- The global range hood market is valued at USD 22.4 billion in 2025.

- The market is projected to grow at a CAGR of 6.1% during the forecast period of 2026 to 2035.

- The wall-mounted range hoods segment holds major share ~44% in the global range hood market, due to their stylish design, efficient smoke and odor extraction, easy installation, and growing preference for modern kitchens.

- The range hood market growing due to the consumers increasingly favor low-noise, energy-efficient, and technologically advanced models.

- The range hood market is driven by growing awareness of indoor air quality is increasing demand for range hoods.

- The top five players accounting for over 25% of the global range hood market share in 2025.

- In October 2025, Zephyr, a leader in kitchen innovation, announces the launch of the Amalfi and Como Wall range hoods.

- In February 2025, aFOTILE launched the X-Series Intelligent Range Hood with dual-core motors, AI smoke detection, and smartphone diagnostics, advancing its presence in the smart kitchen segment.

- Global Range Hood market is likely to create the total forecasting opportunity of ~USD 18 Bn till 2035.

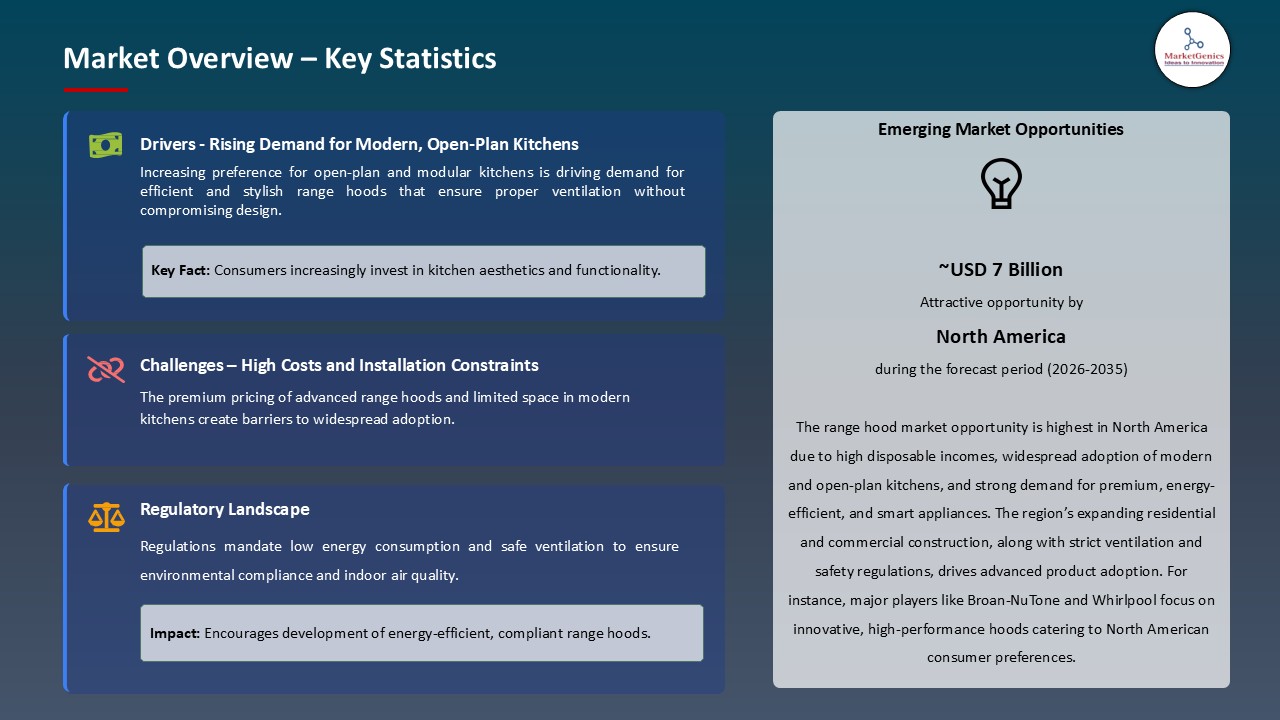

- North America is most attractive region due to high disposable income, modern kitchen trends, strong demand for energy-efficient appliances, and growing awareness of indoor air quality.

- The range hood market is experiencing robust growth rate due to the changes in building codes that have facilitated the establishment of mechanical ventilation of the kitchen and energy efficiency requirements that demand high-performance systems that maximize air exchange and minimize heating and cooling losses.

- For instance, a draft of Mechanical Code of New York State 2024 specifies that residential cooking exhaust systems must have a minimum airflow of 500cfm and be vented outside except in the case of a certified ductless hood with charcoal filtration. The update restricts recirculating hoods and prefers high-performance models, which open the prospects of manufacturers of high-quality products.

- Additionally, the January 2025 ENERGY STAR update introduced efficiency standards, which promoted energy-efficient design and certified products to premium positioning and eligibility of rebates, increased competitive advantage.

- Aligning building regulations, energy efficiency schemes, and green certification requirements sets minimum market standards and allows for higher-quality products with better performance, efficiency, and sustainability.

- The range hood market is constrained by consumer worries about the operational noise that can scare people into using them despite the environmental benefits in the air quality. Although recirculating hoods are appropriate in apartments or other installations that are sensitive in terms of cost, they are less effective than duct systems in the removal of greases and odors, which limits their efficiency in general and their integration with broader kitchenware ecosystems. For instance, a review, recirculating hoods did not achieve removal of 30% PM2.5, and charcoal filter NO 2 had a reduction of 60% to 20% efficiency in 19 days, meaning that it is highly limited in performance.

- Additionally, recirculating range hoods with carbon filters have a small capacity to capture grease and require a regular replacement of filters, which creates recurring expenses. These performance limitations cause them to be less efficient as compared to natural ventilation like opening windows, especially in mild climates where various performance solutions are sufficient to maintain quality air in the houses without necessarily investing in equipment.

- The market is limited to code-based installations or performance-oriented consumers due to continued challenges with balancing ventilation performance and noise, as well as recirculating hood limits.

- The range hood market is experiencing premium segment growth owing to high-end designs which incorporate quiet, powerful ventilation together with luxury finishes and architectural fits that attract high-end, design-oriented customers. As an example, in April 2024, Miele (Germany) has launched new ceiling and wall-mounted extractor hoods with an accent on elegant design and performance, almost flush-mounted installation, increased surfaces of glass, and harmonious integration to suit modern open-plan kitchens.

- Additionally, consumers are moving towards minimalist and compact space-saving kitchen styles, creating an interest in integrated range hoods that have been built into cabinets and downdraft systems that disappear into countertops. The solutions provide smooth aesthetic appearance and maximum use of space, overcoming the weaknesses of the traditional visible hood designs in small or space-conscious designs.

- Manufacturers can capitalize on the premiumization trend by focusing on design-inspired, architecture-based kitchen systems, as well as the willingness of wealthy consumers to spend on luxury cohesiveness, to increase margins.

- The range hood market is experiencing a technological shift towards IoT connectivity, air quality sensors, and smart living room integration through tools such as Alexa and Google Assistant, alongside synchronized smart lighting, to provide greater convenience, real-time monitoring, and data-driven indoor air control to the more classic ventilation functionality. As an example, in 2025, Arspura introduced its P Series with IQV (Inclined Quad-Vortex) Technology with the aim of providing real-time PM2.5 and gas/CO to improve smart ventilation and indoor air control.

- Moreover, the rising customer preference towards convenience and effortless kitchen functioning is also influencing the implementation of voice-controlled and remotely controlled range hoods. These capabilities deal with the issues of the touchpad and dirty hands and leftover cooking smells, improving the compliance of use and providing the opportunity to actively control the state of indoor air, which increases the general user experience. Smart technology can transform range hoods into autonomous air quality control devices that respond to current conditions.

- This improvement enhances indoor environmental quality, allows for product differentiation, provides premium pricing, and opens up new options for recurring revenue through associated services or premium features based on subscription.

- The wall-mounted range hoods segment dominates the global range hood market because of the large use of wall-mounted cooktops and island kitchen layouts makes the wall-mounted range hoods the choice of efficient ventilation, visibility and integration of the modern kitchen decor. As an example, in 2024, Elica released design-led wall-mounted range hoods located in the center of modern kitchens. The new models incorporate sculptural design with high functionality with the hood as a display of the kitchen.

- Additionally, wall-mounted range hoods are better at suction capacity, have superior filtration rates and can be integrated with smart-home technologies, which makes them a solution of choice to consumers interested in high-performance, efficient ventilation in high-end and mid-to-high-end kitchen segments. As an example, in 2024, Robam launched an ultra-thin wall-mounted hood with a 32 cm turbine (40 percent larger than typical models) that has real-time suction control through Lingxi intelligent technology and operates with gestures.

- The global range hood market is growing due to increased demand for design-based and intelligent wall-mounted models. The industry is focusing on high functionality, integrated aesthetics, and intelligent ventilation solutions to enhance kitchen functionality and appeal.

- North America leads the global range hood market, fueled by rising consumer preferences in luxury, energy-efficient, and intelligent range hoods in domestic and remodeling markets in North America is driving the adoption of the advanced range hood market in the residential market and the remodeling market. As an example, in 2025, Zephyr opened its Design and Experience and 5,500 sq. ft. Centre in Alameda, California, to demonstrate the innovations in ventilation and enhance interaction with design professionals and consumers.

- Additionally, the steady growth of spending on home improvement and modern kitchen remodeling projects in the area is another major contributor in the rising speed in the demand of high performance and design-oriented range hoods. As an example, in January 2025, Hauslane announced new kitchen ventilation designs with cabinet- and wall-mounted range hoods with app and gesture controls, high-efficiency filters, and fitted with energy-efficient lighting.

- North America's dominance in the global range hood market is increasing due to high-end kitchen remodeling and technological advancements. Manufacturers are focusing on innovation in engineering, energy efficiency, and intelligent connectivity to meet consumer demands for high-performance, integrated aesthetic ventilation.

- In October 2025, Zephyr declared the introduction of the Amalfi and Como Wall line of the wall hoods. The new models have a sophisticated design, high performance but noisy, and easy to use controls that provide a high and classy cooking experience.

- In February 2025, X-Series Intelligent Range Hood in China and the United States FOTILE launched the X-Series Intelligent Range Hood, which has dual-core motors, AI-enabled smoke sensors and smartphone-based diagnostics. The strategic emphasis of the company on the growth of the smart kitchen appliances segment with the use of advanced IoT integration and improved customer experience is highlighted in this launch.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Best Range Hoods

- Broan-NuTone

- BSH Home Appliances

- Electrolux AB

- Elica S.p.A.

- Faber S.p.A.

- Falmec S.p.A.

- FOTILE

- Haier Group

- LG Electronics

- Midea Group

- Miele

- Panasonic Corporation

- ROBAM Appliances

- Samsung Electronics

- Siemens AG

- Vatti Corporation

- Vent-A-Hood

- Whirlpool Corporation

- Zephyr Ventilation

- ZLINE Kitchen and Bath

- Other Key Players

- Wall-mounted Range Hoods

- Chimney Style

- Flat Canopy Style

- Island Range Hoods

- Ceiling-mounted

- Suspended

- Under-cabinet Range Hoods

- Ducted

- Ductless/Recirculating

- Downdraft Range Hoods

- Built-in/Insert Range Hoods

- Custom/Professional Range Hoods

- Ducted Range Hoods

- External Venting

- In-line Blower Systems

- Ductless Range Hoods

- Charcoal Filter

- Multi-layer Filter

- Convertible Range Hoods

- Smart/Connected Range Hoods

- Wi-Fi Enabled

- App-controlled

- Voice-activated

- Below 400 CFM

- 400-600 CFM

- 600-900 CFM

- Above 900 CFM

- 24 inches

- 30 inches

- 36 inches

- 42 inches

- Above 42 inches

- Residential

- Single-family Homes

- New Construction

- Renovation/Remodeling

- Apartments/Condominiums

- Townhouses

- Luxury Villas/Estates

- Mobile Homes

- Others

- Single-family Homes

- Commercial

- Restaurants

- Quick Service Restaurants

- Fine Dining

- Casual Dining

- Fast Food Chains

- Others

- Hotels & Hospitality

- Hotel Kitchens

- Catering Services

- Others

- Institutional Kitchens

- Schools & Universities

- Hospitals & Healthcare

- Corporate Cafeterias

- Others

- Cloud/Ghost Kitchens

- Food Trucks (Compact Units)

- Catering Services

- Others

- Restaurants

- Industrial

- Food Processing Plants

- Commercial Bakeries

- Central Kitchens

- Manufacturing Facilities

- Others

- DIY Installation

- Professional Installation

- Online

- E-commerce Platforms

- Company Websites

- Online Marketplaces

- Offline

- Home Improvement Stores

- Specialty Kitchen Appliance Stores

- Department Stores

- Direct Sales/Builders

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Range Hood Market Outlook

- 2.1.1. Range Hood Market Size (Volume - Thousand Units and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Range Hood Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for modern, open-plan kitchens with efficient ventilation

- 4.1.1.2. Growth of the commercial and premium residential segments

- 4.1.1.3. Increasing adoption of smart, energy-efficient, and stylish range hoods

- 4.1.2. Restraints

- 4.1.2.1. High cost of premium range hood models

- 4.1.2.2. Availability of alternative ventilation solutions like downdraft systems

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- Component4.4.1. Material Suppliers

- 4.4.2. Range Hood Manufacturers

- 4.4.3. Dealers/ Distributors

- 4.4.4. End-Users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Range Hood Market Demand

- 4.9.1. Historical Market Size – Volume (Thousand Units) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Volume (Thousand Units) and Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Range Hood Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Range Hood Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Wall-mounted Range Hoods

- 6.2.1.1. Chimney Style

- 6.2.1.2. Flat Canopy Style

- 6.2.2. Island Range Hoods

- 6.2.2.1. Ceiling-mounted

- 6.2.2.2. Suspended

- 6.2.3. Under-cabinet Range Hoods

- 6.2.3.1. Ducted

- 6.2.3.2. Ductless/Recirculating

- 6.2.4. Downdraft Range Hoods

- 6.2.5. Built-in/Insert Range Hoods

- 6.2.6. Custom/Professional Range Hoods

- 6.2.1. Wall-mounted Range Hoods

- 7. Global Range Hood Market Analysis, by Technology/Ventilation Type

- 7.1. Key Segment Analysis

- 7.2. Range Hood Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Technology/Ventilation Type, 2021-2035

- 7.2.1. Ducted Range Hoods

- 7.2.1.1. External Venting

- 7.2.1.2. In-line Blower Systems

- 7.2.2. Ductless Range Hoods

- 7.2.2.1. Charcoal Filter

- 7.2.2.2. Multi-layer Filter

- 7.2.3. Convertible Range Hoods

- 7.2.4. Smart/Connected Range Hoods

- 7.2.4.1. Wi-Fi Enabled

- 7.2.4.2. App-controlled

- 7.2.4.3. Voice-activated

- 7.2.1. Ducted Range Hoods

- 8. Global Range Hood Market Analysis, by CFM Rating

- 8.1. Key Segment Analysis

- 8.2. Range Hood Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by CFM Rating, 2021-2035

- 8.2.1. Below 400 CFM

- 8.2.2. 400-600 CFM

- 8.2.3. 600-900 CFM

- 8.2.4. Above 900 CFM

- 9. Global Range Hood Market Analysis, by Size/Width

- 9.1. Key Segment Analysis

- 9.2. Range Hood Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Size/Width, 2021-2035

- 9.2.1. 24 inches

- 9.2.2. 30 inches

- 9.2.3. 36 inches

- 9.2.4. 42 inches

- 9.2.5. Above 42 inches

- 10. Global Range Hood Market Analysis, by End-users

- 10.1. Key Segment Analysis

- 10.2. Range Hood Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 10.2.1. Residential

- 10.2.1.1. Single-family Homes

- 10.2.1.1.1. New Construction

- 10.2.1.1.2. Renovation/Remodeling

- 10.2.1.2. Apartments/Condominiums

- 10.2.1.3. Townhouses

- 10.2.1.4. Luxury Villas/Estates

- 10.2.1.5. Mobile Homes

- 10.2.1.6. Others

- 10.2.1.1. Single-family Homes

- 10.2.2. Commercial

- 10.2.2.1. Restaurants

- 10.2.2.1.1. Quick Service Restaurants

- 10.2.2.1.2. Fine Dining

- 10.2.2.1.3. Casual Dining

- 10.2.2.1.4. Fast Food Chains

- 10.2.2.1.5. Others

- 10.2.2.2. Hotels & Hospitality

- 10.2.2.2.1. Hotel Kitchens

- 10.2.2.2.2. Catering Services

- 10.2.2.2.3. Others

- 10.2.2.3. Institutional Kitchens

- 10.2.2.3.1. Schools & Universities

- 10.2.2.3.2. Hospitals & Healthcare

- 10.2.2.3.3. Corporate Cafeterias

- 10.2.2.3.4. Others

- 10.2.2.4. Cloud/Ghost Kitchens

- 10.2.2.5. Food Trucks (Compact Units)

- 10.2.2.6. Catering Services

- 10.2.2.7. Others

- 10.2.2.1. Restaurants

- 10.2.3. Industrial

- 10.2.3.1. Food Processing Plants

- 10.2.3.2. Commercial Bakeries

- 10.2.3.3. Central Kitchens

- 10.2.3.4. Manufacturing Facilities

- 10.2.3.5. Others

- 10.2.1. Residential

- 11. Global Range Hood Market Analysis, by Installation Type

- 11.1. Key Segment Analysis

- 11.2. Range Hood Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Installation Type, 2021-2035

- 11.2.1. DIY Installation

- 11.2.2. Professional Installation

- 12. Global Range Hood Market Analysis, by Distribution Channel

- 12.1. Key Segment Analysis

- 12.2. Range Hood Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 12.2.1. Online

- 12.2.1.1. E-commerce Platforms

- 12.2.1.2. Company Websites

- 12.2.1.3. Online Marketplaces

- 12.2.2. Offline

- 12.2.3. Home Improvement Stores

- 12.2.3.1. Specialty Kitchen Appliance Stores

- 12.2.3.2. Department Stores

- 12.2.3.3. Direct Sales/Builders

- 12.2.1. Online

- 13. Global Range Hood Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Range Hood Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Range Hood Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Range Hood Market Size Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Technology/Ventilation Type

- 14.3.3. CFM Rating

- 14.3.4. Size/Width

- 14.3.5. End-users

- 14.3.6. Installation Type

- 14.3.7. Distribution Channel

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Range Hood Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Technology/Ventilation Type

- 14.4.4. CFM Rating

- 14.4.5. Size/Width

- 14.4.6. End-users

- 14.4.7. Installation Type

- 14.4.8. Distribution Channel

- 14.5. Canada Range Hood Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Technology/Ventilation Type

- 14.5.4. CFM Rating

- 14.5.5. Size/Width

- 14.5.6. End-users

- 14.5.7. Installation Type

- 14.5.8. Distribution Channel

- 14.6. Mexico Range Hood Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Technology/Ventilation Type

- 14.6.4. CFM Rating

- 14.6.5. Size/Width

- 14.6.6. End-users

- 14.6.7. Installation Type

- 14.6.8. Distribution Channel

- 15. Europe Range Hood Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Range Hood Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Technology/Ventilation Type

- 15.3.3. CFM Rating

- 15.3.4. Size/Width

- 15.3.5. End-users

- 15.3.6. Installation Type

- 15.3.7. Distribution Channel

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Range Hood Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Technology/Ventilation Type

- 15.4.4. CFM Rating

- 15.4.5. Size/Width

- 15.4.6. End-users

- 15.4.7. Installation Type

- 15.4.8. Distribution Channel

- 15.5. United Kingdom Range Hood Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Technology/Ventilation Type

- 15.5.4. CFM Rating

- 15.5.5. Size/Width

- 15.5.6. End-users

- 15.5.7. Installation Type

- 15.5.8. Distribution Channel

- 15.6. France Range Hood Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Technology/Ventilation Type

- 15.6.4. CFM Rating

- 15.6.5. Size/Width

- 15.6.6. End-users

- 15.6.7. Installation Type

- 15.6.8. Distribution Channel

- 15.7. Italy Range Hood Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Technology/Ventilation Type

- 15.7.4. CFM Rating

- 15.7.5. Size/Width

- 15.7.6. End-users

- 15.7.7. Installation Type

- 15.7.8. Distribution Channel

- 15.8. Spain Range Hood Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Technology/Ventilation Type

- 15.8.4. CFM Rating

- 15.8.5. Size/Width

- 15.8.6. End-users

- 15.8.7. Installation Type

- 15.8.8. Distribution Channel

- 15.9. Netherlands Range Hood Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Product Type

- 15.9.3. Technology/Ventilation Type

- 15.9.4. CFM Rating

- 15.9.5. Size/Width

- 15.9.6. End-users

- 15.9.7. Installation Type

- 15.9.8. Distribution Channel

- 15.10. Nordic Countries Range Hood Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Product Type

- 15.10.3. Technology/Ventilation Type

- 15.10.4. CFM Rating

- 15.10.5. Size/Width

- 15.10.6. End-users

- 15.10.7. Installation Type

- 15.10.8. Distribution Channel

- 15.11. Poland Range Hood Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Product Type

- 15.11.3. Technology/Ventilation Type

- 15.11.4. CFM Rating

- 15.11.5. Size/Width

- 15.11.6. End-users

- 15.11.7. Installation Type

- 15.11.8. Distribution Channel

- 15.12. Russia & CIS Range Hood Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Product Type

- 15.12.3. Technology/Ventilation Type

- 15.12.4. CFM Rating

- 15.12.5. Size/Width

- 15.12.6. End-users

- 15.12.7. Installation Type

- 15.12.8. Distribution Channel

- 15.13. Rest of Europe Range Hood Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Product Type

- 15.13.3. Technology/Ventilation Type

- 15.13.4. CFM Rating

- 15.13.5. Size/Width

- 15.13.6. End-users

- 15.13.7. Installation Type

- 15.13.8. Distribution Channel

- 16. Asia Pacific Range Hood Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Asia Pacific Range Hood Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Technology/Ventilation Type

- 16.3.3. CFM Rating

- 16.3.4. Size/Width

- 16.3.5. End-users

- 16.3.6. Installation Type

- 16.3.7. Distribution Channel

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Range Hood Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Technology/Ventilation Type

- 16.4.4. CFM Rating

- 16.4.5. Size/Width

- 16.4.6. End-users

- 16.4.7. Installation Type

- 16.4.8. Distribution Channel

- 16.5. India Range Hood Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Technology/Ventilation Type

- 16.5.4. CFM Rating

- 16.5.5. Size/Width

- 16.5.6. End-users

- 16.5.7. Installation Type

- 16.5.8. Distribution Channel

- 16.6. Japan Range Hood Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Technology/Ventilation Type

- 16.6.4. CFM Rating

- 16.6.5. Size/Width

- 16.6.6. End-users

- 16.6.7. Installation Type

- 16.6.8. Distribution Channel

- 16.7. South Korea Range Hood Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Technology/Ventilation Type

- 16.7.4. CFM Rating

- 16.7.5. Size/Width

- 16.7.6. End-users

- 16.7.7. Installation Type

- 16.7.8. Distribution Channel

- 16.8. Australia and New Zealand Range Hood Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Technology/Ventilation Type

- 16.8.4. CFM Rating

- 16.8.5. Size/Width

- 16.8.6. End-users

- 16.8.7. Installation Type

- 16.8.8. Distribution Channel

- 16.9. Indonesia Range Hood Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Technology/Ventilation Type

- 16.9.4. CFM Rating

- 16.9.5. Size/Width

- 16.9.6. End-users

- 16.9.7. Installation Type

- 16.9.8. Distribution Channel

- 16.10. Malaysia Range Hood Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Technology/Ventilation Type

- 16.10.4. CFM Rating

- 16.10.5. Size/Width

- 16.10.6. End-users

- 16.10.7. Installation Type

- 16.10.8. Distribution Channel

- 16.11. Thailand Range Hood Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Technology/Ventilation Type

- 16.11.4. CFM Rating

- 16.11.5. Size/Width

- 16.11.6. End-users

- 16.11.7. Installation Type

- 16.11.8. Distribution Channel

- 16.12. Vietnam Range Hood Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Technology/Ventilation Type

- 16.12.4. CFM Rating

- 16.12.5. Size/Width

- 16.12.6. End-users

- 16.12.7. Installation Type

- 16.12.8. Distribution Channel

- 16.13. Rest of Asia Pacific Range Hood Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Technology/Ventilation Type

- 16.13.4. CFM Rating

- 16.13.5. Size/Width

- 16.13.6. End-users

- 16.13.7. Installation Type

- 16.13.8. Distribution Channel

- 17. Middle East Range Hood Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Range Hood Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Technology/Ventilation Type

- 17.3.3. CFM Rating

- 17.3.4. Size/Width

- 17.3.5. End-users

- 17.3.6. Installation Type

- 17.3.7. Distribution Channel

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Range Hood Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Technology/Ventilation Type

- 17.4.4. CFM Rating

- 17.4.5. Size/Width

- 17.4.6. End-users

- 17.4.7. Installation Type

- 17.4.8. Distribution Channel

- 17.5. UAE Range Hood Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Technology/Ventilation Type

- 17.5.4. CFM Rating

- 17.5.5. Size/Width

- 17.5.6. End-users

- 17.5.7. Installation Type

- 17.5.8. Distribution Channel

- 17.6. Saudi Arabia Range Hood Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Technology/Ventilation Type

- 17.6.4. CFM Rating

- 17.6.5. Size/Width

- 17.6.6. End-users

- 17.6.7. Installation Type

- 17.6.8. Distribution Channel

- 17.7. Israel Range Hood Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Technology/Ventilation Type

- 17.7.4. CFM Rating

- 17.7.5. Size/Width

- 17.7.6. End-users

- 17.7.7. Installation Type

- 17.7.8. Distribution Channel

- 17.8. Rest of Middle East Range Hood Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Technology/Ventilation Type

- 17.8.4. CFM Rating

- 17.8.5. Size/Width

- 17.8.6. End-users

- 17.8.7. Installation Type

- 17.8.8. Distribution Channel

- 18. Africa Range Hood Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Range Hood Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Technology/Ventilation Type

- 18.3.3. CFM Rating

- 18.3.4. Size/Width

- 18.3.5. End-users

- 18.3.6. Installation Type

- 18.3.7. Distribution Channel

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Range Hood Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Technology/Ventilation Type

- 18.4.4. CFM Rating

- 18.4.5. Size/Width

- 18.4.6. End-users

- 18.4.7. Installation Type

- 18.4.8. Distribution Channel

- 18.5. Egypt Range Hood Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Technology/Ventilation Type

- 18.5.4. CFM Rating

- 18.5.5. Size/Width

- 18.5.6. End-users

- 18.5.7. Installation Type

- 18.5.8. Distribution Channel

- 18.6. Nigeria Range Hood Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Technology/Ventilation Type

- 18.6.4. CFM Rating

- 18.6.5. Size/Width

- 18.6.6. End-users

- 18.6.7. Installation Type

- 18.6.8. Distribution Channel

- 18.7. Algeria Range Hood Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Technology/Ventilation Type

- 18.7.4. CFM Rating

- 18.7.5. Size/Width

- 18.7.6. End-users

- 18.7.7. Installation Type

- 18.7.8. Distribution Channel

- 18.8. Rest of Africa Range Hood Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Technology/Ventilation Type

- 18.8.4. CFM Rating

- 18.8.5. Size/Width

- 18.8.6. End-users

- 18.8.7. Installation Type

- 18.8.8. Distribution Channel

- 19. South America Range Hood Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. South America Range Hood Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Technology/Ventilation Type

- 19.3.3. CFM Rating

- 19.3.4. Size/Width

- 19.3.5. End-users

- 19.3.6. Installation Type

- 19.3.7. Distribution Channel

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Range Hood Market

- 19.4.1. Product Type

- 19.4.2. Technology/Ventilation Type

- 19.4.3. CFM Rating

- 19.4.4. Size/Width

- 19.4.5. End-users

- 19.4.6. Installation Type

- 19.4.7. Distribution Channel

- 19.5. Argentina Range Hood Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Technology/Ventilation Type

- 19.5.4. CFM Rating

- 19.5.5. Size/Width

- 19.5.6. End-users

- 19.5.7. Installation Type

- 19.5.8. Distribution Channel

- 19.6. Rest of South America Range Hood Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Technology/Ventilation Type

- 19.6.4. CFM Rating

- 19.6.5. Size/Width

- 19.6.6. End-users

- 19.6.7. Installation Type

- 19.6.8. Distribution Channel

- 20. Key Players/ Company Profile

- 20.1. Best Range Hoods

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Broan-NuTone

- 20.3. BSH Home Appliances

- 20.4. Electrolux AB

- 20.5. Elica S.p.A.

- 20.6. Faber S.p.A.

- 20.7. Falmec S.p.A.

- 20.8. FOTILE

- 20.9. Haier Group

- 20.10. LG Electronics

- 20.11. Midea Group

- 20.12. Miele

- 20.13. Panasonic Corporation

- 20.14. ROBAM Appliances

- 20.15. Samsung Electronics

- 20.16. Siemens AG

- 20.17. Vatti Corporation

- 20.18. Vent-A-Hood

- 20.19. Whirlpool Corporation

- 20.20. Zephyr Ventilation

- 20.21. ZLINE Kitchen and Bath

- 20.22. Other Key Players

- 20.1. Best Range Hoods

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Range Hood Market Size, Share & Trends Analysis Report by Product Type (Wall-mounted Range Hoods, Island Range Hoods, Under-cabinet Range Hoods, Downdraft Range Hoods, Built-in/Insert Range Hoods, Custom/Professional Range Hoods), Technology/Ventilation Type, CFM Rating, Size/Width, End-users, Installation Type, Distribution Channel, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Range Hood Market Size, Share, and Growth

The global range hood market is experiencing robust growth, with its estimated value of USD 22.4 billion in the year 2025 and USD 40.5 billion by 2035, registering a CAGR of 6.1%, during the forecast period. The demand for the range hood market is driven by rising awareness of indoor air quality, growing popularity of modern and modular kitchens, technological advancements like smart and low-noise models, energy efficiency regulations, and increasing urbanization.

Tong Jingjing, Robam Chief Digital and Marketing Officer, said,

"Robam has conducted nearly 10 years of in-depth research on the North American market, innovating in product design and marketing strategies to meet local consumer demands, developing high-performance products suitable for North American kitchens.”

The global range hood market is driven by increasing the use of open-concept home designs and increased recognition of the health effects of indoor air quality. With the integration of kitchen with living room, proper ventilation is essential to control odors, grease and fumes. For instance, in February 2025, ROBAM announced the “Mega Power” R-Max 3 range hood, which has two suction sources, nano anti grease coating, and automatic integration with a cooktop to improve smoke removal in open kitchens. The innovation highlights the changes in the market to high-performance, designed-based range hoods, which not only focus on air quality but also on the current trends of open-kitchen design.

Additionally, the range hood market is also led by innovations such as variable-speed motors to achieve efficiency and low noise, light-emitting diodes, smart connectivity, and advanced filters that hold ultrafine and health-critical particles. As an example, in 2024, LG Electronics displayed its 2024/25 built-in kitchen products, such as a downdraft hood equipped with ThinQ smart connectivity which integrates state-of-the-art functionality with contemporary outlook. This shows that the market is moving towards smart, efficient, and design-integrated range hoods that can optimize the functionality of the kitchen and indoor air quality.

Adjacent opportunities to the global range hood market include smart kitchen appliances, air purifiers, modular kitchen systems, home ventilation solutions, and energy-efficient lighting. These sectors complement range hood adoption by enhancing kitchen functionality, air quality, and aesthetics. The growth of the market will create globally integrated, health driven and technology-based innovations in the kitchen.

Range Hood Market Dynamics and Trends

Driver: Building Codes and Energy Efficiency Standards

Restraint: Noise Concerns and Recirculating Hood Limitations

Opportunity: Premium Segment and Designer Integration

Key Trend: Smart Connectivity and Air Quality Integration

Range-Hood-Market Analysis and Segmental Data

Wall-mounted Range Hoods Dominate Global Range Hood Market

North America Leads Global Range Hood Market Demand

Range-Hood-Market Ecosystem

The global range hood market is moderately fragmented, with high concentration among key players such as Broan-NuTone, BSH Home Appliances, Electrolux AB, Elica S.p.A., and Faber S.p.A., who dominate through their large product lines, well-developed distribution channels, continuous introduction of intelligent and energy-saving technologies, and in a way of partnerships to enhance their position in the global market.

For instance, in 2024, BSH Home Appliances added to its Bosch Series smart home products with smart hoods with AI-enabled air quality sensors and Home Connect to increase energy efficiency and user control. These technology-based innovations and strategic efforts are strengthening competitive distinction among the major players, speeding up the innovation cycle and defining the market of the global range hood towards intelligent, energy efficient and design-focused ventilating solutions.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 22.4 Bn |

|

Market Forecast Value in 2035 |

USD 40.5 Bn |

|

Growth Rate (CAGR) |

6.1% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Thousand Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Range-Hood-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Range Hood Market, By Product Type |

|

|

Range Hood Market, By Technology/Ventilation Type |

|

|

Range Hood Market, By CFM Rating |

|

|

Range Hood Market, By Size/Width |

|

|

Range Hood Market, By End-users

|

|

|

Range Hood Market, By Installation Type

|

|

|

Range Hood Market, By Distribution Channel

|

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation