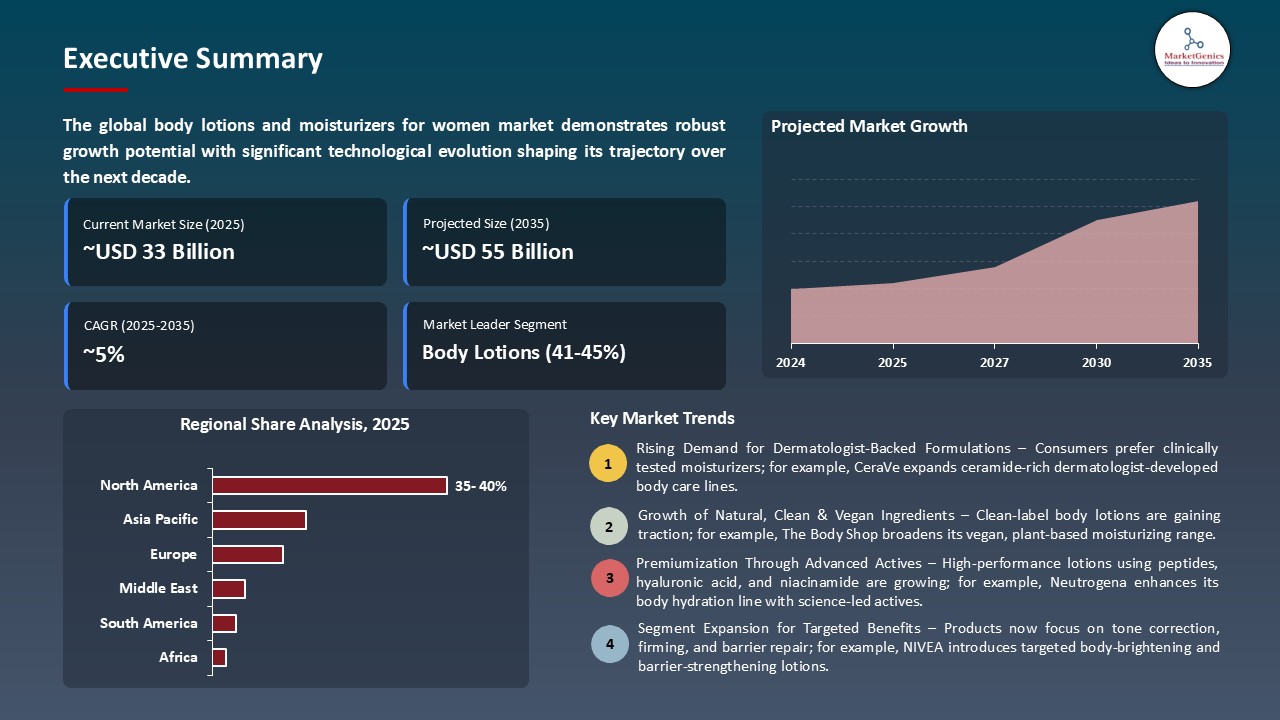

- The global body lotions and moisturizers for women market is valued at USD 32.8 billion in 2025.

- The market is projected to grow at a CAGR of 5.3% during the forecast period of 2026 to 2035.

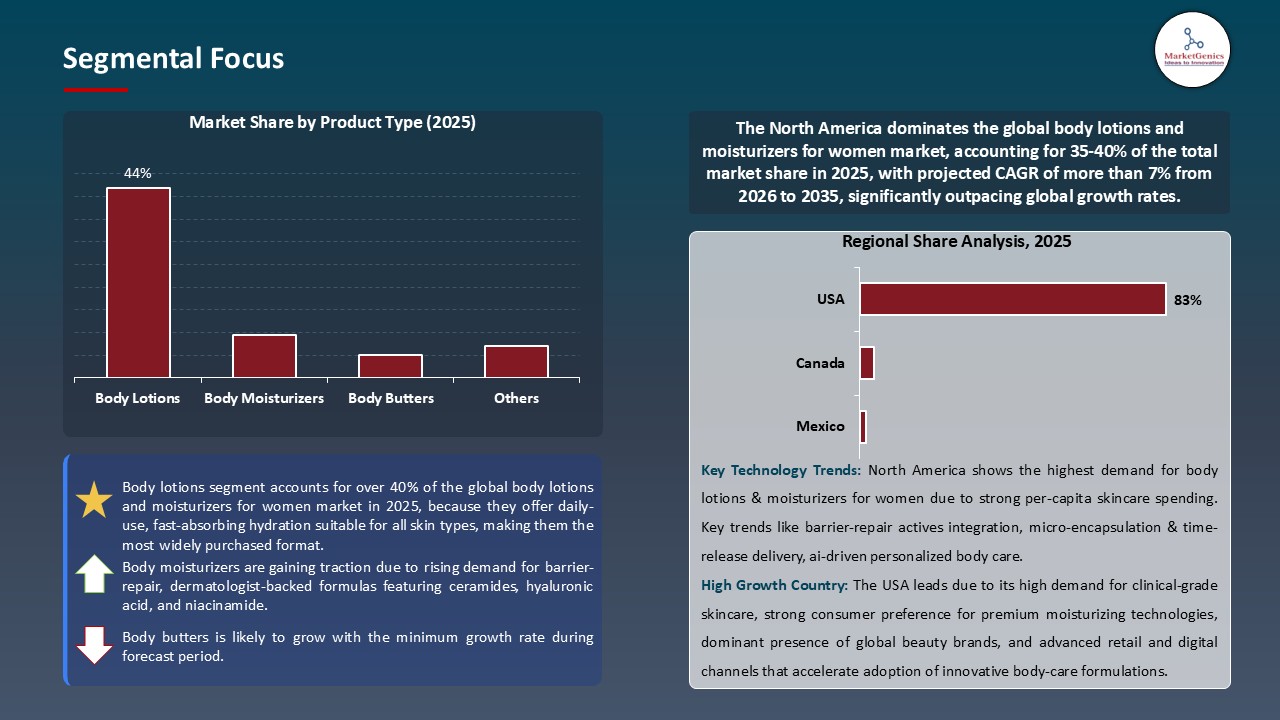

- The body lotions segment holds major share ~44% in the global body lotions and moisturizers for women market, driven by widespread consumer preference for convenience, hydration, and daily skincare benefits. Innovations such as fast-absorbing, nourishing, and skin-friendly formulations further strengthen adoption.

- Growing consumer demand for sustainable and personalized skincare is driving brands to develop eco-friendly Body Lotions and Moisturizers for Women, with subscription-based models catering to convenience, skin type, and lifestyle preferences.

- Innovation is advancing rapidly: companies are introducing plant-based formulations, nutrient-enriched creams, and lightweight, fast-absorbing textures that combine efficacy with environmental responsibility.

- The top five player’s accounts for over 35% of the global body lotions and moisturizers for women market in 2025.

- In October 2025, Reliance relaunched Velvette with Krithi Shetty, featuring body lotions and personal care products with Aqualoc Technology.

- In May 2025, Jasmine Tookes launched Brunel with three AI-optimized mood-enhancing body oils.

- Global Body Lotions and Moisturizers for Women Market is likely to create the total forecasting opportunity of ~USD 22 Bn till 2035.

- North America is a leading region in the global body lotions and moisturizers for women market, driven by high consumer awareness, rising disposable incomes, and strong focus on wellness, skincare, and postpartum care.

- The increased emphasis of self-care and wellness is reforming the women body lotions and moisturizers market that affects the purchasing behavior, brand loyalty and product development. Authenticity, transparency and alignment with personal values are gaining prominence as ideal beauty and personal care factors by Millennials and Gen Z consumers.

- Market leaders are reacting by repackaging portfolios to eliminate controversial ingredients, third-party certifications, sustainable packaging, and corporate values through target marketing. For instance, in 2023, The Vitamin Shoppe introduced its TrueYou Beauty line that uses clinically-studied body lotions, scrubs, and creams with a Core 5 Nutrient Complex to meet the needs of wellness and self-care. The strategies can generate brand differentiation, reinforced consumer trust, and competitive advantages in the markets where sustainability can be used to determine buying behavior and justify high prices.

- These factors are driving market expansion, particularly in developed regions where consumers prioritize efficacy, safety, sustainability, and social impact.

- The existence of intensive competition and pressure of private-label is a major disincentive to growth, market penetration, and profitability along the body lotions and moisturizers value chain amongst women. The awareness gaps, cultural barriers, economic constraints and regulatory complexities increase these restraints and limit the market growth.

- The companies are responding to these issues by use of educational programs, influencer programs, clinical validation, and pricing policies. To operate successfully in this environment, it would be necessary to invest in the environment over a long-term period, be culturally aware, and exercise strategic patience and flexibility to adapt the approach according to regional market conditions, consumer preferences, and competitive forces.

- The implications vary by market segment. Premium offers are more resilient due to their high value propositions and devoted clients, but mass-market categories are more vulnerable, necessitating operational efficiency, marketing innovation, and value engineering to remain competitive and maintain market dominance.

- The introduction of body lotion for different body parts products opens tremendous growth opportunities to body lotion and moisturizers product manufacturers among women. Firms that provide customized, segmented solutions are able to exploit the changing tastes and preferences of consumers through investing in product development, channel diversification, alliances, as well as developing capabilities.

- Geographic expansion in new markets, entry into related product lines, development of premium products, and direct-to-consumer models that do not involve the use of traditional retailers. For example, in December 2024, Dove launched its Cream Serum Collection of body creams, which contain face-grade actives and are intended to target the elasticity, tone, and dark spots of all body parts.

- Efficient implementation necessitates extensive consumer insight, digital competence, rapid operations, and continuous innovation directed by market trends and feedback. Collaborating with other companies, complementary technologies, influencers, and content creators accelerates opportunity capture, reduces investment risk, and provides specialized expertise.

- Companies that excel at discovering, prioritizing, and acting on such opportunities can outperform the market in terms of growth, improve their competitive position, and generate long-term value through distinct products in appealing market niches.

- The adoption of adaptogen and CBD-based formulations is transforming the product capabilities, consumer demands and competition in the female body lotions and moisturizers market. This trend is an indication of technological innovation, scientific validation, sustainability, and the demand of safe and high-performance products. The first movers are developing leadership and developing defendable advantages that cannot be easily duplicated by the competitors.

- The advantages of such trend include increased product performance, better customer satisfaction, brand differentiation and higher pricing power to companies which tap into this trend. The trend has been especially effective in the areas where innovation is compensated and where consumers are sophisticated. For instance, in February 2024, Hempz recently increased the range of beauty actives in its line and introduced new herbal body oils and moisturizers, which show product innovation, the efficacy of the active ingredients, and engagement with consumers. To achieve its potentials, it will need to invest in R&D, clinical validation, and the education of the consumers.

- Enhanced capabilities will transform the market by enabling personalized prescriptions, subscriptions, and outcome-based products, leading to increased customer loyalty and lifetime value as adoption spreads to mass-market and price-sensitive segments.

- The body lotions segment leads the global body lotion and moisturizers for women market with a large user base, established effectiveness, high user satisfaction, and a solid brand image within the various distribution channels. Its management is strengthened in markets where recognition, availability and value perceived follow on its growth even after those new products enter the market.

- Market leaders are also engaging in product innovation, brand development and distribution expansion in order to retain positions and capture growth opportunities. Improved formulations increase performance, sensorial attributes and sustainability and strategic marketing campaigns based on influencer relationship, clinical support and consumer endorsements lead to trial and repeat purchases.

- For instance, in November 2025, Himalaya collaborated with the Indian Women’s Ice Hockey Team to roll out its new serum and body lotion line and showcase the effectiveness of the product and consumer interest in sports partnerships. The segment has a competitive edge due to its established supply chain, manufacturing and regulatory experience, as well as good customer insights.

- These capabilities can be used to drive profitable growth by expanding product lines, entering new geographic markets, and offering high-end items to appeal to high-income consumers seeking more value and luxurious product experiences.

- North America is also one of the major players in the global body lotions and moisturizes for women market due to the strong consumer awareness, the increasing disposable income, and the increasing interest in the wellness, skincare, and postpartum care. The populations of urban and suburban areas are moving toward the demand of clinically proven, safe, and effective products.

- Market development can be achieved through the use of public health interventions, professional recommendations, and online awareness campaigns. For instnace, in January 2025, the HATCH Mama, available in Ulta Beauty, and it is the first national retail store where the brand will be sold in the U.S. that will increase the number of people who can get postpartum education and encourage them to use lotion and moisturizers more often.

- The market is expected to rise due to demographic reasons such as increased female labor force participation, increasing levels of education, and lifestyle-driven spending patterns. With the predominance of e-commerce and targeted marketing initiatives, the North American market for women's body lotions and moisturizers is rapidly expanding.

- In October 2025, Reliance Consumer Products repackaged the classic Tamil Nadu personal-care brand Velvette in collaboration with CK Rajkumar family and with actress Krithi Shetty as the brand ambassador. The renewed line consists of soaps, conditioners, shampoos, shower gel, and body lotions with the Aqualoc Technology that provides prolonged moisture. This strategic re-invention brings Velvette to a youthful audience and uses the heritage as a strength.

- In May 2025, the wellness -beauty brand Brunel by Supermodel Jasmine Tookes, in partnership with former private equity investor Sabrina Castenfelt, launched three mood-regulating body oils. The oils Awakening, Renewal, and Golden Hour Glow are developed on natural oils, vitamin C, and plant extracts with the scents being optimized with the AI (IFF Scentcube) to be used emotionally such as feeling confident and relaxed.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Avon Products

- Burt's Bees

- Clarins

- Colgate-Palmolive

- Johnson & Johnson

- Kao Corporation

- La Roche-Posay

- Coty Inc. Kiehl's

- L'Oréal

- Mary Kay

- Procter & Gamble

- The Body Shop International

- The Estée Lauder Companies

- Shiseido

- Unilever

- Beiersdorf AG

- Other Key Players

- Body Lotions

- Lightweight lotions

- Rich creamy lotions

- Fast-absorbing lotions

- Others

- Body Moisturizers

- Heavy-duty moisturizers

- Intensive care moisturizers

- Daily moisturizers

- Others

- Body Butters

- Body Creams

- Body Oils

- Body Gels

- Body Serums

- Whipped Body Moisturizers

- Natural/Organic

- Plant-based

- Vegan formulations

- Clean beauty formulations

- Others

- Synthetic

- Hybrid

- Dry Skin

- Oily Skin

- Combination Skin

- Sensitive Skin

- Normal Skin

- Hyaluronic Acid-based

- Shea Butter-based

- Coconut Oil-based

- Aloe Vera-based

- Vitamin E-based

- Glycerin-based

- Bottle

- Pump bottles

- Squeeze bottles

- Flip-top bottles

- Tube

- Jar

- Sachet/Pouch

- Bar/Soap Form

- Others

- Floral

- Fruity

- Vanilla/Sweet

- Citrus

- Herbal

- Woody/Musk

- Others

- Online

- E-commerce platforms

- Brand websites

- Online beauty retailers

- Others

- Offline

- Supermarkets/Hypermarkets

- Specialty beauty stores

- Pharmacies/Drug stores

- Department stores

- Spas/Salons

- Direct selling/MLM

- Others

- Personal Care & Cosmetics Industry

- Healthcare & Wellness Industry

- Spa & Salon Industry

- Hospitality Industry

- Retail Industry

- Others

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Body Lotions and Moisturizers for Women Market Outlook

- 2.1.1. Body Lotions and Moisturizers for Women Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Body Lotions and Moisturizers for Women Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Increasing awareness of skincare and personal grooming among women.

- 4.1.1.2. Rising demand for natural, organic, and multifunctional moisturizers.

- 4.1.1.3. Expansion of e-commerce and direct-to-consumer channels improving product accessibility.

- 4.1.2. Restraints

- 4.1.2.1. Presence of counterfeit or low-quality products affecting consumer trust.

- 4.1.2.2. Sensitivity to pricing in emerging markets limiting mass adoption.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Manufacturers

- 4.4.3. Dealers/ Distributors

- 4.4.4. End-Users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Body Lotions and Moisturizers for Women Market Demand

- 4.7.1. Historical Market Size – Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size – Value (US$ Bn), 2026–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Body Lotions and Moisturizers for Women Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Body Lotions and Moisturizers for Women Market Size (Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Body Lotions

- 6.2.1.1. Lightweight lotions

- 6.2.1.2. Rich creamy lotions

- 6.2.1.3. Fast-absorbing lotions

- 6.2.1.4. Others

- 6.2.2. Body Moisturizers

- 6.2.2.1. Heavy-duty moisturizers

- 6.2.2.2. Intensive care moisturizers

- 6.2.2.3. Daily moisturizers

- 6.2.2.4. Others

- 6.2.3. Body Butters

- 6.2.4. Body Creams

- 6.2.5. Body Oils

- 6.2.6. Body Gels

- 6.2.7. Body Serums

- 6.2.8. Whipped Body Moisturizers

- 6.2.1. Body Lotions

- 7. Global Body Lotions and Moisturizers for Women Market Analysis, by Formulation

- 7.1. Key Segment Analysis

- 7.2. Body Lotions and Moisturizers for Women Market Size (Value - US$ Bn), Analysis, and Forecasts, by Formulation, 2021-2035

- 7.2.1. Natural/Organic

- 7.2.2. Plant-based

- 7.2.3. Vegan formulations

- 7.2.4. Clean beauty formulations

- 7.2.5. Others

- 7.2.6. Synthetic

- 7.2.7. Hybrid

- 8. Global Body Lotions and Moisturizers for Women Market Analysis, by Skin Type

- 8.1. Key Segment Analysis

- 8.2. Body Lotions and Moisturizers for Women Market Size (Value - US$ Bn), Analysis, and Forecasts, by Skin Type, 2021-2035

- 8.2.1. Dry Skin

- 8.2.2. Oily Skin

- 8.2.3. Combination Skin

- 8.2.4. Sensitive Skin

- 8.2.5. Normal Skin

- 9. Global Body Lotions and Moisturizers for Women Market Analysis, by Key Ingredients

- 9.1. Key Segment Analysis

- 9.2. Body Lotions and Moisturizers for Women Market Size (Value - US$ Bn), Analysis, and Forecasts, by Key Ingredients, 2021-2035

- 9.2.1. Hyaluronic Acid-based

- 9.2.2. Shea Butter-based

- 9.2.3. Coconut Oil-based

- 9.2.4. Aloe Vera-based

- 9.2.5. Vitamin E-based

- 9.2.6. Glycerin-based

- 10. Global Body Lotions and Moisturizers for Women Market Analysis, by Packaging Type

- 10.1. Key Segment Analysis

- 10.2. Body Lotions and Moisturizers for Women Market Size (Value - US$ Bn), Analysis, and Forecasts, by Packaging Type, 2021-2035

- 10.2.1. Bottle

- 10.2.1.1. Pump bottles

- 10.2.1.2. Squeeze bottles

- 10.2.1.3. Flip-top bottles

- 10.2.2. Tube

- 10.2.3. Jar

- 10.2.4. Sachet/Pouch

- 10.2.5. Bar/Soap Form

- 10.2.6. Others

- 10.2.1. Bottle

- 11. Global Body Lotions and Moisturizers for Women Market Analysis, by Fragrance Profile

- 11.1. Key Segment Analysis

- 11.2. Body Lotions and Moisturizers for Women Market Size (Value - US$ Bn), Analysis, and Forecasts, by Fragrance Profile, 2021-2035

- 11.2.1. Floral

- 11.2.2. Fruity

- 11.2.3. Vanilla/Sweet

- 11.2.4. Citrus

- 11.2.5. Herbal

- 11.2.6. Woody/Musk

- 11.2.7. Others

- 12. Global Body Lotions and Moisturizers for Women Market Analysis, by Distribution Channel

- 12.1. Key Segment Analysis

- 12.2. Body Lotions and Moisturizers for Women Market Size (Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 12.2.1. Online

- 12.2.1.1. E-commerce platforms

- 12.2.1.2. Brand websites

- 12.2.1.3. Online beauty retailers

- 12.2.1.4. Others

- 12.2.2. Offline

- 12.2.2.1. Supermarkets/Hypermarkets

- 12.2.2.2. Specialty beauty stores

- 12.2.2.3. Pharmacies/Drug stores

- 12.2.2.4. Department stores

- 12.2.2.5. Spas/Salons

- 12.2.2.6. Direct selling/MLM

- 12.2.2.7. Others

- 12.2.1. Online

- 13. Global Body Lotions and Moisturizers for Women Market Analysis, by End-users

- 13.1. Key Segment Analysis

- 13.2. Body Lotions and Moisturizers for Women Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 13.2.1. Personal Care & Cosmetics Industry

- 13.2.2. Healthcare & Wellness Industry

- 13.2.3. Spa & Salon Industry

- 13.2.4. Hospitality Industry

- 13.2.5. Retail Industry

- 13.2.6. Others

- 14. Global Body Lotions and Moisturizers for Women Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Body Lotions and Moisturizers for Women Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Body Lotions and Moisturizers for Women Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Body Lotions and Moisturizers for Women Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Formulation

- 15.3.3. Skin Type

- 15.3.4. Key Ingredients

- 15.3.5. Packaging Type

- 15.3.6. Fragrance Profile

- 15.3.7. Distribution Channel

- 15.3.8. End-users

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Body Lotions and Moisturizers for Women Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Formulation

- 15.4.4. Skin Type

- 15.4.5. Key Ingredients

- 15.4.6. Packaging Type

- 15.4.7. Fragrance Profile

- 15.4.8. Distribution Channel

- 15.4.9. End-users

- 15.5. Canada Body Lotions and Moisturizers for Women Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Formulation

- 15.5.4. Skin Type

- 15.5.5. Key Ingredients

- 15.5.6. Packaging Type

- 15.5.7. Fragrance Profile

- 15.5.8. Distribution Channel

- 15.5.9. End-users

- 15.6. Mexico Body Lotions and Moisturizers for Women Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Formulation

- 15.6.4. Skin Type

- 15.6.5. Key Ingredients

- 15.6.6. Packaging Type

- 15.6.7. Fragrance Profile

- 15.6.8. Distribution Channel

- 15.6.9. End-users

- 16. Europe Body Lotions and Moisturizers for Women Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Body Lotions and Moisturizers for Women Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Formulation

- 16.3.3. Skin Type

- 16.3.4. Key Ingredients

- 16.3.5. Packaging Type

- 16.3.6. Fragrance Profile

- 16.3.7. Distribution Channel

- 16.3.8. End-users

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Body Lotions and Moisturizers for Women Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Formulation

- 16.4.4. Skin Type

- 16.4.5. Key Ingredients

- 16.4.6. Packaging Type

- 16.4.7. Fragrance Profile

- 16.4.8. Distribution Channel

- 16.4.9. End-users

- 16.5. United Kingdom Body Lotions and Moisturizers for Women Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Formulation

- 16.5.4. Skin Type

- 16.5.5. Key Ingredients

- 16.5.6. Packaging Type

- 16.5.7. Fragrance Profile

- 16.5.8. Distribution Channel

- 16.5.9. End-users

- 16.6. France Body Lotions and Moisturizers for Women Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Formulation

- 16.6.4. Skin Type

- 16.6.5. Key Ingredients

- 16.6.6. Packaging Type

- 16.6.7. Fragrance Profile

- 16.6.8. Distribution Channel

- 16.6.9. End-users

- 16.7. Italy Body Lotions and Moisturizers for Women Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Formulation

- 16.7.4. Skin Type

- 16.7.5. Key Ingredients

- 16.7.6. Packaging Type

- 16.7.7. Fragrance Profile

- 16.7.8. Distribution Channel

- 16.7.9. End-users

- 16.8. Spain Body Lotions and Moisturizers for Women Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Formulation

- 16.8.4. Skin Type

- 16.8.5. Key Ingredients

- 16.8.6. Packaging Type

- 16.8.7. Fragrance Profile

- 16.8.8. Distribution Channel

- 16.8.9. End-users

- 16.9. Netherlands Body Lotions and Moisturizers for Women Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Formulation

- 16.9.4. Skin Type

- 16.9.5. Key Ingredients

- 16.9.6. Packaging Type

- 16.9.7. Fragrance Profile

- 16.9.8. Distribution Channel

- 16.9.9. End-users

- 16.10. Nordic Countries Body Lotions and Moisturizers for Women Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Formulation

- 16.10.4. Skin Type

- 16.10.5. Key Ingredients

- 16.10.6. Packaging Type

- 16.10.7. Fragrance Profile

- 16.10.8. Distribution Channel

- 16.10.9. End-users

- 16.11. Poland Body Lotions and Moisturizers for Women Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Formulation

- 16.11.4. Skin Type

- 16.11.5. Key Ingredients

- 16.11.6. Packaging Type

- 16.11.7. Fragrance Profile

- 16.11.8. Distribution Channel

- 16.11.9. End-users

- 16.12. Russia & CIS Body Lotions and Moisturizers for Women Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Formulation

- 16.12.4. Skin Type

- 16.12.5. Key Ingredients

- 16.12.6. Packaging Type

- 16.12.7. Fragrance Profile

- 16.12.8. Distribution Channel

- 16.12.9. End-users

- 16.13. Rest of Europe Body Lotions and Moisturizers for Women Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Formulation

- 16.13.4. Skin Type

- 16.13.5. Key Ingredients

- 16.13.6. Packaging Type

- 16.13.7. Fragrance Profile

- 16.13.8. Distribution Channel

- 16.13.9. End-users

- 17. Asia Pacific Body Lotions and Moisturizers for Women Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Asia Pacific Body Lotions and Moisturizers for Women Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Formulation

- 17.3.3. Skin Type

- 17.3.4. Key Ingredients

- 17.3.5. Packaging Type

- 17.3.6. Fragrance Profile

- 17.3.7. Distribution Channel

- 17.3.8. End-users

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Body Lotions and Moisturizers for Women Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Formulation

- 17.4.4. Skin Type

- 17.4.5. Key Ingredients

- 17.4.6. Packaging Type

- 17.4.7. Fragrance Profile

- 17.4.8. Distribution Channel

- 17.4.9. End-users

- 17.5. India Body Lotions and Moisturizers for Women Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Formulation

- 17.5.4. Skin Type

- 17.5.5. Key Ingredients

- 17.5.6. Packaging Type

- 17.5.7. Fragrance Profile

- 17.5.8. Distribution Channel

- 17.5.9. End-users

- 17.6. Japan Body Lotions and Moisturizers for Women Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Formulation

- 17.6.4. Skin Type

- 17.6.5. Key Ingredients

- 17.6.6. Packaging Type

- 17.6.7. Fragrance Profile

- 17.6.8. Distribution Channel

- 17.6.9. End-users

- 17.7. South Korea Body Lotions and Moisturizers for Women Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Formulation

- 17.7.4. Skin Type

- 17.7.5. Key Ingredients

- 17.7.6. Packaging Type

- 17.7.7. Fragrance Profile

- 17.7.8. Distribution Channel

- 17.7.9. End-users

- 17.8. Australia and New Zealand Body Lotions and Moisturizers for Women Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Formulation

- 17.8.4. Skin Type

- 17.8.5. Key Ingredients

- 17.8.6. Packaging Type

- 17.8.7. Fragrance Profile

- 17.8.8. Distribution Channel

- 17.8.9. End-users

- 17.9. Indonesia Body Lotions and Moisturizers for Women Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Product Type

- 17.9.3. Formulation

- 17.9.4. Skin Type

- 17.9.5. Key Ingredients

- 17.9.6. Packaging Type

- 17.9.7. Fragrance Profile

- 17.9.8. Distribution Channel

- 17.9.9. End-users

- 17.10. Malaysia Body Lotions and Moisturizers for Women Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Product Type

- 17.10.3. Formulation

- 17.10.4. Skin Type

- 17.10.5. Key Ingredients

- 17.10.6. Packaging Type

- 17.10.7. Fragrance Profile

- 17.10.8. Distribution Channel

- 17.10.9. End-users

- 17.11. Thailand Body Lotions and Moisturizers for Women Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Product Type

- 17.11.3. Formulation

- 17.11.4. Skin Type

- 17.11.5. Key Ingredients

- 17.11.6. Packaging Type

- 17.11.7. Fragrance Profile

- 17.11.8. Distribution Channel

- 17.11.9. End-users

- 17.12. Vietnam Body Lotions and Moisturizers for Women Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Product Type

- 17.12.3. Formulation

- 17.12.4. Skin Type

- 17.12.5. Key Ingredients

- 17.12.6. Packaging Type

- 17.12.7. Fragrance Profile

- 17.12.8. Distribution Channel

- 17.12.9. End-users

- 17.13. Rest of Asia Pacific Body Lotions and Moisturizers for Women Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Product Type

- 17.13.3. Formulation

- 17.13.4. Skin Type

- 17.13.5. Key Ingredients

- 17.13.6. Packaging Type

- 17.13.7. Fragrance Profile

- 17.13.8. Distribution Channel

- 17.13.9. End-users

- 18. Middle East Body Lotions and Moisturizers for Women Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Body Lotions and Moisturizers for Women Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Formulation

- 18.3.3. Skin Type

- 18.3.4. Key Ingredients

- 18.3.5. Packaging Type

- 18.3.6. Fragrance Profile

- 18.3.7. Distribution Channel

- 18.3.8. End-users

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Body Lotions and Moisturizers for Women Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Formulation

- 18.4.4. Skin Type

- 18.4.5. Key Ingredients

- 18.4.6. Packaging Type

- 18.4.7. Fragrance Profile

- 18.4.8. Distribution Channel

- 18.4.9. End-users

- 18.5. UAE Body Lotions and Moisturizers for Women Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Formulation

- 18.5.4. Skin Type

- 18.5.5. Key Ingredients

- 18.5.6. Packaging Type

- 18.5.7. Fragrance Profile

- 18.5.8. Distribution Channel

- 18.5.9. End-users

- 18.6. Saudi Arabia Body Lotions and Moisturizers for Women Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Formulation

- 18.6.4. Skin Type

- 18.6.5. Key Ingredients

- 18.6.6. Packaging Type

- 18.6.7. Fragrance Profile

- 18.6.8. Distribution Channel

- 18.6.9. End-users

- 18.7. Israel Body Lotions and Moisturizers for Women Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Formulation

- 18.7.4. Skin Type

- 18.7.5. Key Ingredients

- 18.7.6. Packaging Type

- 18.7.7. Fragrance Profile

- 18.7.8. Distribution Channel

- 18.7.9. End-users

- 18.8. Rest of Middle East Body Lotions and Moisturizers for Women Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Formulation

- 18.8.4. Skin Type

- 18.8.5. Key Ingredients

- 18.8.6. Packaging Type

- 18.8.7. Fragrance Profile

- 18.8.8. Distribution Channel

- 18.8.9. End-users

- 19. Africa Body Lotions and Moisturizers for Women Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Body Lotions and Moisturizers for Women Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Formulation

- 19.3.3. Skin Type

- 19.3.4. Key Ingredients

- 19.3.5. Packaging Type

- 19.3.6. Fragrance Profile

- 19.3.7. Distribution Channel

- 19.3.8. End-users

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Body Lotions and Moisturizers for Women Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Formulation

- 19.4.4. Skin Type

- 19.4.5. Key Ingredients

- 19.4.6. Packaging Type

- 19.4.7. Fragrance Profile

- 19.4.8. Distribution Channel

- 19.4.9. End-users

- 19.5. Egypt Body Lotions and Moisturizers for Women Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Formulation

- 19.5.4. Skin Type

- 19.5.5. Key Ingredients

- 19.5.6. Packaging Type

- 19.5.7. Fragrance Profile

- 19.5.8. Distribution Channel

- 19.5.9. End-users

- 19.6. Nigeria Body Lotions and Moisturizers for Women Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Formulation

- 19.6.4. Skin Type

- 19.6.5. Key Ingredients

- 19.6.6. Packaging Type

- 19.6.7. Fragrance Profile

- 19.6.8. Distribution Channel

- 19.6.9. End-users

- 19.7. Algeria Body Lotions and Moisturizers for Women Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Formulation

- 19.7.4. Skin Type

- 19.7.5. Key Ingredients

- 19.7.6. Packaging Type

- 19.7.7. Fragrance Profile

- 19.7.8. Distribution Channel

- 19.7.9. End-users

- 19.8. Rest of Africa Body Lotions and Moisturizers for Women Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Formulation

- 19.8.4. Skin Type

- 19.8.5. Key Ingredients

- 19.8.6. Packaging Type

- 19.8.7. Fragrance Profile

- 19.8.8. Distribution Channel

- 19.8.9. End-users

- 20. South America Body Lotions and Moisturizers for Women Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. South America Body Lotions and Moisturizers for Women Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Formulation

- 20.3.3. Skin Type

- 20.3.4. Key Ingredients

- 20.3.5. Packaging Type

- 20.3.6. Fragrance Profile

- 20.3.7. Distribution Channel

- 20.3.8. End-users

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Body Lotions and Moisturizers for Women Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Formulation

- 20.4.4. Skin Type

- 20.4.5. Key Ingredients

- 20.4.6. Packaging Type

- 20.4.7. Fragrance Profile

- 20.4.8. Distribution Channel

- 20.4.9. End-users

- 20.5. Argentina Body Lotions and Moisturizers for Women Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Formulation

- 20.5.4. Skin Type

- 20.5.5. Key Ingredients

- 20.5.6. Packaging Type

- 20.5.7. Fragrance Profile

- 20.5.8. Distribution Channel

- 20.5.9. End-users

- 20.6. Rest of South America Body Lotions and Moisturizers for Women Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Formulation

- 20.6.4. Skin Type

- 20.6.5. Key Ingredients

- 20.6.6. Packaging Type

- 20.6.7. Fragrance Profile

- 20.6.8. Distribution Channel

- 20.6.9. End-users

- 21. Key Players/ Company Profile

- 21.1. Amorepacific Corporation

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Avon Products

- 21.3. Bath & Body Works

- 21.4. Beiersdorf AG

- 21.5. Burt's Bees

- 21.6. Clarins

- 21.7. Colgate-Palmolive

- 21.8. Coty Inc.

- 21.9. Johnson & Johnson

- 21.10. Kao Corporation

- 21.11. Kiehl's

- 21.12. La Roche-Posay

- 21.13. L'Oréal

- 21.14. Mary Kay

- 21.15. Procter & Gamble

- 21.16. Shiseido

- 21.17. The Body Shop International

- 21.18. The Estée Lauder Companies

- 21.19. Unilever

- 21.20. Other Key Players

- 21.1. Amorepacific Corporation

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Body Lotions and Moisturizers for Women Market by Product Type, Formulation, Skin Type, Key Ingredients, Packaging Type, Fragrance Profile, Distribution Channel, End-users, and Geography

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Body Lotions and Moisturizers for Women Market Size, Share & Trends Analysis Report by Product Type (Body Lotions, Body Moisturizers, Body Butters, Body Creams, Body Oils, Body Gels, Body Serums, Whipped Body Moisturizers), Formulation, Skin Type, Key Ingredients, Packaging Type, Fragrance Profile, Distribution Channel, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Body Lotions and Moisturizers for Women Market Size, Share, and Growth

The global body lotions and moisturizers for women market is experiencing robust growth, with its estimated value of USD 32.8 billion in the year 2025 and ~USD 55 billion by the period 2035, registering a CAGR of 5.3%, during the forecast period. The global body lotions and moisturizers for women market is becoming more and more led by the growing customer concern over wellness, skin health and sustainability. The women are focusing on products that are hydrating, safe on the skin and provide adequate protection and this is driving the need of high quality and clinically proven formulations. Increasing numbers of brands are creating lotions and moisturizers that are both eco-friendly and ethically made in response to an increasing awareness of the value of natural and organic ingredients, eco-friendly sourcing and biodegradable packaging.

Sandeep Verma, Country Head for India, Bangladesh, and Sri Lanka at Bayer’s Consumer Health Division, said,

"What is interesting to note in the 2024 Bepanthen Survey on Dry Skin, is sometimes people cannot distinguish between just dry skin and chronic dry skin, even though some of them look up the internet for more information. We at Bayer aim to bridge this knowledge gap, and aid people in understanding when and how they can seek help. Bepanthen products go beyond just moisturising, they are designed to enhance the quality of life for individuals who often overlook their skin health. Bepanthen’s entry into India marks a significant step in our mission to provide premium science-backed skincare solutions."

The increasing trend of self-care and wellness is transforming the market of body lotions and moisturizers among the women, the trend that affects the buying behavior, brand loyalty and product development. Consumers in the millennial and Gen z generations are becoming more and more concerned with being authentic, transparent, and aligned with their personal values when choosing beauty and personal care products, accelerating preference for clean-label and organic skin care formulations that emphasize ingredient safety and long-term skin health. For instance, in March 2024, Rare Beauty ventured into the world of body care with its Find Comfort line, which debuts on Sephora India, which highlights the importance of wellness, sustainability, and self-acceptance in body-care product lines today. Rare Beauty Fool Comfort Hydrating Body Lotion.

The market leaders are retaliating by redesigning their products to exclude the controversial ingredients, implementing sustainable packaging options, and using digital platforms to interact with the consumers in an authentic way. Through education, brands are incorporating clean beauty principles, attaining certification and incorporating educational content to develop trust and attract lifestyle focused consumers seeking high performance, safe products.

A range of opportunities in the related industries (like customized beauty technology, subservient delivery systems, inclusion of telehealth, and alternative wellness services) is growing. These channels enable the firms to spread their revenues, build customer loyalty, and create integrated ecosystems that respond to various self-care, health, and beauty requirements of women.

Body Lotions and Moisturizers for Women Market Dynamics and Trends

Driver: Growing Self-Care and Wellness Trends

Restraint: Intense Competition and Private Label Pressure

Opportunity: Expansion of Specialized Formulations for Different Body Areas

Key Trend: Integration of Adaptogens and CBD-Infused Formulations

Body-Lotions-and-Moisturizers-for-Women-Market Analysis and Segmental Data

Body Lotions Dominate Global Body Lotions and Moisturizers for Women Market

North America Leads Global Body Lotions and Moisturizers for Women Market Demand

Body-Lotions-and-Moisturizers-for-Women-Market Ecosystem

The global body lotions and moisturizers for women market is moderately fragmented, and the presence of multinational conglomerates, specialty brands, and direct-to-consumer startups in the market helps to meet the demands of different segments and different price brackets. Largely-established market leaders like L'Oréal, Unilever, Beiersdorf AG, Procter and Gamble as well as Johnson and Johnson capitalize on mass-market dominance by taking advantage of scale, research and development, and dense distribution networks, whereas specialty brands distinguish themselves through premium positioning, authenticity and targeted consumer interaction.

Value chain involves suppliers of the ingredients, formulation developers, contract manufactures, packaging service providers, distributors, retailing channels and marketing agencies. The most popular companies are turning to vertical integration, direct-to-consumer solutions, and digital marketing to improve the competitiveness, to maximize their margins, and to establish the direct consumer relationships and the ability to offer personalized products and to build the data-driven innovations.

Recent Development and Strategic Overview

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 32.8 Bn |

|

Market Forecast Value in 2035 |

~USD 55 Bn |

|

Growth Rate (CAGR) |

5.3% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Body-Lotions-and-Moisturizers-for-Women-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Body Lotions and Moisturizers for Women Market, By Product Type |

|

|

Body Lotions and Moisturizers for Women Market, By Formulation |

|

|

Body Lotions and Moisturizers for Women Market, By Skin Type |

|

|

Body Lotions and Moisturizers for Women Market, By Key Ingredients |

|

|

Body Lotions and Moisturizers for Women Market, By Packaging Type |

|

|

Body Lotions and Moisturizers for Women Market, By Fragrance Profile |

|

|

Body Lotions and Moisturizers for Women Market, By Distribution Channel |

|

|

Body Lotions and Moisturizers for Women Market, By End-users |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation