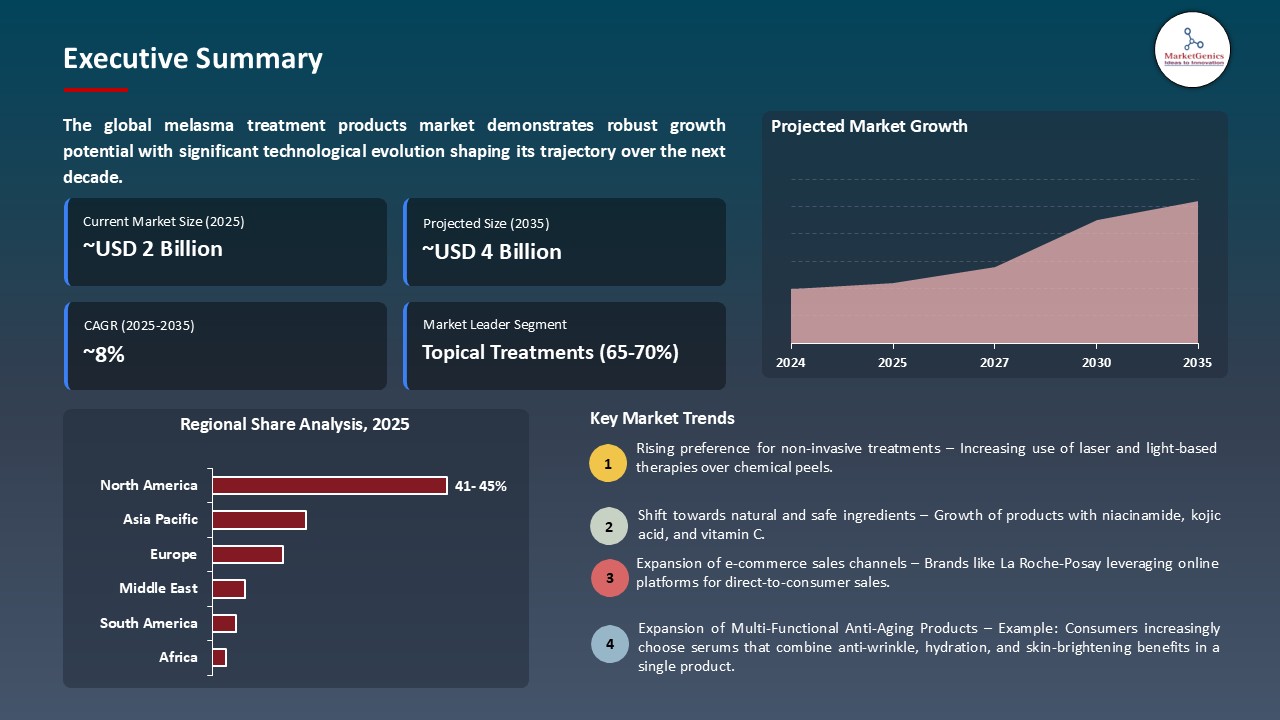

- The global melasma treatment products market is valued at USD 1.8 billion in 2025.

- The market is projected to grow at a CAGR of 7.8% during the forecast period of 2026 to 2035.

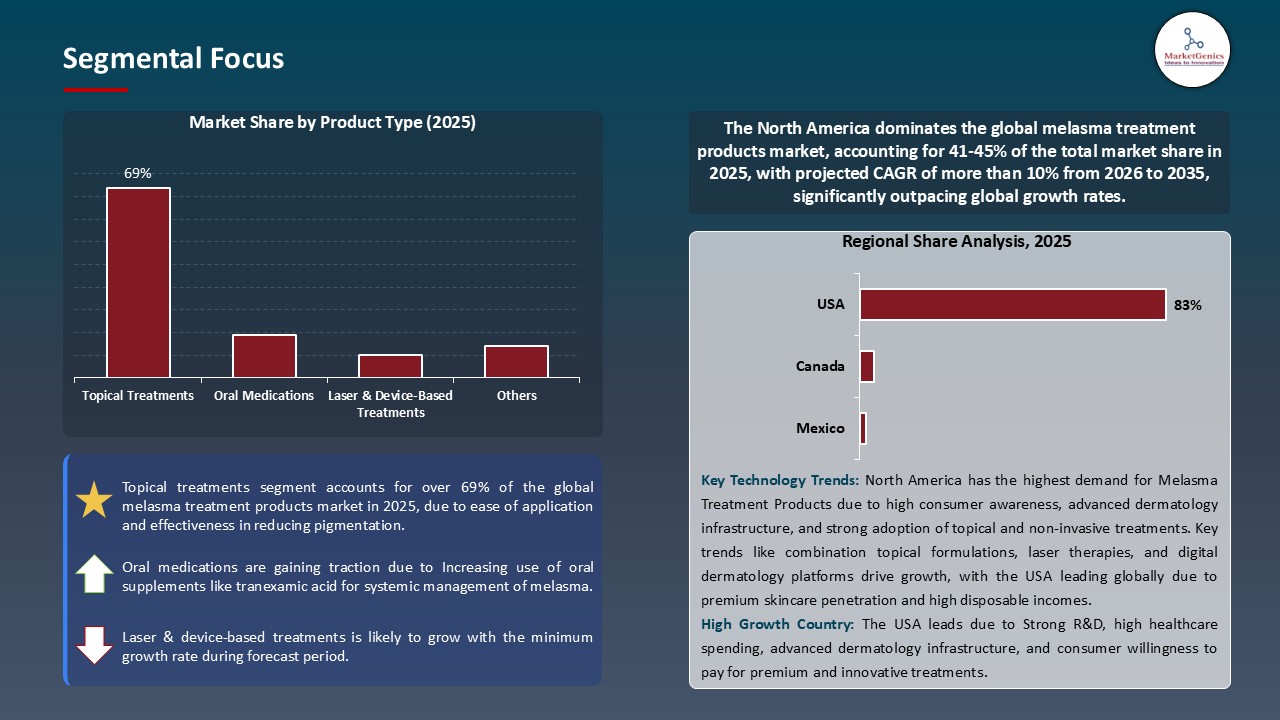

- The topical treatments segment holds major share ~69% in the global melasma treatment products market, because of its high accessibility, non-invasiveness, and cost-effectiveness.

- Rising consumer demand for sustainable and personalized melasma treatments is pushing brands to develop refillable or low-waste topical kits, subscription-based regimens, and tailored formulas that address individual pigmentation patterns, skin types, and lifestyle needs.

- Innovation is accelerating: companies are exploring microneedle patches for controlled delivery, long-release drug systems, and biodegradable transdermal systems, while emphasizing hypoallergenic active ingredients like tranexamic acid or glutathione in skin‑friendly, eco‑engineered formulations.

- The top five player’s accounts for over 25% of the global melasma treatment products market in 2025.

- In October 2025, Dr. Pearl E. Grimes launched P’erl, a new institute focused on clinical care and innovative melasma research to develop novel therapies and explore potential cures.

- In January 2025, La Roche‑Posay introduced Mela B3 Dark Spot Serum and Mela B3 UV Moisturizer SPF 30, featuring Melasyl and niacinamide to reduce pigmentation and protect against UVA/UVB damage.

- Global Melasma Treatment Products Market is likely to create the total forecasting opportunity of ~USD 2 Bn till 2035.

- North America leads the melasma treatment products market, driven by strong consumer purchasing power, high skin‑health awareness, and a robust adoption of clinically validated, wellness‑oriented formulations.

- The expanding market share of melasma treatment products that is being fueled by increasing prevalence of melasma caused by hormonal alterations and sun exposure is influencing consumer purchasing patterns, brand loyalty and the product development product focus, particularly among users of pregnancy skincare products where hormone-driven pigmentation risk is elevated. Health, safety, and sustainability awareness is becoming more and more a factor in decisions, specifically among Gen z and millennials who like transparency and effectiveness in skincare solutions. For instance, in July 2025, Savannah James collaborated with Howard University to release her own skincare brand Reframe Beauty, which focuses on pigmentation and hormonal requests on the skin, and the attention to the region to clinically inform and socially responsible innovations.

- The market leaders are reacting, reformulating their products, cutting out controversial ingredients, gaining third-party certification, switching to sustainable packaging, and conveying corporate values in purposeful campaigns. These programs increase brand differentiation, consumer trust, and as well as maintain higher prices in markets where ethical and sustainable attributes have an impact on consumer buying behavior.

- High purchasing power promotes long-term growth and rewards innovation-driven firms. Established leaders must adapt to meet emerging consumer preferences for safe, effective, and socially responsible melasma solutions.

- Limited treatment efficacy and high relapse rates will be a significant constraint within the melasma treatment product market which will limit sustainable growth, consumer confidence as well as market penetration. These issues are also supported by differences in awareness, cultural attitudes towards pigmentation, financial limitations, and regulation demands which do not allow uniform product use across the regions.

- The manufacturers are trying to overcome these restrictions by clinical validation, education by dermatologists, targeted marketing, and portfolio diversification. Nevertheless, it will take time and cultural sensitivity, as well as culture-specific adjustments to the needs of various consumers and therapeutic expectations to be made.

- Economic ripples differ across product segments. Premium solutions with stronger efficacy claim and brand recognition are the most resilient, whereas mass-market products are more vulnerable due to performance constraints and the need to constantly innovate, engineer value, and communicate clinically approved advantages.

- There is a great potential of companies in the melasma treatment products market due to the increasing use of combination therapy protocols. With changes in consumer demand to more integrated and multi-modal products that can produce faster and more lasting effects, brands are shifting to formulation innovation, increase clinical partnerships, and enhance personalized treatment design.

- This opportunity cuts across high growth areas, adjacent dermatology divisions, superior clinically proven product lines, and direct-to-consumer models which improve engagement and increase margin performance. The capabilities needed in success are excellent consumer insight, digital savvy, agile, and continuous innovation with current clinical evidence and patient expectations.

- The companies that successfully prioritize and implement against this opportunity will be well-positioned to grow in the market through above-average competitive differentiation as well as long-term value creation as the use of combination therapy gains traction in melasma treatment market segments around the globe.

- Tranexamic acid and advanced delivery systems became one of the most popular trends in the melasma treatment products market and are able to increase the level of performance and redefine the competitive landscape. It is brought about by the advancements in science, the growing need of clinically validated solutions, as well as an enhanced interest in safety, precision and sustainability. For instance, in 2024, scientists created a dissolving patch of microneedles with a hyaluronic-acid-based needles filled with tranexamic acid which exhibits increased dermal penetration and has shown early promising results, a move further supporting the trend of improved delivery technology.

- The advantages of companies using these innovations are increased efficacy, increased consumer satisfaction, and increased differentiation that is scientifically validated. It is now a trend in technologically advanced markets and this leads to the continued investment into R&D, formulation engineering, and clinical substantiation.

- Tranexamic acid and innovative delivery options are expected to gain popularity in both mainstream and premium markets as understanding grows. This development will change competition hierarchies and open up prospects for tailored regimes, subscription plans, and result-based solutions that will boost consumer loyalty in the long run.

- The topical treatments segment dominate the global melasma treatment products market which has been backed by the high levels of consumer acceptance coupled with the established clinical efficacy and extensive distribution in both retail and professional. It has a strong leadership that is supported by good familiarity, ease of use and value perception amongst various consumer groups. For instance, in 2023, SkinMedica launched its Even & Correct topical line in the U.S., which has solutions without hydroquinone and promises to deal with dark spots and melasma, as it goes to show that the segment continues to innovate.

- The market leaders are still enhancing their standing by engaging in continuous investment in formulation innovation, multi-channel distribution and portfolio expansion. Differentiation of products is provided by new innovations in active ingredients, sensorial profiles, and sustainability properties, whereas consumer confidence, trial, and loyalty are achieved by target marketing assisted by clinical validation, dermatological recommendation, and influencer involvement.

- The segment will gain from mature supply networks, regulatory knowledge, and customer insights when developing products. The potentials create long-term competitive advantages, allowing enterprises to maintain market share while seeking to grow by offering premiums, expanding into new markets and regions, and constantly upgrading high-performance topical solutions.

- North America dominates the global melasma treatment products market because of a strong customer buying power, high levels of skin care awareness, and universal access to science-based treatments given by dermatologists. The consumers in the area require to see the outcome, their safety and skin health in the long run, as this is what generates the demand in the advanced formulations that often sit alongside anti-aging skincare products within dermatology-led treatment routines.

- The city centers are their test markets and innovators to perfect their formulae, to test assertions and convert through the networks of dermatologists, clinics, and influencers. Favorable regulatory conditions, strong e-commerce, teledermatology and online and digital marketing capacities, help to commercialize products faster and, more importantly, help the brands to target certain needs in skin-tone and lifestyle.

- The availability of large personal care and pharmaceutical firms, robust R&D base, and consumer base, which seek efficacy, sustainability, and clinical validation contribute to the ongoing innovation. All these aspects should continue to serve as a stronghold position of North America in the melasma treatment products market since the world tastes and preferences are shifting to safety, scientificity, and a proven performance.

- In October 2025, Dr. Pearl E. Grimes announced the launch of P’erl, the Melasma Research & Treatment Institute, a new center dedicated to clinical care and pioneering melasma research. The institute aims to re-examine the underlying causes and contributing factors of melasma, develop novel therapies, and ultimately pursue a cure.

- In January 2025, La Roche Posay released its Mela B3 Dark Spot Serum and Mela B3 UV Daily Moisturizer SPF30 (both based on Melasyl), a multi-patented molecule, which took L’Oréal 18 years of research to develop. This serum has 10% niacinamide and Melasyl to make all the pigmentation (sunspots, age spots, post-acne marks, and persistent dark spots) visibly reduce but will not alter all the skin tones. The UV moisturizer is used to prevent pigmentation due to the protection of UVA/UVB damage as well as containing Melasyl plus 5% niacinamide which is used to provide corrective effects.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Alastin Skincare

- Beiersdorf AG

- Clinique Laboratories LLC

- Galderma S.A.

- iS Clinical

- Johnson & Johnson

- L'Oréal S.A.

- Menarini Group

- Merz Pharmaceuticals

- Murad LLC

- Obagi Cosmetics

- Paula's Choice

- Pierre Fabre Group

- Estée Lauder Companies

- Revance Therapeutics

- Revision Skincare

- Shiseido Company Limited.

- Procter & Gamble

- Unilever

- ZO Skin Health

- Other Key Players

- Topical Treatments

- Hydroquinone-based Products

- Tretinoin Products

- Corticosteroid Creams

- Azelaic Acid Formulations

- Others

- Oral Medications

- Tranexamic Acid Tablets

- Antioxidant Supplements

- Glutathione Supplements

- Others

- Procedural Treatments

- Chemical Peels

- Laser Therapy Products

- Microdermabrasion Products

- Light Therapy Devices

- Others

- Creams

- Gels

- Serums

- Lotions

- Ointments

- Tablets/Capsules

- Others

- Low (Below 2%)

- Medium (2-4%)

- High (Above 4%)

- Over-the-Counter (OTC) Strength

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- E-commerce Platforms

- Company Websites

- Online Marketplaces

- Others

- Dermatology Clinics

- Specialty Stores

- Supermarkets/Hypermarkets

- Tube

- Pump Dispensers

- Jar

- Sachet/Pouch

- Airless Containers

- Others

- Normal Skin

- Dry Skin

- Oily Skin

- Sensitive Skin

- Others

- 18-30 years

- 31-45 years

- 46-60 years

- Above 60 years

- Epidermal Melasma Treatment

- Dermal Melasma Treatment

- Mixed Melasma Treatment

- Post-inflammatory Hyperpigmentation

- Prevention/Maintenance Therapy

- Combination with Sun Protection

- Others

- Healthcare/Medical Industry

- Dermatology Clinics

- Hospitals

- Aesthetic Centers

- Medical Spas

- Others

- Pharmaceutical Industry

- Cosmetic Industry

- Beauty & Personal Care Industry

- Wellness Industry

- Other End-users

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Melasma Treatment Products Market Outlook

- 2.1.1. Melasma Treatment Products Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Melasma Treatment Products Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Consumer Goods & Services Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising prevalence of melasma globally due to hormonal changes, UV exposure, and genetics.

- 4.1.1.2. Increasing awareness and demand for aesthetic treatments / skincare among consumers.

- 4.1.1.3. Technological advancements in treatment modalities (e.g. laser therapies, novel topical agents).

- 4.1.2. Restraints

- 4.1.2.1. High cost of treatments (especially lasers, chemical peels, prescription therapies) limiting affordability.

- 4.1.2.2. Limited long-term efficacy and high recurrence rates, plus potential side‑effects of treatments.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Melasma Treatment Products Manufacturers

- 4.4.3. Dealers/ Distributors

- 4.4.4. End-Users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Melasma Treatment Products Market Demand

- 4.7.1. Historical Market Size – Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size – Value (US$ Bn), 2026–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Melasma Treatment Products Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Melasma Treatment Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Topical Treatments

- 6.2.1.1. Hydroquinone-based Products

- 6.2.1.2. Tretinoin Products

- 6.2.1.3. Corticosteroid Creams

- 6.2.1.4. Azelaic Acid Formulations

- 6.2.1.5. Others

- 6.2.2. Oral Medications

- 6.2.2.1. Tranexamic Acid Tablets

- 6.2.2.2. Antioxidant Supplements

- 6.2.2.3. Glutathione Supplements

- 6.2.2.4. Others

- 6.2.3. Procedural Treatments

- 6.2.3.1. Chemical Peels

- 6.2.3.2. Laser Therapy Products

- 6.2.3.3. Microdermabrasion Products

- 6.2.3.4. Light Therapy Devices

- 6.2.3.5. Others

- 6.2.1. Topical Treatments

- 7. Global Melasma Treatment Products Market Analysis, by Formulation

- 7.1. Key Segment Analysis

- 7.2. Melasma Treatment Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Formulation, 2021-2035

- 7.2.1. Creams

- 7.2.2. Gels

- 7.2.3. Serums

- 7.2.4. Lotions

- 7.2.5. Ointments

- 7.2.6. Tablets/Capsules

- 7.2.7. Others

- 8. Global Melasma Treatment Products Market Analysis, by Active Ingredient Concentration

- 8.1. Key Segment Analysis

- 8.2. Melasma Treatment Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Active Ingredient Concentration, 2021-2035

- 8.2.1. Low (Below 2%)

- 8.2.2. Medium (2-4%)

- 8.2.3. High (Above 4%)

- 8.2.4. Over-the-Counter (OTC) Strength

- 9. Global Melasma Treatment Products Market Analysis, by Distribution Channel

- 9.1. Key Segment Analysis

- 9.2. Melasma Treatment Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 9.2.1. Hospital Pharmacies

- 9.2.2. Retail Pharmacies

- 9.2.3. Online Pharmacies

- 9.2.3.1. E-commerce Platforms

- 9.2.3.2. Company Websites

- 9.2.3.3. Online Marketplaces

- 9.2.3.4. Others

- 9.2.4. Dermatology Clinics

- 9.2.5. Specialty Stores

- 9.2.6. Supermarkets/Hypermarkets

- 10. Global Melasma Treatment Products Market Analysis, by Packaging Type

- 10.1. Key Segment Analysis

- 10.2. Melasma Treatment Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Packaging Type, 2021-2035

- 10.2.1. Tube

- 10.2.2. Pump Dispensers

- 10.2.3. Jar

- 10.2.4. Sachet/Pouch

- 10.2.5. Airless Containers

- 10.2.6. Others

- 11. Global Melasma Treatment Products Market Analysis, by Skin Type Compatibility

- 11.1. Key Segment Analysis

- 11.2. Melasma Treatment Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Skin Type Compatibility, 2021-2035

- 11.2.1. Normal Skin

- 11.2.2. Dry Skin

- 11.2.3. Oily Skin

- 11.2.4. Sensitive Skin

- 11.2.5. Others

- 12. Global Melasma Treatment Products Market Analysis, by Age Group

- 12.1. Key Segment Analysis

- 12.2. Melasma Treatment Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Age Group, 2021-2035

- 12.2.1. 18-30 years

- 12.2.2. 31-45 years

- 12.2.3. 46-60 years

- 12.2.4. Above 60 years

- 13. Global Melasma Treatment Products Market Analysis, by Application

- 13.1. Key Segment Analysis

- 13.2. Melasma Treatment Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Application, 2021-2035

- 13.2.1. Epidermal Melasma Treatment

- 13.2.2. Dermal Melasma Treatment

- 13.2.3. Mixed Melasma Treatment

- 13.2.4. Post-inflammatory Hyperpigmentation

- 13.2.5. Prevention/Maintenance Therapy

- 13.2.6. Combination with Sun Protection

- 13.2.7. Others

- 14. Global Melasma Treatment Products Market Analysis, by End-users

- 14.1. Key Segment Analysis

- 14.2. Melasma Treatment Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 14.2.1. Healthcare/Medical Industry

- 14.2.1.1. Dermatology Clinics

- 14.2.1.2. Hospitals

- 14.2.1.3. Aesthetic Centers

- 14.2.1.4. Medical Spas

- 14.2.1.5. Others

- 14.2.2. Pharmaceutical Industry

- 14.2.3. Cosmetic Industry

- 14.2.4. Beauty & Personal Care Industry

- 14.2.5. Wellness Industry

- 14.2.6. Other End-users

- 14.2.1. Healthcare/Medical Industry

- 15. Global Melasma Treatment Products Market Analysis and Forecasts, by Region

- 15.1. Key Findings

- 15.2. Melasma Treatment Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 15.2.1. North America

- 15.2.2. Europe

- 15.2.3. Asia Pacific

- 15.2.4. Middle East

- 15.2.5. Africa

- 15.2.6. South America

- 16. North America Melasma Treatment Products Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. North America Melasma Treatment Products Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Formulation

- 16.3.3. Active Ingredient Concentration

- 16.3.4. Distribution Channel

- 16.3.5. Packaging Type

- 16.3.6. Skin Type Compatibility

- 16.3.7. Age Group

- 16.3.8. Application

- 16.3.9. End-users

- 16.3.10. Country

- 16.3.10.1. USA

- 16.3.10.2. Canada

- 16.3.10.3. Mexico

- 16.4. USA Melasma Treatment Products Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Formulation

- 16.4.4. Active Ingredient Concentration

- 16.4.5. Distribution Channel

- 16.4.6. Packaging Type

- 16.4.7. Skin Type Compatibility

- 16.4.8. Age Group

- 16.4.9. Application

- 16.4.10. End-users

- 16.5. Canada Melasma Treatment Products Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Formulation

- 16.5.4. Active Ingredient Concentration

- 16.5.5. Distribution Channel

- 16.5.6. Packaging Type

- 16.5.7. Skin Type Compatibility

- 16.5.8. Age Group

- 16.5.9. Application

- 16.5.10. End-users

- 16.6. Mexico Melasma Treatment Products Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Formulation

- 16.6.4. Active Ingredient Concentration

- 16.6.5. Distribution Channel

- 16.6.6. Packaging Type

- 16.6.7. Skin Type Compatibility

- 16.6.8. Age Group

- 16.6.9. Application

- 16.6.10. End-users

- 17. Europe Melasma Treatment Products Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Europe Melasma Treatment Products Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Formulation

- 17.3.3. Active Ingredient Concentration

- 17.3.4. Distribution Channel

- 17.3.5. Packaging Type

- 17.3.6. Skin Type Compatibility

- 17.3.7. Age Group

- 17.3.8. Application

- 17.3.9. End-users

- 17.3.10. Country

- 17.3.10.1. Germany

- 17.3.10.2. United Kingdom

- 17.3.10.3. France

- 17.3.10.4. Italy

- 17.3.10.5. Spain

- 17.3.10.6. Netherlands

- 17.3.10.7. Nordic Countries

- 17.3.10.8. Poland

- 17.3.10.9. Russia & CIS

- 17.3.10.10. Rest of Europe

- 17.4. Germany Melasma Treatment Products Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Formulation

- 17.4.4. Active Ingredient Concentration

- 17.4.5. Distribution Channel

- 17.4.6. Packaging Type

- 17.4.7. Skin Type Compatibility

- 17.4.8. Age Group

- 17.4.9. Application

- 17.4.10. End-users

- 17.5. United Kingdom Melasma Treatment Products Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Formulation

- 17.5.4. Active Ingredient Concentration

- 17.5.5. Distribution Channel

- 17.5.6. Packaging Type

- 17.5.7. Skin Type Compatibility

- 17.5.8. Age Group

- 17.5.9. Application

- 17.5.10. End-users

- 17.6. France Melasma Treatment Products Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Formulation

- 17.6.4. Active Ingredient Concentration

- 17.6.5. Distribution Channel

- 17.6.6. Packaging Type

- 17.6.7. Skin Type Compatibility

- 17.6.8. Age Group

- 17.6.9. Application

- 17.6.10. End-users

- 17.7. Italy Melasma Treatment Products Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Formulation

- 17.7.4. Active Ingredient Concentration

- 17.7.5. Distribution Channel

- 17.7.6. Packaging Type

- 17.7.7. Skin Type Compatibility

- 17.7.8. Age Group

- 17.7.9. Application

- 17.7.10. End-users

- 17.8. Spain Melasma Treatment Products Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Formulation

- 17.8.4. Active Ingredient Concentration

- 17.8.5. Distribution Channel

- 17.8.6. Packaging Type

- 17.8.7. Skin Type Compatibility

- 17.8.8. Age Group

- 17.8.9. Application

- 17.8.10. End-users

- 17.9. Netherlands Melasma Treatment Products Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Product Type

- 17.9.3. Formulation

- 17.9.4. Active Ingredient Concentration

- 17.9.5. Distribution Channel

- 17.9.6. Packaging Type

- 17.9.7. Skin Type Compatibility

- 17.9.8. Age Group

- 17.9.9. Application

- 17.9.10. End-users

- 17.10. Nordic Countries Melasma Treatment Products Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Product Type

- 17.10.3. Formulation

- 17.10.4. Active Ingredient Concentration

- 17.10.5. Distribution Channel

- 17.10.6. Packaging Type

- 17.10.7. Skin Type Compatibility

- 17.10.8. Age Group

- 17.10.9. Application

- 17.10.10. End-users

- 17.11. Poland Melasma Treatment Products Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Product Type

- 17.11.3. Formulation

- 17.11.4. Active Ingredient Concentration

- 17.11.5. Distribution Channel

- 17.11.6. Packaging Type

- 17.11.7. Skin Type Compatibility

- 17.11.8. Age Group

- 17.11.9. Application

- 17.11.10. End-users

- 17.12. Russia & CIS Melasma Treatment Products Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Product Type

- 17.12.3. Formulation

- 17.12.4. Active Ingredient Concentration

- 17.12.5. Distribution Channel

- 17.12.6. Packaging Type

- 17.12.7. Skin Type Compatibility

- 17.12.8. Age Group

- 17.12.9. Application

- 17.12.10. End-users

- 17.13. Rest of Europe Melasma Treatment Products Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Product Type

- 17.13.3. Formulation

- 17.13.4. Active Ingredient Concentration

- 17.13.5. Distribution Channel

- 17.13.6. Packaging Type

- 17.13.7. Skin Type Compatibility

- 17.13.8. Age Group

- 17.13.9. Application

- 17.13.10. End-users

- 18. Asia Pacific Melasma Treatment Products Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Asia Pacific Melasma Treatment Products Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Formulation

- 18.3.3. Active Ingredient Concentration

- 18.3.4. Distribution Channel

- 18.3.5. Packaging Type

- 18.3.6. Skin Type Compatibility

- 18.3.7. Age Group

- 18.3.8. Application

- 18.3.9. End-users

- 18.3.10. Country

- 18.3.10.1. China

- 18.3.10.2. India

- 18.3.10.3. Japan

- 18.3.10.4. South Korea

- 18.3.10.5. Australia and New Zealand

- 18.3.10.6. Indonesia

- 18.3.10.7. Malaysia

- 18.3.10.8. Thailand

- 18.3.10.9. Vietnam

- 18.3.10.10. Rest of Asia Pacific

- 18.4. China Melasma Treatment Products Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Formulation

- 18.4.4. Active Ingredient Concentration

- 18.4.5. Distribution Channel

- 18.4.6. Packaging Type

- 18.4.7. Skin Type Compatibility

- 18.4.8. Age Group

- 18.4.9. Application

- 18.4.10. End-users

- 18.5. India Melasma Treatment Products Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Formulation

- 18.5.4. Active Ingredient Concentration

- 18.5.5. Distribution Channel

- 18.5.6. Packaging Type

- 18.5.7. Skin Type Compatibility

- 18.5.8. Age Group

- 18.5.9. Application

- 18.5.10. End-users

- 18.6. Japan Melasma Treatment Products Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Formulation

- 18.6.4. Active Ingredient Concentration

- 18.6.5. Distribution Channel

- 18.6.6. Packaging Type

- 18.6.7. Skin Type Compatibility

- 18.6.8. Age Group

- 18.6.9. Application

- 18.6.10. End-users

- 18.7. South Korea Melasma Treatment Products Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Formulation

- 18.7.4. Active Ingredient Concentration

- 18.7.5. Distribution Channel

- 18.7.6. Packaging Type

- 18.7.7. Skin Type Compatibility

- 18.7.8. Age Group

- 18.7.9. Application

- 18.7.10. End-users

- 18.8. Australia and New Zealand Melasma Treatment Products Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Formulation

- 18.8.4. Active Ingredient Concentration

- 18.8.5. Distribution Channel

- 18.8.6. Packaging Type

- 18.8.7. Skin Type Compatibility

- 18.8.8. Age Group

- 18.8.9. Application

- 18.8.10. End-users

- 18.9. Indonesia Melasma Treatment Products Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Product Type

- 18.9.3. Formulation

- 18.9.4. Active Ingredient Concentration

- 18.9.5. Distribution Channel

- 18.9.6. Packaging Type

- 18.9.7. Skin Type Compatibility

- 18.9.8. Age Group

- 18.9.9. Application

- 18.9.10. End-users

- 18.10. Malaysia Melasma Treatment Products Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Product Type

- 18.10.3. Formulation

- 18.10.4. Active Ingredient Concentration

- 18.10.5. Distribution Channel

- 18.10.6. Packaging Type

- 18.10.7. Skin Type Compatibility

- 18.10.8. Age Group

- 18.10.9. Application

- 18.10.10. End-users

- 18.11. Thailand Melasma Treatment Products Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Product Type

- 18.11.3. Formulation

- 18.11.4. Active Ingredient Concentration

- 18.11.5. Distribution Channel

- 18.11.6. Packaging Type

- 18.11.7. Skin Type Compatibility

- 18.11.8. Age Group

- 18.11.9. Application

- 18.11.10. End-users

- 18.12. Vietnam Melasma Treatment Products Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Product Type

- 18.12.3. Formulation

- 18.12.4. Active Ingredient Concentration

- 18.12.5. Distribution Channel

- 18.12.6. Packaging Type

- 18.12.7. Skin Type Compatibility

- 18.12.8. Age Group

- 18.12.9. Application

- 18.12.10. End-users

- 18.13. Rest of Asia Pacific Melasma Treatment Products Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Product Type

- 18.13.3. Formulation

- 18.13.4. Active Ingredient Concentration

- 18.13.5. Distribution Channel

- 18.13.6. Packaging Type

- 18.13.7. Skin Type Compatibility

- 18.13.8. Age Group

- 18.13.9. Application

- 18.13.10. End-users

- 19. Middle East Melasma Treatment Products Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Middle East Melasma Treatment Products Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Formulation

- 19.3.3. Active Ingredient Concentration

- 19.3.4. Distribution Channel

- 19.3.5. Packaging Type

- 19.3.6. Skin Type Compatibility

- 19.3.7. Age Group

- 19.3.8. Application

- 19.3.9. End-users

- 19.3.10. Country

- 19.3.10.1. Turkey

- 19.3.10.2. UAE

- 19.3.10.3. Saudi Arabia

- 19.3.10.4. Israel

- 19.3.10.5. Rest of Middle East

- 19.4. Turkey Melasma Treatment Products Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Formulation

- 19.4.4. Active Ingredient Concentration

- 19.4.5. Distribution Channel

- 19.4.6. Packaging Type

- 19.4.7. Skin Type Compatibility

- 19.4.8. Age Group

- 19.4.9. Application

- 19.4.10. End-users

- 19.5. UAE Melasma Treatment Products Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Formulation

- 19.5.4. Active Ingredient Concentration

- 19.5.5. Distribution Channel

- 19.5.6. Packaging Type

- 19.5.7. Skin Type Compatibility

- 19.5.8. Age Group

- 19.5.9. Application

- 19.5.10. End-users

- 19.6. Saudi Arabia Melasma Treatment Products Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Formulation

- 19.6.4. Active Ingredient Concentration

- 19.6.5. Distribution Channel

- 19.6.6. Packaging Type

- 19.6.7. Skin Type Compatibility

- 19.6.8. Age Group

- 19.6.9. Application

- 19.6.10. End-users

- 19.7. Israel Melasma Treatment Products Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Formulation

- 19.7.4. Active Ingredient Concentration

- 19.7.5. Distribution Channel

- 19.7.6. Packaging Type

- 19.7.7. Skin Type Compatibility

- 19.7.8. Age Group

- 19.7.9. Application

- 19.7.10. End-users

- 19.8. Rest of Middle East Melasma Treatment Products Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Formulation

- 19.8.4. Active Ingredient Concentration

- 19.8.5. Distribution Channel

- 19.8.6. Packaging Type

- 19.8.7. Skin Type Compatibility

- 19.8.8. Age Group

- 19.8.9. Application

- 19.8.10. End-users

- 20. Africa Melasma Treatment Products Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Africa Melasma Treatment Products Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Formulation

- 20.3.3. Active Ingredient Concentration

- 20.3.4. Distribution Channel

- 20.3.5. Packaging Type

- 20.3.6. Skin Type Compatibility

- 20.3.7. Age Group

- 20.3.8. Application

- 20.3.9. End-users

- 20.3.10. Country

- 20.3.10.1. South Africa

- 20.3.10.2. Egypt

- 20.3.10.3. Nigeria

- 20.3.10.4. Algeria

- 20.3.10.5. Rest of Africa

- 20.4. South Africa Melasma Treatment Products Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Formulation

- 20.4.4. Active Ingredient Concentration

- 20.4.5. Distribution Channel

- 20.4.6. Packaging Type

- 20.4.7. Skin Type Compatibility

- 20.4.8. Age Group

- 20.4.9. Application

- 20.4.10. End-users

- 20.5. Egypt Melasma Treatment Products Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Formulation

- 20.5.4. Active Ingredient Concentration

- 20.5.5. Distribution Channel

- 20.5.6. Packaging Type

- 20.5.7. Skin Type Compatibility

- 20.5.8. Age Group

- 20.5.9. Application

- 20.5.10. End-users

- 20.6. Nigeria Melasma Treatment Products Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Formulation

- 20.6.4. Active Ingredient Concentration

- 20.6.5. Distribution Channel

- 20.6.6. Packaging Type

- 20.6.7. Skin Type Compatibility

- 20.6.8. Age Group

- 20.6.9. Application

- 20.6.10. End-users

- 20.7. Algeria Melasma Treatment Products Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Product Type

- 20.7.3. Formulation

- 20.7.4. Active Ingredient Concentration

- 20.7.5. Distribution Channel

- 20.7.6. Packaging Type

- 20.7.7. Skin Type Compatibility

- 20.7.8. Age Group

- 20.7.9. Application

- 20.7.10. End-users

- 20.8. Rest of Africa Melasma Treatment Products Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Product Type

- 20.8.3. Formulation

- 20.8.4. Active Ingredient Concentration

- 20.8.5. Distribution Channel

- 20.8.6. Packaging Type

- 20.8.7. Skin Type Compatibility

- 20.8.8. Age Group

- 20.8.9. Application

- 20.8.10. End-users

- 21. South America Melasma Treatment Products Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. South America Melasma Treatment Products Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Product Type

- 21.3.2. Formulation

- 21.3.3. Active Ingredient Concentration

- 21.3.4. Distribution Channel

- 21.3.5. Packaging Type

- 21.3.6. Skin Type Compatibility

- 21.3.7. Age Group

- 21.3.8. Application

- 21.3.9. End-users

- 21.3.10. Country

- 21.3.10.1. Brazil

- 21.3.10.2. Argentina

- 21.3.10.3. Rest of South America

- 21.4. Brazil Melasma Treatment Products Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Product Type

- 21.4.3. Formulation

- 21.4.4. Active Ingredient Concentration

- 21.4.5. Distribution Channel

- 21.4.6. Packaging Type

- 21.4.7. Skin Type Compatibility

- 21.4.8. Age Group

- 21.4.9. Application

- 21.4.10. End-users

- 21.5. Argentina Melasma Treatment Products Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Product Type

- 21.5.3. Formulation

- 21.5.4. Active Ingredient Concentration

- 21.5.5. Distribution Channel

- 21.5.6. Packaging Type

- 21.5.7. Skin Type Compatibility

- 21.5.8. Age Group

- 21.5.9. Application

- 21.5.10. End-users

- 21.6. Rest of South America Melasma Treatment Products Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Product Type

- 21.6.3. Formulation

- 21.6.4. Active Ingredient Concentration

- 21.6.5. Distribution Channel

- 21.6.6. Packaging Type

- 21.6.7. Skin Type Compatibility

- 21.6.8. Age Group

- 21.6.9. Application

- 21.6.10. End-users

- 22. Key Players/ Company Profile

- 22.1. Alastin Skincare

- 22.1.1. Company Details/ Overview

- 22.1.2. Company Financials

- 22.1.3. Key Customers and Competitors

- 22.1.4. Business/ Industry Portfolio

- 22.1.5. Product Portfolio/ Specification Details

- 22.1.6. Pricing Data

- 22.1.7. Strategic Overview

- 22.1.8. Recent Developments

- 22.2. Beiersdorf AG

- 22.3. Clinique Laboratories LLC

- 22.4. Estée Lauder Companies

- 22.5. Galderma S.A.

- 22.6. iS Clinical

- 22.7. Johnson & Johnson

- 22.8. L'Oréal S.A.

- 22.9. Menarini Group

- 22.10. Merz Pharmaceuticals

- 22.11. Murad LLC

- 22.12. Obagi Cosmetics

- 22.13. Paula's Choice

- 22.14. Pierre Fabre Group

- 22.15. Procter & Gamble

- 22.16. Revance Therapeutics

- 22.17. Revision Skincare

- 22.18. Shiseido Company Limited

- 22.19. Unilever

- 22.20. ZO Skin Health

- 22.21. Other Key Players

- 22.1. Alastin Skincare

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Melasma Treatment Products Market by Product Type, Formulation, Active Ingredient Concentration, Distribution Channel, Packaging Type, Skin Type Compatibility, Age Group, Application, End-users, and Geography

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Melasma Treatment Products Market Size, Share & Trends Analysis Report by Product Type (Topical Treatments, Oral Medications, Procedural Treatments), Formulation, Active Ingredient Concentration, Distribution Channel, Packaging Type, Skin Type Compatibility, Age Group, Application, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Melasma Treatment Products Market Size, Share, and Growth

The global melasma treatment products market is experiencing robust growth, with its estimated value of USD 1.8 billion in the year 2025 and USD 3.8 billion by 2035, registering a CAGR of 7.8%, during the forecast period. The global melasma treatment products market is being influenced more by the consumerism inclination towards wellness-based, safe, and skin-safe products. The women are also focusing on treatment that also effectively corrects pigments but at the same time fits their values of transparent, clinically proven and sustainable treatments.

Dr. Valerie Callender, board-certified dermatologist, said,

"Discoloration is a common complaint by patients, which occurs in all skin types. Mela B3 serum with Melasyl™ & Niacinamide will improve facial skin discoloration, fade dark spots, and correct uneven skin tone. Mela B3 Lightweight SPF 30 Sunscreen is formulated with Melasyl™ to correct existing dark spots while preventing post-inflammatory hyperpigmentation and discoloration from occurring. I recommend daily use of Mela B3 UV, which provides broad spectrum protection from UVA and UVB light."

The melasma treatment products market is experiencing a strong growth due to the consumer interest in the wellness-based, sustainable, and custom-made skincare products. Women are becoming much more focused on the products that are in line with their values that include the focus on ingredients transparency, ethical sourcing, and the clinically confirmed effectiveness. For instance, in March 2025, L’Oréal Groupe introduced Melasyl, an innovative active ingredient direct to localized pigmentation of the skin, which will reflect the trend towards science-based high-performance treatments.

Market-leaders are rebranding products to remove questionable ingredients, use green packaging and leverage on digital channels to establish meaningful relationships with consumers. For instance, in 2025 the Kerala government expanded on its initiative to distribute Melasma Treatment Products under the program Thinkal where 300,000 Melasma Treatment Products were handed to the needy women as free with resources to increase their knowledge in how to apply them, with the increasing awareness in sustainable menstrual health. Clean beauty is also being applied by the brands, where the companies are gaining certifications and through educational material provides benefits to value conscious knowledgeable consumers.

Some of the adjacent opportunities include subscriptions-based delivery, online menstrual wellness health services and other eco-friendly feminine care products. The areas allow the menstrual cup companies to grow their income, enhance customer lifetime value, and develop full ecosystems that encompass different aspects of female health and beauty.

Melasma Treatment Products Market Dynamics and Trends

Driver: Rising Prevalence Due to Hormonal Changes and Sun Exposure

Restraint: Limited Treatment Efficacy and High Relapse Rates

Opportunity: Development of Combination Therapy Protocols

Key Trend: Integration of Tranexamic Acid and Advanced Delivery Systems

Melasma-Treatment-Products-Market Analysis and Segmental Data

Topical Treatments Dominate Global Melasma Treatment Products Market

North America Leads Global Melasma Treatment Products Market Demand

Melasma-Treatment-Products-Market Ecosystem

The global melasma treatment products market is moderately fragmented, and there are multinational conglomerates, specialty brands, and direct-to-consumer startups that compete in different segments and at various price points. Galderma S.A., Merz Pharmaceuticals, Alastin Skincare, L’Oréal S.A., and Revance Therapeutics are the major players who use the scale, research and development experience and distribution channels to conquer mass-market segments and specialty brands characterize their differentiation by premium positioning and direct targeting of consumers.

Market value chain consists of ingredient suppliers, formulation developers, contract manufacturers, packaging providers, distribution partners, retail channels and marketing agencies to provide comprehensive solutions to satisfy different consumer needs. Major players are becoming more and more committed to vertical integration, direct-to-consumer and digital marketing to gain competitiveness, maximize margins, and provide personalized and data-driven innovations.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 1.8 Bn |

|

Market Forecast Value in 2035 |

USD 3.8 Bn |

|

Growth Rate (CAGR) |

7.8% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Millions Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Melasma-Treatment-Products-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Melasma Treatment Products Market, By Product Type |

|

|

Melasma Treatment Products Market, By Formulation |

|

|

Melasma Treatment Products Market, By Active Ingredient Concentration |

|

|

Melasma Treatment Products Market, By Distribution Channel |

|

|

Melasma Treatment Products Market, By Packaging Type |

|

|

Melasma Treatment Products Market, By Skin Type Compatibility |

|

|

Melasma Treatment Products Market, By Age Group |

|

|

Melasma Treatment Products Market, By Application |

|

|

Melasma Treatment Products Market, By End-users |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation