Coffee Machines Market Size, Share & Trends Analysis Report by Product Type (Drip Coffee Makers, Espresso Machines, Single-Serve/Pod Coffee Makers, French Press, Percolators, Cold Brew Coffee Makers, Bean-to-Cup Coffee Makers, Turkish Coffee Makers, Siphon Coffee Makers, Moka Pots, Others), Technology, Capacity, Distribution Channel, Price Range, Features, Power Source, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Coffee Machines Market Size, Share, and Growth

The global coffee machines market is experiencing robust growth, with its estimated value of USD 12.7 billion in the year 2025 and USD 19.7 billion by 2035, registering a CAGR of 4.5%, during the forecast period. The coffee machines market is boosted due to a growing global coffee culture, rising disposable incomes, and evolving, fast-paced lifestyles that prioritize convenience.

Eliza Woolston Sheffield, President of De'Longhi North America said,

“At De'Longhi, we're constantly evolving to meet the modern coffee lover's ever-changing taste and rituals, whether that means brewing the perfect cold brew or crafting a latte in seconds, as an iconic Italian brand from the birthplace of espresso, we bring decades of expertise to every machine we craft. The La Specialista Touch and the Dedica Duo embody our commitment to fusing tradition with technology in ways that make coffee more creative, accessible, and personal.”

The increasing consumer preference to high-end at-home coffee experiences is driving the growth of the global coffee machines market, with manufacturers competing to innovate in the high-performance espresso machines and intelligent, connected brewing systems that can recreate café-like beverages and provide more convenience through personalized, technology-driven brewing solutions. As an example, Versuni declared its new Philips Baristina espresso machine in July 2024, which is meant to make premium cafe-like espresso at home with one swipe, expected to streamline the process of high-quality home brewing.

Moreover, the need in coffee machines across the world is supported by increasing popularity of specialty coffee and artisanal brewing trends which positively influences consumers to invest in high-performance coffee machines that can produce barista-like outcomes. An example is a new premium GRAEF Estessa espresso machine introduced by GRAEF GmbH, in January 2024 (the flagship model of that brand), the so-called Estessa, using high-end materials and large customization possibilities, to make the home specialty-coffee experience even better. This tendency is fueling the market development through innovation in high-end, customizable espresso machines, which provide barista-level functionality, increasing consumer demand in high end home brewing solutions and broadening the specialty coffee market around the world.

The major market potential of global coffee machine market is grinders, milk frothers and descaling solutions which are used as complementary revenue sources, alongside adjacent household categories such as kitchenware. With Smart home integration platforms, cross-selling is possible with IoT devices. Subscriptions of coffee beans are specialty coffee subscriptions that generate recurrent revenue. Filtration systems remove impurities in water. Maintenance packages and customer service training of professional baristas are additions that increase the customer lifetime value by offering services to the customers.

Coffee Machines Market Dynamics and Trends

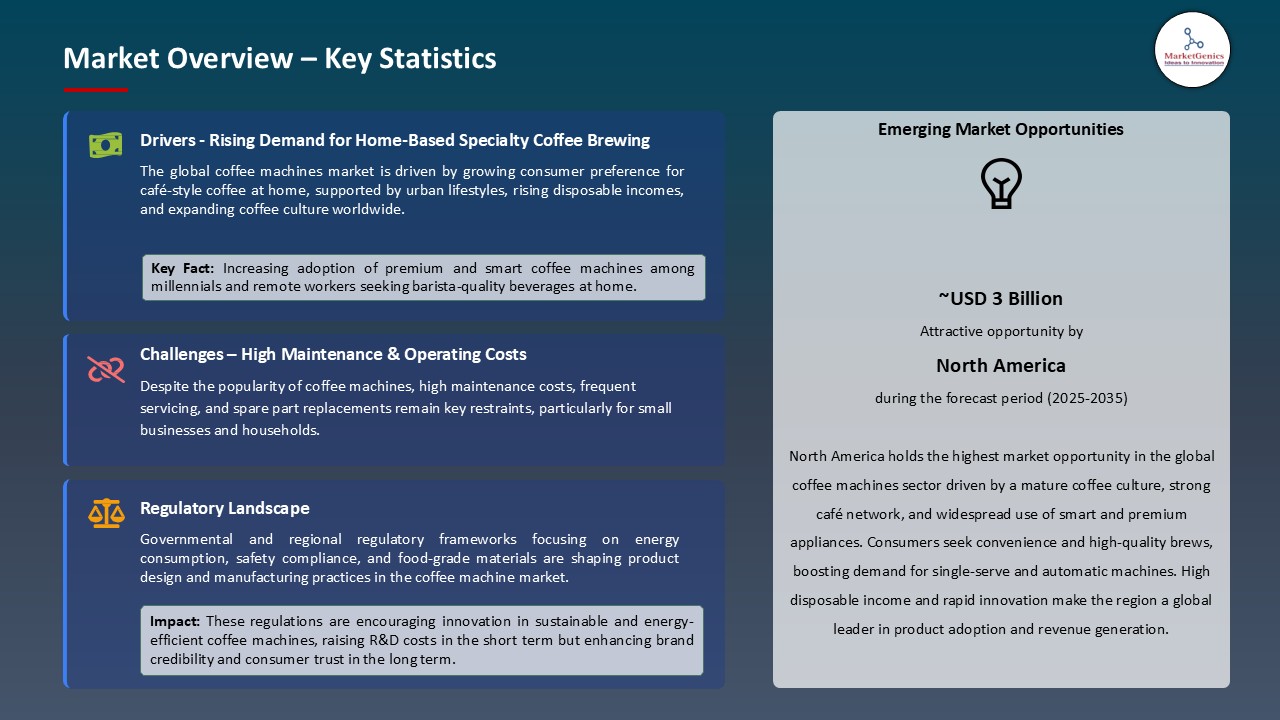

Driver: Accelerating Consumer Shift Toward Premiumization and Artisanal Coffee Culture at Home

- The growing coffee machines market is fueled by the modern customer demands of having cafe-quality drinks in their homes and the adoption of advanced coffee machines. This tendency toward premiumization can be regarded as the indicator of the increased readiness to spend money on the more sophisticated brewing devices providing higher customization, accuracy, and user experience. As an example, in October 2024, the Breville Group released the Oracle Jet, which contains automated micro foam milk texturing and perfect temperature control with the help of dual boiler systems aimed at those who want the results of a barista.

- Furthermore, a coffee machine market will also be influenced by increasing the popularity of the high-end home coffee market due to remote and hybrid work trends becoming the new norm and the living areas turning into individual coffee shops. This change is increasing the need to have high end coffee machines that provide convenience, cafe-style drinks and professional brewing at home. As an example, in January 2025, Meticulous demonstrated a smart espresso machine at CES 2025 with robotic lever mechanics and sensors that produces high precision at home another signifier of the home segment maturing.

- Such trends are fueling market growth through the need to have innovative high-performance coffee machines, that integrate technology, convenience and cafe quality brewing, as they strengthen the premiumization trend and enhance revenue growth in the global coffee machine market.

Restraint: Substantial Initial Investment Costs and Maintenance Requirements Limiting Market Penetration

- The high quality coffee machines present some of the biggest affordability constraints on price conscious consumer groups and more so in the developing economies where high upfront cost and poor purchasing power curtails market penetration and adoption. As an example, the premium fully automatic espresso machines which include built in grinders and smart connectivity capabilities cost in the range of US 1,200-2,500 which is not affordable to many middle income earners in developing markets. This price difference hinders its use in areas like India, Indonesia, and Brazil where many consumers will choose the cheaper semi-automatic or capsule-based versions and have an average level of functionality.

- Also, the complexity and expensive part replacement costs of up to 30-40 percent of the initial purchase price increase the ownership costs, especially in the areas with low disposable incomes and high instant coffee preferences, which prevents ownership by younger, price-sensitive consumers. As an example, in 2024, JURA has defined the pricing tiers of authorized maintenance to service, with prices varying between US145 and US695 per service session, depending on machine type and level of service complexity based on the premium nature and technical complexity of the product lines.

Opportunity: Strategic Expansion Through Sustainable Manufacturing and Circular Economy Business Models

- Coffee machines market is presenting an enormous potential in the international market due to the environmental awareness that is giving manufacturers room to create eco certified products and recycling programs. The pressure of regulations and customer demand of sustainable products is a driving factor behind energy efficient designs and recyclable materials. An example is De'Longhi, in October 2024, released Rivelia machine as the first home coffee machine to be neutral in CO2 emissions, built on the principles of EcoDesign and being certified under PAS 2060.

- Also, circular economy programs like trade-in programs, product refurbishment, and capsule recycling programs are expanding the markets by generating new sources of revenue, lowering environmental harm, as well as enhancing brand equity, and sustainable value-generating. As an example, Nespresso broadened its recycling program of aluminium-capsules in the U.S. in April 2024, seeking to reach 50% recovery of the global footprint by 2025 and to make curbside recycling possible in residential households.

- These sustainability-based innovations are transforming the competitive environment in the coffee machines market to create a long-term value by minimizing carbon footprints, more consumer confidence and satisfaction with the global environmental objectives, which are increasingly solidifying brand differentiation and accelerating green development within the appliance industry.

Key Trend: Integration of Artificial Intelligence and IoT Connectivity Transforming User Experience

- The introduction of intelligent technologies is transforming the functionality of coffee machines, and AI-based systems are allowing users to have a tailored brewing experience and predictive maintenance. The manufacturers provide a smoother user experience, extended product life, and overall premiumization of the coffee experience by using the data analytics to adjust the extraction parameters and track the usage patterns. As an example, in January 2024, Bosch unveiled its new 800 Series fully automatic espresso machines at the CES show, with smart home connectivity (Home Connect) and advanced monitoring to achieve the same results.

- Moreover, the introduction of the IoT connectivity is becoming one of the most important tendencies in the market, as it allows to remotely operate the machines, provide them with maintenance notifications in real-time, and update the firmware automatically, aligning coffee machines with broader smart home ecosystems such as smart lighting. The development adds to the convenience of users, increased performance efficiency, and the increase of equipment durability, strengthening the digitalization of the coffee machine market. An example to see is in September 2025, ADLINK partnered with MediaTek (Genio 510 platform) to Revolutionizing Smart Coffee Machines, in which smart coffee machines are described to have real-time personalization and predictive maintenance features.

- Such technological innovations are contributing to hasten the process of digitalization in the coffee machine market, leading to a greater involvement of consumers, better operational efficiency, and continued product differentiation using smart and data-driven innovation.

Coffee Machines Market Analysis and Segmental Data

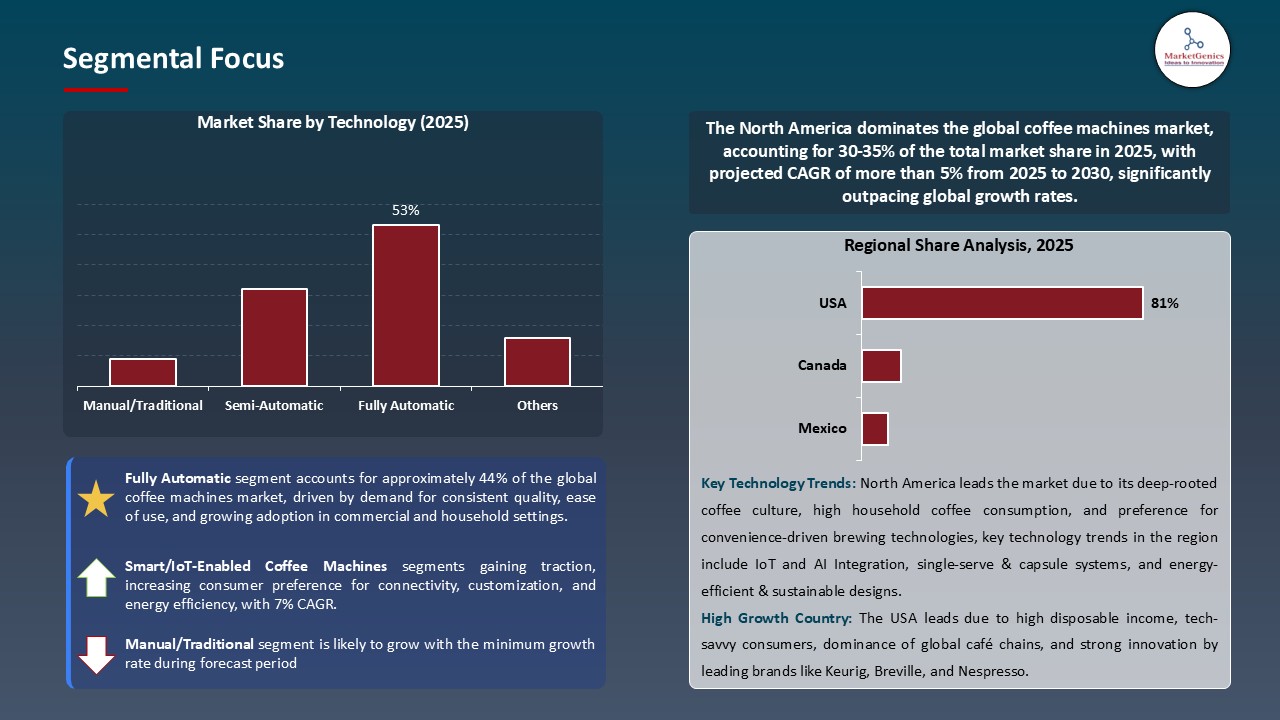

Fully Automatic Dominate Global Coffee Machines Market

- Fully automatic segment dominates the coffee machines market, since fully automatic machines are more convenient as they produce barista level of beverages with minimum effort. Automated milk systems, integrated grinders and programmable settings make the brewing process smooth and consistent so that everyone can do it and it is also efficient to operate. As an example, Sage has in 2025 launched the "Oracle Dual Boiler" which is a high-end fully automatic unit that combines the dual-boiler technology with automated grinding and tamping mechanisms. The model is made to appeal to advanced users at home who have the ability to produce cafe quality drinks with high precision and little human involvement.

- Also, the market is experiencing high growth due to technological advancement that allows charging high prices and offering high user experiences due to user-friendly interfaces and automatic maintenance. Fully automatic systems maximize the consumer attraction as it simplifies the machine and provides the comfort of a cafe.

- The increasing popularity of the specialty coffee making has yet again been a boost to the demand of the advanced and easy-to-use brewing solutions.

North America Leads Global Coffee Machines Market Demand

- The North America region dominates the coffee machine market as it has a strong coffee culture with high disposable income levels that enable the use of premium and fully automatic coffee machines to be wide spread. The high level of retail infrastructure of the region and the preference of people towards convenience-oriented and high-performance appliances also support the market control. As an example, Cumulus Coffee has officially unveiled its launch in flagship Williams Sonoma stores in November 2024. This master franchise agreement is a great move toward the Cumulus Coffee mission of enhancing the cold coffee experience of consumers in the country.

- Besides, it has strong distribution channels, and well-developed retailing networks that improve access to products in the region market. At the same time, increased uptake of the same in the business industry especially in the hospitality, corporate office, and quick service restaurant segments are a huge boost to the overall market demand and revenue growth capabilities.

- All these developments, therefore, reinforce a regional market penetration, which contributes to a sustained growth of revenue based on premiumization, diversified retail presence, and an increase in commercial adoption in hospitality and corporate segments.

Coffee-Machines-Market Ecosystem

The global coffee machines market is moderately consolidated, with high concentration among key players such as Nestlé Nespresso S.A., Keurig Dr Pepper Inc., De'Longhi S.p.A., Philips Electronics N.V., and Breville Group Limited, who dominate through who dominate through extensive product portfolios, technological innovation, strong brand equity, and well-established global distribution networks.

The companies in the coffee machines market sustain their competitive leadership through continuous investment in research and development, integration of sustainable and energy-efficient materials, and expansion of digital and omnichannel retail platforms. Their global presence and market differentiation are further reinforced by strategic collaborations, premium product launches, and rapid innovation cycles that strengthen their position across both residential and commercial coffee segments.

Recent Development and Strategic Overview:

- In August 2025, Breville launched the Oracle Dual Boiler, the latest evolution in its premium espresso machine. Designed to deliver ultimate automation and unparalleled performance, this machine caters to coffee enthusiasts who seek the perfect balance between convenience and control. Offering the ability to switch between auto and manual modes, users can enjoy either a fully automated workflow or hands-on espresso crafting.

- In June 2025, De'Longhi introduced two new additions to its celebrated lineup of espresso machines in the North American market, the La Specialista Touch and the Dedica Duo. Designed to deliver barista-quality results at home, these machines blend intuitive technology with De'Longhi's signature Italian design meeting every coffee preference, style, and skill level.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 12.7 Bn |

|

Market Forecast Value in 2035 |

USD 19.7 Bn |

|

Growth Rate (CAGR) |

4.5% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Thousand Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Coffee-Machines-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Coffee Machines Market, By Product Type |

|

|

Coffee Machines Market, By Technology |

|

|

Coffee Machines Market, By Capacity |

|

|

Coffee Machines Market, By Distribution Channel |

|

|

Coffee Machines Market, By Price Range

|

|

|

Coffee Machines Market, By Features

|

|

|

Coffee Machines Market, By Power Source |

|

|

Coffee Machines Market, By End-users |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Coffee Machines Market Outlook

- 2.1.1. Coffee Machines Market Size (Volume - Thousand Units and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Coffee Machines Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Coffee Machines Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Coffee Machines Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising coffee consumption and café culture worldwide

- 4.1.1.2. Growing adoption of smart and automatic coffee machines in homes and offices

- 4.1.1.3. Expansion of premium coffee brands and specialty beverage trends

- 4.1.2. Restraints

- 4.1.2.1. High initial and maintenance costs of advanced coffee machines

- 4.1.2.2. Environmental concerns related to single-use coffee pods and capsules

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Coffee Machines Manufacturers

- 4.4.3. Distributors/ Suppliers

- 4.4.4. End-users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Coffee Machines Market Demand

- 4.7.1. Historical Market Size - (Volume - Thousand Units and Value - US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - (Volume - Thousand Units and Value - US$ Bn), 2025–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Coffee Machines Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Coffee Machines Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Drip Coffee Makers

- 6.2.2. Espresso Machines

- 6.2.3. Single-Serve/Pod Coffee Makers

- 6.2.4. French Press

- 6.2.5. Percolators

- 6.2.6. Cold Brew Coffee Makers

- 6.2.7. Bean-to-Cup Coffee Makers

- 6.2.8. Turkish Coffee Makers

- 6.2.9. Siphon Coffee Makers

- 6.2.10. Moka Pots

- 6.2.11. Others

- 7. Global Coffee Machines Market Analysis, by Technology

- 7.1. Key Segment Analysis

- 7.2. Coffee Machines Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Technology, 2021-2035

- 7.2.1. Manual/Traditional

- 7.2.2. Semi-Automatic

- 7.2.3. Fully Automatic

- 7.2.4. Smart/IoT-Enabled Coffee Machines

- 7.2.4.1. App-Controlled

- 7.2.4.2. Voice-Activated

- 7.2.4.3. Others

- 7.2.5. Pressure-Based Systems

- 7.2.6. Gravity-Based Systems

- 8. Global Coffee Machines Market Analysis and Forecasts, by Capacity

- 8.1. Key Findings

- 8.2. Coffee Machines Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Capacity, 2021-2035

- 8.2.1. Single Serve

- 8.2.2. Medium Capacity

- 8.2.3. Large Capacity

- 8.2.4. Commercial High-Volume

- 9. Global Coffee Machines Market Analysis and Forecasts, by Distribution Channel

- 9.1. Key Findings

- 9.2. Coffee Machines Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 9.2.1. Online Retail

- 9.2.1.1. E-commerce Platforms

- 9.2.1.2. Company Websites

- 9.2.1.3. Online Marketplaces

- 9.2.2. Offline Retail

- 9.2.2.1. Specialty Stores

- 9.2.2.2. Supermarkets/Hypermarkets

- 9.2.2.3. Department Stores

- 9.2.2.4. Electronics Stores

- 9.2.2.5. Home Appliance Stores

- 9.2.3. Direct Sales

- 9.2.4. Distributors/Wholesalers

- 9.2.1. Online Retail

- 10. Global Coffee Machines Market Analysis and Forecasts, by Price Range

- 10.1. Key Findings

- 10.2. Coffee Machines Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Price Range, 2021-2035

- 10.2.1. Economy/Budget

- 10.2.2. Premium

- 10.2.3. Luxury

- 10.2.4. Ultra-Premium

- 11. Global Coffee Machines Market Analysis and Forecasts, by Features

- 11.1. Key Findings

- 11.2. Coffee Machines Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Features, 2021-2035

- 11.2.1. Built-in Grinder

- 11.2.1.1. Blade Grinder

- 11.2.1.2. Burr Grinder

- 11.2.2. Milk Frother/Steamer

- 11.2.3. Water Filtration System

- 11.2.4. Self-Cleaning Function

- 11.2.5. Multiple Brewing Strength Options

- 11.2.6. Others

- 11.2.1. Built-in Grinder

- 12. Global Coffee Machines Market Analysis and Forecasts, by Power Source

- 12.1. Key Findings

- 12.2. Coffee Machines Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Power Source, 2021-2035

- 12.2.1. Electric

- 12.2.2. Manual

- 12.2.3. Battery-Operated

- 13. Global Coffee Machines Market Analysis and Forecasts, by End-Users

- 13.1. Key Findings

- 13.2. Coffee Machines Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by End-Users, 2021-2035

- 13.2.1. Residential/Household

- 13.2.1.1. Daily Home Brewing

- 13.2.1.2. Entertainment/Guest Service

- 13.2.1.3. Home Office Use

- 13.2.1.4. Kitchen Décor/Lifestyle

- 13.2.1.5. Others

- 13.2.2. Commercial - Food Service

- 13.2.2.1. Restaurants

- 13.2.2.2. Quick Service Restaurants (QSR)

- 13.2.2.3. Full-Service Restaurants

- 13.2.2.4. Fine Dining

- 13.2.3. Others

- 13.2.3.1. Cafés and Coffee Shops

- 13.2.3.2. Independent Coffee Shops

- 13.2.3.3. Chain Coffee Shops

- 13.2.3.4. Specialty Coffee Bars

- 13.2.3.5. Others

- 13.2.3.6. Bakeries

- 13.2.3.7. Food Trucks/Mobile Food Service

- 13.2.4. Commercial - Hospitality

- 13.2.4.1. Hotels

- 13.2.4.2. In-Room Coffee Service

- 13.2.4.3. Hotel Lobbies

- 13.2.4.4. Conference Rooms

- 13.2.4.5. Others

- 13.2.4.6. Resorts

- 13.2.4.7. Bed & Breakfast Establishments

- 13.2.4.8. Guest Houses

- 13.2.5. Commercial - Corporate/Office

- 13.2.5.1. Corporate Offices

- 13.2.5.2. Break Rooms

- 13.2.5.3. Executive Lounges

- 13.2.5.4. Meeting Rooms

- 13.2.5.5. Others

- 13.2.5.6. Co-working Spaces

- 13.2.5.7. Business Centers

- 13.2.6. Institutional

- 13.2.6.1. Healthcare Facilities

- 13.2.6.2. Hospitals (Staff Areas)

- 13.2.6.3. Clinics

- 13.2.6.4. Nursing Homes

- 13.2.6.5. Others

- 13.2.6.6. Educational Institutions

- 13.2.7. Universities

- 13.2.7.1. Schools

- 13.2.7.2. Training Centers

- 13.2.7.3. Others

- 13.2.7.4. Government Buildings

- 13.2.7.5. Military Facilities

- 13.2.8. Retail

- 13.2.8.1. Convenience Stores

- 13.2.8.2. Gas Stations

- 13.2.8.3. Supermarkets (In-Store Cafés)

- 13.2.8.4. Shopping Malls (Food Courts)

- 13.2.8.5. Others

- 13.2.9. Transportation & Travel

- 13.2.9.1. Airports

- 13.2.9.2. Railway Stations

- 13.2.9.3. Bus Terminals

- 13.2.9.4. Airlines (Galley Service)

- 13.2.9.5. Cruise Ships

- 13.2.9.6. Others

- 13.2.10. Recreational

- 13.2.11. Other End-users

- 13.2.1. Residential/Household

- 14. Global Coffee Machines Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Coffee Machines Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Coffee Machines Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Coffee Machines Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Technology

- 15.3.3. Capacity

- 15.3.4. Distribution Channel

- 15.3.5. Price Range

- 15.3.6. Features

- 15.3.7. Power Source

- 15.3.8. End-users

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Coffee Machines Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Technology

- 15.4.4. Capacity

- 15.4.5. Distribution Channel

- 15.4.6. Price Range

- 15.4.7. Features

- 15.4.8. Power Source

- 15.4.9. End-users

- 15.5. Canada Coffee Machines Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Technology

- 15.5.4. Capacity

- 15.5.5. Distribution Channel

- 15.5.6. Price Range

- 15.5.7. Features

- 15.5.8. Power Source

- 15.5.9. End-users

- 15.6. Mexico Coffee Machines Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Technology

- 15.6.4. Capacity

- 15.6.5. Distribution Channel

- 15.6.6. Price Range

- 15.6.7. Features

- 15.6.8. Power Source

- 15.6.9. End-users

- 16. Europe Coffee Machines Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Coffee Machines Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Technology

- 16.3.3. Capacity

- 16.3.4. Distribution Channel

- 16.3.5. Price Range

- 16.3.6. Features

- 16.3.7. Power Source

- 16.3.8. End-users

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Coffee Machines Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Technology

- 16.4.4. Capacity

- 16.4.5. Distribution Channel

- 16.4.6. Price Range

- 16.4.7. Features

- 16.4.8. Power Source

- 16.4.9. End-users

- 16.5. United Kingdom Coffee Machines Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Technology

- 16.5.4. Capacity

- 16.5.5. Distribution Channel

- 16.5.6. Price Range

- 16.5.7. Features

- 16.5.8. Power Source

- 16.5.9. End-users

- 16.6. France Coffee Machines Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Technology

- 16.6.4. Capacity

- 16.6.5. Distribution Channel

- 16.6.6. Price Range

- 16.6.7. Features

- 16.6.8. Power Source

- 16.6.9. End-users

- 16.7. Italy Coffee Machines Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Technology

- 16.7.4. Capacity

- 16.7.5. Distribution Channel

- 16.7.6. Price Range

- 16.7.7. Features

- 16.7.8. Power Source

- 16.7.9. End-users

- 16.8. Spain Coffee Machines Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Technology

- 16.8.4. Capacity

- 16.8.5. Distribution Channel

- 16.8.6. Price Range

- 16.8.7. Features

- 16.8.8. Power Source

- 16.8.9. End-users

- 16.9. Netherlands Coffee Machines Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Technology

- 16.9.4. Capacity

- 16.9.5. Distribution Channel

- 16.9.6. Price Range

- 16.9.7. Features

- 16.9.8. Power Source

- 16.9.9. End-users

- 16.10. Nordic Countries Coffee Machines Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Technology

- 16.10.4. Capacity

- 16.10.5. Distribution Channel

- 16.10.6. Price Range

- 16.10.7. Features

- 16.10.8. Power Source

- 16.10.9. End-users

- 16.11. Poland Coffee Machines Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Technology

- 16.11.4. Capacity

- 16.11.5. Distribution Channel

- 16.11.6. Price Range

- 16.11.7. Features

- 16.11.8. Power Source

- 16.11.9. End-users

- 16.12. Russia & CIS Coffee Machines Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Technology

- 16.12.4. Capacity

- 16.12.5. Distribution Channel

- 16.12.6. Price Range

- 16.12.7. Features

- 16.12.8. Power Source

- 16.12.9. End-users

- 16.13. Rest of Europe Coffee Machines Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Technology

- 16.13.4. Capacity

- 16.13.5. Distribution Channel

- 16.13.6. Price Range

- 16.13.7. Features

- 16.13.8. Power Source

- 16.13.9. End-users

- 17. Asia Pacific Coffee Machines Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. East Asia Coffee Machines Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Technology

- 17.3.3. Capacity

- 17.3.4. Distribution Channel

- 17.3.5. Price Range

- 17.3.6. Features

- 17.3.7. Power Source

- 17.3.8. End-users

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Coffee Machines Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Technology

- 17.4.4. Capacity

- 17.4.5. Distribution Channel

- 17.4.6. Price Range

- 17.4.7. Features

- 17.4.8. Power Source

- 17.4.9. End-users

- 17.5. India Coffee Machines Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Technology

- 17.5.4. Capacity

- 17.5.5. Distribution Channel

- 17.5.6. Price Range

- 17.5.7. Features

- 17.5.8. Power Source

- 17.5.9. End-users

- 17.6. Japan Coffee Machines Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Technology

- 17.6.4. Capacity

- 17.6.5. Distribution Channel

- 17.6.6. Price Range

- 17.6.7. Features

- 17.6.8. Power Source

- 17.6.9. End-users

- 17.7. South Korea Coffee Machines Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Technology

- 17.7.4. Capacity

- 17.7.5. Distribution Channel

- 17.7.6. Price Range

- 17.7.7. Features

- 17.7.8. Power Source

- 17.7.9. End-users

- 17.8. Australia and New Zealand Coffee Machines Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Technology

- 17.8.4. Capacity

- 17.8.5. Distribution Channel

- 17.8.6. Price Range

- 17.8.7. Features

- 17.8.8. Power Source

- 17.8.9. End-users

- 17.9. Indonesia Coffee Machines Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Product Type

- 17.9.3. Technology

- 17.9.4. Capacity

- 17.9.5. Distribution Channel

- 17.9.6. Price Range

- 17.9.7. Features

- 17.9.8. Power Source

- 17.9.9. End-users

- 17.10. Malaysia Coffee Machines Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Product Type

- 17.10.3. Technology

- 17.10.4. Capacity

- 17.10.5. Distribution Channel

- 17.10.6. Price Range

- 17.10.7. Features

- 17.10.8. Power Source

- 17.10.9. End-users

- 17.11. Thailand Coffee Machines Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Product Type

- 17.11.3. Technology

- 17.11.4. Capacity

- 17.11.5. Distribution Channel

- 17.11.6. Price Range

- 17.11.7. Features

- 17.11.8. Power Source

- 17.11.9. End-users

- 17.12. Vietnam Coffee Machines Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Product Type

- 17.12.3. Technology

- 17.12.4. Capacity

- 17.12.5. Distribution Channel

- 17.12.6. Price Range

- 17.12.7. Features

- 17.12.8. Power Source

- 17.12.9. End-users

- 17.13. Rest of Asia Pacific Coffee Machines Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Product Type

- 17.13.3. Technology

- 17.13.4. Capacity

- 17.13.5. Distribution Channel

- 17.13.6. Price Range

- 17.13.7. Features

- 17.13.8. Power Source

- 17.13.9. End-users

- 18. Middle East Coffee Machines Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Coffee Machines Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Technology

- 18.3.3. Capacity

- 18.3.4. Distribution Channel

- 18.3.5. Price Range

- 18.3.6. Features

- 18.3.7. Power Source

- 18.3.8. End-users

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Coffee Machines Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Technology

- 18.4.4. Capacity

- 18.4.5. Distribution Channel

- 18.4.6. Price Range

- 18.4.7. Features

- 18.4.8. Power Source

- 18.4.9. End-users

- 18.5. UAE Coffee Machines Market

- 18.5.1. Product Type

- 18.5.2. Technology

- 18.5.3. Capacity

- 18.5.4. Distribution Channel

- 18.5.5. Price Range

- 18.5.6. Features

- 18.5.7. Power Source

- 18.5.8. End-users

- 18.6. Saudi Arabia Coffee Machines Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Technology

- 18.6.4. Capacity

- 18.6.5. Distribution Channel

- 18.6.6. Price Range

- 18.6.7. Features

- 18.6.8. Power Source

- 18.6.9. End-users

- 18.7. Israel Coffee Machines Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Technology

- 18.7.4. Capacity

- 18.7.5. Distribution Channel

- 18.7.6. Price Range

- 18.7.7. Features

- 18.7.8. Power Source

- 18.7.9. End-users

- 18.8. Rest of Middle East Coffee Machines Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Technology

- 18.8.4. Capacity

- 18.8.5. Distribution Channel

- 18.8.6. Price Range

- 18.8.7. Features

- 18.8.8. Power Source

- 18.8.9. End-users

- 19. Africa Coffee Machines Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Coffee Machines Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Technology

- 19.3.3. Capacity

- 19.3.4. Distribution Channel

- 19.3.5. Price Range

- 19.3.6. Features

- 19.3.7. Power Source

- 19.3.8. End-users

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Coffee Machines Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Technology

- 19.4.4. Capacity

- 19.4.5. Distribution Channel

- 19.4.6. Price Range

- 19.4.7. Features

- 19.4.8. Power Source

- 19.4.9. End-users

- 19.5. Egypt Coffee Machines Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Technology

- 19.5.4. Capacity

- 19.5.5. Distribution Channel

- 19.5.6. Price Range

- 19.5.7. Features

- 19.5.8. Power Source

- 19.5.9. End-users

- 19.6. Nigeria Coffee Machines Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Technology

- 19.6.4. Capacity

- 19.6.5. Distribution Channel

- 19.6.6. Price Range

- 19.6.7. Features

- 19.6.8. Power Source

- 19.6.9. End-users

- 19.7. Algeria Coffee Machines Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Technology

- 19.7.4. Capacity

- 19.7.5. Distribution Channel

- 19.7.6. Price Range

- 19.7.7. Features

- 19.7.8. Power Source

- 19.7.9. End-users

- 19.8. Rest of Africa Coffee Machines Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Technology

- 19.8.4. Capacity

- 19.8.5. Distribution Channel

- 19.8.6. Price Range

- 19.8.7. Features

- 19.8.8. Power Source

- 19.8.9. End-users

- 20. South America Coffee Machines Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Central and South Africa Coffee Machines Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Technology

- 20.3.3. Capacity

- 20.3.4. Distribution Channel

- 20.3.5. Price Range

- 20.3.6. Features

- 20.3.7. Power Source

- 20.3.8. End-users

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Coffee Machines Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Technology

- 20.4.4. Capacity

- 20.4.5. Distribution Channel

- 20.4.6. Price Range

- 20.4.7. Features

- 20.4.8. Power Source

- 20.4.9. End-users

- 20.5. Argentina Coffee Machines Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Technology

- 20.5.4. Capacity

- 20.5.5. Distribution Channel

- 20.5.6. Price Range

- 20.5.7. Features

- 20.5.8. Power Source

- 20.5.9. End-users

- 20.6. Rest of South America Coffee Machines Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Technology

- 20.6.4. Capacity

- 20.6.5. Distribution Channel

- 20.6.6. Price Range

- 20.6.7. Features

- 20.6.8. Power Source

- 20.6.9. End-users

- 21. Key Players/ Company Profile

- 21.1. Breville Group Limited

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. BSH Hausgeräte GmbH

- 21.3. De'Longhi S.p.A.

- 21.4. Electrolux AB

- 21.5. Franke Group

- 21.6. Gaggia S.p.A.

- 21.7. Groupe SEB

- 21.8. Hamilton Beach Brands Inc.

- 21.9. Jura Elektroapparate AG

- 21.10. Keurig Dr Pepper Inc.

- 21.11. La Marzocco S.r.l.

- 21.12. Melitta Group

- 21.13. Morphy Richards

- 21.14. Mr. Coffee

- 21.15. Nestlé Nespresso S.A.

- 21.16. Nuova Simonelli S.p.A.

- 21.17. Panasonic Corporation

- 21.18. Philips Electronics N.V.

- 21.19. Schaerer AG

- 21.20. Smeg S.p.A.

- 21.21. Wilbur Curtis Company

- 21.22. Other Key Players

- 21.1. Breville Group Limited

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation