- The global climbing gym market is valued at USD 5.4 billion in 2025.

- The market is projected to grow at a CAGR of 13.6% during the forecast period of 2026 to 2035.

- The indoor climbing gyms segment holds major share ~48% in the global climbing gym market, due to their year-round accessibility, controlled environments, enhanced safety standards, and integration with urban fitness and recreational lifestyles.

- The climbing gym market growing due to growing preference for social, skill-based bouldering formats attracting urban beginners.

- The climbing gym market is driven by expanding demographic diversity broadens the customer base and membership growth.

- The top five players accounting for over 25% of the global climbing gym market share in 2025.

- In November 2025, Lemur Design launched an adjustable climbing wall system with 12–21% lower costs and tilting features to enhance accessibility for urban, beginner-focused gyms.

- In February 2024, Sender One expanded its Southern California presence with a new Westwood facility featuring sport climbing, bouldering, and youth programs to strengthen community.

- Global Climbing Gym Market is likely to create the total forecasting opportunity of ~USD 14 Bn till 2035.

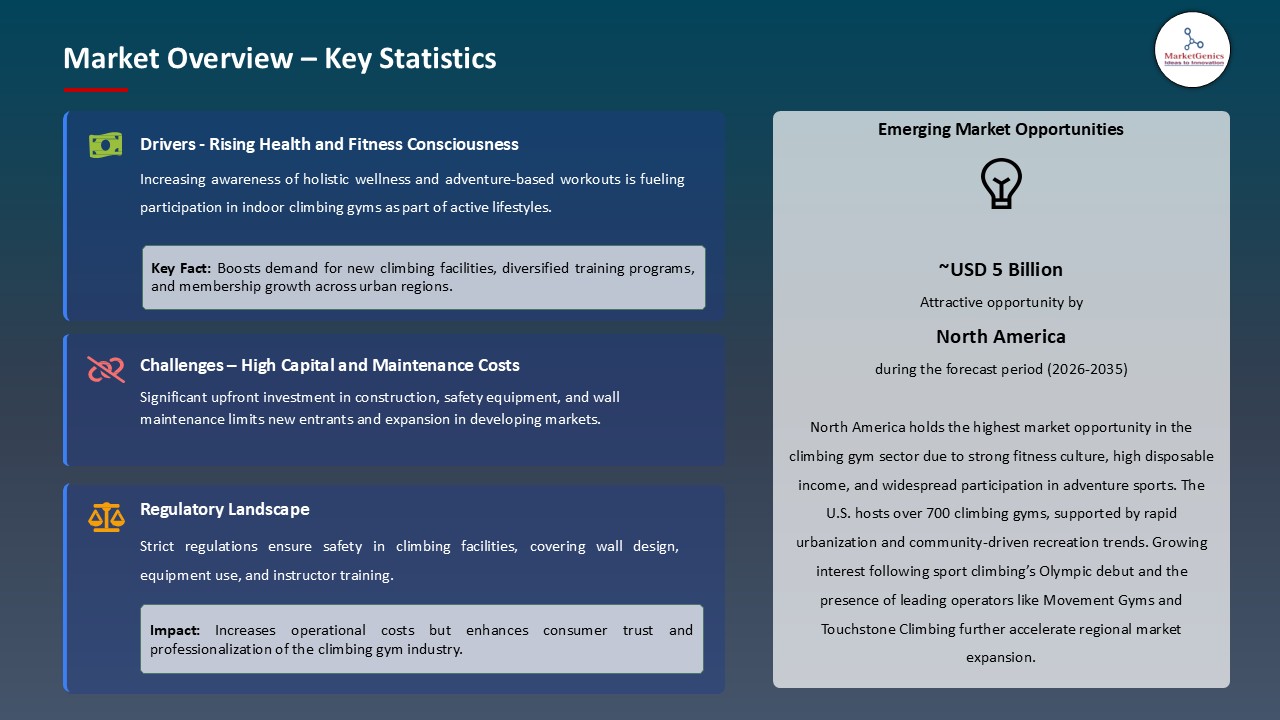

- North America is most attractive region due to its strong fitness culture, high disposable income, extensive gym infrastructure, and rising participation in recreational and competitive climbing activities.

- The climbing gym market is experiencing high growth owing to urban Millennials and Gen z consumers who are seeking skill-based fitness experiences that are socially engaging. Their inclination towards community- based, after-work activities makes climbing gyms very appealing as options to traditional, individualistic fitness settings. For instance, in 2024, Crux Climbing developed a smartphone-based application (202425), which enabled customers to scan walls, route-create, share socially, and track their performance, aiming at Millennial and Gen Z climbers.

- Moreover, the climbing gym market can be influenced by the social nature of the sport, in which partner belaying, collaborative route-solving and mutual accomplishments become a strong ingredient of community ties. This inclusivity and visible skill development boost motivation, lessen intimidation, as well as encourage long-term participation among the members.

- The alignment with urban and educated young professionals, and the high community interest of climbing contribute to high retention rates and high prices, allowing the profitable growth in expensive urban markets in a diversified and experience-driven revenue model.

- The climbing gym market is limited by high capital intensity, which is caused by the expensive construction of walls, specialized equipment requirements, and the demand to occupy large areas in the premium urban location. These increases barriers to entry and require long-term membership to remain profitable and constraining scalability of expansion.

- For instance, new climbing gym projects usually cost USD 38 million with payback periods of 3-5 years, preferring highly capitalized operators. This capital intensity discourages independent growth but provides well-established chains with scale benefits in cost and operations, which moderate the growth in the market as a whole.

- Moreover, the profitability of the climbing gym depends on the ability to reach sufficient membership density in the local markets, which is usually only possible in large cities, regional centers, or college cities. This reliance on concentrated populations limits market penetration in the suburban and rural markets where lower-priced models of fitness can be employed more effectively.

- Thus, strong capital intensity and the geographic barrier are slowing down the market growth, with bigger operations growing its business using capital and experience to expand to multiple sites, and smaller operators unable to expand beyond a single location.

- The climbing gym market has high growth potential due to youth-oriented programs like introductory classes, competitive teams, camps and after-school programs that fulfill parental needs of having Olympic sports and skills building programs. The programs drive short-term revenues and create long-term membership pipelines as the young people grow into adult climbing members and family members.

- For instance, in 2023, strategic alliance between ABC Kids Climbing and Walltopia to build dedicated youth climbing spaces across the globe with ABC building their youth training expertise and Walltopia developing their climbing walls engineering capabilities.

- Additionally, the competitive structured of the USA Climbing which includes local, regional, and national competitions builds up the youth involvement in the sport by offering adequate development of advancement and family commitment to sports. By having gyms, they enjoy greater visibility, brand credibility, and retention of long-term members through loyal climbing families.

- The youth segment is the growth driven by satisfying parental needs with safety and Olympic-style activities and creates early engagement that sustains member relationships with greater lifetime value than short-lived adult memberships.

- The climbing gym market is shifting toward the integrated wellness experience, where climbing gyms will integrate with yoga studios, strength and cardio areas, group fitness classes and physical therapy and social elements like cafes and co-working areas. This diversification increases retention among members, efficiency in facility usage and revenue performance.

- For instance, in May 2025 Movement Climbing, Yoga & Fitness opened its 24,000 sq ft Mountain View location, which has built-in climbing sections, a yoga studio, expansive strength and cardio circuits, and a community lounge to add to the experience and engagement of the members.

- Furthermore, collaborations with physical therapy and sports medicine service providers make climbing gyms a rehabilitation and training center while adjacent demand for home fitness equipment such as hangboards, grip trainers, and portable training rigs boosting medical appeal and opening up to therapeutic and wellness markets not served well by a conventional fitness customer base. The trend of integration is making climbing gyms holistic fitness venues with the power to compete with conventional fitness centers and boutique studios.

- This growth expands the diversity of markets to target and raises household spending; yet, it complicates operations, with larger operators more likely to succeed due to their multidisciplinary administrative abilities.

- The indoor climbing gyms segment dominates the global climbing gym market, due to indoor climbing gyms provide a constant weather-free access, which can offer constant participation and training to the beginners and advanced climbers, in need of safe, reliable and structured environments. For instance, in March 2024, Climb City introduced a 17,000 sq. ft. indoor facility in Noida featuring top-rope, autobelay, and bouldering walls, providing year-round climbing access. The trend reinforces the market dominance of the segment as it fosters constant participation and increased accessibility of the segment to the various urban demographics.

- Additionally, the growth of urban populations and the need to access convenient, proximity-based fitness opportunities contributes to the increased popularity of indoor climbing gyms in urban (metro-based) locations, which is consistent with busy and experience-based urban lifestyles.

- For instance, in 2023, Crux Climbing declared a 22,000 sq ft growth in Second Ward of Houston that would include coworking and childcare options to increase engagement in urban community activities. The urban-based growth reinforces the market penetration by targeting the dense population in search of integrated lifestyle-based fitness opportunities.

- North America leads the global climbing gym market, supported by a strong climbing outdoors base, dense urban population and a high-income consumer base. The area has an advanced fitness ecosystem with an established league or membership model and programming structure allowing large operators to multi-location network scaled and maintain competitive advantages in metropolitan markets.

- For instance, in March 2025, Climbing Business Journal stated that the number of climbing gyms in the United States has topped 625 facilities compared to the 350-year-old in 2019 representing a 11 percent compound annual growth of independent developments and chain expansions. Expansion into saturated metros and the forthcoming suburban areas emphasize the rising feasibility of growth of climbing gyms outside of conventional areas.

- Moreover, the area also has a highly developed ecosystem of a focused climbing industry, with equipment production, route-setting chains, coaching skills, and structured competition systems that increase the efficiency of operations and knowledge exchange. This well-developed infrastructure offers a competitive edge that new markets with the cheapest real estate prices cannot sustain.

- North America is leading the climbing gym market due to its established culture, large population, advanced infrastructure, and pricing power.

- In November 2025, Lemur Design introduced an adjustable climbing wall system, with 12-21% cost reduction and introduce specialized tilting to provide more accessibility and attractiveness to the urban and beginner-oriented climbing gym setting.

- In February 2024, Sender one opened a Westwood to increase its presence in Southern California in order to grow its membership and community programming in the LA market, they opened a high ceiling sport climbing, bouldering and youth-program facility.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Awesome Walls

- Brooklyn Boulders

- Central Rock Gym

- Climb So iLL

- ClimbZone

- Clip 'n Climb

- Earth Treks Climbing Centers

- Momentum Indoor Climbing

- Planet Granite

- Sender One Climbing

- Stone Summit Climbing & Fitness

- Summit Climbing Gym

- Touchstone Climbing

- Vertical Endeavors

- Other Key Players

- Indoor Climbing Gyms

- Bouldering-Only Facilities

- Top-Rope and Lead Climbing Facilities

- Mixed Climbing Facilities

- Outdoor Climbing Gyms

- Mobile/Portable Climbing Walls

- Bouldering Walls

- Top-Rope Walls

- Lead Climbing Walls

- Speed Climbing Walls

- Auto-Belay Walls

- Traverse Walls

- Crack Climbing Walls

- Beginner-Focused Facilities

- Intermediate-Level Facilities

- Advanced/Expert-Level Facilities

- Multi-Level Facilities

- Membership-Based Gyms

- Pay-Per-Visit Gyms

- Hybrid Model

- Self-Guided Climbing

- Instructional Classes

- Competitive Training Programs

- Kids' Programs

- Corporate Team Building

- Personal Coaching

- Individual Recreational Climbers

- Professional/Competitive Climbers

- Fitness Enthusiasts

- Families

- Schools and Educational Institutions

- Corporate Groups

- Sports Organizations

- Military and Special Forces Training

- Physical Therapy and Rehabilitation Centers

- Tourist and Visitors

- Others

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Climbing Gym Market Outlook

- 2.1.1. Climbing Gym Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Climbing Gym Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising consumer focus on fitness, wellness, and adventure sports

- 4.1.1.2. Increasing popularity of indoor recreational activities and urban lifestyle trends

- 4.1.1.3. Expansion of climbing gyms offering advanced facilities and community-based programs

- 4.1.2. Restraints

- 4.1.2.1. High setup and maintenance costs for climbing gym infrastructure

- 4.1.2.2. Limited accessibility and awareness in developing regions

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Equipment & Material Suppliers

- 4.4.2. Facility Design & Construction

- 4.4.3. Gym Operators & Owners

- 4.4.4. End-Users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Climbing Gym Market Demand

- 4.9.1. Historical Market Size –Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size –Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Climbing Gym Market Analysis, by Facility Type

- 6.1. Key Segment Analysis

- 6.2. Climbing Gym Market Size (Value - US$ Bn), Analysis, and Forecasts, by Facility Type, 2021-2035

- 6.2.1. Indoor Climbing Gyms

- 6.2.1.1. Bouldering-Only Facilities

- 6.2.1.2. Top-Rope and Lead Climbing Facilities

- 6.2.2. Mixed Climbing Facilities

- 6.2.3. Outdoor Climbing Gyms

- 6.2.4. Mobile/Portable Climbing Walls

- 6.2.1. Indoor Climbing Gyms

- 7. Global Climbing Gym Market Analysis, by Wall Type

- 7.1. Key Segment Analysis

- 7.2. Climbing Gym Market Size (Value - US$ Bn), Analysis, and Forecasts, by Wall Type, 2021-2035

- 7.2.1. Bouldering Walls

- 7.2.2. Top-Rope Walls

- 7.2.3. Lead Climbing Walls

- 7.2.4. Speed Climbing Walls

- 7.2.5. Auto-Belay Walls

- 7.2.6. Traverse Walls

- 7.2.7. Crack Climbing Walls

- 8. Global Climbing Gym Market Analysis, by Climbing Difficulty Level

- 8.1. Key Segment Analysis

- 8.2. Climbing Gym Market Size (Value - US$ Bn), Analysis, and Forecasts, by Climbing Difficulty Level, 2021-2035

- 8.2.1. Beginner-Focused Facilities

- 8.2.2. Intermediate-Level Facilities

- 8.2.3. Advanced/Expert-Level Facilities

- 8.2.4. Multi-Level Facilities

- 9. Global Climbing Gym Market Analysis, by Business Model

- 9.1. Key Segment Analysis

- 9.2. Climbing Gym Market Size (Value - US$ Bn), Analysis, and Forecasts, by Business Model, 2021-2035

- 9.2.1. Membership-Based Gyms

- 9.2.2. Pay-Per-Visit Gyms

- 9.2.3. Hybrid Model

- 10. Global Climbing Gym Market Analysis, by Training & Programs

- 10.1. Key Segment Analysis

- 10.2. Climbing Gym Market Size (Value - US$ Bn), Analysis, and Forecasts, by Training & Programs, 2021-2035

- 10.2.1. Self-Guided Climbing

- 10.2.2. Instructional Classes

- 10.2.3. Competitive Training Programs

- 10.2.4. Kids' Programs

- 10.2.5. Corporate Team Building

- 10.2.6. Personal Coaching

- 11. Global Climbing Gym Market Analysis, by End-Users

- 11.1. Key Segment Analysis

- 11.2. Climbing Gym Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-Users, 2021-2035

- 11.2.1. Individual Recreational Climbers

- 11.2.2. Professional/Competitive Climbers

- 11.2.3. Fitness Enthusiasts

- 11.2.4. Families

- 11.2.5. Schools and Educational Institutions

- 11.2.6. Corporate Groups

- 11.2.7. Sports Organizations

- 11.2.8. Military and Special Forces Training

- 11.2.9. Physical Therapy and Rehabilitation Centers

- 11.2.10. Tourist and Visitors

- 11.2.11. Others

- 12. Global Climbing Gym Market Analysis and Forecasts, by Region

- 12.1. Key Findings

- 12.2. Climbing Gym Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 12.2.1. North America

- 12.2.2. Europe

- 12.2.3. Asia Pacific

- 12.2.4. Middle East

- 12.2.5. Africa

- 12.2.6. South America

- 13. North America Climbing Gym Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. North America Climbing Gym Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Facility Type

- 13.3.2. Wall Type

- 13.3.3. Climbing Difficulty Level

- 13.3.4. Business Model

- 13.3.5. Training & Programs

- 13.3.6. End-Users

- 13.3.7. Country

- 13.3.7.1. USA

- 13.3.7.2. Canada

- 13.3.7.3. Mexico

- 13.4. USA Climbing Gym Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Facility Type

- 13.4.3. Wall Type

- 13.4.4. Climbing Difficulty Level

- 13.4.5. Business Model

- 13.4.6. Training & Programs

- 13.4.7. End-Users

- 13.5. Canada Climbing Gym Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Facility Type

- 13.5.3. Wall Type

- 13.5.4. Climbing Difficulty Level

- 13.5.5. Business Model

- 13.5.6. Training & Programs

- 13.5.7. End-Users

- 13.6. Mexico Climbing Gym Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Facility Type

- 13.6.3. Wall Type

- 13.6.4. Climbing Difficulty Level

- 13.6.5. Business Model

- 13.6.6. Training & Programs

- 13.6.7. End-Users

- 14. Europe Climbing Gym Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Europe Climbing Gym Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Facility Type

- 14.3.2. Wall Type

- 14.3.3. Climbing Difficulty Level

- 14.3.4. Business Model

- 14.3.5. Training & Programs

- 14.3.6. End-Users

- 14.3.7. Country

- 14.3.7.1. Germany

- 14.3.7.2. United Kingdom

- 14.3.7.3. France

- 14.3.7.4. Italy

- 14.3.7.5. Spain

- 14.3.7.6. Netherlands

- 14.3.7.7. Nordic Countries

- 14.3.7.8. Poland

- 14.3.7.9. Russia & CIS

- 14.3.7.10. Rest of Europe

- 14.4. Germany Climbing Gym Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Facility Type

- 14.4.3. Wall Type

- 14.4.4. Climbing Difficulty Level

- 14.4.5. Business Model

- 14.4.6. Training & Programs

- 14.4.7. End-Users

- 14.5. United Kingdom Climbing Gym Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Facility Type

- 14.5.3. Wall Type

- 14.5.4. Climbing Difficulty Level

- 14.5.5. Business Model

- 14.5.6. Training & Programs

- 14.5.7. End-Users

- 14.6. France Climbing Gym Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Facility Type

- 14.6.3. Wall Type

- 14.6.4. Climbing Difficulty Level

- 14.6.5. Business Model

- 14.6.6. Training & Programs

- 14.6.7. End-Users

- 14.7. Italy Climbing Gym Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Facility Type

- 14.7.3. Wall Type

- 14.7.4. Climbing Difficulty Level

- 14.7.5. Business Model

- 14.7.6. Training & Programs

- 14.7.7. End-Users

- 14.8. Spain Climbing Gym Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Facility Type

- 14.8.3. Wall Type

- 14.8.4. Climbing Difficulty Level

- 14.8.5. Business Model

- 14.8.6. Training & Programs

- 14.8.7. End-Users

- 14.9. Netherlands Climbing Gym Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Facility Type

- 14.9.3. Wall Type

- 14.9.4. Climbing Difficulty Level

- 14.9.5. Business Model

- 14.9.6. Training & Programs

- 14.9.7. End-Users

- 14.10. Nordic Countries Climbing Gym Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Facility Type

- 14.10.3. Wall Type

- 14.10.4. Climbing Difficulty Level

- 14.10.5. Business Model

- 14.10.6. Training & Programs

- 14.10.7. End-Users

- 14.11. Poland Climbing Gym Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Facility Type

- 14.11.3. Wall Type

- 14.11.4. Climbing Difficulty Level

- 14.11.5. Business Model

- 14.11.6. Training & Programs

- 14.11.7. End-Users

- 14.12. Russia & CIS Climbing Gym Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Facility Type

- 14.12.3. Wall Type

- 14.12.4. Climbing Difficulty Level

- 14.12.5. Business Model

- 14.12.6. Training & Programs

- 14.12.7. End-Users

- 14.13. Rest of Europe Climbing Gym Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Facility Type

- 14.13.3. Wall Type

- 14.13.4. Climbing Difficulty Level

- 14.13.5. Business Model

- 14.13.6. Training & Programs

- 14.13.7. End-Users

- 15. Asia Pacific Climbing Gym Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Asia Pacific Climbing Gym Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Facility Type

- 15.3.2. Wall Type

- 15.3.3. Climbing Difficulty Level

- 15.3.4. Business Model

- 15.3.5. Training & Programs

- 15.3.6. End-Users

- 15.3.7. Country

- 15.3.7.1. China

- 15.3.7.2. India

- 15.3.7.3. Japan

- 15.3.7.4. South Korea

- 15.3.7.5. Australia and New Zealand

- 15.3.7.6. Indonesia

- 15.3.7.7. Malaysia

- 15.3.7.8. Thailand

- 15.3.7.9. Vietnam

- 15.3.7.10. Rest of Asia Pacific

- 15.4. China Climbing Gym Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Facility Type

- 15.4.3. Wall Type

- 15.4.4. Climbing Difficulty Level

- 15.4.5. Business Model

- 15.4.6. Training & Programs

- 15.4.7. End-Users

- 15.5. India Climbing Gym Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Facility Type

- 15.5.3. Wall Type

- 15.5.4. Climbing Difficulty Level

- 15.5.5. Business Model

- 15.5.6. Training & Programs

- 15.5.7. End-Users

- 15.6. Japan Climbing Gym Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Facility Type

- 15.6.3. Wall Type

- 15.6.4. Climbing Difficulty Level

- 15.6.5. Business Model

- 15.6.6. Training & Programs

- 15.6.7. End-Users

- 15.7. South Korea Climbing Gym Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Facility Type

- 15.7.3. Wall Type

- 15.7.4. Climbing Difficulty Level

- 15.7.5. Business Model

- 15.7.6. Training & Programs

- 15.7.7. End-Users

- 15.8. Australia and New Zealand Climbing Gym Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Facility Type

- 15.8.3. Wall Type

- 15.8.4. Climbing Difficulty Level

- 15.8.5. Business Model

- 15.8.6. Training & Programs

- 15.8.7. End-Users

- 15.9. Indonesia Climbing Gym Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Facility Type

- 15.9.3. Wall Type

- 15.9.4. Climbing Difficulty Level

- 15.9.5. Business Model

- 15.9.6. Training & Programs

- 15.9.7. End-Users

- 15.10. Malaysia Climbing Gym Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Facility Type

- 15.10.3. Wall Type

- 15.10.4. Climbing Difficulty Level

- 15.10.5. Business Model

- 15.10.6. Training & Programs

- 15.10.7. End-Users

- 15.11. Thailand Climbing Gym Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Facility Type

- 15.11.3. Wall Type

- 15.11.4. Climbing Difficulty Level

- 15.11.5. Business Model

- 15.11.6. Training & Programs

- 15.11.7. End-Users

- 15.12. Vietnam Climbing Gym Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Facility Type

- 15.12.3. Wall Type

- 15.12.4. Climbing Difficulty Level

- 15.12.5. Business Model

- 15.12.6. Training & Programs

- 15.12.7. End-Users

- 15.13. Rest of Asia Pacific Climbing Gym Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Facility Type

- 15.13.3. Wall Type

- 15.13.4. Climbing Difficulty Level

- 15.13.5. Business Model

- 15.13.6. Training & Programs

- 15.13.7. End-Users

- 16. Middle East Climbing Gym Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Middle East Climbing Gym Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Facility Type

- 16.3.2. Wall Type

- 16.3.3. Climbing Difficulty Level

- 16.3.4. Business Model

- 16.3.5. Training & Programs

- 16.3.6. End-Users

- 16.3.7. Country

- 16.3.7.1. Turkey

- 16.3.7.2. UAE

- 16.3.7.3. Saudi Arabia

- 16.3.7.4. Israel

- 16.3.7.5. Rest of Middle East

- 16.4. Turkey Climbing Gym Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Facility Type

- 16.4.3. Wall Type

- 16.4.4. Climbing Difficulty Level

- 16.4.5. Business Model

- 16.4.6. Training & Programs

- 16.4.7. End-Users

- 16.5. UAE Climbing Gym Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Facility Type

- 16.5.3. Wall Type

- 16.5.4. Climbing Difficulty Level

- 16.5.5. Business Model

- 16.5.6. Training & Programs

- 16.5.7. End-Users

- 16.6. Saudi Arabia Climbing Gym Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Facility Type

- 16.6.3. Wall Type

- 16.6.4. Climbing Difficulty Level

- 16.6.5. Business Model

- 16.6.6. Training & Programs

- 16.6.7. End-Users

- 16.7. Israel Climbing Gym Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Facility Type

- 16.7.3. Wall Type

- 16.7.4. Climbing Difficulty Level

- 16.7.5. Business Model

- 16.7.6. Training & Programs

- 16.7.7. End-Users

- 16.8. Rest of Middle East Climbing Gym Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Facility Type

- 16.8.3. Wall Type

- 16.8.4. Climbing Difficulty Level

- 16.8.5. Business Model

- 16.8.6. Training & Programs

- 16.8.7. End-Users

- 17. Africa Climbing Gym Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Africa Climbing Gym Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Facility Type

- 17.3.2. Wall Type

- 17.3.3. Climbing Difficulty Level

- 17.3.4. Business Model

- 17.3.5. Training & Programs

- 17.3.6. End-Users

- 17.3.7. Country

- 17.3.7.1. South Africa

- 17.3.7.2. Egypt

- 17.3.7.3. Nigeria

- 17.3.7.4. Algeria

- 17.3.7.5. Rest of Africa

- 17.4. South Africa Climbing Gym Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Facility Type

- 17.4.3. Wall Type

- 17.4.4. Climbing Difficulty Level

- 17.4.5. Business Model

- 17.4.6. Training & Programs

- 17.4.7. End-Users

- 17.5. Egypt Climbing Gym Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Facility Type

- 17.5.3. Wall Type

- 17.5.4. Climbing Difficulty Level

- 17.5.5. Business Model

- 17.5.6. Training & Programs

- 17.5.7. End-Users

- 17.6. Nigeria Climbing Gym Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Facility Type

- 17.6.3. Wall Type

- 17.6.4. Climbing Difficulty Level

- 17.6.5. Business Model

- 17.6.6. Training & Programs

- 17.6.7. End-Users

- 17.7. Algeria Climbing Gym Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Facility Type

- 17.7.3. Wall Type

- 17.7.4. Climbing Difficulty Level

- 17.7.5. Business Model

- 17.7.6. Training & Programs

- 17.7.7. End-Users

- 17.8. Rest of Africa Climbing Gym Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Facility Type

- 17.8.3. Wall Type

- 17.8.4. Climbing Difficulty Level

- 17.8.5. Business Model

- 17.8.6. Training & Programs

- 17.8.7. End-Users

- 18. South America Climbing Gym Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. South America Climbing Gym Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Facility Type

- 18.3.2. Wall Type

- 18.3.3. Climbing Difficulty Level

- 18.3.4. Business Model

- 18.3.5. Training & Programs

- 18.3.6. End-Users

- 18.3.7. Country

- 18.3.7.1. Brazil

- 18.3.7.2. Argentina

- 18.3.7.3. Rest of South America

- 18.4. Brazil Climbing Gym Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Facility Type

- 18.4.3. Wall Type

- 18.4.4. Climbing Difficulty Level

- 18.4.5. Business Model

- 18.4.6. Training & Programs

- 18.4.7. End-Users

- 18.5. Argentina Climbing Gym Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Facility Type

- 18.5.3. Wall Type

- 18.5.4. Climbing Difficulty Level

- 18.5.5. Business Model

- 18.5.6. Training & Programs

- 18.5.7. End-Users

- 18.6. Rest of South America Climbing Gym Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Facility Type

- 18.6.3. Wall Type

- 18.6.4. Climbing Difficulty Level

- 18.6.5. Business Model

- 18.6.6. Training & Programs

- 18.6.7. End-Users

- 19. Key Players/ Company Profile

- 19.1. Awesome Walls

- 19.1.1. Company Details/ Overview

- 19.1.2. Company Financials

- 19.1.3. Key Customers and Competitors

- 19.1.4. Business/ Industry Portfolio

- 19.1.5. Product Portfolio/ Specification Details

- 19.1.6. Pricing Data

- 19.1.7. Strategic Overview

- 19.1.8. Recent Developments

- 19.2. Brooklyn Boulders

- 19.3. Central Rock Gym

- 19.4. Climb So iLL

- 19.5. ClimbZone

- 19.6. Clip 'n Climb

- 19.7. Earth Treks Climbing Centers

- 19.8. Momentum Indoor Climbing

- 19.9. Planet Granite

- 19.10. Sender One Climbing

- 19.11. Stone Summit Climbing & Fitness

- 19.12. Summit Climbing Gym

- 19.13. The Cliffs Climbing + Fitness

- 19.14. The Climbing Hangar

- 19.15. Touchstone Climbing

- 19.16. Vertical Endeavors

- 19.17. Other Key Players

- 19.1. Awesome Walls

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Climbing Gym Market Size, Share & Trends Analysis Report by Facility Type (Indoor Climbing Gyms, Mixed Climbing Facilities, Outdoor Climbing Gyms, Mobile/Portable Climbing Walls), Wall Type, Climbing Difficulty Level, Business Model, Training & Programs, End-Users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Climbing Gym Market Size, Share, and Growth

The global climbing gym market is experiencing robust growth, with its estimated value of USD 5.4 billion in the year 2025 and USD 19.3 billion by 2035, registering a CAGR of 13.6%, during the forecast period. The climbing gym market is driven by rising fitness awareness, urban lifestyle shifts, Olympic exposure, technological advancements, and growing community-focused, multipurpose facilities promoting wellness, adventure, and social engagement among diverse participants.

Ivaylo Penchev, the CEO of Walltopia, said,

"The partnership with ABC Kids Climbing fills us with great enthusiasm. Our shared vision of delivering extraordinary climbing experiences and fostering children's involvement in the sport makes this collaboration truly remarkable. By combining Walltopia's innovative design-build concepts with the expertise and exceptional climbing experiences of ABC Kids Climbing, we are joining forces to create dedicated climbing gyms exclusively designed for young climbers."

The global climbing gym market is driven by the increasing popularity of alternative fitness activities and the introduction of the sport to the Olympic Games. With the decline of traditional gyms, the growing popularity of climbing gyms is luring new members with full-body moves that use the mind, body, and community connection, while also driving spillover demand for activewear designed for grip flexibility, durability, and multi-directional movement specific to climbing environments. For instance, in July 2024, Foixarda tunnel served as a free public climbing gym with thousands of holds to offer an excellent opportunity to the expanding sport. This tendency contributes to the expansion of the world, enhancing engagement and making climbing gyms one of the major fitness segments.

Moreover, the climbing gym market has significant growth due to the introduction of sport climbing in Tokyo 2020 and its continued acceptance in Paris 2024, which has increased global interest, increased athlete exposure and stimulated youth interest by offering more junior training opportunities. This has fostered the advancement of global markets by enhancing involvement of youths, expansion of facilities, and establishment of climbing as a mainstream fitness and competitive sport.

Adjacent market opportunities to the global climbing gym industry include adventure tourism, fitness equipment manufacturing, outdoor gear retail, sports training and coaching services, and wellness or recovery centers. These interrelated industries are aided by the increased popularity of climbing, with the formation of cross-industry partnerships and innovation that together grow the global active lifestyle economy. These opportunities will improve the diversification of revenue and improve long-term sustainability of the market.

Climbing Gym Market Dynamics and Trends

Driver: Urban Millennials and Social Fitness Communities

Restraint: High Capital Requirements and Real Estate Costs

Opportunity: Youth Programming and Competitive Climbing Development

Key Trend: Hybrid Fitness and Wellness Integration

Climbing-Gym-Market Analysis and Segmental Data

Indoor Climbing Gyms Dominate Global Climbing Gym Market

North America Leads Global Climbing Gym Market Demand

Climbing-Gym-Market Ecosystem

The global climbing gym market is moderately fragmented, with high concentration among key players such as Planet Granite, Earth Treks Climbing Centers, Sender One Climbing, Brooklyn Boulders, and Vertical Endeavors, who dominate through multi-location networks, high brand equity, high-level facility design, and diversified programming that appeals to the engagement and retention of members.

For instance, Movement Climbing, Yoga & Fitness one, which was created due to the merge of the Earth Treks and Planet Granite, declared a single national brand, seven Earth Treks, six Planet Granite and three legacy Movement locations under the brand. The consolidation will help to boost operational efficiency, increase brand awareness, and has the potential to gain a larger market share by allowing the establishment to conduct unified marketing, standardized member experience, and scalable expansion in key urban markets.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 5.4 Bn |

|

Market Forecast Value in 2035 |

USD 19.3 Bn |

|

Growth Rate (CAGR) |

13.6% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Climbing-Gym-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Climbing Gym Market, By Facility Type |

|

|

Climbing Gym Market, By Wall Type |

|

|

Climbing Gym Market, By Climbing Difficulty Level |

|

|

Climbing Gym Market, By Business Model |

|

|

Climbing Gym Market, By Training & Programs

|

|

|

Climbing Gym Market, By End-Users

|

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation