4.8. End-users

- 14.5. Canada Air Fryer Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Capacity

- 14.5.4. Technology

- 14.5.5. Control Type

- 14.5.6. Distribution Channel

- 14.5.7. Power Rating

- 14.5.8. End-users

- 14.6. Mexico Air Fryer Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Capacity

- 14.6.4. Technology

- 14.6.5. Control Type

- 14.6.6. Distribution Channel

- 14.6.7. Power Rating

- 14.6.8. End-users

- 15. Europe Air Fryer Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Air Fryer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Capacity

- 15.3.3. Technology

- 15.3.4. Control Type

- 15.3.5. Distribution Channel

- 15.3.6. Power Rating

- 15.3.7. End-users

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Air Fryer Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Capacity

- 15.4.4. Technology

- 15.4.5. Control Type

- 15.4.6. Distribution Channel

- 15.4.7. Power Rating

- 15.4.8. End-users

- 15.5. United Kingdom Air Fryer Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Capacity

- 15.5.4. Technology

- 15.5.5. Control Type

- 15.5.6. Distribution Channel

- 15.5.7. Power Rating

- 15.5.8. End-users

- 15.6. France Air Fryer Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Capacity

- 15.6.4. Technology

- 15.6.5. Control Type

- 15.6.6. Distribution Channel

- 15.6.7. Power Rating

- 15.6.8. End-users

- 15.7. Italy Air Fryer Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Capacity

- 15.7.4. Technology

- 15.7.5. Control Type

- 15.7.6. Distribution Channel

- 15.7.7. Power Rating

- 15.7.8. End-users

- 15.8. Spain Air Fryer Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Capacity

- 15.8.4. Technology

- 15.8.5. Control Type

- 15.8.6. Distribution Channel

- 15.8.7. Power Rating

- 15.8.8. End-users

- 15.9. Netherlands Air Fryer Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Product Type

- 15.9.3. Capacity

- 15.9.4. Technology

- 15.9.5. Control Type

- 15.9.6. Distribution Channel

- 15.9.7. Power Rating

- 15.9.8. End-users

- 15.10. Nordic Countries Air Fryer Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Product Type

- 15.10.3. Capacity

- 15.10.4. Technology

- 15.10.5. Control Type

- 15.10.6. Distribution Channel

- 15.10.7. Power Rating

- 15.10.8. End-users

- 15.11. Poland Air Fryer Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Product Type

- 15.11.3. Capacity

- 15.11.4. Technology

- 15.11.5. Control Type

- 15.11.6. Distribution Channel

- 15.11.7. Power Rating

- 15.11.8. End-users

- 15.12. Russia & CIS Air Fryer Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Product Type

- 15.12.3. Capacity

- 15.12.4. Technology

- 15.12.5. Control Type

- 15.12.6. Distribution Channel

- 15.12.7. Power Rating

- 15.12.8. End-users

- 15.13. Rest of Europe Air Fryer Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Product Type

- 15.13.3. Capacity

- 15.13.4. Technology

- 15.13.5. Control Type

- 15.13.6. Distribution Channel

- 15.13.7. Power Rating

- 15.13.8. End-users

- 16. Asia Pacific Air Fryer Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Asia Pacific Air Fryer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Capacity

- 16.3.3. Technology

- 16.3.4. Control Type

- 16.3.5. Distribution Channel

- 16.3.6. Power Rating

- 16.3.7. End-users

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Air Fryer Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Capacity

- 16.4.4. Technology

- 16.4.5. Control Type

- 16.4.6. Distribution Channel

- 16.4.7. Power Rating

- 16.4.8. End-users

- 16.5. India Air Fryer Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Capacity

- 16.5.4. Technology

- 16.5.5. Control Type

- 16.5.6. Distribution Channel

- 16.5.7. Power Rating

- 16.5.8. End-users

- 16.6. Japan Air Fryer Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Capacity

- 16.6.4. Technology

- 16.6.5. Control Type

- 16.6.6. Distribution Channel

- 16.6.7. Power Rating

- 16.6.8. End-users

- 16.7. South Korea Air Fryer Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Capacity

- 16.7.4. Technology

- 16.7.5. Control Type

- 16.7.6. Distribution Channel

- 16.7.7. Power Rating

- 16.7.8. End-users

- 16.8. Australia and New Zealand Air Fryer Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Capacity

- 16.8.4. Technology

- 16.8.5. Control Type

- 16.8.6. Distribution Channel

- 16.8.7. Power Rating

- 16.8.8. End-users

- 16.9. Indonesia Air Fryer Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Capacity

- 16.9.4. Technology

- 16.9.5. Control Type

- 16.9.6. Distribution Channel

- 16.9.7. Power Rating

- 16.9.8. End-users

- 16.10. Malaysia Air Fryer Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Capacity

- 16.10.4. Technology

- 16.10.5. Control Type

- 16.10.6. Distribution Channel

- 16.10.7. Power Rating

- 16.10.8. End-users

- 16.11. Thailand Air Fryer Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Capacity

- 16.11.4. Technology

- 16.11.5. Control Type

- 16.11.6. Distribution Channel

- 16.11.7. Power Rating

- 16.11.8. End-users

- 16.12. Vietnam Air Fryer Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Capacity

- 16.12.4. Technology

- 16.12.5. Control Type

- 16.12.6. Distribution Channel

- 16.12.7. Power Rating

- 16.12.8. End-users

- 16.13. Rest of Asia Pacific Air Fryer Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Capacity

- 16.13.4. Technology

- 16.13.5. Control Type

- 16.13.6. Distribution Channel

- 16.13.7. Power Rating

- 16.13.8. End-users

- 17. Middle East Air Fryer Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Air Fryer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Capacity

- 17.3.3. Technology

- 17.3.4. Control Type

- 17.3.5. Distribution Channel

- 17.3.6. Power Rating

- 17.3.7. End-users

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Air Fryer Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Capacity

- 17.4.4. Technology

- 17.4.5. Control Type

- 17.4.6. Distribution Channel

- 17.4.7. Power Rating

- 17.4.8. End-users

- 17.5. UAE Air Fryer Market

- 17.5.1. Product Type

- 17.5.2. Capacity

- 17.5.3. Technology

- 17.5.4. Control Type

- 17.5.5. Distribution Channel

- 17.5.6. Power Rating

- 17.5.7. End-users

- 17.6. Saudi Arabia Air Fryer Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Capacity

- 17.6.4. Technology

- 17.6.5. Control Type

- 17.6.6. Distribution Channel

- 17.6.7. Power Rating

- 17.6.8. End-users

- 17.7. Israel Air Fryer Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Capacity

- 17.7.4. Technology

- 17.7.5. Control Type

- 17.7.6. Distribution Channel

- 17.7.7. Power Rating

- 17.7.8. End-users

- 17.8. Rest of Middle East Air Fryer Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Capacity

- 17.8.4. Technology

- 17.8.5. Control Type

- 17.8.6. Distribution Channel

- 17.8.7. Power Rating

- 17.8.8. End-users

- 18. Africa Air Fryer Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Air Fryer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Capacity

- 18.3.3. Technology

- 18.3.4. Control Type

- 18.3.5. Distribution Channel

- 18.3.6. Power Rating

- 18.3.7. End-users

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Air Fryer Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Capacity

- 18.4.4. Technology

- 18.4.5. Control Type

- 18.4.6. Distribution Channel

- 18.4.7. Power Rating

- 18.4.8. End-users

- 18.5. Egypt Air Fryer Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Capacity

- 18.5.4. Technology

- 18.5.5. Control Type

- 18.5.6. Distribution Channel

- 18.5.7. Power Rating

- 18.5.8. End-users

- 18.6. Nigeria Air Fryer Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Capacity

- 18.6.4. Technology

- 18.6.5. Control Type

- 18.6.6. Distribution Channel

- 18.6.7. Power Rating

- 18.6.8. End-users

- 18.7. Algeria Air Fryer Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Capacity

- 18.7.4. Technology

- 18.7.5. Control Type

- 18.7.6. Distribution Channel

- 18.7.7. Power Rating

- 18.7.8. End-users

- 18.8. Rest of Africa Air Fryer Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Capacity

- 18.8.4. Technology

- 18.8.5. Control Type

- 18.8.6. Distribution Channel

- 18.8.7. Power Rating

- 18.8.8. End-users

- 19. South America Air Fryer Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. South America Air Fryer Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Capacity

- 19.3.3. Technology

- 19.3.4. Control Type

- 19.3.5. Distribution Channel

- 19.3.6. Power Rating

- 19.3.7. End-users

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Air Fryer Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Capacity

- 19.4.4. Technology

- 19.4.5. Control Type

- 19.4.6. Distribution Channel

- 19.4.7. Power Rating

- 19.4.8. End-users

- 19.5. Argentina Air Fryer Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Capacity

- 19.5.4. Technology

- 19.5.5. Control Type

- 19.5.6. Distribution Channel

- 19.5.7. Power Rating

- 19.5.8. End-users

- 19.6. Rest of South America Air Fryer Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Capacity

- 19.6.4. Technology

- 19.6.5. Control Type

- 19.6.6. Distribution Channel

- 19.6.7. Power Rating

- 19.6.8. End-users

- 20. Key Players/ Company Profile

- 20.1. Air Choice

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Avalon Bay

- 20.3. Black+Decker

- 20.4. Breville Group

- 20.5. Chefman

- 20.6. Cosori

- 20.7. Cozyna

- 20.8. Cuisinart (Conair Corp.)

- 20.9. Dash

- 20.10. Emeril Lagasse

- 20.11. Farberware

- 20.12. GoWISE USA

- 20.13. Hamilton Beach

- 20.14. Instant Brands

- 20.15. Ninja Kitchen (SharkNinja)

- 20.16. NuWave

- 20.17. Philips Electronics

- 20.18. PowerXL

- 20.19. Tefal (Groupe SEB)

- 20.20. Tristar Products (Power Air Fryer)

- 20.21. Yedi Houseware Appliances

- 20.22. Other Key Players

- 20.1. Air Choice

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation