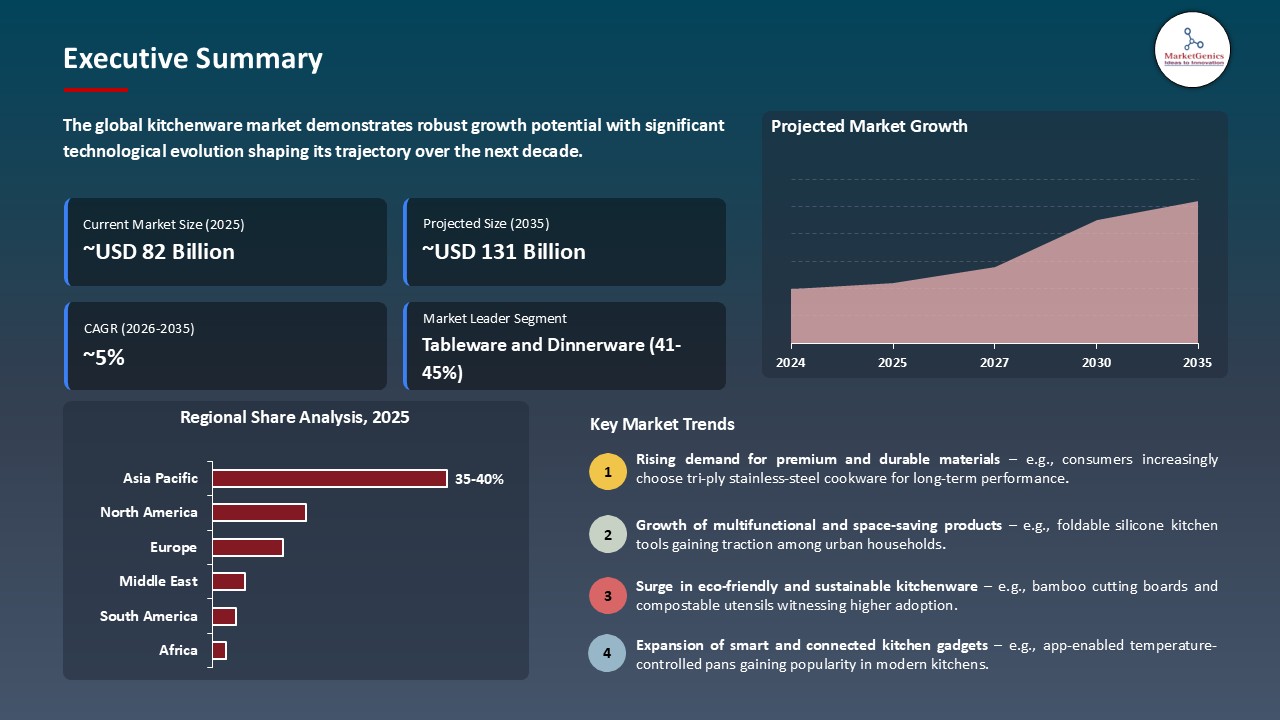

- The global kitchenware market is valued at USD 82.1 billion in 2025.

- The market is projected to grow at a CAGR of 4.8% during the forecast period of 2026 to 2035.

- The tableware and dinnerware segment hold major share ~43% in the global kitchenware market, due to strong demand for premium, aesthetic dining products, rising home-entertaining trends, and increased consumer focus on design-centric table settings.

- The kitchenware market growing due to rising demand for sustainable and eco-friendly kitchenware such as bamboo, ceramic, and recycled-material products.

- The kitchenware market is driven by strong e-commerce expansion improving accessibility to global and premium brands.

- The top five players accounting for nearly 25% of the global kitchenware market share in 2025.

- In June 2025, Le Creuset celebrated its centenary with a limited-edition Flamme Dorée cast-iron collection featuring a premium gold-enamel finish.

- In January 2025, Williams Sonoma launched the exclusive Breville Brass Collection, featuring brass-accented countertop appliances with a premium, luxury-focused design.

- Global Kitchenware Market is likely to create the total forecasting opportunity of ~USD 49 Bn till 2035.

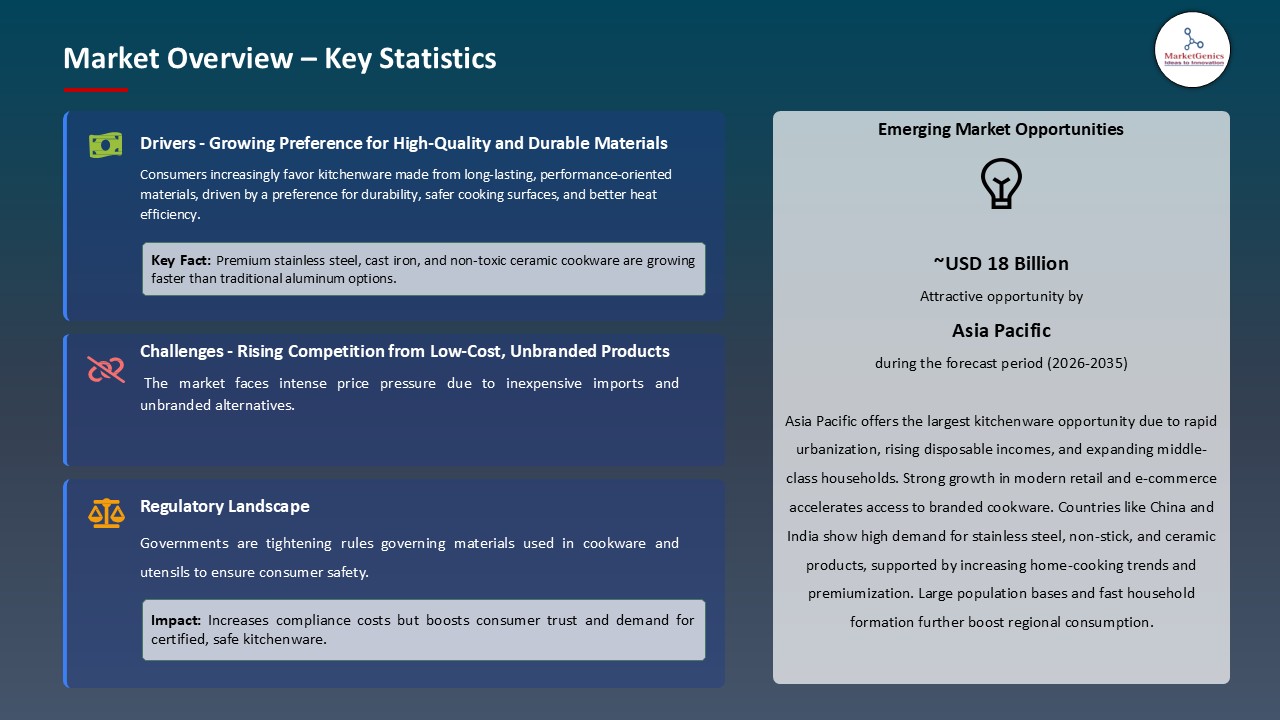

- Asia Pacific is most attractive region due to its large population base, rising middle-class incomes, rapid urbanization, expanding modern retail, and strong demand for affordable as well as premium kitchenware products.

- The global kitchenware market is a growing with high potential because consumer premiumization is under way, leading people to view kitchen appliances as long-term investments that need better quality instead of disposable products. The sustainability and minimalist preferences are enabling this transition, which is driving the increased demand of high-quality materials, excellent craftsmanship, and performance.

- As a manufacturer in the forefront of innovation in materials and design, for instance, in May 2025, Pots & Pans launched the Meyer Presta Tri-Ply Pressure Cooker, with the traditional pressure-cooker look and the high-quality tri-layer stainless-steel construction, providing its customers with superior durability, heat efficiency, and performance.

- Additionally, there is the social media influence of chefs and creators, which is leading to aspirational demand of the professional-grade tools needed in the kitchen as consumers strive to replicate the techniques of the restaurant at home. The appliances that are presented in mainstream food media are becoming seen more as a form of skill and creativity training and less about a simple utility buy.

- Long-term home-cooking trends, superior quality consumption, social media-based gastronomy, and high-end appliances are driving market demand and profits.

- The kitchenware market is limited by long product lifespan especially in the higher end markets where the stainless-steel and cast-iron cookware are of high quality and hence can last decades. This leads to a mature household penetration where demand is largely brought about by new household formation, upgrade to higher levels, and gifting events, as opposed to replacement demands.

- Furthermore, economic uncertainty or inflation tends to slow down the consumer discretionary furniture and kitchenware purchases, as they delay outdated product usage even when they plan to replace. Since the majority of kitchenware purchases are non-essential and deferrable, the category is especially vulnerable to economic mindset changes and consumer trust.

- In highly competitive marketplaces with long-lasting products, manufacturers must focus on increasing market share, premiumization, and category development to attract new customers.

- The kitchenware market is achieving robust growth enabled by e-commerce and DTC platforms, which has allowed brands to circumvent the traditional retail, take larger margins, establish direct customer relationships, and leverage data-driven targeting, as well as expanding market access and generating new revenue streams in existing actors. As an example, in December 2024, the brand recently raised 23.1 crore in a pre-Series A funding round earlier this year, by DSG Ventures, and this fact reflects high investor confidence in its toxin-free, DTC-led business model.

- Additionally, e-commerce is also making personalization, customization and subscription services that would have been too cumbersome in brick and mortar stores. According to Williams-Sonoma, 38% of its kitchenware sales are now generated online due to the popularity of customized products like monogrammed or custom-color products and selected subscription boxes that launch new items and also earn recurring sales.

- The digital revolution in kitchenware retail is creating opportunities for new brands, enabling niche products to reach global markets, refining consumer insights, and redefining competition by lowering entry barriers and rewarding effective digital marketing and customer interaction.

- The kitchenware market is experiencing significant change because customers demand more sustainable materials, responsible production methods, and non-toxic finishes because of health issues related to chemical exposure, especially of the PFAS-based non-stick surfaces. This change is exerting pressure on traditional-technology incumbents and creates strong opportunities to innovators with safer, next-generation solutions.

- For instance, in July 2025, HexClad switched its legacy coating of PTFE to TerraBond by using a ceramic coating that has completely removed PFAS and PFOA and other forever chemicals to meet new regulations and consumer needs of safer and non-toxic cookware.

- Additionally, circular economy ideas are becoming popular with refurbishment schemes, coating renovation schemes, and design-to-disassemble schemes that enable replacement of components instead of disposal of the entire product. These programs minimize effects on the environment, minimize the ownership expenses, increase lifecycle of the premium products, and generate new sources of services revenue.

- The sustainability megatrend distinguishes traditional and price-oriented items from high-priced sustainable products with better margins due to their environmental and health benefits.

- The global kitchenware market is dominated by tableware and dinnerware segments because of increased frequency of at-home dining, increasing number of social hosting events and the impact of visually driven food content in social media are all contributing to rising demand of quality, design-driven tableware and dinnerware. An example, in 2025, Anthropologie partnered with Suzy Karadsheh of The Mediterranean Dish to create a 36-piece, heirloom-quality dinnerwear line with designs inspired by the coasts made out of glazed terracotta, glass, and wood.

- Additionally, the increasing appeal of consumers to more durable, design-driven, and sustainable product materials, including stoneware, porcelain, and recycled glass, is enhancing product improvements and enabling greater sales of higher value items in the category. As an example, in 2025, Ariane Fine Porcelain came out with its Cruise collection within the IMPRESS line, which includes high-quality durable porcelain to be used in high-performance hospitality.

- The premium category, innovation-led brands, and tableware/dinnerware are key drivers of the kitchenware market expansion.

- Asia Pacific leads the global kitchenware market is due to its high population base, urbanization and household formation, growing middle-income consumers, high cultural orientation towards home cooking and high domestic production potential to provide cost effectiveness and match regional market preferences.

- For instance, in 2025, Zhejiang Supor strengthened its research and development capacity and extended its production sites in China and Vietnam to increase its production volume and to assist the development of premium and value-end cookware lineups. This growth enhances the competitive positioning of Supor through improved production capacity, expansion of product line, and faster growth in mass and high-end markets.

- Additionally, Asia Pacific is a significant world manufacturing base of kitchenware with China, India, Thailand and Vietnam providing both domestic and export markets. This concentration contributes to fast product development, competitive cost structure, and efficient regional distribution as well as employment and technical ability which enhances home brand development.

- Moreover, e-commerce sales of kitchenware are also growing significantly in the region, and platforms like Alibaba and JD.com are opening more opportunities to large selections, discounts, and delivery to lower tier cities as well as rural areas that traditional retailers could not enter.

- Asia Pacific is the leading kitchenware market and is expected to drive foreseeable demand expansion because of its demographic scale, fast growing economies, rich culinary culture, manufacturing competitiveness, and well-developed digital commerce systems.

- In June 2025, Le Creuset marked its centenary by launching a limited-edition Flamme Dorée cast-iron collection, featuring a premium gold-enamel finish that highlights the brand’s heritage and design excellence. The collection supports the established role of Le Creuset in the high-end kitchenware category and targets collectors and style-conscious individuals.

- In January 2025, Williams Sonoma launched the exclusive Breville Brass Collection, which incorporates brass-accented countertop appliances in order to provide a high-end, luxury-focused look. The line enhances the brand image of the high-end consumers that want not only functionality but also high-end design of the kitchen.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Calphalon

- Corelle Brands

- Cuisinart

- Fissler

- Groupe SEB

- Hawkins Cookers

- Le Creuset

- Lodge Cast Iron

- Meyer Corporation

- Newell Brands

- OXO International

- Stovekraft

- Tramontina

- TTK Prestige Limited

- Whirlpool Corporation

- Williams Sonoma

- WMF Group

- Zwilling J.A. Henckels

- Other Key Players

- Cookware

- Pots and Pans

- Pressure Cookers

- Stockpots

- Woks

- Dutch Ovens

- Others

- Bakeware

- Baking Sheets and Trays

- Cake Pans

- Muffin Tins

- Loaf Pans

- Pizza Pans

- Others

- Kitchen Tools and Gadgets

- Knives and Cutlery

- Cutting Boards

- Peelers and Graters

- Measuring Cups and Spoons

- Whisks and Spatulas

- Colanders and Strainers

- Others

- Food Storage

- Containers

- Jars and Canisters

- Lunch Boxes

- Vacuum Storage Systems

- Others

- Tableware and Dinnerware

- Plates and Bowls

- Cups and Mugs

- Serving Dishes

- Flatware Sets

- Others

- Kitchen Accessories

- Dish Racks

- Trivets and Pot Holders

- Aprons

- Kitchen Organizers

- Others

- Stainless Steel

- Aluminum

- Cast Iron

- Non-stick Coated

- Glass

- Plastic

- Wood

- Others

- Online

- Company Websites

- E-commerce Platforms

- Online Specialty Stores

- Offline

- Direct Sales

- Supermarkets and Hypermarkets

- Specialty Kitchen Stores

- Department Stores

- Individual/Single Serving

- Family Size 2-4 persons

- Family Size 5+ persons

- Bulk/Commercial

- Residential/Household

- Daily Cooking

- Baking and Pastry Making

- Food Preparation

- Food Storage and Preservation

- Dining and Serving

- Entertaining and Hosting

- Others

- Commercial/Professional

- Restaurants

- Fine Dining

- Quick Service Restaurants (QSR)

- Casual Dining

- Ethnic/Specialty Restaurants

- Others

- Hotels and Hospitality

- Kitchen Operations

- Banquet Services

- Room Service

- Others

- Catering Services

- Event Catering

- Corporate Catering

- Wedding and Party Catering

- Others

- Institutional Kitchens

- Schools and Universities

- Hospitals and Healthcare

- Corporate Cafeterias

- Military Facilities

- Others

- Bakeries and Pastry Shops

- Cafes and Coffee Shops

- Food Processing Units

- Cloud Kitchens/Ghost Kitchens

- Others

- Restaurants

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Kitchenware Market Outlook

- 2.1.1. Kitchenware Market Size (Volume - Million Units and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Kitchenware Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for modern and multifunctional kitchen tools

- 4.1.1.2. Growing consumer preference for premium and durable materials (e.g., stainless steel, non-stick)

- 4.1.1.3. Increasing e-commerce penetration and online sales channels

- 4.1.2. Restraints

- 4.1.2.1. High price of premium and branded kitchenware products

- 4.1.2.2. Volatility in raw material costs affecting manufacturing expenses

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Kitchenware Manufacturers

- 4.4.3. Dealers/ Distributors

- 4.4.4. End-Users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Kitchenware Market Demand

- 4.9.1. Historical Market Size – Volume (Million Units) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Volume (Million Units) and Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Kitchenware Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Kitchenware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Cookware

- 6.2.1.1. Pots and Pans

- 6.2.1.2. Pressure Cookers

- 6.2.1.3. Stockpots

- 6.2.1.4. Woks

- 6.2.1.5. Dutch Ovens

- 6.2.1.6. Others

- 6.2.2. Bakeware

- 6.2.2.1. Baking Sheets and Trays

- 6.2.2.2. Cake Pans

- 6.2.2.3. Muffin Tins

- 6.2.2.4. Loaf Pans

- 6.2.2.5. Pizza Pans

- 6.2.2.6. Others

- 6.2.3. Kitchen Tools and Gadgets

- 6.2.3.1. Knives and Cutlery

- 6.2.3.2. Cutting Boards

- 6.2.3.3. Peelers and Graters

- 6.2.3.4. Measuring Cups and Spoons

- 6.2.3.5. Whisks and Spatulas

- 6.2.3.6. Colanders and Strainers

- 6.2.3.7. Others

- 6.2.4. Food Storage

- 6.2.4.1. Containers

- 6.2.4.2. Jars and Canisters

- 6.2.4.3. Lunch Boxes

- 6.2.4.4. Vacuum Storage Systems

- 6.2.4.5. Others

- 6.2.5. Tableware and Dinnerware

- 6.2.5.1. Plates and Bowls

- 6.2.5.2. Cups and Mugs

- 6.2.5.3. Serving Dishes

- 6.2.5.4. Flatware Sets

- 6.2.5.5. Others

- 6.2.6. Kitchen Accessories

- 6.2.6.1. Dish Racks

- 6.2.6.2. Trivets and Pot Holders

- 6.2.6.3. Aprons

- 6.2.6.4. Kitchen Organizers

- 6.2.6.5. Others

- 6.2.1. Cookware

- 7. Global Kitchenware Market Analysis, by Material Type

- 7.1. Key Segment Analysis

- 7.2. Kitchenware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Material Type, 2021-2035

- 7.2.1. Stainless Steel

- 7.2.2. Aluminum

- 7.2.3. Cast Iron

- 7.2.4. Non-stick Coated

- 7.2.5. Glass

- 7.2.6. Plastic

- 7.2.7. Wood

- 7.2.8. Others

- 8. Global Kitchenware Market Analysis, by Distribution Channel

- 8.1. Key Segment Analysis

- 8.2. Kitchenware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 8.2.1. Online

- 8.2.1.1. Company Websites

- 8.2.1.2. E-commerce Platforms

- 8.2.1.3. Online Specialty Stores

- 8.2.2. Offline

- 8.2.2.1. Direct Sales

- 8.2.2.2. Supermarkets and Hypermarkets

- 8.2.2.3. Specialty Kitchen Stores

- 8.2.2.4. Department Stores

- 8.2.1. Online

- 9. Global Kitchenware Market Analysis, by Capacity/Size

- 9.1. Key Segment Analysis

- 9.2. Kitchenware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Capacity/Size, 2021-2035

- 9.2.1. Individual/Single Serving

- 9.2.2. Family Size 2-4 persons

- 9.2.3. Family Size 5+ persons

- 9.2.4. Bulk/Commercial

- 10. Global Kitchenware Market Analysis, by End-users

- 10.1. Key Segment Analysis

- 10.2. Kitchenware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 10.2.1. Residential/Household

- 10.2.1.1. Daily Cooking

- 10.2.1.2. Baking and Pastry Making

- 10.2.1.3. Food Preparation

- 10.2.1.4. Food Storage and Preservation

- 10.2.1.5. Dining and Serving

- 10.2.1.6. Entertaining and Hosting

- 10.2.1.7. Others

- 10.2.2. Commercial/Professional

- 10.2.2.1. Restaurants

- 10.2.3. Fine Dining

- 10.2.4. Quick Service Restaurants (QSR)

- 10.2.5. Casual Dining

- 10.2.6. Ethnic/Specialty Restaurants

- 10.2.7. Others

- 10.2.7.1. Hotels and Hospitality

- 10.2.8. Kitchen Operations

- 10.2.9. Banquet Services

- 10.2.10. Room Service

- 10.2.11. Others

- 10.2.11.1. Catering Services

- 10.2.12. Event Catering

- 10.2.13. Corporate Catering

- 10.2.14. Wedding and Party Catering

- 10.2.15. Others

- 10.2.15.1. Institutional Kitchens

- 10.2.16. Schools and Universities

- 10.2.17. Hospitals and Healthcare

- 10.2.18. Corporate Cafeterias

- 10.2.19. Military Facilities

- 10.2.20. Others

- 10.2.20.1. Bakeries and Pastry Shops

- 10.2.21. Cafes and Coffee Shops

- 10.2.22. Food Processing Units

- 10.2.23. Cloud Kitchens/Ghost Kitchens

- 10.2.24. Others

- 10.2.1. Residential/Household

- 11. Global Kitchenware Market Analysis and Forecasts, by Region

- 11.1. Key Findings

- 11.2. Kitchenware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 11.2.1. North America

- 11.2.2. Europe

- 11.2.3. Asia Pacific

- 11.2.4. Middle East

- 11.2.5. Africa

- 11.2.6. South America

- 12. North America Kitchenware Market Analysis

- 12.1. Key Segment Analysis

- 12.2. Regional Snapshot

- 12.3. North America Kitchenware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 12.3.1. Product Type

- 12.3.2. Material Type

- 12.3.3. Distribution Channel

- 12.3.4. Capacity/Size

- 12.3.5. End-users

- 12.3.6. Country

- 12.3.6.1. USA

- 12.3.6.2. Canada

- 12.3.6.3. Mexico

- 12.4. USA Kitchenware Market

- 12.4.1. Country Segmental Analysis

- 12.4.2. Product Type

- 12.4.3. Material Type

- 12.4.4. Distribution Channel

- 12.4.5. Capacity/Size

- 12.4.6. End-users

- 12.5. Canada Kitchenware Market

- 12.5.1. Country Segmental Analysis

- 12.5.2. Product Type

- 12.5.3. Material Type

- 12.5.4. Distribution Channel

- 12.5.5. Capacity/Size

- 12.5.6. End-users

- 12.6. Mexico Kitchenware Market

- 12.6.1. Country Segmental Analysis

- 12.6.2. Product Type

- 12.6.3. Material Type

- 12.6.4. Distribution Channel

- 12.6.5. Capacity/Size

- 12.6.6. End-users

- 13. Europe Kitchenware Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. Europe Kitchenware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Product Type

- 13.3.2. Material Type

- 13.3.3. Distribution Channel

- 13.3.4. Capacity/Size

- 13.3.5. End-users

- 13.3.6. Country

- 13.3.6.1. Germany

- 13.3.6.2. United Kingdom

- 13.3.6.3. France

- 13.3.6.4. Italy

- 13.3.6.5. Spain

- 13.3.6.6. Netherlands

- 13.3.6.7. Nordic Countries

- 13.3.6.8. Poland

- 13.3.6.9. Russia & CIS

- 13.3.6.10. Rest of Europe

- 13.4. Germany Kitchenware Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Product Type

- 13.4.3. Material Type

- 13.4.4. Distribution Channel

- 13.4.5. Capacity/Size

- 13.4.6. End-users

- 13.5. United Kingdom Kitchenware Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Product Type

- 13.5.3. Material Type

- 13.5.4. Distribution Channel

- 13.5.5. Capacity/Size

- 13.5.6. End-users

- 13.6. France Kitchenware Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Product Type

- 13.6.3. Material Type

- 13.6.4. Distribution Channel

- 13.6.5. Capacity/Size

- 13.6.6. End-users

- 13.7. Italy Kitchenware Market

- 13.7.1. Country Segmental Analysis

- 13.7.2. Product Type

- 13.7.3. Material Type

- 13.7.4. Distribution Channel

- 13.7.5. Capacity/Size

- 13.7.6. End-users

- 13.8. Spain Kitchenware Market

- 13.8.1. Country Segmental Analysis

- 13.8.2. Product Type

- 13.8.3. Material Type

- 13.8.4. Distribution Channel

- 13.8.5. Capacity/Size

- 13.8.6. End-users

- 13.9. Netherlands Kitchenware Market

- 13.9.1. Country Segmental Analysis

- 13.9.2. Product Type

- 13.9.3. Material Type

- 13.9.4. Distribution Channel

- 13.9.5. Capacity/Size

- 13.9.6. End-users

- 13.10. Nordic Countries Kitchenware Market

- 13.10.1. Country Segmental Analysis

- 13.10.2. Product Type

- 13.10.3. Material Type

- 13.10.4. Distribution Channel

- 13.10.5. Capacity/Size

- 13.10.6. End-users

- 13.11. Poland Kitchenware Market

- 13.11.1. Country Segmental Analysis

- 13.11.2. Product Type

- 13.11.3. Material Type

- 13.11.4. Distribution Channel

- 13.11.5. Capacity/Size

- 13.11.6. End-users

- 13.12. Russia & CIS Kitchenware Market

- 13.12.1. Country Segmental Analysis

- 13.12.2. Product Type

- 13.12.3. Material Type

- 13.12.4. Distribution Channel

- 13.12.5. Capacity/Size

- 13.12.6. End-users

- 13.13. Rest of Europe Kitchenware Market

- 13.13.1. Country Segmental Analysis

- 13.13.2. Product Type

- 13.13.3. Material Type

- 13.13.4. Distribution Channel

- 13.13.5. Capacity/Size

- 13.13.6. End-users

- 14. Asia Pacific Kitchenware Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Asia Pacific Kitchenware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Material Type

- 14.3.3. Distribution Channel

- 14.3.4. Capacity/Size

- 14.3.5. End-users

- 14.3.6. Country

- 14.3.6.1. China

- 14.3.6.2. India

- 14.3.6.3. Japan

- 14.3.6.4. South Korea

- 14.3.6.5. Australia and New Zealand

- 14.3.6.6. Indonesia

- 14.3.6.7. Malaysia

- 14.3.6.8. Thailand

- 14.3.6.9. Vietnam

- 14.3.6.10. Rest of Asia Pacific

- 14.4. China Kitchenware Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Material Type

- 14.4.4. Distribution Channel

- 14.4.5. Capacity/Size

- 14.4.6. End-users

- 14.5. India Kitchenware Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Material Type

- 14.5.4. Distribution Channel

- 14.5.5. Capacity/Size

- 14.5.6. End-users

- 14.6. Japan Kitchenware Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Material Type

- 14.6.4. Distribution Channel

- 14.6.5. Capacity/Size

- 14.6.6. End-users

- 14.7. South Korea Kitchenware Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Product Type

- 14.7.3. Material Type

- 14.7.4. Distribution Channel

- 14.7.5. Capacity/Size

- 14.7.6. End-users

- 14.8. Australia and New Zealand Kitchenware Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Product Type

- 14.8.3. Material Type

- 14.8.4. Distribution Channel

- 14.8.5. Capacity/Size

- 14.8.6. End-users

- 14.9. Indonesia Kitchenware Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Product Type

- 14.9.3. Material Type

- 14.9.4. Distribution Channel

- 14.9.5. Capacity/Size

- 14.9.6. End-users

- 14.10. Malaysia Kitchenware Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Product Type

- 14.10.3. Material Type

- 14.10.4. Distribution Channel

- 14.10.5. Capacity/Size

- 14.10.6. End-users

- 14.11. Thailand Kitchenware Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Product Type

- 14.11.3. Material Type

- 14.11.4. Distribution Channel

- 14.11.5. Capacity/Size

- 14.11.6. End-users

- 14.12. Vietnam Kitchenware Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Product Type

- 14.12.3. Material Type

- 14.12.4. Distribution Channel

- 14.12.5. Capacity/Size

- 14.12.6. End-users

- 14.13. Rest of Asia Pacific Kitchenware Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Product Type

- 14.13.3. Material Type

- 14.13.4. Distribution Channel

- 14.13.5. Capacity/Size

- 14.13.6. End-users

- 15. Middle East Kitchenware Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Middle East Kitchenware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Material Type

- 15.3.3. Distribution Channel

- 15.3.4. Capacity/Size

- 15.3.5. End-users

- 15.3.6. Country

- 15.3.6.1. Turkey

- 15.3.6.2. UAE

- 15.3.6.3. Saudi Arabia

- 15.3.6.4. Israel

- 15.3.6.5. Rest of Middle East

- 15.4. Turkey Kitchenware Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Material Type

- 15.4.4. Distribution Channel

- 15.4.5. Capacity/Size

- 15.4.6. End-users

- 15.5. UAE Kitchenware Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Material Type

- 15.5.4. Distribution Channel

- 15.5.5. Capacity/Size

- 15.5.6. End-users

- 15.6. Saudi Arabia Kitchenware Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Material Type

- 15.6.4. Distribution Channel

- 15.6.5. Capacity/Size

- 15.6.6. End-users

- 15.7. Israel Kitchenware Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Material Type

- 15.7.4. Distribution Channel

- 15.7.5. Capacity/Size

- 15.7.6. End-users

- 15.8. Rest of Middle East Kitchenware Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Material Type

- 15.8.4. Distribution Channel

- 15.8.5. Capacity/Size

- 15.8.6. End-users

- 16. Africa Kitchenware Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Africa Kitchenware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Material Type

- 16.3.3. Distribution Channel

- 16.3.4. Capacity/Size

- 16.3.5. End-users

- 16.3.6. Country

- 16.3.6.1. South Africa

- 16.3.6.2. Egypt

- 16.3.6.3. Nigeria

- 16.3.6.4. Algeria

- 16.3.6.5. Rest of Africa

- 16.4. South Africa Kitchenware Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Material Type

- 16.4.4. Distribution Channel

- 16.4.5. Capacity/Size

- 16.4.6. End-users

- 16.5. Egypt Kitchenware Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Material Type

- 16.5.4. Distribution Channel

- 16.5.5. Capacity/Size

- 16.5.6. End-users

- 16.6. Nigeria Kitchenware Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Material Type

- 16.6.4. Distribution Channel

- 16.6.5. Capacity/Size

- 16.6.6. End-users

- 16.7. Algeria Kitchenware Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Material Type

- 16.7.4. Distribution Channel

- 16.7.5. Capacity/Size

- 16.7.6. End-users

- 16.8. Rest of Africa Kitchenware Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Material Type

- 16.8.4. Distribution Channel

- 16.8.5. Capacity/Size

- 16.8.6. End-users

- 17. South America Kitchenware Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. South America Kitchenware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Material Type

- 17.3.3. Distribution Channel

- 17.3.4. Capacity/Size

- 17.3.5. End-users

- 17.3.6. Country

- 17.3.6.1. Brazil

- 17.3.6.2. Argentina

- 17.3.6.3. Rest of South America

- 17.4. Brazil Kitchenware Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Material Type

- 17.4.4. Distribution Channel

- 17.4.5. Capacity/Size

- 17.4.6. End-users

- 17.5. Argentina Kitchenware Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Material Type

- 17.5.4. Distribution Channel

- 17.5.5. Capacity/Size

- 17.5.6. End-users

- 17.6. Rest of South America Kitchenware Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Material Type

- 17.6.4. Distribution Channel

- 17.6.5. Capacity/Size

- 17.6.6. End-users

- 18. Key Players/ Company Profile

- 18.1. Calphalon

- 18.1.1. Company Details/ Overview

- 18.1.2. Company Financials

- 18.1.3. Key Customers and Competitors

- 18.1.4. Business/ Industry Portfolio

- 18.1.5. Product Portfolio/ Specification Details

- 18.1.6. Pricing Data

- 18.1.7. Strategic Overview

- 18.1.8. Recent Developments

- 18.2. Corelle Brands

- 18.3. Cuisinart

- 18.4. Fissler

- 18.5. Groupe SEB

- 18.6. Hawkins Cookers

- 18.7. Le Creuset

- 18.8. Lodge Cast Iron

- 18.9. Meyer Corporation

- 18.10. Newell Brands

- 18.11. OXO International

- 18.12. Stovekraft

- 18.13. Tramontina

- 18.14. TTK Prestige Limited

- 18.15. Whirlpool Corporation

- 18.16. Williams Sonoma

- 18.17. WMF Group

- 18.18. Zwilling J.A. Henckels

- 18.19. Other Key Players

- 18.1. Calphalon

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Kitchenware Market Size, Share & Trends Analysis Report by Product Type (Cookware, Bakeware, Kitchen Tools and Gadgets, Food Storage, Tableware and Dinnerware, Kitchen Accessories), Material Type, Distribution Channel, Capacity/Size, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Kitchenware Market Size, Share, and Growth

The global Kitchenware market is experiencing robust growth, with its estimated value of USD 82.1 billion in the year 2025 and USD 131.2 billion by 2035, registering a CAGR of 4.8%, during the forecast period. The global kitchenware market is driven by rising home-cooking trends, increasing disposable incomes, demand for premium and durable cookware, growing health and wellness awareness, and the expansion of e-commerce and direct-to-consumer channels.

Thierry de La Tour d’Artaise, Chairman of Groupe SEB said,

“We couldn’t have a better platform than the Bocuse d’Or, an international showcase for culinary talent, for announcing this magnificent partnership between Tefal and Maison Bocuse. Two iconic brands in French gastronomic culture, bringing indisputable savoir-faire to a remarkable signature collection.”

The global kitchenware market is primarily fueled by the increase in home-cooking culture and consumer spending in high-end kitchen appliances, with the continued post-pandemic preparation of meals at home indicating health, cost, and lifestyle concerns. As an example, in June 2024, Tefal launched its high-performance Revive ceramic cookware and tri-ply stainless-steel range at the Tefal Premiere display, with an emphasis on sophisticated design and high-end functionality to appeal to upscale consumers. The trend is leading to the premiumization of the cookware market, increasing the value growth, and the distance between the innovative and low-cost brands.

Moreover, the continued development of materials science, non-stick, ergonomics, and aesthetics is propelling the kitchenware market on the basis of consumer concerns regarding PFAS-free safety, durability, easy cleanability, and pleasing presentation, alongside broader kitchen upgrades that include cookware, storage, and ventilation systems such as the range hood. For instance, in May 2024 the Foundry of Chef launched its P600 cookware, which is Swiss-engineered ceramic-based with PFAS- and PFOA-free finishes, better durability, is fully induction compatible, and easily maintainable. This is increasing the rate of premiumization and the value enhancement in the global kitchenware industry.

Adjacent opportunities include smart cooking appliances, premium food-storage solutions, eco-friendly tableware, connected meal-prep tools, and sustainable kitchen organization products. These segments have the advantage of increased health awareness, convenience requests, and material innovation coupled with cookware trends. The growth of adjacencies enhances cross category growth and value creation in the wider kitchen environment.

Kitchenware Market Dynamics and Trends

Driver: Premiumization and Quality Investment Trends

Restraint: Market Saturation and Long Replacement Cycles

Opportunity: E-Commerce and Direct-to-Consumer Business Models

Key Trend: Sustainability and Non-Toxic Material Innovation

Kitchenware-Market Analysis and Segmental Data

Tableware and Dinnerware Dominate Global Kitchenware Market

Asia Pacific Leads Global Kitchenware Market Demand

Kitchenware-Market Ecosystem

The global kitchenware market is moderately fragmented, with high concentration among key players such as Groupe SEB, Meyer Corporation, Newell Brands, Williams Sonoma, and Zwilling J.A. Henckels, who dominate through large product range, well-established brand loyalty, global distribution of their products, and long-term investment in innovative, premiumization, and omnichannel retailing approaches that increasingly span cookware, tableware, and adjacent kitchen appliances such as coffee machines.

For instance, in April 2025, Zwilling J.A. Henckels launched an exclusive HENCKELS e-commerce platform, which reinforced its brand position and increased direct contact with value consumers. The initiative improves the digital presence of the brand, aids in higher capture of DTC margins, and competitiveness in the value-based segment of consumers.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 82.1 Bn |

|

Market Forecast Value in 2035 |

USD 131.2 Bn |

|

Growth Rate (CAGR) |

4.8% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Kitchenware-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Kitchenware Market, By Product Type |

|

|

Kitchenware Market, By Material Type |

|

|

Kitchenware Market, By Distribution Channel |

|

|

Kitchenware Market, By Capacity/Size |

|

|

Kitchenware Market, By End-users

|

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation