- The global cookware market is valued at USD 27.2 billion in 2025.

- The market is projected to grow at a CAGR of 5.7% during the forecast period of 2026 to 2035.

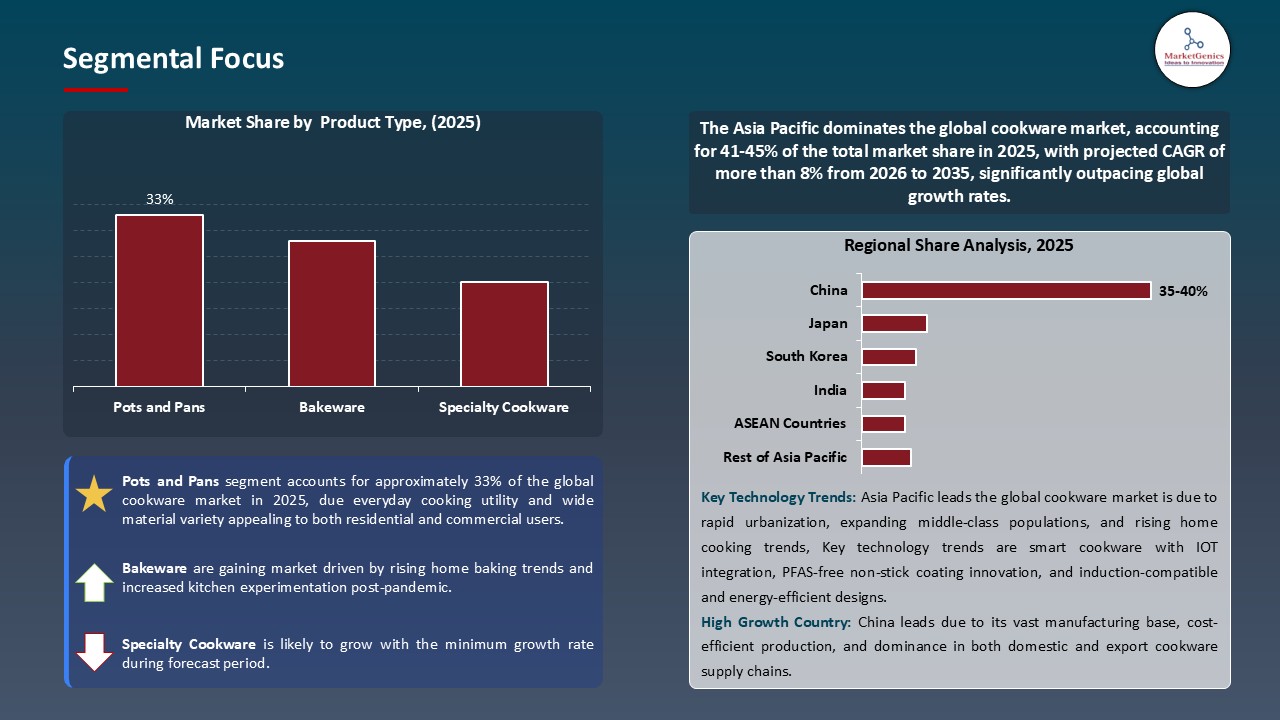

- The pots and pans segment hold major share ~33% in the global cookware market, due to their essential role in everyday cooking and versatility across a wide range of cuisines and cooking methods.

- The cookware market growing due to the growing popularity of induction cooktops is driving demand for induction-compatible cookware.

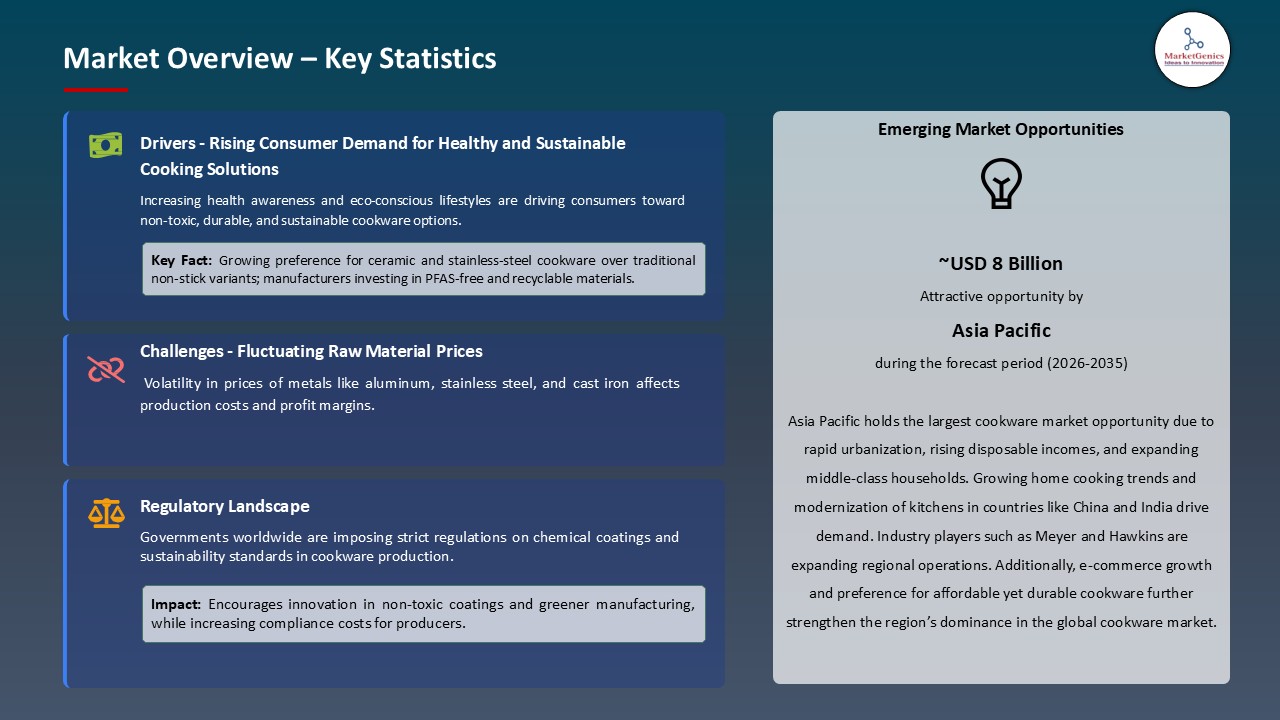

- The cookware market is driven by consumers are shifting toward non-toxic, eco-friendly materials such as stainless steel, ceramic, and cast iron.

- The top five players accounting for nearly 25% of the global cookware market share in 2025.

- In June 2025, TTK Prestige launched the Ceraglide Duo Ceramic Cookware range, featuring durable ceramic coatings and PFOA/PFAS-free construction.

- In March 2024, Joseph Joseph launched the “Space” cookware collection featuring SwingLock fold-in handles and stainless-steel construction for space efficiency.

- Global Cookware Market is likely to create the total forecasting opportunity of ~USD 20 Bn till 2035.

- Asia Pacific is most attractive region due to rapid urbanization, rising disposable incomes, expanding middle-class population, and growing preference for modern, premium cookware products.

- The cookware market is driven by the process of premiumization where customers spend on quality goods that are valued based on performance, design and emotional attachment. Its use as wedding, housewarming, and holiday gifts also increases the demand this generates several purchase motives on the personal use, gifting, and collection-building among culinary enthusiasts. For instance, in April 2024, Arttd’inox, the subsidiary of the Jindal Stainless, recently announced the high-end product lines of the Vida, Stellar, and Timber cookware with a focus on quality stainless steel and a sleek design.

- Additionally, influencer marketing and cooking show product placements will be a useful solution to boost the adoption of premium cookware as aspirational consumers desire to imitate professional chefs with the equipment used by them in the media. Brands like Le Cremeuset, Staub and All-Clad are experiencing organic value in the culinary shows and social media which creates authenticity and consumer desirability which could not be created by traditional advertisements.

- The high-end cookware industry is experiencing long-term growth due to increased culinary interest, high-end material requests, stable gifting, and influencer-led awareness. This leads to greater margins, brand loyalty, and market values that outpace volume growth.

- Cookware market is limited due to high penetration in developed economies where household owners already have adequate cookware. Premium cookware, such as stainless steel and cast iron, is durable and lasts 10-15 years, making them only bought by new homes or lifestyle changes or discretionary upgrades. For instance, the IKEA 365+ stainless steel cookware is meant to be used daily and comes with a 15-year warranty on non-coated/non-stick items.

- Additionally, the cookware market which is dominated by high-durability goods like cast iron and high-quality stainless steel has less repeat purchase, since consumer may not need to replace the same. This poses a strategic conflict between maintaining product quality and brand integrity and seeking business models of premeditated obsolescence or replacement cycle-driven trends, prevalent in other consumer goods sectors.

- Growth in developed economies continues to depend on discovering emerging markets, offering premium products, innovating categories, or diversifying into products with shorter replacement cycles due to market saturation and product longevity.

- The cookware market can experience a massive growth with health-conscious customers willing to find non-toxic items and specialty cookware, including cast iron, copper, or carbon steel, allowing the premiumization and increasing the market share as households increasingly invest in complementary kitchen solutions such as the air fryer for everyday, health-oriented cooking. As an example, in September 2024, Caraway has released its new Enameled Cast Iron, which is 50% recycled, PTFE free, PFOA free, and low maintenance, which signaled its transition into high-end, clean cookware.

- Additionally, the increasing popularity of ethnic cooking contributes to the need of ethnic cookware to support the culinary passion of the local population, like woks, tagines, paella pans, and Dutch ovens to prepare authentic cooking in the world dishes.

- Cookware vendors have the opportunity on health-conscious and specialty cooking trends to extend their target market beyond basic replacements and necessities.

- The cookware market is moving towards sustainable production, the use of recycled products, reduced packaging, carbon-neutral manufacturing, and takeback recycling of the end-of-life products. These initiatives are consistent with increasing consumer demand especially amongst younger, more environmentally conscious populations and reducing resource scarcity and exposure to unstable commodity prices by cycling materials.

- For instance, in August 2024, RL Industry released a new Baker’s Secret bakeware and cookware line consisting of recycled carbon steel and aluminum with packaging created out of recycled paper.

- Furthermore, cookware take-back and recycling initiatives enable manufacturers to reuse the end-of-life products to recover materials and enhance customer interaction by putting up sustainable disposal initiatives. As an example, in 2023, Fissler (Germany) collaborated with Outokumpu (Finland) to use Circle Green stainless steel, with a maximum content of recycled material (98). This project highlights the transition of the industry towards the closed cycle manufacture and low environmental footprint.

- The sustainability megatrend creates a competitive advantage for retailers who prioritize environmental standards. Brands can differentiate themselves and command higher prices among environmentally conscious consumers.

- The pots and pans segment dominate the global cookware market rising interest in home cooking and cooking in the world households is driving the continued demand of multi-purpose pots and pans in the global households. For instance, in May 2025, Meyer Presta launched a tri-ply stainless steel line of pressure cookers in India under its retail brand of Pots and Pans, emphasizing the durability and efficient heat distribution.

- Additionally, product functionality is being pushed by advancements in nonstick coatings, hardy material technologies and induction compatibility making pots and pans crucial segments in the international cookware marketplace. As an example, Teflon has developed the Radiance non-stick coating technology on stainless-steel cookware that is induction compatible, and incorporates ferromagnetic particles so that they can improve the heat distribution and optimize the non-stick behavior of induction cooktops.

- The cookware sector is focusing on innovation, materials, and utility, with pots and pans playing a key role in modern kitchenware performance.

- Asia Pacific leads the global cookware market, due to the large population base of the region, the rising population of the middle-income with increasing disposable income, the home cooking culture, and competitive domestic manufacturing, which facilitate supply chain efficiency. The varied market environment in the region, with one end having fully developed economies like Japan and South Korea and the other end having the fast-developing economies like India and Southeast Asia, offers wide and dynamic growth potential to the cookware manufacturers.

- For instance, in April 2025, Vinod Intelligent Cookware launched its first partnership (with grocery app Waangoo) in Singapore and Southeast Asia, opening a digital booth with its top 100 SKUs, such as stainless steel, tri-ply and pressure cooker collections. This growth increases the presence of the brand in the region and reinforces the increased contribution of Asia Pacific as a central growth center of high-quality cookware.

- Additionally, the well-established manufacturing base of Asia Pacific in which China dominates the production of the majority of all cookware has also offered considerable cost savings, simplified design-to-production cycles, and efficient material sourcing. Manufactures in the region are moving away more and more towards producing under their own brand on Western brands to produce their own high-value brands, which allow them to capture more value at both the local and global level.

- Asia Pacific remains by far the largest and steadily rising consumer of cookware because to its large population, growing middle class, manufacturing power, and diverse market maturity.

- In June 2025, TTK Prestige launched the Ceraglide Duo Ceramic Cookware line, with improved ceramic glazes, improved heat retention, and without PFOA/PFAS.

- In March 2024, Joseph Joseph announced its brand-new Space cookwear range, which is created to overcome the modern kitchen limitations through fold-in SwingLock handles, making the space-saving storage of this cook-toilette without any functionality loss. The collection is comprised of high-quality stainless-steel cookware creating durable, ergonomic, and space-efficient cookware according to trends of multifunctional kitchen solutions.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- All-Clad Metalcrafters LLC

- Anolon

- Berndes

- Calphalon

- Cristel

- Fissler GmbH

- Groupe SEB

- Hawkins Cookers Limited

- Le Creuset

- Lodge Manufacturing Company

- Mauviel

- Meyer Corporation

- Newell Brands

- Nordic Ware

- Rösle GmbH & Co. KG

- Scanpan

- Smithey Ironware Company

- Staub

- The Cookware Company

- Tramontina

- TTK Prestige Limited

- Other Key Players

- Pots and Pans

- Saucepans

- Frying Pans/Skillets

- Stockpots

- Sauté Pans

- Griddles

- Woks

- Others

- Bakeware

- Baking Sheets

- Cake Pans

- Muffin Tins

- Roasting Pans

- Others

- Specialty Cookware

- Pressure Cookers

- Dutch Ovens

- Casserole Dishes

- Grill Pans

- Others

- Stainless Steel

- Aluminum

- Cast Iron

- Non-stick Coated

- Copper

- Glass

- Others

- PTFE (Teflon) Coating

- Ceramic Coating

- Enamel Coating

- Anodized Coating

- Uncoated/Raw Material

- Online

- E-commerce Platforms

- Company Websites

- Online Marketplaces

- Others

- Offline

- Specialty Kitchenware Stores

- Departmental Stores

- Hypermarkets/Supermarkets

- Others

- Wholesale Distributors

- Residential/Household

- Individual Consumers

- Home Chefs

- Cooking Enthusiasts

- Others

- Commercial

- Restaurants

- Hotels

- Catering Services

- Cloud Kitchens

- Institutional Kitchens

- Food Processing Units

- Others

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Cookware Market Outlook

- 2.1.1. Cookware Market Size (Volume - Million Units and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Cookware Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising health- and home-cooking consciousness

- 4.1.1.2. Growth of e-commerce and digital marketing expanding global access

- 4.1.1.3. Innovation in materials and technology, including eco-friendly and non-toxic cookware

- 4.1.2. Restraints

- 4.1.2.1. Volatility in raw material and production costs

- 4.1.2.2. High cost of premium cookware and slower replacement cycles

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Cookware Manufacturers

- 4.4.3. Distributors/ Suppliers

- 4.4.4. End-users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Cookware Market Demand

- 4.7.1. Historical Market Size - in (Volume - Million Units and Value - US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - in (Volume - Million Units and Value - US$ Bn), 2026–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Cookware Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Cookware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Pots and Pans

- 6.2.1.1. Saucepans

- 6.2.1.2. Frying Pans/Skillets

- 6.2.1.3. Stockpots

- 6.2.1.4. Sauté Pans

- 6.2.1.5. Griddles

- 6.2.1.6. Woks

- 6.2.1.7. Others

- 6.2.2. Bakeware

- 6.2.2.1. Baking Sheets

- 6.2.2.2. Cake Pans

- 6.2.2.3. Muffin Tins

- 6.2.2.4. Roasting Pans

- 6.2.2.5. Others

- 6.2.3. Specialty Cookware

- 6.2.3.1. Pressure Cookers

- 6.2.3.2. Dutch Ovens

- 6.2.3.3. Casserole Dishes

- 6.2.3.4. Grill Pans

- 6.2.3.5. Others

- 6.2.1. Pots and Pans

- 7. Global Cookware Market Analysis, by Material Type

- 7.1. Key Segment Analysis

- 7.2. Cookware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Material Type, 2021-2035

- 7.2.1. Stainless Steel

- 7.2.2. Aluminum

- 7.2.3. Cast Iron

- 7.2.4. Non-stick Coated

- 7.2.5. Copper

- 7.2.6. Glass

- 7.2.7. Others

- 8. Global Cookware Market Analysis and Forecasts, by Coating Type

- 8.1. Key Findings

- 8.2. Cookware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Coating Type, 2021-2035

- 8.2.1. PTFE (Teflon) Coating

- 8.2.2. Ceramic Coating

- 8.2.3. Enamel Coating

- 8.2.4. Anodized Coating

- 8.2.5. Uncoated/Raw Material

- 9. Global Cookware Market Analysis and Forecasts, by Distribution Channel

- 9.1. Key Findings

- 9.2. Cookware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 9.2.1. Online

- 9.2.1.1. E-commerce Platforms

- 9.2.1.2. Company Websites

- 9.2.1.3. Online Marketplaces

- 9.2.1.4. Others

- 9.2.2. Offline

- 9.2.2.1. Specialty Kitchenware Stores

- 9.2.2.2. Departmental Stores

- 9.2.2.3. Hypermarkets/Supermarkets

- 9.2.2.4. Others

- 9.2.3. Wholesale Distributors

- 9.2.1. Online

- 10. Global Cookware Market Analysis and Forecasts, by End-Users

- 10.1. Key Findings

- 10.2. Cookware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by End-Users , 2021-2035

- 10.2.1. Residential/Household

- 10.2.1.1. Individual Consumers

- 10.2.1.2. Home Chefs

- 10.2.1.3. Cooking Enthusiasts

- 10.2.1.4. Others

- 10.2.2. Commercial

- 10.2.2.1. Restaurants

- 10.2.2.2. Hotels

- 10.2.2.3. Catering Services

- 10.2.2.4. Cloud Kitchens

- 10.2.2.5. Institutional Kitchens

- 10.2.2.6. Food Processing Units

- 10.2.2.7. Others

- 10.2.1. Residential/Household

- 11. Global Cookware Market Analysis and Forecasts, by Region

- 11.1. Key Findings

- 11.2. Cookware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 11.2.1. North America

- 11.2.2. Europe

- 11.2.3. Asia Pacific

- 11.2.4. Middle East

- 11.2.5. Africa

- 11.2.6. South America

- 12. North America Cookware Market Analysis

- 12.1. Key Segment Analysis

- 12.2. Regional Snapshot

- 12.3. North America Cookware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 12.3.1. Product Type

- 12.3.2. Material Type

- 12.3.3. Coating Type

- 12.3.4. Distribution Channel

- 12.3.5. End-Users

- 12.3.6. Country

- 12.3.6.1. USA

- 12.3.6.2. Canada

- 12.3.6.3. Mexico

- 12.4. USA Cookware Market

- 12.4.1. Country Segmental Analysis

- 12.4.2. Product Type

- 12.4.3. Material Type

- 12.4.4. Coating Type

- 12.4.5. Distribution Channel

- 12.4.6. End-Users

- 12.5. Canada Cookware Market

- 12.5.1. Country Segmental Analysis

- 12.5.2. Product Type

- 12.5.3. Material Type

- 12.5.4. Coating Type

- 12.5.5. Distribution Channel

- 12.5.6. End-Users

- 12.6. Mexico Cookware Market

- 12.6.1. Country Segmental Analysis

- 12.6.2. Product Type

- 12.6.3. Material Type

- 12.6.4. Coating Type

- 12.6.5. Distribution Channel

- 12.6.6. End-Users

- 13. Europe Cookware Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. Europe Cookware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Product Type

- 13.3.2. Material Type

- 13.3.3. Coating Type

- 13.3.4. Distribution Channel

- 13.3.5. End-Users

- 13.3.6. Country

- 13.3.6.1. Germany

- 13.3.6.2. United Kingdom

- 13.3.6.3. France

- 13.3.6.4. Italy

- 13.3.6.5. Spain

- 13.3.6.6. Netherlands

- 13.3.6.7. Nordic Countries

- 13.3.6.8. Poland

- 13.3.6.9. Russia & CIS

- 13.3.6.10. Rest of Europe

- 13.4. Germany Cookware Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Product Type

- 13.4.3. Material Type

- 13.4.4. Coating Type

- 13.4.5. Distribution Channel

- 13.4.6. End-Users

- 13.5. United Kingdom Cookware Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Product Type

- 13.5.3. Material Type

- 13.5.4. Coating Type

- 13.5.5. Distribution Channel

- 13.5.6. End-Users

- 13.6. France Cookware Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Product Type

- 13.6.3. Material Type

- 13.6.4. Coating Type

- 13.6.5. Distribution Channel

- 13.6.6. End-Users

- 13.7. Italy Cookware Market

- 13.7.1. Country Segmental Analysis

- 13.7.2. Product Type

- 13.7.3. Material Type

- 13.7.4. Coating Type

- 13.7.5. Distribution Channel

- 13.7.6. End-Users

- 13.8. Spain Cookware Market

- 13.8.1. Country Segmental Analysis

- 13.8.2. Product Type

- 13.8.3. Material Type

- 13.8.4. Coating Type

- 13.8.5. Distribution Channel

- 13.8.6. End-Users

- 13.9. Netherlands Cookware Market

- 13.9.1. Country Segmental Analysis

- 13.9.2. Product Type

- 13.9.3. Material Type

- 13.9.4. Coating Type

- 13.9.5. Distribution Channel

- 13.9.6. End-Users

- 13.10. Nordic Countries Cookware Market

- 13.10.1. Country Segmental Analysis

- 13.10.2. Product Type

- 13.10.3. Material Type

- 13.10.4. Coating Type

- 13.10.5. Distribution Channel

- 13.10.6. End-Users

- 13.11. Poland Cookware Market

- 13.11.1. Country Segmental Analysis

- 13.11.2. Product Type

- 13.11.3. Material Type

- 13.11.4. Coating Type

- 13.11.5. Distribution Channel

- 13.11.6. End-Users

- 13.12. Russia & CIS Cookware Market

- 13.12.1. Country Segmental Analysis

- 13.12.2. Product Type

- 13.12.3. Material Type

- 13.12.4. Coating Type

- 13.12.5. Distribution Channel

- 13.12.6. End-Users

- 13.13. Rest of Europe Cookware Market

- 13.13.1. Country Segmental Analysis

- 13.13.2. Product Type

- 13.13.3. Material Type

- 13.13.4. Coating Type

- 13.13.5. Distribution Channel

- 13.13.6. End-Users

- 14. Asia Pacific Cookware Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Asia Pacific Cookware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Material Type

- 14.3.3. Coating Type

- 14.3.4. Distribution Channel

- 14.3.5. End-Users

- 14.3.6. Country

- 14.3.6.1. China

- 14.3.6.2. India

- 14.3.6.3. Japan

- 14.3.6.4. South Korea

- 14.3.6.5. Australia and New Zealand

- 14.3.6.6. Indonesia

- 14.3.6.7. Malaysia

- 14.3.6.8. Thailand

- 14.3.6.9. Vietnam

- 14.3.6.10. Rest of Asia Pacific

- 14.4. China Cookware Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Material Type

- 14.4.4. Coating Type

- 14.4.5. Distribution Channel

- 14.4.6. End-Users

- 14.5. India Cookware Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Material Type

- 14.5.4. Coating Type

- 14.5.5. Distribution Channel

- 14.5.6. End-Users

- 14.6. Japan Cookware Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Material Type

- 14.6.4. Coating Type

- 14.6.5. Distribution Channel

- 14.6.6. End-Users

- 14.7. South Korea Cookware Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Product Type

- 14.7.3. Material Type

- 14.7.4. Coating Type

- 14.7.5. Distribution Channel

- 14.7.6. End-Users

- 14.8. Australia and New Zealand Cookware Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Product Type

- 14.8.3. Material Type

- 14.8.4. Coating Type

- 14.8.5. Distribution Channel

- 14.8.6. End-Users

- 14.9. Indonesia Cookware Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Product Type

- 14.9.3. Material Type

- 14.9.4. Coating Type

- 14.9.5. Distribution Channel

- 14.9.6. End-Users

- 14.10. Malaysia Cookware Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Product Type

- 14.10.3. Material Type

- 14.10.4. Coating Type

- 14.10.5. Distribution Channel

- 14.10.6. End-Users

- 14.11. Thailand Cookware Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Product Type

- 14.11.3. Material Type

- 14.11.4. Coating Type

- 14.11.5. Distribution Channel

- 14.11.6. End-Users

- 14.12. Vietnam Cookware Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Product Type

- 14.12.3. Material Type

- 14.12.4. Coating Type

- 14.12.5. Distribution Channel

- 14.12.6. End-Users

- 14.13. Rest of Asia Pacific Cookware Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Product Type

- 14.13.3. Material Type

- 14.13.4. Coating Type

- 14.13.5. Distribution Channel

- 14.13.6. End-Users

- 15. Middle East Cookware Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Middle East Cookware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Material Type

- 15.3.3. Coating Type

- 15.3.4. Distribution Channel

- 15.3.5. End-Users

- 15.3.6. Country

- 15.3.6.1. Turkey

- 15.3.6.2. UAE

- 15.3.6.3. Saudi Arabia

- 15.3.6.4. Israel

- 15.3.6.5. Rest of Middle East

- 15.4. Turkey Cookware Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Material Type

- 15.4.4. Coating Type

- 15.4.5. Distribution Channel

- 15.4.6. End-Users

- 15.5. UAE Cookware Market

- 15.5.1. Product Type

- 15.5.2. Material Type

- 15.5.3. Coating Type

- 15.5.4. Distribution Channel

- 15.5.5. End-Users

- 15.6. Saudi Arabia Cookware Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Material Type

- 15.6.4. Coating Type

- 15.6.5. Distribution Channel

- 15.6.6. End-Users

- 15.7. Israel Cookware Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Material Type

- 15.7.4. Coating Type

- 15.7.5. Distribution Channel

- 15.7.6. End-Users

- 15.8. Rest of Middle East Cookware Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Material Type

- 15.8.4. Coating Type

- 15.8.5. Distribution Channel

- 15.8.6. End-Users

- 16. Africa Cookware Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Africa Cookware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Material Type

- 16.3.3. Coating Type

- 16.3.4. Distribution Channel

- 16.3.5. End-Users

- 16.3.6. Country

- 16.3.6.1. South Africa

- 16.3.6.2. Egypt

- 16.3.6.3. Nigeria

- 16.3.6.4. Algeria

- 16.3.6.5. Rest of Africa

- 16.4. South Africa Cookware Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Material Type

- 16.4.4. Coating Type

- 16.4.5. Distribution Channel

- 16.4.6. End-Users

- 16.5. Egypt Cookware Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Material Type

- 16.5.4. Coating Type

- 16.5.5. Distribution Channel

- 16.5.6. End-Users

- 16.6. Nigeria Cookware Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Material Type

- 16.6.4. Coating Type

- 16.6.5. Distribution Channel

- 16.6.6. End-Users

- 16.7. Algeria Cookware Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Material Type

- 16.7.4. Coating Type

- 16.7.5. Distribution Channel

- 16.7.6. End-Users

- 16.8. Rest of Africa Cookware Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Material Type

- 16.8.4. Coating Type

- 16.8.5. Distribution Channel

- 16.8.6. End-Users

- 17. South America Cookware Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. South America Cookware Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Material Type

- 17.3.3. Coating Type

- 17.3.4. Distribution Channel

- 17.3.5. End-Users

- 17.3.6. Country

- 17.3.6.1. Brazil

- 17.3.6.2. Argentina

- 17.3.6.3. Rest of South America

- 17.4. Brazil Cookware Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Material Type

- 17.4.4. Coating Type

- 17.4.5. Distribution Channel

- 17.4.6. End-Users

- 17.5. Argentina Cookware Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Material Type

- 17.5.4. Coating Type

- 17.5.5. Distribution Channel

- 17.5.6. End-Users

- 17.6. Rest of South America Cookware Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Material Type

- 17.6.4. Coating Type

- 17.6.5. Distribution Channel

- 17.6.6. End-Users

- 18. Key Players/ Company Profile

- 18.1. All-Clad Metalcrafters LLC

- 18.1.1. Company Details/ Overview

- 18.1.2. Company Financials

- 18.1.3. Key Customers and Competitors

- 18.1.4. Business/ Industry Portfolio

- 18.1.5. Product Portfolio/ Specification Details

- 18.1.6. Pricing Data

- 18.1.7. Strategic Overview

- 18.1.8. Recent Developments

- 18.2. Anolon

- 18.3. Berndes

- 18.4. Calphalon

- 18.5. Cristel

- 18.6. Fissler GmbH

- 18.7. Groupe SEB

- 18.8. Hawkins Cookers Limited

- 18.9. Le Creuset

- 18.10. Lodge Manufacturing Company

- 18.11. Mauviel

- 18.12. Meyer Corporation

- 18.13. Newell Brands

- 18.14. Nordic Ware

- 18.15. Rösle GmbH & Co. KG

- 18.16. Scanpan

- 18.17. Smithey Ironware Company

- 18.18. Staub

- 18.19. The Cookware Company

- 18.20. Tramontina

- 18.21. TTK Prestige Limited

- 18.22. Other Key Players

- 18.1. All-Clad Metalcrafters LLC

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Cookware Market Size, Share & Trends Analysis Report by Product Type (Pots and Pans, Bakeware, Specialty Cookware), Material Type, Coating Type, Distribution Channel, End-Users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Cookware Market Size, Share, and Growth

The global cookware market is experiencing robust growth, with its estimated value of USD 27.2 billion in the year 2025 and USD 47.3 billion by 2035, registering a CAGR of 5.7%, during the forecast period. The demand for cookware is driven by rising health consciousness, growing preference for home-cooked meals, and increasing urbanization with higher disposable incomes. Technological innovations such as non-toxic coatings and induction-compatible designs enhance product appeal, while e-commerce expansion improves accessibility.

Jasjeet Kaur, VP, Marketing, Groupe SEB India, said,

“As a flagship brand under Groupe SEB, Tefal brings global innovation tailored to the evolving needs of Indian consumers. We’re honoured to have Dia Mirza, who truly resonates with our philosophy of conscious innovation, unveil our new product portfolio. Our range of powerful mixer grinders, smart cookware, linen care and intuitive home care appliances delivers safety, durability and everyday ease without compromise.”

The global cookware market is propelled by the growing cooking interest influenced by cooking programs and social media, as well as growing health awareness that encourages the use of homemade food. Customers who desire high-performance cookware and premium quality are increasingly spending on high-end, professional-quality cookware. For instance, in June 2025, Tefal launched more than 40 new items, such as the Revive Ceramic Range, Intensium Stainless Tri-Ply Series, and Flavor Force Titanium-Coated Cookware, which were aimed at urban customers with high durability and innovative features. These technological advancements have been cementing the trend towards premiumization and the desire of consumers to use high-performance, health-conscious cookware products.

Additionally, the worldwide cookware market is evolving by the innovations like no-PTFE-non-stick coating, induction-compatible products, and smart cookware with sensors and apps, enabling it to control cooking high-precision. As an example, in January 2024, Kyocera introduced a new line of ceramic-coated cookware that was not only PTFE, PFOA, lead, and heavy metal-free but has a three-layer base to distribute heat evenly, and can be induced. These innovations are boosting consumer confidence and increasing demand of safer, more efficient and technologically advanced cook ware solutions across the world.

The global cookware market presents adjacent opportunities in specialty cooking tools, utensils, cookware organization and storage solutions, cleaning and maintenance products, and digital culinary services such as recipe platforms and online cooking classes. By capitalizing on these segments, manufacturers will be able to create cohesive cooking ecosystems, improve brand loyalty, and create multiple sources of recurring revenues.

Cookware Market Dynamics and Trends

Driver: Premium Segment Growth and Gifting Occasions

Restraint: Market Saturation and Long Replacement Cycles

Opportunity: Health-Conscious and Specialty Cooking Trends

Key Trend: Sustainable Manufacturing and Circular Economy Initiatives

Cookware-Market Analysis and Segmental Data

Pots and Pans Dominate Global Cookware Market

Asia Pacific Leads Global Cookware Market Demand

Cookware-Market Ecosystem

The global cookware market is moderately fragmented, with high concentration among key players such as Groupe SEB, Meyer Corporation, Newell Brands, Tramontina and TTK Prestige, who dominate through strong brand portfolios, innovation, and extensive distribution networks.

For instance, in 2025, the Tefal brand of Groupe SEB, along with the Paul Bocuse culinary brand, introduced a high-end cookware, also made in France, with 18/10 stainless steel and high-performance non-stick aluminium, which improves the longevity and efficiency of cooking. The collaboration underscores the industry’s emphasis on premiumization, material innovation, and strategic partnerships as key drivers of differentiation and sustained growth in the global cookware market.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 27.2 Bn |

|

Market Forecast Value in 2035 |

USD 47.3 Bn |

|

Growth Rate (CAGR) |

5.7% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Cookware-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Cookware Market, By Product Type |

|

|

Cookware Market, By Material Type |

|

|

Cookware Market, By Coating Type |

|

|

Cookware Market, By Distribution Channel |

|

|

Cookware Market, By End-Users

|

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation