Outdoor Apparel Market Size, Share & Trends Analysis Report by Product Type (Jackets & Coats, Pants & Shorts, Base Layers, Mid Layers, Footwear, Accessories), Material Type, Technology/Feature, Consumer Demographics, Price Range, Distribution Channel, Season/Weather Condition, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Outdoor Apparel Market Size, Share, and Growth

The global outdoor apparel market is experiencing robust growth, with its estimated value of USD 61.7 billion in the year 2025 and USD 96.7 billion by the period 2035, registering a CAGR of 4.6%, during the forecast period. The outdoor apparel market is boosted by rising participation in outdoor activities like hiking and camping, a growing focus on health and wellness, and technological innovations in fabrics that offer enhanced performance.

Jonathan Lantz, president of La Sportiva North America said, “This season, we’re proud to introduce pieces such as the Olympus Tech Down Parka and the Alpine Guide GTX Jacket, which both highlight our commitment to innovation and environmental responsibility. These new pieces were designed to withstand the hostile conditions that alpinists face in high-altitude environments, providing athletes with the comfort, mobility, and protection they need to perform at their best.”

The global outdoor apparel market includes the technical apparel in hiking, camping, mountaineering, skiing and other recreation activities. The increasing adventure tourism, more outdoor activities and new performance fabrics in the insulation layers, waterproof outerwear, base layers, footwear and protective outerwear are growth drivers. For instance, in February 2024, La Sportiva has released its Fall 2024 apparel collection. The product of this new line is an integration of innovative products with the Italian brand approach to being environmentally responsible to offer products that will keep you warm, durable, and withstand harsh weather.

Additionally, the global outdoor apparel industry is reinforced by increased engagement in outdoor recreation and the mainstreaming of outdoor-inspired fashion. As the number of visits to national parks and other conservation areas with more than 8 billion visits to these locations each year, the desire to go hiking, camping, and touring nature has continued to generate demand of functional and performance-based gear depending on the environments and the level of activity. As an example, adidas TERREX and National Geographic will launch the fourth chapter of their partnership in July 2024 in the form of an impressive line of clothes aimed at the engagement of the fascinating charm of winter. These head-to-toe outfits are designed to discover the secrets of winter and the icy scenery, with graphics based on laden forests or frozen lakes and interpreted differently and applied in different locations on each piece.

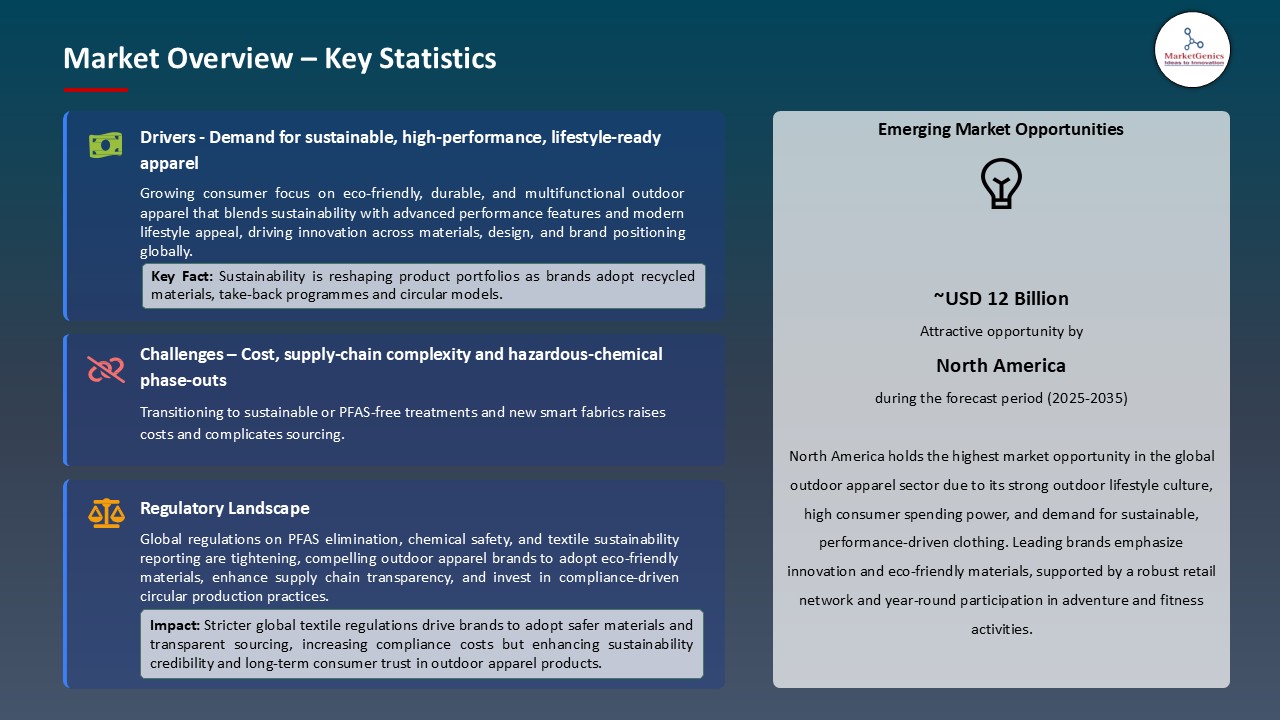

The regulatory framework in across major economies is empowering the outdoor apparel market globally through the promotion of sustainability, principles of a circular economy, and ethical production standards. Governments are enforcing policies to minimize textile wastes, limit the use of harmful chemicals and providing green materials by way of Extended Producer Responsibility (EPR), eco-labeling, and green certification schemes.

The key market opportunities of the global outdoor apparel market are wearable technology, camping and hiking equipment, outdoor footwear, sports nutrition and hydration products, and eco-friendly textile recycling solutions. These industries enjoy the advantage of identical consumers focusing on performance, sustainability, and countryside lifestyles.

Outdoor Apparel Market Dynamics and Trends

Driver: Adventure Tourism and Outdoor Recreation Participation Surging Globally Post-Pandemic

- The increase in adventure tourism activities is opening up the market of outdoor clothing and apparatus. The increasing popularity of such activities as trekking, mountaineering, kayaking, wildlife exploration, especially among the growing population of middle-income in China, India, and other developing high-performance economies, are creating new segments of demand with greater spending power and performance-based dispositions. As an example, in May 2024, Wildcraft signed a strategic partnership with Apparel Group to enter the Gulf Cooperation Council region in six countries, both through offline flagship stores and e-commerce. This growth provides improved market accessibility, greater visibility in its high-growth areas, and emphasizes alignment of the industry with the increasing demand of adventure tourism, leading to continual growth in revenues and ensuring competitiveness in performance-based markets.

- The development of the outdoor education and guided experience has opened up activities that used to be viewed as high-skill or high-equipment activities. Guiding agencies, outdoor education schools like NOLS and Outward Bound, and adventure tour operators are also opening the door to beginner visitors, encouraging them to become acquainted with technical equipment and transforming them into lifetime buyers of personal outdoor products.

Restraint: High-Performance Technical Gear Pricing Creating Accessibility Barriers for Entry-Level Participants

- The high cost of high-quality outdoor clothing promoted by high-quality material technologies, high durability, and brand equity is a constraint to the growth of the market. The high-performance products are still out of the financial reach of entry-level customers and price elastic markets, limiting the market penetration and adoption in the emerging economies. As an example, in 2024, Arc'teryx declared sustained double-digit revenue expansion due to its high-quality technical line, and flagship brands keep their prices high. This pricing, as it fortifies its luxury branding, highlights the price disparity between mass-market and luxury market consumers, especially in the developing world where discretionary spending power is less.

- Moreover, these higher price tags may turn away entry-level buyers, especially younger customers or those who want to buy the equipment to use by several users. Budget-friendly and fast-fashion brands offer cheaper alternatives, but because of the performance constraints, including less durability, worse weather resistance, and reduced breathability, they might have a negative impact on the user experience and discourage continued outdoor activity because of discomfort or safety concerns.

Opportunity: Sustainability Leadership Positioning Outdoor Brands as Environmental Responsibility Champions

- The outdoor apparel sector is offering tremendous potential in the global market as the outdoor apparel brands have a clear upper hand in pursuing sustainable fashion practices owing to their natural orientation to environmental stewardship and an environmentally conscious customer base. A combination of sustainable materials, ethical production, and circular business models helps companies to improve brand equity, appeal to environmentally-conscious consumers, and take advantage of the growing global trend of responsible performance apparel. In the example of September 2024, Patagonia is making another step in their environmental responsibilities by becoming a member of Pack4Good, a sustainable packaging program of Canopy, a solutions-driven non-profit organization focused on protecting forests, species, and climate.

- Additionally, recycled materials usage can offer an immediate route to the improved sustainability performance in the outdoor apparel industry. Dominating brands are also starting to use recycled polyester, nylon, and down to reduce use of virgin resources to maintain technical performance standards. This strategy, effective sustainability positioning is achieved, which supports a strong environmental leadership and justifies the portability of the circular material innovation in product portfolios. For instance, in July 2024, Royal Robbins has committed itself to environmental conservation. The focus on constant improvement is evident in the establishment and realization of targets on the use of lower-impact fibers in the brand.

Key Trend: Technical Innovation in Waterproof-Breathable Membranes Enhancing Comfort and Performance

- The waterproof-breathable fabric technology is a key market trend in the outdoor apparel market the technology has formed the basis of many outdoor apparel innovations, able to provide effective seclusion against external water, but allowing to transfer moisture vapor internally to enhance thermal comfort and insulation properties. As an example, in August 2024, Montane introduced PETRICHOR TECHNOLOGY, a 100% waterproof 3-layer fabric that provides the standard of Past-free protection to high-output outside activities. The development is indicative of the industry transition towards sustainable performance innovation and the increased functionality of products with a decreased environmental impact.

- Additionally, the market of outdoor apparel is rising because the technologies of fluorine-free durable water- repellent (DWR) are a significant step in sustainability because they are free of PFCs that do not leave the body. The major outdoor brands are switching to other chemistries that offer similar protection and life, which show that environmental accountability and elevated technical ability are achievable at the same time. For instance, in March 2024, Bolger and O'Hearn (B&O) created a PFAS-free DWR treatment with the ability to maintain high spray rates and durability through wash cycles to potentially eliminate the use of fluorinated DWR chemistries in textile finishing.

- Membrane technology has been advanced with stretchable waterproof products that provide the mobility and comfort, which are essential to high intensity activities like ski touring and alpine climbing.

Outdoor-Apparel-Market Analysis and Segmental Data

Jackets & Coats Dominate Global Outdoor Apparel Market

- Jackets & Coats dominate the global outdoor apparel market because of they enjoy high average prices and applicability across all activities and climates. The waterproof shells, insulated jackets, fleece mid-layers, and technical vest are of premium positioning because of high-level material, complicated construction, and necessary protection in the face of various weather conditions. As an example, in March 2025, Rab unveiled an extensive expansion to their well-known collection of Pertex Shield shell. Pertex Shield is a breathable, lightweight and packable breathable waterproof windproof fabric. It comes in 2, 2.5 and 3-layer construction according to the activity intensity and the ruggedness needed.

- Additionally, the market is expanding through sustained innovation in the outerwear technology in order to improve the safety, comfort, and performance of the users. The innovations in the waterproof membranes and insulation fabrics and ergonomic design improve functionality and brand value that affect the consumer demand in the wider category of outdoor apparel. As an example, in August 2025, ANTA, in collaboration with Donghua University, officially introduced a completely home-developed high-performance PFAS-FREE waterproof-breathable material AEROVENT ZERO, which marked the initial milestone in the history of the entire high-performance PFAS-FREE waterproof-breathable cloth sector.

North America Leads Global Outdoor Apparel Market Demand

- The North America region leads global outdoor apparel market because of the strong outdoor recreation culture and the consumer buying power in North America are the reasons why performance-based apparel is in demand on a regular basis and the retail ecosystem that is developed in the region supports acceptance of high-quality products. As an example, in March 2025, Columbia Sportswear introduced its waterproof fabric, called Omni-Tech Eco, which uses recycled coffee grounds and PFAS-free DWR, which indicated greater technical investment in brands that serve the premium outdoor market by major brands based in North America.

- Moreover, the innovation leadership and advanced brand infrastructure also make North America the center of technical innovation in the outdoor apparel industry, where the major players take advantage of R&D, sustainability platforms, and expansion of omnichannel retailing to support the market presence and impact on the worldwide product trends. As an example, in 2025, the North Face (USA) released its 2025 collection of the iconic Mountain Jacket, designed using a 100 percent recycled, waterproof, seam-sealed, mono-material structure and Mountain Jacket Gore-Tex to perform in the alps with waterproofing, pit zips, and alpine pockets.

Outdoor-Apparel-Market Ecosystem

The global outdoor apparel market is moderately fragmented, with high concentration among key players such as The North Face, Columbia Sportswear, Patagonia, Arc’teryx, and Jack Wolfskin, who dominate through product innovations, high brand equity and high retail and distribution networks. As an example, in October 2025, The North Face Introduced New Summit Series Advanced Mountain Kit. The Advanced Mountain Kit is the most technologically advanced system that the brand offers in the high alpine in fast and light pursuits.

The companies use their ability to invest in continuous research and development, the use of sustainable materials, and the growth of their digital channels to keep their market leadership. Their competitive differentiation and international presence is further supported by their strategic partnerships and athlete endorsement as well as their quick product turnover cycles that enhance their presence in the world of both high- and mass-market outdoor segments.

Recent Development and Strategic Overview:

- In February 2025, Columbia Sportswear declared an enhanced collaboration with Intuitive Machines to implement patented Omni-Heat insulation technologies to a lunar lander and all this to prove material performance and is driven by R&D credibility to bolster product innovation once again into outerwear lines of consumer products.

- In August 2024, Arc’teryx announced a partnership with robotics developer Skip to create the first powered assist pants with a reservation system in the world, which could be used in the alpines, marking innovation at the boundary of apparel and wearable assistive technology; expected deliveries in late-2025.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 61.7 Bn |

|

Market Forecast Value in 2035 |

USD 96.7 Bn |

|

Growth Rate (CAGR) |

4.6% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Units for Volume (Number of Units Sold) |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Outdoor-Apparel-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Outdoor Apparel Market, By Product Type |

|

|

Outdoor Apparel Market, By Material Type |

|

|

Outdoor Apparel Market, By Technology/Feature

|

|

|

Outdoor Apparel Market, By Consumer Demographics |

|

|

Outdoor Apparel Market, By Price Range

|

|

|

Outdoor Apparel Market, By Distribution Channel

|

|

|

Outdoor Apparel Market, By Season/Weather Condition |

|

|

Outdoor Apparel Market, By End-users |

|

Frequently Asked Questions

The global outdoor apparel market was valued at USD 61.7 Bn in 2025

The global outdoor apparel market industry is expected to grow at a CAGR of 4.6% from 2025 to 2035

The outdoor apparel market is driving due to rising participation in outdoor activities like hiking and camping, a growing focus on health and wellness, and technological innovations in fabrics that offer enhanced performance.

In terms of product type, jackets & coats is the segment accounted for the major share in 2025

North America is a more attractive region for vendors

Key players in the global outdoor apparel market include prominent companies such as Arc'teryx, Berghaus, Black Diamond Equipment, Columbia Sportswear, Fjällräven, Haglöfs, Helly Hansen, Jack Wolfskin, Mammut, Marmot, Merrell, Montane, Mountain Equipment, Mountain Hardwear, Norrøna, Outdoor Research, Patagonia, Rab, Salewa, Salomon, Sherpa Adventure Gear, The North Face, and Other Key Players

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Outdoor Apparel Market Outlook

- 2.1.1. Outdoor Apparel Market Size (Volume - Million Units [Number of Units Sold] and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Outdoor Apparel Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Outdoor Apparel Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Outdoor Apparel Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising participation in outdoor recreational and adventure activities

- 4.1.1.2. Growing consumer focus on health, fitness, and active lifestyles

- 4.1.1.3. Increasing demand for sustainable, high-performance, and weather-resistant fabrics cookers

- 4.1.2. Restraints

- 4.1.2.1. High product costs due to premium materials and advanced technology

- 4.1.2.2. Seasonal demand fluctuations affecting consistent sales

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Outdoor Apparel Manufacturers

- 4.4.3. Distributors/ Suppliers

- 4.4.4. End-users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Outdoor Apparel Market Demand

- 4.7.1. Historical Market Size - (Volume - Million Units [Number of Units Sold] and Value - US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - (Volume - Million Units [Number of Units Sold] and Value - US$ Bn), 2025–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Outdoor Apparel Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Outdoor Apparel Market Size (Volume - Million Units [Number of Units Sold] and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Jackets & Coats

- 6.2.1.1. Insulated Jackets

- 6.2.1.2. Shell Jackets

- 6.2.1.3. Softshell Jackets

- 6.2.1.4. Fleece Jackets

- 6.2.1.5. Parkas

- 6.2.1.6. Others

- 6.2.2. Pants & Shorts

- 6.2.2.1. Hiking Pants

- 6.2.2.2. Climbing Pants

- 6.2.2.3. Rain Pants

- 6.2.2.4. Convertible Pants

- 6.2.2.5. Trail Shorts

- 6.2.2.6. Others

- 6.2.3. Base Layers

- 6.2.3.1. Thermal Underwear

- 6.2.3.2. Compression Wear

- 6.2.3.3. Moisture-Wicking Shirts

- 6.2.3.4. Others

- 6.2.4. Mid Layers

- 6.2.4.1. Fleece Pullovers

- 6.2.4.2. Insulated Vests

- 6.2.4.3. Synthetic Insulation

- 6.2.4.4. Others

- 6.2.5. Footwear

- 6.2.5.1. Hiking Boots

- 6.2.5.2. Trail Running Shoes

- 6.2.5.3. Climbing Shoes

- 6.2.5.4. Waterproof Boots

- 6.2.5.5. Others

- 6.2.6. Accessories

- 6.2.6.1. Gloves & Mittens

- 6.2.6.2. Hats & Beanies

- 6.2.6.3. Scarves & Neck Gaiters

- 6.2.6.4. Socks

- 6.2.6.5. Others

- 6.2.1. Jackets & Coats

- 7. Global Outdoor Apparel Market Analysis, by Material Type

- 7.1. Key Segment Analysis

- 7.2. Outdoor Apparel Market Size (Volume - Million Units [Number of Units Sold] and Value - US$ Bn), Analysis, and Forecasts, by Material Type, 2021-2035

- 7.2.1. Synthetic Materials

- 7.2.1.1. Polyester

- 7.2.1.2. Nylon

- 7.2.1.3. Polypropylene

- 7.2.1.4. Spandex/Elastane

- 7.2.1.5. Others

- 7.2.2. Natural Materials

- 7.2.2.1. Merino Wool

- 7.2.2.2. Cotton Blends

- 7.2.2.3. Down (Duck/Goose)

- 7.2.2.4. Silk

- 7.2.2.5. Others

- 7.2.3. Hybrid/Blended Materials

- 7.2.3.1. Sustainable/Recycled Materials

- 7.2.3.2. Recycled Polyester

- 7.2.3.3. Organic Cotton

- 7.2.3.4. Recycled Nylon

- 7.2.3.5. Others

- 7.2.1. Synthetic Materials

- 8. Global Outdoor Apparel Market Analysis and Forecasts, by Technology/Feature

- 8.1. Key Findings

- 8.2. Outdoor Apparel Market Size (Volume - Million Units [Number of Units Sold] and Value - US$ Bn), Analysis, and Forecasts, by Technology/Feature, 2021-2035

- 8.2.1. Waterproof/Water-Resistant

- 8.2.1.1. Gore-Tex

- 8.2.1.2. eVent

- 8.2.1.3. Proprietary Membranes

- 8.2.1.4. Others

- 8.2.2. Breathable

- 8.2.2.1. Insulated

- 8.2.2.2. Down Insulation

- 8.2.2.3. Synthetic Insulation

- 8.2.2.4. Others

- 8.2.3. UV Protection

- 8.2.3.1. Moisture-Wicking

- 8.2.3.2. Windproof

- 8.2.3.3. Stretch/Flexibility

- 8.2.3.4. Antimicrobial/Odor Control

- 8.2.3.5. Quick-Dry

- 8.2.3.6. Others

- 8.2.1. Waterproof/Water-Resistant

- 9. Global Outdoor Apparel Market Analysis and Forecasts, by Consumer Demographics

- 9.1. Key Findings

- 9.2. Outdoor Apparel Market Size (Volume - Million Units [Number of Units Sold] and Value - US$ Bn), Analysis, and Forecasts, by Consumer Demographics, 2021-2035

- 9.2.1. Men's Apparel

- 9.2.2. Women's Apparel

- 9.2.3. Unisex Apparel

- 9.2.4. Children's Apparel

- 9.2.4.1. Boys

- 9.2.4.2. Girls

- 9.2.4.3. Toddlers

- 10. Global Outdoor Apparel Market Analysis and Forecasts, by Price Range

- 10.1. Key Findings

- 10.2. Outdoor Apparel Market Size (Volume - Million Units [Number of Units Sold] and Value - US$ Bn), Analysis, and Forecasts, by Price Range, 2021-2035

- 10.2.1. Budget/Economy

- 10.2.2. Mid-Range

- 10.2.3. Premium

- 10.2.4. Luxury/High-End

- 11. Global Outdoor Apparel Market Analysis and Forecasts, by Distribution Channel

- 11.1. Key Findings

- 11.2. Outdoor Apparel Market Size (Volume - Million Units [Number of Units Sold] and Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 11.2.1. Online

- 11.2.1.1. Brand Websites

- 11.2.1.2. E-commerce Marketplaces

- 11.2.1.3. Online Specialty Retailers

- 11.2.1.4. Others

- 11.2.2. Offline

- 11.2.2.1. Specialty Outdoor Stores

- 11.2.2.2. Sporting Goods Stores

- 11.2.2.3. Department Stores

- 11.2.2.4. Brand Retail Stores

- 11.2.2.5. Discount Stores

- 11.2.2.6. Warehouse Clubs

- 11.2.2.7. Others

- 11.2.1. Online

- 12. Global Outdoor Apparel Market Analysis and Forecasts, by Season/Weather Condition

- 12.1. Key Findings

- 12.2. Outdoor Apparel Market Size (Volume - Million Units [Number of Units Sold] and Value - US$ Bn), Analysis, and Forecasts, by Season/Weather Condition, 2021-2035

- 12.2.1. Summer/Warm Weather

- 12.2.2. Winter/Cold Weather

- 12.2.3. All-Season

- 12.2.4. Transitional (Spring/Fall)

- 13. Global Outdoor Apparel Market Analysis and Forecasts, by End-Users

- 13.1. Key Findings

- 13.2. Outdoor Apparel Market Size (Volume - Million Units [Number of Units Sold] and Value - US$ Bn), Analysis, and Forecasts, by End-Users, 2021-2035

- 13.2.1. Professional/Commercial Users

- 13.2.1.1. Mountain Guides & Expedition Leaders

- 13.2.1.2. Search & Rescue Teams

- 13.2.1.3. Outdoor Instructors & Educators

- 13.2.1.4. Wildlife Photographers

- 13.2.1.5. Forest Rangers & Park Service

- 13.2.1.6. Military & Defense Personnel

- 13.2.1.7. Others

- 13.2.2. Recreational/Amateur Users

- 13.2.2.1. Weekend Hikers

- 13.2.2.2. Casual Campers

- 13.2.2.3. Adventure Tourists

- 13.2.2.4. Fitness Enthusiasts

- 13.2.2.5. Family Outdoor Participants

- 13.2.2.6. Others

- 13.2.1. Professional/Commercial Users

- 14. Global Outdoor Apparel Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Outdoor Apparel Market Size (Volume - Million Units [Number of Units Sold] and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Outdoor Apparel Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Outdoor Apparel Market Size (Volume - Million Units [Number of Units Sold] and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Material Type

- 15.3.3. Technology/Feature

- 15.3.4. Consumer Demographics

- 15.3.5. Price Range

- 15.3.6. Distribution Channel

- 15.3.7. Season/Weather Condition

- 15.3.8. End-users

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Outdoor Apparel Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Material Type

- 15.4.4. Technology/Feature

- 15.4.5. Consumer Demographics

- 15.4.6. Price Range

- 15.4.7. Distribution Channel

- 15.4.8. Season/Weather Condition

- 15.4.9. End-users

- 15.5. Canada Outdoor Apparel Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Material Type

- 15.5.4. Technology/Feature

- 15.5.5. Consumer Demographics

- 15.5.6. Price Range

- 15.5.7. Distribution Channel

- 15.5.8. Season/Weather Condition

- 15.5.9. End-users

- 15.6. Mexico Outdoor Apparel Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Material Type

- 15.6.4. Technology/Feature

- 15.6.5. Consumer Demographics

- 15.6.6. Price Range

- 15.6.7. Distribution Channel

- 15.6.8. Season/Weather Condition

- 15.6.9. End-users

- 16. Europe Outdoor Apparel Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Outdoor Apparel Market Size (Volume - Million Units [Number of Units Sold] and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Material Type

- 16.3.3. Technology/Feature

- 16.3.4. Consumer Demographics

- 16.3.5. Price Range

- 16.3.6. Distribution Channel

- 16.3.7. Season/Weather Condition

- 16.3.8. End-users

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Outdoor Apparel Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Material Type

- 16.4.4. Technology/Feature

- 16.4.5. Consumer Demographics

- 16.4.6. Price Range

- 16.4.7. Distribution Channel

- 16.4.8. Season/Weather Condition

- 16.4.9. End-users

- 16.5. United Kingdom Outdoor Apparel Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Material Type

- 16.5.4. Technology/Feature

- 16.5.5. Consumer Demographics

- 16.5.6. Price Range

- 16.5.7. Distribution Channel

- 16.5.8. Season/Weather Condition

- 16.5.9. End-users

- 16.6. France Outdoor Apparel Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Material Type

- 16.6.4. Technology/Feature

- 16.6.5. Consumer Demographics

- 16.6.6. Price Range

- 16.6.7. Distribution Channel

- 16.6.8. Season/Weather Condition

- 16.6.9. End-users

- 16.7. Italy Outdoor Apparel Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Material Type

- 16.7.4. Technology/Feature

- 16.7.5. Consumer Demographics

- 16.7.6. Price Range

- 16.7.7. Distribution Channel

- 16.7.8. Season/Weather Condition

- 16.7.9. End-users

- 16.8. Spain Outdoor Apparel Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Material Type

- 16.8.4. Technology/Feature

- 16.8.5. Consumer Demographics

- 16.8.6. Price Range

- 16.8.7. Distribution Channel

- 16.8.8. Season/Weather Condition

- 16.8.9. End-users

- 16.9. Netherlands Outdoor Apparel Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Material Type

- 16.9.4. Technology/Feature

- 16.9.5. Consumer Demographics

- 16.9.6. Price Range

- 16.9.7. Distribution Channel

- 16.9.8. Season/Weather Condition

- 16.9.9. End-users

- 16.10. Nordic Countries Outdoor Apparel Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Material Type

- 16.10.4. Technology/Feature

- 16.10.5. Consumer Demographics

- 16.10.6. Price Range

- 16.10.7. Distribution Channel

- 16.10.8. Season/Weather Condition

- 16.10.9. End-users

- 16.11. Poland Outdoor Apparel Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Material Type

- 16.11.4. Technology/Feature

- 16.11.5. Consumer Demographics

- 16.11.6. Price Range

- 16.11.7. Distribution Channel

- 16.11.8. Season/Weather Condition

- 16.11.9. End-users

- 16.12. Russia & CIS Outdoor Apparel Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Material Type

- 16.12.4. Technology/Feature

- 16.12.5. Consumer Demographics

- 16.12.6. Price Range

- 16.12.7. Distribution Channel

- 16.12.8. Season/Weather Condition

- 16.12.9. End-users

- 16.13. Rest of Europe Outdoor Apparel Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Material Type

- 16.13.4. Technology/Feature

- 16.13.5. Consumer Demographics

- 16.13.6. Price Range

- 16.13.7. Distribution Channel

- 16.13.8. Season/Weather Condition

- 16.13.9. End-users

- 17. Asia Pacific Outdoor Apparel Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. East Asia Outdoor Apparel Market Size (Volume - Million Units [Number of Units Sold] and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Material Type

- 17.3.3. Technology/Feature

- 17.3.4. Consumer Demographics

- 17.3.5. Price Range

- 17.3.6. Distribution Channel

- 17.3.7. Season/Weather Condition

- 17.3.8. End-users

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Outdoor Apparel Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Material Type

- 17.4.4. Technology/Feature

- 17.4.5. Consumer Demographics

- 17.4.6. Price Range

- 17.4.7. Distribution Channel

- 17.4.8. Season/Weather Condition

- 17.4.9. End-users

- 17.5. India Outdoor Apparel Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Material Type

- 17.5.4. Technology/Feature

- 17.5.5. Consumer Demographics

- 17.5.6. Price Range

- 17.5.7. Distribution Channel

- 17.5.8. Season/Weather Condition

- 17.5.9. End-users

- 17.6. Japan Outdoor Apparel Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Material Type

- 17.6.4. Technology/Feature

- 17.6.5. Consumer Demographics

- 17.6.6. Price Range

- 17.6.7. Distribution Channel

- 17.6.8. Season/Weather Condition

- 17.6.9. End-users

- 17.7. South Korea Outdoor Apparel Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Material Type

- 17.7.4. Technology/Feature

- 17.7.5. Consumer Demographics

- 17.7.6. Price Range

- 17.7.7. Distribution Channel

- 17.7.8. Season/Weather Condition

- 17.7.9. End-users

- 17.8. Australia and New Zealand Outdoor Apparel Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Material Type

- 17.8.4. Technology/Feature

- 17.8.5. Consumer Demographics

- 17.8.6. Price Range

- 17.8.7. Distribution Channel

- 17.8.8. Season/Weather Condition

- 17.8.9. End-users

- 17.9. Indonesia Outdoor Apparel Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Product Type

- 17.9.3. Material Type

- 17.9.4. Technology/Feature

- 17.9.5. Consumer Demographics

- 17.9.6. Price Range

- 17.9.7. Distribution Channel

- 17.9.8. Season/Weather Condition

- 17.9.9. End-users

- 17.10. Malaysia Outdoor Apparel Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Product Type

- 17.10.3. Material Type

- 17.10.4. Technology/Feature

- 17.10.5. Consumer Demographics

- 17.10.6. Price Range

- 17.10.7. Distribution Channel

- 17.10.8. Season/Weather Condition

- 17.10.9. End-users

- 17.11. Thailand Outdoor Apparel Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Product Type

- 17.11.3. Material Type

- 17.11.4. Technology/Feature

- 17.11.5. Consumer Demographics

- 17.11.6. Price Range

- 17.11.7. Distribution Channel

- 17.11.8. Season/Weather Condition

- 17.11.9. End-users

- 17.12. Vietnam Outdoor Apparel Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Product Type

- 17.12.3. Material Type

- 17.12.4. Technology/Feature

- 17.12.5. Consumer Demographics

- 17.12.6. Price Range

- 17.12.7. Distribution Channel

- 17.12.8. Season/Weather Condition

- 17.12.9. End-users

- 17.13. Rest of Asia Pacific Outdoor Apparel Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Product Type

- 17.13.3. Material Type

- 17.13.4. Technology/Feature

- 17.13.5. Consumer Demographics

- 17.13.6. Price Range

- 17.13.7. Distribution Channel

- 17.13.8. Season/Weather Condition

- 17.13.9. End-users

- 18. Middle East Outdoor Apparel Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Outdoor Apparel Market Size (Volume - Million Units [Number of Units Sold] and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Material Type

- 18.3.3. Technology/Feature

- 18.3.4. Consumer Demographics

- 18.3.5. Price Range

- 18.3.6. Distribution Channel

- 18.3.7. Season/Weather Condition

- 18.3.8. End-users

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Outdoor Apparel Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Material Type

- 18.4.4. Technology/Feature

- 18.4.5. Consumer Demographics

- 18.4.6. Price Range

- 18.4.7. Distribution Channel

- 18.4.8. Season/Weather Condition

- 18.4.9. End-users

- 18.5. UAE Outdoor Apparel Market

- 18.5.1. Product Type

- 18.5.2. Material Type

- 18.5.3. Technology/Feature

- 18.5.4. Consumer Demographics

- 18.5.5. Price Range

- 18.5.6. Distribution Channel

- 18.5.7. Season/Weather Condition

- 18.5.8. End-users

- 18.6. Saudi Arabia Outdoor Apparel Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Material Type

- 18.6.4. Technology/Feature

- 18.6.5. Consumer Demographics

- 18.6.6. Price Range

- 18.6.7. Distribution Channel

- 18.6.8. Season/Weather Condition

- 18.6.9. End-users

- 18.7. Israel Outdoor Apparel Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Material Type

- 18.7.4. Technology/Feature

- 18.7.5. Consumer Demographics

- 18.7.6. Price Range

- 18.7.7. Distribution Channel

- 18.7.8. Season/Weather Condition

- 18.7.9. End-users

- 18.8. Rest of Middle East Outdoor Apparel Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Material Type

- 18.8.4. Technology/Feature

- 18.8.5. Consumer Demographics

- 18.8.6. Price Range

- 18.8.7. Distribution Channel

- 18.8.8. Season/Weather Condition

- 18.8.9. End-users

- 19. Africa Outdoor Apparel Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Outdoor Apparel Market Size (Volume - Million Units [Number of Units Sold] and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Material Type

- 19.3.3. Technology/Feature

- 19.3.4. Consumer Demographics

- 19.3.5. Price Range

- 19.3.6. Distribution Channel

- 19.3.7. Season/Weather Condition

- 19.3.8. End-users

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Outdoor Apparel Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Material Type

- 19.4.4. Technology/Feature

- 19.4.5. Consumer Demographics

- 19.4.6. Price Range

- 19.4.7. Distribution Channel

- 19.4.8. Season/Weather Condition

- 19.4.9. End-users

- 19.5. Egypt Outdoor Apparel Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Material Type

- 19.5.4. Technology/Feature

- 19.5.5. Consumer Demographics

- 19.5.6. Price Range

- 19.5.7. Distribution Channel

- 19.5.8. Season/Weather Condition

- 19.5.9. End-users

- 19.6. Nigeria Outdoor Apparel Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Material Type

- 19.6.4. Technology/Feature

- 19.6.5. Consumer Demographics

- 19.6.6. Price Range

- 19.6.7. Distribution Channel

- 19.6.8. Season/Weather Condition

- 19.6.9. End-users

- 19.7. Algeria Outdoor Apparel Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Material Type

- 19.7.4. Technology/Feature

- 19.7.5. Consumer Demographics

- 19.7.6. Price Range

- 19.7.7. Distribution Channel

- 19.7.8. Season/Weather Condition

- 19.7.9. End-users

- 19.8. Rest of Africa Outdoor Apparel Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Material Type

- 19.8.4. Technology/Feature

- 19.8.5. Consumer Demographics

- 19.8.6. Price Range

- 19.8.7. Distribution Channel

- 19.8.8. Season/Weather Condition

- 19.8.9. End-users

- 20. South America Outdoor Apparel Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Central and South Africa Outdoor Apparel Market Size (Volume - Million Units [Number of Units Sold] and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Material Type

- 20.3.3. Technology/Feature

- 20.3.4. Consumer Demographics

- 20.3.5. Price Range

- 20.3.6. Distribution Channel

- 20.3.7. Season/Weather Condition

- 20.3.8. End-users

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Outdoor Apparel Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Material Type

- 20.4.4. Technology/Feature

- 20.4.5. Consumer Demographics

- 20.4.6. Price Range

- 20.4.7. Distribution Channel

- 20.4.8. Season/Weather Condition

- 20.4.9. End-users

- 20.5. Argentina Outdoor Apparel Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Material Type

- 20.5.4. Technology/Feature

- 20.5.5. Consumer Demographics

- 20.5.6. Price Range

- 20.5.7. Distribution Channel

- 20.5.8. Season/Weather Condition

- 20.5.9. End-users

- 20.6. Rest of South America Outdoor Apparel Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Material Type

- 20.6.4. Technology/Feature

- 20.6.5. Consumer Demographics

- 20.6.6. Price Range

- 20.6.7. Distribution Channel

- 20.6.8. Season/Weather Condition

- 20.6.9. End-users

- 21. Key Players/ Company Profile

- 21.1. Arc'teryx

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Berghaus

- 21.3. Black Diamond Equipment

- 21.4. Columbia Sportswear

- 21.5. Fjällräven

- 21.6. Haglöfs

- 21.7. Helly Hansen

- 21.8. Jack Wolfskin

- 21.9. Mammut

- 21.10. Marmot

- 21.11. Merrell

- 21.12. Montane

- 21.13. Mountain Equipment

- 21.14. Mountain Hardwear

- 21.15. Norrøna

- 21.16. Outdoor Research

- 21.17. Patagonia

- 21.18. Rab

- 21.19. Salewa

- 21.20. Salomon

- 21.21. Sherpa Adventure Gear

- 21.22. The North Face

- 21.23. Other Key Players

- 21.1. Arc'teryx

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data