Pregnancy Skincare Products Market Size, Share & Trends Analysis Report by Product Type (Face Care Products, Body Care Products, Belly Care Products, Breast Care Products, Specialized Treatment Products), Ingredient Type, Form Type, Distribution Channel, Packaging Type, Skin Concern/Function, End-users, Age Group, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Pregnancy Skincare Products Market Size, Share, and Growth

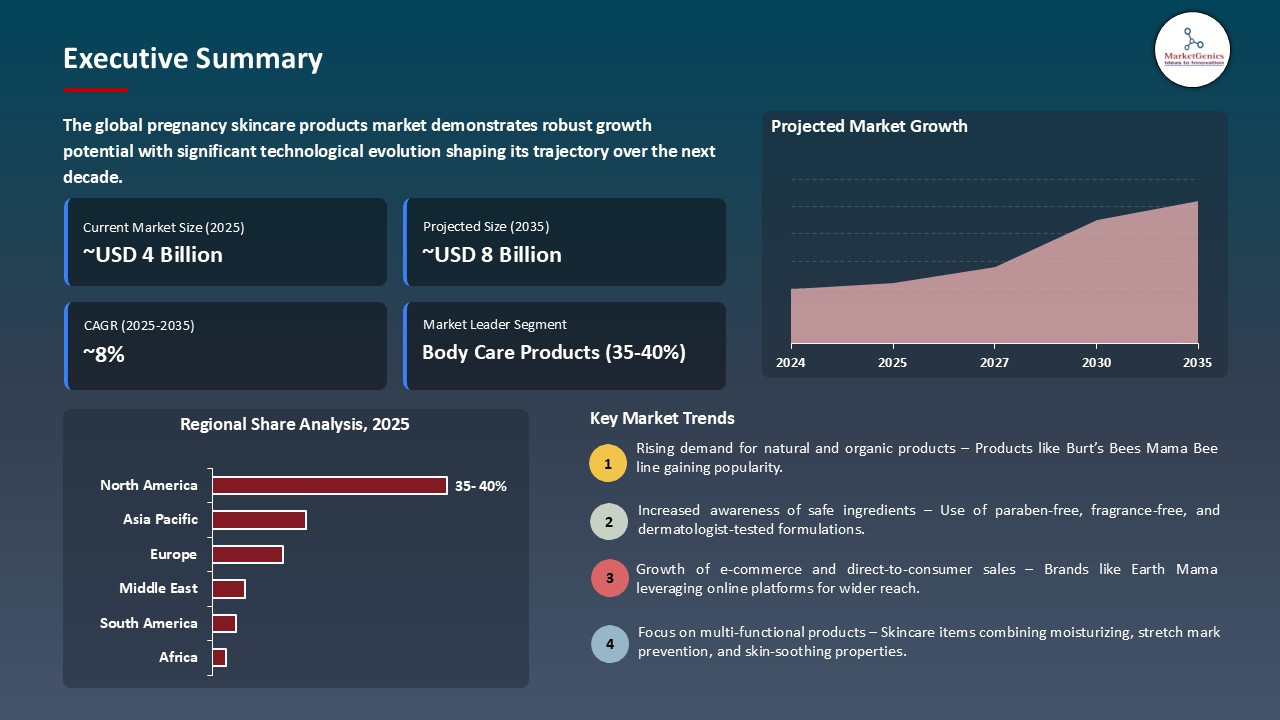

The global pregnancy skincare products market is experiencing robust growth, with its estimated value of USD 3.6 billion in the year 2025 and USD 8.1 billion by 2035, registering a CAGR of 8.4%, during the forecast period. The pregnancy skincare products market is expanding because women are becoming more concerned with the safety-certified, dermatologist-tested, and hormone-safe products that could address the stretch marks, dryness, and sensitivity. An increasing demand of clean, natural, and toxin-free foods is shifting the brands towards organic formulations and recyclable packaging. This trend is driving the need to have clinically proven, transparent, and eco-conscious pregnancy skincare products.

Katy Cottam, Founder of Luna Daily, said:

"With 67% of women feeling a loss of identity as they become mothers, and 72% of women feeling totally invisible with motherhood, it’s clear that needs are not being served by the industry. With our new Motherhood range, we’re hoping not only to revolutionise the product category with our expert-developed, clinically tested products in under-serving categories, but to ensure that women truly feel seen during this life stage."

The pregnancy skincare products market is showing a rapid development because of the growing attention of the consumers to the wellness, sustainability and the transparency of the ingredients, with increasing overlap with organic skin care. Women are giving more emphasis to clinically proven formulations that are safe, ethical and in accordance to personal values. It is indicative of a larger change of informed decision-making in the area of beauty and personal care. Brands which fulfil such expectations are enjoying increased loyalty and market penetration.

Top firms are retaliating by re-creating portfolios in an attempt to remove controversial ingredients in an attempt to improve safety profiles. Sustainable packaging, clean-beauty certifications, and responsible sourcing are now taking a focal point in the competitive strategy. Educational content and open communication are also increasing the speed of digital interaction with the brand and creating credibility. The programs enhance brand equity and facilitate premium positioning within a market that is becoming more value oriented.

The adjacent opportunities are in the sphere of personalized beauty technologies, delivery model as a subscription, and skincare guidance with telehealth. Another trend is that firms are diversifying to other wellness areas to address a wider maternal health audience. These possibilities allow companies to diversify sources of revenues and improve the customer lifetime value. They all contribute to the creation of integrated ecosystems that serve a variety of skincare and wellness needs of women.

Pregnancy Skincare Products Market Dynamics and Trends

Driver: Growing Maternal Age and Awareness of Skin Changes

- The increased maternal age and heightened awareness of changes during pregnancy is transforming the pregnancy skincare category quite a bit, affecting the demand of products, brands preferred, and priorities in innovation. Aging pregnant women and especially those representing millennial and Gen Z groups are more health literate and demand evidence-based choices, safe, and value-oriented skincare products.

- Top brands are focused on putting more emphasis on science-supported formulations, exclusion of potentially sensitizing substances, and improved product transparency. They are also embracing packaging that is sustainability oriented and seeking to achieve the privileged certifications to enhance credibility and to be in tandem with the expectations of the consumers.

- Such strategic programs enhance credibility, promote high-end positioning, and brand divergence in markets that are becoming more competitive. In addition, demand for clinically proven pregnant skincare products is increasing, particularly in developed economies. Consumers are paying higher premiums for goods with superior safety, effectiveness, and ethical standards.

- This shift creates opportunities for innovation in many innovation-based organizations while forcing established players to rethink their portfolios and communication strategies.

Restraint: Safety Concerns and Regulatory Restrictions on Ingredients

- Safety issue and ingredient regulations as a large limitation to the pregnancy care market and hence growth trends, penetration and general business performance. Limited flexibility of formulation and sluggish product development cycle is imposed by rigid compliance guidelines, difference in international regulatory systems, and consumer challenge.

- These challenges have been addressed by companies by investing in clinical validation, transparent communication, product innovation aligned with the regulatory requirements and consumer focused education. The use of strategic healthcare alliances, KOL endorsements, and transparent safety certifications is now a necessity to create confidence and lower the entry barriers in a variety of markets.

- The financial impact of these limitations depends on the segment. Premium brands are more resilient because they have a unique formulation and are well-established in the market, whereas mass-market manufacturers face higher pressure to strike a balance between safety, cost-effectiveness, and competitiveness.

- The regulatory expertise, formulation innovation, and risk-management capabilities that will be required to overcome such limits must be preserved.

Opportunity: Expansion of Clean Beauty and Natural Formulations

- The rising popularity of clean, natural, and pregnancy-safe ingredients offers a major growth opportunity to those brands that can provide high levels of differentiation and high levels of trust formulations. Given the changing market demands, in the effort to ensure that their competitive positioning, leading companies are making strategic investments in innovation, diversification of channels, partnerships, and capability building.

- The opportunity is cross-vectoral, with room to grow into new geographic frontiers with high-growth markets, penetration into related maternal care categories, the introduction of high-quality product lines, and direct-to-consumer modalities. A good capture needs good consumer insight, digital maturity, agility in operations and a desire to constantly optimize products.

- Collaborating with complementary brands, technology partners, and popular content providers can accelerate market penetration without requiring significant expenditure. Competitive companies that are successful in opportunity finding and exploitation typically outperform their competitors, increase their level of competitive advantage, and produce long-term value.

Key Trend: Development of Targeted Solutions for Specific Trimesters

- The introduction of trimester-specific pregnancy skincare is changing the capabilities of the products, the expectations of the consumers, and the competition. With innovative scientific and technological development, sustainability, and increasing demand of safe and effective formulations, early movers are developing good competitive moats. For instance, in 2025, SKN TO SKN, a dermatologist- and GP-led brand, to offer pregnancy-safe skincare, which is hormonally sensitive, in all maternal phases, including conception to postpartum.

- Brands that adopt this trend will reap the following advantages; increased product efficacy, increased consumer satisfaction, increased product differentiation and premium prices. To be successful, it needs to invest in R&D, clinical validation, and consumer education, particularly in high-innovation segments.

- Increasing awareness and dissemination of expert knowledge can reach a wider range of consumers, including those who are cost conscious. This trend is also driving the development of new business models, such as tailored formulations, subscription-based services, and outcome-based guarantees, which increase consumer loyalty and lifetime value.

Pregnancy-Skincare-Products-Market Analysis and Segmental Data

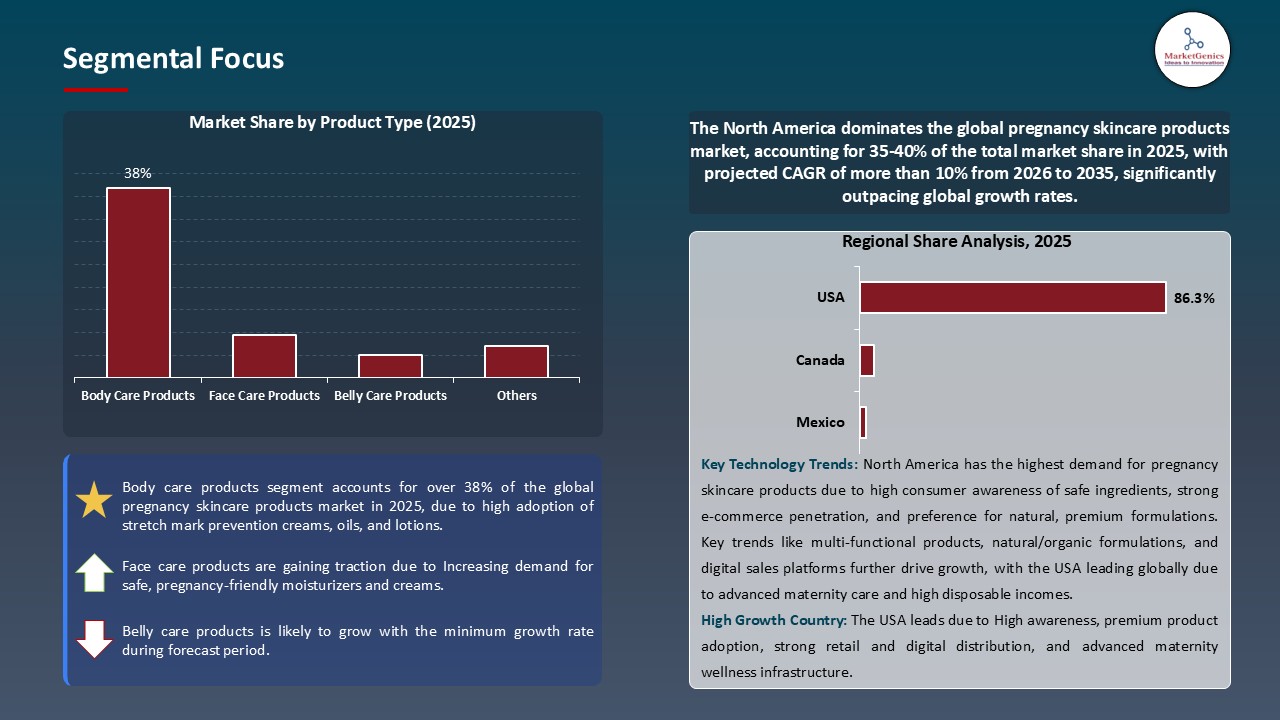

Body Care Products Dominate Global Pregnancy Skincare Products Market

- The body care products segment dominates the pregnancy skincare market which tackle the issues of stretch marks, hydration, skin elasticity, and relaxing sensitive parts during and after pregnancy. The products target pregnant and postpartum women in need of prophylactic and restorative treatment that is comfortable and safe with the skin. For instance, Weleda is launched a Stretch Mark Body Butter which is based on shea butter, cocoa butter, sunflower and jojoba oils, and plant extracts such as Centella asiatica, which are skin elasticity and firmness-supportive.

- Through technological advancements, the competitiveness is also enhanced in the segment. The products have fast-absorbing formulations, skin-firming complexes, natural and hypoallergenic ingredients and environmentally friendly packaging that improve product performance and attractiveness. Sustainability is addressed by emphasizing high-quality ingredients, which satisfy the consumer needs toward effective solutions, safety, and environmental concerns, which sets the segment to further expansion.

- Retail, e-commerce and subscription channels are important in supporting its market expansion. Awareness, collaboration with healthcare providers, prenatal and postpartum education programs increase product adoption. All these combined make body care products a very popular and recognized category in the global pregnancy skincare market.

North America Leads Global Pregnancy Skincare Products Market Demand

- North America is the most expansive market in the region with respect to pregnancy skincare owing to the positive demographics, high disposable incomes, advanced consumerist tastes, and well-established retail channels. The cultural focus on self-care and proactive attitude toward categories of beauty and wellness facilitates the adoption of premium products and ensures further development. For instance, In May 2025, the Hatch Mama brand introduced its intelligently designed maternity skincare collection to Ulta Beauty, making its products pregnancy-safe and emphasizing the high demand on the existence of solutions that are affordable and high-quality.

- It is well-known that major cities are the place in which brands explore, experiment with products, and prove trends, and employ influencers to test before launching across the secondary market. Regulatory systems that are conducive can enable quicker products introduction and still keep the products safe and digital commerce and social media can help to get in touch with consumers and provide them with more personalized services.

- North America has a competitive advantage due to its concentration of leading beauty firms, marketing skills, and content creators with influence. This, combined with consumers' willingness to innovate, will position the region as a leader in the future as global consumer preferences shift towards quality, effectiveness, and sustainability.

Pregnancy-Skincare-Products-Market Ecosystem

The global pregnancy skincare market is moderately fragmented with multinational conglomerates, specialty brands as well as direct-to-consumer startups competing in diverse segments and different price points. The main competitors include Mama Mios, Clarins, Johnson and Johnson, The Honest Company, and Mustela that take advantage of scale, research experience, and massive distribution networks to ensure high positions in mass-market segments. By contrast, specialty brands are targeted at high-end markets, where differentiation, authenticity, and target consumer interactions are used to seize niche markets. The changing consumer tastes of safe, effective, and ethically developed products to suit pregnancy and postpartum issues inform this competitive environment.

The value chain in the market combines suppliers of ingredients, formulation developers, contract manufacturers, packaging suppliers, distribution partners, retailers and marketing agencies to provide the ultimate solutions. The major firms are rapidly investing in vertical integration, online marketing, and direct-to-consumer channeling to improve the margins, build consumer relationships, and offer personalization and innovation based on data. The strategies can promulgate long-term expansion, brand retention, and the sensitivity to new developments in maternal skincare.

Recent Development and Strategic Overview:

- In June 2024, Luna Daily released a new range, Motherhood Collection, which is a dermatologist- and gynaecologist-developed range designed during pregnancy, birth preparation, and post-partum. It has 6 products that include a Post-Birth Soothing Spray, Perineal Prep Oil, Everywhere Motherhood Wash and Nip + Lip Balm. The partnership was also launched with Peanut, a women community site to better guide mothers through every stage.

- In June 2025, SKN TO SKN, a new expert-led skincare brand for pregnancy and postpartum, launched with a focus on hormonally sensitive skin. Developed in collaboration with dermatologists and women’s health GPs, it targets concerns like acne, pigmentation, dryness, and sensitivity. The debut collection features four multitasking products: Balancing Act Gel-to-Oil Cleanser, Sleep Cheat Night Cream, Glow & Go Daily Moisturiser with Mineral SPF 30, and a Multi-Tasking Face Serum.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 3.6 Bn |

|

Market Forecast Value in 2035 |

USD 8.1 Bn |

|

Growth Rate (CAGR) |

8.4% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Volume Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Pregnancy-Skincare-Products-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Pregnancy Skincare Products Market, By Product Type |

|

|

Pregnancy Skincare Products Market, By Ingredient Type |

|

|

Pregnancy Skincare Products Market, By Form Type |

|

|

Pregnancy Skincare Products Market, By Distribution Channel |

|

|

Pregnancy Skincare Products Market, By Packaging Type |

|

|

Pregnancy Skincare Products Market, By Skin Concern/Function |

|

|

Pregnancy Skincare Products Market, By End-users |

|

|

Pregnancy Skincare Products Market, By Age Group |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Pregnancy Skincare Products Market Outlook

- 2.1.1. Pregnancy Skincare Products Market Size (Volume - Units and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Pregnancy Skincare Products Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Increasing awareness among expectant mothers about ingredient safety and the risks of certain skincare chemicals during pregnancy.

- 4.1.1.2. Growing demand for natural, organic, and “clean‑label” pregnancy‑safe skincare products.

- 4.1.1.3. Expansion of e‑commerce and digital channels, making pregnancy-specialized skincare more accessible.

- 4.1.2. Restraints

- 4.1.2.1. High cost of premium and natural pregnancy-safe formulations, limiting affordability.

- 4.1.2.2. Lack of standardized regulations or certification around what constitutes “pregnancy-safe” ingredients, causing consumer confusion.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Pregnancy Skincare Products Manufacturers

- 4.4.3. Dealers/ Distributors

- 4.4.4. End-Users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Pregnancy Skincare Products Market Demand

- 4.9.1. Historical Market Size – Volume (Million Units) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Volume (Million Units) and Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Pregnancy Skincare Products Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Pregnancy Skincare Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Face Care Products

- 6.2.2. Body Care Products

- 6.2.3. Belly Care Products

- 6.2.4. Breast Care Products

- 6.2.5. Specialized Treatment Products

- 7. Global Pregnancy Skincare Products Market Analysis, by Ingredient Type

- 7.1. Key Segment Analysis

- 7.2. Pregnancy Skincare Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, by Ingredient Type, 2021-2035

- 7.2.1. Natural/Organic Ingredients

- 7.2.2. Plant-Based Extracts

- 7.2.2.1. Essential Oils

- 7.2.2.2. Herbal Formulations

- 7.2.2.3. Organic Certified

- 7.2.2.4. Others

- 7.2.3. Synthetic/Chemical Ingredients

- 7.2.3.1. Parabens-Free

- 7.2.3.2. Sulfate-Free

- 7.2.3.3. Phthalate-Free

- 7.2.3.4. Others

- 7.2.4. Hybrid Formulations

- 8. Global Pregnancy Skincare Products Market Analysis, by Form Type

- 8.1. Key Segment Analysis

- 8.2. Pregnancy Skincare Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, by Form Type, 2021-2035

- 8.2.1. Creams

- 8.2.2. Lotions

- 8.2.3. Oils

- 8.2.4. Gels

- 8.2.5. Others

- 9. Global Pregnancy Skincare Products Market Analysis, by Distribution Channel

- 9.1. Key Segment Analysis

- 9.2. Pregnancy Skincare Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 9.2.1. Online Channels

- 9.2.1.1. E-commerce Platforms

- 9.2.1.2. Company Websites

- 9.2.1.3. Online Pharmacies

- 9.2.1.4. Others

- 9.2.2. Offline Channels

- 9.2.2.1. Supermarkets/Hypermarkets

- 9.2.2.2. Pharmacies/Drugstores

- 9.2.2.3. Convenience Stores

- 9.2.2.4. Specialty Stores

- 9.2.2.5. Others

- 9.2.1. Online Channels

- 10. Global Pregnancy Skincare Products Market Analysis, by Packaging Type

- 10.1. Key Segment Analysis

- 10.2. Pregnancy Skincare Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, by Packaging Type, 2021-2035

- 10.2.1. Tube

- 10.2.2. Pump Bottle

- 10.2.3. Jar

- 10.2.4. Sachet/Pouch

- 10.2.5. Bar/Soap Form

- 10.2.6. Others

- 11. Global Pregnancy Skincare Products Market Analysis, by Skin Concern/Function

- 11.1. Key Segment Analysis

- 11.2. Pregnancy Skincare Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, by Skin Concern/Function, 2021-2035

- 11.2.1. Stretch Mark Prevention

- 11.2.2. Hydration & Moisturization

- 11.2.3. Pigmentation Control

- 11.2.4. Itching Relief

- 11.2.5. Skin Firming & Elasticity

- 11.2.6. Scar Healing

- 11.2.7. Others

- 12. Global Pregnancy Skincare Products Market Analysis, by End-users

- 12.1. Key Segment Analysis

- 12.2. Pregnancy Skincare Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 12.2.1. Healthcare

- 12.2.1.1. Hospital Use

- 12.2.1.1.1. Pre-natal Care

- 12.2.1.1.2. Post-natal Care

- 12.2.1.1.3. Labor & Delivery

- 12.2.1.1.4. Others

- 12.2.1.2. Clinic Use

- 12.2.1.2.1. OB-GYN Clinics

- 12.2.1.2.2. Dermatology Clinics

- 12.2.1.2.3. Others

- 12.2.1.1. Hospital Use

- 12.2.2. Retail

- 12.2.2.1. Beauty & Personal Care Retail

- 12.2.2.1.1. Daily Skincare

- 12.2.2.1.2. Special Treatment

- 12.2.2.1.3. Preventive Care

- 12.2.2.1.4. Others

- 12.2.2.2. Maternity Retail

- 12.2.2.2.1. Pregnancy Care

- 12.2.2.2.2. Breastfeeding Care

- 12.2.2.2.3. Post-Delivery Recovery

- 12.2.2.2.4. Others

- 12.2.2.1. Beauty & Personal Care Retail

- 12.2.3. Spa & Wellness

- 12.2.3.1. Maternity Spas

- 12.2.3.1.1. Prenatal Massage

- 12.2.3.1.2. Body Treatment

- 12.2.3.1.3. Relaxation Therapy

- 12.2.3.1.4. Others

- 12.2.3.2. Wellness Centers

- 12.2.3.2.1. Holistic Care

- 12.2.3.2.2. Therapeutic

- 12.2.3.2.3. Others

- 12.2.3.1. Maternity Spas

- 12.2.1. Healthcare

- 13. Global Pregnancy Skincare Products Market Analysis, by Age Group

- 13.1. Key Segment Analysis

- 13.2. Pregnancy Skincare Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, by Age Group, 2021-2035

- 13.2.1. 18-25 years

- 13.2.2. 26-35 years

- 13.2.3. 36-45 years

- 13.2.4. Above 45 years

- 14. Global Pregnancy Skincare Products Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Pregnancy Skincare Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Pregnancy Skincare Products Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Pregnancy Skincare Products Market Size Volume - Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Ingredient Type

- 15.3.3. Form Type

- 15.3.4. Distribution Channel

- 15.3.5. Packaging Type

- 15.3.6. Skin Concern/Function

- 15.3.7. End-users

- 15.3.8. Age Group

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Pregnancy Skincare Products Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Ingredient Type

- 15.4.4. Form Type

- 15.4.5. Distribution Channel

- 15.4.6. Packaging Type

- 15.4.7. Skin Concern/Function

- 15.4.8. End-users

- 15.4.9. Age Group

- 15.5. Canada Pregnancy Skincare Products Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Ingredient Type

- 15.5.4. Form Type

- 15.5.5. Distribution Channel

- 15.5.6. Packaging Type

- 15.5.7. Skin Concern/Function

- 15.5.8. End-users

- 15.5.9. Age Group

- 15.6. Mexico Pregnancy Skincare Products Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Ingredient Type

- 15.6.4. Form Type

- 15.6.5. Distribution Channel

- 15.6.6. Packaging Type

- 15.6.7. Skin Concern/Function

- 15.6.8. End-users

- 15.6.9. Age Group

- 16. Europe Pregnancy Skincare Products Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Pregnancy Skincare Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Ingredient Type

- 16.3.3. Form Type

- 16.3.4. Distribution Channel

- 16.3.5. Packaging Type

- 16.3.6. Skin Concern/Function

- 16.3.7. End-users

- 16.3.8. Age Group

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Pregnancy Skincare Products Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Ingredient Type

- 16.4.4. Form Type

- 16.4.5. Distribution Channel

- 16.4.6. Packaging Type

- 16.4.7. Skin Concern/Function

- 16.4.8. End-users

- 16.4.9. Age Group

- 16.5. United Kingdom Pregnancy Skincare Products Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Ingredient Type

- 16.5.4. Form Type

- 16.5.5. Distribution Channel

- 16.5.6. Packaging Type

- 16.5.7. Skin Concern/Function

- 16.5.8. End-users

- 16.5.9. Age Group

- 16.6. France Pregnancy Skincare Products Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Ingredient Type

- 16.6.4. Form Type

- 16.6.5. Distribution Channel

- 16.6.6. Packaging Type

- 16.6.7. Skin Concern/Function

- 16.6.8. End-users

- 16.6.9. Age Group

- 16.7. Italy Pregnancy Skincare Products Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Ingredient Type

- 16.7.4. Form Type

- 16.7.5. Distribution Channel

- 16.7.6. Packaging Type

- 16.7.7. Skin Concern/Function

- 16.7.8. End-users

- 16.7.9. Age Group

- 16.8. Spain Pregnancy Skincare Products Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Ingredient Type

- 16.8.4. Form Type

- 16.8.5. Distribution Channel

- 16.8.6. Packaging Type

- 16.8.7. Skin Concern/Function

- 16.8.8. End-users

- 16.8.9. Age Group

- 16.9. Netherlands Pregnancy Skincare Products Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Ingredient Type

- 16.9.4. Form Type

- 16.9.5. Distribution Channel

- 16.9.6. Packaging Type

- 16.9.7. Skin Concern/Function

- 16.9.8. End-users

- 16.9.9. Age Group

- 16.10. Nordic Countries Pregnancy Skincare Products Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Ingredient Type

- 16.10.4. Form Type

- 16.10.5. Distribution Channel

- 16.10.6. Packaging Type

- 16.10.7. Skin Concern/Function

- 16.10.8. End-users

- 16.10.9. Age Group

- 16.11. Poland Pregnancy Skincare Products Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Ingredient Type

- 16.11.4. Form Type

- 16.11.5. Distribution Channel

- 16.11.6. Packaging Type

- 16.11.7. Skin Concern/Function

- 16.11.8. End-users

- 16.11.9. Age Group

- 16.12. Russia & CIS Pregnancy Skincare Products Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Ingredient Type

- 16.12.4. Form Type

- 16.12.5. Distribution Channel

- 16.12.6. Packaging Type

- 16.12.7. Skin Concern/Function

- 16.12.8. End-users

- 16.12.9. Age Group

- 16.13. Rest of Europe Pregnancy Skincare Products Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Ingredient Type

- 16.13.4. Form Type

- 16.13.5. Distribution Channel

- 16.13.6. Packaging Type

- 16.13.7. Skin Concern/Function

- 16.13.8. End-users

- 16.13.9. Age Group

- 17. Asia Pacific Pregnancy Skincare Products Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Asia Pacific Pregnancy Skincare Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Ingredient Type

- 17.3.3. Form Type

- 17.3.4. Distribution Channel

- 17.3.5. Packaging Type

- 17.3.6. Skin Concern/Function

- 17.3.7. End-users

- 17.3.8. Age Group

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Pregnancy Skincare Products Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Ingredient Type

- 17.4.4. Form Type

- 17.4.5. Distribution Channel

- 17.4.6. Packaging Type

- 17.4.7. Skin Concern/Function

- 17.4.8. End-users

- 17.4.9. Age Group

- 17.5. India Pregnancy Skincare Products Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Ingredient Type

- 17.5.4. Form Type

- 17.5.5. Distribution Channel

- 17.5.6. Packaging Type

- 17.5.7. Skin Concern/Function

- 17.5.8. End-users

- 17.5.9. Age Group

- 17.6. Japan Pregnancy Skincare Products Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Ingredient Type

- 17.6.4. Form Type

- 17.6.5. Distribution Channel

- 17.6.6. Packaging Type

- 17.6.7. Skin Concern/Function

- 17.6.8. End-users

- 17.6.9. Age Group

- 17.7. South Korea Pregnancy Skincare Products Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Ingredient Type

- 17.7.4. Form Type

- 17.7.5. Distribution Channel

- 17.7.6. Packaging Type

- 17.7.7. Skin Concern/Function

- 17.7.8. End-users

- 17.7.9. Age Group

- 17.8. Australia and New Zealand Pregnancy Skincare Products Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Ingredient Type

- 17.8.4. Form Type

- 17.8.5. Distribution Channel

- 17.8.6. Packaging Type

- 17.8.7. Skin Concern/Function

- 17.8.8. End-users

- 17.8.9. Age Group

- 17.9. Indonesia Pregnancy Skincare Products Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Product Type

- 17.9.3. Ingredient Type

- 17.9.4. Form Type

- 17.9.5. Distribution Channel

- 17.9.6. Packaging Type

- 17.9.7. Skin Concern/Function

- 17.9.8. End-users

- 17.9.9. Age Group

- 17.10. Malaysia Pregnancy Skincare Products Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Product Type

- 17.10.3. Ingredient Type

- 17.10.4. Form Type

- 17.10.5. Distribution Channel

- 17.10.6. Packaging Type

- 17.10.7. Skin Concern/Function

- 17.10.8. End-users

- 17.10.9. Age Group

- 17.11. Thailand Pregnancy Skincare Products Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Product Type

- 17.11.3. Ingredient Type

- 17.11.4. Form Type

- 17.11.5. Distribution Channel

- 17.11.6. Packaging Type

- 17.11.7. Skin Concern/Function

- 17.11.8. End-users

- 17.11.9. Age Group

- 17.12. Vietnam Pregnancy Skincare Products Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Product Type

- 17.12.3. Ingredient Type

- 17.12.4. Form Type

- 17.12.5. Distribution Channel

- 17.12.6. Packaging Type

- 17.12.7. Skin Concern/Function

- 17.12.8. End-users

- 17.12.9. Age Group

- 17.13. Rest of Asia Pacific Pregnancy Skincare Products Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Product Type

- 17.13.3. Ingredient Type

- 17.13.4. Form Type

- 17.13.5. Distribution Channel

- 17.13.6. Packaging Type

- 17.13.7. Skin Concern/Function

- 17.13.8. End-users

- 17.13.9. Age Group

- 18. Middle East Pregnancy Skincare Products Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Pregnancy Skincare Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Ingredient Type

- 18.3.3. Form Type

- 18.3.4. Distribution Channel

- 18.3.5. Packaging Type

- 18.3.6. Skin Concern/Function

- 18.3.7. End-users

- 18.3.8. Age Group

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Pregnancy Skincare Products Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Ingredient Type

- 18.4.4. Form Type

- 18.4.5. Distribution Channel

- 18.4.6. Packaging Type

- 18.4.7. Skin Concern/Function

- 18.4.8. End-users

- 18.4.9. Age Group

- 18.5. UAE Pregnancy Skincare Products Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Ingredient Type

- 18.5.4. Form Type

- 18.5.5. Distribution Channel

- 18.5.6. Packaging Type

- 18.5.7. Skin Concern/Function

- 18.5.8. End-users

- 18.5.9. Age Group

- 18.6. Saudi Arabia Pregnancy Skincare Products Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Ingredient Type

- 18.6.4. Form Type

- 18.6.5. Distribution Channel

- 18.6.6. Packaging Type

- 18.6.7. Skin Concern/Function

- 18.6.8. End-users

- 18.6.9. Age Group

- 18.7. Israel Pregnancy Skincare Products Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Ingredient Type

- 18.7.4. Form Type

- 18.7.5. Distribution Channel

- 18.7.6. Packaging Type

- 18.7.7. Skin Concern/Function

- 18.7.8. End-users

- 18.7.9. Age Group

- 18.8. Rest of Middle East Pregnancy Skincare Products Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Ingredient Type

- 18.8.4. Form Type

- 18.8.5. Distribution Channel

- 18.8.6. Packaging Type

- 18.8.7. Skin Concern/Function

- 18.8.8. End-users

- 18.8.9. Age Group

- 19. Africa Pregnancy Skincare Products Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Pregnancy Skincare Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Ingredient Type

- 19.3.3. Form Type

- 19.3.4. Distribution Channel

- 19.3.5. Packaging Type

- 19.3.6. Skin Concern/Function

- 19.3.7. End-users

- 19.3.8. Age Group

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Pregnancy Skincare Products Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Ingredient Type

- 19.4.4. Form Type

- 19.4.5. Distribution Channel

- 19.4.6. Packaging Type

- 19.4.7. Skin Concern/Function

- 19.4.8. End-users

- 19.4.9. Age Group

- 19.5. Egypt Pregnancy Skincare Products Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Ingredient Type

- 19.5.4. Form Type

- 19.5.5. Distribution Channel

- 19.5.6. Packaging Type

- 19.5.7. Skin Concern/Function

- 19.5.8. End-users

- 19.5.9. Age Group

- 19.6. Nigeria Pregnancy Skincare Products Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Ingredient Type

- 19.6.4. Form Type

- 19.6.5. Distribution Channel

- 19.6.6. Packaging Type

- 19.6.7. Skin Concern/Function

- 19.6.8. End-users

- 19.6.9. Age Group

- 19.7. Algeria Pregnancy Skincare Products Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Ingredient Type

- 19.7.4. Form Type

- 19.7.5. Distribution Channel

- 19.7.6. Packaging Type

- 19.7.7. Skin Concern/Function

- 19.7.8. End-users

- 19.7.9. Age Group

- 19.8. Rest of Africa Pregnancy Skincare Products Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Ingredient Type

- 19.8.4. Form Type

- 19.8.5. Distribution Channel

- 19.8.6. Packaging Type

- 19.8.7. Skin Concern/Function

- 19.8.8. End-users

- 19.8.9. Age Group

- 20. South America Pregnancy Skincare Products Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. South America Pregnancy Skincare Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Ingredient Type

- 20.3.3. Form Type

- 20.3.4. Distribution Channel

- 20.3.5. Packaging Type

- 20.3.6. Skin Concern/Function

- 20.3.7. End-users

- 20.3.8. Age Group

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Pregnancy Skincare Products Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Ingredient Type

- 20.4.4. Form Type

- 20.4.5. Distribution Channel

- 20.4.6. Packaging Type

- 20.4.7. Skin Concern/Function

- 20.4.8. End-users

- 20.4.9. Age Group

- 20.5. Argentina Pregnancy Skincare Products Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Ingredient Type

- 20.5.4. Form Type

- 20.5.5. Distribution Channel

- 20.5.6. Packaging Type

- 20.5.7. Skin Concern/Function

- 20.5.8. End-users

- 20.5.9. Age Group

- 20.6. Rest of South America Pregnancy Skincare Products Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Ingredient Type

- 20.6.4. Form Type

- 20.6.5. Distribution Channel

- 20.6.6. Packaging Type

- 20.6.7. Skin Concern/Function

- 20.6.8. End-users

- 20.6.9. Age Group

- 21. Key Players/ Company Profile

- 21.1. Bamford

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Basq NYC

- 21.3. Belli Skincare

- 21.4. Belly Bandit

- 21.5. Bio-Oil

- 21.6. Burt's Bees

- 21.7. Clarins

- 21.8. Earth Mama Organics

- 21.9. Johnson & Johnson

- 21.10. Mama & Bumps

- 21.11. Mama Mio

- 21.12. Mambino Organics

- 21.13. Motherlove

- 21.14. Mustela

- 21.15. Nine Naturals

- 21.16. Organix South (TheraNeem)

- 21.17. Palmer's (E.T. Browne Drug Company)

- 21.18. Spoiled Mama

- 21.19. The Honest Company

- 21.20. Tummy Honey

- 21.21. Weleda

- 21.22. Other Key Players

- 21.1. Bamford

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation