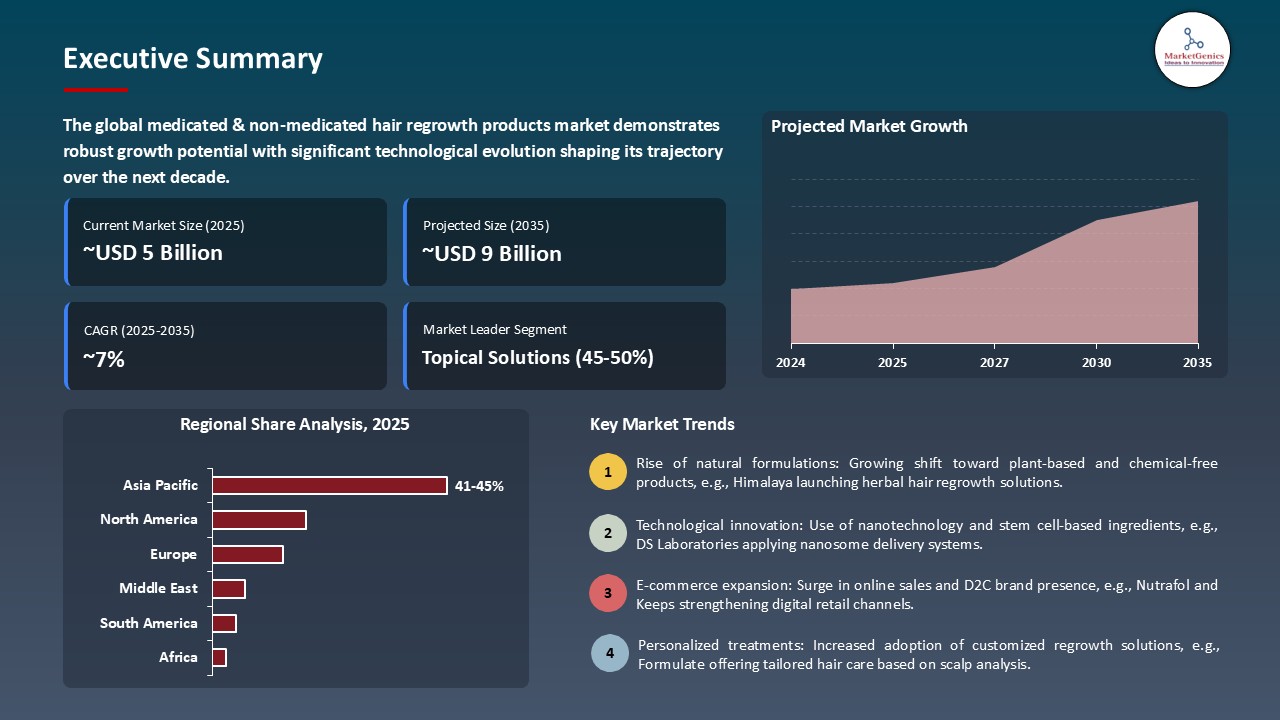

- The global medicated & non-medicated hair regrowth products market is valued at USD 4.7 billion in 2025.

- The market is projected to grow at a CAGR of 6.8% during the forecast period of 2026 to 2035.

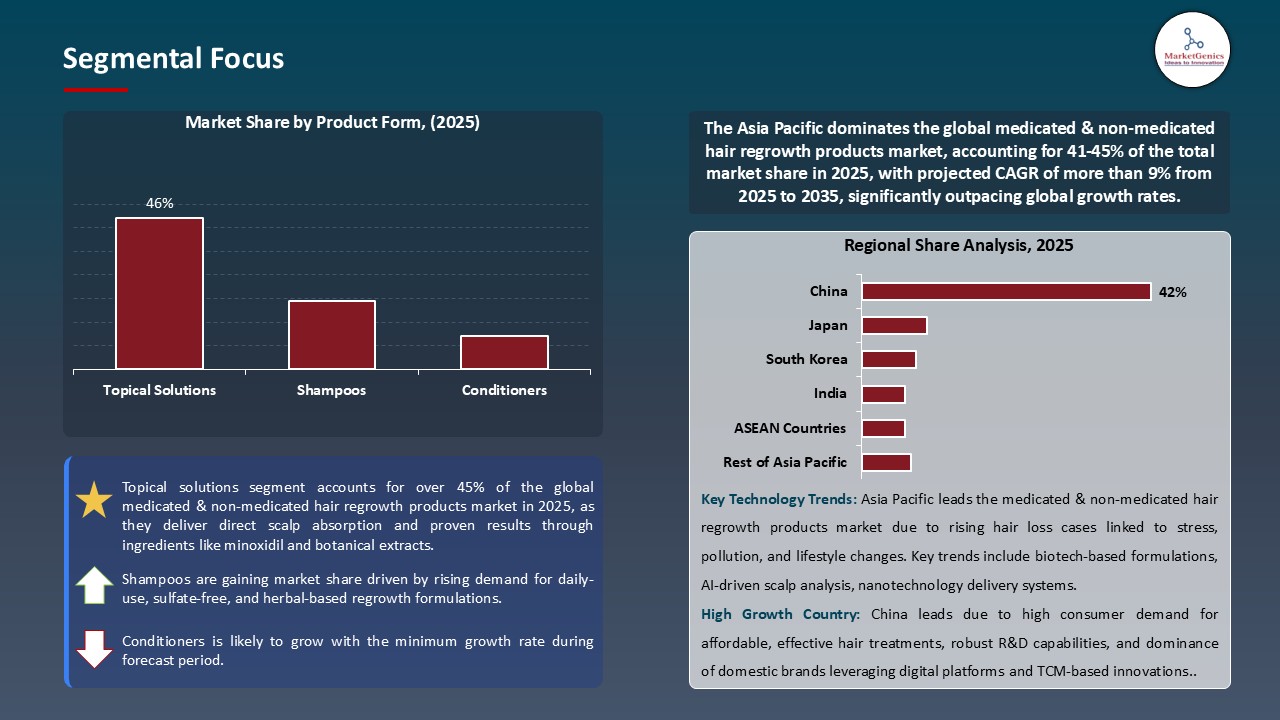

- The topical solutions segment holds major share ~46% in the global medicated & non-medicated hair regrowth products market, driven by convenient, easy-to-apply treatments and innovations in botanical and clinically validated formulations that enhance efficacy and user experience.

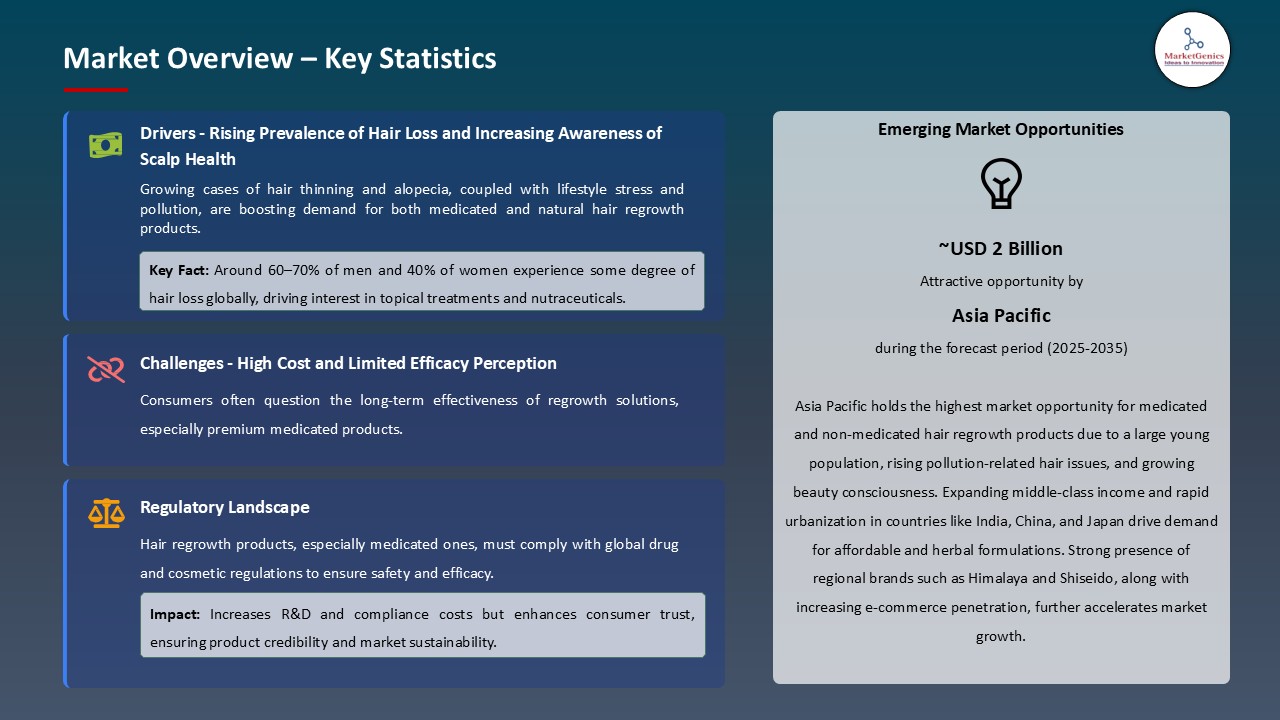

- Rising health-consciousness: Growing awareness of hair loss treatments and preventive hair care is driving global demand for Medicated & Non-Medicated Hair Regrowth Products.

- Product innovation and personalization: Advances in botanical formulations, clinically supported actives, and AI-driven diagnostic tools are improving efficacy, convenience, and treatment outcomes, boosting adoption across diverse consumer segments.

- The top five player’s accounts for over 25% of the global medicated & non-medicated hair regrowth products market in 2025.

- In July 2025, Sun Pharmaceutical Industries launched LEQSELVI (deuruxolitinib) 8 mg tablets in the U.S., offering a new treatment for severe Alopecia Areata and expanding its dermatology portfolio.

- In May 2024, MIT researchers developed a microneedle patch delivering immune‑regulating molecules to the scalp, reversing hair loss from Alopecia Areata.

- Global Medicated & Non-Medicated Hair Regrowth Products Market is likely to create the total forecasting opportunity of ~USD 4 Bn till 2035.

- Asia-Pacific leads medicated & non-medicated hair regrowth products market, driven by increasing awareness of hair loss treatments, high disposable incomes, and strong adoption of advanced healthcare and telehealth solutions, supported by established retail, e-commerce, and professional dermatology networks.

- The increased incidence of hair loss in the younger population is one of the major driving forces behind the global medicated and non-medicated hair regrowth products market. Chronic stress, nutritional and environmental exposure and styling are among other factors that are causing premature thinning of hair and pattern baldness, broadening the market to reach beyond middle-aged and older consumers, while also increasing reliance on cosmetic stopgaps such as hair extensions among younger demographics.

- Population in terms of growing consumer awareness and the necessity of early intervention is influencing market dynamics. For instance, in May 2024, Hims & Hers Health, Inc. released survey data indicating that 66 percent of Gen Z and millennial men believe that they will not experience hair loss until they are in their mid-thirties, even though male pattern hair loss can begin when they are in their twenties.

- The destigmatization of hair loss therapies, coupled with increased awareness of preventative medicine and the effect of social media, are facilitating early adoption, sparking the desire to begin treatment sooner in life, and continuing the global market growth.

- Seasonable effectiveness and lengthy timeframes needed to attain noticeable outcomes are some of the concerns of the hair regrowth products industry. Topical and oral treatments frequently require regular treatment during several months, which test consumer patience and leads to premature withdrawal. The etiology of hair loss, genetic, and adherence contribute to the individual response rate, which restricts perceived effectiveness and overall satisfaction.

- High attrition rates are also being witnessed with a large number of users abandoning products prematurely because of slow results or inconvenient application regimes and this has led to negative word of mouth that may destroy confidence in hair regrowth solutions. Moreover, wrong diagnoses or self-diagnosis of types of hair loss can result in consumers choosing the wrong type of treatment, further decreasing efficacy and satisfaction.

- All these efficacy and adoption problems limit market expansion, and thus it is important to have a strong consumer education, effective communication of realistic expectations and professional guidance in order to enhance adherence and maximize results, and to achieve long-term expansion of the market.

- The combination of AI-based diagnostics and genetic testing is changing the nature of the hair regrowth market, as it offers a chance to adopt a personalized treatment strategy. More sophisticated genetic predisposition, hormonal secretions and scalp microbiome, can be created in a way that each treatment plan is tailored to an individual physiology and hair loss patterns, improving effectiveness and minimizing the trial and error phase of the treatment.

- The trend is being exploited by leading companies that provide personalized and fully integrated hair wellness solutions. For instance, in April 2025, Nutrafol LLC released its Personalized Hair Wellness Plan, a combination of at-home genetic testing, lifestyle, and nutritional testing to provide customized supplement formulas and topical treatment suggestions. Clinical trials indicated considerable advances in satisfaction with treatment as opposed to standardized methods. Such emerging AI platforms additionally increase personalization through hair density monitoring with scalp images over time and gives data-driven product advice.

- Innovations combined with professional consulting and monitoring lead to high-end service offers that improve compliance, maximize results, and increase consumer investment.

- The growing use of natural, botanically derived ingredients by consumers is changing the product development and marketing of the hair regrowth products market. The increased interest in synthetic compounds and their side effects is influencing the demand towards formulations with plant extracts, essential oils, and natural actives with clinical validation. The tendency is especially high among female and younger customers who care about clean beauty and holistic wellness.

- Major manufacturers are now taking advantage of this trend by coming up with innovative, clinically supported supplement and topical formulations. For instance, in July 2025, Vegamour introduced the GRO+ Advanced Hair Growth and Density Supplements, a two-pill complex with botanical DHT-blockers and nutrient-rich softgels developed to promote hair growth. The cruelty-free vegan product contains no synthetic fillers or allergens and in 120 days in an independent clinical trial, users reported a maximum of 91% reduction in hair shedding.

- Using natural substances encourages extraction methods, sustainable sourcing, and improved bioavailability, while also validating traditional medical concepts through clinical research.

- This topical solutions is a dominant segment in the global market of non-medicated and medicated hair regrowth products due to ease of use, direct follicle action and excellent clinical support of treating androgenetic alopecy. Topical applications reduce the systemic absorption issues but provide active ingredients to the affected regions on the scalp, thus the first-line treatment of choice as recommended by dermatologists.

- The segment boasts of delivery system innovation with foams, serums, sprays and leave-in treatments as well as innovation in penetration enhancers, sustained release technology and complementary scalp health ingredients. For instnace, in July 2025, Shed introduced a medical-grade category of oral and topical medications addressing biological causes of hair thinning, emphasizing the desire to offer more integrated and high-quality products.

- Continued formulation enhancement, clinical guideline verification, and consumer-oriented design help secure the further prevalence of topical solutions, and a further development is anticipated with the introduction of the newer technology, making the solutions more effective, tolerable, and pleasing to consumers in general.

- Asia Pacific region continues to dominate the global medicated and non-medicated hair regrowth products market because of the increasing awareness of consumers on the importance of taking care of their hair, the rising population of the middle classes, the rising disposable incomes, the rise of e-commerce and the modern retail networks that have normalized these products into personal care necessities.

- Retail penetration is strong in the region, with hair regrowth products, serum, and topical products being sold in pharmacies, specialty stores, and online. The rising trends of urbanization, the rising use of preventive health activities, and the demand to adopt the benefits of wellness-based beauty regimens often bundled alongside anti-aging skincare, have heightened consumer consumption among various levels of consumers.

- The level of innovation leadership is high, as significant businesses launch next-generation formulations including the use of natural actives, plant-based components, and clinically proven technologies. For instance, in April 2024, Kintor Pharmaceutical took a significant step in the region in advancing their topical hair-regrowth candidate GT-20029 to Phase 3 clinical trials in China, which is a milestone in treating androgenetic alopecia in the region.

- Asia-Pacific is emerging as a hub for industry expansion and innovation, driven by venture capital investments, internet marketing, and growing consumer adoption of innovative hair health products.

- In July 2025, Sun Pharmaceutical Industries introduced LEQSELVI (deuruxolitinib) 8 mg tablets in the U.S. in adults with severe Alopecia Areata, which would be a major addition to its dermatology product line. The therapy showed rapid hair-growth in clinical trials and fills a large unmet need in the treatment of the condition, namely the autoimmune hair-loss disorder.

- In May 2024, Researchers at Massachusetts Institute of Technology and collaborators created a microneedle patch that injects the scalp with immune-regulating molecules to retrain T cells, fixing hair loss caused by the autoimmune disease Alopecia areata.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Avalon Natural Products

- Bayer AG

- Pfizer Inc

- Cipla Limited

- DS Healthcare Group

- Phyto Ales Group

- Henkel AG & Co.

- Johnson & Johnson

- Kao Corporation

- Kerastase (L'Oréal)

- L'Oréal S.A.

- Merck & Co.

- Nioxin (Wella/Coty)

- Costco Wholesale (Kirkland Signature).

- GlaxoSmithKline (GSK)

- Procter & Gamble (P&G)

- Shiseido Company

- Sun Pharmaceutical Industries

- Taisho Pharmaceutical Holdings

- Unilever

- Other Key Players

- Medicated Hair Regrowth Products

- Prescription-based Products

- Over-the-Counter (OTC) Products

- Others

- Non-Medicated Hair Regrowth Products

- Natural/Herbal Products

- Cosmetic Products

- Others

- Minoxidil-based Products

- 2% Minoxidil

- 5% Minoxidil

- 10% Minoxidil

- Finasteride-based Products

- Dutasteride-based Products

- Natural/Herbal Ingredients

- Saw Palmetto

- Biotin

- Caffeine

- Ketoconazole

- Rosemary Oil

- Pumpkin Seed Extract

- Others

- Peptide-based Products

- Stem Cell-based Products

- Platelet-Rich Plasma (PRP) Related Products

- Topical Solutions

- Liquid Solutions

- Foam Solutions

- Shampoos

- Conditioners

- Serums

- Oils

- Tablets/Capsules (Oral)

- Sprays

- Others

- Androgenetic Alopecia

- Alopecia Areata

- Telogen Effluvium

- Traction Alopecia

- Anagen Effluvium

- Cicatricial Alopecia

- Trichotillomania

- General Hair Thinning

- Male

- Young Adults (18-30 years)

- Middle-aged (31-50 years)

- Senior (51+ years)

- Female

- Young Adults (18-30 years)

- Middle-aged (31-50 years)

- Senior (51+ years)

- Unisex Products

- Online Channels

- E-commerce Platforms

- Company Websites

- Online Pharmacies

- Others

- Offline Channels

- Hospital Pharmacies

- Retail Pharmacies

- Supermarkets/Hypermarkets

- Dermatology Clinics

- Others

- DHT (Dihydrotestosterone) Blockers

- Blood Flow Stimulators

- Hair Follicle Activators

- Anti-inflammatory Products

- Nutritional Supplements

- Hormonal Regulators

- Growth Factor Stimulators

- Others

- Individual Consumers

- Men with Male Pattern Baldness

- Women with Female Pattern Hair Loss

- Post-pregnancy Women

- Chemotherapy Patients

- Aging Population

- Athletes/Fitness Enthusiasts

- Others

- Dermatology Clinics

- Hair Transplant Clinics

- Trichology Centers

- Beauty Salons & Spas

- Hospitals

- Other End-users

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Medicated & Non-Medicated Hair Regrowth Products Market Outlook

- 2.1.1. Medicated & Non-Medicated Hair Regrowth Products Market Size Volume (Thousand Units) and Value (US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Medicated & Non-Medicated Hair Regrowth Products Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising prevalence of hair loss due to stress, aging, and lifestyle factors.

- 4.1.1.2. Increasing consumer awareness of scalp health and treatment options.

- 4.1.1.3. Expanding availability of advanced formulations and OTC products.

- 4.1.2. Restraints

- 4.1.2.1. High cost and side effects of medicated solutions.

- 4.1.2.2. Limited efficacy perception of non-medicated products.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Manufacturing

- 4.4.3. Distribution

- 4.4.4. End-Use

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Medicated & Non-Medicated Hair Regrowth Products Market Demand

- 4.9.1. Historical Market Size – Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Medicated & Non-Medicated Hair Regrowth Products Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Medicated & Non-Medicated Hair Regrowth Products Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Medicated Hair Regrowth Products

- 6.2.1.1. Prescription-based Products

- 6.2.1.2. Over-the-Counter (OTC) Products

- 6.2.1.3. Others

- 6.2.2. Non-Medicated Hair Regrowth Products

- 6.2.2.1. Natural/Herbal Products

- 6.2.2.2. Cosmetic Products

- 6.2.2.3. Others

- 6.2.1. Medicated Hair Regrowth Products

- 7. Global Medicated & Non-Medicated Hair Regrowth Products Market Analysis, by Active Ingredient/Formulation

- 7.1. Key Segment Analysis

- 7.2. Medicated & Non-Medicated Hair Regrowth Products Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, by Active Ingredient/Formulation, 2021-2035

- 7.2.1. Minoxidil-based Products

- 7.2.1.1. 2% Minoxidil

- 7.2.1.2. 5% Minoxidil

- 7.2.1.3. 10% Minoxidil

- 7.2.2. Finasteride-based Products

- 7.2.2.1. Dutasteride-based Products

- 7.2.2.2. Natural/Herbal Ingredients

- 7.2.2.3. Saw Palmetto

- 7.2.2.4. Biotin

- 7.2.2.5. Caffeine

- 7.2.2.6. Ketoconazole

- 7.2.2.7. Rosemary Oil

- 7.2.2.8. Pumpkin Seed Extract

- 7.2.2.9. Others

- 7.2.3. Peptide-based Products

- 7.2.4. Stem Cell-based Products

- 7.2.5. Platelet-Rich Plasma (PRP) Related Products

- 7.2.1. Minoxidil-based Products

- 8. Global Medicated & Non-Medicated Hair Regrowth Products Market Analysis, by Product Form

- 8.1. Key Segment Analysis

- 8.2. Medicated & Non-Medicated Hair Regrowth Products Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, by Product Form, 2021-2035

- 8.2.1. Topical Solutions

- 8.2.1.1. Liquid Solutions

- 8.2.1.2. Foam Solutions

- 8.2.2. Shampoos

- 8.2.3. Conditioners

- 8.2.4. Serums

- 8.2.5. Oils

- 8.2.6. Tablets/Capsules (Oral)

- 8.2.7. Sprays

- 8.2.8. Others

- 8.2.1. Topical Solutions

- 9. Global Medicated & Non-Medicated Hair Regrowth Products Market Analysis, by Hair Loss Type/Condition

- 9.1. Key Segment Analysis

- 9.2. Medicated & Non-Medicated Hair Regrowth Products Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, by Hair Loss Type/Condition, 2021-2035

- 9.2.1. Androgenetic Alopecia

- 9.2.2. Alopecia Areata

- 9.2.3. Telogen Effluvium

- 9.2.4. Traction Alopecia

- 9.2.5. Anagen Effluvium

- 9.2.6. Cicatricial Alopecia

- 9.2.7. Trichotillomania

- 9.2.8. General Hair Thinning

- 10. Global Medicated & Non-Medicated Hair Regrowth Products Market Analysis, by Gender

- 10.1. Key Segment Analysis

- 10.2. Medicated & Non-Medicated Hair Regrowth Products Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, by Gender, 2021-2035

- 10.2.1. Male

- 10.2.1.1. Young Adults (18-30 years)

- 10.2.1.2. Middle-aged (31-50 years)

- 10.2.1.3. Senior (51+ years)

- 10.2.2. Female

- 10.2.2.1. Young Adults (18-30 years)

- 10.2.2.2. Middle-aged (31-50 years)

- 10.2.2.3. Senior (51+ years)

- 10.2.3. Unisex Products

- 10.2.1. Male

- 11. Global Medicated & Non-Medicated Hair Regrowth Products Market Analysis, by Distribution Channel

- 11.1. Key Segment Analysis

- 11.2. Medicated & Non-Medicated Hair Regrowth Products Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 11.2.1. Online Channels

- 11.2.1.1. E-commerce Platforms

- 11.2.1.2. Company Websites

- 11.2.1.3. Online Pharmacies

- 11.2.1.4. Others

- 11.2.2. Offline Channels

- 11.2.2.1. Hospital Pharmacies

- 11.2.2.2. Retail Pharmacies

- 11.2.2.3. Supermarkets/Hypermarkets

- 11.2.2.4. Dermatology Clinics

- 11.2.2.5. Others

- 11.2.1. Online Channels

- 12. Global Medicated & Non-Medicated Hair Regrowth Products Market Analysis, by Technology/Mechanism

- 12.1. Key Segment Analysis

- 12.2. Medicated & Non-Medicated Hair Regrowth Products Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, by Technology/Mechanism, 2021-2035

- 12.2.1. DHT (Dihydrotestosterone) Blockers

- 12.2.2. Blood Flow Stimulators

- 12.2.3. Hair Follicle Activators

- 12.2.4. Anti-inflammatory Products

- 12.2.5. Nutritional Supplements

- 12.2.6. Hormonal Regulators

- 12.2.7. Growth Factor Stimulators

- 12.2.8. Others

- 13. Global Medicated & Non-Medicated Hair Regrowth Products Market Analysis, by End-Users

- 13.1. Key Segment Analysis

- 13.2. Medicated & Non-Medicated Hair Regrowth Products Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, by End-Users, 2021-2035

- 13.2.1. Individual Consumers

- 13.2.1.1. Men with Male Pattern Baldness

- 13.2.1.2. Women with Female Pattern Hair Loss

- 13.2.1.3. Post-pregnancy Women

- 13.2.1.4. Chemotherapy Patients

- 13.2.1.5. Aging Population

- 13.2.1.6. Athletes/Fitness Enthusiasts

- 13.2.1.7. Others

- 13.2.2. Dermatology Clinics

- 13.2.3. Hair Transplant Clinics

- 13.2.4. Trichology Centers

- 13.2.5. Beauty Salons & Spas

- 13.2.6. Hospitals

- 13.2.7. Other End-users

- 13.2.1. Individual Consumers

- 14. Global Medicated & Non-Medicated Hair Regrowth Products Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Medicated & Non-Medicated Hair Regrowth Products Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Medicated & Non-Medicated Hair Regrowth Products Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Medicated & Non-Medicated Hair Regrowth Products Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Active Ingredient/Formulation

- 15.3.3. Product Form

- 15.3.4. Hair Loss Type/Condition

- 15.3.5. Gender

- 15.3.6. Distribution Channel

- 15.3.7. Technology/Mechanism

- 15.3.8. End-Users

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Medicated & Non-Medicated Hair Regrowth Products Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Active Ingredient/Formulation

- 15.4.4. Product Form

- 15.4.5. Hair Loss Type/Condition

- 15.4.6. Gender

- 15.4.7. Distribution Channel

- 15.4.8. Technology/Mechanism

- 15.4.9. End-Users

- 15.5. Canada Medicated & Non-Medicated Hair Regrowth Products Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Active Ingredient/Formulation

- 15.5.4. Product Form

- 15.5.5. Hair Loss Type/Condition

- 15.5.6. Gender

- 15.5.7. Distribution Channel

- 15.5.8. Technology/Mechanism

- 15.5.9. End-Users

- 15.6. Mexico Medicated & Non-Medicated Hair Regrowth Products Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Active Ingredient/Formulation

- 15.6.4. Product Form

- 15.6.5. Hair Loss Type/Condition

- 15.6.6. Gender

- 15.6.7. Distribution Channel

- 15.6.8. Technology/Mechanism

- 15.6.9. End-Users

- 16. Europe Medicated & Non-Medicated Hair Regrowth Products Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Medicated & Non-Medicated Hair Regrowth Products Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Active Ingredient/Formulation

- 16.3.3. Product Form

- 16.3.4. Hair Loss Type/Condition

- 16.3.5. Gender

- 16.3.6. Distribution Channel

- 16.3.7. Technology/Mechanism

- 16.3.8. End-Users

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Medicated & Non-Medicated Hair Regrowth Products Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Active Ingredient/Formulation

- 16.4.4. Product Form

- 16.4.5. Hair Loss Type/Condition

- 16.4.6. Gender

- 16.4.7. Distribution Channel

- 16.4.8. Technology/Mechanism

- 16.4.9. End-Users

- 16.5. United Kingdom Medicated & Non-Medicated Hair Regrowth Products Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Active Ingredient/Formulation

- 16.5.4. Product Form

- 16.5.5. Hair Loss Type/Condition

- 16.5.6. Gender

- 16.5.7. Distribution Channel

- 16.5.8. Technology/Mechanism

- 16.5.9. End-Users

- 16.6. France Medicated & Non-Medicated Hair Regrowth Products Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Active Ingredient/Formulation

- 16.6.4. Product Form

- 16.6.5. Hair Loss Type/Condition

- 16.6.6. Gender

- 16.6.7. Distribution Channel

- 16.6.8. Technology/Mechanism

- 16.6.9. End-Users

- 16.7. Italy Medicated & Non-Medicated Hair Regrowth Products Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Active Ingredient/Formulation

- 16.7.4. Product Form

- 16.7.5. Hair Loss Type/Condition

- 16.7.6. Gender

- 16.7.7. Distribution Channel

- 16.7.8. Technology/Mechanism

- 16.7.9. End-Users

- 16.8. Spain Medicated & Non-Medicated Hair Regrowth Products Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Active Ingredient/Formulation

- 16.8.4. Product Form

- 16.8.5. Hair Loss Type/Condition

- 16.8.6. Gender

- 16.8.7. Distribution Channel

- 16.8.8. Technology/Mechanism

- 16.8.9. End-Users

- 16.9. Netherlands Medicated & Non-Medicated Hair Regrowth Products Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Active Ingredient/Formulation

- 16.9.4. Product Form

- 16.9.5. Hair Loss Type/Condition

- 16.9.6. Gender

- 16.9.7. Distribution Channel

- 16.9.8. Technology/Mechanism

- 16.9.9. End-Users

- 16.10. Nordic Countries Medicated & Non-Medicated Hair Regrowth Products Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Active Ingredient/Formulation

- 16.10.4. Product Form

- 16.10.5. Hair Loss Type/Condition

- 16.10.6. Gender

- 16.10.7. Distribution Channel

- 16.10.8. Technology/Mechanism

- 16.10.9. End-Users

- 16.11. Poland Medicated & Non-Medicated Hair Regrowth Products Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Active Ingredient/Formulation

- 16.11.4. Product Form

- 16.11.5. Hair Loss Type/Condition

- 16.11.6. Gender

- 16.11.7. Distribution Channel

- 16.11.8. Technology/Mechanism

- 16.11.9. End-Users

- 16.12. Russia & CIS Medicated & Non-Medicated Hair Regrowth Products Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Active Ingredient/Formulation

- 16.12.4. Product Form

- 16.12.5. Hair Loss Type/Condition

- 16.12.6. Gender

- 16.12.7. Distribution Channel

- 16.12.8. Technology/Mechanism

- 16.12.9. End-Users

- 16.13. Rest of Europe Medicated & Non-Medicated Hair Regrowth Products Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Active Ingredient/Formulation

- 16.13.4. Product Form

- 16.13.5. Hair Loss Type/Condition

- 16.13.6. Gender

- 16.13.7. Distribution Channel

- 16.13.8. Technology/Mechanism

- 16.13.9. End-Users

- 17. Asia Pacific Medicated & Non-Medicated Hair Regrowth Products Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Asia Pacific Medicated & Non-Medicated Hair Regrowth Products Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Active Ingredient/Formulation

- 17.3.3. Product Form

- 17.3.4. Hair Loss Type/Condition

- 17.3.5. Gender

- 17.3.6. Distribution Channel

- 17.3.7. Technology/Mechanism

- 17.3.8. End-Users

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Medicated & Non-Medicated Hair Regrowth Products Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Active Ingredient/Formulation

- 17.4.4. Product Form

- 17.4.5. Hair Loss Type/Condition

- 17.4.6. Gender

- 17.4.7. Distribution Channel

- 17.4.8. Technology/Mechanism

- 17.4.9. End-Users

- 17.5. India Medicated & Non-Medicated Hair Regrowth Products Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Active Ingredient/Formulation

- 17.5.4. Product Form

- 17.5.5. Hair Loss Type/Condition

- 17.5.6. Gender

- 17.5.7. Distribution Channel

- 17.5.8. Technology/Mechanism

- 17.5.9. End-Users

- 17.6. Japan Medicated & Non-Medicated Hair Regrowth Products Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Active Ingredient/Formulation

- 17.6.4. Product Form

- 17.6.5. Hair Loss Type/Condition

- 17.6.6. Gender

- 17.6.7. Distribution Channel

- 17.6.8. Technology/Mechanism

- 17.6.9. End-Users

- 17.7. South Korea Medicated & Non-Medicated Hair Regrowth Products Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Active Ingredient/Formulation

- 17.7.4. Product Form

- 17.7.5. Hair Loss Type/Condition

- 17.7.6. Gender

- 17.7.7. Distribution Channel

- 17.7.8. Technology/Mechanism

- 17.7.9. End-Users

- 17.8. Australia and New Zealand Medicated & Non-Medicated Hair Regrowth Products Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Active Ingredient/Formulation

- 17.8.4. Product Form

- 17.8.5. Hair Loss Type/Condition

- 17.8.6. Gender

- 17.8.7. Distribution Channel

- 17.8.8. Technology/Mechanism

- 17.8.9. End-Users

- 17.9. Indonesia Medicated & Non-Medicated Hair Regrowth Products Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Product Type

- 17.9.3. Active Ingredient/Formulation

- 17.9.4. Product Form

- 17.9.5. Hair Loss Type/Condition

- 17.9.6. Gender

- 17.9.7. Distribution Channel

- 17.9.8. Technology/Mechanism

- 17.9.9. End-Users

- 17.10. Malaysia Medicated & Non-Medicated Hair Regrowth Products Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Product Type

- 17.10.3. Active Ingredient/Formulation

- 17.10.4. Product Form

- 17.10.5. Hair Loss Type/Condition

- 17.10.6. Gender

- 17.10.7. Distribution Channel

- 17.10.8. Technology/Mechanism

- 17.10.9. End-Users

- 17.11. Thailand Medicated & Non-Medicated Hair Regrowth Products Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Product Type

- 17.11.3. Active Ingredient/Formulation

- 17.11.4. Product Form

- 17.11.5. Hair Loss Type/Condition

- 17.11.6. Gender

- 17.11.7. Distribution Channel

- 17.11.8. Technology/Mechanism

- 17.11.9. End-Users

- 17.12. Vietnam Medicated & Non-Medicated Hair Regrowth Products Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Product Type

- 17.12.3. Active Ingredient/Formulation

- 17.12.4. Product Form

- 17.12.5. Hair Loss Type/Condition

- 17.12.6. Gender

- 17.12.7. Distribution Channel

- 17.12.8. Technology/Mechanism

- 17.12.9. End-Users

- 17.13. Rest of Asia Pacific Medicated & Non-Medicated Hair Regrowth Products Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Product Type

- 17.13.3. Active Ingredient/Formulation

- 17.13.4. Product Form

- 17.13.5. Hair Loss Type/Condition

- 17.13.6. Gender

- 17.13.7. Distribution Channel

- 17.13.8. Technology/Mechanism

- 17.13.9. End-Users

- 18. Middle East Medicated & Non-Medicated Hair Regrowth Products Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Medicated & Non-Medicated Hair Regrowth Products Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Active Ingredient/Formulation

- 18.3.3. Product Form

- 18.3.4. Hair Loss Type/Condition

- 18.3.5. Gender

- 18.3.6. Distribution Channel

- 18.3.7. Technology/Mechanism

- 18.3.8. End-Users

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Medicated & Non-Medicated Hair Regrowth Products Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Active Ingredient/Formulation

- 18.4.4. Product Form

- 18.4.5. Hair Loss Type/Condition

- 18.4.6. Gender

- 18.4.7. Distribution Channel

- 18.4.8. Technology/Mechanism

- 18.4.9. End-Users

- 18.5. UAE Medicated & Non-Medicated Hair Regrowth Products Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Active Ingredient/Formulation

- 18.5.4. Product Form

- 18.5.5. Hair Loss Type/Condition

- 18.5.6. Gender

- 18.5.7. Distribution Channel

- 18.5.8. Technology/Mechanism

- 18.5.9. End-Users

- 18.6. Saudi Arabia Medicated & Non-Medicated Hair Regrowth Products Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Active Ingredient/Formulation

- 18.6.4. Product Form

- 18.6.5. Hair Loss Type/Condition

- 18.6.6. Gender

- 18.6.7. Distribution Channel

- 18.6.8. Technology/Mechanism

- 18.6.9. End-Users

- 18.7. Israel Medicated & Non-Medicated Hair Regrowth Products Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Active Ingredient/Formulation

- 18.7.4. Product Form

- 18.7.5. Hair Loss Type/Condition

- 18.7.6. Gender

- 18.7.7. Distribution Channel

- 18.7.8. Technology/Mechanism

- 18.7.9. End-Users

- 18.8. Rest of Middle East Medicated & Non-Medicated Hair Regrowth Products Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Active Ingredient/Formulation

- 18.8.4. Product Form

- 18.8.5. Hair Loss Type/Condition

- 18.8.6. Gender

- 18.8.7. Distribution Channel

- 18.8.8. Technology/Mechanism

- 18.8.9. End-Users

- 19. Africa Medicated & Non-Medicated Hair Regrowth Products Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Medicated & Non-Medicated Hair Regrowth Products Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Active Ingredient/Formulation

- 19.3.3. Product Form

- 19.3.4. Hair Loss Type/Condition

- 19.3.5. Gender

- 19.3.6. Distribution Channel

- 19.3.7. Technology/Mechanism

- 19.3.8. End-Users

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Medicated & Non-Medicated Hair Regrowth Products Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Active Ingredient/Formulation

- 19.4.4. Product Form

- 19.4.5. Hair Loss Type/Condition

- 19.4.6. Gender

- 19.4.7. Distribution Channel

- 19.4.8. Technology/Mechanism

- 19.4.9. End-Users

- 19.5. Egypt Medicated & Non-Medicated Hair Regrowth Products Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Active Ingredient/Formulation

- 19.5.4. Product Form

- 19.5.5. Hair Loss Type/Condition

- 19.5.6. Gender

- 19.5.7. Distribution Channel

- 19.5.8. Technology/Mechanism

- 19.5.9. End-Users

- 19.6. Nigeria Medicated & Non-Medicated Hair Regrowth Products Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Active Ingredient/Formulation

- 19.6.4. Product Form

- 19.6.5. Hair Loss Type/Condition

- 19.6.6. Gender

- 19.6.7. Distribution Channel

- 19.6.8. Technology/Mechanism

- 19.6.9. End-Users

- 19.7. Algeria Medicated & Non-Medicated Hair Regrowth Products Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Active Ingredient/Formulation

- 19.7.4. Product Form

- 19.7.5. Hair Loss Type/Condition

- 19.7.6. Gender

- 19.7.7. Distribution Channel

- 19.7.8. Technology/Mechanism

- 19.7.9. End-Users

- 19.8. Rest of Africa Medicated & Non-Medicated Hair Regrowth Products Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Active Ingredient/Formulation

- 19.8.4. Product Form

- 19.8.5. Hair Loss Type/Condition

- 19.8.6. Gender

- 19.8.7. Distribution Channel

- 19.8.8. Technology/Mechanism

- 19.8.9. End-Users

- 20. South America Medicated & Non-Medicated Hair Regrowth Products Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. South America Medicated & Non-Medicated Hair Regrowth Products Market Size Volume (Thousand Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Active Ingredient/Formulation

- 20.3.3. Product Form

- 20.3.4. Hair Loss Type/Condition

- 20.3.5. Gender

- 20.3.6. Distribution Channel

- 20.3.7. Technology/Mechanism

- 20.3.8. End-Users

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Medicated & Non-Medicated Hair Regrowth Products Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Active Ingredient/Formulation

- 20.4.4. Product Form

- 20.4.5. Hair Loss Type/Condition

- 20.4.6. Gender

- 20.4.7. Distribution Channel

- 20.4.8. Technology/Mechanism

- 20.4.9. End-Users

- 20.5. Argentina Medicated & Non-Medicated Hair Regrowth Products Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Active Ingredient/Formulation

- 20.5.4. Product Form

- 20.5.5. Hair Loss Type/Condition

- 20.5.6. Gender

- 20.5.7. Distribution Channel

- 20.5.8. Technology/Mechanism

- 20.5.9. End-Users

- 20.6. Rest of South America Medicated & Non-Medicated Hair Regrowth Products Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Active Ingredient/Formulation

- 20.6.4. Product Form

- 20.6.5. Hair Loss Type/Condition

- 20.6.6. Gender

- 20.6.7. Distribution Channel

- 20.6.8. Technology/Mechanism

- 20.6.9. End-Users

- 21. Key Players/ Company Profile

- 21.1. Avalon Natural Products.

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Bayer AG

- 21.3. Cipla Limited

- 21.4. Costco Wholesale (Kirkland Signature)

- 21.5. DS Healthcare Group

- 21.6. GlaxoSmithKline (GSK)

- 21.7. Henkel AG & Co.

- 21.8. Johnson & Johnson

- 21.9. Kao Corporation

- 21.10. Kerastase (L'Oréal)

- 21.11. L'Oréal S.A.

- 21.12. Merck & Co.

- 21.13. Nioxin (Wella/Coty)

- 21.14. Pfizer Inc.

- 21.15. Phyto Ales Group

- 21.16. Procter & Gamble (P&G)

- 21.17. Shiseido Company

- 21.18. Sun Pharmaceutical Industries

- 21.19. Taisho Pharmaceutical Holdings

- 21.20. Unilever

- 21.21. Other Key Players

- 21.1. Avalon Natural Products.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Medicated & Non-Medicated Hair Regrowth Products Market by Product Type, Active Ingredient/Formulation, Product Form, Hair Loss Type/Condition, Gender, Distribution Channel, Technology/Mechanism, End-Users, and Geography

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Medicated & Non-Medicated Hair Regrowth Products Market Size, Share & Trends Analysis Report by Product Type (Medicated Hair Regrowth Products, Non-Medicated Hair Regrowth Products), Active Ingredient/Formulation, Product Form, Hair Loss Type/Condition, Gender, Distribution Channel, Technology/Mechanism, End-Users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Medicated & Non-Medicated Hair Regrowth Products Market Size, Share, and Growth

The global medicated & non-medicated hair regrowth products market is experiencing robust growth, with its estimated value of USD 4.7 billion in the year 2025 and USD 9.1 billion by the period 2035, registering a CAGR of 6.8%, during the forecast period. Increased awareness of health, loss of hair as a result of stress and demand of natural and clinically validated formulations lead to growth in the global medicated & non-medicated hair regrowth products market. Market adoption is further being driven by the increased adoption of retail, e-commerce and digital consultation channels.

Richard Ascroft, CEO of Sun Pharma North America, said,

"The launch of LEQSELVI in the U.S. brings an effective, new treatment option for severe alopecia areata to eligible patients and the healthcare providers who treat them. As a company committed to launching new therapeutic options which address the unmet needs of patients, adding LEQSELVI to our dermatology portfolio represents a key milestone for the business and an important advancement for the alopecia areata community."

The increase in the occurrence of androgenetic alopecia, along with the increasing consumer knowledge of the existing medication and non-medication hair growth products, is one of the major forces behind the medicated and non-medicated hair growth products market globally. The rising level of stress, unhealthy eating habits, and lifestyle-related aspects are also leading to earlier hair thinning and pattern baldness, especially in younger populaces. This diversification largely outside the conventional middle-aged consumer market is opening up a larger target market to both preventive and restorative care procedures, which is driving long-term growth prospects.

The market is additionally reinforced by the prevalence of the over-the-counter solutions that provide clinically proven results without prescriptions. Consumers are becoming more and more attracted to the idea of easily accessible treatments that can be easily incorporated into their daily lives and provide them with tangible benefits in terms of their hair density and scalp health. The effectiveness and convenience of these products has increased the rate of adoption that has promoted early intervention and lessened dependence on professional medical consultation as a form of initial intervention in case of hair loss.

Complementary and adjacent services, such as low-level laser therapy, platelet-rich plasma therapy, and nutraceuticals aimed at hair health services, are reinforcing the entire hair restoration ecosystem. Combination of such offerings will enable the use of individualized, multi-modal treatment methods that maximize effectiveness and consumer satisfaction. Through integrating pharmaceutical, cosmetic and technological solutions manufacturers can provide differentiated products, enhance adherence and maintain long term growth in the market among various types of consumers.

Medicated & Non-Medicated Hair Regrowth Products Market Dynamics and Trends

Driver: Rising Prevalence of Hair Loss Across Younger Demographics

Restraint: Limited Efficacy and Slow Visible Results

Opportunity: Personalized and Precision Hair Health Solutions

Key Trend: Natural and Plant-Based Ingredient Formulations

Medicated-and-Non-Medicated-Hair-Regrowth-Products-Market Analysis and Segmental Data

Topical Solutions Dominate Global Medicated & Non-Medicated Hair Regrowth Products Market

Asia Pacific Leads Global Medicated & Non-Medicated Hair Regrowth Products Market Demand

Medicated-and-Non-Medicated-Hair-Regrowth-Products-Market Ecosystem

The medicated and non-medicated hair regrowth products market is moderately consolidated with Tier 1 companies such as Johnson & Johnson, Merck and Co., Unilever, Pfizer Inc., and Sun Pharmaceutical Industries operating in the industry with strong research and development, developed distribution channels, and brand influence. Tier 2 competitors, such as Nutrafol, Hims and Hers, Keeps, Vegamour and Church and Dwight, vary by specialized positioning, direct to consumer model, and emphasis on natural ingredients, whereas Tier 3 includes the private-label manufacturers, regional brands, and up-and-coming biotech companies that are developing new treatments.

This value chain is active sourcing of pharmaceutical ingredients, development of new forms, testing of clinical efficacy, regulatory support, and distribution, through salons, pharmacies, and e-commerce through dermatology offices. Vertical integration and strategic alliances with dermatology KOLs and telehealth platforms are some of the strategies companies use to enhance credibility and consumer access.

The ongoing innovation in pharmaceutical and natural substitutes promotes differentiation in the efficacy, convenience and holistic wellness positioning. Firms are progressively contemplating fresh delivery forms, combination therapies as well as natural/plant-based actives in order to satisfy the growing consumer demand and increase use among the global markets.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 4.7 Bn |

|

Market Forecast Value in 2035 |

USD 9.1 Bn |

|

Growth Rate (CAGR) |

6.8% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Medicated-and-Non-Medicated-Hair-Regrowth-Products-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Medicated & Non-Medicated Hair Regrowth Products Market, By Product Type |

|

|

Medicated & Non-Medicated Hair Regrowth Products Market, By Active Ingredient/Formulation |

|

|

Medicated & Non-Medicated Hair Regrowth Products Market, By Product Form |

|

|

Medicated & Non-Medicated Hair Regrowth Products Market, By Hair Loss Type/Condition |

|

|

Medicated & Non-Medicated Hair Regrowth Products Market, Gender |

|

|

Medicated & Non-Medicated Hair Regrowth Products Market, By Distribution Channel |

|

|

Medicated & Non-Medicated Hair Regrowth Products Market, By Technology/Mechanism |

|

|

Medicated & Non-Medicated Hair Regrowth Products Market, By End-Users |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation