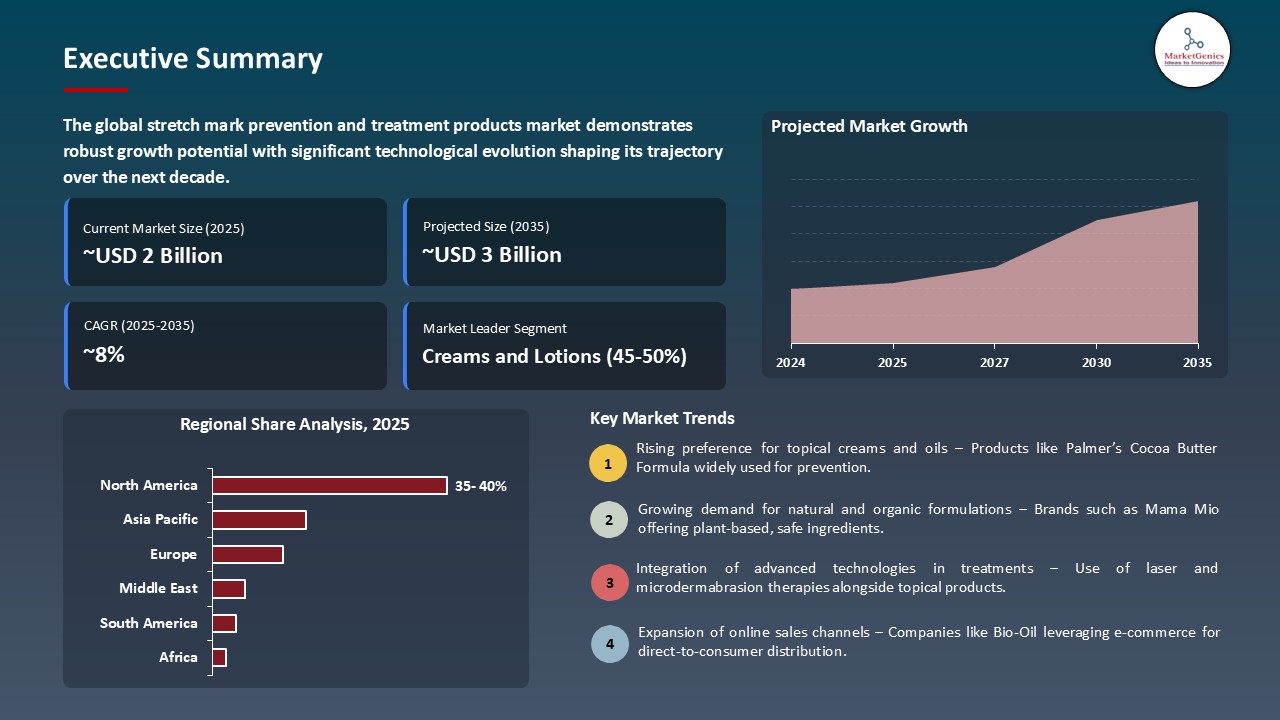

- The global stretch mark prevention and treatment products market is valued at USD 1.6 billion in 2025.

- The market is projected to grow at a CAGR of 7.5% during the forecast period of 2026 to 2035.

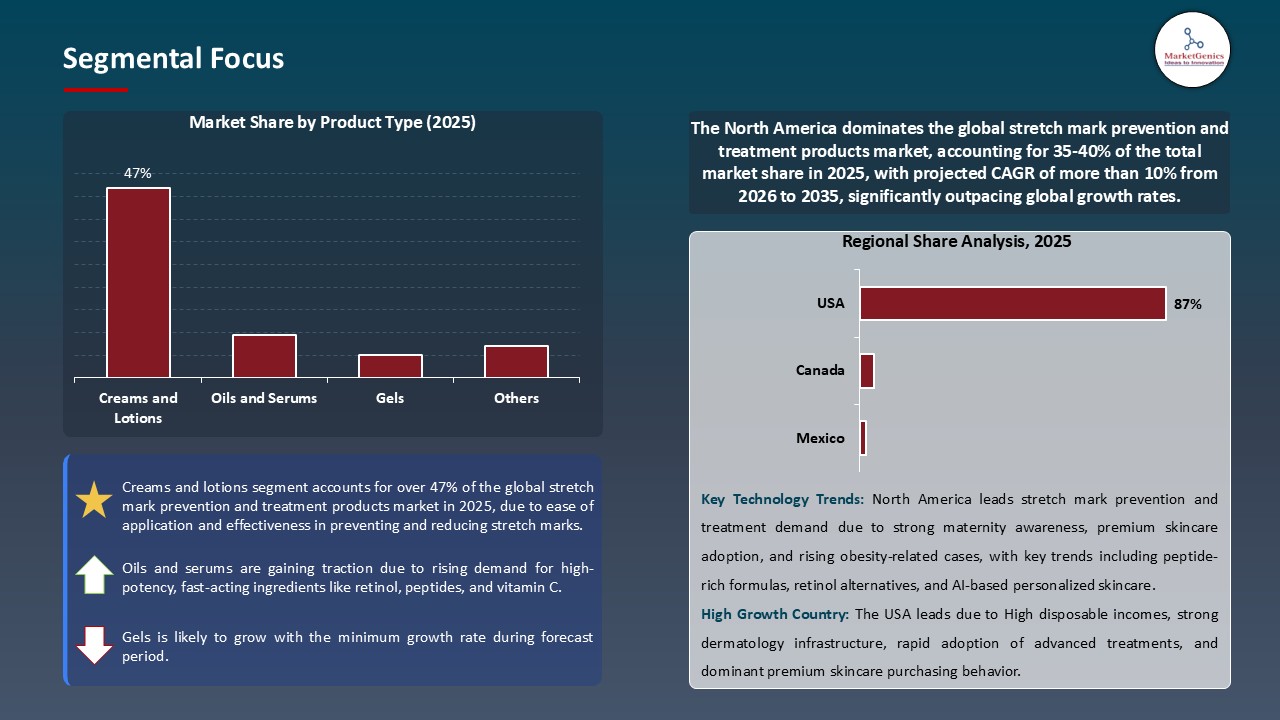

- The creams and lotions segment holds major share ~47% in the global stretch mark prevention and treatment products market, driven by demand for convenience, skin safety, and postpartum care. Rising awareness of pregnancy and postpartum skincare, combined with preferences for clinically validated and natural formulations, supports strong adoption.

- Rising consumer demand for sustainable and personalized skincare is driving brands to develop biodegradable, clean-label stretch mark creams, serums, and oils, as well as subscription-based delivery models tailored to pregnancy and postpartum needs.

- Innovation is accelerating: companies are launching peptide-enriched, clinically validated formulations, organic and natural ingredient variants, and multifunctional products that combine skin elasticity, hydration, and environmental responsibility, meeting both efficacy and sustainability expectations.

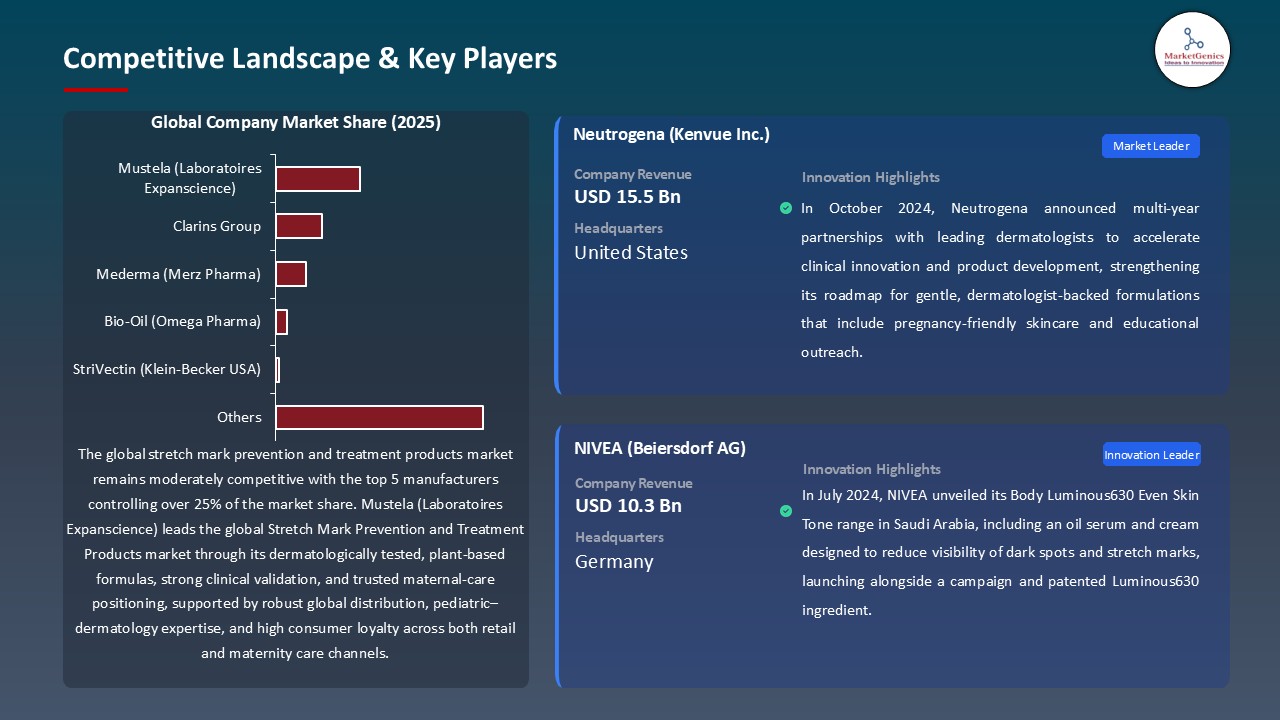

- The top five player’s accounts for over 25% of the global stretch-mark-prevention-and-treatment-products-market in 2025.

- In March 2024, Secret Saviours launched a 3‑step stretch‑mark prevention system in Bangladesh, featuring Day Gel, Night Cream, and intelligent maternity shapewear with Derma Dot pads to reduce skin pressure and prevent stretch marks.

- In July 2024, Nivea introduced its Body Luminous630 Even Skin Tone range in Saudi Arabia, using a patented enzyme to reduce dark spots and early-stage stretch marks while providing hydration and skin-firming benefits.

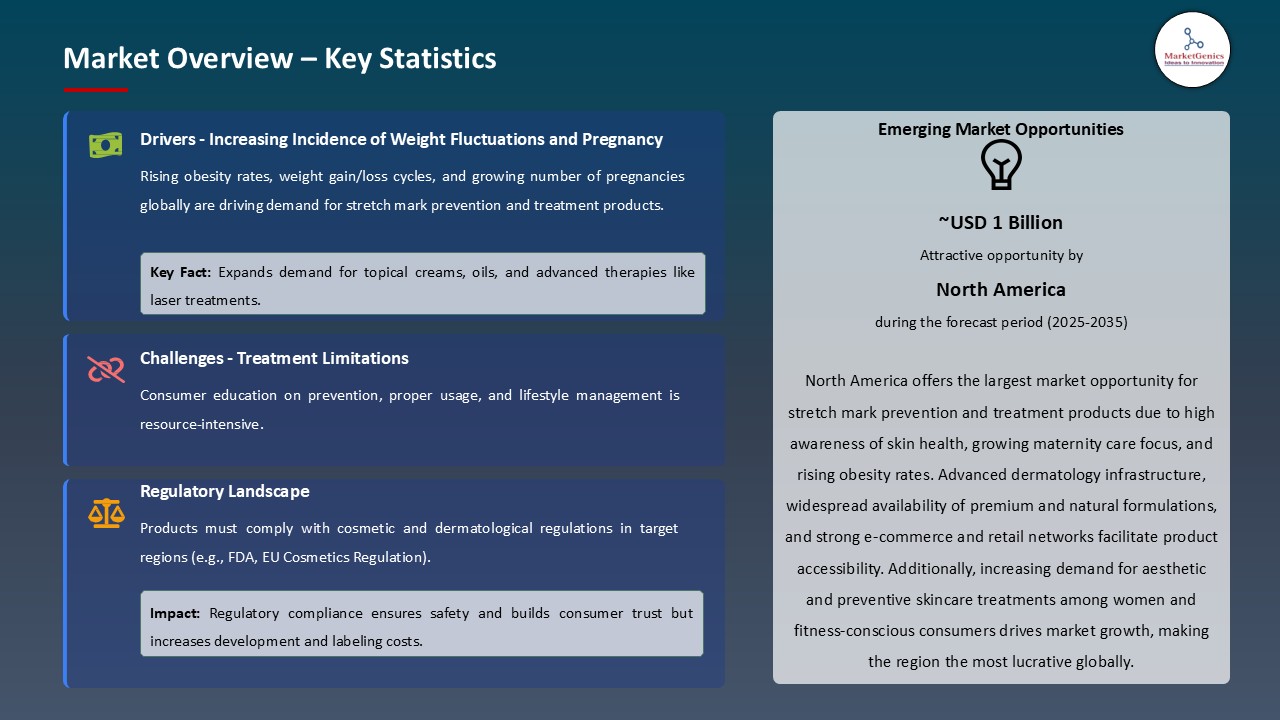

- Global Stretch Mark Prevention and Treatment Products Market is likely to create the total forecasting opportunity of ~USD 2 Bn till 2035.

- North America leads the stretch mark prevention and treatment products market, driven by high consumer awareness, rising disposable incomes, and growing demand for clinically validated skincare.

- The rising pregnancy level and the growing concern over weight management are transforming the global stretch mark prevention and treatment market through such factors as the consumer buying behavior, brand loyalty, and product development priorities. Millennials and Gen Z buyers perceive authenticity, transparency, and the compatibility with personal values as the primary factors in choosing beauty and personal care items in particular.

- Market trends Market leaders are reacting through reformulating portfolios to eliminate controversial ingredients, gaining third-party certification, using sustainable packaging, and expressing corporate principles through targeted marketing. For instance, Metro Private Label, has organic and vegan stretch-mark creams that are specifically created to suit pregnancy and postpartum skin, and which reveal how new product lines are personalized to address the sustainability and clean-ingredient agenda.

- Such programs improve brand differentiation, consumer trust, and competitive advantages in markets where sustainability and social responsibility are becoming an important factor in the purchasing decision and premium pricing. These developments are driving long-term market growth, particularly in developed nations where consumers prioritize high efficacy, safety, sustainability, and social benefits.

- Such an atmosphere encourages innovative leaders while putting conventional players in a position to respond quickly to change and alter their business models to changing expectations.

- The high product efficacy and consumer doubt is a great limiting factor to the growth and market penetration in the stretch mark prevention and treatment products market. There are obstacles associated with the lack of awareness, cultural differences, financial limitations, and regulatory issues that may curb growth and profitability in different geographical locations and consumer categories.

- The companies are using educational programs, influencer relationships, clinical validity, and pricing approaches to resolve these issues. These obstacles can only be overcome successfully with long-term investment, cultural acumen, strategic patience and local market conditions and competitive forces.

- The effects of these restraints on the economy differ by segment. Loyal customers make premium products resilient due to well-developed value propositions, whereas mass-market products are under pressure and require efficiency gains, new marketing, and value engineering.

- The postpartum treatment segment presents huge growth opportunities to the providers of stretch mark prevention and treatment products that do not offer differentiated but consumer-aligned solutions. Best in business are being strategically invested on product innovation, channel expansion, partnerships and capability development in order to capture emerging opportunities. For instance, Clarins introduced a mum-friendly stretch mark cream with PhytoStretchComplex, that is, Centella Asiatica and organic green banana extract that has been clinically proven to increase skin elasticity in post-partum and during weight changes.

- The opportunity is spread over both geographic expansion into high-growth markets, adjacent category penetration, upper-end level development and the implementation of direct-to-consumer approaches that does not rely on the traditional retailing approaches. It takes strong consumer understanding, digital acumen, nimble processing and relentless innovation on the basis of market reactions.

- Strategic alliances with complementary companies, technology partners, influencers, and content creators accelerate time to market, reduce risks, and develop specialized competencies. Companies with great execution can achieve above-market growth, improve their competitive stance, and produce long-term value by providing distinctive postpartum care solutions.

- The combined action of Centella Asiatica and biomimetic peptides in the prevention and treatment of stretch marks is due to increased demand on the use of clinically validated, high-performance formulations. Centella Asiatica is also known to provide collagen stimulating effects, calming effects and barrier repair, and peptides provide specifics of elasticity and dermal regeneration. For instance, StretcHeal with its peptide complexes palmitoyl tetrapeptide-7, palmitoyl tripeptide-1, and palmitoyl tripeptide-5 that point out the importance of science-supported actives to be effective and brand differentiators. This intersection signifies the developments of ingredient technology, sustainability agenda, and consumer demands towards quantified, secure and clear-cut performance.

- The firms that are capitalizing on such innovation-based formulations are attaining better product performances and consumer confidence and better premium positioning. The strategy is heard best in the areas where the evidence-based skincare is the reason to purchase.

- Improved access to ingredients can lead to more competitive products and new frameworks, such as personalized prescriptions, subscriptions, and performance-based guarantees, enhancing long-term consumer relationships.

- Creams and lotions dominate the global stretch mark prevention and treatment products market because they are highly preferred by consumers who prefer topically applied products that are easy to use every day. The feeling that they are safe, they bring about deep hydration benefits, as well as they are compatible with pregnancy and post-partum skin, makes them the most trusted among women in both the developed and emerging markets.

- The segment is strengthened with the products of dermal science such as the use of peptides, centella asiatica, retinoid substitutes, ceramides, and hyaluronic acid in enhancing elasticity and collagen support. For instance, in 2024, Mama Mio reformulated its Stretch Mark Minimiser formula using plant-based actives and micro-lipid delivery technology to increase absorption and efficacy due to the shift towards science-based, skin-friendly products.

- Strong retail presence, e-commerce penetration, and influencers facilitate product discovery and adoption, providing a competitive edge. Partnerships with dermatologists, maternity clinics, and prenatal wellness initiatives will help to build trust and education, establishing creams and lotions as the most popular category of stretch mark care in the globe.

- North America leads the global stretch mark prevention and treatment products market, which is facilitated by good disposable income, mature retailing infrastructure, and consumer demand in high-quality beauty and wellness solutions. Consumers in the region are highly willing to invest in efficient and quality products of personal care which supports the long-term demand.

- Huge urban centers are becoming centers of innovation with brands testing new formulations, confirming trends, and using the influence-based marketing tactics of influencers. Favorable regulatory framework and a well-developed digital commerce platform also allow introducing products quickly, tailor them, and build direct-to-consumer connections.

- North America is well-positioned to stay ahead of the global market due to its industry players, advanced marketing capabilities, and consumer willingness to embrace technological changes that prioritize efficacy, quality, and sustainability.

- In March 2024, Secret Saviours introduced its 3-step stretch-mark preventing system in Bangladesh, as part of the International Women Day. The system incorporates the Day Gel, Night Cream and smart maternity shapers that are produced on the basis of Derma Dot pads which is a new textile technology invented at the University College London Hospitals to diffuse the pressure of the skin and also prevent the route of stretch marks.

- In July 2024, Nivea introduced its Body Luminosity630 Even Skin Tone products in Saudi Arabia, which have a patented Luminous630 enzyme that removes the looks of dark spots and stretch marks. The range is to be used to achieve homogenous skin tone as well as being hydrating and skin-firming, both in pigmentation and in early-stage stretch marks. This introduction underscores the aspect of multifunctional body care solutions that the brand offers in the Middle East market.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Basq Skincare

- Belli Skincare

- Bio-Oil (Omega Pharma)

- Botanic Tree

- Revitol

- Burt's Bees (Clorox Company)

- Clarins Group

- Earth Mama Organics

- Elemis Ltd

- Frank Body

- Mama Mio (Mio Skincare)

- Mederma (Merz Pharma)

- Mustela (Laboratoires Expanscience)

- Palmer's (E.T. Browne Drug Company)

- Sol de Janeiro

- StriVectin (Klein-Becker USA)

- The Honest Company

- TriLASTIN

- Weleda AG

- Other Key Players

- Motherlove Herbal Company

- Creams and Lotions

- Oils and Serums

- Gels

- Body Butters

- Balms and Ointments

- Scrubs and Exfoliants

- Supplements (Oral)

- Medical Devices

- Organic/Natural

- Synthetic

- Vegan

- Cruelty-Free

- Hybrid

- Retinol/Retinoids

- Hyaluronic Acid

- Vitamin E

- Vitamin C

- Cocoa Butter

- Glycolic Acid

- Plant Extracts

- Others

- Preventive Products

- Active Treatment

- Corrective Treatment

- Maintenance Products

- Online Channels

- E-commerce Platforms

- Company Websites

- Online Pharmacies

- Others

- Offline Channels

- Supermarkets/Hypermarkets

- Pharmacies/Drugstores

- Dermatology Clinics

- Specialty Stores

- Others

- Gender

- Women

- Men

- Unisex

- Age Group

- Teenagers (13-19 years)

- Young Adults (20-30 years)

- Adults (31-45 years)

- Middle-aged (46-60 years)

- Seniors (Above 60 years)

- Pregnancy-Related Stretch Marks

- Weight Gain/Loss-Related

- Growth Spurt-Related

- Bodybuilding/Muscle Growth

- Post-Surgery/Medical

- Hormonal Changes

- General Skin Care

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Stretch Mark Prevention and Treatment Products Market Outlook

- 2.1.1. Stretch Mark Prevention and Treatment Products Market Size (Volume - Units and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Stretch Mark Prevention and Treatment Products Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising obesity and weight‑fluctuation rates, leading to more stretch‑mark occurrence.

- 4.1.1.2. Increasing number of pregnancies, boosting demand for prevention and treatment.

- 4.1.1.3. Growing consumer aesthetic awareness and self‑care, driving uptake of topical and non‑invasive treatments.

- 4.1.2. Restraints

- 4.1.2.1. High cost of advanced procedures (like laser treatments) limiting accessibility.

- 4.1.2.2. Limited efficacy and variable results of over-the‑counter topical products.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Manufacturers

- 4.4.3. Dealers/ Distributors

- 4.4.4. End-Users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Stretch Mark Prevention and Treatment Products Market Demand

- 4.9.1. Historical Market Size – Volume (Million Units) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – (Million Units) and Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Stretch Mark Prevention and Treatment Products Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Stretch Mark Prevention and Treatment Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Creams and Lotions

- 6.2.2. Oils and Serums

- 6.2.3. Gels

- 6.2.4. Body Butters

- 6.2.5. Balms and Ointments

- 6.2.6. Scrubs and Exfoliants

- 6.2.7. Supplements (Oral)

- 6.2.8. Medical Devices

- 7. Global Stretch Mark Prevention and Treatment Products Market Analysis, by Formulation

- 7.1. Key Segment Analysis

- 7.2. Stretch Mark Prevention and Treatment Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, by Formulation, 2021-2035

- 7.2.1. Organic/Natural

- 7.2.2. Synthetic

- 7.2.3. Vegan

- 7.2.4. Cruelty-Free

- 7.2.5. Hybrid

- 8. Global Stretch Mark Prevention and Treatment Products Market Analysis, by Active Ingredient

- 8.1. Key Segment Analysis

- 8.2. Stretch Mark Prevention and Treatment Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, by Active Ingredient, 2021-2035

- 8.2.1. Retinol/Retinoids

- 8.2.2. Hyaluronic Acid

- 8.2.3. Vitamin E

- 8.2.4. Vitamin C

- 8.2.5. Cocoa Butter

- 8.2.6. Glycolic Acid

- 8.2.7. Plant Extracts

- 8.2.8. Others

- 9. Global Stretch Mark Prevention and Treatment Products Market Analysis, by Treatment Stage

- 9.1. Key Segment Analysis

- 9.2. Stretch Mark Prevention and Treatment Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, by Treatment Stage, 2021-2035

- 9.2.1. Preventive Products

- 9.2.2. Active Treatment

- 9.2.3. Corrective Treatment

- 9.2.4. Maintenance Products

- 10. Global Stretch Mark Prevention and Treatment Products Market Analysis, by Distribution Channel

- 10.1. Key Segment Analysis

- 10.2. Stretch Mark Prevention and Treatment Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 10.2.1. Online Channels

- 10.2.1.1. E-commerce Platforms

- 10.2.1.2. Company Websites

- 10.2.1.3. Online Pharmacies

- 10.2.1.4. Others

- 10.2.2. Offline Channels

- 10.2.2.1. Supermarkets/Hypermarkets

- 10.2.2.2. Pharmacies/Drugstores

- 10.2.2.3. Dermatology Clinics

- 10.2.2.4. Specialty Stores

- 10.2.2.5. Others

- 10.2.1. Online Channels

- 11. Global Stretch Mark Prevention and Treatment Products Market Analysis, by Consumer Demographic

- 11.1. Key Segment Analysis

- 11.2. Stretch Mark Prevention and Treatment Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, by Consumer Demographic, 2021-2035

- 11.2.1. Gender

- 11.2.1.1. Women

- 11.2.1.2. Men

- 11.2.1.3. Unisex

- 11.2.2. Age Group

- 11.2.2.1. Teenagers (13-19 years)

- 11.2.2.2. Young Adults (20-30 years)

- 11.2.2.3. Adults (31-45 years)

- 11.2.2.4. Middle-aged (46-60 years)

- 11.2.2.5. Seniors (Above 60 years)

- 11.2.1. Gender

- 12. Global Stretch Mark Prevention and Treatment Products Market Analysis, by End-Use Application

- 12.1. Key Segment Analysis

- 12.2. Stretch Mark Prevention and Treatment Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, by End-Use Application, 2021-2035

- 12.2.1. Pregnancy-Related Stretch Marks

- 12.2.2. Weight Gain/Loss-Related

- 12.2.3. Growth Spurt-Related

- 12.2.4. Bodybuilding/Muscle Growth

- 12.2.5. Post-Surgery/Medical

- 12.2.6. Hormonal Changes

- 12.2.7. General Skin Care

- 13. Global Stretch Mark Prevention and Treatment Products Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Stretch Mark Prevention and Treatment Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Stretch Mark Prevention and Treatment Products Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Stretch Mark Prevention and Treatment Products Market Size (Volume Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Formulation

- 14.3.3. Active Ingredient

- 14.3.4. Treatment Stage

- 14.3.5. Distribution Channel

- 14.3.6. Consumer Demographic

- 14.3.7. End-Use Application

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Stretch Mark Prevention and Treatment Products Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Formulation

- 14.4.4. Active Ingredient

- 14.4.5. Treatment Stage

- 14.4.6. Distribution Channel

- 14.4.7. Consumer Demographic

- 14.4.8. End-Use Application

- 14.5. Canada Stretch Mark Prevention and Treatment Products Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Formulation

- 14.5.4. Active Ingredient

- 14.5.5. Treatment Stage

- 14.5.6. Distribution Channel

- 14.5.7. Consumer Demographic

- 14.5.8. End-Use Application

- 14.6. Mexico Stretch Mark Prevention and Treatment Products Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Formulation

- 14.6.4. Active Ingredient

- 14.6.5. Treatment Stage

- 14.6.6. Distribution Channel

- 14.6.7. Consumer Demographic

- 14.6.8. End-Use Application

- 15. Europe Stretch Mark Prevention and Treatment Products Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Stretch Mark Prevention and Treatment Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Formulation

- 15.3.3. Active Ingredient

- 15.3.4. Treatment Stage

- 15.3.5. Distribution Channel

- 15.3.6. Consumer Demographic

- 15.3.7. End-Use Application

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Stretch Mark Prevention and Treatment Products Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Formulation

- 15.4.4. Active Ingredient

- 15.4.5. Treatment Stage

- 15.4.6. Distribution Channel

- 15.4.7. Consumer Demographic

- 15.4.8. End-Use Application

- 15.5. United Kingdom Stretch Mark Prevention and Treatment Products Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Formulation

- 15.5.4. Active Ingredient

- 15.5.5. Treatment Stage

- 15.5.6. Distribution Channel

- 15.5.7. Consumer Demographic

- 15.5.8. End-Use Application

- 15.6. France Stretch Mark Prevention and Treatment Products Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Formulation

- 15.6.4. Active Ingredient

- 15.6.5. Treatment Stage

- 15.6.6. Distribution Channel

- 15.6.7. Consumer Demographic

- 15.6.8. End-Use Application

- 15.7. Italy Stretch Mark Prevention and Treatment Products Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Formulation

- 15.7.4. Active Ingredient

- 15.7.5. Treatment Stage

- 15.7.6. Distribution Channel

- 15.7.7. Consumer Demographic

- 15.7.8. End-Use Application

- 15.8. Spain Stretch Mark Prevention and Treatment Products Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Formulation

- 15.8.4. Active Ingredient

- 15.8.5. Treatment Stage

- 15.8.6. Distribution Channel

- 15.8.7. Consumer Demographic

- 15.8.8. End-Use Application

- 15.9. Netherlands Stretch Mark Prevention and Treatment Products Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Product Type

- 15.9.3. Formulation

- 15.9.4. Active Ingredient

- 15.9.5. Treatment Stage

- 15.9.6. Distribution Channel

- 15.9.7. Consumer Demographic

- 15.9.8. End-Use Application

- 15.10. Nordic Countries Stretch Mark Prevention and Treatment Products Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Product Type

- 15.10.3. Formulation

- 15.10.4. Active Ingredient

- 15.10.5. Treatment Stage

- 15.10.6. Distribution Channel

- 15.10.7. Consumer Demographic

- 15.10.8. End-Use Application

- 15.11. Poland Stretch Mark Prevention and Treatment Products Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Product Type

- 15.11.3. Formulation

- 15.11.4. Active Ingredient

- 15.11.5. Treatment Stage

- 15.11.6. Distribution Channel

- 15.11.7. Consumer Demographic

- 15.11.8. End-Use Application

- 15.12. Russia & CIS Stretch Mark Prevention and Treatment Products Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Product Type

- 15.12.3. Formulation

- 15.12.4. Active Ingredient

- 15.12.5. Treatment Stage

- 15.12.6. Distribution Channel

- 15.12.7. Consumer Demographic

- 15.12.8. End-Use Application

- 15.13. Rest of Europe Stretch Mark Prevention and Treatment Products Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Product Type

- 15.13.3. Formulation

- 15.13.4. Active Ingredient

- 15.13.5. Treatment Stage

- 15.13.6. Distribution Channel

- 15.13.7. Consumer Demographic

- 15.13.8. End-Use Application

- 16. Asia Pacific Stretch Mark Prevention and Treatment Products Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Asia Pacific Stretch Mark Prevention and Treatment Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Formulation

- 16.3.3. Active Ingredient

- 16.3.4. Treatment Stage

- 16.3.5. Distribution Channel

- 16.3.6. Consumer Demographic

- 16.3.7. End-Use Application

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Stretch Mark Prevention and Treatment Products Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Formulation

- 16.4.4. Active Ingredient

- 16.4.5. Treatment Stage

- 16.4.6. Distribution Channel

- 16.4.7. Consumer Demographic

- 16.4.8. End-Use Application

- 16.5. India Stretch Mark Prevention and Treatment Products Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Formulation

- 16.5.4. Active Ingredient

- 16.5.5. Treatment Stage

- 16.5.6. Distribution Channel

- 16.5.7. Consumer Demographic

- 16.5.8. End-Use Application

- 16.6. Japan Stretch Mark Prevention and Treatment Products Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Formulation

- 16.6.4. Active Ingredient

- 16.6.5. Treatment Stage

- 16.6.6. Distribution Channel

- 16.6.7. Consumer Demographic

- 16.6.8. End-Use Application

- 16.7. South Korea Stretch Mark Prevention and Treatment Products Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Formulation

- 16.7.4. Active Ingredient

- 16.7.5. Treatment Stage

- 16.7.6. Distribution Channel

- 16.7.7. Consumer Demographic

- 16.7.8. End-Use Application

- 16.8. Australia and New Zealand Stretch Mark Prevention and Treatment Products Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Formulation

- 16.8.4. Active Ingredient

- 16.8.5. Treatment Stage

- 16.8.6. Distribution Channel

- 16.8.7. Consumer Demographic

- 16.8.8. End-Use Application

- 16.9. Indonesia Stretch Mark Prevention and Treatment Products Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Formulation

- 16.9.4. Active Ingredient

- 16.9.5. Treatment Stage

- 16.9.6. Distribution Channel

- 16.9.7. Consumer Demographic

- 16.9.8. End-Use Application

- 16.10. Malaysia Stretch Mark Prevention and Treatment Products Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Formulation

- 16.10.4. Active Ingredient

- 16.10.5. Treatment Stage

- 16.10.6. Distribution Channel

- 16.10.7. Consumer Demographic

- 16.10.8. End-Use Application

- 16.11. Thailand Stretch Mark Prevention and Treatment Products Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Formulation

- 16.11.4. Active Ingredient

- 16.11.5. Treatment Stage

- 16.11.6. Distribution Channel

- 16.11.7. Consumer Demographic

- 16.11.8. End-Use Application

- 16.12. Vietnam Stretch Mark Prevention and Treatment Products Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Formulation

- 16.12.4. Active Ingredient

- 16.12.5. Treatment Stage

- 16.12.6. Distribution Channel

- 16.12.7. Consumer Demographic

- 16.12.8. End-Use Application

- 16.13. Rest of Asia Pacific Stretch Mark Prevention and Treatment Products Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Formulation

- 16.13.4. Active Ingredient

- 16.13.5. Treatment Stage

- 16.13.6. Distribution Channel

- 16.13.7. Consumer Demographic

- 16.13.8. End-Use Application

- 17. Middle East Stretch Mark Prevention and Treatment Products Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Stretch Mark Prevention and Treatment Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Formulation

- 17.3.3. Active Ingredient

- 17.3.4. Treatment Stage

- 17.3.5. Distribution Channel

- 17.3.6. Consumer Demographic

- 17.3.7. End-Use Application

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Stretch Mark Prevention and Treatment Products Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Formulation

- 17.4.4. Active Ingredient

- 17.4.5. Treatment Stage

- 17.4.6. Distribution Channel

- 17.4.7. Consumer Demographic

- 17.4.8. End-Use Application

- 17.5. UAE Stretch Mark Prevention and Treatment Products Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Formulation

- 17.5.4. Active Ingredient

- 17.5.5. Treatment Stage

- 17.5.6. Distribution Channel

- 17.5.7. Consumer Demographic

- 17.5.8. End-Use Application

- 17.6. Saudi Arabia Stretch Mark Prevention and Treatment Products Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Formulation

- 17.6.4. Active Ingredient

- 17.6.5. Treatment Stage

- 17.6.6. Distribution Channel

- 17.6.7. Consumer Demographic

- 17.6.8. End-Use Application

- 17.7. Israel Stretch Mark Prevention and Treatment Products Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Formulation

- 17.7.4. Active Ingredient

- 17.7.5. Treatment Stage

- 17.7.6. Distribution Channel

- 17.7.7. Consumer Demographic

- 17.7.8. End-Use Application

- 17.8. Rest of Middle East Stretch Mark Prevention and Treatment Products Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Formulation

- 17.8.4. Active Ingredient

- 17.8.5. Treatment Stage

- 17.8.6. Distribution Channel

- 17.8.7. Consumer Demographic

- 17.8.8. End-Use Application

- 18. Africa Stretch Mark Prevention and Treatment Products Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Stretch Mark Prevention and Treatment Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Formulation

- 18.3.3. Active Ingredient

- 18.3.4. Treatment Stage

- 18.3.5. Distribution Channel

- 18.3.6. Consumer Demographic

- 18.3.7. End-Use Application

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Stretch Mark Prevention and Treatment Products Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Formulation

- 18.4.4. Active Ingredient

- 18.4.5. Treatment Stage

- 18.4.6. Distribution Channel

- 18.4.7. Consumer Demographic

- 18.4.8. End-Use Application

- 18.5. Egypt Stretch Mark Prevention and Treatment Products Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Formulation

- 18.5.4. Active Ingredient

- 18.5.5. Treatment Stage

- 18.5.6. Distribution Channel

- 18.5.7. Consumer Demographic

- 18.5.8. End-Use Application

- 18.6. Nigeria Stretch Mark Prevention and Treatment Products Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Formulation

- 18.6.4. Active Ingredient

- 18.6.5. Treatment Stage

- 18.6.6. Distribution Channel

- 18.6.7. Consumer Demographic

- 18.6.8. End-Use Application

- 18.7. Algeria Stretch Mark Prevention and Treatment Products Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Formulation

- 18.7.4. Active Ingredient

- 18.7.5. Treatment Stage

- 18.7.6. Distribution Channel

- 18.7.7. Consumer Demographic

- 18.7.8. End-Use Application

- 18.8. Rest of Africa Stretch Mark Prevention and Treatment Products Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Formulation

- 18.8.4. Active Ingredient

- 18.8.5. Treatment Stage

- 18.8.6. Distribution Channel

- 18.8.7. Consumer Demographic

- 18.8.8. End-Use Application

- 19. South America Stretch Mark Prevention and Treatment Products Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. South America Stretch Mark Prevention and Treatment Products Market Size (Volume - Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Formulation

- 19.3.3. Active Ingredient

- 19.3.4. Treatment Stage

- 19.3.5. Distribution Channel

- 19.3.6. Consumer Demographic

- 19.3.7. End-Use Application

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Stretch Mark Prevention and Treatment Products Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Formulation

- 19.4.4. Active Ingredient

- 19.4.5. Treatment Stage

- 19.4.6. Distribution Channel

- 19.4.7. Consumer Demographic

- 19.4.8. End-Use Application

- 19.5. Argentina Stretch Mark Prevention and Treatment Products Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Formulation

- 19.5.4. Active Ingredient

- 19.5.5. Treatment Stage

- 19.5.6. Distribution Channel

- 19.5.7. Consumer Demographic

- 19.5.8. End-Use Application

- 19.6. Rest of South America Stretch Mark Prevention and Treatment Products Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Formulation

- 19.6.4. Active Ingredient

- 19.6.5. Treatment Stage

- 19.6.6. Distribution Channel

- 19.6.7. Consumer Demographic

- 19.6.8. End-Use Application

- 20. Key Players/ Company Profile

- 20.1. Basq Skincare

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Belli Skincare

- 20.3. Bio-Oil (Omega Pharma)

- 20.4. Botanic Tree

- 20.5. Burt's Bees (Clorox Company)

- 20.6. Clarins Group

- 20.7. Earth Mama Organics

- 20.8. Elemis Ltd

- 20.9. Frank Body

- 20.10. Mama Mio (Mio Skincare)

- 20.11. Mederma (Merz Pharma)

- 20.12. Motherlove Herbal Company

- 20.13. Mustela (Laboratoires Expanscience)

- 20.14. Palmer's (E.T. Browne Drug Company)

- 20.15. Revitol

- 20.16. Sol de Janeiro

- 20.17. StriVectin (Klein-Becker USA)

- 20.18. The Honest Company

- 20.19. TriLASTIN

- 20.20. Weleda AG

- 20.21. Other Key Players

- 20.1. Basq Skincare

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Stretch Mark Prevention and Treatment Products Market by Product Type, Formulation, Active Ingredient, Treatment Stage, Distribution Channel, Consumer Demographic, End-Use Application, and Geography

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Stretch Mark Prevention and Treatment Products Market Size, Share & Trends Analysis Report by Product Type (Creams and Lotions, Oils and Serums, Gels, Body Butters, Balms and Ointments, Scrubs and Exfoliants, Supplements (Oral), Medical Devices), Formulation, Active Ingredient, Treatment Stage, Distribution Channel, Consumer Demographic, End-Use Application, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Stretch Mark Prevention and Treatment Products Market Size, Share, and Growth

The global stretch mark prevention and treatment products market is experiencing robust growth, with its estimated value of USD 1.6 billion in the year 2025 and USD 3.3 billion by the period 2035, registering a CAGR of 7.5%, during the forecast period. The global stretch mark prevention and treatment products market is evolving towards consumer orientation towards well-being, skin health, and sustainability. Women are also focusing on products that assure them of skin safety, comfort, and effectiveness, which is pushing them to seek superior products that are clinically plausible. The increasing awareness of the need to take care of the postpartum, skin changes in pregnancy and the need to have preventive treatments are further driving the growth of the market.

Sophie Hooper, Founder, Secret Saviours, said,

"We like to think that Secret Saviours is life-changing wear for when your life is changing the most."

The consumer demand of wellness, sustainability and personalized solutions are driving the stretch mark prevention and treatment market to a strong growth. Women are also more concerned with products that demonstrate their values and put emphasis on ingredient transparency, ethical sourcing, and clinically-proven effectiveness particularly within pregnancy skincare products, where safety, efficacy, and ingredient credibility carry heightened importance. This change is reflective of the greater social trends that give women freedom to choose about health, beauty, and environmental effects.

The major brands are reacting by reformulating their products to omit the disputable ingredients, using environment-friendly packaging options, and using digital platforms to build an authentic consumer interaction. Third-party certifying programs, cleaning beauty principles and education based marketing campaigns will assist companies to match the informed, lifestyle-driven buying behaviors and develop trust.

The adjacent market opportunities are customized beauty technology, delivering-the-products subscriptions strategy, integration of telehealth and entering the world of complementary wellness. The strategies also help companies to create more revenue sources, customer lifetime value, and holistic ecosystems that would deal with various aspects of female health, beauty and well-being.

Stretch Mark Prevention and Treatment Products Market Dynamics and Trends

Driver: Rising Pregnancy Rates and Weight Management Awareness

Restraint: Variable Product Efficacy and Consumer Skepticism

Opportunity: Growth in Postpartum Treatment Segment

Key Trend: Integration of Centella Asiatica and Biomimetic Peptides

Stretch Mark Prevention and Treatment Products Market Analysis and Segmental Data

Creams and Lotions Dominate Global Stretch Mark Prevention and Treatment Products Market

North America Leads Global Stretch Mark Prevention and Treatment Products Market Demand

Stretch-Mark-Prevention-and-Treatment-Products-Market Ecosystem

The global stretch-mark prevention and treatment products market is a relative market where multinational conglomerate, specialty, and direct-to-consumer start-up companies operate in various segments and cost brackets. The market leaders, which include Mustela (Laboratoires Expanscience), Clarins Group, Mederma (Merz Pharma), Bio-Oil (Omega Pharma) and StriVectin (Klein-Becker USA) seize the mass-market segments with their scale, research strength and the vast network of distribution, and the special brands stand out due to their premium positioning, authenticity, and focus on consumers.

The market value chain reaches out to suppliers of ingredients, developers of formulations, contract manufacturing, packaging suppliers, distributors, retailers, and marketing agencies, which provide end-to-end solutions. Major players are focusing on vertical integration, direct-to-consumer products and digital marketing programs to increase competitiveness, maximize margins and are establishing direct consumer relationships to support personalized product and innovations that are driven by data.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 1.6 Bn |

|

Market Forecast Value in 2035 |

USD 3.3 Bn |

|

Growth Rate (CAGR) |

7.5% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Volume Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Stretch-Mark-Prevention-and-Treatment-Products-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Stretch Mark Prevention and Treatment Products Market, By Product Type |

|

|

Stretch Mark Prevention and Treatment Products Market, By Formulation |

|

|

Stretch Mark Prevention and Treatment Products Market, By Active Ingredient |

|

|

Stretch Mark Prevention and Treatment Products Market, By Treatment Stage |

|

|

Stretch Mark Prevention and Treatment Products Market, By Distribution Channel |

|

|

Stretch Mark Prevention and Treatment Products Market, By Consumer Demographic |

|

|

Stretch Mark Prevention and Treatment Products Market, By End-Use Application |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation